Sulzer Annual Report 2020 (Pdf)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Uni-Fuel System, a Simple and Modern Way to Improve Fuel Consumption and Energy Generating Costs - the Sulzer S20 Diesel Engine As a Basic Model

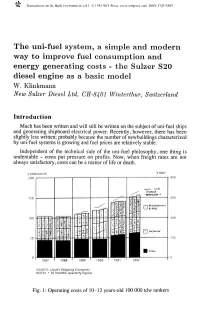

Transactions on the Built Environment vol 1, © 1993 WIT Press, www.witpress.com, ISSN 1743-3509 The uni-fuel system, a simple and modern way to improve fuel consumption and energy generating costs - the Sulzer S20 diesel engine as a basic model W. Klinkmann New Sulzer Diesel Ltd, CH-8401 Winterthur, Switzerland Introduction Much has been written and will still be written on the subject of uni-fuel ships and generating shipboard electrical power. Recently, however, there has been slightly less written; probably because the number of newbuildings characterized by uni-fuel systems is growing and fuel prices are relatively stable. Independent of the technical side of the uni-fuel philosophy, one thing is undeniable - costs put pressure on profits. Now, when freight rates are not always satisfactory, costs can be a matter of life or death. S'OOO* 600 200 1987 1988 1990 SOURCE: Lloyd's Shipping Economist NOTES: * 30 months; quarterly figures Fig. 1: Operating costs of 10-12 years-old 100 000 tdw tankers 12 8 MarinTransactionse Engineerin on the Built Environmentg vol 1, © 1993 WIT Press, www.witpress.com, ISSN 1743-3509 The Principal Economic Parameter Shipping and related activities are risky businesses with high investments and market environments which are highly volatile. The output of ships (tonne-miles) only takes place when vessels are at sea. Reliability of ships and their machinery are therefore of eminent economical importance. The following formula gives us a good basis for judging the influence which different parameters have on -

Internal Combustion Engines Collection of Stationary

ASME International THE COOLSPRING POWER MUSEUM COLLECTION OF STATIONARY INTERNAL COMBUSTION ENGINES MECHANICAL ENGINEERING HERITAGE COLLECTION Coolspring Power Museum Coolspring, Pennsylvania June 16, 2001 The Coolspring Power Museu nternal combustion engines revolutionized the world I around the turn of th 20th century in much the same way that steam engines did a century before. One has only to imagine a coal-fired, steam-powered, air- plane to realize how important internal combustion was to the industrialized world. While the early gas engines were more expensive than the equivalent steam engines, they did not require a boiler and were cheap- er to operate. The Coolspring Power Museum collection documents the early history of the internal- combustion revolution. Almost all of the critical components of hundreds of innovations that 1897 Charter today’s engines have their ori- are no longer used). Some of Gas Engine gins in the period represented the engines represent real engi- by the collection (as well as neering progress; others are more the product of inventive minds avoiding previous patents; but all tell a story. There are few duplications in the collection and only a couple of manufacturers are represent- ed by more than one or two examples. The Coolspring Power Museum contains the largest collection of historically signifi- cant, early internal combustion engines in the country, if not the world. With the exception of a few items in the collection that 2 were driven by the engines, m Collection such as compressors, pumps, and generators, and a few steam and hot air engines shown for comparison purposes, the collection contains only internal combustion engines. -

Because Life Is Fluid

BECAUSE LIFE IS FLUID Geschäftsbericht 2019 Inhalt 3 Brief an die Aktionärinnen und Aktionäre 7 Sulzer auf einen Blick 7 Unser Unternehmen 8 Unsere Kennzahlen 10 Fokus 18 Lagebericht 19 Finanzbericht 26 Lagebericht Divisionen 38 Nachhaltige Entwicklung 39 Mensch und Gemeinschaft 41 Umwelt 44 Arbeitssicherheit 46 Corporate governance (English only) 47 Corporate structure and shareholders 48 Capital structure 49 Board of Directors 57 Executive Committee 58 Shareholder participation rights 59 Takeover and defense measures 60 Auditors 61 Risk management 63 Information policy 64 Compensation report (English only) 65 Letter to the shareholders 68 Special report 71 Compensation governance and principles 74 Compensation architecture for the CEO and EC members 83 Compensation of the Executive Committee for 2019 88 Compensation architecture for the Board of Directors 90 Compensation of the Board of Directors for 2019 93 Auditor’s report 94 Financial reporting (English only) 95 Consolidated financial statements 185 Financial statements of Sulzer Ltd Sulzer Geschäftsbericht 2019 – Brief an die Aktionärinnen und Aktionäre 3 Brief an die Aktionärinnen und Aktionäre Wir von Sulzer wissen: „Life is fluid“. Auf der ganzen Welt werden Flüssigkeiten und Gase im Rahmen kritischer Infrastrukturprojekte transportiert oder verarbeitet. Wir setzen unser Fachwissen im Bereich Fluid-Engineering ein, um tagtäglich das Leben von Millionen von Menschen positiv zu beeinflussen. So erfüllen unsere Pumpen eine zentrale Funktion in Wassersystemen weltweit und helfen, die wertvollste Ressource unseres Planeten über Hunderte von Kilometern zu den Menschen zu transportieren und so die Entwicklung boomender Städte voranzutreiben. Unsere Serviceteams stellen die zuverlässige Stromversorgung für wachsende Volkswirtschaften und eine wachsende Bevölkerung sicher – um letztlich den ständig steigenden Energiebedarf zu decken. -

Serving Our Customers: 100 Years of Knowledge Transfer Sulzer Technical Review 3/2019

4 Serving our customers: 100 years of knowledge transfer Sulzer Technical Review 3/2019 Serving our customers: 100 years of knowledge transfer How does a company like Sulzer succeed in asserting itself on the market for over 185 years, continuously creating innovative products? What influence does the transfer of knowledge have, and how does the curiosi- ty of employees influence knowledge transfer? What will the knowledge transfer of the future look like? In 1919 — 85 years after the company was founded — Sulzer’s first customer magazine was published in French. Since then, the Sulzer Technical Review has provided technical informa- tion on Sulzer’s current product range without interruption. The magazine’s 100th anniversary gives us a glimpse into the history of Sulzer as well as the future of knowledge transfer. Networks for knowledge transfer in pre-industrial times Professional networks are not an invention of our contemporary age. In earlier centuries in Johann Jakob Sulzer (1806–1883) Europe, craftsmen acquired knowledge within the family business, then moved on foot from shop to shop to learn additional skills. Before the Sulzer brothers (Fig. 1) established their new foundry (Fig. 2) in Winterthur in 1834, they collected technical and craft expertise in Switzer- land, France and the Kingdom of Bavaria through apprenticeships. Johann Jakob Sulzer’s journey led him from Bern and Lyon to Paris between 1827 and 1830. Salomon Sulzer apprenticed in Munich, Ulm and Guebwiller in Alsace. Salomon Sulzer (1809–1869) Fig. 1 The two founders of the Sulzer company. Fig. 2 The building where the Sulzer company Fig. -

Energy-Efficient Solutions Who We Are and How We Are Doing

The Company 2010 Energy-efficient solutions Who we are and how we are doing Sulzer is a global partner with reliable and sustainable solutions for performance-critical applications. We specialize in industrial machinery and equipment, surface technology, and rotating equipment maintenance. Combining engineering and application expertise, our innovative solutions add value and strengthen the competitive position of our customers. Sulzer is a leading provider in its key markets: oil and gas, hydrocarbon processing, power generation, automotive, aviation, and pulp and paper. We serve clients worldwide through a network of over 160 locations. Our key markets Oil and gas Hydrocarbon Power processing generation Automotive Aviation Pulp and paper See page 3 for more market information Sulzer | The Company 2010 1 Highlights in 2010 Sales Operating income CHF 3 184m CHF 406m (2009: CHF 3 350m) (2009: CHF 368m) Net income 1) Dividend CHF 300m CHF 3.00 (proposed) (2009: CHF 270m) (2009: CHF 2.80) • Sulzer’s order intake increased, driven by acquisitions and the recovery of early-cycle markets. Sales were still impacted by the strong order intake reduction in 2009. • With a return on sales of 12.8% and a return on capital employed of 28.1%, Sulzer proved its ability to adapt fast to changed market conditions. • Sulzer’s global presence was further strengthened with a major new manufacturing plant in China and facility expansions in Brazil, India, Russia, and Indonesia. Sulzer India Ltd. was taken private. • The service businesses of Sulzer Turbo Services and Sulzer Metco were expanded with the acquisitions of Dowding & Mills and Bekaert’s diamond-like coating activities. -

Annual Financial Statements and Management Report of Deutsche Bank AG 2017 2017 of Deutsche Bank AG Report Management and Statements Financial Annual Deutsche Bank

Deutsche Bank Annual Financial Annual Financial Statements and Management Report of Deutsche Bank 2017 AG Statements and Management Report of Deutsche Bank AG 2017 Deutsche Bank Content 1 — Management Report 3 Operating and Financial Review 15 Outlook 21 Risks and Opportunities 25 Risk Report 51 Compensation Report 93 Internal Control over Financial Reporting 96 Non-financial Statement 115 Information pursuant to Section 289 (4) of the German Commercial Code and Explanatory Report 119 1a – Appendix to the Management Report: Report on equal treatment and equal pay 2 — Annual Financial Statement 122 Balance Sheet as of December 31, 2017 124 Income Statement for the period from January 1 to December 31, 2017 125 Notes to the Accounts 3 — Confirmations 180 Responsibility Statement by the Management Board 181 Independent Auditor’s Report 1 Management Report 3 Operating and Financial Review 3 Our Organization 7 Economic Environment 7 Executive Summary 10 Income Statement 13 Balance Sheet 15 Outlook 21 Risks and Opportunities 25 Risk Report 25 Risk Management Principles 25 Risk Management Framework 26 The Risks of Deutsche Bank AG within the Group Network 27 Risk Management Organization 30 Risk Strategy and Appetite 32 Risk Measurement Tools 33 Types of Risk 38 Risk Profile 39 Credit Risk 41 Market Risk 42 Operational Risk 43 Leverage Ratio 45 Liquidity Risk 46 Capital Requirements and Adequacy 51 Compensation Report 52 Management Board Compensation Report 77 Employee Compensation Report 90 Compensation System for Supervisory Board Members 93 -

Turbocharger - Wikipedia 1 of 21

Turbocharger - Wikipedia 1 of 21 Turbocharger A turbocharger, colloquially known as a turbo, is a turbine-driven, forced induction device that increases an internal combustion engine's efficiency and power output by forcing extra compressed air into the combustion chamber.[1][2] This improvement over a naturally aspirated engine's power output is because the compressor can force more air— and proportionately more fuel—into the combustion chamber than atmospheric pressure (and for that matter, ram air intakes) alone. Turbochargers were originally known as Cut-away view of an air foil bearing-supported turbosuperchargers when all forced turbocharger induction devices were classified as superchargers. Today, the term "supercharger" is typically applied only to mechanically driven forced induction devices. The key difference between a turbocharger and a conventional supercharger is that a supercharger is mechanically driven by the engine, often through a belt connected to the crankshaft, whereas a turbocharger is powered by a turbine driven by the engine's exhaust gas. Compared with a mechanically driven supercharger, turbochargers tend to be more efficient, but less responsive. Twincharger refers to an engine with both a supercharger and a turbocharger. Manufacturers commonly use turbochargers in truck, car, train, aircraft, and construction- equipment engines. They are most often used with Otto cycle and Diesel cycle internal combustion engines. Contents History Turbocharging versus supercharging Operating principle Pressure increase (or boost) Turbocharger lag Boost threshold Key components Turbine Twin-turbo https://en.wikipedia.org/wiki/Turbocharger Turbocharger - Wikipedia 2 of 21 Twin-scroll Variable-geometry Compressor Center housing/hub rotating assembly Additional technologies commonly used in turbocharger installations Intercooling Top-mount (TMIC) vs. -

Sulzer Partners with Swiss AVA Biochem to Expand Its Technology Portfolio for Renewable, Bio-Based and Recyclable Materials Production

MEDIA RELEASE Sulzer Management Ltd Neuwiesenstrasse 15 8401 Winterthur Switzerland Phone +41 52 262 30 00 Fax +41 52 262 31 00 May 6, 2021 Sulzer partners with Swiss AVA Biochem to expand its technology portfolio for renewable, bio-based and recyclable materials production Sulzer and Swiss-based AVA Biochem have entered into an exclusive license agreement to commercialize AVA Biochem’s innovative technology to produce sustainable commodity chemicals from biomass. These are renewable and non-toxic alternatives to fossil-based materials and serve to produce chemicals used in a broad range of applications, for example laminates for flooring. Sulzer’s Chemtech division will commercialize the licensed technology along with its proprietary key separation equipment for bio-based products to offer a one-stop solution. AVA Biochem AG is a pioneer in enabling the decarbonization of traditional chemical and adjacent B2B industries, and it is known for its proprietary COBRIS™ process (Conversion of Biomass to Renewable Industrial Substances). The process turns sugar-rich biomass into a renewable and non-toxic compound (the platform chemical 5-HMF) used to produce a broad range of widely used chemical products such as adhesives, food additives, textile fibers, packaging, films as well as alternatives to formaldehyde used in chipboards. Sulzer Chemtech will commercialize the licensed technology along with its proprietary key equipment for the purification of 5-HMF. Chemtech’s separation equipment is already being used in the unique demonstration plant in Muttenz, Switzerland, where 5-HMF is produced in different forms for a total capacity of six metric tons per year. The partnership supports the large-scale production of bio-based materials, enhancing the sustainability of both the manufacturing and processing sectors. -

Annual Report 2017 Annual Report Annual 2017

Annual Report 2017 Annual Report 2017 WorldReginfo - 6f10804a-2851-4eee-88eb-5806dd08c0be Leading technology & engineering Group Oerlikon Oerlikon engineers materials, equipment and surfaces to enable customers’ products to have high-perfor- mance functions and an extended lifespan. The Group is committed to continually investing and delivering valued technologies, products and services for customers to meet challenges in their markets. For in- stance, Oerlikon helps cars and airplanes use less fuel, makes tools last longer and saves energy in the manufacturing of textiles. A Swiss company with over 100 years of tradition, Oerlikon operates its business in three Segments – Surface Solutions, Manmade Fibers and Drive Systems. It has a global footprint of around 15 000 employ- ees at 186 locations in 37 countries and sales of CHF 2.8 billion in 2017. Segments Surface Solutions Manmade Fibers Drive Systems A world-leading supplier of advanced A world market leader for solutions A leading global provider of high- materials and surface technologies. and systems used to manufacture precision gear, drives and shifting Over 80 years of know-how in manmade fibers. Over 95 years solutions. Over 95 years of experi- advanced materials and surface of competence in enabling custom- ence in developing power transmis- solutions engineering for compo- ers to produce synthetic fibers, sion solutions for electric, mechani- nents, tools and parts used in a which are processed into clothing, cal and hydraulic drive applications wide range of industrial applications carpets, furnishings, airbags, safety and one of the world’s largest where superior materials and belts, industrial textiles and independent full-service gear surface performance are required. -

Sulzer on British Railways (Part 1)

DPW-DG70a Aus der Dieselgeschichten-Sammlung der Dieselpensionierten Winterthur Sulzer on British Railways (Part 1) written by Chris Brooks in 2013 In 1954, B.R. had about 6,000 steam locomotives falling apart at the rivets so embarked on a programme to replace these with 4 classes of main-line locomotives together with some smaller classes of shunting locomotives. Various manufacturers put forward different types of prototypes and very quickly Sulzer won orders for Types 2, 3, and 4 power units: these being 6, 8 and 12 cylinder LDA28 engines respectively. Vickers at Barrow in Furness had geared up in the early 50s to produce submarine engines in large quantities in anticipation of an escalation of the war in Korea. This never happened but Vickers had a large works ready to make LDA size engines in great quantity with very quick deliveries, a situation that was recognised by certain people on BR and Sulzers 'father' of Traction-Tom Schur who was head of Dept. 8 in Switzerland where various sizes of LDA engine were already being built for other railway companies. Sulzer (London) took a license from Winterthur and apart from the first 10 engines built in Switzerland, Vickers built 1,500 engines over a period of 5 years-an engine every working day. This Sulzer order represents the largest single customer contract in the history of Sulzer and will probably stand for all time, a fact stated by Peter Sulzer at the funeral of Tom Schur. I joined Sulzer London in 1966 when the main build programme was nearly complete and even though I was taken on as a Design Liaison Engineer looking after the flow of information and drawings from Winterthur to Barrow, the duties changed very quickly into those supporting development and service. -

Mergers & Acquisitions Quarterly Switzerland

Mergers & Acquisitions Quarterly Switzerland First quarter 2014 April 2014 edition DRAFT Contents 1. Introduction 2 2. Swiss M&A market Q1 2014 and outlook 2014 3 3. Private equity statistics: Germany, Switzerland and Austria 6 4. Industry overview ► Chemicals, Construction and Materials 7 ► Energy and Utilities 9 ► Financial Services 11 ► Healthcare 13 ► Industrial Goods and Services 15 ► Media, Technology and Telecommunications 17 ► Retail and Consumer Products 19 5. Deal of the quarter 21 6. Event calender 22 7. EY selection of M&A opportunities 23 8. Your EY M&A team in Switzerland 24 9. Subscription/Registration form 25 All rights reserved — EY 2014 Mergers & Acquisitions Quarterly Switzerland – Q1 2014 1 DRAFT Introduction Dear Reader We are pleased to present the latest edition of our M&A Quarterly Switzerland. This brochure provides a general overview of the Swiss M&A and European private equity market activity in the first quarter of 2014, as well as an outlook for the remainder of 2014. Following a year of subdued performance, the Swiss M&A market got off to a remarkable start in the first three months of 2014, with a significant increase in deal volume despite a decrease in the number of deals. Looking forward, large transactions are expected more often in the Swiss M&A market as executives’ risk appetite for strategic and transformational deals has increased. The favorable financing conditions prevailing at present will help drive this trend, although continuing economic and geopolitical risks in some areas could disrupt the bright outlook. Our next edition of Mergers & Acquisitions Quarterly Switzerland will be available in July 2014. -

Sulzer Technical Review 3/2018

Sulzer Technical Review 3/2018 Digital insights Turning pump data Rely on digital data for Using digital technologies Big data in into dollars mass transfer columns to create spare parts Sulzer’s factories 2 Imprint Sulzer Technical Review 3/2018 About Sulzer Sulzer’s core strengths are flow control and applicators. We specialize in pumping solutions and services for rotating equipment, as well as separation, mixing and application technology. Our customers benefit from a network of over 180 production and service sites around the world. Sulzer has been headquartered in Winterthur, Switzerland, since 1834. In 2017, we achieved sales of roughly CHF 3.0 billion with around 14’700 employees. Our shares are traded on the SIX Swiss Exchange (SIX: SUN). Pumps Equipment The Pumps Equipment division specializes in pumping solutions. Intensive research and development in fluid dynamics, process-oriented products and special materials as well as reliable service solutions help the company maintain its leading position in its focus market segments. Rotating Equipment Services The Rotating Equipment Services division provides cutting-edge maintenance and service solutions for rotating equipment dedicated to improving customers’ processes and business performance. When pumps, turbines, compressors, generators and motors are essential to operations, Sulzer offers technically advanced and innovative solutions. Chemtech The Chemtech division is represented in all important industrial countries and sets standards in the field of mass transfer and static mixing with its innovative solutions. The product offering ranges from process components to complete separation process plants. The customer support covers engineering services for separation and reaction technology and tower field services to perform tray and packing installation, tower maintenance, welding and plant turnaround projects.