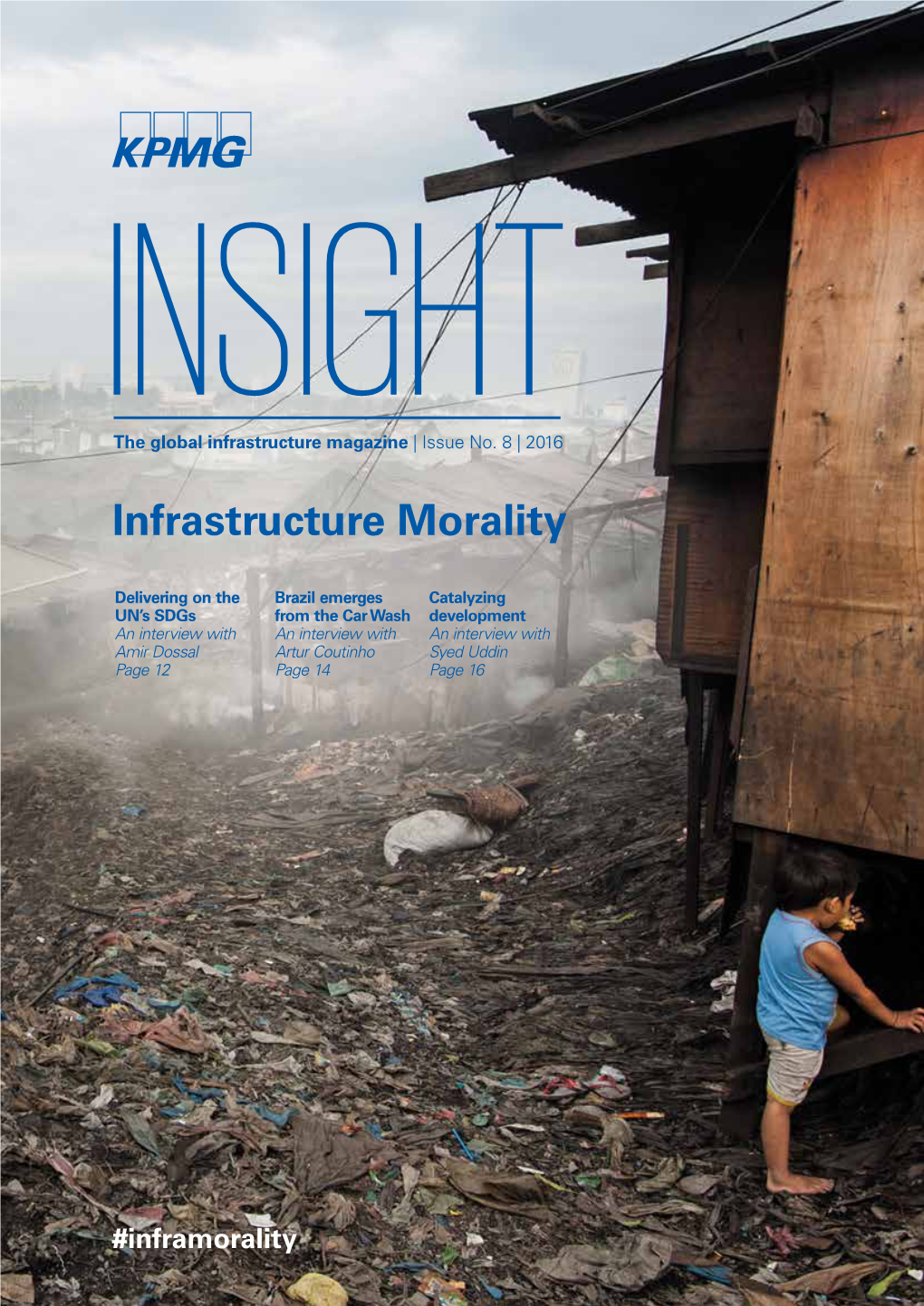

Infrastructure Morality

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Romer V. Evans and the Permissibility of Morality Legislation S

University of Missouri School of Law Scholarship Repository Faculty Publications Winter 1997 Romer v. Evans and the Permissibility of Morality Legislation S. I. Strong University of Missouri School of Law, [email protected] Follow this and additional works at: http://scholarship.law.missouri.edu/facpubs Part of the Civil Law Commons, Criminal Law Commons, and the State and Local Government Law Commons Recommended Citation S.I. Strong, Romer v. Evans and the Permissibility of Morality Legislation, 39 Ariz. L. Rev. 1259 (1997) This Article is brought to you for free and open access by University of Missouri School of Law Scholarship Repository. It has been accepted for inclusion in Faculty Publications by an authorized administrator of University of Missouri School of Law Scholarship Repository. ROMER v. EVANS AND THE PERMISSIBILITY OF MORALITY LEGISLATION S.I. Strong* I. INTRODUCTION ............................................................................................ 1260 II. THE ROMER MAJORrrY .............................................. 1263 III. THE ROMER DISSENT .................................................................................. 1265 IV. LOGIC AND LEGITIMACY: WHAT IS PERMISSIBLE AND WHAT IS POSSIBLE INTHE REALM OF MORALrrY LEGISLATION.................................. 1268 A. The Platonic Ideal 1........................................................................1269 B. The Aristotelian Ideal ................................... 1276 C. The Augustinian Approach ................................ 1280 D. -

Heritage Ethics and Human Rights of the Dead

genealogy Article Heritage Ethics and Human Rights of the Dead Kelsey Perreault ID The Institute for Comparative Studies in Literature, Art, and Culture, Carleton University, Ottawa, ON K1S 5B6, Canada; [email protected] Received: 1 May 2018; Accepted: 13 July 2018; Published: 17 July 2018 Abstract: Thomas Laqueur argues that the work of the dead is carried out through the living and through those who remember, honour, and mourn. Further, he maintains that the brutal or careless disposal of the corpse “is an attack of extreme violence”. To treat the dead body as if it does not matter or as if it were ordinary organic matter would be to deny its humanity. From Laqueur’s point of view, it is inferred that the dead are believed to have rights and dignities that are upheld through the rituals, practices, and beliefs of the living. The dead have always held a place in the space of the living, whether that space has been material and visible, or intangible and out of sight. This paper considers ossuaries as a key site for investigating the relationships between the living and dead. Holding the bones of hundreds or even thousands of bodies, ossuaries represent an important tradition in the cultural history of the dead. Ossuaries are culturally constituted and have taken many forms across the globe, although this research focuses predominantly on Western European ossuary practices and North American Indigenous ossuaries. This paper will examine two case studies, the Sedlec Ossuary (Kutna Hora, Czech Republic) and Taber Hill Ossuary (Toronto, ON, Canada), to think through the rights of the dead at heritage sites. -

Reading Stephen King: Issues of Censorship, Student Choice, and Popular Literature

DOCUMENT RESUME ED 414 606 CS 216 137 AUTHOR Power, Brenda Miller, Ed.; Wilhelm, Jeffrey D., Ed.; Chandler, Kelly, Ed. TITLE Reading Stephen King: Issues of Censorship, Student Choice, and Popular Literature. INSTITUTION National Council of Teachers of English, Urbana, IL. ISBN ISBN-0-8141-3905-1 PUB DATE 1997-00-00 NOTE 246p. AVAILABLE FROM National Council of Teachers of English, 1111 W. Kenyon Road, Urbana, IL 61801-1096 (Stock No. 39051-0015: $14.95 members, $19.95 nonmembers). PUB TYPE Collected Works - General (020) Opinion Papers (120) EDRS PRICE MF01/PC10 Plus Postage. DESCRIPTORS *Censorship; Critical Thinking; *Fiction; Literature Appreciation; *Popular Culture; Public Schools; Reader Response; *Reading Material Selection; Reading Programs; Recreational Reading; Secondary Education; *Student Participation IDENTIFIERS *Contemporary Literature; Horror Fiction; *King (Stephen); Literary Canon; Response to Literature; Trade Books ABSTRACT This collection of essays grew out of the "Reading Stephen King Conference" held at the University of Mainin 1996. Stephen King's books have become a lightning rod for the tensions around issues of including "mass market" popular literature in middle and 1.i.gh school English classes and of who chooses what students read. King's fi'tion is among the most popular of "pop" literature, and among the most controversial. These essays spotlight the ways in which King's work intersects with the themes of the literary canon and its construction and maintenance, censorship in public schools, and the need for adolescent readers to be able to choose books in school reading programs. The essays and their authors are: (1) "Reading Stephen King: An Ethnography of an Event" (Brenda Miller Power); (2) "I Want to Be Typhoid Stevie" (Stephen King); (3) "King and Controversy in Classrooms: A Conversation between Teachers and Students" (Kelly Chandler and others); (4) "Of Cornflakes, Hot Dogs, Cabbages, and King" (Jeffrey D. -

Table of Contents

Table of Contents PART I. Introduction 5 A. Overview 5 B. Historical Background 6 PART II. The Study 16 A. Background 16 B. Independence 18 C. The Scope of the Monitoring 19 D. Methodology 23 1. Rationale and Definitions of Violence 23 2. The Monitoring Process 25 3. The Weekly Meetings 26 4. Criteria 27 E. Operating Premises and Stipulations 32 PART III. Findings in Broadcast Network Television 39 A. Prime Time Series 40 1. Programs with Frequent Issues 41 2. Programs with Occasional Issues 49 3. Interesting Violence Issues in Prime Time Series 54 4. Programs that Deal with Violence Well 58 B. Made for Television Movies and Mini-Series 61 1. Leading Examples of MOWs and Mini-Series that Raised Concerns 62 2. Other Titles Raising Concerns about Violence 67 3. Issues Raised by Made-for-Television Movies and Mini-Series 68 C. Theatrical Motion Pictures on Broadcast Network Television 71 1. Theatrical Films that Raise Concerns 74 2. Additional Theatrical Films that Raise Concerns 80 3. Issues Arising out of Theatrical Films on Television 81 D. On-Air Promotions, Previews, Recaps, Teasers and Advertisements 84 E. Children’s Television on the Broadcast Networks 94 PART IV. Findings in Other Television Media 102 A. Local Independent Television Programming and Syndication 104 B. Public Television 111 C. Cable Television 114 1. Home Box Office (HBO) 116 2. Showtime 119 3. The Disney Channel 123 4. Nickelodeon 124 5. Music Television (MTV) 125 6. TBS (The Atlanta Superstation) 126 7. The USA Network 129 8. Turner Network Television (TNT) 130 D. -

Images of the Religious in Horror Films

Journal of Religion & Film Volume 5 Issue 2 October 2001 Article 7 October 2001 The Sanctification of ear:F Images of the Religious in Horror Films Bryan Stone Boston University School of Theology, [email protected] Follow this and additional works at: https://digitalcommons.unomaha.edu/jrf Recommended Citation Stone, Bryan (2001) "The Sanctification of ear:F Images of the Religious in Horror Films," Journal of Religion & Film: Vol. 5 : Iss. 2 , Article 7. Available at: https://digitalcommons.unomaha.edu/jrf/vol5/iss2/7 This Article is brought to you for free and open access by DigitalCommons@UNO. It has been accepted for inclusion in Journal of Religion & Film by an authorized editor of DigitalCommons@UNO. For more information, please contact [email protected]. The Sanctification of ear:F Images of the Religious in Horror Films Abstract Horror film functions both as a threat and a catharsis by confronting us with our fear of death, the supernatural, the unknown and irrational, ''the other" in general, a loss of identity, and forces beyond our control. Over the last century, religious symbols and themes have played a prominent and persistent role in the on-screen construction of this confrontation. That role is, at the same time, ambiguous insofar as religious iconography has become unhinged from a compelling moral vision and reduced to mere conventions that produce a quasi-religious quality to horror that lacks the symbolic power required to engage us at the deepest level of our being. Although religious symbols in horror films are conventional in their frequent use, they may have lost all connection to deeper human questions. -

Deconsecration Rites of Roman Catholic Church Buildings

religions Article Ritual Void or Ritual Muddle? Deconsecration Rites of Roman Catholic Church Buildings Kim de Wildt Transformation of Sacred Space: Function and Use of Religious Places in Germany (FOR 2733), University of Bonn, 53113 Bonn, Germany; [email protected] Received: 29 August 2020; Accepted: 6 October 2020; Published: 10 October 2020 Abstract: The decrease in people who regularly celebrate liturgy in western Europe has led to the question of what to do with so-called obsolete church buildings. This question not only refers to whether or not a church building will be converted, reused or demolished, but also to the question of whether or not such a building needs to be deconsecrated, and if so, what does deconsecration of a church building actually entail? In this contribution, I will consider the role deconsecration rites play in the Roman Catholic church when a church building is taken out of liturgical use. In Roman Catholic liturgy, there are no prescribed, official deconsecration rites that are mandatory for a church building that is to be taken out of liturgical use. The actual deconsecration of a church building is, according to canon law, established by a decree that is issued by the responsible diocesan bishop. In the case of a church being taken out of liturgical use, however, there seems to be a shift from having a ritual void with regard to deconsecration rites, and also a focus on the “legitimate” way (in the sense of canon law) to deconsecrate a church building (object orientation), towards, in recent decades, paying more attention to a growing pastoral need (subject orientation) for deconsecration rites. -

The Convergence of Morality and Aesthetics in Nabokov's Lolita

Georgia State University ScholarWorks @ Georgia State University English Theses Department of English 6-12-2006 Aesthetic Excuses and Moral Crimes: The Convergence of Morality and Aesthetics in Nabokov's Lolita Jennifer Elizabeth Green Follow this and additional works at: https://scholarworks.gsu.edu/english_theses Part of the English Language and Literature Commons Recommended Citation Green, Jennifer Elizabeth, "Aesthetic Excuses and Moral Crimes: The Convergence of Morality and Aesthetics in Nabokov's Lolita." Thesis, Georgia State University, 2006. https://scholarworks.gsu.edu/english_theses/9 This Thesis is brought to you for free and open access by the Department of English at ScholarWorks @ Georgia State University. It has been accepted for inclusion in English Theses by an authorized administrator of ScholarWorks @ Georgia State University. For more information, please contact [email protected]. AESTHETIC EXCUSES AND MORAL CRIMES: THE CONVERGENCE OF MORALITY AND AESTHETICS IN NABOKOV”S LOLITA by JENNIFER ELIZABETH GREEN Under the Direction of Paul Schmidt ABSTRACT This thesis examines the debate between morality and aesthetics that is outlined by Nabokov in Lolita’s afterword. Incorporating a discussion of Lolita’s critical history in order to reveal how critics have chosen a single, limited side of the debate, either the moral or aesthetic, this thesis seeks to expose the complexities of the novel where morality and aesthetics intersect. First, the general moral and aesthetic features of Lolita are discussed. Finally, I address the two together, illustrating how Lolita cannot be categorized as immoral, amoral, or didactic. Instead, it is through the juxtaposition of form and content, parody and reality, that the intersection of aesthetics and morality appears, subverting and repudiating the voice of its own narrator and protagonist, evoking sympathy for an appropriated and abused child, and challenging readers to evaluate their own ethical boundaries. -

Morality and Problems of Overpopulation

MORALITY AND PROBLEMS OF OVERPOPULATION Alarm signals are being hoisted everywhere in the popular press, warning of an imminent onslaught of world overpopulation.1 Even discriminating readers must be wondering how serious the threat is, and what steps ought to be taken. Pressure for compulsory birth control is building up. Catholic opposition appears unreasonable because contrary to the common good.2 This paper will try to establish four points to your satisfaction, 1 The Population Reference Bureau of Washington, D. C., has a number of able writers on its list who issue widely printed news releases, enter articles into such large circulation periodicals as Time, Redbook, The Saturday Eve- ning Post, Newsweek, Nation's Business, Fortune, Look, Scientific American, and others. They follow the alarmist trend. The Planned Parenthood Federa- tion, with headquarters in New York, is quite outspoken in its efforts to popularize birth control and to refute the stand of the Catholic Church. The Reader's Digest of December, 1958, carried a pessimistic article by Julian Huxley; What's New of Abbott Laboratories carried a similar one by Sir Charles Darwin in the late winter issue of 1959; it also presented an opposing view of the present writer in the spring issue; Kingsley Davis follows the alarmist trend in The New York Times Magazine, March 5, 1959; Newsweek featured a short article entitled "The Avalanche of Babies" on April 27, 1959. The tone of newspaper reports tends toward pessimism, and so does that of a spate of books on the reading stand. 2 Many non-Catholic writers have adopted a moderate attitude in their criticism of the Catholic Church's stand: some suggest ways in which the Church could escape gracefully from what they suppose to be a dilemma. -

Physical and Moral Survival in Stephen King's Universe

Brigham Young University BYU ScholarsArchive Theses and Dissertations 2012-03-06 Monsters and Mayhem: Physical and Moral Survival in Stephen King's Universe Jaime L. Davis Brigham Young University - Provo Follow this and additional works at: https://scholarsarchive.byu.edu/etd Part of the Classics Commons, and the Comparative Literature Commons BYU ScholarsArchive Citation Davis, Jaime L., "Monsters and Mayhem: Physical and Moral Survival in Stephen King's Universe" (2012). Theses and Dissertations. 2979. https://scholarsarchive.byu.edu/etd/2979 This Thesis is brought to you for free and open access by BYU ScholarsArchive. It has been accepted for inclusion in Theses and Dissertations by an authorized administrator of BYU ScholarsArchive. For more information, please contact [email protected], [email protected]. Monsters and Mayhem: Physical and Moral Survival in Stephen King’s Universe Jaime L. Davis A thesis submitted to the faculty of Brigham Young University in partial fulfillment of the requirements for the degree of Master of Arts Carl Sederholm, Chair Kerry Soper Charlotte Stanford Department of Humanities, Classics, and Comparative Literature Brigham Young University April 2012 Copyright © 2012 Jaime L. Davis All Rights Reserved ABSTRACT Monsters and Mayhem: Physical and Moral Survival in Stephen King’s Universe Jaime L. Davis Department of Humanities, Classics, and Comparative Literature, BYU Master of Arts The goal of my thesis is to analyze physical and moral survival in three novels from King’s oeuvre. Scholars have attributed survival in King’s universe to factors such as innocence, imaginative capacity, and career choice. Although their arguments are convincing, I believe that physical and moral survival ultimately depends on a character’s knowledge of the dark side of human nature and an understanding of moral agency. -

The Writings of Thomas King and Mudrooroo

Blurring Representation: the Writings of Thomas King and Mudrooroo Clare Archer-Lean B.A. (First Class Hons) School of Humanities and Social Sciences Centre for Community and Cross-cultural Studies Queensland University of Technology Submitted in full requirement for the degree of Doctor of Philosophy 2002 ii Abstract This thesis explores the issues of representation and identity through an examination of the writings of Thomas King and Mudrooroo. The particular focus of the dissertation is on the similar yet distinctive ways these authors explore past and present possibilities for representing Indigenous peoples in fiction. This discussion has a largely Canadian-Australian cross-cultural comparison because of the national milieux in which each author writes. The research question, then, addresses the authors’ common approaches to Indigenous, colonial and postcolonial themes and the similar textual attitudes to the act of representation of identity in writing. In order to explore these ideas the chapters in the thesis do not each focus on a particular author or even on a specific text. Each chapter examines the writings of both authors comparatively, and reads the novels of both Thomas King and Mudrooroo thematically. The themes unifying each chapter occur in four major movements. Firstly, the Preface and Chapter One are primarily concerned with the methodology of the thesis. This methodology can be summarised as a combination of general postcolonial assumptions about the impact of colonial texts on representations of Indigenous peoples; ideas of reading practice coming from North American and Australian Indigenous writing communities and cultural studies theories on race. A movement in argument then occurs in Chapters Two and Three, which focus upon how the authors interact with colonising narratives from the past. -

By Stephen King (Discussion Questions)

11/22/1963 By Stephen King (Discussion Questions) About the Author: Stephen King was born in Portland, Maine in 1947 and grew up in Durham, Maine. He attended the University of Maine at Orono, where he wrote a weekly column for the school newspaper, The Maine Campus. He was also active in student politics, serving as a member of the Student Senate, and supporting the anti-war movement. King graduated from the University of Maine at Orono in 1970, with a B.A. in English. He married Tabitha Spruce in 1971. King sprang onto the literary scene with the publication of Carrie (Doubleday, 1974) which was later made into a movie. The success of Carrie allowed him to leave his high school teaching position and write full-time. Other bestselling novels followed including The Shining, The Stand and The Dead Zone. Stephen King is known as a prolific writer of horror, suspense, science fiction and fantasy. His books have sold more than 350 million copies worldwide and many of his literature has been adapted to the screen and television. As of 2011, he had written and published 49 novels, including seven under the pen name Richard Bachman, five non-fiction books, and nine collections of short stories. Book Summary: Winner, 2012 Thriller Award for Best Novel Dallas, 11/22/63: Three shots ring out. President John F. Kennedy is dead. Life can turn on a dime—or stumble into the extraordinary, as it does for Jake Epping, a high school English teacher in a Maine town. While grading essays by his GED students, Jake reads a gruesome, enthralling piece penned by janitor Harry Dunning: fifty years ago, Harry somehow survived his father’s sledgehammer slaughter of his entire family. -

Death of Morality: Does It Portend Death of America

Touro Law Review Volume 32 Number 3 Article 6 2016 Death of Morality: Does it Portend Death of America Gerald Walpin Follow this and additional works at: https://digitalcommons.tourolaw.edu/lawreview Part of the Law Commons Recommended Citation Walpin, Gerald (2016) "Death of Morality: Does it Portend Death of America," Touro Law Review: Vol. 32 : No. 3 , Article 6. Available at: https://digitalcommons.tourolaw.edu/lawreview/vol32/iss3/6 This Article is brought to you for free and open access by Digital Commons @ Touro Law Center. It has been accepted for inclusion in Touro Law Review by an authorized editor of Digital Commons @ Touro Law Center. For more information, please contact [email protected]. Walpin: Death of Morality DEATH OF MORALITY: DOES IT PORTEND DEATH OF AMERICA? Gerald Walpin∗ THE ISSUE How many times have you heard that government should not be involved in legislating morality? One representative libertarian objector to government involvement wrote that “if one really cares about morality, why would we let government anywhere near it,” be- cause “[w]hen society turns its aspirational morality over to the state, the state makes a mess of it.”1 Until 1992, the Supreme Court repeatedly rejected that liber- tarian view. For example, in as late as 1991, the Court upheld a state public indecency statute as within “[t]he traditional police power of the States . to provide for the public . morals.”2 That ruling reaf- firmed many similar rulings by the Court, for example, in 1986: “[t]he law . is constantly based on notions of morality . .”3 Then, suddenly, in 1992, the Court did a 180 degree reversal to de- clare that the Government had no right “to mandate our own moral 4 code.” ∗ Hon.