Chapter 2 Accounting for Transactions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

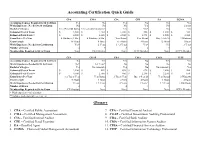

Accounting Certification Quick Guide

Accounting Certification Quick Guide CPA CMA CIA CFE EA CGMA Accounting Courses Required to Sit for Exam Yes No Yes No No Yes Work Experience Needed to Sit for Exam No No No Yes No 2 years Bachelor's Degree Yes (150 credit hours) Yes (can sit b/f graduated) Yes Yes* No Yes Estimated Cost of Exam $ 3,000 $ 1,750 $ 1,500 $ 400 $ 1,000 $ 325 Estimated Total Costs** $ 4,500 $ 2,230 $ 2,300 $ 1,395 $ 1,500 $ 2,600 Exam Dates Per Year 4 Windows (9 Mo.) 4 Windows (6 Mo.) Year Round Year Round May 1-Feb 28 3 Windows Exam Length 16 Hours 8 Hours 6.5 Hours 8 Hours 12 Hours 3 Hours Work Experience Needed for Certification Yes* 2 Years 1 - 2 Years Yes* No 3 Years Number of Exams 4 2 3 4 3 1 Memberships Required to Sit for Exam None IMA Member None ACFE Member None AICPA Member CFA CGAP CBA CISA CFSA CITP Accounting Courses Required to Sit for Exam No Yes Yes No Yes Yes Work Experience Needed to Sit for Exam No* 1-5 Years* No No No No Bachelor's Degree Yes No (associate) Yes No No (associate) Yes Estimated Cost of Exam $ 2,500 $ 855 $ 498 $ 670 $ 2,000 $ 500 Estimated Total Costs** $ 4,600 $ 2,500 $ 900 $ 2,240 $ 2,250 $ 650 Exam Dates Per Year 1-2 Times/ Year Year Round 3 Times/ Year June 1-Sept 23 Year Round 3 Windows Exam Length 18 Hours 3 Hours 4 Parts 4 Hours 3 Hours 4 Hours Work Experience Needed for Certification 4 Years 1-5 Years 2 Years 3 Years* 1-5 Years 1,000 Hours Number of Exams 3 1 4 1 1 1 Memberships Required to Sit for Exam CFA Institute None None None None AICPA Member * Work experience varies by state **Includes study material, fees, test, etc. -

Accounts Receivable Purchase Programs Offer Compelling Financing Advantages

Accounts Receivable Purchase Programs Offer Compelling Financing Advantages By John Padwater Director, Financial Supply Chain Americas [email protected] Although the global financial crisis is behind us, corporations continue to seek new and more advantageous sources of liquidity. One strategic financing option that is gaining popularity is an accounts receivable (A/R) purchase program. In an A/R purchase program, a bank typically purchases a corporation's receivables as soon as the company delivers goods to its customer and issues an invoice. Advantages of such a program can include less expensive financing, favorable off- balance sheet treatment of receivables assets, and reduced credit risk related to the particular obligor. Many corporations are turning to A/R purchase programs because of the negative impact that recent regulatory and accounting changes have had on two other financing alternatives — asset-based lending (ABL) facilities and asset securitization programs. Regulatory and Accounting Drivers Basel III, the latest global regulatory standard for bank capital adequacy, can require financial institutions to hold more capital in support of ABL facilities and asset securitization programs than if they were providing financing through an A/R purchase program. This creates a pricing advantage for corporations selling their receivables. In an asset-based loan, a bank takes a security interest in the collateral. In contrast, with an A/R purchase program, the bank purchases the receivable on a true sale basis, often buying a 100% interest in it on a non-recourse or limited-recourse basis. This affords a particular advantage to non-investment grade companies that have substantial accounts receivable due from investment grade or highly rated counterparties. -

General Ledger Budgeting User Guide

General Ledger Budgeting User Guide Version 9.0 February 2006 Document Number FBUG-90UW-01 Lawson Enterprise Financial Management Legal Notices Lawson® does not warrant the content of this document or the results of its use. Lawson may change this document without notice. Export Notice: Pursuant to your agreement with Lawson, you are required (at your own expense) to comply with all laws, rules, regulations, and lawful orders of any governmental body that apply to you and the products, services or information provided to you by Lawson. This obligation includes, without limitation, compliance with the U.S. Foreign Corrupt Practices Act (which prohibits certain payments to governmental ofÞcials and political parties), U.S. export control regulations, and U.S. regulations of international boycotts. Without limiting the foregoing, you may not use, distribute or export the products, services or information provided to you by Lawson except as permitted by your agreement with Lawson and any applicable laws, rules, regulations or orders. Non-compliance with any such law, rule, regulation or order shall constitute a material breach of your agreement with Lawson. Trademark and Copyright Notices: All brand or product names mentioned herein are trademarks or registered trademarks of Lawson, or the respective trademark owners. Lawson customers or authorized Lawson business partners may copy or transmit this document for their internal use only. Any other use or transmission requires advance written approval of Lawson. © Copyright 2006 Lawson Software, Inc. All rights reserved. Contents List of Figures 7 Chapter 1 Overview of Budgeting 9 Budgeting ProcessFlow...............................................................9 HowBudgeting Integrates WithOtherLawsonApplications..................... 11 What is a Budget?................................................................... -

Accountant Exempt, Full-Time Administrative Department

Accountant Exempt, Full-Time Administrative Department Job Summary: Under general supervision of the Finance Director, responsible for accounting and support services. The employee must routinely use independent judgment when performing tasks. Equipment Used / Job Locations / Work Environment: The work environment characteristics described here are representative of those an employee encounters while performing the essential functions of this class. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions. The employee will operate a computer, fax machines, copier and other modern office equipment. The employee generally works indoors in an office. Essential Functions & Job Responsibilities: The duties listed below are intended only as illustrations of the various types of work that may be performed. The omission of specific statements of duties does not exclude them from the position if the work is similar, related or a logical assignment to this class. Responsible for accounting and financial records of all funds, including reconciling bank statements and invoices, reconciling General Ledger (G/L) accounts and sub ledgers, bond payments, verifying accounts payable, and payroll; balances all receipts and tax collections monthly; responsible for journal entries to G/L; records fixed assets; assists with annual audit; assist with annual budget preparation; assist with annual and monthly financial report; assists users in resolving problems on various accounting systems. Additional Work Performed: Prepares social security and tax withholding reports; prepares quarterly unemployment reports; maintains general records of account according to established accounting classifications, including various ledgers, registers, and journals; posts entries to books and computer from supporting records, makes adjustments, and prepares financial statements. -

Cost of Goods Sold

Cost of Goods Sold Inventory •Items purchased for the purpose of being sold to customers. The cost of the items purchased but not yet sold is reported in the resale inventory account or central storeroom inventory account. Inventory is reported as a current asset on the balance sheet. Inventory is a significant asset that needs to be monitored closely. Too much inventory can result in cash flow problems, additional expenses and losses if the items become obsolete. Too little inventory can result in lost sales and lost customers. Inventory is reported on the balance sheet at the amount paid to obtain (purchase) the items, not at its selling price. Cost of Goods Sold • Inventory management Involves regulation of the size of the investment in goods on hand, the types of goods carried in stock, and turnover rates. The investment in inventory should be kept at a minimum consistent with maintenance of adequate stocks of proper quality to meet sales demand. Increases or decreases in the inventory investment must be tested against the effect on profits and working capital. Standard levels of inventory should be established as adequate for a given volume of business, and stock control procedures applied so as to limit purchase as required. Such controls should not preclude volume purchase of nonperishable items when price advantages may be obtained under unusual circumstances. The rate of inventory turnover is a valuable test of merchandising efficiency and should be computed monthly Cost of Goods Sold • Inventory management All inventories are valued at cost which is defined as invoice price plus freight charges less discounts. -

Cash Receipts /Accounts Receivable

Section 8 – Cash Receipts /Accounts Receivable Overview Most local governments collect revenue over the counter and through the mail from the general public in the form of cash, personal checks, credit and debit card transactions, or money orders. Many local governments are also offering online payment options and direct debit of customers’ bank accounts for repetitive payments such as monthly utility bill payments. Collections may take place at multiple locations throughout the government’s operations and be for a number of purposes including: Tax payments Utility payments Various fees and charges Court collections Permits and licenses Other service charges It is necessary to establish an adequate system of controls to assure that all amounts owed to the government are collected, documented, recorded, and deposited to the bank accounts of the government entity, and to detect and deter error and fraud. Suitable controls should be established at each location where payments are received as well as at the centralized collections point. Documentation for each transaction may be generated manually by the use of a pre-numbered receipt form or through the use of a cash register, computer, or other electronic device that will provide the customer with a validated receipt and detailed and/or summary information for the government to use for balancing, reconciliation and auditing purposes. At the end of the day, this documentation is typically reconciled to the total of the cash, checks, and other forms of payment received. Total daily receipts are either manually recorded to the accounting system, or uploaded automatically by way of an electronic interface between the cash receipting and the accounting systems. -

One Washington Draft Chart of Accounts Model

A Business Transformation Program One Washington Draft Chart of Accounts Model A Business Transformation Program July 20201 A Business Transformation Program Table of Contents Overview .............................................................................................................................. 3 COA strawman ..................................................................................................................... 4 Element Definitions ............................................................................................................. 5 2 A Business Transformation Program Overview About the Chart of Accounts (COA) The new COA is a set of numbers that will tie together financial data across the state. As you will see in the attached COA “Strawman,” each set of numbers provides a different piece of accounting information such as agency name, department name, and geographic location. As the state moves towards a single, integrated Enterprise Resource Planning software system, it will be important for the state to have a single, standardized COA for all agencies. Today, each agency has its’ own COA and they are not standardized across the state. Important caveat: The new COA is a draft and not final – it will be updated and refined after a systems integrator is onboarded this fall. We are sharing the draft “Strawman” now so you can begin thinking ahead about what the new statewide COA will look like and consider what resources your agency will need to complete the work. Objectives and Approach of the Draft -

A73 Cash Basis Accounting

World A73 Cash Basis Accounting Net Change with new Cash Basis Accounting program: The following table lists the enhancements that have been made to the Cash Basis Accounting program as of A7.3 cum 15 and A8.1 cum 6. CHANGE EXPLANATION AND BENEFIT Batch Type Previously cash basis batches were assigned a batch type of ‘G’. Now cash basis batches have a batch type of ‘CB’, making it easier to distinguish cash basis batches from general ledger batches. Batch Creation Previously, if creating cash basis entries for all eligible transactions, all cash basis entries would be created in one batch. Now cash basis entries will be in separate batches based on a one-to-one batch ratio with the originating AA ledger batch. For example, if cash basis entries were created from 5 separate AA ledger batches, there will be 5 resulting AZ ledger batches. This will make it simpler to track posting issues as well as alleviate problems inquiring on cash basis entries where there were potential duplicate document numbers/types within the same batch. Batch Number Previously cash basis batch numbers were unique in relation to the AA ledger batch that corresponded to the cash basis entries. Now the cash basis batch number will match the original AA ledger batch, making it easier to track and audit cash basis entries in relation to the originating transactions. Credit Note Prior to A7.3 cum 14/A8.1 cum 4, the option to assign a document type Reimbursement other than PA to the voucher generated for reimbursement did not exist. -

Issue Paper Chart of Accounts (Version 2018-April)

Issue Paper Chart of Accounts (Version 2018-april) Date April 20th 2018 Topic Chart of Accounts Author Frans HIETBRINK 0. Content 0. CONTENT ....................................................................................................................................................................... 1 1. INTRODUCTION ............................................................................................................................................................. 2 1.1. INTRODUCTION OF FACTSHEET ............................................................................................................................................. 2 1.2. INTRODUCTION OF SBR ...................................................................................................................................................... 2 1.3. INTRODUCTION OF CHART OF ACCOUNTS ............................................................................................................................... 3 2. DOCUMENTATION ......................................................................................................................................................... 3 2.1. DOCUMENTS .................................................................................................................................................................... 3 2.2. WEBSITES ........................................................................................................................................................................ 3 3. CHART OF -

Total Cost and Profit

4/22/2016 Total Cost and Profit Gina Rablau Gina Rablau - Total Cost and Profit A Mini Project for Module 1 Project Description This project demonstrates the following concepts in integral calculus: Indefinite integrals. Project Description Use integration to find total cost functions from information involving marginal cost (that is, the rate of change of cost) for a commodity. Use integration to derive profit functions from the marginal revenue functions. Optimize profit, given information regarding marginal cost and marginal revenue functions. The marginal cost for a commodity is MC = C′(x), where C(x) is the total cost function. Thus if we have the marginal cost function, we can integrate to find the total cost. That is, C(x) = Ȅ ͇̽ ͬ͘ . The marginal revenue for a commodity is MR = R′(x), where R(x) is the total revenue function. If, for example, the marginal cost is MC = 1.01(x + 190) 0.01 and MR = ( /1 2x +1)+ 2 , where x is the number of thousands of units and both revenue and cost are in thousands of dollars. Suppose further that fixed costs are $100,236 and that production is limited to at most 180 thousand units. C(x) = ∫ MC dx = ∫1.01(x + 190) 0.01 dx = (x + 190 ) 01.1 + K 1 Gina Rablau Now, we know that the total revenue is 0 if no items are produced, but the total cost may not be 0 if nothing is produced. The fixed costs accrue whether goods are produced or not. Thus the value for the constant of integration depends on the fixed costs FC of production. -

Absorption Costing - Overview

Absorption Costing - Overview 1. Overview of Absorption costing and Variable Costing 2. Review how costs for Manufacturing are transferred to the product 3. Job Order Vs. Process Costing 4. Overhead Application - Under applied Overhead - Over applied overhead 5. Problems with Absorption Costing 6. Concluding Comments Absorption Costing The focus of this class is on how to allocate manufacturing costs to the product. - Direct Materials - Direct Labor - Overhead Absorption costing is a process of tracing the variable costs of production and the fixed costs of production to the product. Variable Costing traces only the variable costs of production to the product and the fixed costs of production are treated as period expenses. Absorption Costing There are three different types of Absorption Costing Systems: - Job Order Costing - Process Costing - ABC Costing In Job Order Costing costs are assigned to the product in Batches or lots. - Printing - Furniture manufacturing - Bicycle Manufacturing In Process Costing, costs are systematically assigned to the product, since there are no discreet batches to assign costs. - Oil Distilling - Soda Manufacturing ABC Costing assigns cost from cost centers to the product - Best in a multi product firm, where there are different volumes Absorption Costing A simplified view of Production: Introduce Raw Manufacture Store finished Sell Finished Materials Product goods Goods 1. Direct materials 1. Direct labor 1. Production process are purchased applied to completed 2. Direct materials product 2. Goods are shipped are placed into 2. Overhead costs for sale production are incurred Absorption Costing How do we account for the production process? 1. Direct materials are purchased and recorded as an asset. -

Cash Advance Admin User Guide

Concur Expense: Cash Advance Admin User Guide Last Revised: August 27 2021 Applies to these SAP Concur solutions: Expense Professional/Premium edition Standard edition Travel Professional/Premium edition Standard edition Invoice Professional/Premium edition Standard edition Request Professional/Premium edition Standard edition Table of Contents Section 1: Permissions ................................................................................................ 1 Section 2: Overview .................................................................................................... 1 Typical Cash Advance Process ...................................................................................... 1 Receiving Email Notifications of a Cash Advance Pending Issuance ................................... 2 Cash Advances Using a Company Card.......................................................................... 2 Imported Transactions of Type Cash Advance ........................................................... 3 Directly Issued and Auto-Issuance Cash Advances ......................................................... 3 Section 3: Cash Advance Admin Tool ........................................................................... 3 Section 4: Procedures ................................................................................................. 4 Accessing Cash Advance Admin.................................................................................... 4 Searching for Employees ............................................................................................