Functional Area Systems – Accounting Information Systems Lecture Outline 4C Functional Area Information Systems

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cashflow Forecasting Fact Sheet

Cashflow Forecasting Fact Sheet SYSPRO Cashflow Forecasting facilitates the effective projection of currency-based cash flow requirements by providing the capability to create multiple on-line cash flow models from a variety of forward-looking inflow and outflow data, such as future receivables, payables, sales, purchases, demand forecasts, material requirements, budgeted expenses and user-defined projections. SYSPRO Cashflow Forecasting enables managers to view their company's projected cash position in multiple currencies by applying such cash projections to the current bank balances. The cash flow effect of discount maximization can also be determined by comparing different cash flow projections. Multiple cash flow models can be defined to suit your company’s requirements, and the resulting forecasts viewed as graphs and listviews. The models currently enable you to include outstanding payables (cash requirements), receivables (payment projections) and General Ledger movements and add these to the current bank balances. Future releases will enable you to use data from Purchase Order Requisitions, Forecasted Sales and Material Requirements and produce reports using SYSPRO Reporting Services. www.syspro.com © 2011 SYSPRO. All Rights Reserved. All trademarks are recognized. The Facts Fact Sheet The Benefits of Cashflow Forecasting < Movement Collectors can include Cash Book < View your company’s projected cash position into permanent entries, Cash requirements from the future Accounts Payable, Outstanding Purchase Orders, < Personalized -

The Challenge of XBRL: Business Reporting for the Investor

Thechallenge of XBRL: business reportingfor theinvestor Alison Jonesand Mike Willis Abstract The Internet nancialreporting language known asXBRL continues to developand has now reachedthe point wheremuch of its promised benets areavailable. The authors look atthe history of this project, provide acasestudy of how Morgan Stanleyhas madeuse of the system andpredict some developmentsfor the future. Keywords Financial reporting, Financial services,Internet Alison Jones isan Assurance enyears ago, only ahandful of visionaries could haveforeseen the impactof the Internet Partner specializingin on the entire business world andthe information-exchange community. Today, a technology, infocomms and T decadelater, we areon the brinkof anInternet revolution that will redene the ‘‘business entertainment,and media. She reporting’’ paradigm.This revolution will not taketen years to impactbusiness communication. isthe PricewaterhouseCoopers The newInternet technology, eXtensibleBusiness Reporting Language (XBRL), is alreadybeing XBRLServices Leader for the deployedand used across the world. UK, andrepresents the rm on theUK XBRLconsortium. For many companies, the Internet playsa keyrole in communicating business information, MikeWillis, Deputy Chief internally to management andexternally to stakeholders.Company Web sites, extranets and Knowledge Ofcer of intranets enableclients, business partners, employees, nancial marketparticipants and PricewaterhouseCoopers’ other stakeholders to accessbusiness information. Although the needfor standardization of -

General Ledger, Receivables Management, Payables Management, Sales Order Processing, Purchase Order Processing, and Invoicing

Chapter 11: Revenue/Expense Deferrals setup Before you begin using Revenue/Expense Deferrals, you need to set the options you want to use for creating deferral transactions, such as the posting method used, and user access options. This information includes the following sections: • Revenue/Expense Deferrals overview • Deferral posting methods • Balance Sheet posting example • Profit and Loss posting example • Setting up revenue/expense deferrals • Selecting deferral warning options • Setting up a deferral profile • Setting access to a deferral profile Revenue/Expense Deferrals overview Revenue/Expense Deferrals simplifies deferring revenues or distributing expenses over a specified period. Revenue or expense entries can be made to future periods automatically from General Ledger, Receivables Management, Payables Management, Sales Order Processing, Purchase Order Processing, and Invoicing. If you use deferral transactions frequently, you can set up deferral profiles, which are templates of commonly deferred transactions. Using deferral profiles helps ensure that similar transactions are entered with the correct information. For example, if you routinely enter transactions for service contracts your company offers, and the revenue is recognized over a 12-month period, you could set up a deferral profile for these service contracts, specifying the accounts to be used, and the method for calculating how the deferred revenue is recognized. Deferral posting methods You can use two methods for posting the initial transactions and the deferral transactions: the Balance Sheet method, and the Profit and Loss method. Balance Sheet Using the Balance Sheet method, you’ll identify two posting accounts: a Balance Sheet deferral account to be used with the initial transaction for the deferred revenue or expense, and a Profit and Loss recognition account to be used with each period’s deferral transaction that recognizes the expense or revenue. -

OTHER ASSETS and LIABILITIES Core Analysis Decision Factors

Core Analysis Decision Factors OTHER ASSETS AND LIABILITIES Core Analysis Decision Factors Examiners should evaluate the Core Analysis in this section to determine whether an Expanded Analysis is necessary. Click on the hyperlinks found within each of the Core Analysis Decision Factors to reference the applicable Core Analysis Procedures. Do Core Analysis and Decision Factors indicate that risks are appropriately identified, measured, monitored, and controlled? C.1. Are operating policies, procedures, and risk limits adequate? Refer to Core Analysis Procedures #9- 10, Procedure #14, Procedure #18, Procedure #20, Procedure #22, Procedure #27, & Procedures #34. C.2. Are internal controls adequate? Refer to Core Analysis Procedure #11, Procedure #15, Procedure #23, Procedure #28, & Procedure #35. C.3. Are audit or independent review functions adequate? Refer to Core Analysis Procedures #5-8. C.4. Are information and communication systems adequate and accurate? Refer to Core Analysis Procedure #12, Procedure #16, Procedure #21, Procedure #25, Procedure #29, Procedure #33, & Procedure #36. C.5. Is there adequate information to justify carrying values, and are adjustments made on a timely basis? Refer to Core Analysis Procedure #13, Procedures #17, Procedure #24, & Procedures #37-38. C.6. Do the board and senior management provide effective supervision? Refer to Core Analysis Procedure #6, Procedure #19, Procedure #26, & Procedures #30-32. Bank Name: Page 1 of 9 Other Assets and Liabilities Examination Start Date: Examination Modules (09/18) Core Analysis OTHER ASSETS AND LIABILITIES Core Analysis Procedures Examiners are to consider the following procedures but are not expected to perform every procedure at every bank. Examiners should complete only the procedures relevant for the bank’s activities, business model, risk profile, and complexity. -

XBRL and General Ledger Executive Summary

XBRL General Ledger XBRL.org 1 of 3 Executive Summary Last update: 23-April-2001 Comments? [email protected] XBRL General Ledger EXECUTIVE SUMMARY AND STRATEGIC OVERVIEW Business success requires measurement, analysis and communication of information found scattered throughout an organization and from outside sources. This business intelligence includes both traditional accounting and operational measures and new metrics found in ValueReporting. Until now, the tools to effectively capture, analyze and reuse this information have been limited, expensive, and difficult to implement. Now, there is XBRL GL. The opportunity XBRL GL is a new tool designed to overcome the inefficiencies of disparate, non-integrated and outsourced accounting and financial systems by using the power of XML - the Extensible Markup Language. XBRL GL is an agreement on how to represent accounting and after-the-fact operation information - anything that is found in a chart of accounts, journal entries or historical transactions, financial and non-financial - and transfer it to and from a data hub or communicate it in a data stream. That lets adopters of XBRL GL more easily bridge the gap between operational, off-site or outsourced systems and their back office accounting and reporting systems. XBRL GL is chart of accounts independent. It does not require a standardized chart of accounts to gather information, but it can be used to tie legacy charts of accounts and accounting detail to a standardized chart of accounts to increase communications within a business about what needs to be measured and why. XBRL GL is reporting independent. It collects general ledger and after-the-fact receivables, payables, inventory and other non-financial facts, and then permits the representation of that information using traditional summaries and through flexible links to XBRL for reporting. -

XBRL: One Standard – Many Applications

XBRL: One standard – many applications 46 by Bruno Tesnière, Richard Smith and Mike Willis the journal • Tackling the key issues in banking and capital markets Bruno Tesnière Richard Smith Mike Willis Partner, Global XBRL Co-leader Director, Global Risk Global XBRL Co-leader and Founding Management Solutions, UK Chairman XBRL International Tel: 32 2 710 72 26 Tel: 44 20 7213 4705 Tel: 1 813 351 2795 Email: [email protected] Email: [email protected] Email: [email protected] 47 XBRL is a universal information format and formatting of the information needed in these formats (html, pdf, doc, etc). which offers tremendous opportunities for for running the business can be slow, The link between format and content can the financial services industry in terms of prone to error and extremely costly. only be broken by manual parsing (search cost reduction, efficiency gains and data and retrieval) processes, which are labour- analysis. XBRL can be used by banks to Proprietary data standards are often put intensive, time-consuming and prone to radically reduce the time and costs in place for internal purposes but they inputting errors. These factors can drive associated with key business processes require proprietary data translation the cost of producing information up to such as credit analysis and monitoring, schemes so that back-end systems are able a level where, although the information and streamline their own business to retrieve that information. Even less is available, it is effectively redundant. reporting processes. XBRL also allows efficient, electronically delivered disparate information systems to information on the web is today just a XBRL provides a solution to many of communicate seamlessly with each other digital duplicate of a paper report; it is not these problems by making the reported over the internet. -

General Ledger (GL) Codes

General Ledger (GL) Codes Introduction The general ledger is an accounting document that provides a general overview of an organization’s financial transactions. An account, or general ledger (GL) code, is a number used to record business transactions in the general ledger. Boston University stores every general ledger (GL) code in the SAP system. In this section you will find: 1. SPH GL Codes Short List 2. General Ledger (GL) Coding Principles 3. Quick Reference Guide - List of Common GL Codes Helpful Links BU’s GL Income and Expense Account Descriptions GL CODES - 1 General Ledger (GL) Codes 1. SPH GL Codes Short List At the School of Public Health we have developed a GL code short list to help our faculty and staff easily reference the accounts most commonly used when recording expenditures. When looking to code travel and/or Pcard expenditures, departmental and interdepartmental transactions, purchasing, etc. please refer to the list below to find the most appropriate GL code to use. This document may be searched for account numbers or keywords by using the ‘Find’ feature. For Windows, use CTRL+F . For Mac, use COMMAND+F TIP: Unallowable does not mean that the SPH is not allowed to incur these costs; it simply means the government is not willing to pay for them, either directly or indirectly, through government contracts! GL CODES - 2 General Ledger (GL) Codes 2. General Ledger (GL) Coding Principles 1. All General Ledger accounts have a 6-digit number 2. Leading digit of GL account number indicates 3. Payroll related GL account numbers range from 500010 to 500560, plus these stipend GL’s: 523100 & 523105 4. -

Workflow and Process Control – Charles Hoffman, Cpa

MASTERING XBRL-BASED DIGITAL FINANCIAL REPORTING – PART 3: WORKING WITH DIGITAL FINANCIAL REPORTS – WORKFLOW AND PROCESS CONTROL – CHARLES HOFFMAN, CPA 1. Workflow and Process Control The purpose of this section is to discuss the workflow and process control related to the creation of XBRL-based digital financial reports. A financial report is the end of a process from the perspective of a reporting entity. That is exactly correct from the perspective of a reporting entity. But, from the perspective of a financial analyst that is making use of the reported information, the financial report is the beginning of a process. Perspective matters. What we are working with here is not a “silo”, rather it is more of a “chain”. This section shows you how you create an XBRL-based digital financial report. Many times, reports will be automatically generated from an accounting system. 1.1. Workflow Basics Per Wikipedia, workflow is defined as, “A workflow consists of an orchestrated and repeatable pattern of activity, enabled by the systematic organization of resources into processes that transform materials, provide services, or process information.1” From a computer science perspective, workflow is “The computerised facilitation or automation of a business process, in whole or part2”. From a computer science perspective, workflow is concerned with the automation of procedures where documents, information or tasks are passed between participants according to a defined set of rules to achieve, or contribute to, an overall business goal.” Workflow is often associated with Business Process Management, which is concerned with the assessment, analysis, modelling, definition and subsequent operational implementation of the core business processes of an organisation (or other business entity). -

General Ledger and Reporting System Process

Accounting Information Systems Fourteenth Edition Chapter 16 General Ledger and Reporting System ALWAYS LEARNING Copyright © 2017, 2016, 2015 Pearson Education, Inc. All Rights Reserved Learning Objectives • Describe the activities, information needs, and key decisions made in the general ledger and reporting system, explain the general threats in the cycle, and describe the controls that can be used to mitigate those threats. • Explain the process for updating the general ledger, the threats to that process, and the controls that can be used to mitigate those threats. • Explain the purpose and nature of posting adjusting entries, the threats to that process, and the controls that can be used to mitigate those threats. • Explain the process of preparing financial statements, the threats to that process, the controls that can be used to mitigate those threats, and how IT developments such as XBRL can improve the efficiency and effectiveness of preparing financial statements. • Describe the process for producing various managerial reports, the threats to that process, and how tools like responsibility accounting, the balanced scorecard, and well-designed graphs can help mitigate those threats. Copyright © 2017, 2016, 2015 Pearson Education, Inc. All Rights Reserved General Ledger and Reporting System Process • Update general ledger • Post adjusting entries • Prepare financial statements • Produce managerial reports Copyright © 2017, 2016, 2015 Pearson Education, Inc. All Rights Reserved General Threats Throughout the General Ledger and Reporting Cycle Threats Controls 1. Inaccurate or invalid general ledger data 1 a. Data processing integrity 2. Unauthorized disclosure of financial controls statement b. Restriction of access to G/L 3. Loss or destruction of data c. -

General Ledger Reporting

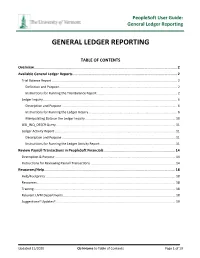

PeopleSoft User Guide: General Ledger Reporting GENERAL LEDGER REPORTING TABLE OF CONTENTS Overview .......................................................................................................................................... 2 Available General Ledger Reports .................................................................................................... 2 Trial Balance Report ........................................................................................................................................... 2 Definition and Purpose ................................................................................................................................... 2 Instructions for Running the Trial Balance Report ......................................................................................... 2 Ledger Inquiry ..................................................................................................................................................... 6 Description and Purpose ................................................................................................................................ 6 Instructions for Running the Ledger Inquiry .................................................................................................. 6 Manipulating Data on the Ledger Inquiry .................................................................................................... 10 LED_INQ_DESCR Query ................................................................................................................................... -

XBRL: a New Tool for Electronic Financial Reporting

5 XBRL: A New Tool For Electronic Financial Reporting Jia Wu and Miklos Vasarhelyi Department of Accounting and Information Systems, Rutgers University, New Jersey Abstract. eXtensible Business Reporting Language (XBRL) is an elec- tronic markup language for the purpose of corporate business reporting. XBRL is based on XML, which is the universal format for structuring documents and data on the web. In an XBRL compliant report, each finan- cial and non-financial item is enclosed by a pair of XBRL tags, which de- scribes the meaning of the item. These tags provide semantic information to the reports and make the financial reports not only human readable but also computer comprehensible. Leveraging the power of computers and the Internet, XBRL provides the financial community a standard to elec- tronically and automatically prepare, publish, exchange, and extract finan- cial statements. It is expected that XBRL will have widespread effects on financial reporting. First, preparing financial reports will be easier with XBRL. Financial information needs to be keyed into the computer only once. XBRL-ready accounting software can generate financial reports in different formats, such as for SEC filing, loan application, or corporate web reporting. It greatly reduces the manual input burden and entry errors. Second, the publication and exchange of financial reports can be facili- tated. Because XBRL-compliant reports use standardized tags, the reports can be conveniently exchanged between different software and computers, independent of the software formats and computer platforms. The financial statement users can view an XBRL report as easily as browse a web page. Third, since XBRL-compliant reports are computer comprehensible, the financial information contained in these reports can be reliably and auto- matically extracted through XBRL-enabled applications for financial analyses. -

General Ledger GENERAL LEDGER 2

PUBLIC SECTOR General Ledger GENERAL LEDGER 2 NOTICE SUNGARD PUBLIC SECTOR BI-TECH LLC MAKES NO REPRESENTATIONS OR WARRANTIES, ORAL OR WRITTEN, EXPRESS OR IMPLIED, WITH RESPECT TO THE SYSTEM, SERVICES, SOFTWARE, DOCUMENTATION, OPERATING ENVIRONMENT, ANY OTHER SOFTWARE OR SERVICES PROVIDED HEREUNDER OR ANY OTHER MATTER ADDRESSED HEREUNDER, AND SUNGARD PUBLIC SECTOR BI-TECH LLC EXPLICITLY DISCLAIMS ALL OTHER WARRANTIES, EXPRESS OR IMPLIED, INCLUDING THE IMPLIED WARRANTIES OF TITLE, MERCHANTABILITY AND FITNESS FOR A SPECIFIC PURPOSE. SunGard Public Sector Bi-Tech LLC shall not be liable for errors contained herein or for incidental or consequential damages in connection with the furnishing, performance or use of this material. This documentation is proprietary and confidential information of SunGard Public Sector Bi- Tech LLC. Copying, reproduction or distribution is strictly prohibited. All rights reserved. Copyright © 2008 by SunGard Public Sector Bi-Tech LLC 890 Fortress Street Chico, CA 95973 Should you wish to make a comment, or if you find an error in the text, please contact us via email: [email protected] GENERAL LEDGER 3 Document Change Log Version Date Change Description 7.9 April 2008 7.9 Version GENERAL LEDGER 4 Contents 1 System Overview ............................................................................................................... 8 1.1 Introduction .............................................................................................................................. 8 1.2 System Flow Diagram ...........................................................................................................