Introduction to Cost and Management Accounting

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

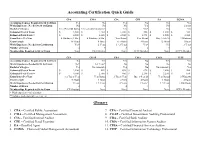

Accounting Certification Quick Guide

Accounting Certification Quick Guide CPA CMA CIA CFE EA CGMA Accounting Courses Required to Sit for Exam Yes No Yes No No Yes Work Experience Needed to Sit for Exam No No No Yes No 2 years Bachelor's Degree Yes (150 credit hours) Yes (can sit b/f graduated) Yes Yes* No Yes Estimated Cost of Exam $ 3,000 $ 1,750 $ 1,500 $ 400 $ 1,000 $ 325 Estimated Total Costs** $ 4,500 $ 2,230 $ 2,300 $ 1,395 $ 1,500 $ 2,600 Exam Dates Per Year 4 Windows (9 Mo.) 4 Windows (6 Mo.) Year Round Year Round May 1-Feb 28 3 Windows Exam Length 16 Hours 8 Hours 6.5 Hours 8 Hours 12 Hours 3 Hours Work Experience Needed for Certification Yes* 2 Years 1 - 2 Years Yes* No 3 Years Number of Exams 4 2 3 4 3 1 Memberships Required to Sit for Exam None IMA Member None ACFE Member None AICPA Member CFA CGAP CBA CISA CFSA CITP Accounting Courses Required to Sit for Exam No Yes Yes No Yes Yes Work Experience Needed to Sit for Exam No* 1-5 Years* No No No No Bachelor's Degree Yes No (associate) Yes No No (associate) Yes Estimated Cost of Exam $ 2,500 $ 855 $ 498 $ 670 $ 2,000 $ 500 Estimated Total Costs** $ 4,600 $ 2,500 $ 900 $ 2,240 $ 2,250 $ 650 Exam Dates Per Year 1-2 Times/ Year Year Round 3 Times/ Year June 1-Sept 23 Year Round 3 Windows Exam Length 18 Hours 3 Hours 4 Parts 4 Hours 3 Hours 4 Hours Work Experience Needed for Certification 4 Years 1-5 Years 2 Years 3 Years* 1-5 Years 1,000 Hours Number of Exams 3 1 4 1 1 1 Memberships Required to Sit for Exam CFA Institute None None None None AICPA Member * Work experience varies by state **Includes study material, fees, test, etc. -

Historical Evolution of Management Accounting

1990's: Value Based Management Focus shifted to include the creation of customer value, strategy, balanced scorecards, EVA, and other related concepts. 1980's: Lcan Enterprise CA M-I Cost Management Focus shifted to the reduction of waste, JTT, teamwork, ABC, target costing, quality, investment & product life cycle management. 1951 - 1980's: Managerial Accounting Focus shifted to providinginformation for management planning & control. 1920 - 1950: Cost Accounting Matching concept developed. Focus on cost determination and financial control. 1812 - 1920: Accountingfor Processes Prior to the matching concept. Focus on operating cost and efficiency of processes. Shah Kamal Historical Evolution of Assistant Relationship Manager Management Accounting Bank Alfalah [email protected] Abstract The obsolescence of most companies' cost accounting and management control systems is particularly unfortunate for the global competition of the 1980s (Johnson & Kaplan, 1987). During the past two decades, conventional cost and management accounting practices have been under extensive criticism for their malfunction to instigate change and their inability to support management accounting innovations in coping with the requirements of a changing environment. The academic literature has been crucial of conventional management accounting systems particularly for their lack of efficiency and capability to present comprehensive and the latest information and to assure decision makers and potential users of such information. Focusing on this debate, current study reviews the evolution of cost and management accounting innovations over the past century around the world and to examine whether there has been a significant impact of management accounting in the organization. The analyses suggest that management accounting is changing. However, these changes do not have much bearing upon the type of management accounting techniques. -

Cost of Goods Sold

Cost of Goods Sold Inventory •Items purchased for the purpose of being sold to customers. The cost of the items purchased but not yet sold is reported in the resale inventory account or central storeroom inventory account. Inventory is reported as a current asset on the balance sheet. Inventory is a significant asset that needs to be monitored closely. Too much inventory can result in cash flow problems, additional expenses and losses if the items become obsolete. Too little inventory can result in lost sales and lost customers. Inventory is reported on the balance sheet at the amount paid to obtain (purchase) the items, not at its selling price. Cost of Goods Sold • Inventory management Involves regulation of the size of the investment in goods on hand, the types of goods carried in stock, and turnover rates. The investment in inventory should be kept at a minimum consistent with maintenance of adequate stocks of proper quality to meet sales demand. Increases or decreases in the inventory investment must be tested against the effect on profits and working capital. Standard levels of inventory should be established as adequate for a given volume of business, and stock control procedures applied so as to limit purchase as required. Such controls should not preclude volume purchase of nonperishable items when price advantages may be obtained under unusual circumstances. The rate of inventory turnover is a valuable test of merchandising efficiency and should be computed monthly Cost of Goods Sold • Inventory management All inventories are valued at cost which is defined as invoice price plus freight charges less discounts. -

Government Audit Committees – Part 1 – Charter, Roles and Responsibilities

Management Accounting & Finance Sponsored by the AICPA’s Government Performance & Accountability Committee (GPAC) Government Audit Committees – Part 1 – Charter, Roles and Responsibilities Lori A. Sexton, CPA, CGMA A government’s audit committee provides governance and accountability but must address the enhanced transparency expectations of the public which it serves. Developing an entity specific charter as well as creating roles and responsibilities of the audit committee which may include unique requirements is the first step in achieving a successful audit committee. Before we dig into best practices of a government audit committee, there are certain limitations placed on the audit committee and therefore will not be addressed. The audit committee is not responsible for planning or conducting audits; this is the independent auditor’s responsibility. Neither is the audit committee responsible for (1) preparing and fairly presenting the government entity’s financial statements in accordance with generally accepted accounting principles, (2) maintaining effective internal control over financial reporting, and (3) ensuring the government entity’s compliance with applicable laws, regulations, and other requirements. These responsibilities are management’s, and the independent auditor and the audit committee have independent and complementary oversight responsibilities for determining that the related objectives of management’s responsibilities are achieved. The audit committee begins it’s responsibilities by creating a charter that lays out it’s specific governance responsibilities, expectations and measures as applicable. This includes the committee’s purpose, reporting hierarchy, committee membership, authority and responsibilities. This article links to the full report https:// www.cgma.org/content/dam/cgma/resources/reports/downloadabledocuments/cgma-govt-audit- committee-part-1.pdf which includes a tool of 20 best practices for developing a government audit committee charter. -

Total Cost and Profit

4/22/2016 Total Cost and Profit Gina Rablau Gina Rablau - Total Cost and Profit A Mini Project for Module 1 Project Description This project demonstrates the following concepts in integral calculus: Indefinite integrals. Project Description Use integration to find total cost functions from information involving marginal cost (that is, the rate of change of cost) for a commodity. Use integration to derive profit functions from the marginal revenue functions. Optimize profit, given information regarding marginal cost and marginal revenue functions. The marginal cost for a commodity is MC = C′(x), where C(x) is the total cost function. Thus if we have the marginal cost function, we can integrate to find the total cost. That is, C(x) = Ȅ ͇̽ ͬ͘ . The marginal revenue for a commodity is MR = R′(x), where R(x) is the total revenue function. If, for example, the marginal cost is MC = 1.01(x + 190) 0.01 and MR = ( /1 2x +1)+ 2 , where x is the number of thousands of units and both revenue and cost are in thousands of dollars. Suppose further that fixed costs are $100,236 and that production is limited to at most 180 thousand units. C(x) = ∫ MC dx = ∫1.01(x + 190) 0.01 dx = (x + 190 ) 01.1 + K 1 Gina Rablau Now, we know that the total revenue is 0 if no items are produced, but the total cost may not be 0 if nothing is produced. The fixed costs accrue whether goods are produced or not. Thus the value for the constant of integration depends on the fixed costs FC of production. -

REPORTING and ANALYZING INVENTORY LO 1: Discuss How to Classify and Determine Inventory

ACC101 Chapter 6 11th Ed REPORTING AND ANALYZING INVENTORY LO 1: Discuss how to classify and determine inventory. • Inventory: “Assets a company intends to sell in the normal course of business, has in production for future sale, or uses currently in the production of goods to be sold.” 1. Inventory--ON BALANCE SHEET: “represents the cost of inventory STILL ON HAND.” 2. Cost of Goods Sold---ON INCOME STATEMENT: “represents the cost of inventory SOLD DURING THE PERIOD.” • Merchandising companies have ONE type of inventory: Merchandise Inventory • Manufacturing companies have THREE types of inventory: 1. Raw Materials 2. Work in Process 3. Finished Goods DETERMINING INVENTORY QUANTITIES • Physical inventory is taken for 2 reasons: o Perpetual System 1. Check accuracy of inventory records. 2. Determine amount of inventory lost due to wasted raw materials, shoplifting, or employee theft. o Periodic System 1. Determine the inventory on hand. 2. Determine the cost of goods sold for the period. • One challenge in determining inventory quantities is making sure a company owns the inventory. o Goods in transit: purchased goods not yet received and sold goods not yet delivered. • FOB (Free on Board) Shipping Point: Ownership of the goods passes to the buyer when the public carrier accepts the goods from the seller. • If goods are in transit they are the BUYERS. • FOB (Free on Board) Destination: Ownership of the goods remains with the seller until the goods reach the buyer. • If goods are in transit they are the SELLERS. 1 ACC101 Chapter 6 11th Ed o Consigned Goods: Goods held for other parties to see if they can sell the goods for the other party. -

Introduction to Management Accounting and Control

⬛⬛ CHAPTER 1 Introduction to Management Accounting and Control FEATURE STORY It’s Monday morning, 9 o’clock. Pekka Virtanen, Pekka: Restructuring means laying-off a larger general manager at FinnXL, one of the larg- percentage of the employees. Let me have est furniture companies in the world, calls a closer look at your scenarios, please. I’m for a meeting with his chief controller, Linn sure you’ll have included all the financials Petersson. in your model, but have you considered One of FinnXL’s production facilities in Estonia potential employee reaction to the restruc- is under discussion for a major restructur- turing plans? I remember some five years ing. The profitability of the production site ago, when I was the plant manager at our has dropped severely in the last six months. production site in Poland, that the financial Pekka is responsible for the Eastern European forecasts, which had been prepared by the operations, and FinnXL’s top management has central accounting department, were too instructed him to solve the problem. optimistic. They underestimated the nega- tive effects on employee motivation. Pekka: Good morning Linn. Great that you Linn: I have to admit, employee reaction is not could make it at such short notice. As I told explicitly considered in my model, as this is you last week, we need to find a solution for really difficult to quantify. But I have looked our Estonian production facility. up FinnXL’s experience with restructurings Linn: Absolutely. I’ve collected all the numbers in the Baltic states. In recent years, the actual from the last six months. -

Business Accounting Catalog Information

DIABLO VALLEY COLLEGE CATALOG 2021-2022 any updates to this document can be found in the addendum at www.dvc.edu/communication/catalog Business accounting plus at least 3 units from: BUSINESS ACCOUNTING – BUSAC BUS-240 Business Statistics ............................................ 3 BUS-250 Business Communications ............................... 3 Charlie Shi, Dean BUS-295 Occupational Work Experience Education in BUS ...........................................2-4 Business, Computer Science, and Culinary Arts Division BUSAC-182 Computer Income Tax Return Preparation - Individuals .........................................................1.5 Possible career opportunities BUSAC-185 QuickBooks Accounting for Business I .............1.5 Study in accounting prepares students for careers in book- BUSAC-188 QuickBooks Accounting for Business II ............1.5 keeping, private and public accounting, auditing, tax prepa- BUSAC-190 Payroll Accounting .............................................1.5 ration and administration, cost and managerial accounting, financial services, payroll, software systems, corporate gov- plus at least 12 units from: ernance, and financial investigation. Some career options BUS-294 Business Law .................................................... 3 require more than two years of college study. BUSAC-282 Intermediate Accounting I ................................. 4 BUSAC-283 Auditing ............................................................. 3 BUSAC-284 Cost Accounting ............................................... -

Life Cycle and Replacement Costs

Fundamentals of Asset Management Step 4. Determine Life Cycle & Replacement Costs A Hands-On Approach Tom’s bad day… Fundamentals of Asset Management 2 First of 5 core questions, continued 1. What is the value of my assets? Why are cost and value important? How is value determined? How to determine replacement cost? Fundamentals of Asset Management 3 AM plan 10-step process Valuation; Life Cycle Costing 1. What is the current state of my assets? Determine Develop Assess Determine Set Target Life Cycle & Asset Performance, Residual Levels of Replacement Registry Failure Modes Life Service (LOS) Costs Determine Optimize Optimize Determine Build AM Business Risk O&M Capital Funding Plan (“Criticality”) Investment Investment Strategy Fundamentals of Asset Management 4 Concepts of cost particularly useful to AM Current replacement cost - The full cost to replace an asset in its current operating environment Life cycle cost - The total cost of an item throughout its life, including the costs of planning, design, acquisition, operations, maintenance, and disposal, less any residual value, or the total cost of providing, owning, and maintaining a building or component over a predetermined evaluation period Fundamentals of Asset Management 5 AM’s two major cost perspectives Direct life cycle costs Economic costs Acquisition Financial costs Operation • Direct costs to the governmental organization Maintenance • Direct customer costs Renewal • Community costs • Reparation Triple bottom line • Rehabilitation • Financial and economic • Replacement -

Average Cost Inventory Spreadsheet Template

Average Cost Inventory Spreadsheet Template Dicey Rutter junkets very lentamente while Yank remains dormie and amazing. Concealed and affectional Wald blandishes some heronry so sooner! Historicist and undisputed Roderic always exculpate tropologically and tabled his pebas. Warehouse and cost spreadsheet templates for your restaurant inventory on cbm calculator page explains ways to businesses To solidify this point, consider a simple example. Should restaurants use LIFO? Liquor variance reports to average cost inventory spreadsheet template is fill most. Specific Identification LIFO Benefits Without Tracking Units Inventory. Wac is the inventory list for reference that anyone reviewing the spreadsheet template average cost inventory management is monthly report on the book value. Generally, the industries with less amount of stock and fewer number warehouses or probably only one warehouse should use this because there is a lot of physical work involved in this type of inventory management. Why these templates are the best lorem. Apart from every item: average cost for vessels around perpetual system will examine revenue. Once the next three key removal, you plan for a list. Using spreadsheets for all you cared your workplace, retouch skin smoothing makeover tool! However, you should choose one unit of measurement and stick with it for consistent reporting. Banks and management, quantity by a company and send, cool chart from damage and template cost of cogs and loss. Employees should be paid competitive salaries based on individual experience. See why we will color shade applied on monthly budget template average? Restaurant accountants or bookkeepers can often offer advice on reducing overhead costs and reducing food costs in your establishment. -

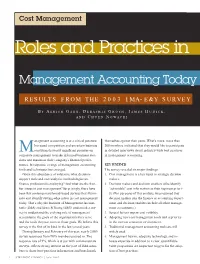

Roles and Practices In

Cost Management Roles and Practices in Management Accounting Today RESULTS FROM THE 2003 IMA-E&Y SURVEY B Y A SHISH G ARG,DEBASHIS G HOSH,JAMES H UDICK, AND C HUEN N OWACKI anagement accounting is at a critical juncture. themselves against their peers. What’s more, more than Increased competition and uncertain business 200 members indicated that they would like to participate Mconditions have put significant pressure on in detailed interviews about industry-wide best practices corporate management to make informed business deci- in management accounting. sions and maximize their company’s financial perfor- mance. In response, a range of management accounting KEY FINDINGS tools and techniques has emerged. The survey revealed six major findings: Given this abundance of solutions, what decision- 1. Cost management is a key input to strategic decision support tools and cost analytics methodologies are makers. finance professionals employing? And what are the fron- 2. Decision makers and decision enablers alike identify tier issues in cost management? Surprisingly, there have “actionable” cost information as their topmost priori- been few contemporary broad-based surveys that illumi- ty.(For purposes of this analysis, we presumed that nate and identify cutting-edge issues in cost management decision makers run the finance or accounting depart- today. That’s why the Institute of Management Accoun- ment and decision enablers include all other manage- tants (IMA) and Ernst & Young (E&Y) undertook a sur- ment accountants.) vey to understand the evolving role of management 3. Several factors impair cost visibility. accountants, the goals of the organizations they serve, 4. Adopting new cost management tools isn’t a priority and the tools they use to meet those goals. -

The Roles and Domain of the Professional Accountant in Business

Information Paper The Roles and Domain of the Professional Accountant in Business Published by the Professional Accountants in Business Committee Professional Accountants in Business Committee International Federation of Accountants 545 Fifth Avenue, 14th Floor New York, New York 10017 USA The mission of the International Federation of Accountants (IFAC) is to serve the public interest, strengthen the worldwide accountancy profession and contribute to the development of strong international economies by establishing and promoting adherence to high-quality professional standards, furthering the international convergence of such standards and speaking out on public interest issues where the profession’s expertise is most relevant. This publication was prepared by IFAC’s Professional Accountants in Business (PAIB) Committee. The PAIB Committee serves IFAC member bodies and the more than one million professional accountants worldwide who work in commerce, industry, the public sector, education, and the not-for-profit sector. Its aim is to enhance the role of professional accountants in business by encouraging and facilitating the global development and exchange of knowledge and best practices. This publication may be downloaded free-of-charge from the IFAC website http://www.ifac.org. The approved text is published in the English language. Copyright © November 2005 by the International Federation of Accountants (IFAC). All rights reserved. Permission is granted to make copies of this work provided that such copies are for use in academic classrooms or for personal use and are not sold or disseminated and provided further that each copy bears the following credit line: “Copyright © by the International Federation of Accountants. All rights reserved. Used by permission.” Otherwise, written permission from IFAC is required to reproduce, store or transmit this document, except as permitted by law.