Inner 32 Arbitrage Fund Low

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Petronet LNG (PETLNG)

Petronet LNG (PETLNG) CMP: | 242 Target: | 275 (14%) Target Period: 12 months HOLD February 14, 2021 Sales volume dips; margins drive profitability... Particulars Ss Petronet LNG reported a mixed set of Q3FY21 numbers. While sales volume Particu lar Am o u n t was below estimates, blended margins were ahead of expectations. Total Market Capitaliz ation (₹ Crore) 36,315.0 volumes were flattish YoY and down 7.5% QoQ to 235 tbtu due to lower Total Debt (FY 20) (₹ Crore) 3,440.2 regas volumes. Revenues were down 17.8% YoY to | 7328.2 crore (I-direct Cash and Investments (FY 20) ( ₹ Crore) 4,432.0 estimate: | 7591 crore). EBITDA was | 1335.3 crore, up 20.6% YoY, down EV (₹ Crore) 35,323.2 2% QoQ (our estimate: | 1215.4 crore). Blended margins were at 52 week H/L 285/171 ₹ | 63.2/mmbtu on account of inventory gains and higher margin on spot Equity capital ( Crore) 1,500.0 Face value (₹) 1 0.0 volumes (our estimate: | 54.8/mmbtu). PAT increased 30.1% YoY to | 878.5 s ss crore (our estimate: | 761.7 crore). On a QoQ basis, it dipped 5.3%. Update Result Key Highlights Higher spot LNG prices lead to dip in regas volumes QoQ Results were a mixed bag as Petronet LNG’s total volumes were below our estimates on account of lower blended margins were ahead of regasification volumes from Dahej terminal. Total sales volumes came in at estimates while regas volume 235 tbtu, compared to 233 tbtu in Q3FY20 (up 0.9% YoY) and 254 tbtu in were lower than expected Q2FY21 (down 7.5% QoQ). -

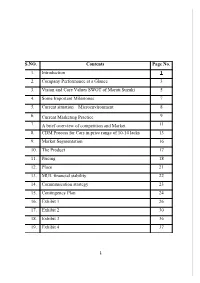

S.NO. Contents Page No. 1. Introduction 1 2. Company Performance at a Glance 3 3. Vision and Core Values SWOT of Maruti Suzuki 5 4

S.NO. Contents Page No. 1. Introduction 1 2. Company Performance at a Glance 3 3. Vision and Core Values SWOT of Maruti Suzuki 5 4. Some Important Milestones 7 5. Current situation – Microenvironment 8 6. Current Marketing Practice 9 7. A brief overview of competition and Market 11 8. CDM Process for Cars in price range of 10-14 lacks 13 9. Market Segmentation 16 10. The Product 17 11. Pricing 18 12. Place 21 13. MUL financial stability 22 14. Communication strategy 23 15. Contingency Plan 24 16. Exhibit 1 26 17. Exhibit 2 30 18. Exhibit 3 36 19. Exhibit 4 37 1 1. I NTRODUCTION Maruti Suzuki India Ltd. – Company Profile Maruti Suzuki India Ltd. (current logo) Maruti Udyog Ltd. (old logo) Maruti Suzuki is one of the leading automobile manufacturers of India, and is the leader in the car segment both in terms of volume of vehicle sold and revenue earned. It was established in February, 1981 as Maruti Udyog Ltd. (MUL), but actual production started in 1983 with the Maruti 800 (based on the Suzuki Alto kei car of Japan), which was the only modern car available in India at that time. Previously, the Government of India held a 18.28% stake in the company, and 54.2% was held by Suzuki of Japan. However, in June 2003, the Government of India held an initial public offering of 25%. By May 10, 2007 sold off its complete share to Indian financial institutions. Through 2004, Maruti Suzuki has produced over 5 million cars. Now, the company annually exports more than 50,000 cars and has an extremely large domestic market in India selling over 730,000 cars annually. -

CHAPTER - I Through International Competitive Biddings in a 1

CHAPTER - I through international competitive biddings in a 1. INTRODUCTION deregulated scenario. Appraisal of 35% of the total sedimentary basins is targeted together with 1.1 The Ministry of Petroleum & Natural Gas acquisition of acreages abroad and induction of (MOP&NG) is concerned with exploration & advanced technology. The results of the initiatives production of oil & natural gas (including import taken since 1999 have begun to unfold. of Liquefied Natural Gas), refining, distribution & 1.8 ONGC-Videsh Limited (OVL) a wholly owned marketing, import, export and conservation of subsidiary of ONGC is pursing to acquire petroleum products. The work allocated to the exploration acreage and oil/gas producing Ministry is given in Appendix-I. The names of the properties abroad. OVL has already acquired Public Sector Oil Undertakings and other discovered/producing properties in Vietnam (gas organisations under the ministry are listed in field-45% share), Russia (oil & gas field – 20% Appendix-II. share) and Sudan (oil field-25% share). The 1.2 Shri Ram Naik continued to hold the charge as production from Vietnam and Sudan is around Minister of Petroleum & Natural Gas during the 7.54 Million Metric Standard Cubic meters per financial year 2003-04. Smt. Sumitra Mahajan day (MMSCMD) of gas and 2,50,000 barrels of assumed the charge of Minister of State for oil per day (BOPD) respectively. The first Petroleum & Natural Gas w.e.f 24.05.2003. consignment of crude oil from Sudan project of OVL was received in May, 2003 by MRPL 1.3 Shri B.K. Chaturvedi continued to hold the charge (Mangalore Refinery Petrochemicals Limited) in as Secretary, Ministry of Petroleum & Natural Gas. -

Maruti Suzuki India Ltd

Business in India Content 1. Success Stories of Japanese companies in India a) Suzuki b) Daikin c) KUMON Global 2. Success story of McDonald in India 3. Corporate Frauds 4. GST Maruti Suzuki India Ltd. Connected For Success Sustained Performance 1.57 million cars in the financial year 2016-17 9.8% growth Hyundai, sold close to 509,707 units in 2016- 17 7 6 5 4 sales (mn) yr 2 3 sales (mn) Yr 1 2 1 0 2015-16 2016-17 Background • Founded in 1981 • To provide affordable mobility to India’s masses • Minute detail-orientation of the Japanese • Observing customers in detail, identifying their needs • Aligning the whole value chain to deliver this need at an appropriate value Guiding Principle . Osamu Suzuki’s conviction . “Cleanliness would drive effectiveness” . Check signs of inefficiency and waste . Every employee is equal . Open offices, one uniform, a common canteen for everyone from sweeper to Managing Director Philosophy that drove Maruti’s success Smaller, lighter, lesser and more beautiful “1 component, 1 gram, 1 yen” initiative . Identify cost improvements of at least ¥1 as well as weight reduction of at least one gram. Mobilized an army of about 6,000 employees Exchange programmes • Adherence to standards • Continuous improvement of standards via Kaizen • Management principles such as 3G, 3K, 3M and 5S. • Phased manufacturing programme • Balance between handholding and leveraging competition • Quality of components: increased cooperation between OEM and supplier • Financially responsible: Displaying real profits in books • Create more value than potential tax “savings” Digital training academy • First large-scale deployment of satellite broadband solution • Facilitating training in a corporate environment. -

Model Portfolio Update

Model Portfolio update January 21, 2016 LatestDeal Team Model – PortfolioAt Your Service Large cap Midcap Name of the company Weightage(%) Name of the company Weightage(%) Auto 14 Aviation 6 Tata Motor DVR 4 Interglobe Aviation 6 Bosch 3 Auto 6 Maruti 4 Bharat Forge 6 EICHER Motors 3 BFSI 6 BFSI 23 BjjFiBajaj Finserve 6 HDFC Bank 8 Capital Goods 6 Axis Bank 3 HDFC 8 Bharat Electronics 6 Bajaj Finance 4 Cement 6 Capital Goods 5 Ramco Cement 6 L & T 5 Consumer 24 Cement 3 Symphony 6 UltraTech Cement 3 Supreme Ind 6 FMCG/Consumer 14 Kansai Nerolac 6 ITC 7 Pidilite 6 United Spirits 2 FMCG 8 Asian Paints 5 Nestle 8 IT 21 Infrastructure 8 Infosys 10 NBCC 8 TCS 8 Oil & Gas 6 Wipro 3 Meida 2 CtlCastrol 6 Zee Entertainment 2 Logistics 6 Metal 2 Container Corporation of India 6 Tata Steel 2 Pharma 12 Oil & Gas 4 Natco Pharma 6 Reliance Industries 4 Torrent Pharma 6 Pharma 12 Textile 6 Lupin 5 Arvind 6 Dr Reddys 4 Total 100 Aurobindo Pharma 3 Total 100 • Exclusion - Eicher Motors, Bajaj Finance (transferred to large cap), PVR, • Exclusion- State Bank of India, Bharti Airtel and ONGC CARE, Cummins & Shree Cement • Inclusion – Eicher Motors, Bajaj Finance (transferred from midcap), Wipro, • Inclusion – Ramco Cement, Bajaj Finserv, Supreme Industries, Indigo, Reliance Industries & Aurobindo Pharma Pidilite, Bharat Electronics and Bharat Forge Source: Bloomberg, ICICIdirect.com Research *Diversified portfolio - Combination of 70% large cap and 30% midcap portfolio OutperformanceDeal Team – At continues Your Service across all portfolios… • Our indicative large cap equity model portfolio (“Quality -20”) has • In the large cap space we continue to remain positive on pharma & IT. -

Eicher Motors

Techno Funda Pick SiScrip IDiI-Direct Co de AiAction Target UidUpside Maruti Suzuki MARUTI Buy in the range of 5770-5910 6640.00 14% Eicher Motors EICMOT Buy in the range of 23300-23600 27450.00 17% Time Frame: 6 Months Research Analysts Dharmesh Shah [email protected] Nishit Zota [email protected] January 27, 2017 Techno Funda Pick: Maruti Suzuki (MARUTI) Time Frame: 6 Months CMP: | 5885. 00 BiBuying Range: | 5770-5910 Tt|Target: | 6640. 00 UidUpside: 14% Stock Data Key technical observations Recommended Price 5770-5910 The share price of Maruti has remained in a secular uptrend since 2014 as it continues to form higher peak and higher Price Target 6570 trough in all time frame and has consistently generated superior returns for investors over the long term. Within this structural bull run, the stock has undergone periodic phases of consolidation providing fresh entry opportunities for 52 Week High 5974 medium term players to ride the uptrend. We believe the consolidation over the last three months has approached 52 Week Low 3193 maturity and the stock provides a good entry opportunity for medium term investors. 50 days EMA 5474 The stock rebounded from a major support area ... 200 days EMA 4995 The stock after hitting a life-time high of | 5974 in the first week of November 2016 has entered a corrective 52 Week EMA 4888 consolidation phase to work off the excesses post the breakout rally from March 2016 low of | 3185 to the life-time *Recommendation given on i-click to gain on January high of 5974. -

Auto, IT Firms Lead Growth Surge

ADVANCE TAX COLLECTION Auto, IT firms lead growth surge SHRIMI CHOUDHARY such as State Bank of India (SBI) and KEY CONTRIBUTORS New Delhi, 22 June ICICI Bank reported lower (but dou- Amount paid (in ~ cr) YoY growth (%) ble-digit) growth in tax payment. Maruti Suzuki 150 200 Tech Mahindra 190 35 Sharp growth in advance tax payment According to officials, the first- by India Inc has been led mainly by quarter numbers have been compared Hero Motocorp 126 96 SBI 1,910 21 automakers and technology giants with the beginning of the pandemic- TCS 1,160 65 HUL 397 20 including Maruti Suzuki, Hero induced lockdown, so automatically L&T 30 50 Cipla 126 20 MotoCorp, Tata Consultancy (TCS), the figures showed a sharp jump. The and Infosys. second instalment will have a clearer P&G 32 45 NTPC 485 10 These four companies reported a picture, they said. Infosys 720 44 Dr Reddy’s 60 9 jump between 44 per cent and 200 per Meanwhile, final advance tax col- ICICI Bank 800 39 HDFC Bank 2,100 8 cent in the April-June quarter of this lection by companies showed 51 per financial year on account of a low base. cent growth (YoY) for the first quarter. Note: Figures for April 1-June 21 Source: CBDT sources Even top financial institutions Turn to Page 13 > > FROM PAGE 1 Auto, IT firms lead growth surge Earlier, the preliminary data impact on the companies’ increased its tax outflow by Suzuki paid ~150 crore. showed a growth rate of 146 growth. 35 per cent at ~190 crore. -

Annexure to the Board Report | L&T Annual Report 2019-20

Annexure ‘A’ to the Board Report and EnPI reduction of CG moulding energy consumption. Information as required to be given under Section 134(3) zz Implemented Smart COMM Energy Management (m) read with Rule 8(3) of the Companies (Accounts) system at ASW & Digital Dashboard. Rules, 2014. zz Replacement of conventional light fittings with [A] CONSERVATION OF ENERGY: Solar lighting system in SSII, Open yard-5 and (i) Steps taken or impact on conservation of Grit blasting & painting areas at Production/ energy: Utility areas at EWL Kancheepuram factory and Kansbahal works. zz Implementation of LED lights in HE-Hazira campus and other project sites and Solar Pipes in zz Replacement of conventional MH Lamps and SG fabrication area. fluorescent tube lights by LED lamps in working areas at office and projects as well as for street zz Installation of an Off Grid Mini-Solar Power Plant for meeting the energy requirement of site & lights. workmen habitats at Ranchi Smart City Project. zz Installation of energy efficient water coolers and submersible pumps zz Installed Local Pre/ Post Weld Heat Treatment (PWHT) using PID Technology which ensures zz Replacing existing aged inefficient Split AC units uniform heating and reduction in energy with energy efficient units wastage. zz Utilization of Chiller for HVAC System – Campus zz Implemented the use of Metal Halide (400 Watt) FMD initiated and control the chiller running EOT Crane under bay lights with LED Lights. hour for HVAC need during holidays and extended working hours. zz Installed Energy efficient burners for Furnaces and pre heating. zz Initiative has been taken for replacement of Air-Cooled Chiller with Water Cooled Chiller. -

Equity Strategy

FOR EXTERNAL DISTRIBUTION TO THE FOLLOWING GROUP OF CUSTOMERS ONLY: 1. Accredited Investors (Singapore: Priority Banking). Further distribution of this publication to other group(s) is STRICTLY PROHIBITED. India Top Picks equity strategy This reflects the views of the Wealth Management Group equities | 07 March 2014 Sensex consolidating in a narrow range Contents No changes to our Top Picks this month Sensex consolidating in a narrow range 1 On Watch: India Top Picks 2 – Maruti Suzuki (MSIL IN) to Cut (waiting for a rebound) India Top Picks Review 2 – Tata Power (TPWR IN) and HPCL (HPCL IN) or Oil India Range-bound till elections 7 (OINL IN) under consideration to Add Technical Commentary 8 Indian markets were up last month because of better-than- India Top Picks – Results Update 18 expected inflation data and pre-election opinion polls suggesting Sector – Performance & Valuations 19 that the BJP-led coalition is the frontrunner for forming the next List of Equity Market Commentary Publication 21 government at the Centre. Important Information 22 Of the stocks we highlight, we believe those with the most favourable technicals are Cipla (CIPLA IN), Lupin (LPC IN) and Tech Mahindra (TECHM IN). We would advocate investors consider adding to these names at current levels. In the Interim Union Budget, the Finance Minister surprised the market by announcing that the FY14 fiscal deficit would be 4.8%, 20bps lower than previously forecast. Other highlights include the lack of populist measures ahead of the budget and excise duty Rob Aspin, CFA reduction in automobiles, capital goods and non-consumer Head, Equity Investment Strategy durables. -

A Fundamental Analysis of Indian Automobile Industry with Special Reference to Tata, Maruti & Mahindra & Mahindra

International Journal of Marketing, Sales and Brand Management Volume 1 Issue 2 A Fundamental Analysis of Indian Automobile Industry with Special Reference to Tata, Maruti & Mahindra & Mahindra Mukund S Assistant Professor Department of M.B.A Marian International Institute of Management, Kuttikkanam, Kerala Corresponding Author’s email: [email protected] DOI: http://doi.org/ 10.5281/zenodo.3626835 Abstract The intrinsic value or the real value of any stock should be known to the investor prior to the initiation of investment in the particular company. Therefore fundamental analysis can be used to find out the intrinsic value. Fundamental analysis is based on certain factors including industry, competition, operational efficiency, dividend policy, capital structure, ratios etc. Those factors tend to change according to the industry and economy. Indian automobile industry had witnessed a growth rate of 8 % during 2019-20. The fuel prices have played an important role in the growth of automobile industry when it comes to price sensitive consumers in India. This study has attempted to analyze the fundamental components of three Indian made automobiles by using various financial and statistical techniques. Maruti stands No. 1 in the segment followed by TATA. Keywords: Automobile Industry, Dividend policy, Fundamental analysis, Operational efficiency, Ratios. INTRODUCTION to sales. 2017-18 can be considered as Indian automobile industry is a lucrative their best time of sales. It marked a double industry which is currently one of the digit growth rate from 1st April 2017 to largest markets in the world with regards 31st March 2018. We have taken three 1 Page 1-9 © MANTECH PUBLICATIONS 2019. -

AIF Green Fund Letter

1 Private and Confidential – Circulation to Unit Holders only UNIFI AIF 2 – The Green Fund February 2020 UNIFI AIF 2 – The Green Fund The Green fund targets capital appreciation by investing in the next generation of winners arising from India’s evolution towards a more sustainable economy. The investment universe would comprise of well managed businesses offering best in class solutions to address challenges in the areas of Energy, Emissions, Waste and Water. Quarterly Review FUND DETAILS The third quarter of FY-2020 has been good, with most of the fund’s investee companies delivering along expected lines. In Q3 of FY-20, the weighted average PBT growth for green Launch Date: portfolio was 16% YoY (this excludes contribution from Gravita India where PBT grew from 31 July 2017 Rs.1cr., to Rs.21cr YoY). During the quarter, turnaround in financial performance was visible in companies like Gravita India and Srikalahasti Pipes. We continue to rebalance Scheme AUM: Green portfolio towards investments with higher conviction of near-term earnings. INR 1.03 bn Towards this objective, the new additions in portfolio during the quarter gone by include – Petronet LNG, Symphony Ltd, Tube Investments and Hindustan Oil Exploration Company. Theme AUM1: While consumption trends in the economy continue to be soft, FY21 is expected to be INR 2.74 bn moderately better due to base effect (BS-6 transition, weak rural incomes in FY20, and disruptions due to the general elections). However, challenges to all the major drivers of Firm AUM: GDP remain given low household income growth, weak government consumption (high INR 45 bn fiscal deficit) and cautious corporate balance sheets. -

PPAC's Snapshot of India's Oil & Gas Data

PPAC's Snapshot of India’s Oil & Gas data Abridged Ready Reckoner May, 2021 Petroleum Planning & Analysis Cell (Ministry of Petroleum & Natural Gas) As on 18.06.2021 Petroleum Planning & Analysis Cell (PPAC), an attached office of the Ministry of Petroleum & Natural Gas (MoPNG), Government of India, collects and analyses data on the Oil and Gas sector. It disseminates many reports on the Oil & Gas sector to the various stakeholders. The data is obtained from the Public Sector companies, Government agencies as well as the Private companies. Given the ever-increasing demand for energy and transition of energy demand to renewables and Biofuels, Policy makers and Analysts need to be well informed about the updated trends in the Oil & Gas industry. The PPAC’s Snapshot of India’s Oil & Gas data (Abridged Ready Reckoner) provides a comprehensive compilation of the latest data/information in a single volume for the latest month and historical time series. The Snapshot of India’s Oil & Gas data is also published on PPAC’s website (www.ppac.gov.in) and is accessible on mobile app-PPACE. This publication is a concerted effort by all divisions of PPAC. The cooperation of the oil and gas industry is acknowledged for their timely inputs. Table of contents Table Description Page No. Highlights for the month 2-3 ECONOMIC INDICATORS 1 Selected indicators of the Indian economy 5 2 Crude oil, LNG and petroleum products at a glance; Graph 6-7 CRUDE OIL, REFINING & PRODUCTION 3 Indigenous crude oil production 9 4 Domestic oil & gas production vis-à-vis overseas