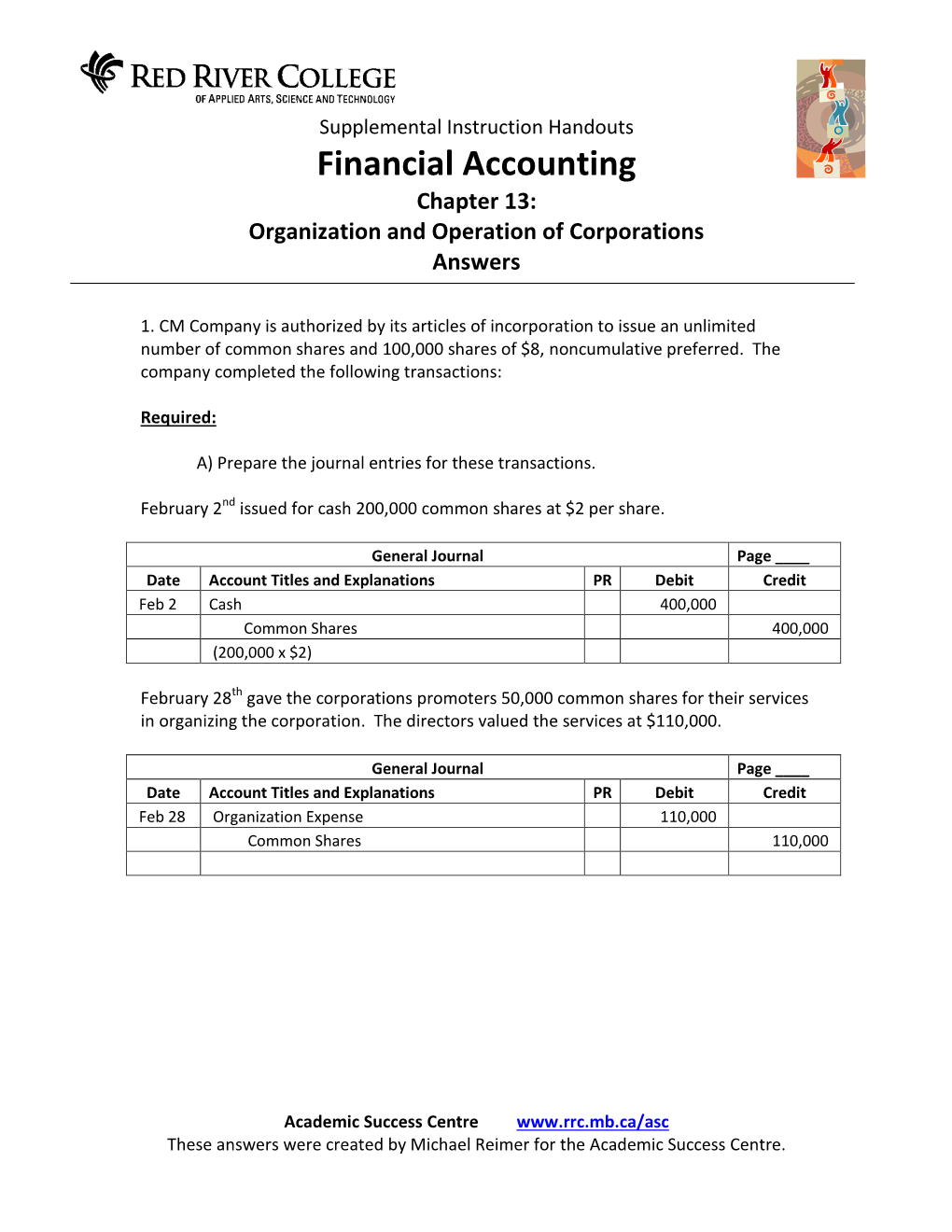

Financial Accounting Chapter 13: Organization and Operation of Corporations Answers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A73 Cash Basis Accounting

World A73 Cash Basis Accounting Net Change with new Cash Basis Accounting program: The following table lists the enhancements that have been made to the Cash Basis Accounting program as of A7.3 cum 15 and A8.1 cum 6. CHANGE EXPLANATION AND BENEFIT Batch Type Previously cash basis batches were assigned a batch type of ‘G’. Now cash basis batches have a batch type of ‘CB’, making it easier to distinguish cash basis batches from general ledger batches. Batch Creation Previously, if creating cash basis entries for all eligible transactions, all cash basis entries would be created in one batch. Now cash basis entries will be in separate batches based on a one-to-one batch ratio with the originating AA ledger batch. For example, if cash basis entries were created from 5 separate AA ledger batches, there will be 5 resulting AZ ledger batches. This will make it simpler to track posting issues as well as alleviate problems inquiring on cash basis entries where there were potential duplicate document numbers/types within the same batch. Batch Number Previously cash basis batch numbers were unique in relation to the AA ledger batch that corresponded to the cash basis entries. Now the cash basis batch number will match the original AA ledger batch, making it easier to track and audit cash basis entries in relation to the originating transactions. Credit Note Prior to A7.3 cum 14/A8.1 cum 4, the option to assign a document type Reimbursement other than PA to the voucher generated for reimbursement did not exist. -

Consolidation-Date of Acquisition

Consolidation-Date of Acquisition Chapter 4 • Consolidated statements bring together the operating results and financial position of two or more separate legal entities into a single set of Consolidation As statements for the economic entity as a whole. Of The Date Of Acquisition • To accomplish this, the consolidation process includes procedures that eliminate all effects of intercorporate ownership and intercompany transactions. McGraw-Hill/Irwin Copyright © 2005 by The McGraw-Hill Companies, Inc. All rights reserved. 4-2 Consolidation-Date of Acquisition Consolidation-GAAP • The procedures used in accounting for intercorporate investments were discussed in Chapter 2. • These procedures are important for the preparation of consolidated statements because • Consolidated and unconsolidated financial the specific consolidation procedures depend on statements are prepared using the same the way in which the parent accounts for its generally accepted accounting principles. investment in a subsidiary. • The consolidated statements, however, are the same regardless of the method used by the parent company to account for the investment. 4-3 4-4 Roadmap—Chapter 4 Roadmap—Chapters 5 to 10 • After introducing the consolidation workpaper, • Chapter 5 includes the preparation of a full set of this chapter provides the foundation for an consolidated financial statements in subsequent understanding of the preparation of consolidated periods, that is, after the date of acquisition. financial statements by discussing the preparation of a consolidated balance sheet immediately following the establishment of a • Chapters 6 through 10 deal with intercorporate parent-subsidiary relationship. transfers and other more complex topics. 4-5 4-6 1 Consolidation Workpapers Consolidation Workpapers • The consolidation workpaper provides a • The parent and its subsidiaries, as separate mechanism for efficiently combining the legal and accounting entities, each maintain accounts of the separate companies involved in their own books. -

Workflow and Process Control – Charles Hoffman, Cpa

MASTERING XBRL-BASED DIGITAL FINANCIAL REPORTING – PART 3: WORKING WITH DIGITAL FINANCIAL REPORTS – WORKFLOW AND PROCESS CONTROL – CHARLES HOFFMAN, CPA 1. Workflow and Process Control The purpose of this section is to discuss the workflow and process control related to the creation of XBRL-based digital financial reports. A financial report is the end of a process from the perspective of a reporting entity. That is exactly correct from the perspective of a reporting entity. But, from the perspective of a financial analyst that is making use of the reported information, the financial report is the beginning of a process. Perspective matters. What we are working with here is not a “silo”, rather it is more of a “chain”. This section shows you how you create an XBRL-based digital financial report. Many times, reports will be automatically generated from an accounting system. 1.1. Workflow Basics Per Wikipedia, workflow is defined as, “A workflow consists of an orchestrated and repeatable pattern of activity, enabled by the systematic organization of resources into processes that transform materials, provide services, or process information.1” From a computer science perspective, workflow is “The computerised facilitation or automation of a business process, in whole or part2”. From a computer science perspective, workflow is concerned with the automation of procedures where documents, information or tasks are passed between participants according to a defined set of rules to achieve, or contribute to, an overall business goal.” Workflow is often associated with Business Process Management, which is concerned with the assessment, analysis, modelling, definition and subsequent operational implementation of the core business processes of an organisation (or other business entity). -

Basic Accounting Terminology: • Event: a Happening Or Consequence

GOVERNMENTAL ACCOUNTING All those involved in the oversight or management of government operations, and those whose livelihood and interest rely on the finances of local governments, need to have a clear understanding of governmental accounting, auditing, and financial reporting which are based on a sound set of principles and interrelated practices and procedures. Accounting, financial reporting, and the financial statement audit provide the informational infrastructure of public finance. Accountability: Term used by GASB to describe a government’s duty to justify the raising and spending of public resources. The GASB has identified accountability as the “paramount objective” of financial reporting “from which all other objectives must flow”. Accounting and financial reporting (primarily the responsibility of management) are complementary rather than identical. Accounting: The process of assembling, analyzing, classifying, and recording data relevant to a government’s finances. Financial reporting: “Accounting” and “financial reporting” are similar but distinctly different terms that are often used together. The process of taking the information thus assembled, analyzed, classified, and recorded and providing it in usable form to those who need it. Financial reporting can take one of three forms: internal financial reporting (management reports), special purpose financial reporting (outside parties), and general purpose external financial reporting (GPEFR). The nationally recognized standards that govern GPEFR are known as generally accepted accounting principles (GAAP). 1 Display: The display method of communication provides that items are reported as dollar amounts on the face of the financial statements if they both 1) meet the definition of one of the seven financial statement elements and 2) can be reliably measured. -

Special Journals

SPECIAL JOURNALS Special journals are used to make recording and posting frequently occurring transactions more efficient. Special journals are customized to fit the needs of each business. Special journals are made up of “special” columns labeled with account titles for accounts used in frequently occurring transactions. All special journals also include an “Other” or “Sundry” column that is used to hold accounts and amounts for items that do not fit in the special columns. When using a special journal system, analyze transactions as normal and record the transaction in the appropriate journal as discussed below. Posting from special journals occurs differently from the General Journal. Any amounts affecting a customer or creditor are posted immediately from the special journal to the appropriate account in the Accounts Receivable or Accounts Payable subsidiary ledger. A check mark is placed in the Post Reference column of the journal to indicate this amount has been posted to the customer or creditor account. Any amounts in the Other column are posted immediately to the account written in the account title column. The account number is placed in the post reference column to show this amount has been posted. Special columns are posted at the end of the month as a column total. Account numbers are placed under each column total in parentheses to indicate that these amounts have been posted. A check mark is placed under the Other column total to indicate that this amount has already been posted (when the individual amounts were posted). POSTING ORDER OF JOURNALS In order to avoid negative balances, the following order of posting column totals is recommended: Purchases Sales/Revenue Cash Receipts Cash Payments MORE ABOUT SPECIAL JOURNALS Four special journals are generally used—Purchases Journal, Revenue/Sales Journal, Cash Receipts Journal and Cash Payments Journal. -

Growing Pains at Groupon

ISSUES IN ACCOUNTING EDUCATION American Accounting Association Vol. 29, No. 1 DOI: 10.2308/iace-50595 2014 pp. 229–245 Growing Pains at Groupon Saurav K. Dutta, Dennis H. Caplan, and David J. Marcinko ABSTRACT: On November 4, 2011, Groupon Inc. went public with an initial market capitalization of $13 billion. The business was formed a couple of years earlier as an offshoot of ‘‘The Point.’’ The business grew rapidly and increased its reported revenue from $14.5 million in 2009 to $1.6 billion in 2011. Soon after going public, prior to its announcement of its first-quarter results, the company’s auditors required Groupon to disclose a material weakness in its internal controls over financial reporting that impacted its disclosures on revenue and its estimation of returns. This case uses Groupon to motivate discussion of financial reporting issues in e- commerce businesses. Specifically, the case focuses on (1) revenue recognition practices for ‘‘agency’’ type e-commerce businesses, (2) accounting for sales with a right of return for new products, and (3) use of alternative financial metrics to better convey the intrinsic value of a business. The case requires students to critically read, analyze, and apply authoritative accounting guidance, and to read and analyze communications between the Securities and Exchange Commission (SEC) and the registrant. Keywords: Groupon; revenue recognition; allowance for sales returns; e-commerce; non-GAAP metrics. GROWING PAINS AT GROUPON s an undergraduate music major at Northwestern University, Andrew Mason eagerly sought a version of rock music that would fuse punk with the Beatles and Cat Stevens. -

Chapter 3 Preparing Financial Statements

Revised Summer 2012 CHAPTER 3 PREPARING FINANCIAL STATEMENTS Key Terms and Concepts to Know Accounting Period: Time Period Principle Calendar vs. Fiscal Year Accounting Cycle: Know the steps in order. Use the steps as a reference to insure that journal entries, trial balances and financial statements are prepared in the proper order. Accrual Basis Accounting: Accrual vs. Cash Basis Accounting Revenue Recognition Principle requires that revenues are reported in the period in which they are earned, regardless of when payment is received. Matching Principle requires that all expenses incurred (whether paid or not) are recorded in the same accounting period as the revenues earned as a result of these expenses. Adjusting Entries: Accrued revenues and accrued expenses Deferred revenues and deferred expenses Unbilled vs. unearned revenues Closing Process: Records the current year’s net income and dividends in retained earnings and zeros-out the balance in all revenue, expense and dividend accounts at year-end. Revenue and expense account balances are transferred into the Income Summary account. The balance in the income summary represents net income (revenues minus expenses) which is then transferred into retained earnings. Dividends are transferred directly into retained earnings, bypassing the income summary because dividends are not part of the calculation of net income and do not appear on the income statement. Profit Margin ratio and Current ratio Page 1 of 27 Revised Summer 2012 Key Topics to Know Adjusting Entries Adjusting entries are required to record internal transactions and to bring assets and liability accounts to their proper balances and record expenses or revenues in the proper accounting period. -

General Ledger Vs General Journal: What Is the Difference?

What’s The Difference Between General Ledger and General Journal? General Ledger Vs General Journal: What Is The Difference? When it comes to business finances, using a double-entry system that makes use of both a general ledger and a general journal is the best method for checking overall statistics and keeping things running smoothly and profitably. But to understand how a double-entry accounting system, or double-entry bookkeeping works, it is first necessary to understand the different functions associated with the general ledger and the general journal. https://planergy.com/blog/general-ledger-vs-general-journal/ 1 / 6 The General Ledger The general ledger, also known as the book of second entry. It is used to track assets, liabilities, owner capital, revenues, and expenses. It is a book or file used to record all relevant accounts. Each account is a two-columns in a T shaped table where the book taper typically places the account title at the top of the T while recording that debit entries on the left side and credit entries on the right. Sometimes, you’ll find that the general ledger displays additional columns for particulars such as a description of the transaction, serial number, and date. Transactions from general journals are posted in the general ledger accounts and then balances are calculated and transferred from the general ledger to a trial balance. You also use it to create the chart of accounts, or the list of all the accounts used in the organization’s general ledger. The act of recording a transaction in the ledger is called posting. -

General Fixed Asset Accounting

University of Tennessee, Knoxville TRACE: Tennessee Research and Creative Exchange MTAS History Municipal Technical Advisory Service (MTAS) 9-1992 General Fixed Asset Accounting Dick Phebus Municipal Technical Advisory Service Follow this and additional works at: https://trace.tennessee.edu/utk_mtashist Part of the Public Administration Commons The MTAS publications provided on this website are archival documents intended for informational purposes only and should not be considered as authoritative. The content contained in these publications may be outdated, and the laws referenced therein may have changed or may not be applicable to your city or circumstances. For current information, please visit the MTAS website at: mtas.tennessee.edu. Recommended Citation Phebus, Dick, "General Fixed Asset Accounting" (1992). MTAS History. https://trace.tennessee.edu/utk_mtashist/23 This Report is brought to you for free and open access by the Municipal Technical Advisory Service (MTAS) at TRACE: Tennessee Research and Creative Exchange. It has been accepted for inclusion in MTAS History by an authorized administrator of TRACE: Tennessee Research and Creative Exchange. For more information, please contact [email protected]. Accounting ARCHIVES \ ,\ ' �. ijifQ!t � ....----1,� i 1---------. j 'Flm • I i!i I: IS I ...----� General Fixed Asset Accounting By C. Richard Phebus MTAS Finance and Accounting Consultant The University of Tennessee �unlclpal Technical Munidpal Technical AdvisoiyService AdvlsilryService In cooperationwith The Tennesssee Municipal League September 1992 TH IRS 105 Kn The Municipal Technical Advisory Service (MTAS) is a statewide agency of The University of Tennessee's Institute for Public Service. MTAS operates in cooperation with the Tennessee . Municipal League in providing technical assistance services to officials of Tennessee's incor porated municipalities. -

Chapter 3: General Journals

Chapter 3: General Journals CHAPTER 3: GENERAL JOURNALS Objectives The objectives are: • Explain the General Journal entry and posting system. • Create and post General Journal entries. • Describe Recurring Journals, including fields and allocations. • Demonstrate how to use Recurring Journals with allocations and to record accruals. • Explain the processes of reversing and correcting journal entries. Introduction General Journals are used to post information into general ledger and other accounts, such as cost allocations and adjustments to ledger accounts. This section includes information on using General Journals in Microsoft Dynamics™ NAV 5.0. In addition to an overview of the General Journal structure, this section explains the process of creating and posting journal entries and a description of recurringjournals - including information on using allocations on recurring entry lines. The final section explains how to use General Journals to reverse and correct erroneous entries. Microsoft Official Training Materials for Microsoft Dynamics ™ 3 - 1 Your use of this content is subject to your current services agreement Finance in Microsoft Dynamics™ NAV 5.0 Journal Overview General journals are used to enter data into general ledger accounts and other accounts, such as customers, vendors, and banks. The journal entry system has three layers: • Journal templates • Journal batches • Journal lines Figure 3.1 displays an illustration of the journal structure. FIGURE 3.1 JOURNAL STRUCTURE: TEMPLATES, BATCHES, AND LINES Although all three -

(A) GENERAL JOURNAL Date Accounts Debit Credit Cash

I-14.04 Journal entries and statement of stockholders' equity (a) GENERAL JOURNAL Date Accounts Debit Credit Cash 2,000,000 Common Stock 600,000 Pd-in Cap in Excess of Par - CS 1,400,000 To record issuance of 200,000 shares of $3 par value common stock at $10 per share A Cash 5,100,000 Preferred Stock 5,000,000 Pd-in Cap in Excess of Par - PS 100,000 To record issuance of 50,000 shares of $100 par value preferred stock at $102 per share B Treasury Stock 120,000 Cash 120,000 To record acquisition of 10,000 treasury shares at $12 per share C Dividends 319,000 Dividends Payable 319,000 To record dividend declaration (($5,000,000 X 6%) + ((200,000 - 10,000) X $0.10)) D Dividends Payable 319,000 Cash 319,000 To record payment of previously declared dividends GENERAL JOURNAL Date Accounts Debit Credit E Cash 150,000 Treasury Stock 120,000 Pd-in Cap in Excess of Par - CS 30,000 To record reissue of 10,000 treasury shares at $15 per share F Retained Earnings 52,000 Common Stock 12,000 Pd-in Cap in Excess of Par - CS 40,000 To record issuance of a 2% stock dividend (200,000 shares X 2% X $13 per share market price) G Treasury Stock 220,000 Cash 220,000 To record acquisition of 20,000 treasury shares at $11 per share H Income Summary 800,000 Retained Earnings 800,000 To close net income to retained earnings (b) Dry Dock Container Corporation Statement of Stockholders’ Equity For the Year Ending December 31, 20X5 Paid-in Paid-in Total Preferred Common Capital Capital Stock- Stock, Stock, $3 in Excess of in Excess of Retained Treasury holders’ $100 -

JOURNAL ENTRIES What Is a Journal Entry?

JOURNAL ENTRIES What is a journal entry? A journal entry is a logging of a transaction into an accounting journal. Each line of a transaction recorded is either a debit or a credit. The total amount for the debits must equal the total amount for the credits. While most entries are generated automatically in QuickBooks from writing checks, entered deposits, receiving payments, etc., there are a few times why you need to do some of your own accounting using journal entries. Example of when we use journal entries: To set up opening balances in accounts. To reassign accounts. Example: You may start out tracking income in one account, but decide you want to divide income into 2 different accounts. To move income from one account to another, you would use a journal entry to debit the income for the first account and credit it to the second. To correct account assignments. You can reassign or reclass an expense to another expense account using a journal entry. To reassign classes. You can transfer income and expense from one class to another using a journal entry. To depreciate assets. You decrease the value of an asset account each year that you own a depreciable asset. Record pre-paid payroll and labor distribution Record pre-paid expenses. You can record a monthly assignment of the expense using a journal entry. Record liability for assessment. Record year-end transactions. 1 Balancing Debits and Credits If you increase the amount in one account, you have to decrease it in another. A journal entry transaction must balance.