S.No. Scrip Name Symbol Series Leverage (In Times) 1 MARICO

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download Full Report

CONTENTS 02 Unstoppable Corporate overview We have been persistent 02 Unstoppable in our aim to establishing 04 Chairman’s Message and maintaining market leadership to be able to achieve 06 Vice Chairman’s Message unprecedented growth for our 08 Board of Directors stakeholders. 10 Management Board 12 Key Performance Highlights 14 14 Integrated Report Integrated Report 28 Management Discussion & Analysis Apollo Tyres’ contribution 51 Sustainability Snapshot to social and economic development is critical to create and sustain an enabling environment for investment. This has enabled the Company’s positioning as a credible Statutory Reports stakeholder partner. 84 Board’s Report 95 Annual Report on CSR 28 102 Business Responsibility Report Management 126 Corporate Governance Report Discussion & Analysis Financial Statements 161 Standalone Financial Statements 223 Consolidated Financial Statements UNSTOPPABLE Since inception, we have worked towards establishing ourselves as a leading player in the sale and manufacture of tyres. We have been persistent in our aim to establishing and maintaining market leadership and be able to achieve unprecedented growth for our stakeholders. In FY2018-19 (FY2019), we continued to focus We are unstoppable in establishing our on our key revenue generating regions APMEA leadership across multiple segments. (Asia Pacific, Middle East and Africa, including Our consistently advancing product range coupled India) and Europe. We expanded our presence in with product innovations are enabling us to achieve Americas by added new territories and increasing the same. our value proposition. The APMEA operation continued its focus on consolidating its leadership We are unstoppable in working towards achieving and enhancing share in India through the cutting edge manufacturing capabilities and introduction of best in class and technologically world-class R&D. -

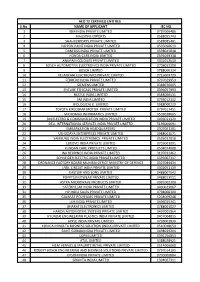

Inner 20 Ethical Fund Low

Tata Ethical Fund (An open ended equity scheme following Shariah principles) As on 30th June 2020 PORTFOLIO No. of Market Value % of No. of Market Value % of INVESTMENT STYLE Company name Company name An equity scheme which invests primarily in equities of Shares Rs. Lakhs Assets Shares Rs. Lakhs Assets Shariah compliant companies and other instrument if Equity & Equity Related Total 49401.57 90.21 Oil allowed under Shariah principles. Auto Oil & Natural Gas Co. 925000 752.49 1.37 INVESTMENT OBJECTIVE Hero Motocorp Ltd. 31300 797.20 1.46 Pesticides To provide medium to long- term capital gains by investing Auto Ancillaries Rallis India Ltd. 502000 1366.95 2.50 in Shariah compliant equity and equity related instruments Wabco India Ltd. 15800 1087.06 1.99 Petroleum Products of well-researched value and growth - oriented companies. Sundram Fasteners Ltd. 267000 999.38 1.83 Bharat Petroleum Corporation Ltd. 435000 1626.90 2.97 Tata Ethical Fund aims to generate medium to long term Amara Raja Batteries Ltd. 116849 759.99 1.39 Castrol India Ltd. 505000 634.79 1.16 capital growth by investing in equity and equity related Cement Pharmaceuticals instruments of shariah compliant companies. Shree Cement Ltd. 3800 875.94 1.60 Alkem Laboratories Ltd. 83000 1965.69 3.59 DATE OF ALLOTMENT Commercial Services Ipca Laboratories Ltd. 93750 1569.75 2.87 May 24,1996 3M India Ltd. 4500 845.79 1.54 Lupin Ltd. 145000 1322.11 2.41 Consumer Durables Software FUND MANAGER Titan Company Ltd. 113000 1073.33 1.96 Tata Consultancy Services Ltd. -

Pharma Limited. Lupin Limited, Lupin

Case 8:15-cv-03437-GJH Document 1 Filed 11/10/15 Page 1 of 17 UNITED STATES DISTRICT COURT FOR THE DISTRICT OF MARYLAND SHIRE PHARMACEUTICAL DEVELOPMENT INC., SHIRE DEVELOPMENT LLC, COSMO TECHNOLOGIES LIMITED, and NOGRA Civil Action No. PHARMA LIMITED. Plaintiffs, v. LUPIN LIMITED, LUPIN PHARMACEUTICALS INC., LUPIN INC., and LUPIN ATLANTIS HOLDINGS SA Defendants. COMPLAINT Plaintiffs Shire Pharmaceutical Development Inc., Shire Development LLC (collectively, "Shire"), Cosmo Technologies Limited ("Cosmo"), and Nogra Pharma Limited ("Nogra") (collectively, "Plaintiffs") by their undersigned attomeys, for their Complaint against defendants Lupin Limited ("Lupin Ltd."), Lupin Pharmaceuticals Inc. ("LPI"), Lupin Inc. ("Lupin Inc."), and Lupin Atlantis Holdings SA ("Lupin Atlantis") (collectively "Lupin" or "Defendants") herein, allege as follows: NATURE OF THE ACTION l. This is a civil action for patent infringement arising under the patent laws of the United States, Title 35, United States Code, involving United States Patent No.6,773,720 ("the '720 patent" or "the patent-in-suit"), attached hereto as Exhibit A. Case 8:15-cv-03437-GJH Document 1 Filed 11/10/15 Page 2 of 17 THE PARTIES 2. Plaintiff Shire Pharmaceutical Development Inc. is a corporation organized and existing under the laws of the state of Maryland, having its principal place of business at 1200 Morris Drive, Wayne, PA 19087. 3. Plaintiff Shire Development LLC is a limited liability company organized and existing under the laws of the State of Delaware, having its principal place of business at735 Chesterbrook Boulevard and 1200 Monis Drive, Wayne, Pennsylvania 19087. 4. Plaintiff Cosmo is a company organized and existing under the laws of Ireland, having its principal place of business at The Connolly Building, 42-43 Amiens Street, Dublin l, Ireland. -

MAHANAGAR GAS LIMITED MAHANAGAR (GAIL, Govt

MAHANAGAR GAS LIMITED MAHANAGAR (GAIL, Govt. of Maharashtra & BGAPH Enterprise) GAS Ref: MGL/CS/SE/2018/160 Date: July 10, 2018 To, Head, Listing Compliance Department Head, Listing Compliance Department BSE Limited National Stock Exchange of India Ltd P. J. Towers, Exchange Plaza, Bandra —Kuria Complex, Dalai Street, Bandra (East), Mumbai - 400 001 Mumbai - 400051 Scrip Code/Symbol: 539957; MGL Script Symbol: MGL Sub: Regulation 30 of SEBI (LODR) Regulations, 2015 — Investors Presentation. Dear Sir/Madam, Pursuant to Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, please find attached herewith an Investors Presentation. You are requested to take the above information on your records and disseminate the same on your website. Thanking you, Yours sincerely, For Mahanagar Gas Limited 1 ,6 Alok Mishra Company Secretary and Compliance Officer Encl. : As above Regd. Office: MGL House, Block G-33, Bandra - Kuria Complex, Bandra (East), Mumbai - 400 051.1 T +91 22 6678 5000 F +91 22 2654 0092 I E [email protected] I W www.mahanagargas.com CIN No. L40200MH1995PLC088133 I An ISO 9001, 14001 & OHSAS 18001 Certified Company PRESENTATION TO INVESTORS MGL : An Introduction 2 One of the largest CGD Companies in India Attractive Sole authorized distributor of CNG and PNG in Mumbai, its Adjoining Areas and Raigad Market with more than 23 year track record in Mumbai (1) Low-Cost Gas Cost-effective availability of domestic natural gas with sourcing flexibility Availability Strong CNG supplied to over 0.61 mn vehicles and PNG to approximately 1.03 mn domestic Customer households(2) Base Infrastructure Over 5,042 kms of pipeline(2) with infrastructure exclusivity(3) and 223 CNG filling stations(2) Exclusivity Commitment Safety management systems to seek to ensure safe, reliable and uninterrupted distribution to Health and of gas Safety Robust Revenue CAGR (FY13-18): 10.2% Return on Net Worth (FY17): 19.1% Financial Total cash balance of INR 8.1bn(4,5) Performance Net worth of INR 21.0 bn(5) BG Asia Pacific Holding Pte. -

Nominee List

NOMINEE LIST Best financial reporting (large cap) Cipla Hindalco Industries Hindustan Unilever Infosys Kotak Mahindra Bank Mahindra & Mahindra Piramal Enterprises Tata Steel Vedanta Best financial reporting (small to mid-cap) CEAT Everest Industries Hikal Hindustan Foods IIFL Holdings KEC International Minda Industries Raymond The Phoenix Mills Zensar Technologies Best investor meetings (large cap) Bharti Airtel Hindustan Unilever Infosys Lupin Mahindra & Mahindra Piramal Enterprises Best investor meetings (mid-cap) Balkrishna Industries IIFL Holdings Mindtree RPG Group Sterlite Technologies The Phoenix Mills NOMINEE LIST Best investor meetings (small cap) Amber Enterprises India Equitas Holdings Greenlam Industries Music Broadcast Navin Fluorine International NOCIL Raymond Zensar Technologies Best investor relations officer (large cap) Bharti Airtel Komal Sharan Bharti Airtel Aparna Vyas Garg Bharti Infratel Surabhi Chandna Cipla Naveen Bansal HDFC Conrad D'Souza Hindustan Unilever Suman Hegde Infosys Sandeep Mahindroo Kotak Mahindra Bank Nimesh Kampani Lupin Arvind Bothra Best investor relations officer (small to mid-cap) CEAT Pulkit Bhandari Jindal Steel & Power Nishant Baranwal Motilal Oswal Financial Services Rakesh Shinde PNB Housing Finance Deepika Gupta Padhi Raymond J Mukund RPG Group Pulkit Bhandari Schneider Electric Infrastructure Vineet Jain The Phoenix Mills Varun Parwal NOMINEE LIST Best investor relations team (large cap) Bharti Airtel Cipla Hindustan Unilever Infosys Kotak Mahindra Bank Larsen & Toubro Infotech Power -

The Great Tekhelet Debate—Blue Or Purple? Baruch and Judy Taubes Sterman

archaeological VIEWS The Great Tekhelet Debate—Blue or Purple? Baruch and Judy Taubes Sterman FOR ANCIENT ISRAELITES, TEKHELET WAS writings of rabbinic scholars and Greek and Roman God’s chosen color. It was the color of the sumptu- naturalists had convinced Herzog that tekhelet was a ous drapes adorning Solomon’s Temple (2 Chroni- bright sky-blue obtained from the natural secretions cles 3:14) as well as the robes worn by Israel’s high of a certain sea snail, the Murex trunculus, known to priests (Exodus 28:31). Even ordinary Israelites produce a dark purple dye.* were commanded to tie one string of tekhelet to But the esteemed chemist challenged Herzog’s the corner fringes (Hebrew, tzitzit) of their gar- contention: “I consider it impossible to produce a ments as a constant reminder of their special rela- pure blue from the purple snails that are known to Tekhelet was tionship with God (Numbers 15:38–39). me,” Friedländer said emphatically.1 But how do we know what color the Biblical writ- Unfortunately, neither Herzog nor Friedländer God’s chosen ers had in mind? While tekhelet-colored fabrics and lived to see a 1985 experiment by Otto Elsner, a color. It colored clothes were widely worn and traded throughout the chemist with the Shenkar College of Fibers in Israel, ancient Mediterranean world, by the Roman period, proving that sky-blue could, in fact, be produced the drapes donning tekhelet and similar colors was the exclusive from murex dye. During a specific stage in the dyeing of Solomon’s privilege of the emperor. -

Escorts Limited •• S~F2

c ESCORTS February 19, 2021 BSE Limited National Stock Exchange of Delhi Stock Exchange Limited Phiroze Jeejeebhoy India Limited DSE House, 3/1, Asaf Ali Road, Towers, Dalal Street, Exchange Plaza, Sandra New Delhi -110002 Mumbai - 400001 Kurla Complex, Bandra East, Mumbai - 400051 BSE-500495 NSE - ESCORTS DSE -00012 ••'*' Subject: Intimation pursuant to Regulation 31A of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 Dear Sir/ Madam, In compliance of Regulation 31A of Securities and Exchange Board of India (Listing Obligations And Disclosure Requirements) Regulations, 2015, we wish to inform you that the Company has received the enclosed request letter cum undertaking dated February 19, 2021 from the following shareholders currently belonging to Promoter/ Promoter Group of the Company for their reclassification from category of 'Promoter/ Promoter Group' to 'Public': Name No. of Shares as on date Mr. Girish Behari Mathur- Promoter Group 179 Ms. Rachna Mathur - Promoter group I Person acting 75 in concert The Company would take necessary actions to give effect to the above request. ,, You are requested to take the same on record Thanking You, Yours faithfully, For Escorts Limited •• s~f2. Company Secretary & Compliance Officer Encl: As above ESCORTS LIMITED CorporatE1 Secretarial & Low Registered Office : 15/5, Mothura Rood, Foridobod - 121 003, Horyana, Indio Phone : +91-129-2250222, ' E·moil : [email protected], Website : www.escortsgroup.com Corporate Identification Number - L74899HR1944PLC039088 Date: February 19, 2021 To The Board of Directors Escorts limited 15/5, Mathura Road, Faridabad -121003, Haryana Dear Sir/ Madam, Sub: Removal of my name along with the Person acting in Concert from Promoter and Promoter Group shareholding of the Escorts Limited ("Company") Ref: Regulation 31A of the SEBI (Listing Obligations and Disclosure Requirements) regulations, 2015 With reference to the above, I would like to inform that I, Girish Behari Mathur, along with my spouse Mrs. -

IN the BUSINESS of PROGRESS CONTENTS Apollo Tyres in Brief

Annual Report 2019-20 IN THE BUSINESS OF PROGRESS CONTENTS Apollo Tyres in brief 01-03 Apollo Tyres is one of the most trusted Corporate factsheet names in the manufacture and sale of tyres. The Company was founded in 1972 and is 04-13 headquartered in Gurugram, Haryana (India). Leadership and governance 06 Chairman’s message 08 Vice-Chairman’s message 10 Board of Directors Catering to all tyre segments 12 Management Team TRUCK AND BUS LIGHT TRUCK 14-77 Performance and progress 16 Key performance indicators 18 Know our capitals 20 Business model 22 Capital-wise information 36 Progress amidst volatility 38 Progress that is sustainable 40 Progress through people centricity 42 Value created for the stakeholders PASSENGER VEHICLES TWO-WHEELER 78-93 Management Discussion & Analysis 94-170 Statutory Reports 94 Board’s Report 107 Annual Report on CSR 113 Business Responsibility Report 138 Corporate Governance Report OFF-HIGHWAY 171-305 Financial Statements 171 Standalone 233 Consolidated Apollo Tyres’ success as a leading tyre such as: geo-political relations, economic manufacturer is inextricably linked with the growth, industry cyclicality, environmental progress of the people, the businesses we issues, technological innovation, safety and partner and the planet at large. We have consumer attitudes. Our FY20 performance is always persevered to exceed expectations, a reflection of the resulting uncertainties. It set new benchmarks and in some cases, is also a testament to our foundational values shape the future of the industry. and intrinsic strengths that have helped us navigate through these uncertainties. Our marquee brands, Apollo and Vredestein, enjoy premium positions in the commercial As we step into a new decade, replete with and passenger vehicle tyre segments in unexplored opportunities, we are keen on India and Europe, respectively. -

S.No. NAME of APPLICANT IEC NO. 1 IBM INDIA PRIVATE LIMITED 0797006486 2 MAGSONS EXPORTS 0588055743 3 SHAHI EXPORTS PRIVATE LIMI

AEO T2 CERTIFIED ENTITIES S.No. NAME OF APPLICANT IEC NO. 1 IBM INDIA PRIVATE LIMITED 0797006486 2 MAGSONS EXPORTS 0588055743 3 SHAHI EXPORTS PRIVATE LIMITED 0588085481 4 NIPPON PAINT INDIA PRIVATE LIMITED 0505090619 5 DANFOSS INDIA PRIVATE LIMITED 0598045848 6 HONDA CARS INDIA LIMITED 0595049338 7 ANUPAM COLOURS PRIVATE LIMITED 0301012610 8 BOSCH AUTOMOTIVE ELECTRONICS INDIA PRIVATE LIMITED 0708022308 9 BOSCH LIMITED 0788000314 10 VELANKANI ELECTRONICS PRIVATE LIMITED 0715009729 11 FERRERO INDIA PRIVATE LIMITED 0707029953 12 SIEMENS LIMITED 0388070005 13 ENCUBE ETHICALS PRIVATE LIMITED 0396057993 14 NESTLE INDIA LIMITED 0588000531 15 3M INDIA LIMITED 0793012112 16 BIOLOGICAL E. LIMITED 0988000229 17 TOYOTA KIRLOSKAR MOTOR PRIVATE LIMITED 0797012451 18 MICROMAX INFORMATICS LIMITED 0503028665 19 3M ELECTRO & COMMUNICATION INDIA PRIVATE LIMITED 0493021329 20 DELL INTERNATIONAL SERVICES INDIA PRIVATE LIMITED 5196000691 21 EMBARKATION HEADQUARTERS 0307061281 22 USHODAYA ENTERPRISES PRIVATE LIMITED 0988001071 23 SAMSUNG INDIA ELECTRONICS PRIVATE LIMITED 0595032818 24 LENOVO INDIA PRIVATE LIMITED 0705001091 25 KUNDAN CARE PRODUCTS LIMTED 0504074008 26 INA BEARINGS INDIA PRIVATE LIMITED 3197032462 27 SCHNEIDER ELECTRIC INDIA PRIVATE LIMITED 0595007317 28 ORDNANCE FACTORY BOARD MUMBAI OFFICE MINISTRY OF DEFENCE 0307084434 29 JABIL CIRCUIT INDIA PRIVATE LIMITED 0302051139 30 KASTURI AND SONS LIMITED 0488007542 31 POPPYS KNITWEAR PRIVATE LIMITED 0488013011 32 ASTRA MICROWAVE PRODUCTS LIMITED 0991002300 33 CATERPILLAR INDIA PRIVATE LIMITED 0400023067 -

Sustainable Development Report 2017

I II X Sustainability The essence of our existence. Organisation Profile GRI-102, SDG-8, 9 Ambuja Cements Limited (ACL), started in 1986, is India’s leading Cement Company. Ambuja Cement is the premier cement brand in India for Ordinary Portland Cement (OPC), and low carbon products such as Pozzolana Portland Cement (PPC) and Pozzolana Composite Cement (PCC) having significant footprints across the Western, Eastern and Northern markets of India. Our customers range from Individual House Builders (IHBs) to governments to global construction firms. The total cement production for 2017 was 22.98 MT against the annual capacity of 29.65 million tonnes per annum (MTPA). Our employee strength stood at 5,328. In line with the 2030 SDG targets, Ambuja aims to achieve higher level of economic productivity through diversification, technological upgradation and innovation, with a focus on value-added products and services with sustainable human capital deployment. Nature of Company Ownership Ambuja Cements Limited (ACL) is a public limited company listed on the Bombay Stock Exchange Limited and National Stock Exchange of India Limited. The GDRs issued by the Company are listed on the Luxembourg Stock Exchange. LafargeHolcim Limited, Switzerland, is the majority shareholder. For the detailed shareholding pattern, please see the Annual Report on our website: www.ambujacement.com . Integrated Cement Plants Bulk Cement Terminals 1. Ambujanagar, Taluka Kodinar, District Gir 1. Muldwarka, District Gir Somnath, Gujarat; Somnath, Gujarat; 2. Panvel, District Raigad, Maharashtra; 2. Darlaghat, District Solan, Himachal Pradesh; 3. Kochi, Kerala; 3. Maratha Cement Works, District Chandrapur, 4. Surat, Gujarat; Maharashtra; 5. Mangalore, Karnataka. 4. -

Corporate Overview Statutory Reports Financial Statements

Corporate Overview Statutory Reports Financial Statements Deepak Nitrite Limited | 1 INDEX CORPORATE OVERVIEW On a Golden Pedestal 01 Financial Highlights 03 Building Sustainable Future 04 Our Strength 06 Message from the Founder (Chairman Emeritus) 14 CEO’s Communique (Outgoing CEO) 17 Enhancing Value Brick by Brick 18 From the Desk of Chairman & Managing Director 21 CEO’s Letter 24 CFO’s Communique 27 Board Of Directors 30 Responsive to Challenges with Resilience 34 Building Sustainable Future with Responsible Chemistry 37 Our Team Our Strength 40 Creating Socially Inclusive and Empowered Society 42 Our COVID-19 Initiatives 47 Corporate Information 48 STATUTORY REPORTS Management Discussion and Analysis 50 Notice 66 Directors’ Report 74 Corporate Governance Report 114 FINANCIAL STATEMENTS Standalone Independent Auditor’s Report 135 Balance Sheet 142 Statement of Profit and Loss 143 Cash Flow Statement 144 Statement of Changes in Equity 146 Notes forming part of the Financial Statements 147 Consolidated Independent Auditor’s Report 189 Balance Sheet 196 Statement of Profit and Loss 197 Cash Flow Statement 198 Statement of Changes in Equity 200 Notes forming part of the Financial Statements 201 Forty-Ninth Annual General Meeting Day & Date : Friday, August 7, 2020 Time : 11:30 A.M. Through Video Conferencing/Other Audio Visual Means Cautionary Statement Regarding Forward-Looking Statement This Report may contain certain forward-looking statements relating to the future business, development and economic performance. Such Statements may -

Successful Auctions So Far

Successful Auctions so far: S State Name of the Block Mineral Date of ML / Area Reserves (in Final Preferred Bidder No auction CL (in MT) Bid (in Ha) %) 1 Andhra Gudipadu block Limestone 08.06.2016 ML 40.82 26.66 8.12 Penna Cements Pradesh 2 Andhra Erragudi-Hussainapuram Limestone 26.09.2017 ML 131.57 9.03 10.6 Sree Jayajothi Pradesh –Yanakandla Cements Pvt Ltd 3 Andhra Nandavaram–Venkatapuram Limestone 26.09.2017 ML 24.739 1.66 10.7 Sree Jayajothi Pradesh Cements Pvt Ltd 4 Andhra Chigargunta – Bisanatham Gold 27.07.2018 ML 262.01 2.22 38.25 NMDC Limited Pradesh 5 Andhra Chintalayapalle- Limestone 28.11.2018 ML 417.51 92.24 13.4 Adani Cementation Pradesh Abdullapuram-Korumanipalli Ltd (CAK) 6 Andhra Gorlagutta Limestone 27.05.2021 ML 181.03 61.14 7.25 M/s. Sree Jayajothi Pradesh Cements Private Limited 7 Chhattisgarh Karhi-Chandi Limestone 18.02.2016 ML 242.13 155 58.95 Shree Cement 8 Chhattisgarh Kesla Limestone 19.02.2016 ML 108 67 10.15 Century Cement 9 Chhattisgarh Baghmara Gold 26.02.2016 CL 474.3 2.7 12.55 Vedanta Ltd 10 Chhattisgarh Kesla II Limestone 01.05.2017 ML 357.07 215 96.15 Dalmia (bharat) cement 11 Chhattisgarh Guma Limestone block, Palari Limestone 12.03.2018 ML 249.03 124 138.25 Ultratech Cement 12 Chhattisgarh Mohra (Block A), Limestone 08.09.2020 ML 127.05 56.847 5.45 State Govt to inform Balodabazar, Balodabazar- Bhatapara 13 Chhattisgarh Parsabhadar, Balodabazar, Limestone 08.09.2020 ML 28.461 9.614 34.15 State Govt to inform Balodabazar-Bhatapara 14 Gujarat Mudhvay Sub- block B Limestone 25.05.2017 ML 233.5 301.5