Financial Statements Bulletin

Total Page:16

File Type:pdf, Size:1020Kb

Load more

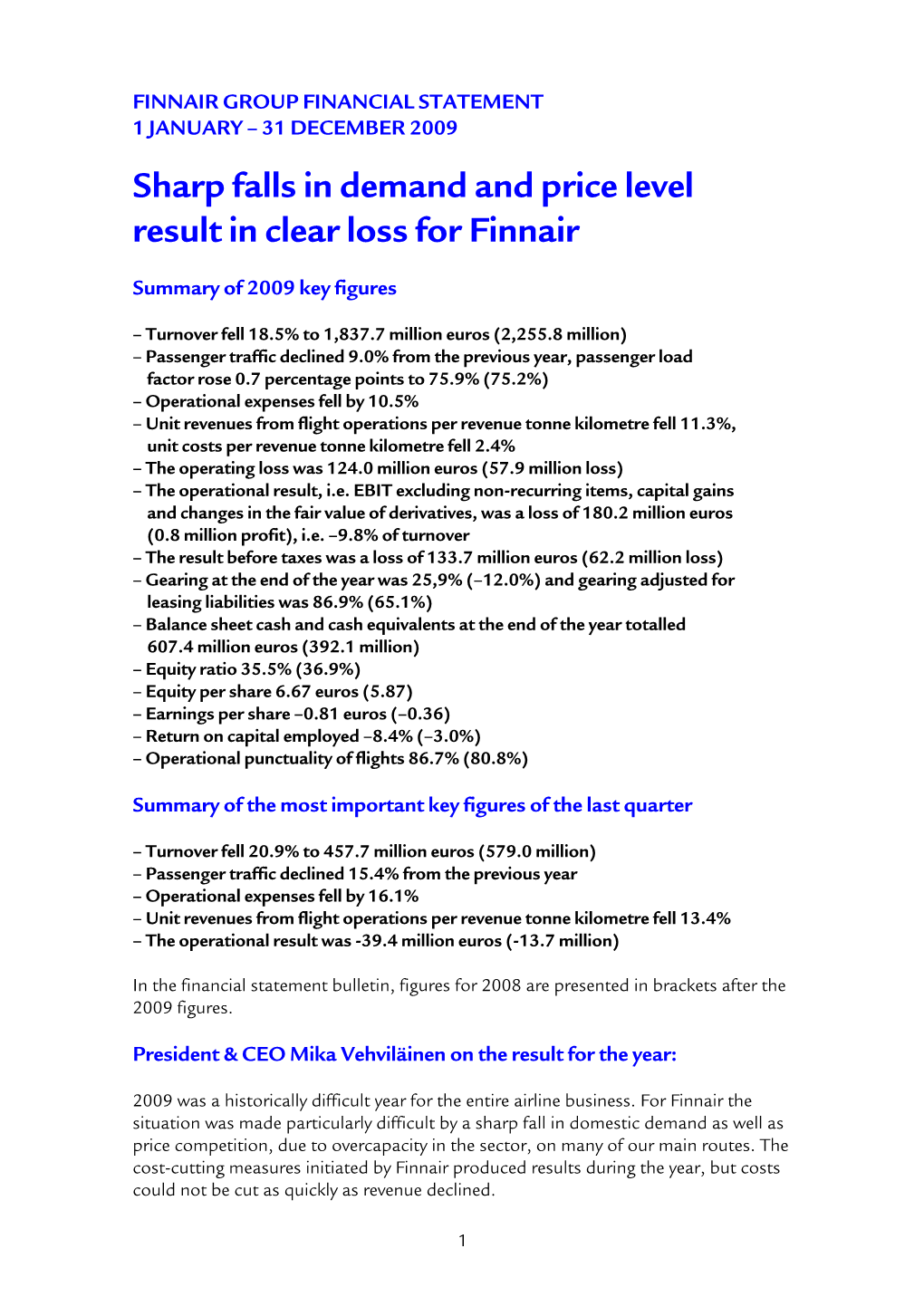

Recommended publications

-

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

Flygtrafiken Och Den Regionala Utvecklingen I Finland

Flygtrafiken och den regionala utvecklingen i Finland Christian Krohn 3 november 2015 Magisteravhandling Handledare: Staffan Ringbom Institutionen för Nationalekonomi Svenska handelshögskolan Helsingfors Sammanfattning Denna avhandling studerar flygtrafikens och den regionala utvecklingens sam- band i de Finländska regionerna. Enligt tidigare forskning kan flygtrafiken ha en positiv effekt på en regions ekonomiska utveckling men relationen är dock inte fullständigt allmängiltig. I denna avhandling skiljs inrikes- och internationell- passagerartrafik åt från den totala passagerartrafiken i de flesta regressionerna. Genom denna delning erhåller vi intressanta resultat vilka kan diskuteras med Finlands flygtrafikpolitik. I avhandlingen har även flygfrakt studerats som en för- klarande variabel på den regionala utvecklingen, detta har inte gjorts i tidigare studier i Finska flygtransporten. Empiriska delen baserar sig på paneldataana- lys där Finland har delats upp i mindre regioner, först i storområden och sedan mer finfördelat i landskap som har aktiv flygtrafik. Differentierade OLS model- ler används som bas i den empiriska delen och kompletteras med WLS-modeller. Resultaten av denna undersökning visar att inrikespassagerartrafik har en signifi- kant positiv elasticitet på ca. 0,1% mot sysselsättningen samt BNP:n. Resultaten i denna studie är en aning kontroversiella jämfört med resultaten från tidigare internationell forskning för flygfrakt. Enligt resultaten i föreliggande avhandling stimulerar flygfrakt inte ekonomiska utvecklingen i Finland, tvärtom kan flygfrakt ha en tom. negativ effekt på utvecklingen. Det negativa sambandet är motsatsen till vad ledande forskningen inom detta område har kommit fram till. Resultaten av empiriska delen kan ge dels vidare grund för användningen av allmän trafik- plikt (Public Service Obligation) och andra subventioner för inrikesflygtrafiken i Finland. Nyckelord: Finland, flygfrakt, flygtrafik, flygtransport, paneldata, region, tillväxt, ut- veckling Innehåll 1Inledning 1 1.1 Problemområde.............................. -

Investigation Report Airliner Fuel System Malfunction: Incident During

Investigation report C7/2010L Airliner fuel system malfunction: incident during an approach to Helsinki-Vantaa aerodrome on 5 July 2010 Translation of the original Finnish report OH-ATK (FCM256K) ATR 72-212A According to Annex 13 to the Convention on International Civil Aviation, paragraph 3.1, the purpose of aircraft accident and incident investigation is the prevention of accidents. It is not the purpose of the investigation report to apportion blame or to assign responsibility. This basic rule is also contained in the Investigation of Accidents Act, 3 May 1985 (373/85) and European Union Regulation No 996/2010. Use of the report for reasons other than improvement of safety should be avoided. Onnettomuustutkintakeskus Centralen för undersökning av olyckor Accident Investigation Board Osoite / Address: Sörnäisten rantatie 33 C Adress: Sörnäs strandväg 33 C FIN-00500 HELSINKI 00500 HELSINGFORS Puhelin / Telefon: (09) 1606 7643 Telephone: +358 9 1606 7643 Fax: (09) 1606 7811 Fax: +358 9 1606 7811 Sähköposti: [email protected] tai [email protected] E-post: [email protected] eller förnamn.slä[email protected] E-mail: [email protected] or first name.last [email protected] Internet: www.onnettomuustutkinta.fi Henkilöstö / Personal / Personnel: Johtaja / Direktör / Director Veli-Pekka Nurmi Hallintopäällikkö / Förvaltningsdirektör / Administrative Director Pirjo Valkama-Joutsen Osastosihteeri / Avdelningssekreterare / Assistant Sini Järvi Toimistosihteeri / Byråsekreterare / Assistant Leena Leskelä Ilmailuonnettomuudet / Flygolyckor -

Airliner Census Western-Built Jet and Turboprop Airliners

World airliner census Western-built jet and turboprop airliners AEROSPATIALE (NORD) 262 7 Lufthansa (600R) 2 Biman Bangladesh Airlines (300) 4 Tarom (300) 2 Africa 3 MNG Airlines (B4) 2 China Eastern Airlines (200) 3 Turkish Airlines (THY) (200) 1 Equatorial Int’l Airlines (A) 1 MNG Airlines (B4 Freighter) 5 Emirates (300) 1 Turkish Airlines (THY) (300) 5 Int’l Trans Air Business (A) 1 MNG Airlines (F4) 3 Emirates (300F) 3 Turkish Airlines (THY) (300F) 1 Trans Service Airlift (B) 1 Monarch Airlines (600R) 4 Iran Air (200) 6 Uzbekistan Airways (300) 3 North/South America 4 Olympic Airlines (600R) 1 Iran Air (300) 2 White (300) 1 Aerolineas Sosa (A) 3 Onur Air (600R) 6 Iraqi Airways (300) (5) North/South America 81 RACSA (A) 1 Onur Air (B2) 1 Jordan Aviation (200) 1 Aerolineas Argentinas (300) 2 AEROSPATIALE (SUD) CARAVELLE 2 Onur Air (B4) 5 Jordan Aviation (300) 1 Air Transat (300) 11 Europe 2 Pan Air (B4 Freighter) 2 Kuwait Airways (300) 4 FedEx Express (200F) 49 WaltAir (10B) 1 Saga Airlines (B2) 1 Mahan Air (300) 2 FedEx Express (300) 7 WaltAir (11R) 1 TNT Airways (B4 Freighter) 4 Miat Mongolian Airlines (300) 1 FedEx Express (300F) 12 AIRBUS A300 408 (8) North/South America 166 (7) Pakistan Int’l Airlines (300) 12 AIRBUS A318-100 30 (48) Africa 14 Aero Union (B4 Freighter) 4 Royal Jordanian (300) 4 Europe 13 (9) Egyptair (600R) 1 American Airlines (600R) 34 Royal Jordanian (300F) 2 Air France 13 (5) Egyptair (600R Freighter) 1 ASTAR Air Cargo (B4 Freighter) 6 Yemenia (300) 4 Tarom (4) Egyptair (B4 Freighter) 2 Express.net Airlines -

Helsinki Malmin Lentoasema (EFHF)

Helsinki-Malmin Lentoasema (EFHF), Suomen siviiliammattilentokoulutuksen keskus 1950 luvulta lähtien. Lentoasemaa pitää kehittää, ei ajaa alas, kuten Helsingin kaupunki on koko 2000-luvun yrittänyt tehdä. Maa-alueen vuokra-aika päättyy v. 2034, sitä pitää jatkaa. Uhkana on muuten siviili- ammattilentäjäkoulutuksen loppuminen Suomessa. Lare Karjalainen lentokapteeni no 63 Yli 50 vuotta Malmia palvellut majuri, tarkastuslentäjä, lennonopettaja, liikennelentäjä evp [email protected] 1 25.3.2014 Varhaishistoriasta vuodelta 1934 ja 1935 nykypäivään vuoteen 2008 on julkaistu kirja: MALMI HELSINGIN LENTOASEMA – 70 vuotta suomalaista ilmailua Seppo Sipilä – Raine Haikarainen – Hannu-Matti Wahl 2008 Kirja kertoo myös sen, että n.80 % Suomen siviiliammattilentäjistä koulutetaan Malmilla. Pari lainausta kirjasta: 1935: Sopimus valtion ja Helsingin kaupungin välillä 10.5.1935. …Sopimuksen merkittävin kohta oli sen ensimmäinen pykälä. Sen mukaan Helsingin kaupunki luovutti valtiolle korvauksetta Helsingin lentokenttäalueeksi (sisältäen tiealueen) noin 55 hehtaarin suuruisen alueen kaupungin omistamasta Tattarisuon viljelysalueesta Helsingin pitäjän Malmin kylästä noin 12 kilometrin päässä kaupungin keskustasta. Alue luovutettiin posti- ja siviili-ilma- liikenteeseen. Alue annettiin käyttöön 99 vuodeksi, ja sopimuksen voimassaolo päättyy 10. toukokuuta 2034… …Sopimukseen liittyi 17.7.1935 tehty lisäsopimus, mikä koski lentoaseman maa-alueen laajenta- mista… (Ensimmäinen lentokurssi alkoi Malmilla 27.9.1937, oppilaina Akateemisen Ilmasuojeluyhdistyksen vapaaehtoiset reservilentäjä- ylioppilaat, opettajana kapteeni S-E Siren, koulukoneena TU-163 Pilven Veikko). 2 25.3.2014 Malmin alasajo 2000-luvun alusta Hgin kaupunginhallitus halusi 2001 alussa purkaa valtion kanssa tehdyn vuoteen 2034 ulottuvan vuokrasopimuksen Malmin lentokentästä saadakseen sen asuntoalueeksi 2010 loppuun mennessä (HS 18.01.2001). Mielipidetiedusteluissa suurin osa helsinkiläisistä halusi säilyttää sen ilmailukäytössä (HS 18.01.2001), mikä toistui 15.10.2004 ja 06.01.2006 HS:n gallupkyselyissä. -

Finnair Group Interim Report January 1 – March 31, 2011

FINNAIR GROUP INTERIM REPORT JANUARY 1 – MARCH 31, 2011 28. huhtikuuta 2011 1 Key Facts from the First Quarter 1 Industry continues on growth track • Air Traffic on the rise: – IATA estimate for the capacity growth 6%* in 2011 – Weak Net Profit Margins expected (1.4 %) • External disturbances and overcapacity have a negative effect on the load factors, the fuel cost increase cannot be transferred to ticket prices • Finnair Q1 traffic +12.1% (ASK): – Asian traffic grew 20.2% (ASK) – Asian traffic revenue +23% – Global corporate sales +19%, outside Finland +43% • Finnair Passenger load factor 72.6% – Q4 2010 Strike continued to have an effect on Asian leisure demand during Q1 – Events in Japan , Middle East and Africa affected strongly on the Q1 sales • Cargo continued to develop positively, revenue up by 57% * compared with previous year Traffic Region Development Q1 2011 vs. Q1 2010 North Atlantic Europe Asia ASK 15,1 % ASK 9,7 % ASK 20,2 % RPK 9,6 % RPK -0,8 % RPK 5,0 % PLF% -3,7 %-p PLF% -6,4 %-p PLF% -10,7 %-p Traffic revenue 18,8 % Traffic revenue 0,4 % Traffic revenue 22,9 % Leisure traffic Domestic Total ASK -3,1 % ASK 20,0 % ASK 12,1 % RPK -3,8 % RPK 5,1 % RPK 1,7 % PLF% -0,7 %-p PLF% -7,6 %-p PLF% -7,4 %-p Traffic revenue -2,3 % Traffic revenue 9,6 % Traffic revenue 9,4 % Cargo ATK 62,4 % RTK 42,5 % CLF% -8,7 %-p Traffic revenue 57,0 % 2 We are Investing in Growth and Partnerships • Singapore route launch in May 2011; outlook positive • We are developing our cooperation in feeder fraffic and cargo to enable growth and to increase -

Air Transport Industry

ANALYSIS OF THE EU AIR TRANSPORT INDUSTRY Final Report 2004 Contract no: TREN/05/MD/S07.52077 By Cranfield University CONTENTS GLOSSARY...........................................................................................................................................................6 1. AIR TRANSPORT INDUSTRY OVERVIEW ..................................................................................12 2. REGULATORY DEVELOPMENTS .................................................................................................18 3. CAPACITY ...........................................................................................................................................24 4. AIR TRAFFIC ......................................................................................................................................36 5. AIRLINE FINANCIAL PERFORMANCE .......................................................................................54 6. AIRPORTS............................................................................................................................................86 7. AIR TRAFFIC CONTROL ...............................................................................................................104 8. THE ENVIRONMENT......................................................................................................................114 9. CONSUMER ISSUES ........................................................................................................................118 10 AIRLINE ALLIANCES.....................................................................................................................126 -

Air Transport: Annual Report 2005

ANALYSIS OF THE EU AIR TRANSPORT INDUSTRY Final Report 2005 Contract no: TREN/05/MD/S07.52077 by Cranfield University Department of Air Transport Analysis of the EU Air Transport Industry, 2005 1 CONTENTS 1 AIR TRANSPORT INDUSTRY OVERVIEW......................................................................................11 2 REGULATORY DEVELOPMENTS.....................................................................................................19 3 CAPACITY ............................................................................................................................................25 4. AIR TRAFFIC........................................................................................................................................36 5. AIRLINE FINANCIAL PERFORMANCE............................................................................................54 6. AIRPORTS.............................................................................................................................................85 7 AIR TRAFFIC CONTROL ..................................................................................................................102 8. THE ENVIRONMENT ........................................................................................................................110 9 CONSUMER ISSUES..........................................................................................................................117 10 AIRLINE ALLIANCES .......................................................................................................................124 -

Air Traffic Slowly Recovers

ISSUE 16 (146) • 22 – 28 APRIL 2010 • €3 • WWW.HELSINKITIMES.FI HEALTH & WELLBEING DOMESTIC LIFESTYLE CULTURE EAT & DRINK Special Breaking the Star-studded Visions Tasting health cycle of April Jazz of former the delicious issue bullying festival Helsinki Burgundy pages 12-13 page 5 page 14 page 15 page 16 LEHTIKUVA / JUSSI NUKARI Growing worries over healthcare inequalities STT ALEKSIS TORO – HT ropean average. However, struc- tural problems related to shortages of doctors in the public health sys- THE FINNISH healthcare system is tem, enhancing trends towards pri- founded on the constitutional re- vatisation, and the threats posed by sponsibility of public authorities to cuts to state subsidies in the wake provide medical services and pro- of the recent economic recession mote the health of all residents re- are compounding worries that uni- gardless of place of residence and versal and fair distribution of public ability to pay. In addition to offering health services is no longer feasible. comprehensive, universal coverage The ensuing discussion centres on of health services, Finnish health- worries about growing welfare dis- Finnair flight AY006 from New York landed in Helsinki on April 19. It was the first flight to do so after the closure of air- care policy has also long aimed at fair parities and the ever more thorough space due to the safety risk posed by the volcanic ash cloud from Iceland. distribution of services and costs. social exclusion of the minorities According to the patient safety who are already worst-off and ever and health service quality survey more in need of the dwindling pub- published by the EU Commission lic health and social services. -

Liikenne- 2009 Lentäjä

Nro 2 LIIKENNE- 2009 LENTÄJÄ Lentokapteenista ylioppilaaksi Koulutusta eilen, tänään ja tulevaisuudessa 70-luku esittelyssä Tyytyväisenä Thaimaassa 2 2/2009 PUHEENJOHTAJAN PALSTA Quo Vadis, Suomen ilmailu? FPA:n on saavutt anut yhden sen tavoitt elemistaan merkkipaaluista. Viimeinenkin raskaan len- toliikenteen lentäjäyhdistys on hakenut ja tullaan hyväksymään yhdistykseemme. Sen jäl- keen FPA katt aa kaikki merkitt ävät lentoliikenteen yhdistykset Suomessa. Asett amani ta- voite on saavutett u. Lomalentäjät – Finnish Charter Pilots – FCP, tervetuloa joukkoom- me! Turvatoimikuntamme ja LL-lehti odott avat panostanne ja tutt avuutt anne. eitä on nyt noin 1060 ja jäse- saan? Luott amusta? Toivott avasti asiat nistöömme kuuluu seitsemän saadaan kuntoon, kun pöly on laskeu- Mjäsenyhdistystä. Olemme suo- tunut. malaisen liikenne-, liike-, ja helikopteri- Tilanne on nyt ja tulevaisuudessa lentämisen ammatt iklusteri, käytt ääk- Daavidin ja Goljatin taistelua, on ky- seni virasto- ja lentoyhtiöiden mieliter- seessä mikä lentäjäryhmä hyvänsä. miä. Asiantuntemuksemme alalta on Isot ja kalliit tiedotusosastot ja vapaa- katt ava ja kelpaa kaikille alamme foo- ehtoisista koostuvat lentäjäryhmät tule- rumeille. vat jatkossakin kohtaamaan ammatt im- Miten Suomen ilmailulla muuten me ympärillä vellovassa arvostelussa. menee? Eipä voi kehua. Jos ainoa po- Matti Allonen Lopuksi vielä jaksan ihmetellä, miten sitiivinen uutisointi kuukauden aikana FPA:n puheenjohtaja työnantajan ja omistajatahojen antamaa on se, ett ä kaikki ilmailun merkitt ävät B757-kapteeni, Finnair tietoa kuvitellaan aina absoluutt isesti vaikutustahot pystyivät tekemään yk- todemmaksi kuin toisen osapuolen? simielisen lausunnon Ilmailuhallinnon mia. Yltiöpäiset kasvutavoitt eet ja ko- Jos Suomen lentoliikenne tarvitsee alueellistamista vastaan ja ett ä liiken- neinvestoinnit muutt uvat realistisiksi rakennemuutoksia ja yleisiä toimiala- nenministeri ott i mielipiteen huomi- tuott omarginaalien pienetyessä edel- järjestelyjä, olisiko kuitenkin helpoin tie oon, olemme aika syvällä ongelmien leen. -

Self-Service Check-In Speeds up Easter Departures

Source: Finnair Oyj March 30, 2010 03:05 ET Self-service check-in speeds up Easter departures Check-inandsecurityinspectionsmightbeverybusyatFinnishairportsduring theEasterperiod.Airportprocedurescanbeaccelerated,however,by performingcheck-ininadvance. -WerecommendthatpassengersuseFinnair'sinternetortextmessagecheck-in servicesortheself-servicecheck-inkiosksattheairport.Thiscanspeeds thingsupsignificantly,saysFinnair'sMarkkuRemes,whoisresponsiblefor passengerexperiencedevelopment.Whencheck-inisdoneinadvance,baggagecan beleftinHelsinki-VantaaAirportataBaggageDropdeskwithintheframework ofminimumcheck-intimes. Check-incanbedoneontheinternetonthedaybeforetheflightforall FinnairandFinncommAirlinesscheduledflightsattheaddresswww.finnair.fi. ExceptionsareflightsfromBergen,Geneva,Ekaterinburg,Kiev,Ljubljana, MoscowandSt.Petersburg,wherepassengersshouldcheckinattheairport. FinnairPlusmemberscanconfirmacheck-inproposalsenttothembytext messageforFinnairandFinncommAirlinesdomesticandinternationalscheduled flights,whenthedepartureisfromFinland,Amsterdam,Brussels,Gothenburg, Copenhagen,London,Madrid,Manchester,Oslo,Paris,Prague,Riga,Stockholm, WarsaworVilnius.Thisservicecanbeactivatedontheinternetorby contactingtheFinnairPlusservicecentre.Themessageissentformorning flightsbetween5p.m.and7p.m.ontheeveningbeforeandforflights departingintheafternoonaroundthreehoursbeforetheflightdeparture. ForFinnairandFinncommAirlinesdomesticandinternationalflightsdeparting fromHelsinki,check-incanbeperformedusingtheautomatickiosksin Helsinki-Vantaa'sTerminal2.Thecheck-inkioskscanalsobeusedwhen -

Financial-Report-2008.Pdf

Financial Report Group Report 2008 www.finnair.com/group 1 Financial Report CONTENTS Finnair Group Key Figures .......................................................2 Board of Directors’ Report .....................................................4 Shares and Shareholders .......................................... 13 Financial Indicators 2006–2008 ............................ 18 Calculation of Key Indicators .................................. 19 Financial Statements, 1 January–31 December 2008 ... 21 Consolidated Income Statement ........................... 22 Consolidated Balance Sheet .................................... 23 Consolidated Cash Flow Statement ...................... 24 Shareholders’ Equity ................................................. 26 Notes to the Financial Statements ........................ 27 Board of Directors’ Proposal on the Dividend ... 79 Auditors’ Report ......................................................... 80 Corporate Governance .......................................................... 81 Risk Management .................................................................... 84 Stock Exchange Releases in 2008 ....................................... 87 The Brokerage Firms analysing Finnair Equity ................ 89 Information for Shareholders .............................................. 90 Contact Information .............................................................. 92 2 Financial Report Finnair Group Key figures FINNAIR GROUP KEY FIGURES 2008 2007 2006 Turnover EUR mill. 2,263 2,181 1,990 Operating