Coverstory Machinerytechnology

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

People & Economic Activity

PEOPLE & ECONOMIC ACTIVITY STARBUCKS An economic enterpise at a local scale Dr Susan Bliss STAGE 6: Geographical investigation ‘Students will conduct a geographical study of an economic enterprise operating at a local scale. The business could be a firm or company such as a chain of restaurants. 1. Nature of the economic enterprise – chain of 5. Ecological dimension restaurants, Starbucks • Inputs: coffee, sugar, milk, food, energy, water, • Overview of coffee restaurants – types sizes and transport, buildings growth. Latte towns, coffee shops in gentrified inner • Outputs: carbon and water footprints; waste. suburbs and coffee sold in grocery stores, petrol stations and book stores. Drive through coffee places • Environmental goals: sustainability.‘Grounds for your and mobile coffee carts. Order via technology-on garden’, green power, reduce ecological footprints demand. Evolving coffee culture. and waste, recycling, corporate social responsibilities, farmer equity practices, Fairtrade, Ethos water, • Growth of coffee restaurant chains donations of leftover food 2. Locational factors 6. Environmental constraints: climate change, • Refer to website for store locations and Google Earth environmental laws (local, national). • Site, situation, latitude, longitude 7. Effects of global changes on enterprise: • Scale – global, national, local prices, trade agreements, tariffs, climate change, competition (e.g. McDonalds, soft drinks, tea, water), • Reasons for location – advantages changing consumer tastes. Growth of organic and • Growth in Asian countries https://www.starbucks. speciality coffees. Future trends – Waves of Coffee com/store- locator?map=40.743095,-95.625,5z Starbucks chain of restaurants 3. Flows Today Starbucks is the largest coffee chain in the world, • People: customers – ages as well as the premier roaster and retailer of specialty • Goods: coffee, milk, sugar, food coffee. -

Menù UNICO MAGGIO 2021 INGLESE

WWW.MAGENTINOMILANO.IT CUCINA TRADIZIONALMENTE ITALIANA WWW.MAGENTINOMILANO.IT CORSO MAGENTA 14 20123 MILANO TEL. 02 84945372 CUCINA E GOLOSITÀ CORSO MAGENTA 14 20123 MILANO TEL. 02 84945368 WWW.MAGENTINO.IT delicious dishes and goodies martini cocktails HAUSE MARTINI €. 7,00 PLATTER OF COLD MEATS AND CHEESE €. 18,00 DRY MARTINI €. 7,00 GIBSON €. 7,00 PERFECT €. 7,00 PARMA HAM AND MOZZARELLA CHEESE 125g. €. 13,00 MANTGOMERY €. 7,00 VESPER €. 7,00 PARMA HAM AND MOZZARELLA CHEESE 250g. €. 15,00 SMOKED MARTINI €. 7,00 CANDY MARTINI €. 7,00 DIRTY €. 7,00 GRILLED VEGETABLES AND MOZZARELLA CHEESE 125g €. 13,00 LADY MARTINI €. 7,00 APPLE MARTINI €. 7,00 GRILLED VEGETABLES AND MOZZARELLA CHEESE 250g. €. 15,00 drinks with tomato sauce BLOODY MARY vodka, tomato juice, condiments €. 7,00 RICOTTA CHEESE AND GRILLED VEGETABLES €. 12,50 VIRGIN MARY tomato juice, condiments €. 6,00 BULL SHOT vodka, meat broth €. 7,00 BRESAOLA HAM, ROCKET SALAD, PARMESAN CHEESE AND BLOODY BULL vodka, tomato juice, condiments, meat broth €. 7,00 CHERRY TOMATOES €. 14,00 BLOODY BEER vodka, beer, tomato juice, condiments €. 7,00 SANGRITA tomato juice, orange juice, alcohol based €. 7,00 salads timeless cocktails original versions WILD SALAD: mixed salad, cherry tomatoes, grilled zucchini, EEG NOG alcohol based alcol, sugar, milk, yolk, nutmeg. €. 7,00 smoked meat, scamorza cheese. €. 12,00 BLACK O WHITE RUSSIAN vodka, coffee liqueur, cream. €. 7,00 MARGARITA tequila, lime, triple sec. €. 7,00 MOJITO ORIGINAL rum, lime, sugar, mint, soda. €. 7,00 MAGENTINO CLUB SALAD: salad, cherry tomatoes, bacon, MOJITO FIDEL rum, lime, sugar, mint, beer. €. 7,00 chicken, hard-boiled egg, bread croutons, club sauce. -

Coca-Cola at the Copacabana

An Appeal to Members and Officers of Labor Unions COCA-COLA’S WIDESPREAD LABOR, HUMAN RIGHTS AND ENVIRONMENTAL ABUSES are described on the reverse side of this flyer. We are appealing to unions and their members, a major market for Coca-Cola, to remove all Coke products from their union halls, offices and workplaces until the company acts responsibly. All evidence shows that Coca-Cola is a corporate system full of lies, deception, immorality, corruption and widespread labor, human rights and environmental abuses. No union that prides itself a center of ethics and solidarity should be lending its name and credibility to Coca-Cola, nor serve as a marketplace for its sales and advertising. We hope that your union will protect its integrity and stand up for human rights, labor and the environment. Please join the campaign to remove all Coca- Cola products from union halls, offices and workplaces! STAND UP FOR HUMAN RIGHTS, LABOR & THE ENVIRONMENT! BECOME A COCA-COLA-FREE UNION! PLEASE REMOVE ALL COKE PRODUCTS, INCLUDING: Dasani, Fanta, Minute Maid, Nestea, Odwalla, Powerade and Sprite Campaign to Stop Killer Coke • [email protected] Call Coke and Tell Them to Stop Their Abuses • 1-800-GET-COKE (438-2653) An Appeal to Members and Officers of Labor Unions COCA-COLA’S WIDESPREAD LABOR, HUMAN RIGHTS AND ENVIRONMENTAL ABUSES are described on the reverse side of this flyer. We are appealing to unions and their members, a major market for Coca-Cola, to remove all Coke products from their union halls, offices and workplaces until the company acts responsibly. -

Casey V. Odwalla, Inc., Et

Case 7:17-cv-02148 Document 1 Filed 03/24/17 Page 1 of 16 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK TARA CASEY, on behalf of herself and all others similarly situated, Plaintiff, v. Case No. 7:17-cv-2148 CLASS ACTION COMPLAINT ODWALLA, INC., and THE COCA-COLA COMPANY, DEMAND FOR JURY TRIAL Defendants. Plaintiff Tara Casey (“Plaintiff”), on behalf of herself and all other persons similarly situated, files this Class Action Complaint (“Complaint”) against Defendants Odwalla, Inc., (“Odwalla”) and the Coca-Cola Company (“Coca-Cola”) (collectively “Defendants”), and alleges the following: NATURE OF THE ACTION 1. This is a proposed class action against Defendants for misleading consumers about the nature of the ingredients of Defendants’ “100% Juice” juices (“Products”) as compared to similar products. Defendant prominently label the Products with a “No Added Sugar” claim which does not comply with Food and Drug Administration (“FDA”) regulations promulgated pursuant to the Food, Drug and Cosmetic Act of 1938 (“FDCA”) regarding labeling nutrient content claims for sugar, regulations which are intended to stop the exact behavior in which Defendants are engaged. 2. FDA guidance provides that “the purpose of the ‘no sugar added’ claim is to present consumers with information that allows them to differentiate between similar foods that Case 7:17-cv-02148 Document 1 Filed 03/24/17 Page 2 of 16 would normally be expected to contain added sugars, with respect to the presence or absence of added sugars. Therefore, the ‘no added sugar’ claim is not appropriate to describe foods that do not normally contain added sugars.”1 3. -

Coffees Serving Size Caffeine (Mg)

Coffees Serving Size Caffeine (mg) Dunkin' Donuts Coffee with Turbo Shot large, 20 fl. oz. 436 Starbucks Coffee venti, 20 fl. oz. 415 Starbucks Coffee grande, 16 fl. oz. 330 Panera Frozen Mocha 16.5 fl. oz. 267 Starbucks Coffee tall, 12 fl. oz. 260 Starbucks Caffè Americano grande, 16 fl. oz. 225 Panera Coffee regular, 16.8 fl. oz. 189 Starbucks Espresso Frappuccino venti, 24 fl. oz. 185 Dunkin' Donuts Coffee medium, 14 fl. oz. 178 Starbucks Caffè Mocha grande, 16 fl. oz. 175 Starbucks Iced Coffee grande, 16 fl. oz. 165 Maxwell House Ground Coffee—100% Colombian, Dark Roast, 2 Tbs., makes 12 fl. Master Blend, or Original Roast oz. 100-160 Dunkin' Donuts Cappuccino large, 20 fl. oz. 151 Starbucks—Caffè Latte, Cappuccino, or Caramel Macchiato grande, 16 fl. oz. 150 Starbucks Espresso doppio, 2 fl. oz. 150 Keurig Coffee K-Cup, all varieties 1 cup, makes 8 fl. oz. 75-150 2 tsp., makes 12 fl. Folgers Classic Roast Instant Coffee oz. 148 Starbucks Doubleshot Energy Coffee, can 15 fl. oz. 146 Starbucks Mocha Frappuccino venti, 24 fl. oz. 140 1 packet, makes 8 fl. Starbucks VIA House Blend Instant Coffee oz. 135 McDonald's Coffee large, 16 fl. oz. 133 2⅔ Tbs., makes 12- Maxwell House International Café, all flavors 16 fl. oz. 40-130 Seattle's Best Coffee—Iced Latte or Iced Mocha, can 9.5 fl. oz. 90 Starbucks Frappuccino Coffee, bottle 9.5 fl. oz. 90 International Delight Iced Coffee 8 fl. oz. 76 2 Tbs., makes 12 fl. Maxwell House Lite Ground Coffee oz. -

Thirst for Innovation

QUENCH YOUR THIRST FOR INNOVATION In a market like this, you need to operate at peak performance. Beverage processors need every advantage they can get. Today, your biggest opportunity lies in innovation. At the Worldwide Food Expo, you’ll see how new technologies can address today’s hot topics — from trends and ingredients to food safety, sustainability and how to “green” your operations and packaging. This is the one event that encompasses the entire dairy, food and beverage production process from beginning to end. So go ahead, quench your thirst and better your bottomline. WHERE THE DAIRY AND FOOD INDUSTRY COME TOGETHER OCTOBER 28–31, 2009 CHICAGO, ILLINOIS McCORMICK PLACE WWW.WORLDWIDEFOOD.COM MOVING AT THE SPEED OF INNOVATION REGISTER TODAY! USE PRIORITY CODE ASD08 Soft Drinks Internationa l – October 2009 ConTEnTS 1 news Europe 4 Africa 6 Middle East 8 The leading English language magazine published in Europe, devoted exclusively to the Asia Pacific 10 manufacture, distribution and marketing of soft drinks, fruit juices and bottled water. Americas 12 Ingredients 14 features Juices & Juice Drinks 18 Energy & Sports 20 Drinks With Attitude 26 The energy drinks caTegory conTinues Waters & Water Plus Drinks 22 To grow and boosTed by The inTroduc - Carbonates 23 Tion of innovaTion such as The energy shoT. Rob Walker gives his analysis. Building A Green Employment Brand 36 Packaging 46 User Friendly Fortification RecruiTing and reTaining like-minded Environment 48 employees can pay dividends, reporTs 28 MargueriTe GranaT. People On-Trend, producT innovaTion has 50 been made easier, according To Events 51 Glanbia NuTriTionals. Sincerity 38 Jo Jacobius Takes a look aT boTTled Bubbling Up 53 waTer producers who Truly Take Meeting The Challenge 30 environmenTal and susTainabiliTy Choosing The righT sweeTener sysTem issues To hearT. -

Coca-Cola Owns Odwalla

Coca-Cola owns Odwalla In the past two Don’t Buy Odwalla. years, the global, grassroots campaign Until the Food Co-op establishes against Coca-Cola has a formal boycott policy, we are Other grown into the largest asking shoppers to voluntarily ways to anticorporate move- join the global campaign with ment since the help: campaign against other co-ops, campus groups, The international Nike for sweat- teachers federations, postal Campaign to Stop shop abuses. workers, union groups & more Killer Coke is From the Cam- who have passed resolutions to working to stop the cycle of murders, paign to Stop Killer boycott Coke-Odwalla products. Coke, to anti-Coke boycotts at over kidnappings and torture, to force Coca- 130 colleges and universities world- Cola to prevent further bloodshed and to wide, to the International Teamsters provide safe working conditions. See Among Coke’s more than www.killercoke.org action to blow the whistle on Coke’s 300 other brands to boycott: environmental, human rights, and International Brotherhood labor rights abuses, Coca-Cola is Dasani and Evian water, Sprite, Fanta, A&W, Dannon, Canada Dry, of Teamsters facing pressure for: Seagrams, Fresca, Nescafe, Barq’s, is the largest US union of Nestea, PowerAde, Bacardi Mixers, Coke’s own employees. • contaminating local ecosystems Fruitopia, Minute Maid, Sun Maid, Sign the Teamsters petition worldwide through the dumping of Hi-C, Dr. Pepper, Schweppes. “Tell Coke to Clean Up Its Act” toxic waste from its plants; pollution For the complete list, see www.thecoca-colacompany.com/ www.cokewatch.org of agricultural land, rivers and brands/brandlist.html groundwater. -

A Guide to the Soft Drink Industry Acknowledgments

BREAKING DOWN THE CHAIN: A GUIDE TO THE SOFT DRINK INDUSTRY ACKNOWLEDGMENTS This report was developed to provide a detailed understanding of how the soft drink industry works, outlining the steps involved in producing, distributing, and marketing soft drinks and exploring how the industry has responded to recent efforts to impose taxes on sugar-sweetened beverages in particular. The report was prepared by Sierra Services, Inc., in collaboration with the Supply Chain Management Center (SCMC) at Rutgers University – Newark and New Brunswick. The authors wish to thank Kristen Condrat for her outstanding support in all phases of preparing this report, including literature review and identifying source documents, writing, data analysis, editing, and final review. Special thanks also goes to Susanne Viscarra, who provided copyediting services. Christine Fry, Carrie Spector, Kim Arroyo Williamson, and Ayela Mujeeb of ChangeLab Solutions prepared the report for publication. ChangeLab Solutions would like to thank Roberta Friedman of the Yale Rudd Center for Food Policy and Obesity for expert review. For questions or comments regarding this report, please contact the supervising professors: Jerome D. Williams, PhD Prudential Chair in Business and Research Director – The Center for Urban Entrepreneurship & Economic Development (CUEED), Rutgers Business School – Newark and New Brunswick, Management and Global Business Department 1 Washington Park – Room 1040 Newark, NJ 07102 Phone: 973-353-3682 Fax: 973-353-5427 [email protected] www.business.rutgers.edu/CUEED Paul Goldsworthy Senior Industry Project Manager Department of Supply Chain Management & Marketing Sciences Rutgers Business School Phone: 908-798-0908 [email protected] Design: Karen Parry | Black Graphics The National Policy & Legal Analysis Network to Prevent Childhood Obesity (NPLAN) is a project of ChangeLab Solutions. -

Menupro 2013Diningmenu

Appetizers New England Style Clam Chowder ... 4.95 5.95 Onion rings ..................................... 5.95 6.95 Made from scratch using a recipe dating back A heaping pile made fresh to order to 1872 Battered Mushrooms ...................... 5.95 6.95 Battered Beets ................................ 5.95 6.95 Mushrooms cut and lightly battered made Thin sliced beetroot in a light batter made fresh to order fresh to order Slitheen Fresh Garden Salad ................................. 4.95 Scotch Egg Salad .................................................... 8.95 with choice of ranch, blue cheese, honey A hard boiled egg wrapped in sausage meat, mustard, Italian, raspberry vinaigrette, coated in breadcrumbs and deep fried, then balsamic vinaigrette or thousand islands served on a garden salad. Main Catch Pollock ..................................................................................................................................................... 6.95 8.95 Cod Fish & Chips ...................................................................................................................................... 9.95 12.95 Red Snapper Fish & Chips ........................................................................................................................ 9.95 12.95 Haddock Fish & Chips .............................................................................................................................. 9.95 12.95 Halibut Fish & Chips ........................................................................................................................................... -

Securities and Exchange Commission Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 -------------- SCHEDULE TO (Rule 14d-100) Tender Offer Statement Under Section 14(d)(1) or 13(e)(1) of the Securities Exchange Act of 1934 ODWALLA, INC. (Name of Subject Company (Issuer)) TCCC ACQUISITION CORP. and THE COCA-COLA COMPANY (Offerors) (Names of Filing Persons(identifying status as offeror, issuer or other person)) Common Stock, no par value per share (Title of Class of Securities) 676111107 (Cusip Number of Class of Securities) ------------------------- TCCC Acquisition Corp. c/o The Coca-Cola Company One Coca-Cola Plaza Atlanta, Georgia 30313 Attention: Paul Etchells Telephone: (404) 676-2121 (Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Bidders) ---------------- Copies to: C. William Baxley, Esq. Alana L. Griffin, Esq. King & Spalding 191 Peachtree Street Atlanta, Georgia 30303-1763 Telephone: (404) 572-4600 ---------------- CALCULATION OF FILING FEE ================================================================================ TRANSACTION VALUATION* AMOUNT OF FILING FEE ---------------------- -------------------- $199,191,108 $39,839 ================================================================================ * For the purpose of calculating the fee only, this amount assumes the purchase of 13,061,712 shares of common stock, no par value per share, of Odwalla, Inc. at $15.25 per share. Such number includes all outstanding shares as of October 25, 2001, and assumes the exercise of all stock options and warrants to purchase shares of Common Stock which are outstanding as of such date. --- Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. -

Odwalla® Bars

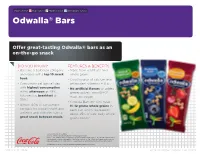

Approved for: High School Middle School Elementary School Odwalla® Bars Offer great-tasting Odwalla® bars as an on-the-go snack DID YOU KNOW? FEATURES & BENEFITS • Bars are a $5 billion category • Made from real fruits and and represent a top 10 snack whole grains 1 food. • Good source of calcium and • Consumers eat bars all day antioxidant vitamins A & E with highest consumption • No artificial flavors or added in the afternoon at 48%, p r e s e r v a t i v e s , n o n - G M O * , followed by breakfast at most are vegan 39%.2 • Odwalla Bars for Kids have • Almost 60% of consumers 11 -12 grams whole grains in eat bars for overall health and each bar, which represents wellness and consider bars a about 25% of kids’ daily whole 2 great snack between meals. grains needs3 Source 1: AOC YTD thru 6/29/13 Source 2: Mintel, February 2012 Nutrition and Energy Bar Report Source 3: The USDA My Plate food guidance system recommends kids ages 4 – 13 years old consume half of their daily grain intake as whole grains. Odwalla Bars for Kids has 12g – 13g of whole grains per bar which is equivalent to about 25% of kids’ daily whole grain needs, as recommended by the Whole Grains Council. *Odwalla chooses not to use bioengineered ingredients when a choice exists. ©2014 Coca-Cola Company EDUCATION CHANNEL | Odwalla Bars | v2.0 | 02-2014 BRAND FACTS Odwalla® Bars potentialyour potential profits profits Odwalla Bars are formulated with a good source of essential vitamins and minerals, including vitamins A, E and AverageAverage retailretail calcium. -

2021 Q2 Earnings Release

Coca-Cola Reports Strong Results in Second Quarter; Updates Full Year Guidance Global Unit Case Volume Grew 18% Net Revenues Grew 42%; Organic Revenues (Non-GAAP) Grew 37% Operating Income Grew 52%; Comparable Currency Neutral Operating Income (Non-GAAP) Grew 46% Operating Margin Was 29.8% Versus 27.7% in the Prior Year; Comparable Operating Margin (Non-GAAP) Was 31.7% Versus 30.0% in the Prior Year EPS Grew 48% to $0.61; Comparable EPS (Non-GAAP) Grew 61% to $0.68 ATLANTA, July 21, 2021 – The Coca-Cola Company today reported strong second quarter 2021 results and year-to- date performance. “Our results in the second quarter show how our business is rebounding faster than the overall economic recovery, led by our accelerated transformation. As a result, we are encouraged and, despite the asynchronous nature of the recovery, we are raising our full year guidance,” said James Quincey, Chairman and CEO of The Coca-Cola Company. “We are executing against our growth plans and our system is aligned. We are better equipped than ever to win in this growing, vibrant industry and to accelerate value creation for our stakeholders.” Highlights Quarterly Performance • Revenues: Net revenues grew 42% to $10.1 billion, and organic revenues (non-GAAP) grew 37%. Revenue performance included 26% growth in concentrate sales and 11% growth in price/mix. Revenue growth was driven by the ongoing recovery in markets where coronavirus-related uncertainty is abating, along with the benefit from cycling revenue declines from the impact of the coronavirus pandemic last year. • Margin: Operating margin, which included items impacting comparability, was 29.8% versus 27.7% in the prior year, while comparable operating margin (non-GAAP) was 31.7% versus 30.0% in the prior year.