Economic Brief

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tunisia Summary Strategic Environmental and Social

PMIR Summary Strategic Environmental and Social Assessment AFRICAN DEVELOPMENT BANK GROUP PROJECT: ROAD INFRASTRUCTURE MODERNIZATION PROJECT COUNTRY: TUNISIA SUMMARY STRATEGIC ENVIRONMENTAL AND SOCIAL ASSESSMENT (SESA) Project Team: Mr. P. M. FALL, Transport Engineer, OITC.2 Mr. N. SAMB, Consultant Socio-Economist, OITC.2 Mr. A. KIES, Consultant Economist, OITC 2 Mr. M. KINANE, Principal Environmentalist, ONEC.3 Mr. S. BAIOD, Consultant Environmentalist ONEC.3 Project Team Sector Director: Mr. Amadou OUMAROU Regional Director: Mr. Jacob KOLSTER Division Manager: Mr. Abayomi BABALOLA 1 PMIR Summary Strategic Environmental and Social Assessment Project Name : ROAD INFRASTRUCTURE MODERNIZATION PROJECT Country : TUNISIA Project Number : P-TN-DB0-013 Department : OITC Division: OITC.2 1 Introduction This report is a summary of the Strategic Environmental and Social Assessment (SESA) of the Road Project Modernization Project 1 for improvement works in terms of upgrading and construction of road structures and primary roads of the Tunisian classified road network. This summary has been prepared in compliance with the procedures and operational policies of the African Development Bank through its Integrated Safeguards System (ISS) for Category 1 projects. The project description and rationale are first presented, followed by the legal and institutional framework in the Republic of Tunisia. A brief description of the main environmental conditions is presented, and then the road programme components are presented by their typology and by Governorate. The summary is based on the projected activities and information contained in the 60 EIAs already prepared. It identifies the key issues relating to significant impacts and the types of measures to mitigate them. It is consistent with the Environmental and Social Management Framework (ESMF) developed to that end. -

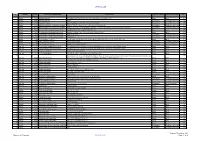

December 2020 Contract Pipeline

OFFICIAL USE No Country DTM Project title and Portfolio Contract title Type of contract Procurement method Year Number 1 2021 Albania 48466 Albanian Railways SupervisionRehabilitation Contract of Tirana-Durres for Rehabilitation line and ofconstruction the Durres of- Tirana a new Railwaylink to TIA Line and construction of a New Railway Line to Tirana International Works Open 2 Albania 48466 Albanian Railways Airport Consultancy Competitive Selection 2021 3 Albania 48466 Albanian Railways Asset Management Plan and Track Access Charges Consultancy Competitive Selection 2021 4 Albania 49351 Albania Infrastructure and tourism enabling Albania: Tourism-led Model For Local Economic Development Consultancy Competitive Selection 2021 5 Albania 49351 Albania Infrastructure and tourism enabling Infrastructure and Tourism Enabling Programme: Gender and Economic Inclusion Programme Manager Consultancy Competitive Selection 2021 6 Albania 50123 Regional and Local Roads Connectivity Rehabilitation of Vlore - Orikum Road (10.6 km) Works Open 2022 7 Albania 50123 Regional and Local Roads Connectivity Upgrade of Zgosth - Ura e Cerenecit road Section (47.1km) Works Open 2022 8 Albania 50123 Regional and Local Roads Connectivity Works supervision Consultancy Competitive Selection 2021 9 Albania 50123 Regional and Local Roads Connectivity PIU support Consultancy Competitive Selection 2021 10 Albania 51908 Kesh Floating PV Project Design, build and operation of the floating photovoltaic plant located on Vau i Dejës HPP Lake Works Open 2021 11 Albania 51908 -

Draft Outline

Tunisia Resilience and Community Empowerment Activity Quarterly Report Year Two, Quarter One – October 1, 2019 – December 30, 2019 Submission Date: January 30, 2019 Agreement Number: 72066418CA00001 Activity Start Date and End Date: SEPTEMBER 1, 2018 to AUGUST 31, 2023 AOR Name: Hind Houas Submitted by: Nadia Alami, Chief of Party FHI360 Tanit Business Center, Ave de la Fleurs de Lys, Lac 2 1053 Tunis, Tunisia Tel: (+216) 58 52 56 20 Email: [email protected] This document was produced for review by the United States Agency for International Development. July 2008 1 Contents Acronyms and Abbreviations ...................................................................................................................................... ii 1. Project Overview/ Summary .......................................................................................................................... 1 1.1 Introduction and Project Description ........................................................................................................ 2 1.2 Analysis of Overall Program Progress Toward Results .................................................................... 4 2. Summary of Activities Conducted ............................................................................................................ 12 2.1 Objective 1: Strengthened Community Resilience ........................................................................... 12 RESULT 1.1: COMMUNITY MEMBERS, IN PARTICULAR MARGINALIZED GROUPS, DEMONSTRATE AN ENHANCED LEVEL OF ENGAGEMENT, -

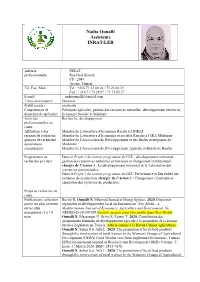

Nadia Ounalli Assistante INRAT/LER

Nadia Ounalli Assistante INRAT/LER Adresse INRAT, professionnelle Rue Hedi Karray CP : 2049 Ariana, Tunisia Tel, Fax, Mob. Tel : +216 71 23 00 24 / 71 23 02 39 Fax : +216 71 75 28 97 / 71 71 65 37 E-mail [email protected] Titres universitaire Doctorat Statut (grade) assistante Compétences et Politiques agricoles, gestion des ressources naturelles, développement territorial, domaines de spécialité Economie Sociale et Solidaire Activités Recherche, développement professionnelles en cours Affiliation à des Membre du Laboratoire d’Economie Rurale à l’INRAT réseaux de recherche, Membre du Laboratoire d’Economie et sociétés Rurales à l’IRA Médenine groupes de recherche, Membre de l’Association de Développement et des études stratégiques de associations Médenine scientifiques Membre de l’Association de Développement Agricole et Rurale de Haidra Programmes de Dans le Projet 3 du contrat programme du LER : développement territorial, recherche en cours gestion des ressources naturelles et foncières et changement institutionnel, chargée de l’Action 3 : Le développement territorial et la valorisation des ressources patrimoniales. Dans le Projet 2 du contrat programme du LER: Performance et Durabilité des systèmes de production, chargée de l’Action 3 : Changement climatique et adaptation des systèmes de production. Projet de recherche en cours Publications (sélection Bechir R, Ounalli N. Mhemed Jaoued et Mongi Sghaier, 2020. Disparités parmi les plus récentes régionales et développement local au Sud tunisien. New Medit - A ou les plus Mediterranean Journal of Economics, Agriculture and Environment. No. marquantes) 5 à 10 NEMED-D-20-00010R1(article accepté pour être publié dans New Medit) max Ounalli N, Marzougui N, Selmi S, Fazeni T, 2020. -

Durham E-Theses

Durham E-Theses Integrated rural development a case study of monastir governorate Tunisia Harrison, Ian C. How to cite: Harrison, Ian C. (1982) Integrated rural development a case study of monastir governorate Tunisia, Durham theses, Durham University. Available at Durham E-Theses Online: http://etheses.dur.ac.uk/9340/ Use policy The full-text may be used and/or reproduced, and given to third parties in any format or medium, without prior permission or charge, for personal research or study, educational, or not-for-prot purposes provided that: • a full bibliographic reference is made to the original source • a link is made to the metadata record in Durham E-Theses • the full-text is not changed in any way The full-text must not be sold in any format or medium without the formal permission of the copyright holders. Please consult the full Durham E-Theses policy for further details. Academic Support Oce, Durham University, University Oce, Old Elvet, Durham DH1 3HP e-mail: [email protected] Tel: +44 0191 334 6107 http://etheses.dur.ac.uk INTEGRATED RURAL DEVELOPMENT A CASE STUDY OP MONASTIR GOVERNORATE TUNISIA IAN C. HARRISON The copyright of this thesis tests with the author. No quotation from it should be published without bis prior written consent and information derived from it should be acknowledged. Thesis submitted for the degree of PhD, Department of Geography, University of Durham. March 1982. ABSTRACT The Tunisian government has adopted an integrated rural development programme to tackle the problems of the national rural sector. The thesis presents an examination of the viability and success of the programme with specific reference to the Governorate of Monastir. -

National Case Study

National Case Study TUNISIA Center of Arab Women for Training and Research, Tunis, Tunisia General Data Country TUNISIA Localizations (name) 1NCS Code of National Case NCS- TUNISIA -1 Keywords Informal sector; Young rappers; Young activists; Family; Education; Artistic expression; Religion Abstract Short description of the main points. Summarise related with clusters This paper aims to reflect on the situation of young people in the post-revolutionary context. At the time of its revolution, Tunisia was marked by social movements. The “awakening of civil society” in the post-revolutionary period would become a leitmotif for the young people who were better equipped to invest in the public space and become aware of their importance as a pressure group that is increasingly called upon to position itself and play a role in the efforts made in the transition to democracy. With the aim of approaching this issue, we have investigated the youth of three regions of Tunisia that represent the north, the southeast, and the southwest of the country: Cité Ibn Khaldoun, Gafsa and Djerba Island. We put together three groups of young people whose profiles would help us to understand the differential logics of young people positioning themselves in the public sphere in the post-revolutionary period. These three groups are: young activists, rappers and young people in the informal sector. National Case Study - TUNISIA Introduction This paper aims to reflect on the situation of young people in the post-revolutionary context. At the time of its revolution, Tunisia was marked by social movements. The “awakening of civil society” in the post-revolutionary period would become a leitmotif for the young people who were better equipped to invest in the public space and become aware of their importance as a pressure group that is increasingly called upon to position itself and play a role in the efforts made in the transition to democracy. -

S.No Governorate Cities 1 L'ariana Ariana 2 L'ariana Ettadhamen-Mnihla 3 L'ariana Kalâat El-Andalous 4 L'ariana Raoued 5 L'aria

S.No Governorate Cities 1 l'Ariana Ariana 2 l'Ariana Ettadhamen-Mnihla 3 l'Ariana Kalâat el-Andalous 4 l'Ariana Raoued 5 l'Ariana Sidi Thabet 6 l'Ariana La Soukra 7 Béja Béja 8 Béja El Maâgoula 9 Béja Goubellat 10 Béja Medjez el-Bab 11 Béja Nefza 12 Béja Téboursouk 13 Béja Testour 14 Béja Zahret Mediou 15 Ben Arous Ben Arous 16 Ben Arous Bou Mhel el-Bassatine 17 Ben Arous El Mourouj 18 Ben Arous Ezzahra 19 Ben Arous Hammam Chott 20 Ben Arous Hammam Lif 21 Ben Arous Khalidia 22 Ben Arous Mégrine 23 Ben Arous Mohamedia-Fouchana 24 Ben Arous Mornag 25 Ben Arous Radès 26 Bizerte Aousja 27 Bizerte Bizerte 28 Bizerte El Alia 29 Bizerte Ghar El Melh 30 Bizerte Mateur 31 Bizerte Menzel Bourguiba 32 Bizerte Menzel Jemil 33 Bizerte Menzel Abderrahmane 34 Bizerte Metline 35 Bizerte Raf Raf 36 Bizerte Ras Jebel 37 Bizerte Sejenane 38 Bizerte Tinja 39 Bizerte Saounin 40 Bizerte Cap Zebib 41 Bizerte Beni Ata 42 Gabès Chenini Nahal 43 Gabès El Hamma 44 Gabès Gabès 45 Gabès Ghannouch 46 Gabès Mareth www.downloadexcelfiles.com 47 Gabès Matmata 48 Gabès Métouia 49 Gabès Nouvelle Matmata 50 Gabès Oudhref 51 Gabès Zarat 52 Gafsa El Guettar 53 Gafsa El Ksar 54 Gafsa Gafsa 55 Gafsa Mdhila 56 Gafsa Métlaoui 57 Gafsa Moularès 58 Gafsa Redeyef 59 Gafsa Sened 60 Jendouba Aïn Draham 61 Jendouba Beni M'Tir 62 Jendouba Bou Salem 63 Jendouba Fernana 64 Jendouba Ghardimaou 65 Jendouba Jendouba 66 Jendouba Oued Melliz 67 Jendouba Tabarka 68 Kairouan Aïn Djeloula 69 Kairouan Alaâ 70 Kairouan Bou Hajla 71 Kairouan Chebika 72 Kairouan Echrarda 73 Kairouan Oueslatia 74 Kairouan -

Tunisia Fragil Democracy

German Council on Foreign Relations No. 2 January 2020 – first published in REPORT December 2018 Edited Volume Tunisia’s Fragile Democracy Decentralization, Institution-Building and the Development of Marginalized Regions – Policy Briefs from the Region and Europe Edited by Dina Fakoussa and Laura Lale Kabis-Kechrid 2 No. 2 | January 2020 – first published in December 2018 Tunisia’s Fragile Democracy REPORT The following papers were written by participants of the workshop “Promotion of Think Tank Work on the Development of Marginalized Regions and Institution-Building in Tunisia,” organized by the German Council on Foreign Relations’ Middle East and North Africa Program in the summer and fall of 2018 in cooperation with the Friedrich-Ebert-Stiftung in Tunis. The workshop is part of the program’s project on the promotion of think tank work in the Middle East and North Africa, which aims to strengthen the scientific and technical capacities of civil society actors in the region and the EU who are engaged in research and policy analysis and advice. It is realized with the support of the German Federal Foreign Office and the Institute for Foreign Cultural Relations (ifa e.V.). The content of the papers does not reflect the opinion of the DGAP. Responsibility for the information and views expressed herein lies entirely with the authors. The editorial closing date was October 28, 2018. Authors: Aniseh Bassiri Tabrizi, Mohamed Lamine Bel Haj Amor, Arwa Ben Ahmed, Elhem Ben Aicha, Ahmed Ben Nejma, Laroussi Bettaieb, Zied Boussen, Giulia Cimini, Rim Dhaouadi, Jihene Ferchichi, Darius Görgen, Oumaima Jegham, Tahar Kechrid, Maha Kouas, Anne Martin, and Ragnar Weilandt Edited by Dina Fakoussa and Laura Lale Kabis-Kechrid No. -

Kasserine and the Birth of a New Protest Movement in Tunisia

ASSESSMENT REPORT Kasserine and the Birth of a New Protest Movement in Tunisia Policy Analysis Unit - ACRPS | Feb 2016 Kasserine and the Birth of a New Protest Movement in Tunisia Series: Assessment Report Policy Analysis Unit – ACRPS | Feb 2016 Copyright © 2016 Arab Center for Research and Policy Studies. All Rights Reserved. ____________________________ The Arab Center for Research and Policy Studies is an independent research institute and think tank for the study of history and social sciences, with particular emphasis on the applied social sciences. The Center’s paramount concern is the advancement of Arab societies and states, their cooperation with one another and issues concerning the Arab nation in general. To that end, it seeks to examine and diagnose the situation in the Arab world - states and communities- to analyze social, economic and cultural policies and to provide political analysis, from an Arab perspective. The Center publishes in both Arabic and English in order to make its work accessible to both Arab and non-Arab researchers. Arab Center for Research and Policy Studies PO Box 10277 Street No. 826, Zone 66 Doha, Qatar Tel.: +974 44199777 | Fax: +974 44831651 www.dohainstitute.org Table of Contents Introduction 1 Failure to Address the Causes 2 Conflicts of the Elite and the Worries of the Normal Citizen 2 (Not) Dealing with the Crisis 4 Conclusion 5 KASSERINE, A NEW PROTEST MOVEMENT IN TUNISIA Introduction On January 19, a massive popular uprising erupted in the Tunisian city of Kasserine, located 300 km from the capital, Tunis, within the Tunisian hinterland and close to the Algeria frontier, on the eve of an anticipated country-wide celebration marking five years since a peaceful revolution toppled Zein El Abidine Ben Ali and established the country’s first pluralist government. -

Leishmania Major in Tunisia by Microsatellite Analysis

RESEARCH ARTICLE Spatio-temporal Genetic Structuring of Leishmania major in Tunisia by Microsatellite Analysis Myriam Harrabi1,2*, Jihène Bettaieb1, Wissem Ghawar1, Amine Toumi1, Amor Zaâtour1, Rihab Yazidi1, Sana Chaâbane1, Bilel Chalghaf1, Mallorie Hide3, Anne-Laure Bañuls3, Afif Ben Salah1 1 Institut Pasteur, Tunis, Tunisia, 2 Faculté des Sciences de Bizerte-Université de Carthage, Tunis, Tunisia, 3 UMR MIVEGEC (IRD 224-CNRS5290-Universités Montpellier 1 et 2), Centre IRD, Montpellier, France * [email protected] Abstract In Tunisia, cases of zoonotic cutaneous leishmaniasis caused by Leishmania major are increasing and spreading from the south-west to new areas in the center. To improve the current knowledge on L. major evolution and population dynamics, we performed multi- locus microsatellite typing of human isolates from Tunisian governorates where the disease is endemic (Gafsa, Kairouan and Sidi Bouzid governorates) and collected during two peri- OPEN ACCESS ods: 1991–1992 and 2008–2012. Analysis (F-statistics and Bayesian model-based approach) of the genotyping results of isolates collected in Sidi Bouzid in 1991–1992 and Citation: Harrabi M, Bettaieb J, Ghawar W, Toumi A, – Zaâtour A, Yazidi R, et al. (2015) Spatio-temporal 2008 2012 shows that, over two decades, in the same area, Leishmania parasites evolved Genetic Structuring of Leishmania major in Tunisia by by generating genetically differentiated populations. The genetic patterns of 2008–2012 iso- Microsatellite Analysis. PLoS Negl Trop Dis 9(8): lates from the three governorates indicate that L. major populations did not spread gradually e0004017. doi:10.1371/journal.pntd.0004017 from the south to the center of Tunisia, according to a geographical gradient, suggesting Editor: Gabriele Schönian, Charité University that human activities might be the source of the disease expansion. -

School of Economics and Management TECHNICAL UNIVERSITY of LISBON

School of Economics and Management TECHNICAL UNIVERSITY OF LISBON Department of Economics AntónioCarlos Afonso, Pestana Mohamed Barros &Ayadi, Nicolas Sourour Peypoch Ramzi Assessment of efficiency in basic and secondary education in A Comparative AnalysisTunisia of a Productregionalivity analysis Change in Italian and Portuguese Airports WP 06/2013/DE/UECE ___________________________________ ______________________ WP 006/2007/DE _________________________________________________________ WORKING PAPERS ISSN Nº 0874-4548 Assessment of efficiency in basic and secondary education in Tunisia: a regional analysis António AFONSO,† Mohamed AYADI,‡Sourour RAMZI * February 2013 Abstract We evaluate the efficiency of basic and secondary education in 24 governorates of Tunisia during the period 1999-2008 using a non-parametric approach, DEA (Data Envelopment Analysis). We use four inputs: number of teacher per 100 students, number of classes per 100 students, number of schools per million inhabitants and education spending per student, while the output measures include the success rate of baccalaureate exam and the rate of non- doubling in the 9th year. Our results show that there is a positive relationship between school resources and student achievement and performance. Moreover, there was an increase in output efficiency scores in most governorates through the period from 1999 to 2008. Keywords: basic and secondary education, efficiency, DEA, Tunisia JEL Codes: C14, H52, I21 † ISEG/UTL - Technical University of Lisbon, Department of Economics; UECE – Research Unit on Complexity and Economics.R. Miguel Lupi 20, 1249-078 Lisbon, Portugal. UECE is supported by FCT (Fundação para a Ciência e a Tecnologia, Portugal), email: [email protected]. ‡ UAQUAP-Institut Supérieur de Gestion de Tunis.e-mail : [email protected], Tél :(216) 98 377 467. -

Tunisia Investment Plan

Republic of Tunisia FOREST INVESTMENT PROGRAM IN TUNISIA 1. Independent Review of the FIP Tunisia 2. Matrix: Responses to comments and remarks of the independent expert November 2016 Ministère de l’Agriculture, des Direction Ressources Hydrauliques et de Générale des la Pêche Forêts 1 CONTENTS _______________________ I. Independent Review of the Forest Investment Plan of Tunisia 3 II. Matrix: Response to comments and remarks of the independent expert 25 2 I. Independent Review of the Forest Investment Plan of Tunisia Reviewer: Marjory-Anne Bromhead Date of review: (first draft review, 18th August 2016) PART I: Setting the context (from the reviewers overall understanding of the FIP document) Tunisia is the first country in North Africa and the Middle East to benefit from FIP support1, and provides an important example of a country where climate change mitigation and climate resilience go hand in hand. Tunisia is largely “forest poor”, with forests concentrated in the high rainfall areas in the north and North West of the country and covering only 5 percent of the territory (definitions vary). However rangelands are more widespread, covering 27 percent of the land area and are also a source of rural livelihoods and carbon sequestration, while both forests and rangelands are key to broader watershed management (Tunisia is water-scarce). Tunisia, together with the North Africa and Middle East region more broadly, is one of the regions most affected by climate change, with higher temperatures, more periods of extreme heat and more erratic rainfall. REDD actions will help to control erosion and conserve soil moisture and fertility, increasing climate resilience, while also reducing the country’s carbon footprint; the two benefits go hand in hand.