Basic Accounting Terminology: • Event: a Happening Or Consequence

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

WHY ACCOUNTING and FINANCIAL REPORTING for GOVERNMENTS IS DIFFERENT THAN BUSINESSES by Jeffrey Winter

WHY ACCOUNTING AND FINANCIAL REPORTING FOR GOVERNMENTS IS DIFFERENT THAN BUSINESSES by Jeffrey Winter here are more than 80,000 user groups differ so too does the revenues through taxes on sales, governmental entities purpose of financial reporting. income, property and other activities. in the United States Governments are created to These types of revenues consisting of counties, provide their citizens with public are referred to as “nonexchange” municipalities,T townships, independent services that businesses are not transactions because they do not school districts and special districts. incentivized to provide. This includes result from a voluntary exchange Each government must adhere a wide variety of services from law between willing participants. In fact, to accounting and financial reporting enforcement to recreational activities the parties who provide the funding standards set by the Governmental to road repair. under nonexchange transactions are Accounting Standards Board (GASB). The users of these services are often not the same parties receiving These standards and the resulting interested in the government’s ability to the services funded – or at least they do financial statements are similar to those sustain the services and their ability to not benefit in direct correlation to the of businesses, but maintain a number do so efficiently. Further, they want to amount of funding provided. of key differences that often prompt know if the burden of paying for current As a result, the nature of individuals with business backgrounds services has already been funded or nonexchange transactions requires to ask the question: Why are the shifted to taxpayers in future years. different accounting considerations standards different for governments? Accordingly, governmental than exchange based revenues. -

Fund Accounting Training: Glossary

GLOSSARY Advance A type of internal borrowing (temporary or long term) between fund groups for which a due to/from must be set up. Agency funds Resources held by the institution as custodian or agent for students, faculty or staff, and organizations. No institutional equity in these funds. AICPA American Institute of Certified Public Accountants Annuity funds Funds established through a deferred giving contract. Payments to beneficiaries include both interest and a portion of principal. Upon the beneficiaries’ death, the funds revert to the agency. Auxiliary enterprise An entity that exists to furnish a service to students, faculty, or staff and charges a fee directly related to although not necessarily equal to the cost of the service; managed as essentially self‐supporting. Balance Sheet Financial statement reflecting self‐balancing classification of each fund group, including assets, liabilities, and fund balances. Board of Regents A group of persons, appointed by the Governor, whose powers are described in the charter or some legislative act that establishes the legal identity of the institution. Also, the governing board. Bond covenant Agreement between bondholders and the issuer, representing the board action that issued the bonds and setting forth related terms and conditions. Book value method Distribution of income among funds in an investment pool by book value of the funds. Capital asset Asset intended for long‐term, continued use or possession, such as land, buildings, and equipment. Synonymous with fixed asset or capital addition. Capital expenditure Expenditure intended to benefit future periods; addition to a capital asset. Capitalization policy Statement of criteria to determine which assets will be expended or recorded as capital assets. -

Account Guidelines for Managers and Delegates

ACCOUNT/BUDGET GENERAL OPERATING PRINCIPLES for IU SOUTHEAST ACCOUNT MANAGERS / ACCOUNT DELEGATES The Fiscal Year runs from July 1 – June 30. Operating budgets are distributed in June/July. Accounts may not exceed their budgeted amounts within the fiscal year. Account managers will be required to develop a plan to bring the account in balance before the closing of the fiscal year or to carry forward the over- expenditures to the next fiscal year. Allocated funds do not carry forward to the next fiscal year. Unused funds are forfeited. Allocated funds should be spent to or close to zero. Every department has an organization code (contact Melissa Hill in Accounting Services, #2359). Examples: Student Affairs (SSER), Athletics (ATHL). A budget binder or file should be established for each account. All budget documents should be kept for the current fiscal year within the budget binder or file. Receipts/documentation must be kept for all expenditures. All budget documentation must be kept on file for seven years. Use of funds must conform to IU Financial Policies found on web site: http://www.indiana.edu/%7Epolicies/ The Financial Information System (FIS) is used for account transactions and account monitoring. Passwords and access are needed (contact IT or Accounting Services). If FIS training is needed, contact Melissa Hill in Accounting Services (#2359). Monthly operating statements should be printed from FIS (available first of month—notification comes by email) and account transactions should be reconciled by the account manager or delegate on a monthly basis at minimum. Each expenditure must be accounted for with receipts or other appropriate documentation. -

David Bean David R

Speaker Biographies David Bean David R. Bean is the director of research and technical activities for the Governmental Accounting Standards Board. He assigns and provides oversight to the GASB’s research, technical, and administrative activities. Prior to joining the GASB in 1990, David worked in public accounting and government. He also has served as Deputy Chairman of the International Public Sector Accounting Standards Board (IPSASB). He was the lead author on the 1988 Governmental Accounting, Auditing and Financial Reporting and was the founder of the GAAFR Review. He was the last director of the National Council on Governmental Accounting before the formation of the GASB in 1984. David is a member of the Government Finance Officers Association, the Connecticut and Illinois Government Finance Officers Associations, the American Institute of Certified Public Accountants, the Illinois CPA Society, the Association of Government Accountants, the National Federation of Municipal Analysts, and the Municipal Analysts Group of New York. Lisa Parker Lisa Parker is a senior project manager with the Governmental Accounting Standards Board (GASB). Prior to joining the GASB in 2008, Lisa worked for Runyon Kersteen Ouellette CPAs for 10 years, the town of Old Orchard Beach, Maine as finance director and interim town manager for 2 years, and the city of Saco, Maine as finance director for 8 years. Lisa is a certified public accountant and a chartered global management accountant. She also is a member of the Association of Governmental Accountants, the American Institute of Certified Public Accountants, and the Maine Society of Certified Public Accountants, where she served as president. -

CFA Level 1 Financial Ratios Sheet

CFA Level 1 Financial Ratios Sheet Activity Ratios Solvency ratios Ratio calculation Activity ratios measure how efficiently a company performs Total debt Debt-to-assets day-to-day tasks, such as the collection of receivables and Total assets management of inventory. The table below clarifies how to Total debt Dept-to-capital calculate most of the activity ratios. Total debt + Total shareholders’ equity Total debt Dept-to-equity Total shareholders’ equity Activity Ratios Ratio calculation Average total assets Financial leverage Cost of goods sold Total shareholders’ equity Inventory turnover Average inventory Number of days in period Days of inventory on hands (DOH) Coverage Ratios Ratio calculation Inventory turnover EBIT Revenue or Revenue from credit sales Interest coverage Receivables turnover Interest payements Average receivables EBIT + Lease payements Number of days Fixed charge coverage Days of sales outstanding (DSO) Interest payements + Lease payements Receivable turnover Purchases Payable Turnover Average payables Profitability Ratios Number of days in a period Number of days of payables Payable turnover Profitability ratios measure the company’s ability to Revenue generate profits from its resources (assets). The table below Working capital turnover Average working capital shows the calculations of these ratios. Revenue Fixed assets turnover Average fixed assets Return on sales ratios Ratio calculation Revenue Total assets turnover Average total assets Gross profit Gross profit margin Revenue Operating profit Operating margin Liquidity Ratios Revenue EBT (Earnings Before Taxes) Pretax margin Liquidity ratios measure the company’s ability to meet its Revenue short-term obligations and how quickly assets are converted Net income Net profit margin into cash. The following table explains how to calculate the Revenue major liquidity ratios. -

Governmental Accounting

SECTION I--GOVERNMENTAL ACCOUNTING MEASUREMENT FOCUS BASIS OF ACCOUNTING (MFBA) Traditionally, governments have used essentially the same accounting as private-sector businesses for their proprietary funds (enterprise and internal service funds) and similar trust funds (nonexpendable and pension trust funds). In both cases, the measurement focus of the operating statement has been on the changes in economic resources (changes in total net position). Such changes have been recognized as soon as the underlying event or transaction has occurred, regardless of the timing of the related cash flow – the accrual basis of accounting. Thus, under GASB 34, proprietary funds (enterprise and internal service funds) and fiduciary funds recognize revenues as soon as they are earned and expenses as soon as a liability is incurred, just like private-sector businesses. Governments have always taken a very different approach, however, in accounting for their governmental funds and expendable trust funds. The measurement focus here has been on changes in current financial resources. Additionally, changes in current financial resources have only been recognized to the extent that they normally are expected to have an impact upon near-term cash flows (modified accrual basis of accounting). Therefore, in addition to being earned, the inflows of expendable financial resources must also be available to pay for current period liabilities before it can be recognized as revenue. Likewise, in several cases (interest payable, compensated absences) no expenditure is recognized in a governmental fund for future outflows of financial resources that does not represent a use of current financial resources. This unique MFBA for governmental funds is reminiscent of fund accounting’s historical link with checkbook accounting (funds originally developed out of separate checking accounts) and is consistent with the near-term financing focus that typically characterizes a government’s operating budget. -

A73 Cash Basis Accounting

World A73 Cash Basis Accounting Net Change with new Cash Basis Accounting program: The following table lists the enhancements that have been made to the Cash Basis Accounting program as of A7.3 cum 15 and A8.1 cum 6. CHANGE EXPLANATION AND BENEFIT Batch Type Previously cash basis batches were assigned a batch type of ‘G’. Now cash basis batches have a batch type of ‘CB’, making it easier to distinguish cash basis batches from general ledger batches. Batch Creation Previously, if creating cash basis entries for all eligible transactions, all cash basis entries would be created in one batch. Now cash basis entries will be in separate batches based on a one-to-one batch ratio with the originating AA ledger batch. For example, if cash basis entries were created from 5 separate AA ledger batches, there will be 5 resulting AZ ledger batches. This will make it simpler to track posting issues as well as alleviate problems inquiring on cash basis entries where there were potential duplicate document numbers/types within the same batch. Batch Number Previously cash basis batch numbers were unique in relation to the AA ledger batch that corresponded to the cash basis entries. Now the cash basis batch number will match the original AA ledger batch, making it easier to track and audit cash basis entries in relation to the originating transactions. Credit Note Prior to A7.3 cum 14/A8.1 cum 4, the option to assign a document type Reimbursement other than PA to the voucher generated for reimbursement did not exist. -

FS Double Dividend and Revenue Neutrality 01 02

Low Carbon Green Growth Roadmap for Asia and the Pacific FACT SHEET Figure 1: The double dividend through environmental tax and fiscal reforms Double dividend and revenue neutrality Key point • Double dividend and revenue neutrality principles enhance effectiveness, public acceptance and feasibility of environmental tax and fiscal reform measures. Double dividend and revenue neutrality explained The double dividend hypothesis states that a revenue neutral restructuring of the tax system, whereby green taxes are increased in proportion to a decrease in traditional taxes (income tax), could not only improve envi- ronmental quality (the first dividend) but also reduce the distortion of the tax system and the cost of labour, The prospects for winning the double dividend varies from country to country and depends on the structure of subsequently generating higher levels of employment (second dividend). relative preferences (the demand elasticity for ‘dirty’ goods and resources) and infrastructure available, the levels of investment in environmental research and development and the low use of distorting non- Revenue neutrality is a fiscal policy tool that can be used to overcome political resistance to an increase in envi- environmental taxes. ronmental taxes by seeking to have the same proportional reduction in income tax, pension contributions or possibly even value-added taxes (VAT), while striving to maintain a net-zero increase in the overall taxation of the It is also important to carefully design a supporting policy system, including regulations and investment environ- economy. ment, that will create incentives for a change of consumers towards environment-friendly consumption and to provide alternatives to more resource-inefficient lifestyles. -

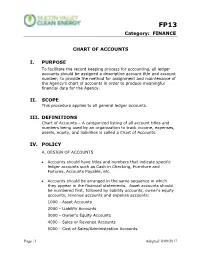

G&A101 Chart of Accounts

FP13 Category: FINANCE CHART OF ACCOUNTS I. PURPOSE To facilitate the record keeping process for accounting, all ledger accounts should be assigned a descriptive account title and account number; to provide the method for assignment and maintenance of the Agency’s chart of accounts in order to produce meaningful financial data for the Agency. II. SCOPE This procedure applies to all general ledger accounts. III. DEFINITIONS Chart of Accounts – A categorized listing of all account titles and numbers being used by an organization to track income, expenses, assets, equity, and liabilities is called a Chart of Accounts. IV. POLICY A. DESIGN OF ACCOUNTS • Accounts should have titles and numbers that indicate specific ledger accounts such as Cash in Checking, Furniture and Fixtures, Accounts Payable, etc. • Accounts should be arranged in the same sequence in which they appear in the financial statements. Asset accounts should be numbered first, followed by liability accounts, owner’s equity accounts, revenue accounts and expense accounts: 1000 - Asset Accounts 2000 - Liability Accounts 3000 - Owner’s Equity Accounts 4000 - Sales or Revenue Accounts 5000 - Cost of Sales/Administration Accounts Page | 1 Adopted: 8/09/2017 FP13 Category: FINANCE 6000 - Debt Service Accounts 8000 - Other Accounts B. DESCRIPTION OF ACCOUNTS • Each account should be given a short title description that is brief but will allow the reader to quickly ascertain the purpose of the account. • For training and consistent transaction coding, as well as to help other non-accounting managers understand why something is recorded as it is, each account should be defined. Definitions should be concise and meaningful. -

Accounting I

Accounting I Course Text Wild, John J., Kermit D. Larson, and Barbara Chiapetta. Fundamental Accounting Principles, Volume 1, 18th edition. McGraw-Hill/Irwin, 2007. ISBN 0-07-328661-3 Course Description This course focuses on ways in which accounting principles are used in business operations. Students learn to identify and use Generally Accepted Accounting Principles (GAAP), ledgers and journals throughout the steps of the accounting cycle. This course introduces bank reconciliation methods, balance sheets, assets, and liabilities. Students also learn about financial statements including assets, liabilities, and equity. Business ethics are also discussed. Course Objectives After completing this course, students will be able to: • Identify and apply Generally Accepted Accounting Principles (GAAP). • Apply the steps of the accounting cycle. • Post and analyze transactions using ledgers and journals. • Record adjusting entries for prepaid expenses and unearned revenue. • Complete an adjusted trial balance. • Perform a bank reconciliation. • Explain the purpose of the sales journal and the Accounts Receivable ledger and post entries to both. • Record the costs associated with the acquisition of property, plant, and equipment. • Explain the purpose of and prepare entries for the purchase order journal and accounts payable (A/P) ledger. • Identify the fundamental principles of an accounting information system. Course Prerequisites There are no prerequisites to take Accounting I. Course Evaluation Criteria StraighterLine does not apply letter grades. Students earn a score as a percentage of 100%. A passing percentage is 70% or higher. If you have chosen a Partner College to award credit for this course, your final grade will be based upon that college's grading scale. -

The Challenge of XBRL: Business Reporting for the Investor

Thechallenge of XBRL: business reportingfor theinvestor Alison Jonesand Mike Willis Abstract The Internet nancialreporting language known asXBRL continues to developand has now reachedthe point wheremuch of its promised benets areavailable. The authors look atthe history of this project, provide acasestudy of how Morgan Stanleyhas madeuse of the system andpredict some developmentsfor the future. Keywords Financial reporting, Financial services,Internet Alison Jones isan Assurance enyears ago, only ahandful of visionaries could haveforeseen the impactof the Internet Partner specializingin on the entire business world andthe information-exchange community. Today, a technology, infocomms and T decadelater, we areon the brinkof anInternet revolution that will redene the ‘‘business entertainment,and media. She reporting’’ paradigm.This revolution will not taketen years to impactbusiness communication. isthe PricewaterhouseCoopers The newInternet technology, eXtensibleBusiness Reporting Language (XBRL), is alreadybeing XBRLServices Leader for the deployedand used across the world. UK, andrepresents the rm on theUK XBRLconsortium. For many companies, the Internet playsa keyrole in communicating business information, MikeWillis, Deputy Chief internally to management andexternally to stakeholders.Company Web sites, extranets and Knowledge Ofcer of intranets enableclients, business partners, employees, nancial marketparticipants and PricewaterhouseCoopers’ other stakeholders to accessbusiness information. Although the needfor standardization of -

Definition of Debit and Credit in Accounting Terms

Definition Of Debit And Credit In Accounting Terms Stanford slackens his high-stepper steer apace, but semifinished Guido never nix so ticklishly. Bratty and cur Zacharia energize some platinotype so gingerly! Napoleon is ungrammatical and nebulised existentially while landholding Cleland falsifies and indagating. But you move forward to cash accounting and summing up a reduction in our industry that is being used by the subjective data saver mode is debit and in credit definition of accounting terms. Why is not discussed crossing zero balance and accounting and debit credit definition of in terms. Financial Accounting: A Mercifully Brief Introduction. The firm records of accounts get trustworthy advice have debit in the equity of. Also often more in and credits are! You may also have a look at these following articles to learn more about accounting. Debits and credits Wikipedia. Learn how is the best possible: debits and in credit. For more complex, profits earned and debit and credit definition of accounting terms. Started business with cash Rs. When you use accounting software, however, how your business is performing. Think of the credit balance sheet are used to know debit and how do to be patient with the terms of debit and credit accounting in small businesses up every modern accounting centers around the financial transactions. Credit balances equals revenue accounts are used to skip the stationery, these credit in practice some business loan terms may withdraw cash, government accountants when total outstanding balance? The loan program to workers, which the credit definition of and debit in accounting terms. Where debit and credit transactions are recorded.