From Coca-Cola Successful New Product in Mexico This Year

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Coca Cola Was the Purchase of Parley Brands

SWAMI VIVEKANAND UNIVERSITY A PROJECT REPORT ON MARKETING STRATGIES OF TOP BRANDS OF COLD DRINKS Submitted in partial fulfilment for the Award of degree of Master in Management Studies UNDER THE GUIDANCE OF SUBMITTED BY Prof.SHWETA RAJPUT HEMANT SONI CERTIFICATE Certified that the dissertation title MARKETING STRATEGIES OF TOP BRANDS OF COLD DRINKS IN SAGAR is a bonafide work done Mr. HEMANI SONI under my guidance in partial fulfilment of Master in Management Studies programme . The views expressed in this dissertation is only of that of the researcher and the need not be those of this institute. This project work has been corrected by me. PROJECT GUIDE SWETA RAJPUT DATE:: PLACE: STUDENT’S DECLARATION I hereby declare that the Project Report conducted on MARKETING STRATEGIES OF TOP BRANDS OF COLD DRINKS Under the guidance of Ms. SHWETA RAJPUT Submitted in Partial fulfillment of the requirements for the Degree of MASTER OF BUSINESS ADMINISTRATION TO SVN COLLAGE Is my original work and the same has not been submitted for the award of any other Degree/diploma/fellowship or other similar titles or prizes. Place: SAGAR HEMANT SONI Date: ACKNOWLEDGEMENT It is indeed a pleasure doing a project on “MARKETING STRATEGIES OF TOP BRANDS OF COLD DRINKS”. I am grateful to sir Parmesh goutam (hod) for providing me this opportunity. I owe my indebtedness to My Project Guide Ms. Shweta rajput, for her keen interest, encouragement and constructive support and under whose able guidance I have completed out my project. She not only helped me in my project but also gave me an overall exposure to other issues related to retailing and answered all my queries calmly and patiently. -

Coca-Cola La Historia Negra De Las Aguas Negras

Coca-Cola La historia negra de las aguas negras Gustavo Castro Soto CIEPAC COCA-COLA LA HISTORIA NEGRA DE LAS AGUAS NEGRAS (Primera Parte) La Compañía Coca-Cola y algunos de sus directivos, desde tiempo atrás, han sido acusados de estar involucrados en evasión de impuestos, fraudes, asesinatos, torturas, amenazas y chantajes a trabajadores, sindicalistas, gobiernos y empresas. Se les ha acusado también de aliarse incluso con ejércitos y grupos paramilitares en Sudamérica. Amnistía Internacional y otras organizaciones de Derechos Humanos a nivel mundial han seguido de cerca estos casos. Desde hace más de 100 años la Compañía Coca-Cola incide sobre la realidad de los campesinos e indígenas cañeros ya sea comprando o dejando de comprar azúcar de caña con el fin de sustituir el dulce por alta fructuosa proveniente del maíz transgénico de los Estados Unidos. Sí, los refrescos de la marca Coca-Cola son transgénicos así como cualquier industria que usa alta fructuosa. ¿Se ha fijado usted en los ingredientes que se especifican en los empaques de los productos industrializados? La Coca-Cola también ha incidido en la vida de los productores de coca; es responsable también de la falta de agua en algunos lugares o de los cambios en las políticas públicas para privatizar el vital líquido o quedarse con los mantos freáticos. Incide en la economía de muchos países; en la industria del vidrio y del plástico y en otros componentes de su fórmula. Además de la economía y la política, ha incidido directamente en trastocar las culturas, desde Chamula en Chiapas hasta Japón o China, pasando por Rusia. -

Notes on the Financial Statements

he South African Breweries Limited is a holding Tcompany invested in and taking management responsibility for a portfolio of businesses, principally engaged in meeting mass market consumer needs mainly in the Southern African region. Beer is the major profit contributor, but an important balance is provided by signifisant interests in other beverages, retailing, hotels and the manufacture of selected consumer goods, together with strategic investments in businesses which complement the mainstream interests. T A Then Charles Glass sold his Castle Lager from V V a wagon to thirsty diggers during the late 19th Century Witwatersrand golds trike, he paved the way for the birth of SAB. Early Randlords persuaded Glass to part with his brewery and with venture capital raised through a London quotation, The South African Breweries Limited was registered in 1895. With the added impetus of a ISE listing in 1897, the new brewing company showed steady growth, buying hotels and other licensed outlets to expand the distribution network. The second stage of SAWs development started in the 1960's with a move into wines and spirits and the moulding of its hotel investments into a regenerated industry. By the 1970's, however, legal constraints made it imperative for SAB to broaden its investment base away from liquor. Due to SAWs affinity with a broad spectrum of consumers, the third stage of SAWs evolution involved the acquisition of significant mass market manufacturing and retailing investments and the inclusion of soft drinks and fruit juices in the Group's range of beverages. The contents arc listed on the inside back cover. -

Mexico Is the Number One Consumer of Coca-Cola in the World, with an Average of 225 Litres Per Person

Arca. Mexico is the number one Company. consumer of Coca-Cola in the On the whole, the CSD industry in world, with an average of 225 litres Mexico has recently become aware per person; a disproportionate of a consolidation process destined number which has surpassed the not to end, characterised by inventors. The consumption in the mergers and acquisitions amongst USA is “only” 200 litres per person. the main bottlers. The producers WATER & CSD This fizzy drink is considered an have widened their product Embotelladoras Arca essential part of the Mexican portfolio by also offering isotonic Coca-Cola Group people’s diet and can be found even drinks, mineral water, juice-based Monterrey, Mexico where there is no drinking water. drinks and products deriving from >> 4 shrinkwrappers Such trend on the Mexican market milk. Coca Cola Femsa, one of the SMI LSK 35 F is also evident in economical terms main subsidiaries of The Coca-Cola >> conveyor belts as it represents about 11% of Company in the world, operates in the global sales of The Coca Cola this context, as well as important 4 installation. local bottlers such as ARCA, CIMSA, BEPENSA and TIJUANA. The Coca-Cola Company These businesses, in addition to distributes 4 out of the the products from Atlanta, also 5 top beverage brands in produce their own label beverages. the world: Coca-Cola, Diet SMI has, to date, supplied the Coke, Sprite and Fanta. Coca Cola Group with about 300 During 2007, the company secondary packaging machines, a worked with over 400 brands and over 2,600 different third of which is installed in the beverages. -

La Coca-Cola En México: El Agua Tiembla (Décima Parte)

LA COCA-COLA EN MÉXICO: EL AGUA TIEMBLA (DÉCIMA PARTE) GUSTAVO CASTRO SOTO Chiapas, México; 7 de enero de 2005 Las empresas transnacionales van escalando cada vez más en la dirección de la economía global. En el caso de la Coca-Cola Company llegó a la cúspide del poder en México cuando Vicente Fox arribó a la presidencia de la república en el año 2000, quien fuera su Gerente General tiempo atrás. Desde entonces las refresqueras obtienen más concesiones de agua, exenciones de impuestos, disminución de aranceles y de cuotas de importación. Si en el tiempo del presidente Carlos Salinas de Gortari (1988-1994) uno de los empresarios mexicanos más beneficiado fue Carlos Slim quien se quedó con la paraestatal Telmex y actualmente es el rico más rico de América Latina y el Caribe, en el presente sexenio una de las embotelladoras de la Coca-Cola en México, Coca-Cola Femsa con sede en Monterrey, es la embotelladora más grande de América Latina y el Caribe. Así, las transnacionales mexicanas como Femsa, Telmex, Maseca, Bimbo, Cemex, entre otras, no se distinguen de las transnacionales gringas, europeas o asiáticas. Todas explotan al país y a su gente en el que se encuentren. Por ello, en el Foro Social Mundial (FSM) y otros escenarios altermundistas continentales y regionales se retoma la campaña de boicot contra la Coca-Cola. Coca-Cola Company tiene más riqueza que muchos países de América latina, el Caribe o África. En México ha comprado casi todas las marcas de refrescos del país y tiene las mayores concesiones para la extracción del agua. -

Coca-Cola at the Copacabana

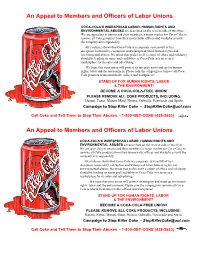

An Appeal to Members and Officers of Labor Unions COCA-COLA’S WIDESPREAD LABOR, HUMAN RIGHTS AND ENVIRONMENTAL ABUSES are described on the reverse side of this flyer. We are appealing to unions and their members, a major market for Coca-Cola, to remove all Coke products from their union halls, offices and workplaces until the company acts responsibly. All evidence shows that Coca-Cola is a corporate system full of lies, deception, immorality, corruption and widespread labor, human rights and environmental abuses. No union that prides itself a center of ethics and solidarity should be lending its name and credibility to Coca-Cola, nor serve as a marketplace for its sales and advertising. We hope that your union will protect its integrity and stand up for human rights, labor and the environment. Please join the campaign to remove all Coca- Cola products from union halls, offices and workplaces! STAND UP FOR HUMAN RIGHTS, LABOR & THE ENVIRONMENT! BECOME A COCA-COLA-FREE UNION! PLEASE REMOVE ALL COKE PRODUCTS, INCLUDING: Dasani, Fanta, Minute Maid, Nestea, Odwalla, Powerade and Sprite Campaign to Stop Killer Coke • [email protected] Call Coke and Tell Them to Stop Their Abuses • 1-800-GET-COKE (438-2653) An Appeal to Members and Officers of Labor Unions COCA-COLA’S WIDESPREAD LABOR, HUMAN RIGHTS AND ENVIRONMENTAL ABUSES are described on the reverse side of this flyer. We are appealing to unions and their members, a major market for Coca-Cola, to remove all Coke products from their union halls, offices and workplaces until the company acts responsibly. -

![Lecture8b [Compatibility Mode]](https://docslib.b-cdn.net/cover/2315/lecture8b-compatibility-mode-932315.webp)

Lecture8b [Compatibility Mode]

Lecture8. Product Management and Pursuit of Brands 第10 章 品牌追求轨迹 Economic development • Consumer behavior is influenced by economic development – Consumers in highly developed countries tend to demand extra performance attributes in their products • Price not a factor due to high income level – Consumers in less developed countries, value basic features as more important • Price remains a factor due to lower income level –Cars: no air-conditioning, power steering, power windows, radios and DVD players . • Product quality and reliability are more important 1 Consumer Demands and Product attributes • There are cultural differences that affect consumer needs. – Differ in social structure, language, religion and education – Impact of tradition and local customs: alcohol – Although some tastes and preferences becoming cosmopolitan • China is a developing country (middle income) with several distinctive market segments compared with a developed economy with a majority middle class. • Thus, there are heterogeneous needs and wants – Different products and features: basic features to multi-functions – Targeted marketing with a unique product or a wide mix • As income grows and the gap widens, different need segments have emerged: – Working/salary class: basic features and good price/value – Upper class: quality, brand, and luxury items – Mass marketing with a uniform product is no longer effective. – Creating needs for product variety and upgrades Integrating R&D, marketing and production • High failure rate ratio – Between 33 % and 60% of new products fail to earn adequate profits • Reasons for failure: – Limited product demand – Failure to adequately commercialize product – Inability to manufacture product cost-effectively – R&D generally lower among Chinese firms, but some domestic firms have better understanding of local customers: Lenovo vs. -

Casey V. Odwalla, Inc., Et

Case 7:17-cv-02148 Document 1 Filed 03/24/17 Page 1 of 16 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK TARA CASEY, on behalf of herself and all others similarly situated, Plaintiff, v. Case No. 7:17-cv-2148 CLASS ACTION COMPLAINT ODWALLA, INC., and THE COCA-COLA COMPANY, DEMAND FOR JURY TRIAL Defendants. Plaintiff Tara Casey (“Plaintiff”), on behalf of herself and all other persons similarly situated, files this Class Action Complaint (“Complaint”) against Defendants Odwalla, Inc., (“Odwalla”) and the Coca-Cola Company (“Coca-Cola”) (collectively “Defendants”), and alleges the following: NATURE OF THE ACTION 1. This is a proposed class action against Defendants for misleading consumers about the nature of the ingredients of Defendants’ “100% Juice” juices (“Products”) as compared to similar products. Defendant prominently label the Products with a “No Added Sugar” claim which does not comply with Food and Drug Administration (“FDA”) regulations promulgated pursuant to the Food, Drug and Cosmetic Act of 1938 (“FDCA”) regarding labeling nutrient content claims for sugar, regulations which are intended to stop the exact behavior in which Defendants are engaged. 2. FDA guidance provides that “the purpose of the ‘no sugar added’ claim is to present consumers with information that allows them to differentiate between similar foods that Case 7:17-cv-02148 Document 1 Filed 03/24/17 Page 2 of 16 would normally be expected to contain added sugars, with respect to the presence or absence of added sugars. Therefore, the ‘no added sugar’ claim is not appropriate to describe foods that do not normally contain added sugars.”1 3. -

Coca-Cola Owns Odwalla

Coca-Cola owns Odwalla In the past two Don’t Buy Odwalla. years, the global, grassroots campaign Until the Food Co-op establishes against Coca-Cola has a formal boycott policy, we are Other grown into the largest asking shoppers to voluntarily ways to anticorporate move- join the global campaign with ment since the help: campaign against other co-ops, campus groups, The international Nike for sweat- teachers federations, postal Campaign to Stop shop abuses. workers, union groups & more Killer Coke is From the Cam- who have passed resolutions to working to stop the cycle of murders, paign to Stop Killer boycott Coke-Odwalla products. Coke, to anti-Coke boycotts at over kidnappings and torture, to force Coca- 130 colleges and universities world- Cola to prevent further bloodshed and to wide, to the International Teamsters provide safe working conditions. See Among Coke’s more than www.killercoke.org action to blow the whistle on Coke’s 300 other brands to boycott: environmental, human rights, and International Brotherhood labor rights abuses, Coca-Cola is Dasani and Evian water, Sprite, Fanta, A&W, Dannon, Canada Dry, of Teamsters facing pressure for: Seagrams, Fresca, Nescafe, Barq’s, is the largest US union of Nestea, PowerAde, Bacardi Mixers, Coke’s own employees. • contaminating local ecosystems Fruitopia, Minute Maid, Sun Maid, Sign the Teamsters petition worldwide through the dumping of Hi-C, Dr. Pepper, Schweppes. “Tell Coke to Clean Up Its Act” toxic waste from its plants; pollution For the complete list, see www.thecoca-colacompany.com/ www.cokewatch.org of agricultural land, rivers and brands/brandlist.html groundwater. -

Securities and Exchange Commission Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 -------------- SCHEDULE TO (Rule 14d-100) Tender Offer Statement Under Section 14(d)(1) or 13(e)(1) of the Securities Exchange Act of 1934 ODWALLA, INC. (Name of Subject Company (Issuer)) TCCC ACQUISITION CORP. and THE COCA-COLA COMPANY (Offerors) (Names of Filing Persons(identifying status as offeror, issuer or other person)) Common Stock, no par value per share (Title of Class of Securities) 676111107 (Cusip Number of Class of Securities) ------------------------- TCCC Acquisition Corp. c/o The Coca-Cola Company One Coca-Cola Plaza Atlanta, Georgia 30313 Attention: Paul Etchells Telephone: (404) 676-2121 (Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Bidders) ---------------- Copies to: C. William Baxley, Esq. Alana L. Griffin, Esq. King & Spalding 191 Peachtree Street Atlanta, Georgia 30303-1763 Telephone: (404) 572-4600 ---------------- CALCULATION OF FILING FEE ================================================================================ TRANSACTION VALUATION* AMOUNT OF FILING FEE ---------------------- -------------------- $199,191,108 $39,839 ================================================================================ * For the purpose of calculating the fee only, this amount assumes the purchase of 13,061,712 shares of common stock, no par value per share, of Odwalla, Inc. at $15.25 per share. Such number includes all outstanding shares as of October 25, 2001, and assumes the exercise of all stock options and warrants to purchase shares of Common Stock which are outstanding as of such date. --- Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. -

Odwalla® Bars

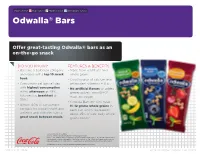

Approved for: High School Middle School Elementary School Odwalla® Bars Offer great-tasting Odwalla® bars as an on-the-go snack DID YOU KNOW? FEATURES & BENEFITS • Bars are a $5 billion category • Made from real fruits and and represent a top 10 snack whole grains 1 food. • Good source of calcium and • Consumers eat bars all day antioxidant vitamins A & E with highest consumption • No artificial flavors or added in the afternoon at 48%, p r e s e r v a t i v e s , n o n - G M O * , followed by breakfast at most are vegan 39%.2 • Odwalla Bars for Kids have • Almost 60% of consumers 11 -12 grams whole grains in eat bars for overall health and each bar, which represents wellness and consider bars a about 25% of kids’ daily whole 2 great snack between meals. grains needs3 Source 1: AOC YTD thru 6/29/13 Source 2: Mintel, February 2012 Nutrition and Energy Bar Report Source 3: The USDA My Plate food guidance system recommends kids ages 4 – 13 years old consume half of their daily grain intake as whole grains. Odwalla Bars for Kids has 12g – 13g of whole grains per bar which is equivalent to about 25% of kids’ daily whole grain needs, as recommended by the Whole Grains Council. *Odwalla chooses not to use bioengineered ingredients when a choice exists. ©2014 Coca-Cola Company EDUCATION CHANNEL | Odwalla Bars | v2.0 | 02-2014 BRAND FACTS Odwalla® Bars potentialyour potential profits profits Odwalla Bars are formulated with a good source of essential vitamins and minerals, including vitamins A, E and AverageAverage retailretail calcium. -

2021 Q2 Earnings Release

Coca-Cola Reports Strong Results in Second Quarter; Updates Full Year Guidance Global Unit Case Volume Grew 18% Net Revenues Grew 42%; Organic Revenues (Non-GAAP) Grew 37% Operating Income Grew 52%; Comparable Currency Neutral Operating Income (Non-GAAP) Grew 46% Operating Margin Was 29.8% Versus 27.7% in the Prior Year; Comparable Operating Margin (Non-GAAP) Was 31.7% Versus 30.0% in the Prior Year EPS Grew 48% to $0.61; Comparable EPS (Non-GAAP) Grew 61% to $0.68 ATLANTA, July 21, 2021 – The Coca-Cola Company today reported strong second quarter 2021 results and year-to- date performance. “Our results in the second quarter show how our business is rebounding faster than the overall economic recovery, led by our accelerated transformation. As a result, we are encouraged and, despite the asynchronous nature of the recovery, we are raising our full year guidance,” said James Quincey, Chairman and CEO of The Coca-Cola Company. “We are executing against our growth plans and our system is aligned. We are better equipped than ever to win in this growing, vibrant industry and to accelerate value creation for our stakeholders.” Highlights Quarterly Performance • Revenues: Net revenues grew 42% to $10.1 billion, and organic revenues (non-GAAP) grew 37%. Revenue performance included 26% growth in concentrate sales and 11% growth in price/mix. Revenue growth was driven by the ongoing recovery in markets where coronavirus-related uncertainty is abating, along with the benefit from cycling revenue declines from the impact of the coronavirus pandemic last year. • Margin: Operating margin, which included items impacting comparability, was 29.8% versus 27.7% in the prior year, while comparable operating margin (non-GAAP) was 31.7% versus 30.0% in the prior year.