Oocl Tidings

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Review of Maritime Transport 2020 37

2 The present chapter focuses on key developments related to the supply of maritime transport during this past year. It also assesses the early impact of the COVID-19 pandemic on the supply of maritime transport services and industries and discusses the responses, lessons learned and possible implications of the pandemic in terms of forces shaping supply and the industry’s long-term goal of decarbonization. The pandemic has had a significant impact on the shipping industry. On the one hand, lockdowns and factory closures gradually affected demand for maritime transport, due to reduced cargo volumes (see chapter 1). On the other hand, safety measures applied to contain the spread of the virus, such as lockdowns and travel restrictions, affected the movement of maritime transport workers and procedural changes introduced in ports, and induced operational disruptions in the supply of maritime transport. These prompted changes in shipping operations and requests for government support in the sector. They made the industry reflect on ways to enhance resilience of the sector to future shocks. This chapter reviews world fleet developments such as MARITIME annual fleet growth, changes to the structure and age of the fleet. It considers selected segments of the maritime TRANSPORT supply chain, such as shipbuilding, ship recycling, ship ownership, ship registration and the maritime workforce, SERVICES AND emphasizing the impacts of the pandemic on maritime INFRASTRUCTURE transport and marine manufacturing industries and on the supply of shipping services. SUPPLY It also examines the impact of the pandemic on the container, dry bulk and tanker freight markets; government responses to support shipping; and industry prospects, in particular with regard to accelerated digitalization and the prioritization of environmental sustainability. -

Hyundai Merchant Marine’ Rebrands As ‘HMM’ 2020-03-31

March 2021 HMM Co.,Ltd. HMM Service Promotion Material Table of Contents I. About HMM 1. Company Overview - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 4 2. Financial Status - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 6 3. Expansion Plan & Sustainability - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 7 4. HMM News - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 13 5. Container Solutions - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 25 II. Market Outlook 1. Supply & Demand - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 41 2. Market Issue - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 47 HMM Co.,Ltd. 2 Contents I. About HMM 1. Company Overview - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 4 2. Financial Status - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 6 3. Expansion Plan & Sustainability - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 7 4. HMM News - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 13 5. Container Solutions - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 25 II. Market Outlook HMM Co.,Ltd. 3 I -1. Company Overview The Bridge To Your Dream …… Since its humble beginning with just three VLCCs in 1976, HMM has developed over the years, overcoming numerous crises, to become a leading light in the Korean maritime industry. HMM is now a world-renowned integrated logistics company, operating around 120 state-of-the-art-vessels, and broad range -

CONTAINER SERVICES BERTH WINDOW SCHEDULE Last Updated January 12, 2018

CONTAINER SERVICES BERTH WINDOW SCHEDULE Last Updated January 12, 2018 Sunday Monday Tuesday Wednesday Thursday Friday Saturday 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30* 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 WEST WEST CEN-5 WOOD Barge Barge WOOD (2) CENTERM CEN-6 TP1 - 2M CPNW - OCEAN TP9 - 2M Sunday Monday Tuesday Wednesday Thursday Friday Saturday 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30* 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 VTM-5 PNW3 - OCEAN PNW1 - OCEAN PN2 - HMM PNW3 VTM-6 VANTERM Sunday Monday Tuesday Wednesday Thursday Friday Saturday 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30* 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 MSC - CALIFORNIA DPT-1 ZMP PN1 - THE ALLIANCE ZMP - ZIM EXPRESS DPT-2 PN2 PNW4 - OCEAN PN2 - THE ALLIANCE DELTAPORT DPT-3 PN3 - THE ALLIANCE PN3 Sunday Monday Tuesday Wednesday Thursday Friday Saturday 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30* 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 MPS Berth 7 AL5 (MedPac) Berth 8 OCEANIA DOCKS Berth 9 FRASER SURREY FRASER L I N E / C O N S O R T I U M S e r v i c e N a m e COSCO SHIPPING CPWN (China/Canada & U.S. -

October 31St, 2016 to Whom It May Concern, Kawasaki Kisen Kaisha

October 31 st , 2016 To Whom it May Concern, Kawasaki Kisen Kaisha, Ltd. Eizo Murakami, President & CEO Mitsui O.S.K. Lines, Ltd. Junichiro Ikeda, President & CEO Nippon Yusen Kabushiki Kaisha Tadaaki Naito, President Notice of Agreement to the Integration of Container Shipping Businesses Kawasaki Kisen Kaisha, Ltd., Mitsui O.S.K. Lines Ltd., and Nippon Yusen Kabushiki Kaisha have agreed, after the resolution by the board of directors of each company held today, and subject to regulatory approval from the authorities, to establish a new joint-venture company to integrate the container shipping businesses (including worldwide terminal operating businesses excluding Japan) of all three companies and to sign a business integration contract and a shareholders agreement. 1. Background Although growing modestly, the container shipping industry has struggled in recent years due to a decline in the container growth rate and the rapid influx of newly built vessels. These two factors have contributed to an imbalance of supply and demand which has destabilized the industry and has created an environment that is adverse to container line profitability. In order to combat these factors, industry participants have sought to gain scale merit through mergers and acquisitions and consequently the structure of the industry is changing through consolidation. Under these circumstances, three companies have now decided to integrate their respective container shipping on an equal footing to ensure future stable, efficient and competitive business operations. The new joint-venture company is expected to create a synergy effect by utilizing the best practices of the three companies. And by taking advantage of scale merit of its vessel fleet totaling 1.4 million TEUs, realize integration effect of approximately 110 billion Japanese Yen annually and seek swiftly financial performance stabilization. -

APL (Also See ANL & CMA) MC's Need to Call Equipment Control on Waivers Or RRG Approvals 757/961-2574 Dispute Contact PSW

Frequently Called Equipment Providers as of 09/16/2021 and how they receive updates APL (also see ANL & MC’s need to call Equipment Control on Waivers or RRG 757/961-2574 Internet CMA) Approvals Dispute Contact [email protected] 866/574-1364 Equipment East [email protected] 757/961-2102 Atlanta, Baltimore, Boston, Buffalo, Charleston, Charlotte, Greensboro, Greer, Jacksonville, Memphis, Miami, Nashville, New York, Norfolk, Philadelphia, Pittsburgh, Richmond, Savannah, Tampa. Equipment Midwest & [email protected] 757/961-2105 Gulf Chicago, Cincinnati, Cleveland, Columbus, Dallas, Detroit, Houston, Indianapolis, Kansas City, Loredo, Louisville, Minneapolis, Mobile, New Orleans, Omaha, Rochelle, San Antonio, Santa Teresa. Equipment West [email protected] 602/586-4940 Denver, Long Beach, Los Angeles, Oakland, Phoenix, Portland, Salt Lake City, Seattle, Tacoma. Special Equipment (US) [email protected] 757/961-2600 Equipment Canada (Dry & [email protected] 514/908-7866 Special) Calgary, Edmonton, Halifax, Montreal, Prince George, Prince Rupert, Saskatoon, St. John/New Brunswick, Toronto, Vancouver, Winnipeg. LAX/LGB [email protected] Or [email protected] 562/624-5676 Long Beach, Los Angeles. City Code for Emails- Dallas: USDAL-El Paso: USELP-Houston: USHOU- Mobile: Please add City Code to USMOB- New Orleans: USMSY- San Antonio: USSAT- Santa subject line on your Tereas: USSXT emails for CMA and APL Atlanta:USATL-Baltimore:USBAL-Boston:USBOS- Bessemer:USBMV-Buffalo: USBUF-Chicago:USCHI- Cincinnatti:USCVG-Charleston:USCHS-Charlotte:USCLT- Cleveland: USCLE-Columbus:USCMH-Denver:USDEN- Detroit: USDET-Greensboro: USGBO-Indianapolis: USIND- Jacksonville:USJAX-Joliet: USJOT-Kansas City:USKCK- Laredo:USLRD-Louisville:USLUI-Los Angeles:USLAX- Memphis:USMEM-Miami:USMIA-Minneapolis:USMES- Nashville:USBNA-New York:USNYC-Norfolk:USORF- Oakland:USOAK-Omaha:USOMA-Phildelphia:USPHL- Phoenix:USPHX-Pittsburgh:USPIT-Portland:USPDX-Salt Lake City: USSLC-Savannah:USSAV-Seattle:USSEA-St. -

The Last 23 Years Progression of Asia-Europe Carrier Alliances

The Last 23 Years Progression of Asia-Europe Carrier Alliances Number of Providers Grand Alliance Global Alliance 1996 Tricon-Hanjin Hapag-Lloyd Nedlloyd HMM DSR-Senator OOCL Maersk MSC CMA COSCO K Line Evergreen NYK 23 Sea-Land Yangming Choyang LLoyd Triestino MISC Norasia Hanjin NOL APL P&O MOL Grand Alliance Global Alliance 1997 CYK Consortium Hapag-Lloyd Nedlloyd Maersk MSC COSCO Evergreen OOCL HMM CMA NYK MISC 20 Sea-Land Norasia K Line LLoyd Triestino NOL Yangming APL P&O MOL Grand Alliance New World 1998 CKY Consortium United Alliance Hapag-Lloyd Alliance COSCO Choyang NYK Maersk MSC Norasia Evergreen APL 21 Sea-Land CMA K Line Hanjin-Senator LLoyd Triestino OOCL MOL Yangming UASC MISC P&O Nedlloyd HMM 1999-2000 Grand Alliance New World Maersk- CKY Consortium United Alliance Evergreen-LT Hapag-Lloyd Alliance Sealand COSCO Choyang NYK MSC Norasia APL 19 Maersk acquired CMA CGM K Line Hanjin-Senator OOCL MOL Sea-Land Yangming UASC MISC P&O Nedlloyd HMM United Alliance Grand Alliance New World 2001 CKY Consortium CSCL Hanjin-Senator Evergreen-LT Hapag-Lloyd Alliance COSCO NYK Maersk- MSC CMA CGM UASC APL 20 Sealand Zim K Line CSAV Norasia OOCL MOL Yangming Choyang Bankrupt MISC P&O Nedlloyd HMM 2002-2004 Grand Alliance CKYH Alliance Evergreen-LT New World CSCL COSCO Hapag-Lloyd Alliance NYK Maersk- MSC CMA CGM UASC K Line APL 20 Sealand OOCL Zim Yangming MISC MOL Hanjin-Senator CSAV Norasia P&O Nedlloyd HMM CKYH Alliance Grand Alliance New World 2005 Maersk- CSCL Evergreen-LT COSCO Hapag-Lloyd Alliance Sealand MSC CMA CGM UASC K Line -

Last Updated : 2021-08-25 ASIA CHINA INDIA EXPRESS 3

Last Updated : 2021-10-06 KOREA INBOUND ASIA CHINA INDIA EXPRESS 3(CIX3) VESSEL VOY BUSAN Xingang Hong Kong Singapore Port Kelang Pipavav Nhava Sheva SEAMAX STRATFORD 111 W 10/21 10/19 10/15 10/10 10/8 9/30 9/28 - - - - - - - - - XIN HONG KONG 050 W 11/3 11/1 10/28 10/23 10/21 10/13 10/11 THORSTAR 038 W 11/5 11/3 10/30 10/25 10/23 10/15 10/13 OOCL SAN FRANCISCO 161 W 11/12 11/10 11/6 11/1 10/30 10/22 10/20 TO BE ADVISED 001 W 11/19 11/17 11/13 11/8 11/6 10/29 10/27 FAR EAST CHENNAI (FCS) VESSEL VOY BUSAN Manila Singapore Port Kelang Vizag Chennai AKA BHUM 003 E 10/18 10/14 10/9 10/8 10/3 9/30 KMTC MUMBAI 004 E 10/25 10/21 10/16 10/15 10/10 10/7 XIN LIAN YUN GANG 088 E 10/31 10/27 10/22 10/21 10/16 10/13 CMA CGM RACINE 001 E 11/10 11/6 11/1 10/31 10/26 10/23 - - - - - - - - TS SYDNEY 002 E 11/18 11/14 11/9 11/8 11/3 10/31 CHINA LAEM CHABANG (CHL) VESSEL VOY Incheon Shekou Hong Kong Ho Chi Minh - - - - - - YM CREDENTIAL 021 N 10/21 10/18 10/17 10/14 XUTRA BHUM 908 N 10/27 10/24 10/23 10/20 GH BORA 069 N 11/3 10/31 10/30 10/27 YM CREDENTIAL 022 N 11/10 11/7 11/6 11/3 XUTRA BHUM 909 N 11/17 11/14 11/13 11/10 Laem VESSEL VOY Incheon Xiamen Hong Kong Chabang - - - - - - OOCL AMERICA 135 N 10/20 10/10 10/9 10/4 COSCO SHANGHAI 185 N 10/27 10/17 10/16 10/11 WAN HAI 511 075 N 11/9 10/30 10/29 10/24 COSCO HAMBURG 248 N 11/10 10/31 10/30 10/25 OOCL AMERICA 136 N 11/17 11/7 11/6 11/1 Asia-North Europe Loop 4 (LL4) VESSEL VOY BUSAN Xingang Xiamen Port Kelang CMA CGM SORBONNE 001 E 10/13 10/10 10/5 9/29 CMA CGM CHAMPS ELYSEES 005 W 10/20 10/17 10/12 -

Singapore - Outbound to USA

Singapore - Outbound to USA Closing Singapore (ETA) USA VESSEL VOY Reference Code CYETA ETD LAX OAKHAL NYC SAV CHS ORF CMA CGM ANDROMEDA 0TUJVE1M SEAP-CDM-005-E 13-Oct 14-Oct 16-Oct 9-Nov 13-Nov - - - - - APL SENTOSA 0TUL1S1M SEAP-APS-411-S 17-Oct 18-Oct 19-Oct - - 12-Nov 14-Nov 19-Nov - 17-Nov COSCO SHIPPING ALPS 020S VCE-CJA-020-S 19-Oct 20-Oct 20-Oct - - - 13-Nov 17-Nov - - COSCO AFRICA 069S VCE-CCI-069-S 22-Oct 23-Oct 23-Oct - - - 16-Nov 20-Nov - - CMA CGM MEXICO 0TUJZE1M SEAP-EXI-007-E 23-Oct 24-Oct 26-Oct 19-Nov 23-Nov - - - - - CMA CGM CORTE REAL 0TUK3E1M SEAP-GCR-243-E 27-Oct 28-Oct 30-Oct 23-Nov 27-Nov - - - - - CMA CGM A. LINCOLN 0TUL9S1MA SEAP-GLC-409-S 30-Oct 31-Oct 1-Nov - - 25-Nov 27-Nov 2-Dec - 30-Nov COSCO OCEANIA 083S VCE-CSO-083-S 2-Nov 3-Nov 3-Nov - - - 27-Nov 1-Dec - - CMA CGM J. MADISON 0TUK7E1M SEAP-CJS-132-E 3-Nov 4-Nov 6-Nov 30-Nov 4-Dec - - - - - MA CGM PANAMA 0TUL5S1M SEAP-GPN-009-S 5-Nov 6-Nov 7-Nov - - 1-Dec 3-Dec 8-Dec - 6-Dec CMA CGM BRAZIL 0TUKBE1M SEAP-CZM-005-E 10-Nov 11-Nov 13-Nov 7-Dec 11-Dec - - - - - COSCO SHIPPING ROSE 022S VCE-IPR-022-S 13-Nov 14-Nov 14-Nov - - - 8-Dec 12-Dec - - CMA CGM JULES VERNE 0TULHS1M SEAP-AVR-429-S 14-Nov 15-Nov 16-Nov - - 10-Dec 12-Dec 17-Dec - 15-Dec CMA CGM ALEXANDER VON0TULDS1M HUMBOLDT SEAP-GCV-420-S 16-Nov 17-Nov 18-Nov - - 12-Dec 14-Dec 19-Dec - 17-Dec CMA CGM MARCO POLO 0TUKFE1M SEAP-GCM-335-E 17-Nov 18-Nov 20-Nov 14-Dec 18-Dec - - - - - CMA CGM THALASSA 0TULLS1M SEAP-TLA-422-S 21-Nov 22-Nov 23-Nov - - 17-Dec 19-Dec 24-Dec - 22-Dec CMA CGM CHILE 0TUKJE1M SEAP-ILH-007-E 24-Nov 25-Nov 27-Nov 21-Dec 25-Dec - - - - - CMA CGM J. -

MOL AR08 E 前半.Indd

MI T SUI O. S For further information, please contact: .K. LI Investor Relations Office Mitsui O.S.K. Lines NE 1-1, Toranomon 2-chome, Minato-ku, S Tokyo 105-8688, Japan Telephone: +81-3-3587-6224 Facsimile: +81-3-3587-7734 e-mail: [email protected] Annual Report 2008 URL: http://www.mol.co.jp/ The MOL ADVANCE Challenge Annual Report 2008 Year ended March 31, 2008 This annual report was printed entirely on FSC-certified paper with soy-based ink. Printed in Japan Shareholder Information BRASIL MARU by Capital: ¥65,350,351,028 Head office: 1-1, Toranomon 2-chome, Minato-ku, Tokyo 105-8688, Japan the Numbers Number of MOL employees: 892 In 2007, the Brasil Maru, one of the world’s largest iron ore carriers, Number of MOL Group employees: 9,626 began plying the route between Japan and Brazil. Her massive size has (The parent company and consolidated subsidiaries) changed the world of natural resource shipping. Take a closer look. Total number of shares authorized: 3,154,000,000 Number of shares issued: 1,206,195,642 Number of shareholders: 102,316 Shares listed in: Tokyo, Osaka, Nagoya, Fukuoka Share transfer agent: Mitsubishi UFJ Trust and Banking Corporation 4-5, Marunouchi 1-chome, Chiyoda-ku, Tokyo 100-8212, Japan Communications materials: Annual Report (English/Japanese) Investor Guidebook (English/Japanese) Market Information (English/Japanese) News Releases (English/Japanese) Web Site (English/Japanese) Quarterly Newsletter Open Sea (English/Web Site) Monthly Newsletter Unabara (Japanese) Environmental and Social Report (English/Japanese) As of March 31, 2008 Stock price range (Tokyo Stock Exchange) and volume of stock trade Fiscal 2005 High Fiscal 2006 High Fiscal 2007 High (¥) ¥1,094 ¥1,443 ¥2,020 2,000 Low ¥611 Low ¥723 Low ¥1,077 1,800 1,600 1,400 1,200 1,000 (Million shares) 800 400 Width: 600 300 400 200 200 100 meters 0 0 05 06 07 08 The same width as /4 5 6 7 8 9 10 11 12 /1 2 3 4 5 6 7 8 9 10 11 12 /1 2 3 4 5 6 7 8 9 10 11 12 /1 2 3 4 5 the wing span of a jumbo jet. -

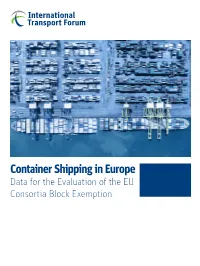

Container Shipping in Europe: Data for the Evaluation of the EU Consortia Block Exemption”, Working Document, International Transport Forum, Paris

CPB Corporate Partnership Board Container Shipping in Europe Data for the Evaluation of the EU Consortia Block Exemption Container Shipping in Europe Data for the Evaluation of the EU Consortia Block Exemption The International Transport Forum The International Transport Forum is an intergovernmental organisation with 59 member countries. It acts as a think tank for transport policy and organises the Annual Summit of transport ministers. ITF is the only global body that covers all transport modes. The ITF is politically autonomous and administratively integrated with the OECD. The ITF works for transport policies that improve peoples’ lives. Our mission is to foster a deeper understanding of the role of transport in economic growth, environmental sustainability and social inclusion and to raise the public profile of transport policy. The ITF organises global dialogue for better transport. We act as a platform for discussion and pre- negotiation of policy issues across all transport modes. We analyse trends, share knowledge and promote exchange among transport decision-makers and civil society. The ITF’s Annual Summit is the world’s largest gathering of transport ministers and the leading global platform for dialogue on transport policy. The Members of the Forum are: Albania, Armenia, Argentina, Australia, Austria, Azerbaijan, Belarus, Belgium, Bosnia and Herzegovina, Bulgaria, Canada, Chile, China (People’s Republic of), Croatia, Czech Republic, Denmark, Estonia, Finland, France, Georgia, Germany, Greece, Hungary, Iceland, India, Ireland, Israel, Italy, Japan, Kazakhstan, Korea, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Mexico, Republic of Moldova, Montenegro, Morocco, the Netherlands, New Zealand, North Macedonia, Norway, Poland, Portugal, Romania, Russian Federation, Serbia, Slovak Republic, Slovenia, Spain, Sweden, Switzerland, Turkey, Ukraine, the United Arab Emirates, the United Kingdom and the United States. -

Factbook 2014

◇◆◇◆◇◆ INDEX ◆◇◆◇◆◇ 1. Management Plan and Improvement of Business Structure 3-5. Emerging Markets (China) ① Grain Transportation Driven by China (Soy Bean) P21 1-1. 2012 April "K"Line Vision 100 "Bridge to the Future" ② Trade Trends for China ①Review of the Medium-term Management Plan P1 ③ Energy Consumption in China ②Missions for Medium-term Management Plan ④ Per Capita GDP by Province in China ③Target for Financial Indices ⑤ Economic gap between Urban and Rural Areas ④Trends of Business Performance (P/L) P2 4. Bulk Carrier Business ⑤Improvement in Financial Position 4-1. "K"Line Fleet ① "K"Line Dry Bulk Fleet P22 ⑥Segment-wise Performance ② "K"Line Energy Transportation Fleet ⑦Fleet Upgrading Plan and Investment P3 ③ Ship Price as of Placing Order (Same as 3-2-①) ⑧Investment CF ④ Number of LNG Carriers ⑨New Buildings (Results and Plan) 4-2. Demand on Dry Bulk ① Transition of Crude Steel Production P23 1-2. History of Management Plans P4-5 ② Global Main Trades of Coal P24 1-3. Trends of Financial Indices ①Net Income and Dividend per Share P6 ③ World Coal Consumption ②Consolidated ROE/ROA ④ Iron Ore Import into Major Asian Countries ③Consolidated Assets Turnover ⑤ Iron Ore Stocks at Chinese Ports ④Consolidated EV/EBITDA ⑥ Port Congestion in Australia ⑤Operating Cash Flow 5. Car Carrier Business ⑥Consolidated Interest Coverage Ratio 5-1. Fleet and Cargo Movements ① "K"Line PCC Fleet P25 1-4. Effort for Structural Reform ①Exchange rate and No. of Japanese Seafarers P7 ② Cars/Trucks Transported by Our Fleet ②Exchange rate and K"Line Employee ③ Total Cars/Trucks Exported from Japan ③Operating Revenues and Ordinary Income 5-2. -

(Manila) - Outbound to USA

Philippines (Manila) - Outbound to USA PACIFIC VIETNAM CHINA SOUTH (PVCS-E) - sails Kaohsiung every Wednesday Container LCT ETA Manila North Harbour Manila South Harbour Manila North Harbour Loading Manila South Harbour Loading VESSEL VOY ETA KHH Trunk Vessel VOY ETD KHH REEFER / PEZA / REEFER / PEZA / LAS via DRY PERISHABLE DRY PERISHABLE LGB BTC KDV CMH MEM DAL ETA ETD ETA ETD LGB (FRI/0400H) CARGOES (SAT/0500H) CARGOES (SAT/0200H) (SAT/1500H) BLANK SAILING - - 12-Sep 12-Sep 16-Sep COSCO PORTUGAL 046 24-Sep 7-Oct 9-Oct 13-Oct 13-Oct 2-Oct 14-Oct 12-Oct YM CREDIBILITY 034 14-Sept / 0800 18-Sept / 0200H 17-Sep 19-Sep 21-Sep COSCO PORTUGAL 046 24-Sep 7-Oct 9-Oct 13-Oct 13-Oct 2-Oct 14-Oct 12-Oct SIMA SAHBA 114 17-Sept / 1300H 17-Sept / 2300H 19-Sep 21-Sep 24-Sep COSCO PORTUGAL 046 24-Sep 7-Oct 9-Oct 13-Oct 13-Oct 2-Oct 14-Oct 12-Oct YM CREDIBILITY 035 24-Sep 25-Sep 24-Sep 26-Sep 28-Sep COSCO SHIPPING ANDES 019 30-Sep 13-Oct 15-Oct 19-Oct 19-Oct 8-Oct 20-Oct 18-Oct SIMA SAHBA 115 TBA TBA 27-Sep 27-Sep 30-Sep COSCO SHIPPING ANDES 019 30-Sep 13-Oct 15-Oct 19-Oct 19-Oct 8-Oct 20-Oct 18-Oct YM CREDIBILITY 037 1-Oct 2-Oct 1-Oct 3-Oct 5-Oct COSCO NETHERLANDS 046 14-Oct 27-Oct 29-Oct 2-Nov 2-Nov 22-Oct 3-Nov 1-Nov SIMA SAHBA 116 2-Oct 2-Oct 3-Oct 3-Oct 7-Oct COSCO NETHERLANDS 046 14-Oct 27-Oct 29-Oct 2-Nov 2-Nov 22-Oct 3-Nov 1-Nov YM CREDIBILITY 038 8-Oct 9-Oct 8-Oct 10-Oct 12-Oct COSCO NETHERLANDS 046 14-Oct 27-Oct 29-Oct 2-Nov 2-Nov 22-Oct 3-Nov 1-Nov SIMA SAHBA 117 9-Oct 9-Oct 10-Oct 10-Oct 14-Oct COSCO NETHERLANDS 046 14-Oct 27-Oct 29-Oct 2-Nov