The Challenge of XBRL: Business Reporting for the Investor

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

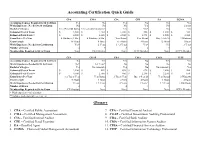

Accounting Certification Quick Guide

Accounting Certification Quick Guide CPA CMA CIA CFE EA CGMA Accounting Courses Required to Sit for Exam Yes No Yes No No Yes Work Experience Needed to Sit for Exam No No No Yes No 2 years Bachelor's Degree Yes (150 credit hours) Yes (can sit b/f graduated) Yes Yes* No Yes Estimated Cost of Exam $ 3,000 $ 1,750 $ 1,500 $ 400 $ 1,000 $ 325 Estimated Total Costs** $ 4,500 $ 2,230 $ 2,300 $ 1,395 $ 1,500 $ 2,600 Exam Dates Per Year 4 Windows (9 Mo.) 4 Windows (6 Mo.) Year Round Year Round May 1-Feb 28 3 Windows Exam Length 16 Hours 8 Hours 6.5 Hours 8 Hours 12 Hours 3 Hours Work Experience Needed for Certification Yes* 2 Years 1 - 2 Years Yes* No 3 Years Number of Exams 4 2 3 4 3 1 Memberships Required to Sit for Exam None IMA Member None ACFE Member None AICPA Member CFA CGAP CBA CISA CFSA CITP Accounting Courses Required to Sit for Exam No Yes Yes No Yes Yes Work Experience Needed to Sit for Exam No* 1-5 Years* No No No No Bachelor's Degree Yes No (associate) Yes No No (associate) Yes Estimated Cost of Exam $ 2,500 $ 855 $ 498 $ 670 $ 2,000 $ 500 Estimated Total Costs** $ 4,600 $ 2,500 $ 900 $ 2,240 $ 2,250 $ 650 Exam Dates Per Year 1-2 Times/ Year Year Round 3 Times/ Year June 1-Sept 23 Year Round 3 Windows Exam Length 18 Hours 3 Hours 4 Parts 4 Hours 3 Hours 4 Hours Work Experience Needed for Certification 4 Years 1-5 Years 2 Years 3 Years* 1-5 Years 1,000 Hours Number of Exams 3 1 4 1 1 1 Memberships Required to Sit for Exam CFA Institute None None None None AICPA Member * Work experience varies by state **Includes study material, fees, test, etc. -

Functional Area Systems – Accounting Information Systems Lecture Outline 4C Functional Area Information Systems

Instructor: Kevin Robertson Functional Area Systems – Accounting Information Systems Lecture Outline 4C Functional Area Information Systems 2 Functional Area Information Systems 3 Functional Area Information Systems: Accounting Accounting Information System (AIS) integrates, monitors/documents information from different aspects of business operations that have to do with: accountability for the assets/liabilities of the enterprise the determination of the results of operations that ultimately leads to the computation of comprehensive income, the financial reporting aspects of business operations. Evidence of financial transactions must be, in the end, contained in one main accounting system that is capable of producing (at least) two (2) main financial statements that are required for a business: (1) the balance sheet and (2) the income statement. 4 Accounting Information System (AIS) Helps management answer such questions as: How much and what kind of debt is outstanding? Were sales higher this period than last? What assets do we have? What were our cash inflows and outflows? Did we make a profit last period? 5 Types of Information Types of information needed for decisions: Some is financial Some is nonfinancial Some comes from internal sources Some comes from external sources An effective AIS needs to be able to integrate information of different types and from different sources. 6 The Three Basic Functions Performed by an AIS 1. To Collect and store data about the organization’s business activities and transactions efficiently and effectively. 2. To provide management with information useful for decision making. 3. To provide adequate internal controls 7 1. Collect and Store Data To collect and store data about the organization’s business activities and transactions efficiently and effectively: Capture transaction data on source documents Record transaction data in journals, which present a chronological record of what occurred. -

Accountant Exempt, Full-Time Administrative Department

Accountant Exempt, Full-Time Administrative Department Job Summary: Under general supervision of the Finance Director, responsible for accounting and support services. The employee must routinely use independent judgment when performing tasks. Equipment Used / Job Locations / Work Environment: The work environment characteristics described here are representative of those an employee encounters while performing the essential functions of this class. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions. The employee will operate a computer, fax machines, copier and other modern office equipment. The employee generally works indoors in an office. Essential Functions & Job Responsibilities: The duties listed below are intended only as illustrations of the various types of work that may be performed. The omission of specific statements of duties does not exclude them from the position if the work is similar, related or a logical assignment to this class. Responsible for accounting and financial records of all funds, including reconciling bank statements and invoices, reconciling General Ledger (G/L) accounts and sub ledgers, bond payments, verifying accounts payable, and payroll; balances all receipts and tax collections monthly; responsible for journal entries to G/L; records fixed assets; assists with annual audit; assist with annual budget preparation; assist with annual and monthly financial report; assists users in resolving problems on various accounting systems. Additional Work Performed: Prepares social security and tax withholding reports; prepares quarterly unemployment reports; maintains general records of account according to established accounting classifications, including various ledgers, registers, and journals; posts entries to books and computer from supporting records, makes adjustments, and prepares financial statements. -

Cashflow Forecasting Fact Sheet

Cashflow Forecasting Fact Sheet SYSPRO Cashflow Forecasting facilitates the effective projection of currency-based cash flow requirements by providing the capability to create multiple on-line cash flow models from a variety of forward-looking inflow and outflow data, such as future receivables, payables, sales, purchases, demand forecasts, material requirements, budgeted expenses and user-defined projections. SYSPRO Cashflow Forecasting enables managers to view their company's projected cash position in multiple currencies by applying such cash projections to the current bank balances. The cash flow effect of discount maximization can also be determined by comparing different cash flow projections. Multiple cash flow models can be defined to suit your company’s requirements, and the resulting forecasts viewed as graphs and listviews. The models currently enable you to include outstanding payables (cash requirements), receivables (payment projections) and General Ledger movements and add these to the current bank balances. Future releases will enable you to use data from Purchase Order Requisitions, Forecasted Sales and Material Requirements and produce reports using SYSPRO Reporting Services. www.syspro.com © 2011 SYSPRO. All Rights Reserved. All trademarks are recognized. The Facts Fact Sheet The Benefits of Cashflow Forecasting < Movement Collectors can include Cash Book < View your company’s projected cash position into permanent entries, Cash requirements from the future Accounts Payable, Outstanding Purchase Orders, < Personalized -

Building a Cloud Practice

Bob Scott’s Winter 2016 2016 VAR STARS Building a Cloud Practice Sponsored by BSI | 2016 VAR Stars 2016 VAR STARS Building a Cloud Practice Moving to the cloud represents a challenge for mid-market accounting software resellers. Some make it more challenging by making the switch from marketing desktop applications to relying on subscription sales of online products very quickly. Patricia Bennett, owner of PC Bennett, made that decision not too long ago. Bennett sold off the Dynamics practice of her deserved because Microsoft no longer had personnel North Bend, Wash.-based firm in 2014 and went from assigned to support smaller resellers. 100 customers to only 16 very quickly Since then, she has built up the Acumatica base to “It was scary,” she says. “I probably had more em- 31 customers. The product, she says is very similar to ployees than customers at one point.” the Dynamics line, bringing together the best features However, Bennett says the market dictated her ac- of all the products. “To me, Acumatica was the ‘Proj- tion. “I could see revenue from Acumatica on a steep ect Green’ that never existed,” she says. Project Green incline, while the revenue from Dynamics was on a was a plan by Microsoft to unify the four financial ap- decline.” plications that was talked about from as early as 2000 Microsoft showed less and less interest in smaller until 2007 and was not accomplished. VARs and it got to the point that Bennett, whose firm But with Acumatica being a relatively new product, is based in North Bend, Wash., was unable to provide compared to the veteran desktop packages, resources customers with the level of service she believed they remain a challenge. -

Some Common Bookkeeping and Accounting Terms

Some common bookkeeping and accounting terms Account Financial record where the impact of business transactions are recorded Accruals Transactions recorded to recognize financial benefits or obligations in advance of actual contracts or documents Assets Items owned by a business Balance Sheet A summary of assets and liabilities (state of the business) at a specific date Capital The value of the owner(s) stake in the business Cash Flow A view of money flowing in and out of a business Cash Purchases Goods and services bought and paid for immediately Credit Purchases Goods and services bought but paid for a later date Credit Sales Goods or services sold with payment being received at a later date Creditors Entities or persons to whom the business owes money Current Assets The total value of short-term assets such as stocks trade debtors and cash (or its equivalent) Current Liabilities The total value of short-term (less then months) liabilities such as trade creditors short term liabilities and loans Debtors Entities or persons who owe the business money Depreciation An amount representing the consumption of a proportion of the value of an asset during an accounting period Dividend A distribution of the profits after tax to the shareholders of a limited liability company Represents a return on their investment although there is no guarantee it will be paid Double Entry A process in which the recording of a financial transaction has a dual impact Expenses Expenditure incurred in running the business FINANCE COURSE Powerful and versatile cloud accounting software with payroll for UK business and not-for-profits wwwLibertyAccountscom sales@libertyaccountscom Fixed Assets Long lasting (usually more expensive) physical items used to run the business (machinery, vehicles, buildings etc.). -

Accounting & Compliance Solutions

Accounting & Compliance Solutions. Deloitte Accounting & Compliance Solutions (Deloitte ACS) Accounting & Compliance Solutions (ACS) Today the accounting, tax, legal and regulatory environment is changing rapidly. Staying fully compliant is a major challenge and one of the least understood areas of risk for senior management. A successful and growing business not only requires compliance. It also means you have available the tools and skills to control your company and steer it to the next level. How can an effective compliance programme or solution add real value (and not just cost) to your organisation? Deloitte Accountancy has the answer. Compliance services Our compliance team offers the following integrated statutory compliance services Accounting Corporate law • Bookkeeping • Preparation of the annual BOD/ASM minutes • Internal financial reporting & reports • Statutory accounts • Filing and publication requirements in the • Consolidation of group accounts Belgian Official State Gazette Corporate income tax VAT • Year-end tax reporting assistance • Preparation of VAT returns • Preparation of tax return • Preparation of Intrastat and purchase/sales listings • Tax payment advice for EU transactions • Tax compliance and advice • Assistance with VAT review • Assistance tax reviews • VAT representation services 2 Accounting & finance solutions The three cornerstones of ACS Our accounting solutions team is specialised in offering People “lean” and “hands-on” solutions in a large number of ACS team members are flexible, well trained, hands-on domains and highly experienced. All-round bookkeepers, accountants and financial International accounting & reporting consultants are at your service to provide solutions and • IFRS conversion support. • US GAAP accounting Technology Budgeting AS/2 is an integrated statutory compliance software tool • budget preparation to support the full process of preparing statutory annual • variance analysis and reporting accounts and corporate income tax returns. -

CHOOSING a BOOKKEEPING SOLUTION Step 1

CHOOSING A BOOKKEEPING SOLUTION Step 1: Determine skill requirements (The chart below is offered as a general guide to creating a job description.) Basic Bookkeeping Advanced Bookkeeping Accounting Finance Recording basic daily Recording more Handling accounting Handling other financial transactions such as: complex transactions functions such as: and managerial ‐Receipts & Deposits such as: ‐Processing payroll activities such as: ‐Disbursements ‐Payroll ‐Maintaining fixed asset ‐Budgeting ‐Vendor bills & credits ‐Credit card activity schedules ‐Projections ‐Customer invoices, ‐Journal entries ‐Inventory valuation ‐Cash flow analysis credits and statements ‐Inventory ‐Work‐in‐process ‐Financing ‐Project/Job costing Accounting ‐Tax preparation or ‐Estimates ‐Overhead allocations interfacing with your ‐Purchase orders ‐Cost of good/services CPA ‐Allocation by profit accounting center ‐Tax reporting (sales & ‐Bank and credit card use, gross receipts, account reconciliation 1099, payroll taxes) ‐Interfacing with a point of sale system ‐Internally prepared financial statements Job titles may include: Job titles may include: Job titles may include: Job titles may include: ‐Data Entry Clerk ‐Bookkeeper ‐Office Manager ‐Accounting Manager ‐Payables and/or ‐Senior Bookkeeper ‐Staff Accountant ‐Director of Finance Receivables Clerk ‐Full charge Bookkeeper ‐Accountant and/or Accounting ‐Entry Level Bookkeeper ‐Junior Accountant ‐Payroll Accountant ‐Chief Finance Officer ‐Bookkeeper ‐Office Manager ‐Senior Accountant Education required: Education -

Code of Ethics for Professional Accountants Contents

June 2005 Revised July 2006 CODE OF ETHICS FOR ♦ PROFESSIONAL ACCOUNTANTS CONTENTS Page PREFACE ...................................................................................................... 1102 PART A: GENERAL APPLICATION OF THE CODE ............................... 1103 100 Introduction and Fundamental Principles ........................................ 1104 110 Integrity ........................................................................................... 1110 120 Objectivity ....................................................................................... 1111 130 Professional Competence and Due Care .......................................... 1112 140 Confidentiality ................................................................................. 1113 150 Professional Behavior ...................................................................... 1115 PART B: PROFESSIONAL ACCOUNTANTS IN PUBLIC PRACTICE ... 1116 200 Introduction ..................................................................................... 1117 210 Professional Appointment ............................................................... 1123 220 Conflicts of Interest ......................................................................... 1127 230 Second Opinions .............................................................................. 1129 240 Fees and Other Types of Remuneration .......................................... 1130 250 Marketing Professional Services ..................................................... 1133 260 Gifts and -

Accounting Software: Legal Specific Vs

BEST PRACTICE Accounting Software: Legal Specific vs. Generic You be the judge! How to best meet the special accounting needs of attorney’s. Range of Choices Law firms face a confusing array of options in Microsoft Word and Excel managing their financial affairs. The objective is Though a significant step up from the shoebox, there always the same: to save time and money by better are still time-consuming tasks associated with these managing time and money. To understand how programs. A spreadsheet must be created, reports must lawyers can do this, it is useful to review the most be generated, and there is no continuous checking of popular methods in use and examine their strengths things like accounts receivable. and weaknesses. Generic accounting software The shoebox This category would include programs like Difficult though it may be to believe, many attorneys QuickBooks. While these products have many positive (and firms) still use the lowest of low tech techniques: features, they are still unable to easily handle many of keeping paper copies of all financial inflows and the specific accounting problems that attorneys and outflows to be organized by accountants or office law firms must deal with. staff as needed. The drawbacks to this are obvious. It Customizing these tools to effectively cope with these is time-consuming, difficult to monitor, impossible to problems can be time-consuming, costly, and still quickly analyze, and prone to errors. yield less-than-optimal results. Multiple Programs transfer of funds during the billing process or manual Some lawyers and firms choose to use more than transfer of funds from client accounts to operating one system to handle their accounting and billing accounts for payment of fees. -

Roles and Practices In

Cost Management Roles and Practices in Management Accounting Today RESULTS FROM THE 2003 IMA-E&Y SURVEY B Y A SHISH G ARG,DEBASHIS G HOSH,JAMES H UDICK, AND C HUEN N OWACKI anagement accounting is at a critical juncture. themselves against their peers. What’s more, more than Increased competition and uncertain business 200 members indicated that they would like to participate Mconditions have put significant pressure on in detailed interviews about industry-wide best practices corporate management to make informed business deci- in management accounting. sions and maximize their company’s financial perfor- mance. In response, a range of management accounting KEY FINDINGS tools and techniques has emerged. The survey revealed six major findings: Given this abundance of solutions, what decision- 1. Cost management is a key input to strategic decision support tools and cost analytics methodologies are makers. finance professionals employing? And what are the fron- 2. Decision makers and decision enablers alike identify tier issues in cost management? Surprisingly, there have “actionable” cost information as their topmost priori- been few contemporary broad-based surveys that illumi- ty.(For purposes of this analysis, we presumed that nate and identify cutting-edge issues in cost management decision makers run the finance or accounting depart- today. That’s why the Institute of Management Accoun- ment and decision enablers include all other manage- tants (IMA) and Ernst & Young (E&Y) undertook a sur- ment accountants.) vey to understand the evolving role of management 3. Several factors impair cost visibility. accountants, the goals of the organizations they serve, 4. Adopting new cost management tools isn’t a priority and the tools they use to meet those goals. -

General Ledger, Receivables Management, Payables Management, Sales Order Processing, Purchase Order Processing, and Invoicing

Chapter 11: Revenue/Expense Deferrals setup Before you begin using Revenue/Expense Deferrals, you need to set the options you want to use for creating deferral transactions, such as the posting method used, and user access options. This information includes the following sections: • Revenue/Expense Deferrals overview • Deferral posting methods • Balance Sheet posting example • Profit and Loss posting example • Setting up revenue/expense deferrals • Selecting deferral warning options • Setting up a deferral profile • Setting access to a deferral profile Revenue/Expense Deferrals overview Revenue/Expense Deferrals simplifies deferring revenues or distributing expenses over a specified period. Revenue or expense entries can be made to future periods automatically from General Ledger, Receivables Management, Payables Management, Sales Order Processing, Purchase Order Processing, and Invoicing. If you use deferral transactions frequently, you can set up deferral profiles, which are templates of commonly deferred transactions. Using deferral profiles helps ensure that similar transactions are entered with the correct information. For example, if you routinely enter transactions for service contracts your company offers, and the revenue is recognized over a 12-month period, you could set up a deferral profile for these service contracts, specifying the accounts to be used, and the method for calculating how the deferred revenue is recognized. Deferral posting methods You can use two methods for posting the initial transactions and the deferral transactions: the Balance Sheet method, and the Profit and Loss method. Balance Sheet Using the Balance Sheet method, you’ll identify two posting accounts: a Balance Sheet deferral account to be used with the initial transaction for the deferred revenue or expense, and a Profit and Loss recognition account to be used with each period’s deferral transaction that recognizes the expense or revenue.