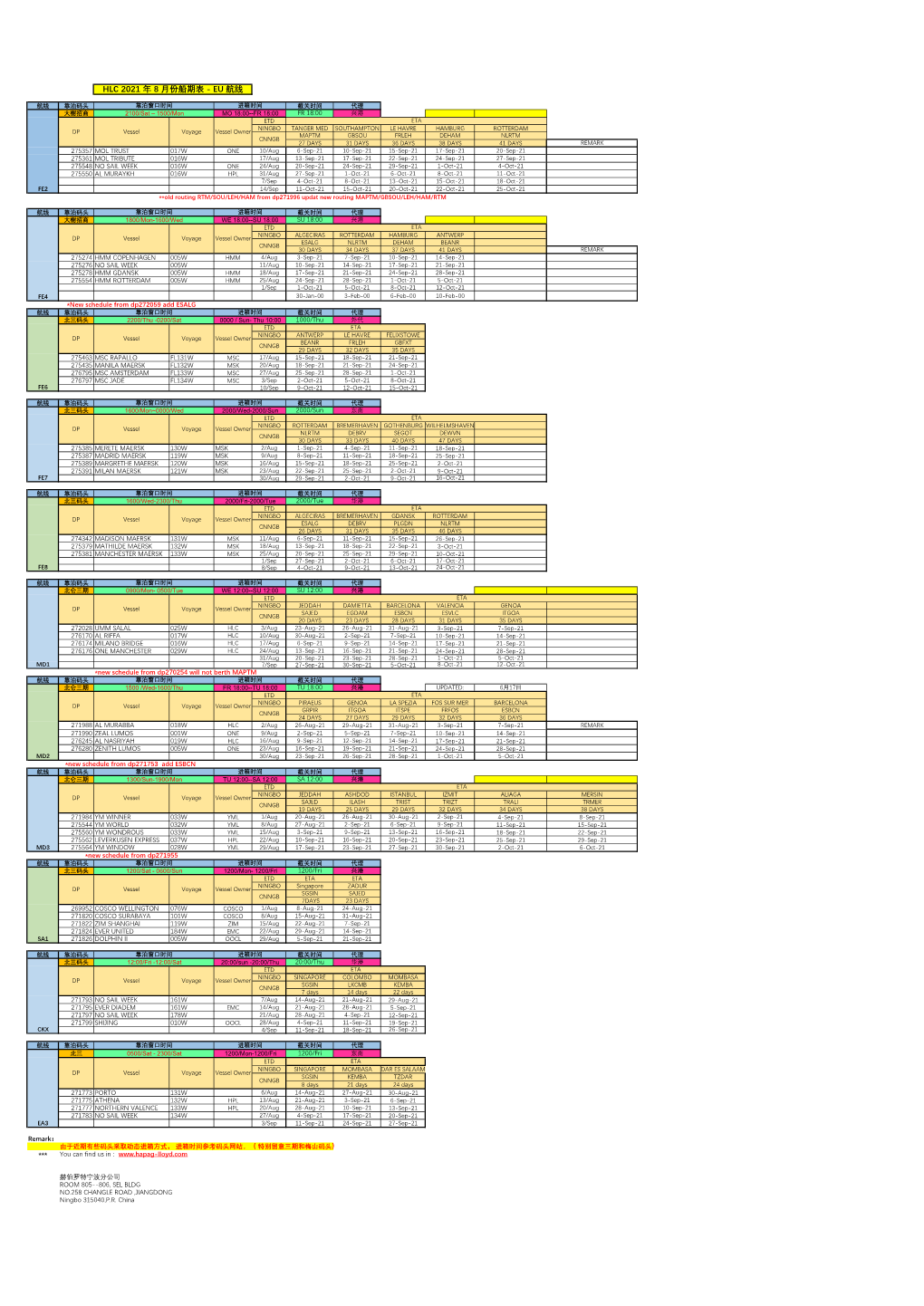

Hlc 2021 年8 月份船期表- Eu 航线

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Review of Maritime Transport 2020 37

2 The present chapter focuses on key developments related to the supply of maritime transport during this past year. It also assesses the early impact of the COVID-19 pandemic on the supply of maritime transport services and industries and discusses the responses, lessons learned and possible implications of the pandemic in terms of forces shaping supply and the industry’s long-term goal of decarbonization. The pandemic has had a significant impact on the shipping industry. On the one hand, lockdowns and factory closures gradually affected demand for maritime transport, due to reduced cargo volumes (see chapter 1). On the other hand, safety measures applied to contain the spread of the virus, such as lockdowns and travel restrictions, affected the movement of maritime transport workers and procedural changes introduced in ports, and induced operational disruptions in the supply of maritime transport. These prompted changes in shipping operations and requests for government support in the sector. They made the industry reflect on ways to enhance resilience of the sector to future shocks. This chapter reviews world fleet developments such as MARITIME annual fleet growth, changes to the structure and age of the fleet. It considers selected segments of the maritime TRANSPORT supply chain, such as shipbuilding, ship recycling, ship ownership, ship registration and the maritime workforce, SERVICES AND emphasizing the impacts of the pandemic on maritime INFRASTRUCTURE transport and marine manufacturing industries and on the supply of shipping services. SUPPLY It also examines the impact of the pandemic on the container, dry bulk and tanker freight markets; government responses to support shipping; and industry prospects, in particular with regard to accelerated digitalization and the prioritization of environmental sustainability. -

Hyundai Merchant Marine’ Rebrands As ‘HMM’ 2020-03-31

March 2021 HMM Co.,Ltd. HMM Service Promotion Material Table of Contents I. About HMM 1. Company Overview - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 4 2. Financial Status - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 6 3. Expansion Plan & Sustainability - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 7 4. HMM News - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 13 5. Container Solutions - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 25 II. Market Outlook 1. Supply & Demand - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 41 2. Market Issue - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 47 HMM Co.,Ltd. 2 Contents I. About HMM 1. Company Overview - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 4 2. Financial Status - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 6 3. Expansion Plan & Sustainability - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 7 4. HMM News - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 13 5. Container Solutions - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 25 II. Market Outlook HMM Co.,Ltd. 3 I -1. Company Overview The Bridge To Your Dream …… Since its humble beginning with just three VLCCs in 1976, HMM has developed over the years, overcoming numerous crises, to become a leading light in the Korean maritime industry. HMM is now a world-renowned integrated logistics company, operating around 120 state-of-the-art-vessels, and broad range -

The Last 23 Years Progression of Asia-Europe Carrier Alliances

The Last 23 Years Progression of Asia-Europe Carrier Alliances Number of Providers Grand Alliance Global Alliance 1996 Tricon-Hanjin Hapag-Lloyd Nedlloyd HMM DSR-Senator OOCL Maersk MSC CMA COSCO K Line Evergreen NYK 23 Sea-Land Yangming Choyang LLoyd Triestino MISC Norasia Hanjin NOL APL P&O MOL Grand Alliance Global Alliance 1997 CYK Consortium Hapag-Lloyd Nedlloyd Maersk MSC COSCO Evergreen OOCL HMM CMA NYK MISC 20 Sea-Land Norasia K Line LLoyd Triestino NOL Yangming APL P&O MOL Grand Alliance New World 1998 CKY Consortium United Alliance Hapag-Lloyd Alliance COSCO Choyang NYK Maersk MSC Norasia Evergreen APL 21 Sea-Land CMA K Line Hanjin-Senator LLoyd Triestino OOCL MOL Yangming UASC MISC P&O Nedlloyd HMM 1999-2000 Grand Alliance New World Maersk- CKY Consortium United Alliance Evergreen-LT Hapag-Lloyd Alliance Sealand COSCO Choyang NYK MSC Norasia APL 19 Maersk acquired CMA CGM K Line Hanjin-Senator OOCL MOL Sea-Land Yangming UASC MISC P&O Nedlloyd HMM United Alliance Grand Alliance New World 2001 CKY Consortium CSCL Hanjin-Senator Evergreen-LT Hapag-Lloyd Alliance COSCO NYK Maersk- MSC CMA CGM UASC APL 20 Sealand Zim K Line CSAV Norasia OOCL MOL Yangming Choyang Bankrupt MISC P&O Nedlloyd HMM 2002-2004 Grand Alliance CKYH Alliance Evergreen-LT New World CSCL COSCO Hapag-Lloyd Alliance NYK Maersk- MSC CMA CGM UASC K Line APL 20 Sealand OOCL Zim Yangming MISC MOL Hanjin-Senator CSAV Norasia P&O Nedlloyd HMM CKYH Alliance Grand Alliance New World 2005 Maersk- CSCL Evergreen-LT COSCO Hapag-Lloyd Alliance Sealand MSC CMA CGM UASC K Line -

MOL AR08 E 前半.Indd

MI T SUI O. S For further information, please contact: .K. LI Investor Relations Office Mitsui O.S.K. Lines NE 1-1, Toranomon 2-chome, Minato-ku, S Tokyo 105-8688, Japan Telephone: +81-3-3587-6224 Facsimile: +81-3-3587-7734 e-mail: [email protected] Annual Report 2008 URL: http://www.mol.co.jp/ The MOL ADVANCE Challenge Annual Report 2008 Year ended March 31, 2008 This annual report was printed entirely on FSC-certified paper with soy-based ink. Printed in Japan Shareholder Information BRASIL MARU by Capital: ¥65,350,351,028 Head office: 1-1, Toranomon 2-chome, Minato-ku, Tokyo 105-8688, Japan the Numbers Number of MOL employees: 892 In 2007, the Brasil Maru, one of the world’s largest iron ore carriers, Number of MOL Group employees: 9,626 began plying the route between Japan and Brazil. Her massive size has (The parent company and consolidated subsidiaries) changed the world of natural resource shipping. Take a closer look. Total number of shares authorized: 3,154,000,000 Number of shares issued: 1,206,195,642 Number of shareholders: 102,316 Shares listed in: Tokyo, Osaka, Nagoya, Fukuoka Share transfer agent: Mitsubishi UFJ Trust and Banking Corporation 4-5, Marunouchi 1-chome, Chiyoda-ku, Tokyo 100-8212, Japan Communications materials: Annual Report (English/Japanese) Investor Guidebook (English/Japanese) Market Information (English/Japanese) News Releases (English/Japanese) Web Site (English/Japanese) Quarterly Newsletter Open Sea (English/Web Site) Monthly Newsletter Unabara (Japanese) Environmental and Social Report (English/Japanese) As of March 31, 2008 Stock price range (Tokyo Stock Exchange) and volume of stock trade Fiscal 2005 High Fiscal 2006 High Fiscal 2007 High (¥) ¥1,094 ¥1,443 ¥2,020 2,000 Low ¥611 Low ¥723 Low ¥1,077 1,800 1,600 1,400 1,200 1,000 (Million shares) 800 400 Width: 600 300 400 200 200 100 meters 0 0 05 06 07 08 The same width as /4 5 6 7 8 9 10 11 12 /1 2 3 4 5 6 7 8 9 10 11 12 /1 2 3 4 5 6 7 8 9 10 11 12 /1 2 3 4 5 the wing span of a jumbo jet. -

Container Shipping in Europe: Data for the Evaluation of the EU Consortia Block Exemption”, Working Document, International Transport Forum, Paris

CPB Corporate Partnership Board Container Shipping in Europe Data for the Evaluation of the EU Consortia Block Exemption Container Shipping in Europe Data for the Evaluation of the EU Consortia Block Exemption The International Transport Forum The International Transport Forum is an intergovernmental organisation with 59 member countries. It acts as a think tank for transport policy and organises the Annual Summit of transport ministers. ITF is the only global body that covers all transport modes. The ITF is politically autonomous and administratively integrated with the OECD. The ITF works for transport policies that improve peoples’ lives. Our mission is to foster a deeper understanding of the role of transport in economic growth, environmental sustainability and social inclusion and to raise the public profile of transport policy. The ITF organises global dialogue for better transport. We act as a platform for discussion and pre- negotiation of policy issues across all transport modes. We analyse trends, share knowledge and promote exchange among transport decision-makers and civil society. The ITF’s Annual Summit is the world’s largest gathering of transport ministers and the leading global platform for dialogue on transport policy. The Members of the Forum are: Albania, Armenia, Argentina, Australia, Austria, Azerbaijan, Belarus, Belgium, Bosnia and Herzegovina, Bulgaria, Canada, Chile, China (People’s Republic of), Croatia, Czech Republic, Denmark, Estonia, Finland, France, Georgia, Germany, Greece, Hungary, Iceland, India, Ireland, Israel, Italy, Japan, Kazakhstan, Korea, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Mexico, Republic of Moldova, Montenegro, Morocco, the Netherlands, New Zealand, North Macedonia, Norway, Poland, Portugal, Romania, Russian Federation, Serbia, Slovak Republic, Slovenia, Spain, Sweden, Switzerland, Turkey, Ukraine, the United Arab Emirates, the United Kingdom and the United States. -

Factbook 2014

◇◆◇◆◇◆ INDEX ◆◇◆◇◆◇ 1. Management Plan and Improvement of Business Structure 3-5. Emerging Markets (China) ① Grain Transportation Driven by China (Soy Bean) P21 1-1. 2012 April "K"Line Vision 100 "Bridge to the Future" ② Trade Trends for China ①Review of the Medium-term Management Plan P1 ③ Energy Consumption in China ②Missions for Medium-term Management Plan ④ Per Capita GDP by Province in China ③Target for Financial Indices ⑤ Economic gap between Urban and Rural Areas ④Trends of Business Performance (P/L) P2 4. Bulk Carrier Business ⑤Improvement in Financial Position 4-1. "K"Line Fleet ① "K"Line Dry Bulk Fleet P22 ⑥Segment-wise Performance ② "K"Line Energy Transportation Fleet ⑦Fleet Upgrading Plan and Investment P3 ③ Ship Price as of Placing Order (Same as 3-2-①) ⑧Investment CF ④ Number of LNG Carriers ⑨New Buildings (Results and Plan) 4-2. Demand on Dry Bulk ① Transition of Crude Steel Production P23 1-2. History of Management Plans P4-5 ② Global Main Trades of Coal P24 1-3. Trends of Financial Indices ①Net Income and Dividend per Share P6 ③ World Coal Consumption ②Consolidated ROE/ROA ④ Iron Ore Import into Major Asian Countries ③Consolidated Assets Turnover ⑤ Iron Ore Stocks at Chinese Ports ④Consolidated EV/EBITDA ⑥ Port Congestion in Australia ⑤Operating Cash Flow 5. Car Carrier Business ⑥Consolidated Interest Coverage Ratio 5-1. Fleet and Cargo Movements ① "K"Line PCC Fleet P25 1-4. Effort for Structural Reform ①Exchange rate and No. of Japanese Seafarers P7 ② Cars/Trucks Transported by Our Fleet ②Exchange rate and K"Line Employee ③ Total Cars/Trucks Exported from Japan ③Operating Revenues and Ordinary Income 5-2. -

Intermodal Motor Carriers Conference, ) American Trucking Associations, Inc

BEFORE THE FEDERAL MARITIME COMMISSION ________________________________________________ INTERMODAL MOTOR CARRIERS CONFERENCE, ) AMERICAN TRUCKING ASSOCIATIONS, INC. ) ) Complainant, ) ) v. ) ) FMC Docket No. 20-14 OCEAN CARRIER EQUIPMENT MANAGEMENT ) ASSOCIATION, INC.; CONSOLIDATED CHASSIS ) MANAGEMENT, LLC; CMA CGM S.A.; COSCO ) SHIPPING LINES CO. LTD.; EVERGREEN LINE ) JOINT SERVICE AGREEMENT, FMC NO. 011982; ) HAPAG-LLOYD AG; HMM CO. LTD.; MAERSK ) A/S; MSC MEDITERRANEAN SHIPPING ) COMPANY S.A.; OCEAN NETWORK EXPRESS ) PTE. LTD.; WAN HAI LINES LTD.; YANG MING ) MARINE TRANSPORT CORP.; AND ) ZIM INTEGRATED SHIPPING SERVICES, ) ) Respondents. ) ________________________________________________) MEMORANDUM OF LAW IN SUPPORT OF RESPONDENTS’ MOTION FOR LEAVE TO APPEAL Wayne R. Rohde Gerald A. Morrissey III Christopher Raleigh Christopher Nolan Kathryn Sobotta 800 17th Street N.W., Suite 1100 Cozen O’Connor Holland & Knight 1200 19th Street N.W., Suite #300 Washington, D.C. 20006 Washington, D.C. 20036 (202) 469-5497 (202) 463-2507 Deana E. Rose Paul M. Keane Manelli Selter PLLC Cichanowicz Callan Keane & De May, LLP 1725 I Street NW. 50 Main Street, Suite 1045 Washington, D.C. 20006 White Plains, NY 10606 (202) 261-1016 (212) 344-7042 December 3, 2020 Table of Contents Page I. Introduction ......................................................................................................................... 1 II. Applicable Legal Standard ................................................................................................. -

Bringing Value to Life. Nippon Yusen Kabushiki Kaisha

Bringing value to life. Nippon Yusen Kabushiki Kaisha Nippon Yusen Kabushiki Kaisha Kabushiki Nippon Yusen NYK Report 2018 NYK Report 2018 3-2, Marunouchi 2-chome, Chiyoda-ku, Tokyo 100-0005, Japan Telephone: +81-3-3284-5151 Website: https://www.nyk.com/english/ Printed in Japan Contents Contents/Evaluation from Society 2 Toward Sustainable Growth (Material Issues) 30 Materiality 1 Safety NYK Group at a Glance 4 Initiatives for Safe Operation 32 Materiality 2 The Environment OurWHY purpose in society What Has the NYK Group Accomplished? 4 Proactive Environmental Conservation 36 Materiality 3 Human Resources What Has the NYK Group Been Doing in Utilizing/Strengthening Human Capital 40 Recent Years? 6 Environment, Social, and Governance(ESG) Data Schematic Diagram of 44 the New Medium-Term Bringing value to life. What Is the NYK Group Pursuing Now? 8 Toward Sustainable Growth Management Plan What Is the NYK Group Aiming to Accomplish? 10 (Strategy by Business) 46 At a Glance 46 Global Logistics 48 Our Mission Moving Ahead with Bulk Shipping Business 52 Our Management Plan 12 Others 58 OurWHAT aspirations over the next 10 years 10-year Summary Message from the President 12 60 Our Vision • Contribute to the resolution of social and environmental issues Special 1 Corporate Governance 64 through our business activities Feature Digitalization Medium-Term Directors, Audit and Supervisory Board • Act responsibly and respect the highest ethical and social standards & Green 20 Members, and Corporate Officers 64 Management Plan Expertise and Experience of Directors 66 • Create new value through constant “staying half a step ahead” spirit 2 Dialogue Messages from Independent Outside Directors 67 • Develop a well-balanced revenue structure Ensuring Safe and Dependable Corporate Governance 68 Maritime Shipping through Corporate Data/Editorial Policy for NYK Report Exhaustive and Ongoing 74 Initiatives Extending beyond Compliance PDF The following information is included in the digital version. -

Quarterly Financial Report Q1 2021

Q1 2021 Hapag-Lloyd AG Quarterly financial report 1 January to 31 March 2021 SUMMARY OF HAPAG-LLOYD KEY FIGURES QUARTERLY FINANCIAL REPORT Q1 2021 1.1. – 1.1. – Change 31.3.2021 31.3.2020 absolute Key operating figures¹ Total vessels 241 248 –7 Aggregate capacity of vessels TTEU 1,734 1,745 –11 Aggregate container capacity TTEU 2,758 2,587 171 Freight rate (average for the period) USD / TEU 1,509 1,094 415 Transport volume TTEU 2,975 3,053 –79 Revenue million EUR 4,067 3,343 724 EBITDA million EUR 1,584 469 1,115 EBIT million EUR 1,277 160 1,117 Group profit / loss million EUR 1,203 25 1,179 Earnings per share EUR 6.83 0.12 6.71 Cash flow from operating activities million EUR 1,366 381 986 Key return figures¹ EBITDA margin (EBITDA / revenue) % 38.9 14.0 24.9 ppt EBIT margin (EBIT / revenue) % 31.4 4.8 26.6 ppt ROIC (Return on Invested Capital)² % 43.3 4.5 38.8 ppt Key balance sheet figures as at 31 March¹ Balance sheet total million EUR 17,298 15,184 2,113 Equity million EUR 8,291 6,723 1,568 Equity ratio (equity / balance sheet total) % 47.9 44.3 3.7 ppt Borrowed capital million EUR 9,007 8,462 545 Key financial figures as at 31 March¹ Financial debt and lease liabilities million EUR 5,332 5,136 196 Cash and cash equivalents million EUR 1,615 681 933 1 The key operating figures and key return figures refer to the respective reporting period. -

Federal Register/Vol. 85, No. 238/Thursday, December 10, 2020

79490 Federal Register / Vol. 85, No. 238 / Thursday, December 10, 2020 / Notices NOTICE OF INTENT TO TERMINATE RECEIVERSHIPS Date of Fund Receivership name City State appointment of receiver 10311 .. Copper Star Bank ................................................................................. Scottsdale ..................................... AZ ....... 11/12/2010 10313 .. Tifton Banking Company ...................................................................... Tifton ............................................. GA ....... 11/12/2010 10319 .. Appalachian Community Bank ............................................................. McCaysville ................................... GA ....... 12/17/2010 10353 .. Bartow County Bank ............................................................................. Cartersville .................................... GA ....... 04/15/2011 10371 .. McIntosh State Bank ............................................................................ Jackson ......................................... GA ....... 06/17/2011 10377 .. High Trust Bank .................................................................................... Stockbridge ................................... GA ....... 07/15/2011 10426 .. Central Bank of Georgia ....................................................................... Ellaville .......................................... GA ....... 02/24/2012 10476 .. Douglas County Bank ........................................................................... Douglasville .................................. -

July 10, 2017 Kawasaki Kisen Kaisha, Ltd. Eizo Murakami

July 10, 2017 Kawasaki Kisen Kaisha, Ltd. Eizo Murakami, President & CEO Mitsui O.S.K. Lines, Ltd. Junichiro Ikeda, President & CEO Nippon Yusen Kabushiki Kaisha Tadaaki Naito, President Notice of Establishment of Holding Company and Operating Company for New Integrated Container Shipping Business (2) For the integration of their container shipping businesses, including worldwide terminal operation businesses outside Japan, Kawasaki Kisen Kaisha, Ltd., Mitsui O.S.K. Lines, Ltd., and Nippon Yusen Kabushiki Kaisha have announced details of the companies established on July 7 th , 2017 as per attached. Inquiries Inquiries can be directed to the following representatives: Kawasaki Kisen Kaisha, Ltd. Kiyoshi Tokonami, General Manager, Investor & Public Relations Group (TEL: +81-3- 3595-5189) Mitsui O.S.K. Lines, Ltd. Keiichiro Nakanishi, General Manager, Public Relations Office (TEL: +81-3- 3587-7015) Nippon Yusen Kabushiki Kaisha Ushio Koiso, General Manager, Corporate Communication and CSR Group (TEL: +81-3-3284-5058) This document includes information that constitutes “forward-looking statements” relating to the success and failure or the results of the integration of Kawasaki Kisen Kaisha Ltd., Mitsui O.S.K. Lines Ltd., and Nippon Yusen Kabushiki Kaisha. To the extent that statements in this document do not relate to historical or current facts, they constitute forward-looking statements. These forward-looking statements are based on the current assumptions and beliefs of the three companies in light of the information currently available to them, and involve known or unknown risks, uncertainties and other factors. Such factors may cause the actual results to be materially different from the contents of this document with respect to any future performance, achievements or financial position of one or all of the three companies (or the new company after the integration) expressed or implied by these forward-looking statements. -

Comments of the U.S. Department of Justice on the OCEAN Alliance

DEPARTMENT OF JUSTICE Antitrust Division RENATA B. HESSE Acting Assistant Attorney General Main Justice Building 950 Pennsylvania Avenue, NW Washington, D.C. 20530-0001 (202) 353-1535 I (202) 616-2645 (Fax) November 22, 2016 Secretary, Federal Maritime Commission 800 North Capitol Street, N.W. Washington, D.C. 20573-0001 Re: THE Alliance Agreement, FMC Agreement No. 012439 Dear Secretary: The Antitrust Division of the United States Department of Justice ("Department") respectfully submits these comments in response to the filing of THE Alliance Agreement ("Agreement"), No. 012439. See 81 Fed. Reg. 79028 (November 10, 2016). 1 THE Alliance Agreement raises a number of significant competitive concerns, particularly as it comes on the heels of the recently approved OCEAN Alliance. The creation of these two new alliances will result in a significant increase in concentration in the industry as the existing four major shipping alliances are replaced by only three. This increase in concentration and reduction in the number of shipping alliances will likely facilitate coordination in an industry that is already prone to collusion. For example, four companies (three of which are slated to join THE 2 Alliance ) have pled guilty, and eight corporate executives have been indicted or pled guilty in connection with a worldwide conspiracy involving price fixing, bid-rigging, and market allocation among providers ofroll-on, roll-off shipping.3 THE Alliance Agreement raises many of the same types of concerns we expressed in connection with the OCEAN Alliance. See Letter from Renata B. Hesse to Federal Maritime Commission Secretary (Sept. 19, 2016), attached. For example, Article 5.3 would allow the carriers to exchange a number of categories of competitively sensitive information, which may 1 Members include Hapag Lloyd Aktiengesellschaft and Hapag-Lloyd USA LLC ("Hapag-Lloyd"), Kawasaki Kisen Kaisha, Ltd.