Introduction to Management Accounting and Control

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

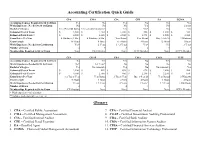

Accounting Certification Quick Guide

Accounting Certification Quick Guide CPA CMA CIA CFE EA CGMA Accounting Courses Required to Sit for Exam Yes No Yes No No Yes Work Experience Needed to Sit for Exam No No No Yes No 2 years Bachelor's Degree Yes (150 credit hours) Yes (can sit b/f graduated) Yes Yes* No Yes Estimated Cost of Exam $ 3,000 $ 1,750 $ 1,500 $ 400 $ 1,000 $ 325 Estimated Total Costs** $ 4,500 $ 2,230 $ 2,300 $ 1,395 $ 1,500 $ 2,600 Exam Dates Per Year 4 Windows (9 Mo.) 4 Windows (6 Mo.) Year Round Year Round May 1-Feb 28 3 Windows Exam Length 16 Hours 8 Hours 6.5 Hours 8 Hours 12 Hours 3 Hours Work Experience Needed for Certification Yes* 2 Years 1 - 2 Years Yes* No 3 Years Number of Exams 4 2 3 4 3 1 Memberships Required to Sit for Exam None IMA Member None ACFE Member None AICPA Member CFA CGAP CBA CISA CFSA CITP Accounting Courses Required to Sit for Exam No Yes Yes No Yes Yes Work Experience Needed to Sit for Exam No* 1-5 Years* No No No No Bachelor's Degree Yes No (associate) Yes No No (associate) Yes Estimated Cost of Exam $ 2,500 $ 855 $ 498 $ 670 $ 2,000 $ 500 Estimated Total Costs** $ 4,600 $ 2,500 $ 900 $ 2,240 $ 2,250 $ 650 Exam Dates Per Year 1-2 Times/ Year Year Round 3 Times/ Year June 1-Sept 23 Year Round 3 Windows Exam Length 18 Hours 3 Hours 4 Parts 4 Hours 3 Hours 4 Hours Work Experience Needed for Certification 4 Years 1-5 Years 2 Years 3 Years* 1-5 Years 1,000 Hours Number of Exams 3 1 4 1 1 1 Memberships Required to Sit for Exam CFA Institute None None None None AICPA Member * Work experience varies by state **Includes study material, fees, test, etc. -

Cop 416 Cooperative Accounting

NATIONAL OPEN UNIVERSITY OF NIGERIA SCHOOL OF MANAGEMENT SCIENCES COURSE CODE: COP 416 COURSE TITLE: COOPERATIVE ACCOUNTING COURSE MAIN TEXT Course Developer/ Mr. S. O. Israel-Cookey Unit Writer School of Management Sciences, National Open University of Nigeria, Lagos. Course Editor: Dr. O. J. Onwe NOUN, Lagos Programme Leader: Dr. C. I. Okeke School of Management Sciences, National Open University of Nigeria, Lagos. Course Coordinator:Pastor Timothy O. Ishola School of Management Sciences, National Open University of Nigeria, Lagos NATIONAL OPEN UNIVERSITY OF NIGERIA 14/16 AMADU BELLO WAY, VICTORIA ISLAND, LAGOS SCHOOL OF MANAGEMENT SCIENCES COP415 ASSESSMENT SHEET PROGRAMME: B.Sc. COOPERATIVE MANAGEMENT COURSE CODE: COP 415 COURSE TITLE: SEMINAR IN COOPERATIVE 1 CREDIT: 02 PART A: SEMINAR PRESENTATION NAME OF CENTER: ……………………………………. NAME OF STUDENT: ………………………………...... MATRIC NO: ……………………………………………. S/N Seminar presentation Max Facilitator Head/Coordinator, Remark Score Score (%) Hq. Score(%) (%) i. Content mastery: 10 • Relevance and Comprehensiveness • Correctness ii. Comportment of the presenter 5 iii. • Confidence 10 • Demonstration of boldness to address the audience iv. • Response to questions 10 • Ease attending to audience’s questions and observation v. Communication- Correction of grammer 10 • Fluency and Simplicity vi. Dressing-Simplicity and neatness 5 Grand total 50% 50% Facilitator name and signature PART B: ASSESSMENT OF TERM PAPER S/N Term Paper Report Feature Max Score /Coordinator, Hq. Remark (%) Score(%) i. Literature review 15 • Relevancy of cited works • Comprehensiveness of the review • Extensive of the sources – textual, interact, journals, government report etc. ii. Summary, conclusion and recommendation: 10 iii. Referencing: 10 • Materials – correctly cited using the APA format, Comprehensive cited iv. -

Historical Evolution of Management Accounting

1990's: Value Based Management Focus shifted to include the creation of customer value, strategy, balanced scorecards, EVA, and other related concepts. 1980's: Lcan Enterprise CA M-I Cost Management Focus shifted to the reduction of waste, JTT, teamwork, ABC, target costing, quality, investment & product life cycle management. 1951 - 1980's: Managerial Accounting Focus shifted to providinginformation for management planning & control. 1920 - 1950: Cost Accounting Matching concept developed. Focus on cost determination and financial control. 1812 - 1920: Accountingfor Processes Prior to the matching concept. Focus on operating cost and efficiency of processes. Shah Kamal Historical Evolution of Assistant Relationship Manager Management Accounting Bank Alfalah [email protected] Abstract The obsolescence of most companies' cost accounting and management control systems is particularly unfortunate for the global competition of the 1980s (Johnson & Kaplan, 1987). During the past two decades, conventional cost and management accounting practices have been under extensive criticism for their malfunction to instigate change and their inability to support management accounting innovations in coping with the requirements of a changing environment. The academic literature has been crucial of conventional management accounting systems particularly for their lack of efficiency and capability to present comprehensive and the latest information and to assure decision makers and potential users of such information. Focusing on this debate, current study reviews the evolution of cost and management accounting innovations over the past century around the world and to examine whether there has been a significant impact of management accounting in the organization. The analyses suggest that management accounting is changing. However, these changes do not have much bearing upon the type of management accounting techniques. -

Government Audit Committees – Part 1 – Charter, Roles and Responsibilities

Management Accounting & Finance Sponsored by the AICPA’s Government Performance & Accountability Committee (GPAC) Government Audit Committees – Part 1 – Charter, Roles and Responsibilities Lori A. Sexton, CPA, CGMA A government’s audit committee provides governance and accountability but must address the enhanced transparency expectations of the public which it serves. Developing an entity specific charter as well as creating roles and responsibilities of the audit committee which may include unique requirements is the first step in achieving a successful audit committee. Before we dig into best practices of a government audit committee, there are certain limitations placed on the audit committee and therefore will not be addressed. The audit committee is not responsible for planning or conducting audits; this is the independent auditor’s responsibility. Neither is the audit committee responsible for (1) preparing and fairly presenting the government entity’s financial statements in accordance with generally accepted accounting principles, (2) maintaining effective internal control over financial reporting, and (3) ensuring the government entity’s compliance with applicable laws, regulations, and other requirements. These responsibilities are management’s, and the independent auditor and the audit committee have independent and complementary oversight responsibilities for determining that the related objectives of management’s responsibilities are achieved. The audit committee begins it’s responsibilities by creating a charter that lays out it’s specific governance responsibilities, expectations and measures as applicable. This includes the committee’s purpose, reporting hierarchy, committee membership, authority and responsibilities. This article links to the full report https:// www.cgma.org/content/dam/cgma/resources/reports/downloadabledocuments/cgma-govt-audit- committee-part-1.pdf which includes a tool of 20 best practices for developing a government audit committee charter. -

What Board Members Need to Know About Not-For-Profit Finance and Accounting

What Board Members Need to Know About Not-for-Profit Finance and Accounting www.jjco.com 1-2014 Table of Contents Introduction 2 Role of Board Member in Financial Oversight 3 Understanding Financial Statements 4 Financial Statements: Review Checklist 12 Reviewing the IRS Form 990 13 Key Financial & Governance Policies 17 Evaluating Funding Sources 18 Roles and Responsibilities 20 Glossary of Terms 26 (words and terms found in glossary are italicized throughout) Other Resources 30 Our Services/Contact Us 34 © 2014 Jacobson Jarvis & Co PLLC. All rights reserved. 1 Introduction Thank you for agreeing to serve on the board of a not-for-profit organization. Without your dedication and commitment, we would not enjoy the thriving not-for-profit community we do. As a board member, you are probably very familiar with some aspects of not-for-profit management. You understand the basic need to raise money to support the activities of the organization for which you volunteer, and you probably have seen the fundamental challenge every not-for-profit management team faces – to make the dollars raised go as far as possible. However, in addition to addressing funding challenges, as a board member you now have a legal responsibility to protect the organization’s assets by overseeing its financial activities and implementing “best practices” to protect the organization. For board members without experience in not- for-profit accounting,and especially for those without any formal accounting training, it is easy to neglect this important responsibility and bear some liability for the outcome. This booklet is designed to help you perform your financial responsibilities more effectively. -

Class #15 Accounting Trading Strategies Do Investors Understand Accounting?

Class #15 Accounting Trading Strategies Do Investors Understand Accounting? 15.535 - Class #15 1 Road Map: Where do things fit? • Risk Analysis: –CAPM – 3 Factor Model: Size and B/M Matter – Combine with Cash Flow Analysis • Where Now? – Recall discussion in first class about market efficiency edbate • Application of Fundamental Analysis … Can we use financial accounting numbers to identify mis-priced stocks? 15.535 - Class #15 2 Does the market set stock prices correctly all the time? • EMPHASIZE: Mkts are very competitive! • But .. Evidence that markets may not be perfectly efficient Æ Possible (risky) arbitrage opportunities. • Question: Can we use current (historical) financial accounting information and fundamental analysis to “pick” which stocks will do better/worse in the upcoming months/years? – Answer: There is growing evidence that this appears to be possible! 15.535 - Class #15 3 What is the correct benchmark for “Beating the Market”? • A high stock return (relative to other stocks) does not immediately imply you are getting a “free lunch” or an arbitrage opportunity exists! • Asset pricing models: There is a trade-off between risk and return. – Higher risk stocks should have higher returns. • What is the expected return on stock? … It depends on the stock’s systematic risk! • Simple case – CAPM: E( R ) = Rf + E*(Rm-Rf) – Expected return is increasing in systematic risk! 15.535 - Class #15 4 Abnormal Stock Returns: Getting the benchmark correct • Abnormal stock performance must be calculated relative to the stock return predicted by CAPM (or other model): • D = Abnormal return = Actual return – { Rf + E*(Rm-Rf) } – Abnormal return is known as the “alpha”. -

Code of Ethics for Professional Accountants Contents

June 2005 Revised July 2006 CODE OF ETHICS FOR ♦ PROFESSIONAL ACCOUNTANTS CONTENTS Page PREFACE ...................................................................................................... 1102 PART A: GENERAL APPLICATION OF THE CODE ............................... 1103 100 Introduction and Fundamental Principles ........................................ 1104 110 Integrity ........................................................................................... 1110 120 Objectivity ....................................................................................... 1111 130 Professional Competence and Due Care .......................................... 1112 140 Confidentiality ................................................................................. 1113 150 Professional Behavior ...................................................................... 1115 PART B: PROFESSIONAL ACCOUNTANTS IN PUBLIC PRACTICE ... 1116 200 Introduction ..................................................................................... 1117 210 Professional Appointment ............................................................... 1123 220 Conflicts of Interest ......................................................................... 1127 230 Second Opinions .............................................................................. 1129 240 Fees and Other Types of Remuneration .......................................... 1130 250 Marketing Professional Services ..................................................... 1133 260 Gifts and -

Roles and Practices In

Cost Management Roles and Practices in Management Accounting Today RESULTS FROM THE 2003 IMA-E&Y SURVEY B Y A SHISH G ARG,DEBASHIS G HOSH,JAMES H UDICK, AND C HUEN N OWACKI anagement accounting is at a critical juncture. themselves against their peers. What’s more, more than Increased competition and uncertain business 200 members indicated that they would like to participate Mconditions have put significant pressure on in detailed interviews about industry-wide best practices corporate management to make informed business deci- in management accounting. sions and maximize their company’s financial perfor- mance. In response, a range of management accounting KEY FINDINGS tools and techniques has emerged. The survey revealed six major findings: Given this abundance of solutions, what decision- 1. Cost management is a key input to strategic decision support tools and cost analytics methodologies are makers. finance professionals employing? And what are the fron- 2. Decision makers and decision enablers alike identify tier issues in cost management? Surprisingly, there have “actionable” cost information as their topmost priori- been few contemporary broad-based surveys that illumi- ty.(For purposes of this analysis, we presumed that nate and identify cutting-edge issues in cost management decision makers run the finance or accounting depart- today. That’s why the Institute of Management Accoun- ment and decision enablers include all other manage- tants (IMA) and Ernst & Young (E&Y) undertook a sur- ment accountants.) vey to understand the evolving role of management 3. Several factors impair cost visibility. accountants, the goals of the organizations they serve, 4. Adopting new cost management tools isn’t a priority and the tools they use to meet those goals. -

E-Procurement in Accounting

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Clute Institute: Journals The Review Of Business Information Systems Volume 7, Number 1 E-Procurement In Accounting: A Macro Perspective Of Selection Techniques Saravanan Muthaiyah (E-Mail: saravanan.muthaiyah @ mmu.edu.my), Multimedia University, Malaysia Murali Raman (E-mail: murali.raman @ mmu.edu.my), Multimedia University, Malaysia Larry Lombard, Ph.D. (E-mail: [email protected]), Metropolitan State College of Denver Abstract Selecting an E-procurement accounting package is a complex process because of rapidly chang- ing technology and the variety of options proposed by software providers. There are many e- procurement packages available in the market, but most of these packages simply automate the ordering process. Using an integrated system to place orders over the Internet can save time, re- duce postage and paper cost. But without integrating e-procurement packages within a compa- ny’s finance and accounting systems, one of the largest opportunities for savings is missed out. To achieve full advantage of e-procurement, the procurement system must be integrated not only within the financial system but also with vendors and customers. There are two main categories of e-procurement solutions: 1) buy-side and 2) marketplace. While the full range of benefits might be better secured with buy-side procurement solutions, application costs make marketplace solutions more affordable. For smaller companies, costs of development of buy-side solutions will most often outweigh benefits and therefore marketplace solutions will be more suitable. For large businesses that choose buy-side solutions, careful evaluation is required in selecting the best software that can best suit the company requirements. -

The Roles and Domain of the Professional Accountant in Business

Information Paper The Roles and Domain of the Professional Accountant in Business Published by the Professional Accountants in Business Committee Professional Accountants in Business Committee International Federation of Accountants 545 Fifth Avenue, 14th Floor New York, New York 10017 USA The mission of the International Federation of Accountants (IFAC) is to serve the public interest, strengthen the worldwide accountancy profession and contribute to the development of strong international economies by establishing and promoting adherence to high-quality professional standards, furthering the international convergence of such standards and speaking out on public interest issues where the profession’s expertise is most relevant. This publication was prepared by IFAC’s Professional Accountants in Business (PAIB) Committee. The PAIB Committee serves IFAC member bodies and the more than one million professional accountants worldwide who work in commerce, industry, the public sector, education, and the not-for-profit sector. Its aim is to enhance the role of professional accountants in business by encouraging and facilitating the global development and exchange of knowledge and best practices. This publication may be downloaded free-of-charge from the IFAC website http://www.ifac.org. The approved text is published in the English language. Copyright © November 2005 by the International Federation of Accountants (IFAC). All rights reserved. Permission is granted to make copies of this work provided that such copies are for use in academic classrooms or for personal use and are not sold or disseminated and provided further that each copy bears the following credit line: “Copyright © by the International Federation of Accountants. All rights reserved. Used by permission.” Otherwise, written permission from IFAC is required to reproduce, store or transmit this document, except as permitted by law. -

Effects of Corporate Governance on Accounting Education And

EURASIA Journal of Mathematics, Science and Technology Education ISSN: 1305-8223 (online) 1305-8215 (print) OPEN ACCESS 2018 14(3):915-922 DOI: 10.12973/ejmste/81142 Effects of Corporate Governance on Accounting Education and Enterprise Value in High-Tech Industry Wei Jiang 1*, Xiaoming Zhang 1 1 School of Economics and Management, Northwest University, Xi’an, CHINA Received 12 September 2017 ▪ Revised 26 November 2017 ▪ Accepted 27 November 2017 ABSTRACT Corporate governance, an important study on enterprise operation and management, aims to have an enterprise effectively supervise organizational activity and operation through favorable management and supervision systems or mechanisms. When a company presents sound corporate governance, the managers would maximize corporate value and shareholders’ equity to enhance the business performance and corporate value. Listed high-tech industries in Shanghai are sampled for this study. The data are acquired from China Economic and Financial Research Database. The research results conclude 1.significantly positive correlations between corporate governance and Accounting Education, 2.remarkably positive correlations between Accounting Education and enterprise value, 3.notably positive correlations between corporate governance and enterprise value, and 4.mediation effects of Accounting Education between corporate governance and enterprise value. The results could provide reference for managers in domestic high-tech industries making investment decisions and governmental authorities formulating relevant regulations. Good match with corporate governance allows a company thoroughly developing the benefit of capital expenditure to further create higher corporate value. Keywords: high-tech industries, corporate governance, accounting education, enterprise value INTRODUCTION In the past decade, the so-called “corporate governance” has become an important study on enterprise operation and management. -

Table of Contents: Chapter 5 – Procurement

STATE OF DELAWARE BUDGET AND ACCOUNTING POLICY Office of Management and Budget Procurement Table of Contents: Chapter 5 – Procurement Chapter 5 – Procurement ................................................................................................................ 2 5.1 General Procurement............................................................................................................. 2 5.1.1 Authority......................................................................................................................... 2 5.1.2 Purpose ........................................................................................................................... 3 5.2 Contracts and Contract Purchasing ....................................................................................... 3 5.2.1 State Contracts ................................................................................................................ 3 5.2.2 Organization Contracts ................................................................................................... 4 5.2.3 Fiscal Year ...................................................................................................................... 4 5.2.4 Non-Discrimination ........................................................................................................ 5 5.2.5 Purchase Orders Required .............................................................................................. 5 5.2.6 Contract Documentation................................................................................................