Accounting Principles and Standards Handbook

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tax Accounting Perspectives ASC 740 Considerations As Income Tax Returns Are Finalized September 28, 2018

Tax Accounting Perspectives ASC 740 considerations as income tax returns are finalized September 28, 2018 Tax provision processes include analyzing the impact of changes for “return-to-provision” items that result when estimates used for the provision are different than amounts reported on income tax returns. Companies should record the tax accounting impact in the period they identify the adjustments and may need to differentiate these from SAB 118 adjustments. What's new? Potential tax expense (or benefit) for adjustments related to temporary What's new differences Potential tax expense (or benefit) The tax accounting impact of return-to-provision (“RTP”) adjustments (also for adjustments related to known as return-to-accrual adjustments or true-ups) should be recorded in the temporary differences period identified. Adjustments may be identified or finalized in the period income tax returns are filed assuming they are not known in an earlier reporting period. For calendar-year companies, returns are due in the fourth quarter and companies finalize RTP adjustments at that time. This timeframe coincides with Highlights the end of the up to one-year measurement period provided by SAB 118 that Analyzing return-to-provision requires final adjustments be recorded for the impact of tax reform. Therefore, adjustments many companies are evaluating both RTP and measurement period adjustments at the same time. After tax reform, adjustments for temporary differences that historically may not have impacted a company’s overall tax expense may now impact a company’s overall tax expense or benefit. For example, a calendar- What does this mean for you year corporation may have a RTP adjustment that increases or decreases Documenting change in estimate current taxes at a 35% rate with the offset to deferred taxes at a 21% rate, ‒ which would impact the overall tax expense. -

Account Guidelines for Managers and Delegates

ACCOUNT/BUDGET GENERAL OPERATING PRINCIPLES for IU SOUTHEAST ACCOUNT MANAGERS / ACCOUNT DELEGATES The Fiscal Year runs from July 1 – June 30. Operating budgets are distributed in June/July. Accounts may not exceed their budgeted amounts within the fiscal year. Account managers will be required to develop a plan to bring the account in balance before the closing of the fiscal year or to carry forward the over- expenditures to the next fiscal year. Allocated funds do not carry forward to the next fiscal year. Unused funds are forfeited. Allocated funds should be spent to or close to zero. Every department has an organization code (contact Melissa Hill in Accounting Services, #2359). Examples: Student Affairs (SSER), Athletics (ATHL). A budget binder or file should be established for each account. All budget documents should be kept for the current fiscal year within the budget binder or file. Receipts/documentation must be kept for all expenditures. All budget documentation must be kept on file for seven years. Use of funds must conform to IU Financial Policies found on web site: http://www.indiana.edu/%7Epolicies/ The Financial Information System (FIS) is used for account transactions and account monitoring. Passwords and access are needed (contact IT or Accounting Services). If FIS training is needed, contact Melissa Hill in Accounting Services (#2359). Monthly operating statements should be printed from FIS (available first of month—notification comes by email) and account transactions should be reconciled by the account manager or delegate on a monthly basis at minimum. Each expenditure must be accounted for with receipts or other appropriate documentation. -

Cost of Goods Sold

Cost of Goods Sold Inventory •Items purchased for the purpose of being sold to customers. The cost of the items purchased but not yet sold is reported in the resale inventory account or central storeroom inventory account. Inventory is reported as a current asset on the balance sheet. Inventory is a significant asset that needs to be monitored closely. Too much inventory can result in cash flow problems, additional expenses and losses if the items become obsolete. Too little inventory can result in lost sales and lost customers. Inventory is reported on the balance sheet at the amount paid to obtain (purchase) the items, not at its selling price. Cost of Goods Sold • Inventory management Involves regulation of the size of the investment in goods on hand, the types of goods carried in stock, and turnover rates. The investment in inventory should be kept at a minimum consistent with maintenance of adequate stocks of proper quality to meet sales demand. Increases or decreases in the inventory investment must be tested against the effect on profits and working capital. Standard levels of inventory should be established as adequate for a given volume of business, and stock control procedures applied so as to limit purchase as required. Such controls should not preclude volume purchase of nonperishable items when price advantages may be obtained under unusual circumstances. The rate of inventory turnover is a valuable test of merchandising efficiency and should be computed monthly Cost of Goods Sold • Inventory management All inventories are valued at cost which is defined as invoice price plus freight charges less discounts. -

Financial Forecasts and Projections 1473

Financial Forecasts and Projections 1473 AT Section 301 Financial Forecasts and Projections Source: SSAE No. 10; SSAE No. 11; SSAE No. 17. Effective when the date of the practitioner’s report is on or after June 1, 2001, unless otherwise indicated. Introduction .01 This section sets forth standards and provides guidance to practition- ers who are engaged to issue or do issue examination (paragraphs .29–.50), compilation (paragraphs .12–.28), or agreed-upon procedures reports (para- graphs .51–.56) on prospective financial statements. .02 Whenever a practitioner (a) submits, to his or her client or others, prospective financial statements that he or she has assembled, or assisted inas- sembling, that are or reasonably might be expected to be used by another (third) party1 or (b) reports on prospective financial statements that are, or reasonably might be expected to be used by another (third) party, the practitioner should perform one of the engagements described in the preceding paragraph. In de- ciding whether the prospective financial statements are or reasonably might be expected to be used by a third party, the practitioner may rely on either the written or oral representation of the responsible party, unless information comes to his or her attention that contradicts the responsible party's represen- tation. If such third-party use of the prospective financial statements is not reasonably expected, the provisions of this section are not applicable unless the practitioner has been engaged to examine, compile, or apply agreed-upon procedures to the prospective financial statements. .03 This section also provides standards for a practitioner who is engaged to examine, compile, or apply agreed-upon procedures to partial presentations. -

Cash Flow Statement

LESSON 7 Cash Flow Statement 1 Financial Accounting 08/09 2ºDE – LESSON 7 © Mª Cristina Abad Navarro, 2009 Outline 7.1. Introduction: definition and purpose. 7.2. Format of the Cash Flow Statement. 7.3. Definition of cash and cash equivalents. 7.4. Cash flows from operating activities. 7.5. Cash flows from investing activities. 7.6. Cash flows from financing activities 2 Financial Accounting 08/09 2ºDE – LESSON 7 © Mª Cristina Abad Navarro, 2009 1 The annual accounts Balance Sheet Income Statement Statement of Changes in Equity Cash Flow Statement Notes to the Financial Statements 3 Financial Accounting 08/09 2ºDE – LESSON 7 © Mª Cristina Abad Navarro, 2009 Statements of financial flows Includes information about: • Financial resources (cash flows) obtained by the firm during the period • Applications of those financial resources (cash flows) Business Operating Purchase of activity activity assets Shareholders’ Distribution of contributions Dividends New debt Payment of debt . Sale of assets . 4 Financial Accounting 08/09 2ºDE – LESSON 7 © Mª Cristina Abad Navarro, 2009 2 Cash Flow Statement The Cash Flow Statement shows: • cash receipts, and • cash payments during the year. These cash receipts and payments explain the changes in the cash account (*) of the Balance Sheet during the year. (*) Cash will include cash and cash equivalents 5 Financial Accounting 08/09 2ºDE – LESSON 7 © Mª Cristina Abad Navarro, 2009 Cash Flow Statement Regulation INTERNATIONAL IAS 7 SPANISH P.G.C. 2007 Is voluntary for: • Companies that can publish abbreviated -

Bank & Financial Institution Modeling

The Provision for Credit Losses & the Allowance for Loan Losses How Much Do You Expect to Lose? This Lesson: VERY Specific to Banks This is about a key accounting topic for banks and financial institutions. It’s only important in that industry. So if you are not interested in banks, you don’t have to watch this (unless you really want to…). Lesson Outline: • Part 1: Allowance for Loan Losses vs. Regulatory Capital • Part 2: Loan Loss Accounting on the Financial Statements • Part 3: Example Scenarios to Illustrate the Mechanics • Part 4: How Regulatory Capital and the Allowance for LLs are Linked Business Model of Commercial Banks • Banks: Collect money from customers (deposits), and then lend it to people who need money (loans) • They expect to lose something on these loans because people and companies default and are unable to pay back their loans • But there are two categories: expected losses and unexpected losses (e.g., a random disaster happens and everyone in a certain region of the country loses everything) • This Tutorial: All about expected losses and how unexpected losses eventually turn into expected losses Expectations Matter! • Poker Scenario: If you bet a lot with no real hand, you should expect to lose everything… and plan accordingly! • But: What happens if you have a Straight Flush and you then do the same thing? Now you expect to win… or at least not lose much • But Then: You keep playing, and it turns out someone else has a Royal Flush – you lose everything you bet! Oops. • First Scenario: Allowance for Loan Losses – Expected Losses • Second Scenario: Regulatory Capital – Unexpected Losses Allowance for Loan Losses on the Statements • Balance Sheet: The Allowance is a contra-asset that’s netted against Gross Loans to calculate Net Loans . -

Total Cost and Profit

4/22/2016 Total Cost and Profit Gina Rablau Gina Rablau - Total Cost and Profit A Mini Project for Module 1 Project Description This project demonstrates the following concepts in integral calculus: Indefinite integrals. Project Description Use integration to find total cost functions from information involving marginal cost (that is, the rate of change of cost) for a commodity. Use integration to derive profit functions from the marginal revenue functions. Optimize profit, given information regarding marginal cost and marginal revenue functions. The marginal cost for a commodity is MC = C′(x), where C(x) is the total cost function. Thus if we have the marginal cost function, we can integrate to find the total cost. That is, C(x) = Ȅ ͇̽ ͬ͘ . The marginal revenue for a commodity is MR = R′(x), where R(x) is the total revenue function. If, for example, the marginal cost is MC = 1.01(x + 190) 0.01 and MR = ( /1 2x +1)+ 2 , where x is the number of thousands of units and both revenue and cost are in thousands of dollars. Suppose further that fixed costs are $100,236 and that production is limited to at most 180 thousand units. C(x) = ∫ MC dx = ∫1.01(x + 190) 0.01 dx = (x + 190 ) 01.1 + K 1 Gina Rablau Now, we know that the total revenue is 0 if no items are produced, but the total cost may not be 0 if nothing is produced. The fixed costs accrue whether goods are produced or not. Thus the value for the constant of integration depends on the fixed costs FC of production. -

REPORTING and ANALYZING INVENTORY LO 1: Discuss How to Classify and Determine Inventory

ACC101 Chapter 6 11th Ed REPORTING AND ANALYZING INVENTORY LO 1: Discuss how to classify and determine inventory. • Inventory: “Assets a company intends to sell in the normal course of business, has in production for future sale, or uses currently in the production of goods to be sold.” 1. Inventory--ON BALANCE SHEET: “represents the cost of inventory STILL ON HAND.” 2. Cost of Goods Sold---ON INCOME STATEMENT: “represents the cost of inventory SOLD DURING THE PERIOD.” • Merchandising companies have ONE type of inventory: Merchandise Inventory • Manufacturing companies have THREE types of inventory: 1. Raw Materials 2. Work in Process 3. Finished Goods DETERMINING INVENTORY QUANTITIES • Physical inventory is taken for 2 reasons: o Perpetual System 1. Check accuracy of inventory records. 2. Determine amount of inventory lost due to wasted raw materials, shoplifting, or employee theft. o Periodic System 1. Determine the inventory on hand. 2. Determine the cost of goods sold for the period. • One challenge in determining inventory quantities is making sure a company owns the inventory. o Goods in transit: purchased goods not yet received and sold goods not yet delivered. • FOB (Free on Board) Shipping Point: Ownership of the goods passes to the buyer when the public carrier accepts the goods from the seller. • If goods are in transit they are the BUYERS. • FOB (Free on Board) Destination: Ownership of the goods remains with the seller until the goods reach the buyer. • If goods are in transit they are the SELLERS. 1 ACC101 Chapter 6 11th Ed o Consigned Goods: Goods held for other parties to see if they can sell the goods for the other party. -

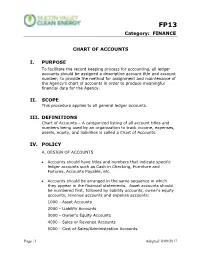

G&A101 Chart of Accounts

FP13 Category: FINANCE CHART OF ACCOUNTS I. PURPOSE To facilitate the record keeping process for accounting, all ledger accounts should be assigned a descriptive account title and account number; to provide the method for assignment and maintenance of the Agency’s chart of accounts in order to produce meaningful financial data for the Agency. II. SCOPE This procedure applies to all general ledger accounts. III. DEFINITIONS Chart of Accounts – A categorized listing of all account titles and numbers being used by an organization to track income, expenses, assets, equity, and liabilities is called a Chart of Accounts. IV. POLICY A. DESIGN OF ACCOUNTS • Accounts should have titles and numbers that indicate specific ledger accounts such as Cash in Checking, Furniture and Fixtures, Accounts Payable, etc. • Accounts should be arranged in the same sequence in which they appear in the financial statements. Asset accounts should be numbered first, followed by liability accounts, owner’s equity accounts, revenue accounts and expense accounts: 1000 - Asset Accounts 2000 - Liability Accounts 3000 - Owner’s Equity Accounts 4000 - Sales or Revenue Accounts 5000 - Cost of Sales/Administration Accounts Page | 1 Adopted: 8/09/2017 FP13 Category: FINANCE 6000 - Debt Service Accounts 8000 - Other Accounts B. DESCRIPTION OF ACCOUNTS • Each account should be given a short title description that is brief but will allow the reader to quickly ascertain the purpose of the account. • For training and consistent transaction coding, as well as to help other non-accounting managers understand why something is recorded as it is, each account should be defined. Definitions should be concise and meaningful. -

Economic Brief March 2012, EB12-03

Economic Brief March 2012, EB12-03 Loan Loss Reserve Accounting and Bank Behavior By Eliana Balla, Morgan J. Rose, and Jessie Romero The rules governing banks’ loan loss provisioning and reserves require a trade-off between the goals of bank regulators, who emphasize safety and soundness, and the goals of accounting standard setters, who emphasize the transparency of fi nancial statements. A strengthening of accounting priorities in the decade prior to the fi nancial crisis was associated with a decrease in the level of loan loss reserves in the banking system. The recent fi nancial crisis has prompted an bank’s fi nancial statements: the balance sheet evaluation of many aspects of banks’ fi nancing (Figure 1) and the income statement (Figure 2).2 and accounting practices. One area of renewed Outstanding loans are recorded on the asset interest is the appropriate level of loan loss side of a bank’s balance sheet. The loan loss reserves, the money banks set aside to off set reserves account is a “contra-asset” account, future losses on outstanding loans.1 Deter- which reduces the loans by the amount the mining that level depends on balancing the bank’s managers expect to lose when some requirements of bank regulators, who empha- portion of the loans are not repaid. Periodically, size the importance of loan loss reserves to the bank’s managers decide how much to add protect the safety and soundness of the bank, to the loan loss reserves account, and charge and of accounting regulators, who emphasize this amount against the bank’s current earnings. -

Provisions Are Charged As an Expense to the Appropriate Service Line In

Provisions are charged as an expense to the appropriate service line in the Comprehensive Income and Expenditure Statement where an event has taken place that gives the Council a legal or constructive obligation that probably requires settlement by a transfer of economic benefits or service potential, and a reliable estimate can be made of the amount of the obligation. Provisions are charged as the best estimate at the balance sheet date of the expenditure required to settle the obligation, taking into account relevant risks and uncertainties. L. Termination Benefits Termination benefits are charged on an accruals basis to the appropriate service at the earlier of when the Council can no longer withdraw the offer of those benefits or when the Council recognises costs for a restructuring. M. Changes in Accounting Policies Prior period adjustments may arise as a result of a change in accounting policies or to correct a material error. Changes in accounting estimates are accounted for prospectively, i.e. in the current and future years affected by the change and do not give rise to a prior period adjustment. Changes in accounting policies are only made when required by proper accounting practices or the change provides more reliable or relevant information about the effect of transactions, other events and conditions on the Authority’s financial position or financial performance. Where a change is made, it is applied retrospectively (unless stated otherwise) by adjusting opening balances and comparative amounts for the prior period as if the new policy had always been applied. N. Cash and cash equivalents Cash is represented by cash in hand and deposits with financial institutions repayable without penalty on notice of not more than 24 hours. -

Business Accounting Catalog Information

DIABLO VALLEY COLLEGE CATALOG 2021-2022 any updates to this document can be found in the addendum at www.dvc.edu/communication/catalog Business accounting plus at least 3 units from: BUSINESS ACCOUNTING – BUSAC BUS-240 Business Statistics ............................................ 3 BUS-250 Business Communications ............................... 3 Charlie Shi, Dean BUS-295 Occupational Work Experience Education in BUS ...........................................2-4 Business, Computer Science, and Culinary Arts Division BUSAC-182 Computer Income Tax Return Preparation - Individuals .........................................................1.5 Possible career opportunities BUSAC-185 QuickBooks Accounting for Business I .............1.5 Study in accounting prepares students for careers in book- BUSAC-188 QuickBooks Accounting for Business II ............1.5 keeping, private and public accounting, auditing, tax prepa- BUSAC-190 Payroll Accounting .............................................1.5 ration and administration, cost and managerial accounting, financial services, payroll, software systems, corporate gov- plus at least 12 units from: ernance, and financial investigation. Some career options BUS-294 Business Law .................................................... 3 require more than two years of college study. BUSAC-282 Intermediate Accounting I ................................. 4 BUSAC-283 Auditing ............................................................. 3 BUSAC-284 Cost Accounting ...............................................