1 Reliance Industries Limited 2 Tata Consultancy Services (TCS)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Indiaghg-Aug15 0.Pdf

The India Greenhouse Gas (GHG) Program is a voluntary, industry-led partnership, focused on building institutional capabilities towards measuring and managing greenhouse gas emissions, based on the GHG Protocol WHO WE ARE The India GHG Program was launched in July 2013 by WRI India, The Energy and Resources Institute (TERI), and the Confederation of Indian Industry (CII), with support from India’s key businesses as founding member companies. Several progressive companies, including automotive, aviation, telecom, cement, chemicals, manufacturing, financial services, information technology, consumer, agri-business, textiles, and others are voluntary members of the Program. The total inventory managed by businesses under the India GHG Program ranges from 300 to 360 million TCO2e. This is equivalent to 15 to 25 percent of India’s total emissions. What climate change challenges does India face? While it is difficult to quantify the expected impact of climate change, a recent orldW Bank study indicates that countries like India will need USD 70 to 100 billion each year through 2050 to meet the current and future climate adaptation needs. However, our current spending is around USD 4.4 billion. The challenges, including water availability, changing rainfall patterns, resilience capabilities, disaster management, and others hold serious implications for communities, businesses, and for the country’s future growth and development. What role can the corporate sector play? Businesses are not only essential for continued economic growth, but they also have an immense opportunity in aiding large-scale reduction of emissions which can help mitigate the impacts of climate change. Approximately 38 percent of India’s greenhouse gas emissions come from energy generation and industrial and commercial users consume about 76 percent of that energy. -

Annual Report 2017-18

Godrej Industries Ltd. www.godrejindustries.com ANNUAL REPORT 2017-18 Contents Board of Directors 02 Corporate Information 04 Chairman’s Statement 06 Financial Highlights 11 Notice & Explanatory Statement 13 Board's Report 27 Report on Corporate Governance 93 Auditor’s Report (Consolidated) 113 Consolidated Accounts 120 Auditor's Report (Standalone) 217 Standalone Accounts 224 Statement Pursuant to Section 129 283 1 BOARD OF DIRECTORS A. B. Godrej Chairman N. B. Godrej Managing Director T. A. Dubash Executive Director & Chief Brand Officer J. N. Godrej V. M. Crishna N. S. Nabar Executive Director & President (Chemicals) K. K. Dastur S. A. Ahmadullah A. B. Choudhury A. D. Cooper K. N. Petigara K. M. Elavia Corporate Information AUDITORS : BSR & Co. LLP, Chartered Accountants BOARD COMMITTEES Audit Committee : K. K. Dastur (Chairman) S. A. Ahmadullah K. N. Petigara A. B. Choudhury Nomination & : S. A. Ahmadullah (Chairman) Compensation Committee A. B. Choudhury K. N. Petigara Stakeholders Relationship/ : A. B. Godrej (Chairman) Shareholders Committee N. B. Godrej T. A. Dubash N. S. Nabar Corporate Social : N. B. Godrej (Chairman) Responsibility Committee: T. A. Dubash K. N. Petigara A. B. Choudhury Risk Management Committee : N. B. Godrej (Chairman) T. A. Dubash N. S. Nabar Management Committee : A. B. Godrej (Chairman) N. B. Godrej A. D. Cooper T. A. Dubash N. S. Nabar CHIEF FINANCIAL OFFICER : Clement Pinto COMPANY SECRETARY : Nilufer Shekhawat REGISTERED OFFICE : Godrej One, Pirojshanagar, Eastern Express Highway, Vikhroli (East), Mumbai 400 079. Phone: 022-2518 8010, 2518 8020, 2518 8030 Fax: 022-2518 8066 website: www.godrejindustries.com CIN No.: L24241MH1988PLC097781 4 REGISTRARS & TRANSFER AGENT : Computech Sharecap Ltd. -

Big Power Trade - Futuros National Stock Exchange of India (NSE)

BiG Power Trade - Futuros National Stock Exchange of India (NSE) País / Região Bolsa Produto Horário Futuros (Moeda, National Stock Exchange of India (NSE) Segunda-feira - Sexta-feira: Acções, Índices de 9:15-15:30 IST* Índia www.nseindia.com acções) IB Simbolo Instrumento Simbolo Moeda ACC ACC LIMITED ACC INR ADANIPOWE ADANI POWER LIMITED ADANIPOWER INR AJANTPHAR AJANTA PHARMA LTD AJANTPHARM INR ALBK ALLAHABAD BANK ALBK INR AMARAJABA AMARA RAJA BATTERIES LTD AMARAJABAT INR AMBUJACEM AMBUJA CEMENTS LIMITED AMBUJACEM INR ANDHRABAN ANDHRA BANK ANDHRABANK INR APOLLOHOS APOLLO HOSPITALS ENTERPRISE APOLLOHOSP INR APOLLOTYR APOLLO TYRES LIMITED APOLLOTYRE INR ARVIND ARVIND LTD ARVIND INR ASHOKLEY ASHOK LEYLAND LIMITED ASHOKLEY INR ASIANPAIN ASIAN PAINTS LTD ASIANPAINT INR AUROPHARM AUROBINDO PHARMA LTD AUROPHARMA INR AXISBANK AXIS BANK LTD AXISBANK INR BAJAJ-AUT BAJAJ AUTO LIMITED BAJAJ-AUTO INR BAJAJFINS BAJAJ FINSERV LTD BAJAJFINSV INR BAJFINANC BAJAJ FINANCE LTD BAJFINANCE INR BALKRISIN BALKRISHNA INDUSTRIES LTD BALKRISIND INR BALRAMCHI BALRAMPUR CHINI MILLS LTD BALRAMCHIN INR BANKBAROD BANK OF BARODA BANKBARODA INR BANKINDIA BANK OF INDIA BANKINDIA INR BANKNIFTY Nifty Bank BANKNIFTY INR BATAINDIA BATA INDIA LTD BATAINDIA INR BEL BHARAT ELECTRONICS LTD BEL INR BEML BEML LIMITED BEML INR BERGEPAIN BERGER PAINTS INDIA LTD BERGEPAINT INR BHARATFIN BHARAT FINANCIAL INCLUSION L BHARATFIN INR BHARATFOR BHARAT FORGE LIMITED BHARATFORG INR BHARTIART BHARTI AIRTEL LIMITED BHARTIARTL INR BHEL BHARAT HEAVY ELECTRICALS BHEL INR BIOCON BIOCON LTD BIOCON -

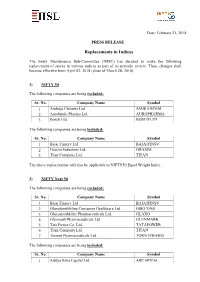

Replacements in Indices

Date: February 21, 2018 PRESS RELEASE Replacements in Indices The Index Maintenance Sub-Committee (IMSC) has decided to make the following replacement of stocks in various indices as part of its periodic review. These changes shall become effective from April 02, 2018 (close of March 28, 2018). 1) NIFTY 50 The following companies are being excluded: Sr. No. Company Name Symbol 1 Ambuja Cements Ltd. AMBUJACEM 2 Aurobindo Pharma Ltd. AUROPHARMA 3 Bosch Ltd. BOSCHLTD The following companies are being included: Sr. No. Company Name Symbol 1 Bajaj Finserv Ltd. BAJAJFINSV 2 Grasim Industries Ltd. GRASIM 3 Titan Company Ltd. TITAN The above replacements will also be applicable to NIFTY50 Equal Weight Index. 2) NIFTY Next 50 The following companies are being excluded: Sr. No. Company Name Symbol 1 Bajaj Finserv Ltd. BAJAJFINSV 2 GlaxoSmithkline Consumer Healthcare Ltd. GSKCONS 3 Glaxosmithkline Pharmaceuticals Ltd. GLAXO 4 Glenmark Pharmaceuticals Ltd. GLENMARK 5 Tata Power Co. Ltd. TATAPOWER 6 Titan Company Ltd. TITAN 7 Torrent Pharmaceuticals Ltd. TORNTPHARM The following companies are being included: Sr. No. Company Name Symbol 1 Aditya Birla Capital Ltd. ABCAPITAL Sr. No. Company Name Symbol 2 Ambuja Cements Ltd. AMBUJACEM 3 Aurobindo Pharma Ltd. AUROPHARMA 4 Bosch Ltd. BOSCHLTD 5 General Insurance Corporation of India GICRE 6 L&T Finance Holdings Ltd. L&TFH 7 SBI Life Insurance Company Ltd. SBILIFE 3) NIFTY 500 The following companies are being excluded: Sr. No. Company Name Symbol 1 Adani Enterprises Ltd. ADANIENT 2 Ahluwalia Contracts (India) Ltd. AHLUCONT 3 Apar Industries Ltd. APARINDS 4 AstraZenca Pharma India Ltd. ASTRAZEN 5 Corporation Bank CORPBANK 6 Dalmia Bharat Ltd. -

Nominee List

NOMINEE LIST Best financial reporting (large cap) Cipla Hindalco Industries Hindustan Unilever Infosys Kotak Mahindra Bank Mahindra & Mahindra Piramal Enterprises Tata Steel Vedanta Best financial reporting (small to mid-cap) CEAT Everest Industries Hikal Hindustan Foods IIFL Holdings KEC International Minda Industries Raymond The Phoenix Mills Zensar Technologies Best investor meetings (large cap) Bharti Airtel Hindustan Unilever Infosys Lupin Mahindra & Mahindra Piramal Enterprises Best investor meetings (mid-cap) Balkrishna Industries IIFL Holdings Mindtree RPG Group Sterlite Technologies The Phoenix Mills NOMINEE LIST Best investor meetings (small cap) Amber Enterprises India Equitas Holdings Greenlam Industries Music Broadcast Navin Fluorine International NOCIL Raymond Zensar Technologies Best investor relations officer (large cap) Bharti Airtel Komal Sharan Bharti Airtel Aparna Vyas Garg Bharti Infratel Surabhi Chandna Cipla Naveen Bansal HDFC Conrad D'Souza Hindustan Unilever Suman Hegde Infosys Sandeep Mahindroo Kotak Mahindra Bank Nimesh Kampani Lupin Arvind Bothra Best investor relations officer (small to mid-cap) CEAT Pulkit Bhandari Jindal Steel & Power Nishant Baranwal Motilal Oswal Financial Services Rakesh Shinde PNB Housing Finance Deepika Gupta Padhi Raymond J Mukund RPG Group Pulkit Bhandari Schneider Electric Infrastructure Vineet Jain The Phoenix Mills Varun Parwal NOMINEE LIST Best investor relations team (large cap) Bharti Airtel Cipla Hindustan Unilever Infosys Kotak Mahindra Bank Larsen & Toubro Infotech Power -

50 KW Offer Solar Copy 2

21st Century Enviro Engineers Pvt.Ltd. Plot No. 120(10 Marla), COMPANY Industrial Area Phase II Chandigarh - 160002, India PROFILE www.21stcenturyenviro.com INTRODUCTION 21st CENTURY ENVIRO ENGINEERS PVT. LTD. is a Company dealing in the field of Environmental Engineering related activities. We are Registered Environmental Consultants of Pollution Control Board to Supply ETP’s, STP’s, APCD’s, Incinerators, Water Treatment Plants, Reverse Osmosis, Evaporators, Solid Waste Management and Rain Water Harvesting and to carry out EIA Studies . The Directors of the company are young Technocrats having versatile experience in this field. We have a back up of highly qualified and experienced technical team having versatile experience in Designing, Erection, Commissioning and Operation of different types of Effluent Treatment Plants. Our Managing Director himself is a Chemical Engineer with almost 25 Years Experience in this line and Technical Director is PhD. in Environmental Science with almost 30 Years working experience on various types of effluent treatment Technologies. Our team comprises of almost 150 people from different backgrounds e.g. Chemical, Environmental, Mechanical, Instrumentation, Civil, Accounts, Purchase, Marketing etc. We have our Marketing/ Design Office in Chandigarh and regional offices in Dhaka, Mumbai, New Delhi, Sikkim etc. and have our own testing Laboratory for Effluent/Water Testing and to study treatability of effluent on pilot scale. We have our own full-fledged manufacturing unit of Pollution Control Equipments in Village Kunjhal Baddi (HP). We also undertake annual operation and maintenance contracts and liasining services for the systems supplied by us. We are also Registered with CREST (Chandigarh Renewable Energy & Technology Promotion Society) and SECI (Solar Energy Corporation of India) for supplying Online/Offline Solar systems in Chandigarh, Himachal Pradesh, Uttarakhand, J&K, Punjab, Haryana, Delhi, Bihar etc. -

Glenmark Pharmaceuticals (GLEPHA)

Glenmark Pharmaceuticals (GLEPHA) CMP: | 483 Target: | 560 (16%) Target Period: 12 months BUY August 17, 2020 Subdued topline; margin expansion to the fore… Revenues stayed flattish growing just 0.9% YoY to | 2345 crore due to subdued growth of 1.6% in US to | 743 crore, 3.7% growth in domestic sales to | 780 crore. Europe business grew 12.8% YoY to | 274 crore. RoW markets de-grew 18.1% YoY to 212 crore. EBITDA margins improved 567 bps YoY to 20.4% mainly due to lower other expenditure. EBITDA grew Particulars 39.8% YoY to | 478 crore. Adjusted PAT grew 106.9% YoY to | 226 crore. P articular Am ount Delta vis-à-vis EBITDA was due to higher other income. Exceptional items in Market Capitalisation | 13615 crore Q1FY21 were | 28 crore on gain arising from sale of Vwash brand to HUL. Debt (FY20) | 4868 crore Result Update Result Cash & equivalent (FY20) | 1111 crore US growth dependent on new launches E V | 17371 crore 52 week H/L (|) 573/168 US generics comprise ~30% of total revenues. So far, the company has E quity capital | 28.2 crore Face value | 1 received approval for 164 ANDAs while another 44 are pending approval, of which 24 are Para IV applications. However, Glenmark’s derma portfolio is Key Highlights facing stiff pricing pressure in the US. Going ahead, traction from the newly commissioned US based Monroe facility will be the key determinant besides Q1FY21 revenues remained flattish sustained product launches. We expect the US to grow at 5.2% CAGR in due to subdued US growth amid FY20-22E to | 3479 crore on the back of new launches. -

First Light 11May-Research

FIRST LIGHT 11 May 2021 Click or tap here to e nter text. RESEARCH TOP PICKS [#3 Meeting of Minds] Automobiles LARGE-CAP IDEAS Gearing up for EV battery technology Company Rating Target DCB Bank | Target: Rs 100 | +10% | ADD Cipla Buy 1,000 Recoveries to improve gradually – upgrade to ADD TCS Buy 3,780 BOB Economics Research | Weekly Wrap Tech Mahindra Buy 1,190 Local restrictions impact economic activity MID-CAP IDEAS Company Rating Target SUMMARY Alkem Labs Buy 3,750 Greenply Industries Buy 195 Automobiles Laurus Labs Buy 540 We hosted Stefan Louis, CEO of Nexcharge – a technology-based JV between Transport Corp Buy 320 Exide Industries and Leclanché of Switzerland – catering to lithium-ion tech in Source: BOBCAPS Research India. The company is eyeing business in the domestic 2W, 3W, bus and telecom segments. Per Stefan, the complex nature of battery technology would warrant DAILY MACRO INDICATORS 2D 1M 12M JVs between auto OEMs and battery manufacturers. He expects the Indian Indicator Current (%) (%) (%) lithium-ion battery industry to grow to Rs 40bn-50bn in four years and US 10Y 1.58 1bps (8bps) 94bps Nexcharge to capture 25% of the market with double-digit margins once local yield (%) India 10Y 6.02 4bps (11bps) (1bps) manufacturing begins. yield (%) USD/INR 73.51 0.3 (0.1) 3.0 Click here for the full report. Brent Crude 68.28 0.3 8.8 131.8 (US$/bbl) Dow 34,778 0.7 4.0 45.7 DCB Bank Shanghai 3,419 (0.7) (1.8) 19.1 DCB Bank’s (DCBB) Q4FY21 PAT of Rs 0.8bn (+13% YoY) beat our estimate Sensex 49,206 0.5 0.0 56.5 India FII 6 May MTD CYTD FYTD on below-expected provisions. -

1St Floor, Akruti Corporate Park, Near GE Garden

NATIONAL COMMODITY CLEARING LIMITED Circular to all Members of the Clearing Corporation Circular No. : NCCL/RISK-001/2020 Date : January 29, 2020 Subject : Approved Securities under Scheme of Deposit – List of Eligible Securities All members are hereby informed that in terms of SEBI circular No. CDMRD/DMP/CIR/P/2018/126 dated September 07, 2018 and further to Clearing Corporation Circular No. NCCL/RISK-036/2019 dated December 27, 2019, the Clearing Corporation has now revised the list of eligible securities to be accepted as collateral with appropriate haircut. The updated list of securities that shall be accepted as collateral along with their respective haircuts is given in Annexure I and Annexure II. Annexure III and Annexure IV contain the changes from the existing list. The new list will be applicable from beginning of trading day February 5, 2020. Members and participants are requested to note the above. For and on behalf of National Commodity Clearing Limited Ruchit Chaturvedi Head – Risk Management For further information / clarifications, please contact 1. Customer Service Group on toll free number: 1800 266 6007 2. Customer Service Group by e-mail to : [email protected] 1 / 16 Registered Office: 1st Floor, Akruti Corporate Park, Near G.E. Garden, LBS Road, Kanjurmarg West, Mumbai 400 078, India. CIN No. U74992MH2006PLC163550 Toll Free: 1800 266 6007, Website: www.nccl.co.in Annexure I – List of Approved Securities with applicable haircut of 15% or VaR, whichever is higher. I. The maximum value of any Security acceptable as collateral shall not exceed INR 35 Crores across all members at any given point in time. -

Ultratech Corporate Dossier August

INDIA'S LARGEST CORPORATE CEMENT DOSSIER COMPANY Stock code: BSE: 532538 NSE: ULTRACEMCO Reuters: UTCL.NS Bloomberg: UTCEM IS / UTCEM LX Contents ADITYA BIRLA OPERATIONAL ECONOMIC INDIAN CEMENT ULTRATECH GROUP- AND FINANCIAL ENVIRONENT SECTOR LANDSCAPE OVERVIEW PERFORMANCE GLOSSARY Mnt – Million Metric tons Lmt – Lakhs Metric tons MTPA – Million Tons Per Annum MW – Mega Watts Q1 – April-June Q4 – January-March CY – Current year period LY – Corresponding Period last Year FY – Financial Year (April-March) ROCE – Return on Average Capital Employed ROIC – Return on Invested Capital 2 Note: The financial figures in this presentation have been rounded off to the nearest ` 1 cr. 1 US$ = ` 64.46 ADITYA BIRLA GROUP - OVERVIEW Aditya Birla Group – Overview Premium global US$ ~41 billion Corporation conglomerate In the League of Fortune 500 Operating in 36 countries with over 50% Group revenues from overseas Anchored by about 120,000 employees from 42 nationalities Ranked No. 1 corporate in the Nielsen’s Corporate Image Monitor FY15 # 1 cement player in India by Capacity A global metal powerhouse – 3rd biggest # 4 largest cement producers globally producers of primary aluminum in Asia (ex China) # 1 in viscose staple fibre in globally # 2 player in viscose filament yarn in India Globally 5th largest producer of acrylic Globally 4th largest producer of insulators fibre A leading player in life insurance and AM Indian Listed Entities Entities Listed Indian # 3 cellular operator in India Top fashion and lifestyle player in India Among top 2 supermarket chains in retail in India Our Values Integrity Commitment Passion Seamlessness Speed 4 UltraTech Cement India’s largest cement company No. -

Hy Sun Missed the Pharma Rally: the Answer Is Hidden in a Bet Many Failed — Speciality Drugs - the Economic Times

12/3/2020 Sun Pharma: Why Sun missed the pharma rally: the answer is hidden in a bet many failed — speciality drugs - The Economic Times Home ETPrime Markets News Industry RISE Politics Wealth MF Tech Jobs Opinion NRI Panache ET NOW More Aayush English Edition | E-Paper Tech Consumer Markets Corporate Governance Telecom + OTT Auto + Aviation Pharma Fintech + BFSI Economy Infra Environment Energy Business News › Prime › Pharma › Why Sun missed the pharma rally: the answer is hidden in a bet many failed — speciality drugs Getty Images MARKETS hy Sun missed the pharma rally: the answer is hidden in a bet many failed — speciality drugs Dilip Shanghvi, founder and managing director, Sun Pharmaceuticals Synopsis Sun Pharma is the only Indian company to have made some inroads into speciality drugs. What worries investors is high investments and uncertainties over ramp up in revenue. The stock can still see upside because of its current valuations, strong India business, and any positive surprises in US generic business. But it is crucial that its speciality bet pays off. BACK TO TOP https://economictimes.indiatimes.com/prime/pharma-and-healthcare/why-sun-missed-the-pharma-rally-the-answer-is-hidden-in-a-bet-many-failed-spe… 1/11 12/3/2020 Sun Pharma: Why Sun missed the pharma rally: the answer is hidden in a bet many failed — speciality drugs - The Economic Times Home ETPrime Markets NeCwasllI nitd uas trbyleRssISiEngP oilniti cdsisWgeuailthse fMoFr tTheceh InJodbisanOpinion NRI Panache ET NOW More pharmaceutical industry. The stocks of pharma companies have been on a tear since the beginning of the Covid-19 crisis. -

Pharmaceutical Cluster in Andhra Pradesh

Pharmaceutical Cluster in Andhra Pradesh Microeconomics of Competitiveness Final Project Harvard Business School Helene Herve | Lhakpa Bhuti | Saurabh Agarwal | Sonny Kushwaha | Akbar Causer May 2013 Table of Contents 1 Executive Summary ............................................................................................................................ 3 2 Introduction to India ........................................................................................................................... 4 2.1 History and Political Climate ....................................................................................................... 5 2.2 Competitive Positioning of India ................................................................................................. 6 2.2.1 Endowments .......................................................................................................................... 6 2.2.2 Economic Performance To-Date and Macroeconomic Policy .............................................. 7 2.2.3 Summary of Export Clusters ................................................................................................. 9 2.2.4 Social Infrastructure and Political Institutions .................................................................... 10 2.2.5 India Diamond .................................................................................................................... 11 3 Andhra Pradesh ................................................................................................................................