Working July 2021.Xlsx

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2017-18

Godrej Industries Ltd. www.godrejindustries.com ANNUAL REPORT 2017-18 Contents Board of Directors 02 Corporate Information 04 Chairman’s Statement 06 Financial Highlights 11 Notice & Explanatory Statement 13 Board's Report 27 Report on Corporate Governance 93 Auditor’s Report (Consolidated) 113 Consolidated Accounts 120 Auditor's Report (Standalone) 217 Standalone Accounts 224 Statement Pursuant to Section 129 283 1 BOARD OF DIRECTORS A. B. Godrej Chairman N. B. Godrej Managing Director T. A. Dubash Executive Director & Chief Brand Officer J. N. Godrej V. M. Crishna N. S. Nabar Executive Director & President (Chemicals) K. K. Dastur S. A. Ahmadullah A. B. Choudhury A. D. Cooper K. N. Petigara K. M. Elavia Corporate Information AUDITORS : BSR & Co. LLP, Chartered Accountants BOARD COMMITTEES Audit Committee : K. K. Dastur (Chairman) S. A. Ahmadullah K. N. Petigara A. B. Choudhury Nomination & : S. A. Ahmadullah (Chairman) Compensation Committee A. B. Choudhury K. N. Petigara Stakeholders Relationship/ : A. B. Godrej (Chairman) Shareholders Committee N. B. Godrej T. A. Dubash N. S. Nabar Corporate Social : N. B. Godrej (Chairman) Responsibility Committee: T. A. Dubash K. N. Petigara A. B. Choudhury Risk Management Committee : N. B. Godrej (Chairman) T. A. Dubash N. S. Nabar Management Committee : A. B. Godrej (Chairman) N. B. Godrej A. D. Cooper T. A. Dubash N. S. Nabar CHIEF FINANCIAL OFFICER : Clement Pinto COMPANY SECRETARY : Nilufer Shekhawat REGISTERED OFFICE : Godrej One, Pirojshanagar, Eastern Express Highway, Vikhroli (East), Mumbai 400 079. Phone: 022-2518 8010, 2518 8020, 2518 8030 Fax: 022-2518 8066 website: www.godrejindustries.com CIN No.: L24241MH1988PLC097781 4 REGISTRARS & TRANSFER AGENT : Computech Sharecap Ltd. -

Big Power Trade - Futuros National Stock Exchange of India (NSE)

BiG Power Trade - Futuros National Stock Exchange of India (NSE) País / Região Bolsa Produto Horário Futuros (Moeda, National Stock Exchange of India (NSE) Segunda-feira - Sexta-feira: Acções, Índices de 9:15-15:30 IST* Índia www.nseindia.com acções) IB Simbolo Instrumento Simbolo Moeda ACC ACC LIMITED ACC INR ADANIPOWE ADANI POWER LIMITED ADANIPOWER INR AJANTPHAR AJANTA PHARMA LTD AJANTPHARM INR ALBK ALLAHABAD BANK ALBK INR AMARAJABA AMARA RAJA BATTERIES LTD AMARAJABAT INR AMBUJACEM AMBUJA CEMENTS LIMITED AMBUJACEM INR ANDHRABAN ANDHRA BANK ANDHRABANK INR APOLLOHOS APOLLO HOSPITALS ENTERPRISE APOLLOHOSP INR APOLLOTYR APOLLO TYRES LIMITED APOLLOTYRE INR ARVIND ARVIND LTD ARVIND INR ASHOKLEY ASHOK LEYLAND LIMITED ASHOKLEY INR ASIANPAIN ASIAN PAINTS LTD ASIANPAINT INR AUROPHARM AUROBINDO PHARMA LTD AUROPHARMA INR AXISBANK AXIS BANK LTD AXISBANK INR BAJAJ-AUT BAJAJ AUTO LIMITED BAJAJ-AUTO INR BAJAJFINS BAJAJ FINSERV LTD BAJAJFINSV INR BAJFINANC BAJAJ FINANCE LTD BAJFINANCE INR BALKRISIN BALKRISHNA INDUSTRIES LTD BALKRISIND INR BALRAMCHI BALRAMPUR CHINI MILLS LTD BALRAMCHIN INR BANKBAROD BANK OF BARODA BANKBARODA INR BANKINDIA BANK OF INDIA BANKINDIA INR BANKNIFTY Nifty Bank BANKNIFTY INR BATAINDIA BATA INDIA LTD BATAINDIA INR BEL BHARAT ELECTRONICS LTD BEL INR BEML BEML LIMITED BEML INR BERGEPAIN BERGER PAINTS INDIA LTD BERGEPAINT INR BHARATFIN BHARAT FINANCIAL INCLUSION L BHARATFIN INR BHARATFOR BHARAT FORGE LIMITED BHARATFORG INR BHARTIART BHARTI AIRTEL LIMITED BHARTIARTL INR BHEL BHARAT HEAVY ELECTRICALS BHEL INR BIOCON BIOCON LTD BIOCON -

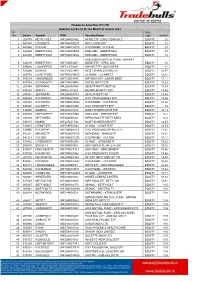

(P) LTD Approve Scrip List for the Month of August 2021 Sr

Tradebulls Securities (P) LTD Approve Scrip List for the Month of August 2021 Sr. Sub No. Series Symbol ISIN Security Name Type Haircut 1 205775 NETFLTGILT INF204KB1882 NI IND ETF LONG TERM GILT EQUITY 12 2 541097 LIQUIDETF INF740KA1EU7 DSP LIQUID ETF EQUITY 12 3 541946 ICICILIQ INF109KC1KT9 ICICIPRAMC - ICICILIQ EQUITY 12 4 542908 EBBETF0423 INF754K01KN4 EDELAMC - EBBETF0423 EQUITY 12 5 542909 EBBETF0430 INF754K01KO2 EDELAMC - EBBETF0430 EQUITY 12 EDELWEISS MUTUAL FUND - BHARAT 6 543216 EBBETF0431 INF754K01LE1 BOND ETF - APRIL 2031 EQUITY 12 7 590096 LIQUIDBEES INF732E01037 NIP IND ETF LIQUID BEES EQUITY 12 8 533385 MON100 INF247L01AP3 MOST SHARES N100 ETF EQUITY 12.57 9 205772 LICNETFGSC INF767K01MV5 LICNAMC - LICNMFET EQUITY 12.91 10 590104 JUNIORBEES INF732E01045 NIP INDIA ETF JUNIOR BEES EQUITY 13.11 11 537708 KOTAKNIFTY INF174K014P6 KOTAK NIFTY ETF EQUITY 13.29 12 203358 SETFNN50 INF200KA1598 SBI-ETF NIFTY NEXT 50 EQUITY 13.33 13 590110 QNIFTY INF082J01028 QUANTUM NIFTY ETF EQUITY 13.45 14 204361 SETFNIF50 INF200KA1FS1 SBI-ETF NIFTY 50 EQUITY 13.48 15 555555 ICICISENSX INF346A01034 ICICI PRUD SENSEX ETF EQUITY 13.53 16 541809 ICICINXT50 INF109KC1NS5 ICICIPRAMC - ICICINXT50 EQUITY 13.96 17 537007 ICICINIFTY INF109K012R6 ICICI PRUD NIFTY ETF EQUITY 14 18 536960 MOM100 INF247L01023 MOST SHARES M100 ETF EQUITY 14.13 19 539516 HDFCNIFETF INF179KC1965 HDFCAMC - HDFCNIFETF EQUITY 14.2 20 590103 NIFTYBEES INF204KB14I2 NIPPO IND ETF NIFTY BEES EQUITY 14.2 21 590115 MOM50 INF247L01536 MOST SHARES M50 ETF EQUITY 14.45 22 539313 UTINIFTETF -

Motilal Oswal Nifty Smallcap 250 Index Fund (MOFSMALLCAP) (An Open Ended Scheme Replicating / Tracking Nifty Smallcap 250 Index)

FACT SHEETth As on 30 April 2021 BUY RIGHT : SIT TIGHT Buying quality companies and riding their growth cycle Motilal Oswal Focused 25 Fund (MOF25) (An open ended equity scheme investing in maximum 25 stocks intending to focus on Large Cap stocks) Investment Objective Performance (As on 30-April-2021) The investment objective of the Scheme is to achieve long term capital appreciation by 1 Year 3 Year 5 Year Since Inception investing in up to 25 companies with long term Current Value Current Value Current Value Current Value sustainable competitive advantage and CAGR of Investment CAGR of Investment CAGR of Investment CAGR of Investment growth potential. However, there can be no (%) of ` 10,000 (%) of ` 10,000 (%) of ` 10,000 (%) of ` 10,000 assurance or guarantee that the investment 38.7 13,865 10.4 13,465 13.9 19,225 14.5 29,354 objective of the Scheme would be achieved. Scheme Nifty 50 TRI (Benchmark) Benchmark 49.9 14,989 12.2 14,135 14.7 19,869 13.3 27,015 Nifty 50 TRI S&P BSE Sensex TRI (Additional Benchmark) 46.3 14,626 12.9 14,377 15.1 20,260 13.6 27,579 Continuous Offer NAV (`) Per Unit 21.1712 21.8001 15.2688 10.0000 Minimum Application Amount : ` 500/- and in (29.3541 : as on 30-Apr-2021) multiples of `1 /- thereafter. Date of inception: 13-May-13. = Incase, the start/end date of the concerned period is non business date (NBD), the NAV of the previous date is considered for Additional Application Amount : ` 500/- and in computation of returns. -

Media Release

| INDUSTRIES Media Release Mumbai, May 30, 2011 Consolidated Total Income for FY 2010-11 at ` 4602 crore up by 24% Consolidated PBDIT for FY 2010-11 at ` 466 crore up by 34% Consolidated PBT for FY 2010-11 at ` 323 crore up by 52% Consolidated Net Profit for FY 2010-11 at ` 293 crore up by 44% Board of Directors recommend 175% final dividend Godrej Industries Limited today reported its financial performance for Q4 & FY 2010-2011. Highlights of the financial results for Q4 & FY 2010-11: ` Cr. Q4 Q4 % FY FY % FY 2011 FY 2010 increase 2011 2010 increase Total Income 1431 1099 30% 4602 3716 24% PBDIT 175 123 42% 466 347 34% PBT 134 96 39% 323 213 52% Net Profit 109 76 43% 293 203 44% EPS (`) (annualised) 13.7 9.6 43% 9.2 6.4 44% Final Dividend proposed for FY 2010-11, subject to shareholders’ approval, is ` 1.75 per equity share of ` 1/- each (previous year ` 1.50 per equity share of ` 1/- each). HIGHLIGHTS OF PERFORMANCE (Q4 FY 2010-11) • Total Income increased by 30% to ` 1431 crore. • PBDIT higher by 42% to ` 175 crore. • Profit Before Tax up by 39% to ` 134 crore. • Net Profit increased by 43% to ` 109 crore. CHAIRMAN’S COMMENTS Commenting on the performance for Q4 & FY 2010-11, Mr. A. B. Godrej, Chairman, Godrej Industries Limited, said: “It gives me great pleasure to announce that it has been an excellent year for all our operating businesses thereby reinforcing the efficacy of our business model, our vision and values, and ‘CREATE’, our strategy for growth. -

NIFTY Bank Index Comprises of the Most Liquid and Large Indian Banking Stocks

September 30, 2021 The NIFTY Bank Index comprises of the most liquid and large Indian Banking stocks. It provides investors and market intermediaries a benchmark that captures the capital market performance of the Indian banks. The Index comprises of maximum 12 companies listed on National Stock Exchange of India (NSE). NIFTY Bank Index is computed using free float market capitalization method. NIFTY Bank Index can be used for a variety of purposes such as benchmarking fund portfolios, launching of index funds, ETFs and structured products. Index Variant: NIFTY Bank Total Returns Index. Portfolio Characteristics Index Since Methodology Periodic Capped Free Float QTD YTD 1 Year 5 Years Returns (%) Inception No. of Constituents 12 Price Return 7.63 19.71 74.46 14.18 18.11 Launch Date September 15, 2003 Total Return 7.76 20.13 75.09 14.60 19.75 Base Date January 01, 2000 Since Statistics ## 1 Year 5 Years Base Value 1000 Inception Calculation Frequency Real-Time Std. Deviation * 24.94 25.19 29.89 Index Rebalancing Semi-Annually Beta (NIFTY 50) 1.40 1.24 1.09 Correlation (NIFTY 50) 0.86 0.90 0.83 1 Year Performance Comparison of Sector Indices Fundamentals P/E P/B Dividend Yield 24.32 2.81 0.33 Top constituents by weightage Company’s Name Weight(%) HDFC Bank Ltd. 28.02 ICICI Bank Ltd. 20.92 State Bank of India 13.03 Kotak Mahindra Bank Ltd. 12.67 Axis Bank Ltd. 12.36 IndusInd Bank Ltd. 5.30 AU Small Finance Bank Ltd. 2.01 Bandhan Bank Ltd. -

NTDOP Strategy December 2018 Update

NTDOP Strategy December 2018 Update Investment Objective Top 10 Holding & Top 5 Sectors The Strategy aims to deliver superior returns by investing in stocks Scrip Names % Holdings from sectors that can benefit from the Next Trillion Dollar GDP growth by focusing on different Multicap stocks Kotak Mahindra Bank Ltd. 11.10 Page Industries Ltd. 10.17 Performance Voltas Ltd. 8.87 Bajaj Finance Ltd. 5.33 5.63X Eicher Motors Ltd. 5.26 65 NTDOP Strategy Nifty 500 City Union Bank Ltd. 4.99 55 L&T Technology Services Ltd. 4.38 45 Bosch Ltd. 4.27 35 Max Financial Services Ltd. 3.97 25 Godrej Industries Ltd. 3.89 15 1.79X Sectors % Allocation 5 Banking & Finance 30.21 -5 FMCG 17.98 Jul-12 Jul-17 Jan-10 Jan-15 Jun-10 Jun-15 Oct-08 Oct-13 Oct-18 Apr-11 Apr-16 Sep-11 Feb-12 Sep-16 Feb-17 Dec-07 Dec-12 Dec-17 Aug-09 Aug-14 Nov-10 Nov-15 Mar-09 Mar-14 May-13 May-18 May-08 Auto & Auto Ancillaries 13.11 Diversified 12.76 29.54 Infotech 8.05 NTDOP Strategy Nifty 500 26.72 26.64 Cash 0.14 17.02 15.53 16.42 15.84 13.01 13.43 13.81 13.26 10.86 Market Capitalization 7.12 5.45 Market Capitalization % Equity 1 year 2 Year 3 Years 4 Years 5 Years 7 Years 10 years Since Large cap 43 -3.00 -0.50 Inception Midcap 51 Smallcap 6 Weighted Average Market Cap (Rs. -

20200331001 NIFTY 100 Fund

Get the Top 100 on your side. AXIS NIFTY 100 INDEX FUND An open-ended index fund tracking the NIFTY 100 Index December 2020 About the Fund • Nifty 50 is typically used as a large Performance (NAV Movement) 31st December 2020 cap substitute consisting of large bluechip companies. Axis Nifty 100 Index Fund - Regular Plan - Growth Option ` 11,920 • However, Nifty Next 50 Index also NIFTY 100 Index TRI offers attractive opportunities as there are many well-established and mature companies. 18th October 2019 • Nifty 100 essentially captures the entire large cap universe in the `12,074 market. ` 10,000 Achieving Investor Objectives with an Index Fund 1 Year 3 Years@ 5 Years@@ Since Inception Index Funds have relatively Current Current Current Current lower expenses than actively Value of Value of Value of Value of Lower Expenses CAGR CAGR CAGR CAGR managed funds. (%) Investment (%) Investment (%) Investment (%) Investment of of of of ` 10,000/- ` 10,000/- ` 10,000/- ` 10,000/- Axis Nifty 100 Index Fund - NIFTY 100 represents top 100 14.90% 11,495 NA NA NA NA 15.68% 11,920 Consistent Style Regular Plan - Growth Option companies based on full market capitalisation from NIFTY 500. NIFTY 100 Index TRI (Benchmark) 16.03% 11,608 NA NA NA NA 16.92% 12,074 Nifty 100 Index consist of Nifty 50 TRI (Additional Benchmark) 16.09% 11,614 NA NA NA NA 17.37% 12,130 Diversification 100 companies spread across 16 Industries. Past performance may or may not be sustained in future. Since inception ( 18th October 2019).The performance data for 3 & 5 years period has not been provided, since scheme is in existence for less than 3 years. -

Mirae Asset Nifty Next 50 Etf

MIRAE ASSET NIFTY NEXT 50 ETF Mirae Asset Investment Managers MIRAE ASSET NIFTY NEXT 50 ETF (An open ended scheme replicating/tracking Nifty Next 50 Index) NIFTY Next 50: Profile Parameter NIFTY 50 NIFTY Next 50 NIFTY Midcap 150 Segment Large Cap Mid Cap Companies ranked from 101 Criteria Top 50 stocks by M-Cap Remaining 50 Stocks to 250 based on full MCap Constituents 50 50 150 Avg. MCap 1,84,085 46,234 15,498 Avg. MCap (Top 25) 2,99,812 54,824 22,544 Avg. MCap (Next 25) 68,357 37,643 18,164 Reliance (13.24) Adani Green (4.41) Apollo Hospital (2.18) HDFC Bank (10.25) Avenue Supermart (4.39) PI Industries (1.89) Top 5 Stocks Infosys (7.74) Tata Consumer (3.89) Zee Entertainment (1.84) (% Weight) HDFC (6.87) Dabur India(3.81) Jubilant Foodworks (1.78) ICICI General Insurance (3 TCS (5.58) Voltas (1.75) .55) NIFTY Next 50 portfolio aims to captures the essence of large caps and midcaps Source: NSE, Oct 30, 2020. The sector(s)/stock(s)/issuer(s) mentioned in this presentation do not constitute any research report/recommendation of the same. 2 Mirae Asset Mutual Fund NIFTY Next 50: Sector distribution 36% 29% OTHER FINANCIAL 5.4% SERVICES 19% 17% 15% 14% 6.8% 12% NBFC 10% 2.4% 6% 6% 7% 4% 5% 6% 4% 3% 2.4% 2% 2% 3% INSURANCE 1% 1.5% PHARMA IT Others AUTOMOBILE CONSUMER GOODS CONSUMER FINANCIAL SERVICES FINANCIAL SERVICES POWER CEMENT & CEMENT & CEMENT CEMENT OIL & GAS & OIL HOUSING PRODUCTS FINANCE 6.9% FINANCIAL 1.3% INSTITUTION 3.2% NIFTY 50 NIFTY Next 50 BANKS 24.7% 0.0% 10.0% 20.0% 30.0% NIFTY Next 50 portfolio is more diversified as compared to NIFTY 50 Source: NSE, as on Oct 30, 2020. -

Approved Securities List July 2021

Approved Securities List July 2021 Scrip Name ISIN Mindspace Business Parks REIT INE0CCU25019 Max Healthcare Institute Limited INE027H01010 Happiest Minds Technologies Limited INE419U01012 Route Mobile Limited INE450U01017 Computer Age Management Services Limited INE596I01012 Chemcon Speciality Chemicals Limited INE03YM01018 Kotak Mahindra MF - Kotak NV 20 ETF - DP INF174K01Z71 DSP BlackRock Liquid ETF (Daily Dividend INF740KA1EU7 ICICI Prudential Bank ETF INF109KC1E27 Sundaram Finance Holdings Limited INE202Z01029 ABB India Ltd INE117A01022 Amara Raja Batteries Ltd INE885A01032 Hdfc Ltd INE001A01036 Bombay Dyeing & Manu. Company Ltd INE032A01023 Atul Ltd INE100A01010 Force Motors Ltd INE451A01017 Bajaj Finance Ltd INE296A01024 Banco Products India Ltd INE213C01025 Century Textiles & Industries Ltd INE055A01016 Bannari Amman Sugars Ltd INE459A01010 BASF India Ltd INE373A01013 Bata India Ltd INE176A01028 BEML Limited INE258A01016 Bharat Electronics Ltd INE263A01024 Blue Star Ltd INE472A01039 CESC Ltd INE486A01013 Exide Industries Ltd INE302A01020 Cipla Ltd INE059A01026 DIC INDIA LTD INE303A01010 Dabur India Ltd INE016A01026 Bharat Heavy Electricals Ltd INE257A01026 Hindustan Petroleum Corporation Ltd INE094A01015 IFCI Ltd INE039A01010 Mahanagar Telephone Nigam Ltd INE153A01019 Mangalore Refinery & Petrochemicals Ltd INE103A01014 Chennai Petroleum Corporation Ltd INE178A01016 State Bank of India INE062A01020 Steel Authority of India Limited INE114A01011 Titan Company Ltd INE280A01028 IDBI Bank Limited INE008A01015 Dr Reddys Laboratories -

Sensex, Nifty at Lifetime Highs, Rally to Continue

TUESDAY • AUGUST 31, 2021 CHENNAI ₹10 • Pages 10 • Volume 28 • Number 242 DATA FOCUS ONE DISTRICT ONE PRODUCT SCHEME 5G ROLLOUT Venture capital, debt funding surpass Dedicated team set up to identify products Airtel intends to roll out 5G network 2019 levels as pentup economic from 739 districts and devise plan for in key cities at the earliest, says activity and recovery chip in p2 export promotion p3 Chairman Sunil Bharti Mittal p7 Bengaluru Chennai Coimbatore Hubballi Hyderabad Kochi Kolkata Madurai Malappuram Mangaluru Mumbai Noida Thiruvananthapuram Tiruchirapalli Tirupati Vijayawada Visakhapatnam Regd. TN/ARD/14/2012-2014, RNI No. 55320/94 Powell effect: Sensex, Nifty at Malaysia lockdown may dent upcoming festival auto sales lifetime highs, rally to continue tain parts. We are also trying to Adds to the woes find out availability from the Sensex nears 57k, rupee gains 40 paise cent trading takes place in it. of OEMs that are stockists and directly purchas So, when it falls, it simply ing them at a higher price,” on Fed’s dovish stance; midcaps revive means that investors are buy already facing severe Chandra said. ing assets and hence pushing chip shortage According to Shashank OUR BUREAU prices and stock prices. Mar up its price. In India, the trend Srivastava, Senior Executive Dir Mumbai, August 30 kets are likely to remain posit has been that IT stocks rise S RONENDRA SINGH ector (Marketing & Sales), Amid the perception that ive and rising for the next one when the dollar rises since New Delhi, August 30 Maruti Suzuki India (MSIL), the stock market valuations were year at least. -

Company Reliance Industries Limited Tata Consultancy Services

Top 1000 Private Sector Companies (Rank-wise List) Company Reliance Industries Limited Tata Consultancy Services (TCS) Infosys Technologies Ltd Wipro Limited Bharti Tele-Ventures Limited ITC Limited Hindustan Lever Limited ICICI Bank Limited Housing Development Finance Corp. Ltd. TATA Steel Limited Ranbaxy Laboratories Limited HDFC Bank Ltd Tata Motors Limited Larsen & Toubro Limited (L&T) Satyam Computer Services Ltd. Maruti Udyog Limited Bajaj Auto Ltd. HCL Technologies Ltd. Hero Honda Motors Limited Hindalco Industries Ltd Reliance Energy Limited Grasim Industries Limited Jet Airways (India) Ltd. Sun Pharmaceuticals Industries Ltd Cipla Ltd. Gujarat Ambuja Cements Ltd. Videsh Sanchar Nigam Limited The Tata Power Company Limited Sterlite Industries (India) Ltd. Associated Cement Companies Ltd. Nestlé India Ltd. Hindustan Zinc Limited GlaxoSmithKline Pharmaceuticals Limited Siemens India Ltd. Motor Industries Company Limited Mahindra & Mahindra Limited UTI Bank Ltd. Zee Telefilms Limited Bharat Forge Limited ABB Limited i-Flex Solutions Ltd. Dr. Reddy's Laboratories Ltd. Nicholas Piramal India Limited Kotak Mahindra Bank Limited Reliance Capital Ltd. Ultra Tech Cement Ltd. Patni Computer Systems Ltd. Wockhardt Limited Indian Petrochemicals Corporation Limited Biocon India Limited Essar Oil Limited. Asian Paints Ltd. Dabur India Limited Jaiprakash Associates Limited JSW Steel Limited Tata Chemicals Limited Tata Tea Limited Tata Teleservices (Maharashtra) Limited The Indian Hotels Co. Ltd. Glenmark Pharmaceuticals Limited NIRMA Limited Jindal Steel & Power Ltd HCL Infosystems Ltd. Cadila Healthcare Limited Colgate-Palmolive (India) Limited The Great Eastern Shipping Company Limited Aventis Pharma India Ltd Ashok Leyland Limited Pantaloon Retail (India) Limited Indian Rayon And Industries Limited Financial Technologies (India) Ltd United Phosphorus Limited Matrix Laboratories Limited Sesa Goa Limited Lupin Ltd Cummins India Limited Crompton Greaves Limited.