XBRL: One Standard – Many Applications

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Functional Area Systems – Accounting Information Systems Lecture Outline 4C Functional Area Information Systems

Instructor: Kevin Robertson Functional Area Systems – Accounting Information Systems Lecture Outline 4C Functional Area Information Systems 2 Functional Area Information Systems 3 Functional Area Information Systems: Accounting Accounting Information System (AIS) integrates, monitors/documents information from different aspects of business operations that have to do with: accountability for the assets/liabilities of the enterprise the determination of the results of operations that ultimately leads to the computation of comprehensive income, the financial reporting aspects of business operations. Evidence of financial transactions must be, in the end, contained in one main accounting system that is capable of producing (at least) two (2) main financial statements that are required for a business: (1) the balance sheet and (2) the income statement. 4 Accounting Information System (AIS) Helps management answer such questions as: How much and what kind of debt is outstanding? Were sales higher this period than last? What assets do we have? What were our cash inflows and outflows? Did we make a profit last period? 5 Types of Information Types of information needed for decisions: Some is financial Some is nonfinancial Some comes from internal sources Some comes from external sources An effective AIS needs to be able to integrate information of different types and from different sources. 6 The Three Basic Functions Performed by an AIS 1. To Collect and store data about the organization’s business activities and transactions efficiently and effectively. 2. To provide management with information useful for decision making. 3. To provide adequate internal controls 7 1. Collect and Store Data To collect and store data about the organization’s business activities and transactions efficiently and effectively: Capture transaction data on source documents Record transaction data in journals, which present a chronological record of what occurred. -

Cashflow Forecasting Fact Sheet

Cashflow Forecasting Fact Sheet SYSPRO Cashflow Forecasting facilitates the effective projection of currency-based cash flow requirements by providing the capability to create multiple on-line cash flow models from a variety of forward-looking inflow and outflow data, such as future receivables, payables, sales, purchases, demand forecasts, material requirements, budgeted expenses and user-defined projections. SYSPRO Cashflow Forecasting enables managers to view their company's projected cash position in multiple currencies by applying such cash projections to the current bank balances. The cash flow effect of discount maximization can also be determined by comparing different cash flow projections. Multiple cash flow models can be defined to suit your company’s requirements, and the resulting forecasts viewed as graphs and listviews. The models currently enable you to include outstanding payables (cash requirements), receivables (payment projections) and General Ledger movements and add these to the current bank balances. Future releases will enable you to use data from Purchase Order Requisitions, Forecasted Sales and Material Requirements and produce reports using SYSPRO Reporting Services. www.syspro.com © 2011 SYSPRO. All Rights Reserved. All trademarks are recognized. The Facts Fact Sheet The Benefits of Cashflow Forecasting < Movement Collectors can include Cash Book < View your company’s projected cash position into permanent entries, Cash requirements from the future Accounts Payable, Outstanding Purchase Orders, < Personalized -

XBRL and Its Adjacent XML Languages: an Overview

XBRL INTERNATIONAL XBRL and its Adjacent XML Languages: An Overview 27 May 2002 Goal The UK Office of the e-Envoy raised a key question: is XBRL the only XML specification on offer whose domain of discourse covers business reporting? The answer is yes, and the purpose of this paper is to supply the evidence for that conclusion. The approach taken here is to compare and contrast XBRL with other open specifications that occupy spaces that are “adjacent” to it, in the sense that they are based on XML and address subject matter that is closely related to business reporting, or that have been adopted in business processes that involve an important type of business reporting. Examples of areas adjacent to business reporting include credit and investment analysis, market data distribution, equity and derivatives trading, ERP integration, and taxation. The scope of this document addresses only open specifications (excluding proprietary but “de facto standards” such as PDF) and includes reporting related to accounting, financial, or economics. XBRL International has always kept its focus on business reporting and has maintained liaison relationships with other open specifications consortia in related domains. Not only do many XBRL International members belong to these other consortia, but XBRL International itself has liaison relationships with MDDL, RIXML, ITPC (NewsML), SDMX, OASIS, UN/CEFACT, BUS CRD (GRE FIS), ACORD, and BITS. Consequently, in each of these relationships there has been a clear delineation of scope, and some consideration has been given to details of technical compatibility and the potential for interoperability. Where the domain of interest may overlap, agreements such as the Interoperability Pledge made by OASIS, OMG, HR-XML and XBRL (see References) tends to ensure at least that technical work is not duplicated, and at best that the specifications are truly complementary. -

One Washington Draft Chart of Accounts Model

A Business Transformation Program One Washington Draft Chart of Accounts Model A Business Transformation Program July 20201 A Business Transformation Program Table of Contents Overview .............................................................................................................................. 3 COA strawman ..................................................................................................................... 4 Element Definitions ............................................................................................................. 5 2 A Business Transformation Program Overview About the Chart of Accounts (COA) The new COA is a set of numbers that will tie together financial data across the state. As you will see in the attached COA “Strawman,” each set of numbers provides a different piece of accounting information such as agency name, department name, and geographic location. As the state moves towards a single, integrated Enterprise Resource Planning software system, it will be important for the state to have a single, standardized COA for all agencies. Today, each agency has its’ own COA and they are not standardized across the state. Important caveat: The new COA is a draft and not final – it will be updated and refined after a systems integrator is onboarded this fall. We are sharing the draft “Strawman” now so you can begin thinking ahead about what the new statewide COA will look like and consider what resources your agency will need to complete the work. Objectives and Approach of the Draft -

Issue Paper Chart of Accounts (Version 2018-April)

Issue Paper Chart of Accounts (Version 2018-april) Date April 20th 2018 Topic Chart of Accounts Author Frans HIETBRINK 0. Content 0. CONTENT ....................................................................................................................................................................... 1 1. INTRODUCTION ............................................................................................................................................................. 2 1.1. INTRODUCTION OF FACTSHEET ............................................................................................................................................. 2 1.2. INTRODUCTION OF SBR ...................................................................................................................................................... 2 1.3. INTRODUCTION OF CHART OF ACCOUNTS ............................................................................................................................... 3 2. DOCUMENTATION ......................................................................................................................................................... 3 2.1. DOCUMENTS .................................................................................................................................................................... 3 2.2. WEBSITES ........................................................................................................................................................................ 3 3. CHART OF -

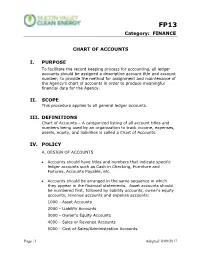

G&A101 Chart of Accounts

FP13 Category: FINANCE CHART OF ACCOUNTS I. PURPOSE To facilitate the record keeping process for accounting, all ledger accounts should be assigned a descriptive account title and account number; to provide the method for assignment and maintenance of the Agency’s chart of accounts in order to produce meaningful financial data for the Agency. II. SCOPE This procedure applies to all general ledger accounts. III. DEFINITIONS Chart of Accounts – A categorized listing of all account titles and numbers being used by an organization to track income, expenses, assets, equity, and liabilities is called a Chart of Accounts. IV. POLICY A. DESIGN OF ACCOUNTS • Accounts should have titles and numbers that indicate specific ledger accounts such as Cash in Checking, Furniture and Fixtures, Accounts Payable, etc. • Accounts should be arranged in the same sequence in which they appear in the financial statements. Asset accounts should be numbered first, followed by liability accounts, owner’s equity accounts, revenue accounts and expense accounts: 1000 - Asset Accounts 2000 - Liability Accounts 3000 - Owner’s Equity Accounts 4000 - Sales or Revenue Accounts 5000 - Cost of Sales/Administration Accounts Page | 1 Adopted: 8/09/2017 FP13 Category: FINANCE 6000 - Debt Service Accounts 8000 - Other Accounts B. DESCRIPTION OF ACCOUNTS • Each account should be given a short title description that is brief but will allow the reader to quickly ascertain the purpose of the account. • For training and consistent transaction coding, as well as to help other non-accounting managers understand why something is recorded as it is, each account should be defined. Definitions should be concise and meaningful. -

Management Reporter User Guide Microsoft Corporation Published: March 2013

Management Reporter User Guide Microsoft Corporation Published: March 2013 Management Reporter for Microsoft Dynamics ERP Microsoft Dynamics is a line of integrated, adaptable business management solutions that enables you and your people to make business decisions with greater confidence. Microsoft Dynamics works like and with familiar Microsoft software, automating and streamlining financial, customer relationship, and supply chain processes in a way that helps you drive business success. U.S. and Canada Toll Free 1-888-477-7989 Worldwide +1-701-281-6500 www.microsoft.com/dynamics This document is provided "as-is." Information and views expressed in this document, including URL and other Internet Web site references, may change without notice. You bear the risk of using it. Some examples are for illustration only and are fictitious. No real association is intended or inferred. This document does not provide you with any legal rights to any intellectual property in any Microsoft product. You may copy and use this document for your internal, reference purposes. This document is confidential and proprietary to Microsoft. It is disclosed and can be used only pursuant to a non-disclosure agreement. Copyright © 2013 Microsoft. All rights reserved. Internet Explorer, Microsoft, Microsoft Dynamics, Microsoft Excel, Microsoft FRx, Microsoft Lync, Microsoft PowerPoint, Microsoft SharePoint, Microsoft Word, Windows, Windows Server, Windows 7, Windows XP, Windows Vista are trademarks of the Microsoft group of companies. All other trademarks are -

The Challenge of XBRL: Business Reporting for the Investor

Thechallenge of XBRL: business reportingfor theinvestor Alison Jonesand Mike Willis Abstract The Internet nancialreporting language known asXBRL continues to developand has now reachedthe point wheremuch of its promised benets areavailable. The authors look atthe history of this project, provide acasestudy of how Morgan Stanleyhas madeuse of the system andpredict some developmentsfor the future. Keywords Financial reporting, Financial services,Internet Alison Jones isan Assurance enyears ago, only ahandful of visionaries could haveforeseen the impactof the Internet Partner specializingin on the entire business world andthe information-exchange community. Today, a technology, infocomms and T decadelater, we areon the brinkof anInternet revolution that will redene the ‘‘business entertainment,and media. She reporting’’ paradigm.This revolution will not taketen years to impactbusiness communication. isthe PricewaterhouseCoopers The newInternet technology, eXtensibleBusiness Reporting Language (XBRL), is alreadybeing XBRLServices Leader for the deployedand used across the world. UK, andrepresents the rm on theUK XBRLconsortium. For many companies, the Internet playsa keyrole in communicating business information, MikeWillis, Deputy Chief internally to management andexternally to stakeholders.Company Web sites, extranets and Knowledge Ofcer of intranets enableclients, business partners, employees, nancial marketparticipants and PricewaterhouseCoopers’ other stakeholders to accessbusiness information. Although the needfor standardization of -

General Ledger, Receivables Management, Payables Management, Sales Order Processing, Purchase Order Processing, and Invoicing

Chapter 11: Revenue/Expense Deferrals setup Before you begin using Revenue/Expense Deferrals, you need to set the options you want to use for creating deferral transactions, such as the posting method used, and user access options. This information includes the following sections: • Revenue/Expense Deferrals overview • Deferral posting methods • Balance Sheet posting example • Profit and Loss posting example • Setting up revenue/expense deferrals • Selecting deferral warning options • Setting up a deferral profile • Setting access to a deferral profile Revenue/Expense Deferrals overview Revenue/Expense Deferrals simplifies deferring revenues or distributing expenses over a specified period. Revenue or expense entries can be made to future periods automatically from General Ledger, Receivables Management, Payables Management, Sales Order Processing, Purchase Order Processing, and Invoicing. If you use deferral transactions frequently, you can set up deferral profiles, which are templates of commonly deferred transactions. Using deferral profiles helps ensure that similar transactions are entered with the correct information. For example, if you routinely enter transactions for service contracts your company offers, and the revenue is recognized over a 12-month period, you could set up a deferral profile for these service contracts, specifying the accounts to be used, and the method for calculating how the deferred revenue is recognized. Deferral posting methods You can use two methods for posting the initial transactions and the deferral transactions: the Balance Sheet method, and the Profit and Loss method. Balance Sheet Using the Balance Sheet method, you’ll identify two posting accounts: a Balance Sheet deferral account to be used with the initial transaction for the deferred revenue or expense, and a Profit and Loss recognition account to be used with each period’s deferral transaction that recognizes the expense or revenue. -

OTHER ASSETS and LIABILITIES Core Analysis Decision Factors

Core Analysis Decision Factors OTHER ASSETS AND LIABILITIES Core Analysis Decision Factors Examiners should evaluate the Core Analysis in this section to determine whether an Expanded Analysis is necessary. Click on the hyperlinks found within each of the Core Analysis Decision Factors to reference the applicable Core Analysis Procedures. Do Core Analysis and Decision Factors indicate that risks are appropriately identified, measured, monitored, and controlled? C.1. Are operating policies, procedures, and risk limits adequate? Refer to Core Analysis Procedures #9- 10, Procedure #14, Procedure #18, Procedure #20, Procedure #22, Procedure #27, & Procedures #34. C.2. Are internal controls adequate? Refer to Core Analysis Procedure #11, Procedure #15, Procedure #23, Procedure #28, & Procedure #35. C.3. Are audit or independent review functions adequate? Refer to Core Analysis Procedures #5-8. C.4. Are information and communication systems adequate and accurate? Refer to Core Analysis Procedure #12, Procedure #16, Procedure #21, Procedure #25, Procedure #29, Procedure #33, & Procedure #36. C.5. Is there adequate information to justify carrying values, and are adjustments made on a timely basis? Refer to Core Analysis Procedure #13, Procedures #17, Procedure #24, & Procedures #37-38. C.6. Do the board and senior management provide effective supervision? Refer to Core Analysis Procedure #6, Procedure #19, Procedure #26, & Procedures #30-32. Bank Name: Page 1 of 9 Other Assets and Liabilities Examination Start Date: Examination Modules (09/18) Core Analysis OTHER ASSETS AND LIABILITIES Core Analysis Procedures Examiners are to consider the following procedures but are not expected to perform every procedure at every bank. Examiners should complete only the procedures relevant for the bank’s activities, business model, risk profile, and complexity. -

XBRL and General Ledger Executive Summary

XBRL General Ledger XBRL.org 1 of 3 Executive Summary Last update: 23-April-2001 Comments? [email protected] XBRL General Ledger EXECUTIVE SUMMARY AND STRATEGIC OVERVIEW Business success requires measurement, analysis and communication of information found scattered throughout an organization and from outside sources. This business intelligence includes both traditional accounting and operational measures and new metrics found in ValueReporting. Until now, the tools to effectively capture, analyze and reuse this information have been limited, expensive, and difficult to implement. Now, there is XBRL GL. The opportunity XBRL GL is a new tool designed to overcome the inefficiencies of disparate, non-integrated and outsourced accounting and financial systems by using the power of XML - the Extensible Markup Language. XBRL GL is an agreement on how to represent accounting and after-the-fact operation information - anything that is found in a chart of accounts, journal entries or historical transactions, financial and non-financial - and transfer it to and from a data hub or communicate it in a data stream. That lets adopters of XBRL GL more easily bridge the gap between operational, off-site or outsourced systems and their back office accounting and reporting systems. XBRL GL is chart of accounts independent. It does not require a standardized chart of accounts to gather information, but it can be used to tie legacy charts of accounts and accounting detail to a standardized chart of accounts to increase communications within a business about what needs to be measured and why. XBRL GL is reporting independent. It collects general ledger and after-the-fact receivables, payables, inventory and other non-financial facts, and then permits the representation of that information using traditional summaries and through flexible links to XBRL for reporting. -

XBRL GL at 10: the Wonder Years?

XBRL GL at 10: The Wonder Years? Abu Dhabi, UAE 24th XBRL International Conference Academic Track Introduction and Disclaimer • Who I am • What I am about to share does not necessarily reflect the opinions of … Original Plans Looked Deeper • From “Highlights” of Initial XFRML Steering Committee, 10/14/99 – “[XFRML] should have its roots in the "Audit Supply Chain." XFRML as technical standard for seamless process of exchange across all audit processes. – Our opportunity is to address things internationally at the level below the financial reporting level since there is more commonality at that level.” – This is still the place of XBRL’s Global Ledger Taxonomy Framework – the detailed information found in ERP systems. XBRL GL Business Reporting Supply Chain XBRL Global Ledger InternalFramework External Investment, Business Economic Processes Business Business Lending, Operations Policymaking Reporting Reporting Regulation XBRL “Financial Reporting” Financial Publishers Central Companies Investors Participants and Data Banks Aggregators Trading Management Internal External Regulators and Administrators Partners Accountants Auditors Auditors Software Vendors and Service Providers XBRL GL: a Recommendation from XII • The only TAXONOMY directly from XII • Predecessor (ADFST:1999) is one of two initial seeds for XBRL • V1 Recommendation 2002 • V2 Recommendation 2005 • A different layer of abstraction Every System as XBRL System 1 System 2 System 3 XBRL GL XBRL GL XBRL GL Account# 勘定科目番号 accountMainID accountMainID IdentificadoraccountMainID