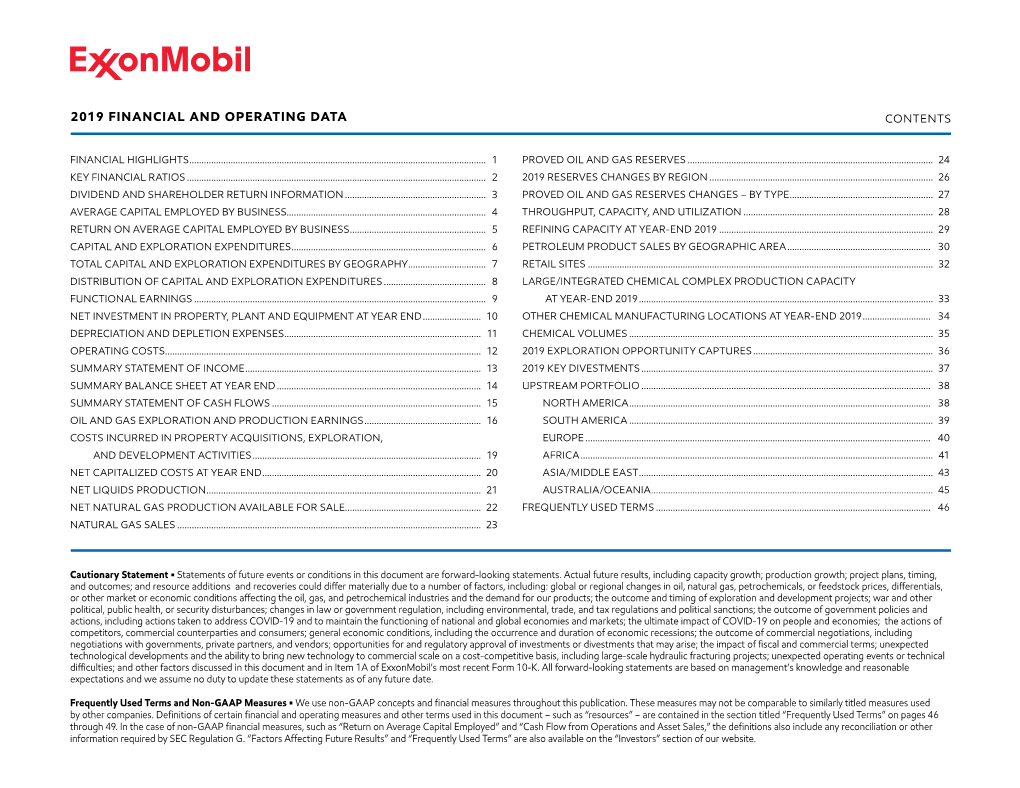

2019 Financial and Operating Data Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Oil Shale and Tar Sands

Fundamentals of Materials for Energy and Environmental Sustainability Editors David S. Ginley and David Cahen Oil shale and tar sands James W. Bunger 11 JWBA, Inc., Energy Technology and Engineering, Salt Lake City, UT, USA 11.1 Focus 11.2 Synopsis Tar sands and oil shale are “uncon- Oil shale and tar sands occur in dozens of countries around the world. With in-place ventional” oil resources. Unconven- resources totaling at least 4 trillion barrels (bbl), they exceed the world's remaining tional oil resources are characterized petroleum reserves, which are probably less than 2 trillion bbl. As petroleum becomes by their solid, or near-solid, state harder to produce, oil shale and tar sands are finding economic and thermodynamic under reservoir conditions, which parity with petroleum. Thermodynamic parity, e.g., similarity in the energy cost requires new, and sometimes of producing energy, is a key indicator of economic competitiveness. unproven, technology for their Oil is being produced on a large commercial scale by Canada from tar sands, recovery. For tar sands the hydrocar- and to a lesser extent by Venezuela. The USA now imports well over 2 million barrels bon is a highly viscous bitumen; for of oil per day from Canada, the majority of which is produced from tar sands. oil shale, it is a solid hydrocarbon Production of oil from oil shale is occurring in Estonia, China, and Brazil albeit on called “kerogen.” Unconventional smaller scales. Importantly, the USA is the largest holder of oil-shale resources. oil resources are found in greater For that reason alone, and because of the growing need for imports in the USA, quantities than conventional petrol- oil shale will receive greater development attention as petroleum supplies dwindle. -

Husky Energy and BP Announce Integrated Oil Sands Joint Development

December 5, 2007 For immediate release Husky Energy and BP Announce Integrated Oil Sands Joint Development CALGARY, Alberta – Husky Energy Inc is pleased to announce that an agreement has been reached with BP to create an integrated, North American oil sands business consisting of pre-eminent upstream and downstream assets. The development will be comprised of two joint 50/50 partnerships, a Canadian oil sands partnership to be operated by Husky and a U.S. refining LLC to be operated by BP. Husky and BP will each contribute assets of equal value to the business. Husky will contribute its Sunrise asset located in the Athabasca oil sands in northeast Alberta, Canada and BP will contribute its Toledo refinery located in Ohio, USA. The transaction, which is subject to the execution of final definitive agreements and regulatory approval, is expected to close in the first quarter of 2008 and with effective date January 1, 2008. "This transaction completes Husky’s Sunrise Oil Sands total integration with respect to upstream and downstream solutions," said Mr. John C.S. Lau, President & Chief Executive Officer of Husky Energy Inc. “Husky is extremely pleased to be partnering with BP, a world class global E & P and Refining company. The joint venture will provide better monitoring of project execution, costs and completion timing for this mega project development.” “Toledo and Sunrise are excellent assets. BP’s move into oil sands with Husky is an opportunity to build a strategic, material position and the huge potential of Sunrise is the ideal entry point for BP into Canadian oil sands.” said Tony Hayward, BP’s group chief executive. -

Offshore Wind and Hydrogen: Solving the Integration Challenge

OFFSHORE WIND AND HYDROGEN SOLVING THE INTEGRATION CHALLENGE OSW-H2: SOLVING THE INTEGRATION CHALLENGE 1 ACKNOWLEDGMENTS The study was jointly supported by the Offshore Wind Industry Council (OWIC) and Offshore Renewable Energy (ORE) Catapult, and delivered by ORE Catapult. The Offshore Wind Industry Council is a senior Government and industry forum established in 2013 to drive the development of the UK’s world- leading offshore wind sector. OWIC is responsible for overseeing implementation of the UK Offshore Wind Industrial Strategy. ORE Catapult is a not-for-profit research organisation, established in 2013 by the UK Government as one of a network of Catapults in high growth industries. It is the UK’s leading innovation centre for offshore renewable energy and helps to create UK economic benefit in the sector by helping to reduce the cost of offshore renewable energy, and support the growth of the industry. AUTHORS: ANGELIKI SPYROUDI KACPER STEFANIAK DAVID WALLACE STEPHANIE MANN GAVIN SMART ZEYNEP KURBAN The authors would like to thank a number of organisations and stakeholders for their support through Steering Committee and Expert Group meetings or individually. They include, in alphabetical order: Atkins (David Cole), BEIS (Tasnim Choudhury, Simone Cooper Searle, David Curran, Rose Galloway – Green, Fiona Mettam, Alan Morgan, Allan Taylor, Mark Taylor, Rita Wadey, Alex Weir) Committee on Climate Change (Mike Hemsley, David Joffe, Julia King), Crown Estate Scotland (Mark McKean), EDF Energy (David Acres), Energy Systems Catapult (Nick -

Statoil ASA Statoil Petroleum AS

Offering Circular A9.4.1.1 Statoil ASA (incorporated with limited liability in the Kingdom of Norway) Notes issued under the programme may be unconditionally and irrevocably guaranteed by Statoil Petroleum AS (incorporated with limited liability in the Kingdom of Norway) €20,000,000,000 Euro Medium Term Note Programme On 21 March 1997, Statoil ASA (the Issuer) entered into a Euro Medium Term Note Programme (the Programme) and issued an Offering Circular on that date describing the Programme. The Programme has been subsequently amended and updated. This Offering Circular supersedes any previous dated offering circulars. Any Notes (as defined below) issued under the Programme on or after the date of this Offering Circular are issued subject to the provisions described herein. This does not affect any Notes issued prior to the date hereof. Under this Programme, Statoil ASA may from time to time issue notes (the Notes) denominated in any currency agreed between the Issuer and the relevant Dealer (as defined below). The Notes may be issued in bearer form or in uncertificated book entry form (VPS Notes) settled through the Norwegian Central Securities Depositary, Verdipapirsentralen ASA (the VPS). The maximum aggregate nominal amount of all Notes from time to time outstanding will not exceed €20,000,000,000 (or its equivalent in other currencies calculated as described herein). The payments of all amounts due in respect of the Notes issued by the Issuer may be unconditionally and irrevocably guaranteed by Statoil A6.1 Petroleum AS (the Guarantor). The Notes may be issued on a continuing basis to one or more of the Dealers specified on page 6 and any additional Dealer appointed under the Programme from time to time, which appointment may be for a specific issue or on an ongoing basis (each a Dealer and together the Dealers). -

Press Release

Press Release First quarter 2021 results With results of more than $3 billion, Total fully benefits from rebound in hydrocarbon prices LNG and renewables represent one-third of results Change Change 1Q21 1Q20 1Q19 vs 1Q20 vs 1Q19 Oil price - Brent ($/b) 61.1 50.1 +22% 63.1 -3% Average price of LNG ($/Mbtu) 6.1 6.3 -4% 7.2 -16% Variable cost margin - Refining Europe, VCM ($/t) 5.3 26.3 -80% 33.0 -84% Adjusted net income (Group share)1 - in billions of dollars (B$) 3.0 1.8 69% 2.8 +9% - in dollars per share 1.10 0.66 +68% 1.02 +8% DACF1 (B$) 5.8 4.3 +34% 6.3 -8% Cash Flow from operations (B$) 5.6 1.3 x4.3 3.6 +54% Net income (Group share) of 3.3 B$ in 1Q21 Net-debt-to-capital ratio of 19.5% at March 31, 2021 vs. 21.7% at December 31, 20202 Hydrocarbon production of 2,863 kboe/d in 1Q21, a decrease of 7% compared to 1Q20 First 2021 interim dividend set at 0.66 €/share 2 Paris, April 29, 2021 - The Board of Directors of Total SE, meeting on April 28, 2021, under the chairmanship of Chairman and Chief Executive Officer Patrick Pouyanné, approved the Group's first quarter 2021 accounts. On this occasion, Patrick Pouyanné said: « In the first quarter, the Group fully benefited from rising oil and gas prices, up 38% and 24%, respectively quarter-to- quarter, and its strategy to grow LNG and Renewables and Electricity. -

UK Offshore Oil and Gas

House of Commons Energy and Climate Change Committee UK offshore oil and gas First Report of Session 2008–09 Volume II Oral and written evidence Ordered by The House of Commons to be printed date 17 June 2009 HC 341-II Published on date 30 June 2009 by authority of the House of Commons London: The Stationery Office Limited £16.50 The Committee Name The Energy and Climate Change Committee is appointed by the House of Commons to examine the expenditure, administration, and policy of the Department of Energy and Climate Change and associated public bodies. Current membership Mr Elliot Morley MP (Labour, Scunthorpe) (Chairman) Mr David Anderson MP (Labour, Blaydon) Colin Challen MP (Labour, Morley and Rothwell) Nadine Dorries MP (Conservative, Mid Bedfordshire) Charles Hendry MP (Conservative, Wealden) Miss Julie Kirkbride MP (Conservative, Bromsgrove) Anne Main MP (Conservative, St Albans) Judy Mallaber MP (Labour, Amber Valley) John Robertson MP (Labour, Glasgow North West) Sir Robert Smith MP (Liberal Democrats, West Aberdeenshire and Kincardine) Paddy Tipping MP (Labour, Sherwood) Dr Desmond Turner MP (Labour, Brighton Kemptown) Mr Mike Weir MP (Scottish National Party, Angus) Dr Alan Whitehead MP (Labour, Southampton Test) Powers The committee is one of the departmental select committees, the powers of which are set out in House of Commons Standing Orders, principally in SO No 152. These are available on the Internet via www.parliament.uk. Publication The Reports and evidence of the Committee are published by The Stationery Office by Order of the House. All publications of the Committee (including press notices) are on the Internet at www.parliament.uk/parliamentary_committees/ecc.cfm. -

Norwegian Petroleum Technology a Success Story ISBN 82-7719-051-4 Printing: 2005

Norwegian Academy of Technological Sciences Offshore Media Group Norwegian Petroleum Technology A success story ISBN 82-7719-051-4 Printing: 2005 Publisher: Norwegian Academy of Technological Sciences (NTVA) in co-operation with Offshore Media Group and INTSOK. Editor: Helge Keilen Journalists: Åse Pauline Thirud Stein Arve Tjelta Webproducer: Erlend Keilen Graphic production: Merkur-Trykk AS Norwegian Academy of Technological Sciences (NTVA) is an independent academy. The objectives of the academy are to: – promote research, education and development within the technological and natural sciences – stimulate international co-operation within the fields of technology and related fields – promote understanding of technology and natural sciences among authorities and the public to the benefit of the Norwegian society and industrial progress in Norway. Offshore Media Group (OMG) is an independent publishing house specialising in oil and energy. OMG was established in 1982 and publishes the magazine Offshore & Energy, two daily news services (www.offshore.no and www.oilport.net) and arranges several petro- leum and energy based conferences. The entire content of this book can be downloaded from www.oilport.net. No part of this publication may be reproduced in any form, in electronic retrieval systems or otherwise, without the prior written permission of the publisher. Publisher address: NTVA Lerchendahl gaard, NO-7491 TRONDHEIM, Norway. Tel: + (47) 73595463 Fax: + (47) 73590830 e-mail: [email protected] Front page illustration: FMC Technologies. Preface In many ways, the Norwegian petroleum industry is an eco- passing $ 160 billion, and political leaders in resource rich nomic and technological fairy tale. In the course of a little oil countries are looking to Norway for inspiration and more than 30 years Norway has developed a petroleum guidance. -

The Context of Public Acceptance of Hydraulic Fracturing: Is Louisiana

Louisiana State University LSU Digital Commons LSU Master's Theses Graduate School 2012 The context of public acceptance of hydraulic fracturing: is Louisiana unique? Crawford White Louisiana State University and Agricultural and Mechanical College, [email protected] Follow this and additional works at: https://digitalcommons.lsu.edu/gradschool_theses Part of the Environmental Sciences Commons Recommended Citation White, Crawford, "The onc text of public acceptance of hydraulic fracturing: is Louisiana unique?" (2012). LSU Master's Theses. 3956. https://digitalcommons.lsu.edu/gradschool_theses/3956 This Thesis is brought to you for free and open access by the Graduate School at LSU Digital Commons. It has been accepted for inclusion in LSU Master's Theses by an authorized graduate school editor of LSU Digital Commons. For more information, please contact [email protected]. THE CONTEXT OF PUBLIC ACCEPTANCE OF HYDRAULIC FRACTURING: IS LOUISIANA UNIQUE? A Thesis Submitted to the Graduate Faculty of the Louisiana State University and Agricultural and Mechanical College in partial fulfillment of the requirements for the degree of Master of Science in The Department of Environmental Sciences by Crawford White B.S. Georgia Southern University, 2010 August 2012 Dedication This thesis is dedicated to the memory of three of the most important people in my life, all of whom passed on during my time here. Arthur Earl White 4.05.1919 – 5.28.2011 Berniece Baker White 4.19.1920 – 4.23.2011 and Richard Edward McClary 4.29.1982 – 9.13.2010 ii Acknowledgements I would like to thank my committee first of all: Dr. Margaret Reams, my advisor, for her unending and enthusiastic support for this project; Professor Mike Wascom, for his wit and legal expertise in hunting down various laws and regulations; and Maud Walsh for the perspective and clarity she brought this project. -

Secure Fuels from Domestic Resources ______Profiles of Companies Engaged in Domestic Oil Shale and Tar Sands Resource and Technology Development

5th Edition Secure Fuels from Domestic Resources ______________________________________________________________________________ Profiles of Companies Engaged in Domestic Oil Shale and Tar Sands Resource and Technology Development Prepared by INTEK, Inc. For the U.S. Department of Energy • Office of Petroleum Reserves Naval Petroleum and Oil Shale Reserves Fifth Edition: September 2011 Note to Readers Regarding the Revised Edition (September 2011) This report was originally prepared for the U.S. Department of Energy in June 2007. The report and its contents have since been revised and updated to reflect changes and progress that have occurred in the domestic oil shale and tar sands industries since the first release and to include profiles of additional companies engaged in oil shale and tar sands resource and technology development. Each of the companies profiled in the original report has been extended the opportunity to update its profile to reflect progress, current activities and future plans. Acknowledgements This report was prepared by INTEK, Inc. for the U.S. Department of Energy, Office of Petroleum Reserves, Naval Petroleum and Oil Shale Reserves (DOE/NPOSR) as a part of the AOC Petroleum Support Services, LLC (AOC- PSS) Contract Number DE-FE0000175 (Task 30). Mr. Khosrow Biglarbigi of INTEK, Inc. served as the Project Manager. AOC-PSS and INTEK, Inc. wish to acknowledge the efforts of representatives of the companies that provided information, drafted revised or reviewed company profiles, or addressed technical issues associated with their companies, technologies, and project efforts. Special recognition is also due to those who directly performed the work on this report. Mr. Peter M. Crawford, Director at INTEK, Inc., served as the principal author of the report. -

Technip Awarded a Services Contract for a Hydrodesulphurization Unit in Germany

Technip awarded a services contract for a hydrodesulphurization unit in Germany December 7, 2007 Paris, December 7, 2007 Technip has been awarded by Total an engineering, procurement and construction management (EPCM) services contract, worth approximately €90 million, for a new kerosene hydrodesulphurization* unit. This unit will be built in the Leuna refinery, located near Leipzig, Germany. The contract covers the implementation of a new hydrotreating unit at low pressure. The unit will produce 120 tons per hour of kerosene and light diesel oil, in compliance with the German light heating oil sulphur specification of 50 parts per million. Technip's operating center in Düseldorf (Germany) will execute the contract, which is scheduled to be completed in October 2009. This award marks a new step in the collaboration between Technip and Total in Germany, for whom Technip has already carried out the basic engineering for this project and is currently performing engineering, procurement and construction services in the Leuna refinery. _______ * Hydrodesulphurization is a catalytic refining technology consisting in extracting sulphur contained in a petroleum product either to protect downstream unit catalysts or to maintain sulphur content at the level prescribed by the European norm intended to reduce transportation-related air pollution. * * * With a workforce of 22,000 people, Technip ranks among the top five corporations in the field of oil, gas and petrochemical engineering, construction and services. The Group is headquartered in Paris. The Group's main operating centers and business units are located in France, Italy, Germany, the UK, Norway, Finland, the Netherlands, the USA, Brazil, Abu-Dhabi, China, India, Malaysia and Australia. -

Drilling the Monterey Shale

A New California Oil Boom? Drilling the Monterey Shale By Robert Collier December 2013 Table of Contents Table of Contents 2 Part 1: Distracted by Fracking? 3 Part 2: The Most dangerous chemical you’ve never heard of 6 Part 3: The Climate conundrum 9 Part 4: Monterey Shale: Twice as polluting as Keystone XL? 13 Part 5: Is California really like North Dakota? 18 Part 6: Keeping the story straight: industry reports at odds on California oil 24 Notes 27 Page 2 | Drilling the Monterey Shale Part 1: Distracted by Fracking? Over the past few years, the United States has found the more likely candidate for tapping the Monterey itself in the midst of a major boom in oil and gas Shale: A technique, already widely in use in the oil production. Rapid expansion in the use of a drilling industry, known as “acidizing.” technique called hydraulic fracturing, or “fracking,” has opened up previously unreachable pockets of oil It’s not widely discussed in publicly, but for some and gas, and returned the U.S. to its historic position time oil companies have found acidizing more as a major global producer of these fossil fuels. effective in the Monterey Shale than fracking. And it seems the boom may be coming to Acidizing typically involves the injection of high California. Once a leading producer of oil in the U.S., volumes of hydrofluoric acid, a powerful solvent, California’s production has fallen off dramatically (abbreviated as “HF”) into the oil well to dissolve over the years as oil fields age and are depleted. -

Advancing Understanding of Resource Recovery and Environmental Impacts Via Field Laboratories

Advancing Understanding of Resource Recovery and Environmental Impacts via Field Laboratories Jared Ciferno – Oil and Gas Technology Manager, NETL Upstream Workshop Houston, TX February 14, 2018 The National Laboratory System Idaho National Lab National Energy Technology Laboratory Pacific Northwest Ames Lab Argonne National Lab National Lab Fermilab Brookhaven National Lab Berkeley Lab Princeton Plasma Physics Lab SLAC National Accelerator Thomas Jefferson National Accelerator Lawrence Livermore National Lab Oak Ridge National Lab Sandia National Lab Savannah River National Lab Office of Science National Nuclear Security Administration Environmental Management Fossil Energy Nuclear Energy National Renewable Energy Efficiency & Renewable Energy Los Alamos Energy Lab National Lab 2 Why Field Laboratories? • Demonstrate and test new technologies in the field in a scientifically objective manner • Gather and publish comprehensive, integrated well site data sets that can be shared by researchers across technology categories (drilling and completion, production, environmental) and stakeholder groups (producers, service companies, academia, regulators) • Catalyze industry/academic research collaboration and facilitate data sharing for mutual benefit 3 Past DOE Field Laboratories Piceance Basin • Multi-well Experiment (MWX) and M-Site project sites in the Piceance Basin where tight gas sand research was done by DOE and GRI in the 1980s • Data and analysis provided an extraordinary view of reservoir complexities and “… played a significant role