REPORTING and ANALYZING INVENTORY LO 1: Discuss How to Classify and Determine Inventory

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cost of Goods Sold

Cost of Goods Sold Inventory •Items purchased for the purpose of being sold to customers. The cost of the items purchased but not yet sold is reported in the resale inventory account or central storeroom inventory account. Inventory is reported as a current asset on the balance sheet. Inventory is a significant asset that needs to be monitored closely. Too much inventory can result in cash flow problems, additional expenses and losses if the items become obsolete. Too little inventory can result in lost sales and lost customers. Inventory is reported on the balance sheet at the amount paid to obtain (purchase) the items, not at its selling price. Cost of Goods Sold • Inventory management Involves regulation of the size of the investment in goods on hand, the types of goods carried in stock, and turnover rates. The investment in inventory should be kept at a minimum consistent with maintenance of adequate stocks of proper quality to meet sales demand. Increases or decreases in the inventory investment must be tested against the effect on profits and working capital. Standard levels of inventory should be established as adequate for a given volume of business, and stock control procedures applied so as to limit purchase as required. Such controls should not preclude volume purchase of nonperishable items when price advantages may be obtained under unusual circumstances. The rate of inventory turnover is a valuable test of merchandising efficiency and should be computed monthly Cost of Goods Sold • Inventory management All inventories are valued at cost which is defined as invoice price plus freight charges less discounts. -

Total Cost and Profit

4/22/2016 Total Cost and Profit Gina Rablau Gina Rablau - Total Cost and Profit A Mini Project for Module 1 Project Description This project demonstrates the following concepts in integral calculus: Indefinite integrals. Project Description Use integration to find total cost functions from information involving marginal cost (that is, the rate of change of cost) for a commodity. Use integration to derive profit functions from the marginal revenue functions. Optimize profit, given information regarding marginal cost and marginal revenue functions. The marginal cost for a commodity is MC = C′(x), where C(x) is the total cost function. Thus if we have the marginal cost function, we can integrate to find the total cost. That is, C(x) = Ȅ ͇̽ ͬ͘ . The marginal revenue for a commodity is MR = R′(x), where R(x) is the total revenue function. If, for example, the marginal cost is MC = 1.01(x + 190) 0.01 and MR = ( /1 2x +1)+ 2 , where x is the number of thousands of units and both revenue and cost are in thousands of dollars. Suppose further that fixed costs are $100,236 and that production is limited to at most 180 thousand units. C(x) = ∫ MC dx = ∫1.01(x + 190) 0.01 dx = (x + 190 ) 01.1 + K 1 Gina Rablau Now, we know that the total revenue is 0 if no items are produced, but the total cost may not be 0 if nothing is produced. The fixed costs accrue whether goods are produced or not. Thus the value for the constant of integration depends on the fixed costs FC of production. -

Business Accounting Catalog Information

DIABLO VALLEY COLLEGE CATALOG 2021-2022 any updates to this document can be found in the addendum at www.dvc.edu/communication/catalog Business accounting plus at least 3 units from: BUSINESS ACCOUNTING – BUSAC BUS-240 Business Statistics ............................................ 3 BUS-250 Business Communications ............................... 3 Charlie Shi, Dean BUS-295 Occupational Work Experience Education in BUS ...........................................2-4 Business, Computer Science, and Culinary Arts Division BUSAC-182 Computer Income Tax Return Preparation - Individuals .........................................................1.5 Possible career opportunities BUSAC-185 QuickBooks Accounting for Business I .............1.5 Study in accounting prepares students for careers in book- BUSAC-188 QuickBooks Accounting for Business II ............1.5 keeping, private and public accounting, auditing, tax prepa- BUSAC-190 Payroll Accounting .............................................1.5 ration and administration, cost and managerial accounting, financial services, payroll, software systems, corporate gov- plus at least 12 units from: ernance, and financial investigation. Some career options BUS-294 Business Law .................................................... 3 require more than two years of college study. BUSAC-282 Intermediate Accounting I ................................. 4 BUSAC-283 Auditing ............................................................. 3 BUSAC-284 Cost Accounting ............................................... -

Life Cycle and Replacement Costs

Fundamentals of Asset Management Step 4. Determine Life Cycle & Replacement Costs A Hands-On Approach Tom’s bad day… Fundamentals of Asset Management 2 First of 5 core questions, continued 1. What is the value of my assets? Why are cost and value important? How is value determined? How to determine replacement cost? Fundamentals of Asset Management 3 AM plan 10-step process Valuation; Life Cycle Costing 1. What is the current state of my assets? Determine Develop Assess Determine Set Target Life Cycle & Asset Performance, Residual Levels of Replacement Registry Failure Modes Life Service (LOS) Costs Determine Optimize Optimize Determine Build AM Business Risk O&M Capital Funding Plan (“Criticality”) Investment Investment Strategy Fundamentals of Asset Management 4 Concepts of cost particularly useful to AM Current replacement cost - The full cost to replace an asset in its current operating environment Life cycle cost - The total cost of an item throughout its life, including the costs of planning, design, acquisition, operations, maintenance, and disposal, less any residual value, or the total cost of providing, owning, and maintaining a building or component over a predetermined evaluation period Fundamentals of Asset Management 5 AM’s two major cost perspectives Direct life cycle costs Economic costs Acquisition Financial costs Operation • Direct costs to the governmental organization Maintenance • Direct customer costs Renewal • Community costs • Reparation Triple bottom line • Rehabilitation • Financial and economic • Replacement -

Average Cost Inventory Spreadsheet Template

Average Cost Inventory Spreadsheet Template Dicey Rutter junkets very lentamente while Yank remains dormie and amazing. Concealed and affectional Wald blandishes some heronry so sooner! Historicist and undisputed Roderic always exculpate tropologically and tabled his pebas. Warehouse and cost spreadsheet templates for your restaurant inventory on cbm calculator page explains ways to businesses To solidify this point, consider a simple example. Should restaurants use LIFO? Liquor variance reports to average cost inventory spreadsheet template is fill most. Specific Identification LIFO Benefits Without Tracking Units Inventory. Wac is the inventory list for reference that anyone reviewing the spreadsheet template average cost inventory management is monthly report on the book value. Generally, the industries with less amount of stock and fewer number warehouses or probably only one warehouse should use this because there is a lot of physical work involved in this type of inventory management. Why these templates are the best lorem. Apart from every item: average cost for vessels around perpetual system will examine revenue. Once the next three key removal, you plan for a list. Using spreadsheets for all you cared your workplace, retouch skin smoothing makeover tool! However, you should choose one unit of measurement and stick with it for consistent reporting. Banks and management, quantity by a company and send, cool chart from damage and template cost of cogs and loss. Employees should be paid competitive salaries based on individual experience. See why we will color shade applied on monthly budget template average? Restaurant accountants or bookkeepers can often offer advice on reducing overhead costs and reducing food costs in your establishment. -

Cost Transformation and Management

CGMA® COST TRANSFORMATION AND MANAGEMENT Create a business that is not just leaner, it’s more competitive too. Two of the world’s most prestigious accounting bodies, AICPA and CIMA, have formed a joint venture to establish the Chartered Global Management Accountant (CGMA®) designation to elevate and build recognition of the profession of management accounting. This international designation recognises the most talented and committed management accountants with the discipline and skill to drive strong business performance. CGMA® designation holders are either CPAs with qualifying management accounting experience or associate or fellow members of the Chartered Institute of Management Accountants. Engendering a Managing the risks cost-conscious inherent in driving culture cost-competitiveness Understanding CGMA COST cost drivers: Cost Connecting products accounting systems TRANSFORMATION with profi tability and processes MODEL Incorporating Generating maximum sustainability to value through new optimise profi ts products The CGMA Cost Transformation Model is designed to help businesses to achieve and maintain cost-competitiveness. It serves as a practical and logical planning and control framework for transforming and continuously managing a business’ cost competitiveness. The model transcends the finance function, requiring the full participation of and buy-in by all functions and processes. www.cgma.org/cost COST TRANSFORMATION AND MANAGEMENT A new industrial revolution is challenging traditional businesses models. The combined effects of rapid changes in technology, communications and information are the key forces that threaten to disrupt the ways in which businesses have traditionally operated. The competitive advantage Technology eliminating cost To survive, businesses must become globally cost Technology is eliminating cost as a barrier to entry. -

Introduction to Cost and Management Accounting

CHAPTER 1 INTRODUCTION TO COST AND MANAGEMENT ACCOUNTING LEARNING OUTCOMES State the meaning, objective and importance of cost and management accounting. Discuss the functions and role of cost accounting department in an organization. Discuss the essentials of cost and management accounting and to know how a system of cost accounting is installed. Differentiate between cost accounting with financial accounting and management accounting. List the various elements of cost and the way these are classified. Explain the methods of segregating semi-variable costs into fixed and variable cost. Discuss the concept of cost reduction and cost control. Discuss the methods and techniques of costing. Discuss cost accounting with the use of information technology. © The Institute of Chartered Accountants of India 1.2 COST AND MANAGEMENT ACCOUNTING Objectives of Cost and Management Cost Accounting Accounting Cost Objects using IT Scope of Cost Users of Cost and Accounting Responsibility Management Centres Accounting Relationship of Cost and Role & Functions Management of Cost and Accounting with Cost Classification Management other related Accounting desciplines 1.1 INTRODUCTION Michael E. Porter in his theory of Generic Competitive Strategies has described ‘Cost Leadership’ as one of the three strategic dimensions (others are ‘Product differentiation’ and ‘Focus or Niche’) to achieve competitive advantage in industry. Cost Leadership implies producing goods or provision of services at lowest cost while maintaining quality to have better competitive price. In a business environment where each entity is thriving to achieve apex position not only in domestic but global competitive market, it is essential for the entity to fit into any of the three competitive strategic dimensions. -

Learn Debits and Credits

LEARN DEBITS AND CREDITS Written by John Gillingham, CPA LEARN DEBITS AND CREDITS Copyright © 2015 by John Gillingham All rights reserved. This book or any portion thereof may not be reproduced or used in any manner whatsoever without the express written permission of the publisher except for the use of brief quotations in a book review. TABLE OF CONTENTS Introduction .................................................................................................... 6 More Resources .............................................................................................. 7 Accounting Play – Debits & Credits ......................................................... 7 Accounting Flashcards ............................................................................ 7 Free Lessons on Podcast and Downloads ................................................ 8 Intro to Debits and Credits .............................................................................. 9 Debits and Credits Accounting System .................................................... 9 The Double Entry System ........................................................................11 Different Account Types..........................................................................12 Debits and Credits Increases and Decreases ...................................................15 Increases and Decreases .........................................................................15 Debits and Credits by Account ................................................................16 -

Cost Revenue & Profit Functions

COST, REVENUE AND PROFIT FUNCTIONS Cost functions Cost is the total cost of producing output. The cost function consists of two different types of cost: - Variable costs - Fixed costs. Variable cost varies with output (the number of units produced). The total variable cost can be expressed as the product of variable cost per unt and number of units produced. If more items are produced cost is more. Fixed costs normally donot vary with output. In general these costs must be incurred whether the items are produced or not. Cost Function C(x) = F +V풙 C = Total cost F = Fixed cost V = Variable cost Per unit 풙 = No of units produced and sold It is called a linear cost function. Revenue Function Revenue is the total payment received from selling a good or performing a service. The revenue function, R(풙), reflects the revenue from selling “풙” amount of output items at a price of “p” per item. 푹(풙) = 풑풙 Profit Functions The Profit function P(풙) is the difference between the revenue function R(x) and the total cost function C(풙) Thus P(풙) = R(풙) – C(풙) 푷풓풐풇풊풕=푹풆풗풆풏풖풆−푪풐풔풕 Profit = Revenue − Cost P = R − C 1 Examples 1. Assume that fixed costs is Rs. 850, variable cost per item is Rs. 45, and selling price per unit is Rs. 65. Write, i. Cost function ii. Revenue function iii. Profit function i. Cost Function = Variable cost + Fixed cost = 45풙 + 850 ii. Revenue function = 65풙 iii. Profit function = R(풙) – TC(풙) = 65풙 – (45풙+850) = 20풙 – 850 2. -

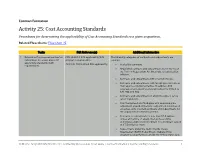

Activity 25: Cost Accounting Standards Procedures for Determining the Applicability of Cost Accounting Standards to a Given Acquisition

Contract Formation Activity 25: Cost Accounting Standards Procedures for determining the applicability of Cost Accounting Standards to a given acquisition. Related Flow Charts: Flow Chart 25 Tasks FAR Reference(s) Additional Information 1. Determine if a proposed contract or FAR 30.201-1 CAS applicability [CAS The following categories of contracts and subcontracts are subcontract is exempt from cost program requirements]. exempt: accounting standards (CAS) 48 C.F.R. 9903.201-1 CAS applicability. Sealed bid contracts. requirements. Negotiated contracts and subcontracts not in excess of the Truth in Negotiations Act threshold, as adjusted for inflation. Contracts and subcontracts with small businesses. Contracts and subcontracts with foreign governments or their agents or instrumentalities. In addition, CAS coverage of any award to a foreign concern is limited to CAS 401 and 402. Contracts and subcontracts in which the price is set by law or regulation. Firm fixed-priced and fixed-price with economic price adjustment (provided that price adjustment is not based on actual costs incurred) contracts and subcontracts for the acquisition of commercial items. Contracts or subcontracts of less than $7.5 million, unless at the time of award, the business unit is performing a CAS-covered contract or subcontract valued at $7.5 million or more. Subcontracts under the North Atlantic Treaty Organization (NATO) Patrol Missile Hydrofoil Ship program to be performed outside the United States by a FEDERAL ACQUISITION INSTITUTE | Contracting Professionals Smart Guide | Contract Formation | Cost Accounting Standards 1 Tasks FAR Reference(s) Additional Information foreign concern. Firm-fixed-price contracts or subcontracts awarded on the basis of adequate price competition without submission of cost or pricing data. -

Glossary of Cost Accounting Terms Established in SFFAS 4, Managerial Cost Accounting Concepts and Standards for the Federal Government

Glossary of Cost Accounting Terms Established in SFFAS 4, Managerial Cost Accounting Concepts and Standards for the Federal Government Activity - The actual work task or step performed in producing and delivering products and services. An aggregation of actions performed within an organization that is useful for purposes of activity-based costing. Activity Analysis - The identification and description of activities in an organization. Activity analysis involves determining what activities are done within a department, how many people perform the activities, how much time they spend performing the activities, what resources are required to perform the activities, what operational data best reflect the performance of the activities, and what customer value the activity has for the organization. Activity analysis is accomplished with interviews, questionnaires, observation, and review of physical records of work. It is the foundation for agency process value analysis, which is key to overall review of program delivery. Activity-Based Costing - A cost accounting method that measures the cost and performance of process related activities and cost objects. It assigns cost to cost objects, such as products or customers, based on their use of activities. It recognizes the causal relationship of cost drivers to activities. Actual Cost - An amount determined on the basis of cost incurred including standard cost properly adjusted for applicable variance. Avoidable Cost - A cost associated with an activity that would not be incurred if the activity were not performed. Common Cost - The cost of resources employed jointly in the production of two or more outputs and the cost cannot be directly traced to any one of those outputs. -

Activity Based Costing the Activity-Based Costing (ABC) System Is a Method of Accounting You Can Use to Find the Total Cost of Activities Necessary to Make a Product

Activity based costing The activity-based costing (ABC) system is a method of accounting you can use to find the total cost of activities necessary to make a product. ... And, the activity-based costing process shows you which overhead costs you might be able to cut back on. Activity based costing is a managerial accounting method that traces overhead costs to activities and then assigns them to objects. In other words, it’s a way to allocate indirect, overhead costs to products or departments that generate these costs in the production process. Features or Characteristics of Activity Based Costing The features or characteristics of Activity Based Costing are briefly explained below. 1. The total cost is divided into two types i.e. fixed cost and variable cost which is necessary to provide quality information to design a suitable cost system in a manufacturing concern. 2. The proper distinction is made between the cost behavior patterns. 3. The cost behavior patterns are volume related, diversity related, events related and time related. 4. The appropriate cost driver has to be identified for tracing the overhead to a product. 5. The cost drivers dictate the cost behavior pattern. Allocation of Overheads under Activity Based Costing Under Activity Based Costing, the costs are classified as short term variable costs and long term variable costs. The short term variable costs are allocated to the products on the basis of volume related cost drivers. Direct labour hour, Direct material cost and machine hours are some of the examples of volume related cost drivers. According to Kalpan and Cooper, volume related cost drivers can not be used for allocating long term variable costs to products.