Evaluation of DCA Guarantees to MCC and SOGESOL

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Freedom As Marronage

Freedom as Marronage Freedom as Marronage NEIL ROBERTS The University of Chicago Press Chicago and London Neil Roberts is associate professor of Africana studies and a faculty affiliate in political science at Williams College. The University of Chicago Press, Chicago 60637 The University of Chicago Press, Ltd., London © 2015 by The University of Chicago All rights reserved. Published 2015. Printed in the United States of America 24 23 22 21 20 19 18 17 16 15 1 2 3 4 5 ISBN- 13: 978- 0- 226- 12746- 0 (cloth) ISBN- 13: 978- 0- 226- 20104- 7 (paper) ISBN- 13: 978- 0- 226- 20118- 4 (e- book) DOI: 10.7208/chicago/9780226201184.001.0001 Jacket illustration: LeRoy Clarke, A Prophetic Flaming Forest, oil on canvas, 2003. Library of Congress Cataloging- in- Publication Data Roberts, Neil, 1976– author. Freedom as marronage / Neil Roberts. pages ; cm Includes bibliographical references and index. ISBN 978- 0- 226- 12746- 0 (cloth : alk. paper) — ISBN 978- 0- 226- 20104- 7 (pbk : alk. paper) — ISBN 978- 0- 226- 20118- 4 (e- book) 1. Maroons. 2. Fugitive slaves—Caribbean Area. 3. Liberty. I. Title. F2191.B55R62 2015 323.1196'0729—dc23 2014020609 o This paper meets the requirements of ANSI/NISO Z39.48– 1992 (Permanence of Paper). For Karima and Kofi Time would pass, old empires would fall and new ones take their place, the relations of countries and the relations of classes had to change, before I discovered that it is not quality of goods and utility which matter, but movement; not where you are or what you have, but where you have come from, where you are going and the rate at which you are getting there. -

Danceafrica 2003

BAM 2003 Spring Brooklyn Academy of Music Alan H. Fishman William I. Campbell Chairman of the Board Vice Chairman of the Board Karen Brooks Hopkins Joseph V. Melillo President Executive Producer presents DanceAfrica 2003 Approximate Rhythmic Rites and Rituals: running time: Connecting Cultural Borders 2 hours 30 BAM Howard Gilman Opera House minutes with May 23 & 24 at 7:30pm; May 24 at 2pm; May 25 at 3pm one intermission Artistic director Chuck Davis Lighting design William H. Grant III Kulu Mele African American Dance Ensemble (Philadelphia) Muntu Dance Theatre of Chicago Resurrection Dance Theater of Haiti and BAM/Restoration DanceAfrica Ensemble Stage manager N'Goma Woolbright Assistant stage manager Normadien Woolbright Production stage manager Janet D. Clancy BAM 2003 Spring Season is sponsored by Altria Group, Inc. Major support for DanceAfrica 2003 is provided by AT&T and Morgan Stanley. Additional support is provided by Con Edison and KeySpan Foundation. BAM Dance is supported by The Harkness Foundation for Dance. BAM thanks Theatre Development Fund for its support of this season. ~l PrOQram Rhythmic Rites and Rituals: Connecting Cultural Borders (Note: A Libation Ceremony in front of BAM precedes the May 23 opening night performance.) Processional The audience members are asked to remain seated to acknowledge the presence of the elders whose collective knowledge guides us into the future. The dressing of the first two seats honors the Elders who have made the transition to the Ancestral Grounds: Baba Walter P Brown, Papa Scuddie McGee, Mama Sarah McGee, and Baba M.B. Olatunji. Jalibah Baba Chuck Davis extends the traditional greetings and welcomes all to the Bantaba (dancing ground). -

PDF (Author Accepted Manuscript)

Article People without Shoes: Jacques Roumain, Langston Hughes and Their Transnational Ti Nèg Aesthetic Willson, Nicole Louise Available at http://clok.uclan.ac.uk/30584/ Willson, Nicole Louise ORCID: 0000-0001-5935-9075 (2017) People without Shoes: Jacques Roumain, Langston Hughes and Their Transnational Ti Nèg Aesthetic. Comparative American Studies An International Journal, 15 (3-4). pp. 141-161. ISSN 1477-5700 It is advisable to refer to the publisher’s version if you intend to cite from the work. http://dx.doi.org/10.1080/14775700.2017.1551601 For more information about UCLan’s research in this area go to http://www.uclan.ac.uk/researchgroups/ and search for <name of research Group>. For information about Research generally at UCLan please go to http://www.uclan.ac.uk/research/ All outputs in CLoK are protected by Intellectual Property Rights law, including Copyright law. Copyright, IPR and Moral Rights for the works on this site are retained by the individual authors and/or other copyright owners. Terms and conditions for use of this material are defined in the policies page. CLoK Central Lancashire online Knowledge www.clok.uclan.ac.uk People Without Shoes: Jacques Roumain, Langston Hughes and their Transnational Ti Nèg Aesthetic Nicole Louise Willson, University of Kent In 1931, the Harlem Renaissance thinker, writer, and activist Langston Hughes travelled to Haiti via Cuba with a young African-American art student named Zell Ingram. During their three- month stay, they developed an acute insight into the lives of the Haitian people and the cultural, political, and economic turmoil wrought by a fifteen-year imperialist occupation by the United States—an occupation which would last at least another three years, but whose effects would continue to be felt long beyond. -

A TIMELINE of DOMINICAN HISTORY Ruth Glasser

UNIT 7 • READING A TIMELINE OF DOMINICAN HISTORY Ruth Glasser PERIOD 3000 BC AD 700s 1400s POLITICAL Several discrete Taíno tribes 1492 The Spanish Taíno tribes exist attempt to Columbus arrives Crown quells on the island, ruled confederate, on Quisqueya, rebellions by caciques, or are interrupted names it among the early chiefs. by the arrival Hispaniola Spanish settlers of the Spanish. (Española in by granting Spanish), and them land and builds the fort indigenous La Navidad. people as slaves. SOCIAL/ECONOMIC Taínos on the Spanish decide island have to mine for gold. evolved into a well-defi ned society built around fi shing, farming, and hunting. DEMOGRAPHIC Indigenous As many as Early Spanish settlers arrive, groups migrate 500,000 Taínos primarily from Andalusia. from South live on the America to the island. Caribbean, including to the island later known as Quisqueya. This image of Alcázar de Colon constrasts the old and new—the 1490s fortress built by Columbus and the sculpted trees of Ciudad Trujillo, as Santo Domingo was renamed during the dictator’s regime. SOURCES: Silvio Torres-Saillant and Ramona Hernández, Th e Dominican Americans (Westport, CT: Greenwood Press, 1998); Jan Knippers Black, Th e Dominican Republic: Politics and Development in an Unsovereign State (Boston: Allen and Unwin, 1986); Frank Moya Pons, Th e Dominican Republic: A National History (New Rochelle, NY: Hispaniola Books, 1995); H. Hoetink, Th e Dominican People 1850–1900: Notes for a Historical Sociology (Baltimore: Johns Hopkins University Press, 1982); BBC News, “Timeline: Dominican Republic,” http://news.bbc.co.uk/1/hi/world/americas/country_profi les/1216926.stm PART I: GEOGRAPHY, HISTORY, ECONOMY 27 A TIMELINE OF DOMINICAN HISTORY PERIOD 1500s MAP COLLECTION, UNIVERSITYYALE LIBRARY 1600s POLITICAL 1500 1605 First governor of the island is Colonial authorities appointed by the Spanish monarchs. -

Les Parcours Du Marronnage Dans L'histoire Haïtienne

Les parcours du marronnage dans l’histoire Haïtienne Dimitri Béchacq To cite this version: Dimitri Béchacq. Les parcours du marronnage dans l’histoire Haïtienne : Entre instrumentalisation politique et réinterprétation sociale. Ethnologies, Folklore Studies Association of Canada, 2006, Haïti - Face au passé, 28 (1), pp.203-240. 10.7202/014155ar. hal-01896241 HAL Id: hal-01896241 https://hal.archives-ouvertes.fr/hal-01896241 Submitted on 15 Oct 2018 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. Copyright Document généré le 15 oct. 2018 13:45 Ethnologies Les parcours du marronnage dans l’histoire haïtienne : Entre instrumentalisation politique et réinterprétation sociale Dimitri Béchacq Résumé de l'article Haïti - Face au passé Volume 28, numéro 1, 2006 En s’appuyant sur de nombreuses sources imprimées et orales, l’auteur examine dans cet article les usages sociaux et URI : id.erudit.org/iderudit/014155ar politiques du phénomène du marronnage, terme qui désignait la fuite des esclaves hors du système des plantations dans la DOI : 10.7202/014155ar colonie française de Saint-Domingue. Après 1804, date qui consacre la révolte des esclaves commencée en 1791, les Aller au sommaire du numéro pratiques coercitives du nouvel État haïtien favorisèrent la poursuite de stratégies de résistance et orientèrent la construction d’une histoire officielle haïtienne. -

Children of Hispaniola: Báez and Duval-Carrie— Mending the Future

CHILDREN OF HISPANIOLA: BÁEZ AND DUVAL-CARRIÉ—MENDING THE FUTURE BY VISUALLY EXPLORING A TURBULENT PAST AND PRESENT Mariah Morales A Thesis Submitted to the Graduate College of Bowling Green State University in partial fulfillment of the requirements for the degree of MASTER OF ARTS August 2018 Committee: Rebecca L. Skinner Green, Advisor Sean V. Leatherbury © 2018 Mariah Morales All Rights Reserved iii ABSTRACT Rebecca L. Skinner Green, Advisor The goal of this thesis is to delve into the tumultuous past and present of Hispaniola and to explore the ways Haiti and the Dominican Republic have developed and coexist on this island. Each country developed a completely different social, political, linguistic, and cultural system than that of its neighbor. I am focusing on particular historic political episodes from Haiti’s Revolution (1781-1804),i the emancipation of Dominican Republic (1844),ii and slave era Louisiana, and why these events influenced two diasporan artists—Firelei Báez and Edouard Duval-Carrié—and how they are using their art to create a means for reestablishing mutual respect among their respective compatriots. This thesis will follow the path of dislocation that resulted from the booming slave trade on the Island of Hispaniola to the creolization of the new colony of Louisiana. The thesis will analyze the visual resistance of Afro- Caribbean women in 1800s Louisiana and how this resistance can inspire people of today. Artists and cultures have been embedded within globalization and creolization for centuries, even though non-Western artists such as Báez and Duval-Carrié and their cultures have remained in the periphery of the Western mindset. -

Marronnage Dans L’Histoire Haïtienne Entre Instrumentalisation Politique Et Réinterprétation Sociale Dimitri Béchacq

Document généré le 23 sept. 2021 06:24 Ethnologies Les parcours du marronnage dans l’histoire haïtienne Entre instrumentalisation politique et réinterprétation sociale Dimitri Béchacq Haïti - Face au passé Résumé de l'article Haïti - Confronting the Past En s’appuyant sur de nombreuses sources imprimées et orales, l’auteur Volume 28, numéro 1, 2006 examine dans cet article les usages sociaux et politiques du phénomène du marronnage, terme qui désignait la fuite des esclaves hors du système des URI : https://id.erudit.org/iderudit/014155ar plantations dans la colonie française de Saint-Domingue. Après 1804, date qui DOI : https://doi.org/10.7202/014155ar consacre la révolte des esclaves commencée en 1791, les pratiques coercitives du nouvel État haïtien favorisèrent la poursuite de stratégies de résistance et orientèrent la construction d’une histoire officielle haïtienne. Ces rapports de Aller au sommaire du numéro domination nourrirent un registre de mémoires plurielles dont les traces marquent jusqu’à aujourd’hui les diverses réinterprétations publiques du marronnage, de la rumeur populaire aux commémorations officielles. Avec Éditeur(s) l’exemple de la statue du Marron Inconnu, l’examen du statut changeant du marronnage dans l’histoire haïtienne ainsi que l’analyse des différents usages Association Canadienne d'Ethnologie et de Folklore langagiers de ce terme, permettent d’éclairer la longévité et la diversité des valeurs véhiculées par la figure du marron, entre héroïsme et anti-modèle ISSN social. Cette dichotomie illustre la présence massive et diffuse de l’histoire dans 1481-5974 (imprimé) le paysage social et politique haïtien, et elle véhicule le poids des 1708-0401 (numérique) catégorisations sociales et raciales héritées de la période esclavagiste. -

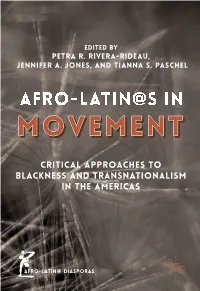

Movementmovement

Edited by Petra R. Rivera-Rideau, Jennifer A. Jones, and Tianna S. Paschel AFRO-LATIN@S IN MOVEMENTMOVEMENT Critical Approaches to Blackness and Transnationalism in the Americas Afro-Latin@ Diasporas The Afro-Latin@ Diasporas Book Series publishes scholarly and cre- ative writing on the African diasporic experience in Latin America, the Caribbean, and the United States. The Series includes books which address all aspects of Afro-Latin@ life and cultural expression throughout the hemisphere, with a strong focus on Afro-Latin@s in the United States. This Series is the fi rst-of-its-kind to combine such a broad range of topics, including religion, race, transnational identity, history, literature, music and the arts, social and cultural theory, biography, class and economic relations, gender, sexuality, sociology, politics, and migration. More information about this series at http://www.springer.com/series/14759 Petra R. Rivera-Rideau • Jennifer A. Jones • Tianna S. Paschel Editors Afro-Latin@s in Movement Critical Approaches to Blackness and Transnationalism in the Americas Editors Petra R. Rivera-Rideau Tianna S. Paschel Wellesley College University of California Berkeley Wellesley , Massachusetts, USA Berkeley , California , USA Jennifer A. Jones University of Notre Dame Notre Dame , Indiana , USA Afro-Latin@ Diasporas ISBN 978-1-137-60320-3 ISBN 978-1-137-59874-5 (eBook) DOI 10.1057/978-1-137-59874-5 Library of Congress Control Number: 2016907723 © The Editor(s) (if applicable) and The Author(s) 2016 This work is subject to copyright. All rights are solely and exclusively licensed by the Publisher, whether the whole or part of the material is concerned, specifi cally the rights of translation, reprinting, reuse of illustrations, recitation, broadcasting, reproduction on microfi lms or in any other physical way, and transmission or information storage and retrieval, electronic adaptation, computer software, or by similar or dissimilar methodology now known or hereafter developed. -

Haiti Appeal English

APPEAL TO THE EUROPEAN UNION AND ITS MEMBER STATES IN THE AFTERMATH OF HAITI’S EARTHQUAKE The voice of Haitians must be heard and Haitians must be allowed to determine their future. E, AS EUROPEAN NGOS and solidarity groups working in long-term partnership with the Haitian people, wish to convey the following to the European Union and its member Wstates. There has been overwhelming immediate support to Haiti following the earthquake of 12 January. More than 46 countries, including many from the EU, have contributed to search and rescue, the provision of food and non-food items, water, shelter while others have provided immediate medical attention to the most needy. This, in addition to the millions that have been raised by development agencies within the EU, attests to the extraordinary response to the disaster that has claimed thousands of lives. However, the longer-term problem of reconstruction starts now, even as the immediate relief operations are still underway. Haitians have been living in poverty for decades. Prior to the earthquake, much of its services and infrastructure insufficiently provided for the needs of its population, and many of its state and non-state institutions were already weak. The few existing governmental structures to bring relief and development have now been severely damaged. This has limited the involvement of the Haitian state in the relief effort and complicates both the short-term emergency relief and makes longer-term reconstruction very difficult. We believe that the Haitian government and civil society must determine their own future and therefore should have a leading role in establishing the proper structures to make this happen. -

University Micrdfilms International 300 N

INFORMATION TO USERS This was produced from a copy of a document sent to us for microfilming. While the most advanced technological means to photograph and reproduce this document have been used, the quality is heavily dependent upon the quality of the material submitted. The following explanation of techniques is provided to help you understand markings or notations which may appear on this reproduction. 1.The sign or “target” for pages apparently lacking from the document photographed is “Missing Page(s)”. If it was possible to obtain the missing page(s) or section, they are spliced into the film along with adjacent pages. This may have necessitated cutting through an image and duplicating adjacent pages to assure you of complete continuity. 2. When an image on the film is obliterated with a round black mark it is an indication that the film inspector noticed either blurred copy because of movement during exposure, or duplicate copy. Unless we meant to delete copyrighted materials that should not have been filmed, you will find a good image of the page in the adjacent frame. 3. When a map, drawing or chart, etc., is part of the material being photo graphed the photographer has followed a definite method in “sectioning” the material. It is customary to begin filming at the upper left hand corner of a large sheet and to continue from left to right in equal sections with small overlaps. If necessary, sectioning is continued again—beginning below the first row and continuing on until complete. 4. For any illustrations that cannot be reproduced satisfactorily by xerography, photographic prints can be purchased at additional cost and tipped into your xerographic copy. -

Marronage, Representation, and Memory in the Great Dismal Swamp

Through the Muck and Mire: Marronage, Representation, and Memory in the Great Dismal Swamp By Kathryn Elise Benjamin Golden A dissertation submitted in partial satisfaction of the requirements for the degree of Doctor of Philosophy in African American Studies in the Graduate Division of the University of California, Berkeley Committee in charge: Professor Stephen Small, Chair Professor Ula Taylor Professor Carolyn Finney Professor Lok Siu Spring 2018 Abstract Through the Muck and Mire: Marronage, Representation, and Memory in the Great Dismal Swamp By Kathryn Elise Benjamin Golden Doctor of Philosophy in African American Studies University of California, Berkeley Professor Stephen Small, Chair This dissertation is a critical examination of both the history of the Dismal Swamp maroon communities (independent and resistant communities of individuals some would label “runaway slaves”) and of the politics of race and representation of enslaved resistance in public historical narratives and in local Black collective memory. Principally, this is a critical exploration of the legacies of slavery and enslaved resistance evidenced by Black people’s resilience in and around the swamp across time – from maroon resilience through the physical swamp muck and mire, an appealing alternative to bondage, to the present-day resilience of Black community memory of enslaved people’s historical agency, in spite of the metaphysical muck and mire, or the entanglement of race and power that too often silences the narrative of Black resistance. Once recently an extremely understudied and under-researched topic, my research on the history and legacy of U.S. marronage advances the fields of slavery, public history, and collective memory by: (1) connecting the activities of the Dismal Swamp maroons to a hemispheric Black tradition not merely of flight, but organized violence against slaveholding societies as freedom and self-defense; (2) comprehensively clarifying the specificity of U.S. -

Hacia Una Historia De Lo Imposible: La Revolución Haitiana Y El “Libro De Pinturas” De José Antonio Aponte

HACIA UNA HISTORIA DE LO IMPOSIBLE: LA REVOLUCIÓN HAITIANA Y EL “LIBRO DE PINTURAS” DE JOSÉ ANTONIO APONTE. by Juan Antonio Hernández Licenciado en Letras, Universidad Central de Venezuela, 1994 Master of Arts, University of Pittsburgh, 2000 Submitted to the Graduate Faculty of Arts and Sciences in partial fulfillment of the requirements for the degree of Doctor of Philosophy University of Pittsburgh 2005 UNIVERSITY OF PITTSBURGH ARTS AND SCIENCES This dissertation was presented by Juan Antonio Hernández It was defended on 12, 13, 2005 and approved by Alejandro de la Fuente, Associate Professor, History Jerome Branche, Associate Professor, Hispanic Languages and Literatures Gerald Martin, Mellon Professor, Associate Professor, Hispanic Languages and Literatures John Beverley, Full Professor, Hispanic Languages and Literatures ii Copyright © by Juan Antonio Hernández 2005 iii HACIA UNA HISTORIA DE LO IMPOSIBLE: LA REVOLUCIÓN HAITIANA Y EL “LIBRO DE PINTURAS” DE JOSÉ ANTONIO APONTE. Juan Antonio Hernández, PhD University of Pittsburgh, 2005 In its first two sections, this dissertation offers a discussion of contemporary debates about the Haitian Revolution (1791-1804), its relation to Western Modernity, and its immediate consequences in the Caribbean of the early 19th century. The argument begins with an extended critique of Modernity Disavowed (2004) and its theorizations of cultural “hybridity” and “alternative modernities” as a model for understanding the Revolution and the possibilities it opens up. Fischer’s perspective does not give sufficient attention to the political and cultural practices of the insurgent masses of slaves. To do so requires criticizing the prevalent distinctions between tradition and modernity or between the “pre-political” and “the political” in the most influential historical representations of the Revolution (CLR James, Genovese, Buck- Morss, etc).