AGM Notice – 17 Jul 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Notice LARSEN & TOUBRO LIMITED

LARSEN & TOUBRO LIMITED Regd. Office : L&T House, Ballard Estate, Mumbai 400 001. CIN : L99999MH1946PLC004768 Notice NOTICE IS HEREBY GIVEN THAT the Sixty-ninth Annual 9) To appoint a Director in place of Mr. A. M. Naik General Meeting of LARSEN & TOUBRO LIMITED will (DIN-00001514), who retires by rotation and is eligible be held at Birla Matushri Sabhagar, 19, Marine Lines, for re-appointment; Mumbai - 400 020 on Friday, August 22, 2014 at 3.00 10) To consider and, if thought fit, to pass with or without p.m. to transact the following business :- modification(s), as an ORDINARY RESOLUTION the 1) To consider and adopt the Balance Sheet as at March following: 31, 2014, the Profit & Loss Account for the year ended “RESOLVED THAT Mr. Subodh Bhargava on that date and the Reports of the Board of Directors (DIN-00035672) be and is hereby appointed as an and Auditors thereon; Independent Director of the Company to hold office 2) To declare a dividend on equity shares; up to March 29, 2017 with effect from April 1, 2014.” 3) To consider and, if thought fit, to pass with or without 11) To consider and, if thought fit, to pass with or without modification(s), as an ORDINARY RESOLUTION the modification(s), as an ORDINARY RESOLUTION the following: following: “RESOLVED THAT pursuant to Section 149(13) of the “RESOLVED THAT Mr. M. M. Chitale (DIN-00101004) Companies Act, 2013 the Independent Directors of the be and is hereby appointed as an Independent Director Company shall not be liable to retire by rotation.” of the Company to hold office up to March 31, 2019 4) To consider and, if thought fit, to pass with or without with effect from April 1, 2014.” modification(s), as an ORDINARY RESOLUTION the 12) To consider and, if thought fit, to pass with or without following: modification(s), as an ORDINARY RESOLUTION the “RESOLVED THAT the vacancy caused due to retirement following: by rotation of Mr. -

Model Portfolio Update

Model Portfolio update January 21, 2016 LatestDeal Team Model – PortfolioAt Your Service Large cap Midcap Name of the company Weightage(%) Name of the company Weightage(%) Auto 14 Aviation 6 Tata Motor DVR 4 Interglobe Aviation 6 Bosch 3 Auto 6 Maruti 4 Bharat Forge 6 EICHER Motors 3 BFSI 6 BFSI 23 BjjFiBajaj Finserve 6 HDFC Bank 8 Capital Goods 6 Axis Bank 3 HDFC 8 Bharat Electronics 6 Bajaj Finance 4 Cement 6 Capital Goods 5 Ramco Cement 6 L & T 5 Consumer 24 Cement 3 Symphony 6 UltraTech Cement 3 Supreme Ind 6 FMCG/Consumer 14 Kansai Nerolac 6 ITC 7 Pidilite 6 United Spirits 2 FMCG 8 Asian Paints 5 Nestle 8 IT 21 Infrastructure 8 Infosys 10 NBCC 8 TCS 8 Oil & Gas 6 Wipro 3 Meida 2 CtlCastrol 6 Zee Entertainment 2 Logistics 6 Metal 2 Container Corporation of India 6 Tata Steel 2 Pharma 12 Oil & Gas 4 Natco Pharma 6 Reliance Industries 4 Torrent Pharma 6 Pharma 12 Textile 6 Lupin 5 Arvind 6 Dr Reddys 4 Total 100 Aurobindo Pharma 3 Total 100 • Exclusion - Eicher Motors, Bajaj Finance (transferred to large cap), PVR, • Exclusion- State Bank of India, Bharti Airtel and ONGC CARE, Cummins & Shree Cement • Inclusion – Eicher Motors, Bajaj Finance (transferred from midcap), Wipro, • Inclusion – Ramco Cement, Bajaj Finserv, Supreme Industries, Indigo, Reliance Industries & Aurobindo Pharma Pidilite, Bharat Electronics and Bharat Forge Source: Bloomberg, ICICIdirect.com Research *Diversified portfolio - Combination of 70% large cap and 30% midcap portfolio OutperformanceDeal Team – At continues Your Service across all portfolios… • Our indicative large cap equity model portfolio (“Quality -20”) has • In the large cap space we continue to remain positive on pharma & IT. -

Annexure to the Board Report | L&T Annual Report 2019-20

Annexure ‘A’ to the Board Report and EnPI reduction of CG moulding energy consumption. Information as required to be given under Section 134(3) zz Implemented Smart COMM Energy Management (m) read with Rule 8(3) of the Companies (Accounts) system at ASW & Digital Dashboard. Rules, 2014. zz Replacement of conventional light fittings with [A] CONSERVATION OF ENERGY: Solar lighting system in SSII, Open yard-5 and (i) Steps taken or impact on conservation of Grit blasting & painting areas at Production/ energy: Utility areas at EWL Kancheepuram factory and Kansbahal works. zz Implementation of LED lights in HE-Hazira campus and other project sites and Solar Pipes in zz Replacement of conventional MH Lamps and SG fabrication area. fluorescent tube lights by LED lamps in working areas at office and projects as well as for street zz Installation of an Off Grid Mini-Solar Power Plant for meeting the energy requirement of site & lights. workmen habitats at Ranchi Smart City Project. zz Installation of energy efficient water coolers and submersible pumps zz Installed Local Pre/ Post Weld Heat Treatment (PWHT) using PID Technology which ensures zz Replacing existing aged inefficient Split AC units uniform heating and reduction in energy with energy efficient units wastage. zz Utilization of Chiller for HVAC System – Campus zz Implemented the use of Metal Halide (400 Watt) FMD initiated and control the chiller running EOT Crane under bay lights with LED Lights. hour for HVAC need during holidays and extended working hours. zz Installed Energy efficient burners for Furnaces and pre heating. zz Initiative has been taken for replacement of Air-Cooled Chiller with Water Cooled Chiller. -

List of Nodal Officer

List of Nodal Officer Designa S.No tion of Phone (With Company Name EMAIL_ID_COMPANY FIRST_NAME MIDDLE_NAME LAST_NAME Line I Line II CITY PIN Code EMAIL_ID . Nodal STD/ISD) Officer 1 VIPUL LIMITED [email protected] PUNIT BERIWALA DIRT Vipul TechSquare, Golf Course Road, Sector-43, Gurgaon 122009 01244065500 [email protected] 2 ORIENT PAPER AND INDUSTRIES LTD. [email protected] RAM PRASAD DUTTA CSEC BIRLA BUILDING, 9TH FLOOR, 9/1, R. N. MUKHERJEE ROAD KOLKATA 700001 03340823700 [email protected] COAL INDIA LIMITED, Coal Bhawan, AF-III, 3rd Floor CORE-2,Action Area-1A, 3 COAL INDIA LTD GOVT OF INDIA UNDERTAKING [email protected] MAHADEVAN VISWANATHAN CSEC Rajarhat, Kolkata 700156 03323246526 [email protected] PREMISES NO-04-MAR New Town, MULTI COMMODITY EXCHANGE OF INDIA Exchange Square, Suren Road, 4 [email protected] AJAY PURI CSEC Multi Commodity Exchange of India Limited Mumbai 400093 0226718888 [email protected] LIMITED Chakala, Andheri (East), 5 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 6 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 7 NECTAR LIFE SCIENCES LIMITED [email protected] SUKRITI SAINI CSEC NECTAR LIFESCIENCES LIMITED SCO 38-39, SECTOR 9-D CHANDIGARH 160009 01723047759 [email protected] 8 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 9 SMIFS CAPITAL MARKETS LTD. -

Havells India (HAVIND)

Havells India (HAVIND) CMP: | 1031 Target: | 1215 (18%) Target Period: 12 months BUY May 22, 2021 Strong recovery across product segments... Havells continued its growth momentum in Q4FY21 with topline growth of 50% YoY in line with our estimate of 48%. The company witnessed strong Particulars revenue growth in all business verticals cables, switchgears, electrical Particular Amount consumer durable (ECD), Lloyd, lightings and others by 51%, 53%, 71%, Market Capitalization (| Cr) 64,324.1 29%, 40% and 71%, respectively. The management reiterated market share Total Debt (FY21) (| Cr) 393.7 gains, strong demand traction in rural helped drive sales recovery for Havells Cash and Inv (FY21) (| Cr) 1,931.0 India in Q4 and in FY21. The company reported ~11% topline growth in EV (| Cr) 62,786.7 FY21 despite a washout in Q1. The key takeaways from conference call are: 52 week H/L 1238 / 454 Equity capital (| Cr) 62.6 Update Result 1) strong sales traction in first two weeks of April 2021 before lockdown Face value (|) 1.0 sseSFsfsf imposed in many states, 2) May sales hit by lockdown across the country, 3) price hikes of 10% in fans and 45-50% in cable business to offset Price Performance sseSFsfsf inflationary pressure, 4) focus on capacity building of Lloyd (future launches in refrigerators and washing machines categories), 5) focus on tapping rural 1400 20000 1200 and semi urban markets for the long term. However, considering lockdowns 1000 15000 and higher input prices, we revise our FY22E revenue, PAT estimate 800 10000 downward by ~7%, 6%, respectively. 600 400 5000 200 Strong b/s helps navigate challenging scenario 0 0 Havells India reported revenue, PAT CAGR of ~13%, ~15%, respectively, in Oct-18 Apr-21 Jan-20 Jun-20 Dec-17 Nov-20 Aug-19 Mar-19 the last 10 years with EBITDA margin expansion of 200 bps YoY to 15%. -

BUT TOGETHER, WE ARE STRONGER and SAFER. from the Desk of SNS

SAFETY IS OUR RESPONSIBILITY. BUT TOGETHER, WE ARE STRONGER AND SAFER. From the Desk of SNS and every functional department can and drive these down to the individual or Lives are too precious to be lost due to need to contribute to create and maintain personal level to monitor and measure elementary mistakes and therefore we a safe work culture. Each one has a vital safe behaviour. It is imperative to make need to be extra careful to ensure that no DIGITALIZATION IS THE VITAL EDGE WE role to play and by integrating EHS into all it a consultative and participative process lives are lost. ENJOY, AND DIGITAL TOOLS CAN MAKE THE our business processes, we have already in which every individual at site is fully Cause analysis made it clear how important safety and aware of what is expected of him or her BIGGEST IMPACT TO FURTHER IMPROVE OUR Near miss reporting is perhaps the most a positive attitude towards EHS is in our to maintain complete safety. This is the crucial aspect of safety management SAFETY RECORD. WE JUST NEED MORE OF general scheme of things. only way we can make people own their because a near miss is an accident responsibility and make them accountable YOU TO CHAMPION THIS CAUSE. During recruitment, we have already waiting to happen. It reveals a lacuna for their actions. started to verify EHS competence in the system, a gap that needs to be Conflict management and attitude; planning teams have immediately identified and plugged. Sustainable solutions safety record. We just need more of you Project directors and managers sometimes been impressed upon to consider risk Every individual, especially workmen, The slew of safety awards that we, as to champion this cause. -

Avenue Supermarts (DMART IN)

Avenue Supermarts (DMART IN) Rating: BUY | CMP: Rs3,378 | TP: Rs3,686 July 10, 2021 Rising Footfalls, Online scalability Positive Q1FY22 Result Update Quick Pointers: Change in Estimates | ☑ Target | Reco . Q1FY22 saw a stronger second wave resulting in loss of more days or higher restriction on number of hours of store operations. Change in Estimates Current Previous . No significant impact on supply chain during the quarter, Inventory moving FY22E FY23E FY22E FY23E Rating BUY BUY towards normal levels. Target Price 3,686 3,366 Sales (Rs. m) 2,89,846 4,08,606 2,89,846 4,08,606 D’Mart 1Q results depicted impact of a strong second wave with business % Chng. - - EBITDA (Rs. m) 23,781 37,290 23,781 37,290 loss of more days (versus last year) and higher restriction on operating hours % Chng. - - /non-essential sales. However, rising footfalls, vaccination drive, 203% sales EPS (Rs.) 22.5 36.0 22.5 36.0 % Chng. - - growth in D’Mart ready and work on new store openings is positive. Key Financials - Consolidated Despite near term challenges we remain optimistic about the long term Y/e Mar FY20 FY21 FY22E FY23E potential of D’Mart on back of 1) Increasing scale and scope D’Mart Ready 2) Sales (Rs. m) 2,48,702 2,41,431 2,89,846 4,08,606 Extending offerings on D’Mart ready app to include general merchandise, EBITDA (Rs. m) 21,284 17,431 23,781 37,290 fresh food and vegetable 3) Growth in General merchandise sales over lower Margin (%) 8.6 7.2 8.2 9.1 PAT (Rs. -

Indigo Paints Ltd

Stock Idea Sector: Consumer Goods August 23, 2021 Indigo Paints Ltd Paint your portfolio bright Powered by Sharekhan’s 3R Research Philosophy Indigo Paints Ltd Paint your portfolio bright Stock Idea Stock Powered by the Sharekhan 3R Research Philosophy Consumer Goods Sharekhan code: INDIGOPNTS Initiating Coverage 3R MATRIX + = - Summary We initiate coverage on Indigo Paints Ltd (IPL) with a Buy and assign a target price of Rs. 3,305. Right Sector (RS) ü Differentiated business model, excellent return profile and strong structural growth outlook will keep valuation at a premium of 60x/44x its FY2023/24E earnings versus peers. Right Quality (RQ) ü With a differentiated product portfolio and bottom-up approach, IPL is emerging as one of India’s fastest growing paints companies. Revenues and PAT clocked a CAGR of 22% and 71% over FY2018-21. Right Valuation (RV) ü Gross margins are highest among peers at ~48% led by IPL’s locational advantage and healthy mix of revenues from differentiated products. + Positive = Neutral - Negative Better working capital management has kept net working capital cycle low at 13-14 days. Operating cash flows (OCF) improved from Rs. 42.8 crore to Rs. 101.4 crore over FY2019-21. Reco/View Indigo Paints Limited (IPL) is an emerging player, which has created a niche for itself in the highly competitive paints industry by launching differentiated products, creating brand equity through one prominent brand ‘Indigo’ and follow bottoms-up approach to expand its distribution in the Reco: Buy domestic market. It has market share of 2% but has strong potential to improve it in the coming years. -

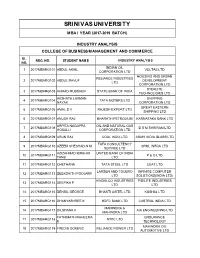

Srinivas University M Ba I Year (2017-2019 Batch)

SRINIVAS UNIVERSITY M BA I YEAR (2017-2019 BATCH) INDUSTRY ANALYSIS COLLEGE OF BUSINESS MANAGEMENT AND COMMERCE SL . REG. NO. STUDENT NAM E INDUSTRY ANALYSIS NO. INDIAN OIL 1 2017MBARG101 ABDUL AKHIL VOLTAS LTD CORPORATION LTD HOUSING AND URBAN RELIANCE INDUSTRIES 2 2017MBARG102 ABDUL RAVUF DEVELOPMENT LTD CORPORATION LTD STERLITE 3 2017MBARG103 AHMAD MUBSHER STATE BANK OF INDIA TECHNOLIGIES LTD AKSHATA LAXMAN SHIPPING 4 2017MBARG104 TATA MOTERS LTD NAYAK CORPORATION LTD GREAT EASTERN 5 2017MBARG105 AMAL S V RAJESH EXPORT LTD SHIPPING LTD 6 2017MBARG107 ANUSH RAJ BHARATH PETROLIUM KARNATAKA BANK LTD ARPITA NAGAPPA OIL AND NATURAL GAS 7 2017MBARG108 D S M SHRIRAM LTD HOSALLI CORPORATION LTD 8 2017MBARG109 ARUN RAJ COAL INDIA LTD ASAHI INDIA GLASS LTD TATA CONSULTENCY 9 2017MBARG110 AZEEM SHESHAD N M SPML INFRA LTD SERVICE LTD AZIZAHMAD IBRAHIM UNITED BANK OF INDIA 10 2017MBARG111 P & G LTD TANJI LTD 11 2017MBARG112 CHETHANA TATA STEEL LTD CEAT LTD LARSEN AND TOUBRO INFINITE COMPUTER 12 2017MBARG113 DEEKSHITH POOJARY LTD SOLUTIONS(INDIA LTD) HINDALCO INDUSTRIES PIDILITE INDUSTRIES 13 2017MBARG114 DEEPIKA P LTD LTD 14 2017MBARG115 DENSIL GEORGE BHARTI AIRTEL LTD KUSHAL LTD 15 2017MBARG116 DHANYASHREE K HDFC BANK LTD CASTROL INDIA LTD MAHINDRA & 16 2017MBARG117 DILSHANA K AIA ENGINEERING LTD MAHINDRA LTD FATHIMATH RAHEEMA ENDURANCE 17 2017MBARG118 NTPC LTD K TECHNOLOGY MAHINDRA CIE 18 2017MBARG119 FREDIN DOMINIC RELIANCE POWER LTD AUTOMOTIVE LTD GAYATRI GAJANANA RAYMOND COMPANY 19 2017MBARG120 INFOSYS LTD PAI LTD MARUTI SUZUKI INDIA AMARA -

Sharekhan Special August 31, 2021

Sharekhan Special August 31, 2021 Index Q1FY2022 Results Review Automobiles • Capital Goods • Consumer Discretionary • Consumer Goods • Infrastructure/Cement/Logistics/Building Material • IT • Oil & Gas • Pharmaceuticals • Agri Inputs and Speciality Chemical • Miscellaneous • Visit us at www.sharekhan.com For Private Circulation only Q1FY2022 Results Review In-line quarter, healthy outlook Results Review Results Summary: After ending FY2021 on a strong note, Q1FY2022 earnings of broader indices showed a promising start (Nifty/ Sensex companies’ PAT rose 100%/66% y-o-y) in the new fiscal with strong growth momentum on low base. Management commentaries on earnings outlook remained positive, on improving economic activity post second COVID-19 wave and anticipation of strong demand revival. Demand recovery and ramp-up of vaccinations look encouraging. We expect economic activity to increase in the upcoming festive season. Nifty trades at 23x and 20x EPS based on FY2022E/FY2023E EPS, at a premium to mean average. Valuation gap between large and mid-caps has shrunk, we advise investors to focus on stocks with strong earnings growth potential with reasonable valuation. High-conviction investment ideas: o Large-caps: Infosys, ICICI Bank, M&M, L&T, UltraTech, SBI, HDFC Ltd, Godrej Consumer Products, Divis Labs and Titan. o Mid-caps: NAM India, BEL, Gland Pharma, Dalmia Bharat, Laurus Labs, Max Financial Services, LTI. o Small-caps: TCI Express, Kirloskar Oil, Suprajit Engineering, Repco Home Finance, PNC Infratech, Mahindra Lifespaces, Birlasoft. After ending FY2021 on a strong note, Q1FY2022 corporate earnings of broader indices showed a promising start with continued strong growth momentum on the low base of Q1FY2021, though it was along the expected lines. -

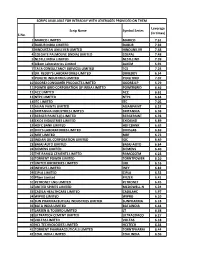

S.No. Scrip Name Symbol Series Leverage (In Times) 1 MARICO

SCRIPS AVAILABLE FOR INTRADAY WITH LEVERAGES PROVIDED ON THEM Leverage Scrip Name Symbol Series (in times) S.No. 1 MARICO LIMITED MARICO 7.61 2 DABUR INDIA LIMITED DABUR 7.92 3 HINDUSTAN UNILEVER LIMITED HINDUNILVR 7.48 4 COLGATE PALMOLIVE (INDIA) LIMITED COLPAL 7.48 5 NESTLE INDIA LIMITED NESTLEIND 7.39 6 Alkem Laboratories Limited ALKEM 6.91 7 TATA CONSULTANCY SERVICES LIMITED TCS 7.24 8 DR. REDDY'S LABORATORIES LIMITED DRREDDY 6.54 9 PIDILITE INDUSTRIES LIMITED PIDILITIND 7.07 10 GODREJ CONSUMER PRODUCTS LIMITED GODREJCP 5.79 11 POWER GRID CORPORATION OF INDIA LIMITED POWERGRID 6.46 12 ACC LIMITED ACC 6.61 13 NTPC LIMITED NTPC 6.64 14 ITC LIMITED ITC 7.05 15 ASIAN PAINTS LIMITED ASIANPAINT 6.52 16 BRITANNIA INDUSTRIES LIMITED BRITANNIA 6.98 17 BERGER PAINTS (I) LIMITED BERGEPAINT 6.78 18 EXIDE INDUSTRIES LIMITED EXIDEIND 6.89 19 HDFC BANK LIMITED HDFCBANK 6.63 20 DIVI'S LABORATORIES LIMITED DIVISLAB 6.69 21 MRF LIMITED MRF 6.73 22 INDIAN OIL CORPORATION LIMITED IOC 6.49 23 BAJAJ AUTO LIMITED BAJAJ-AUTO 6.64 24 SIEMENS LIMITED SIEMENS 6.40 25 THE RAMCO CEMENTS LIMITED RAMCOCEM 6.23 26 TORRENT POWER LIMITED TORNTPOWER 6.10 27 UNITED BREWERIES LIMITED UBL 6.16 28 INFOSYS LIMITED INFY 6.82 29 CIPLA LIMITED CIPLA 6.52 30 Pfizer Limited PFIZER 6.41 31 PETRONET LNG LIMITED PETRONET 6.45 32 UNITED SPIRITS LIMITED MCDOWELL-N 6.24 33 CADILA HEALTHCARE LIMITED CADILAHC 5.97 34 WIPRO LIMITED WIPRO 6.10 35 SUN PHARMACEUTICAL INDUSTRIES LIMITED SUNPHARMA 6.18 36 BATA INDIA LIMITED BATAINDIA 6.44 37 LARSEN & TOUBRO LIMITED LT 6.38 38 ULTRATECH CEMENT -

Globalization Journey of Brand by Creating Experience Wave

Academy of Marketing Studies Journal Volume 25, Issue 5, 2021 GLOBALIZATION JOURNEY OF BRAND BY CREATING EXPERIENCE WAVE Achutha Jois, Indian Institute of Management Kashipur Somnath Chakrabarti, Indian Institute of Management Kashipur ABSTRACT As the global economic outlook is uncertain, revenue growth is becoming a bigger challenge, organizations are leveraging their brands to go global. Authors have used case approach to study the globalization journey of brand. Information Technology (IT) sector has been one of the major success stories for Indian economy, Indian IT organizations have undergone major brand transformation to go global however Indian higher education sector is yet to transform. Authors have selected brands from IT and higher education sector for their research work. Research work has tried to analyze the dilemma of both educators and brand managers as dilemma has changed with changing times. Education brands have seen sea of change due to globalization of brands. MNC IT brands such as IBM, Accenture and western education brands such as Harvard, INSEAD have gone transnational to serve widespread international markets. Brands from emerging economies are immense under pressure due to expansion of western brands. Author's research work has focused on global brand building framework and customer (student customer) experience model by observing experience wave created by select IT organizations and Indian higher education institutions. Keywords: Global Brand building; Innovation; Strategy; Student Loyalty; Student Satisfaction; Customer Experience; International Marketing; Branding; Business Model; Experience Wave; Disruption; Differentiation; Value Addition; Brand Recognition; Business Plan. Declarations of Interest: None This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.