Delhaize Group and Ahold Reach Agreements with Buyers to Divest 86 U.S

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lidl Expanding to New York with Best Market Purchase

INSIDE TAKING THIS ISSUE STOCK by Jeff Metzger At Capital Markets Day, Ahold Delhaize Reveals Post-Merger Growth Platform Krasdale Celebrates “The merger and integration of Ahold and Delhaize Group have created a 110th At NYC’s Museum strong and efficient platform for growth, while maintaining strong business per- Of Natural History formance and building a culture of success. In an industry that’s undergoing 12 rapid change, fueled by shifting customer behavior and preferences, we will focus on growth by investing in our stores, omnichannel offering and techno- logical capabilities which will enrich the customer experience and increase efficiencies. Ultimately, this will drive growth by making everyday shopping easier, fresher and healthier for our customers.” Those were the words of Ahold Delhaize president and CEO Frans Muller to the investment and business community delivered at the company’s “Leading Wawa’s Mike Sherlock WWW.BEST-MET.COM Together” themed Capital Markets Day held at the Citi Executive Conference Among Those Inducted 20 In SJU ‘Hall Of Honor’ Vol. 74 No. 11 BROKERS ISSUE November 2018 See TAKING STOCK on page 6 Discounter To Convert 27 Stores Next Year Lidl Expanding To New York With Best Market Purchase Lidl, which has struggled since anteed employment opportunities high quality and huge savings for it entered the U.S. 17 months ago, with Lidl following the transition. more shoppers.” is expanding its footprint after an- Team members will be welcomed Fieber, a 10-year Lidl veteran, nouncing it has signed an agree- into positions with Lidl that offer became U.S. CEO in May, replac- ment to acquire 27 Best Market wages and benefits that are equal ing Brendan Proctor who led the AHOLD DELHAIZE HELD ITS CAPITAL MARKETS DAY AT THE CITIBANK Con- stores in New York (26 stores – to or better than what they cur- company’s U.S. -

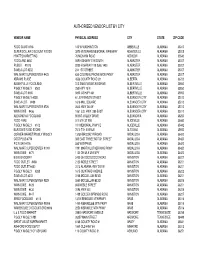

Agtnum Agent Name Agent Address Agent City

AGTNUM AGENT_NAME AGENT_ADDRESS AGENT_CITY STATE ZIP 10175 FIDDLE STIX 6501 GLENWOOD AVE RALEIGH NC 27612 12983 BILL PAYMENT CENTER 215 W MARTIN ST RALEIGH NC 27601 13497 FOOD LION #253 570 RIVERBEND DR CHARLOTTESVILLE VA 22911 13498 FOOD LION #484 501 EAST MAIN ST LOUISA VA 23093 13499 FOOD LION #864 1740 TIMBERWOOD BLVD CHARLOTTESVILLE VA 22911 13501 FOOD LION #870 15105 PATRICK HENRY HWY AMELIA COURT HOUSE VA 23002 13502 FOOD LION #940 136 CEDAR GROVE RD RUCKERSVILLE VA 22968 13504 FOOD LION #959 264 TURKEYSAG TRL PALMYRA VA 22963 13506 FOOD LION #1186 585 BRANCHLANDS BLVD CHARLOTTESVILLE VA 22901 13507 FOOD LION #1298 408 W GORDON AVE GORDONSVILLE VA 22942 13508 FOOD LION #1361 2105 ACADEMY RD POWHATAN VA 23139 13509 FOOD LION #1402 577 MADISON RD ORANGE VA 22960 13510 FOOD LION #1531 85 CALOHILL DR LOVINGSTON VA 22949 13511 FOOD LION #1536 32 MILL CREEK DR CHARLOTTESVILLE VA 22902 13515 FOOD LION #1576 38 S CONSTITUTION RD DILLWYN VA 23936 13516 FOOD LION #2567 46 MADISON PLAZA DR MADISON VA 22727 13519 FOOD LION #297 9157 STAPLES MILL RD RICHMOND VA 23228 13524 FOOD LION #299 11130 HULL STREET RD MIDLOTHIAN VA 23112 13529 FOOD LION #478 8201 HULL STREET RD RICHMOND VA 23235 13531 FOOD LION #514 1288 CONCORD AVE RICHMOND VA 23228 13532 FOOD LION #545 11 DUNLOP VLG COLONIAL HEIGHTS VA 23834 13533 FOOD LION #601 3089 MECHANICSVILLE TPKE RICHMOND VA 23223 13538 FOOD LION #620 15702 JEFFERSON DAVIS HW COLONIAL HEIGHTS VA 23834 13540 FOOD LION #623 8006 BUFORD CT RICHMOND VA 23235 13541 FOOD LION #628 9502 CHAMBERLAYNE RD MECHANICSVILLE -

ECRM Ad Comparisons the LEADING PROVIDER of PROMOTIONAL DATA and BUSINESS INTELLIGENCE St

ECRM Ad Comparisons THE LEADING PROVIDER OF PROMOTIONAL DATA AND BUSINESS INTELLIGENCE St. Patrick’s Day Promotional Review 2013 versus 2014 Confidential and Proprietary to ECRM 1 METHODOLOGY Effective Ad Count Used in Study: Effective Ad Count gives partial credit to any product that shares an ad block with other products in order to provide more context in promotional analysis. For example: If 4 products are present in an ad block each will only receive a .25 count for that particular promotion. If 3 products are present each one receives .33 count. Time Periods: Current Year: 2/16/2014 - 3/22/2014 Prior Year: 2/17/2013 - 3/23/2013 Retailers Used in Representative Market Review: A & P, Albertson's - SoCal (SVU), Albertsons SOC, CVS, Dollar General, Family Dollar, Food Lion, Giant Eagle, Giant Food Landover, H.E.B., Jewel-Osco (NAI), Jewel-Osco (SVU), Kmart, Kroger CIN, Meijer, Rite Aid, Safeway Stores, Stater Bros, Super 1 Foods, Target Stores, Walgreens, Walmart-US, Winn Dixie. Representative Markets Used. Retailers Used in Promoted Price Study: Chicago Market Retailers: CVS, Dominick's Finer Foods, Food 4 Less, Meijer, Strack & Van Til, Target Stores, Ultra Foods. Media Type: Circular Promotions. Sampling Methodology: A typical basket of St. Patrick’s Day items was developed using the following categories: Beef, Cheese, Cheese Chunk/Block, Cordial, Deli Beef/Roast Beef, Deli Cheese, Dry Potatoes, Fingerling Potatoes, Fresh Cut Flowers, Grated Cheese, Imported Beer, Irish Whiskey, Other Vegetables, Petite Potatoes, Potato Chips, Red Potatoes, Russet Potatoes, Specialty Cheeses, White Potatoes, Yellow Potatoes and Bakery In-Store. The basket was used to identify pages containing St. -

Alabama Vendor List.Xlsx

AUTHORIZED VENDOR LIST BY CITY VENDOR NAME PHYSICAL ADDRESS CITY STATE ZIP CODE FOOD GIANT #716 100 W WASHINGTON ABBEVILLE ALABAMA 36310 SUPER DOLLAR DISCOUNT FOODS 3970 VETERANS MEMORIAL PARKWAY ADAMSVILLE ALABAMA 35005 HYATT'S MARKET INC 70 MCHANN ROAD ADDISON ALABAMA 35540 FOODLAND #450 509 HIGHWAY 119 SOUTH ALABASTER ALABAMA 35007 PUBLIX #1073 9200 HIGHWAY 119 Suite 1400 ALABASTER ALABAMA 35007 SAVE-A-LOT #202 244 1ST STREET ALABASTER ALABAMA 35007 WAL MART SUPERCENTER #423 630 COLONIAL PROMENADE PKWY ALABASTER ALABAMA 35007 ABRAMS PLACE 4556 COUNTY ROAD 29 ALBERTA ALABAMA 36720 ALBERTVILLE FOODLAND 313 SAND MOUNTAIN DRIVE ALBERTVILLE ALABAMA 35950 PIGGLY WIGGLY #500 250 HWY 75 N ALBERTVILLE ALABAMA 35950 SAVE-A-LOT #165 5850 US HWY 431 ALBERTVILLE ALABAMA 35950 PIGGLY WIGGLY #238 61 JEFFERSON STREET ALEXANDER CITY ALABAMA 35010 SAVE-A-LOT #489 1616 MILL SQUARE ALEXANDER CITY ALABAMA 35010 WAL MART SUPERCENTER #726 2643 HWY 280 W ALEXANDER CITY ALABAMA 35010 WINN DIXIE #456 1061 U.S. HWY. 280 EAST ALEXANDER CITY ALABAMA 35010 ALEXANDRIA FOODLAND 85 BIG VALLEY DRIVE ALEXANDRIA ALABAMA 36250 FOOD FARE 517 5TH ST NW ALICEVILLE ALABAMA 35442 PIGGLY WIGGLY #102 101 MEMORIAL PKWY E ALICEVILLE ALABAMA 35442 BURTON'S FOOD STORE 7010 7TH AVENUE ALTOONA ALABAMA 35952 CORNER MARKET/PIGGLY WIGGLY 13759 BROOKLYN ROAD ANDALUSIA ALABAMA 36420 COST PLUS #774 305 EAST THREE NOTCH STREET ANDALUSIA ALABAMA 36420 PIC N SAV #776 550 W BYPASS ANDALUSIA ALABAMA 36420 WAL MART SUPERCENTER #1091 1991 MARTIN LUTHER KING PKWY ANDALUSIA ALABAMA 36420 WINN DIXIE -

ANALYSIS of AGREEMENT CONTAINING CONSENT ORDERS to AID PUBLIC COMMENT in the Matter of Koninklijke Ahold N.V./Safeway Inc., File No

ANALYSIS OF AGREEMENT CONTAINING CONSENT ORDERS TO AID PUBLIC COMMENT In the Matter of Koninklijke Ahold N.V./Safeway Inc., File No. 121-0055, Docket No. I. Introduction and Background The Federal Trade Commission (“Commission”) has accepted for public comment, and subject to final approval, an Agreement Containing Consent Orders (“Consent Agreement”) from Koninklijke Ahold N.V. (“Ahold”), its subsidiary, Giant Food Stores, LLC (“Giant”), Safeway Inc. (“Safeway”), and its subsidiary (“Genuardi’s”) (collectively “Respondents”), that is designed to remedy the anticompetitive effects that otherwise would result from Ahold’s acquisition of certain Genuardi’s supermarkets owned by Safeway. The proposed Consent Agreement requires divestiture of the Genuardi’s supermarket in Newtown, Pennsylvania, and its related assets to a Commission-approved purchaser. The proposed Consent Agreement also requires Ahold and Safeway to divest all related assets and real property necessary to ensure the buyer of the divested supermarket will be able to quickly and fully replicate the competition that would have been eliminated by the acquisition. The proposed Consent Agreement has been placed on the public record for 30 days to solicit comments from interested persons. Comments received during this period will become part of the public record. After 30 days, the Commission again will review the proposed Consent Agreement and comments received, and decide whether it should withdraw the Consent Agreement, modify it, or make it final without modification. On January 4, 2012, Ahold and Safeway executed an agreement whereby Ahold would acquire 16 of the Genuardi’s supermarkets from Safeway. The Commission’s Complaint alleges that the proposed acquisition, if consummated, would violate Section 7 of the Clayton Act, as amended, 15 U.S.C. -

Supermarkets & Grocery Stores in the US

WWW.IBISWORLD.COM Supermarkets & Grocery Stores in the US April 2019 1 Shop smart: Increasing premium brand sales and healthy eating trends will spur growth This report was provided to Illinois SBDC (2133312863) by IBISWorld on 28 June 2019 in accordance with their license agreement with IBISWorld IBISWorld Industry Report 44511 Supermarkets & Grocery Stores in the US April 2019 Darshan Kalyani 2 About this Industry 18 International Trade 31 Whole Foods Market Inc. 2 Industry Definition 19 Business Locations 31 Wakefern Food Corporation 2 Main Activities 32 Walmart Inc. 2 Similar Industries 21 Competitive Landscape 3 Additional Resources 21 Market Share Concentration 33 Operating Conditions 21 Key Success Factors 33 Capital Intensity 4 Industry at a Glance 22 Cost Structure Benchmarks 34 Technology and Systems 23 Basis of Competition 35 Revenue Volatility 5 Industry Performance 24 Barriers to Entry 35 Regulation and Policy 5 Executive Summary 25 Industry Globalization 36 Industry Assistance 5 Key External Drivers 7 Current Performance 26 Major Companies 37 Key Statistics 9 Industry Outlook 26 The Kroger Co. 37 Industry Data 12 Industry Life Cycle 27 Albertsons Companies LLC 37 Annual Change 28 Publix Super Markets Inc. 37 Key Ratios 14 Products and Markets 29 Ahold Delhaize 38 Industry Financial Ratios 14 Supply Chain 30 HEB Grocery Company LP 14 Products and Services 30 Meijer Inc. 39 Jargon & Glossary 16 Demand Determinants 30 ALDI US 17 Major Markets 31 Trader Joe’s www.ibisworld.com | 1-800-330-3772 | [email protected] WWW.IBISWORLD.COM Supermarkets & Grocery Stores in the US April 2019 2 About this Industry Industry Definition The Supermarkets and Grocery Stores fresh and prepared meats, poultry and industry makes up the largest food retail seafood, canned and frozen foods, fresh channel in the United States. -

Supermarkets, Eager to Grow, Set Sights on Northern Virginia Page 1 of 4

washingtonpost.com: Supermarkets, Eager to Grow, Set Sights on Northern Virginia Page 1 of 4 washingtonpost.com CORRECTION TO THIS ARTICLE A Jan. 3 Washington Business article incorrectly said that Wegmans Food Markets Inc. will open its second Washington area store in Fairfax City. The store will be in Fairfax County. Supermarkets, Eager to Grow, Set Sights on Northern Virginia By Michael Barbaro Washington Post Staff Writer Monday, January 3, 2005; Page E01 Get ready for a food fight in Northern Virginia. Over the next year, Harris Teeter will open three supermarkets -- all of them in Loudoun County. Safeway will open stores in Fairfax City, Herndon and Mount Vernon, but just one in Maryland. And Wegmans, which built its first Washington area store in Sterling, will open another one in Fairfax City. This year, the region's supermarket chains will focus their already fierce battle for customers on the Virginia suburbs, lured by its rapid population growth, high incomes and -- compared with other parts of the region -- available land. "It is no secret that grocers are targeting Northern Virginia over suburban Maryland," said Gregory H. Leisch, chief executive of Delta Associates, an Alexandria-based real estate research firm. "That is where the greatest growth is right now." The rest of the region won't be completely left out. There are to be a smattering of new stores this year in Maryland and the District -- including a long-promised Giant Food in the city's Columbia Heights neighborhood -- and the chains hint at more to come. Harris Teeter Inc., which operates six stores in the area, has signed leases for 10 new stores, eight of them in Northern Virginia, spokeswoman Jennifer Panetta said. -

Center for Food and Agricultural Business CAB CS 11.4

Center for Food and Agricultural Business CAB CS 11.4 Giant Pursues Ukrop’s Introduction Rick Herring grimaced at the irony. For all his years in the retailing business, Herring had longed to take charge of repositioning another company. But he now realized the wry truth to the old adage “be careful what you wish for.” Herring was the president of Giant Food Stores, a division of the multinational Dutch retailer Royal Ahold, and had been a key part of the team charged with making a recommendation to the parent company on the potential acquisition of Ukrop’s, a chain of high-end supermarkets in Richmond, Va. Ukrop’s was a family owned company that, for generations, had been regarded by consumers as an integral part of the Richmond community. It boasted one of the strongest levels of consumer brand image of any supermarket company in the United States and was particularly regarded for its high level of customer service and the quality of its fresh foods. But sales and profit performance had recently weakened, and industry speculation suggested that a sale was possible. After an unprecedented amount of due diligence and exhausting negotiations, Herring’s team turned in a positive recommendation to make an offer. On December 17, 2009, Herring was present to witness the signing over of Ukrop’s to Royal Ahold as the newest group of stores to join Giant Foods. However, he was barely able to savor the moment. A large question loomed in front of him: Could Ukrop’s, a high-touch, high-quality company, actually fit into Giant, whose business model was based on the supply chain efficiencies and low prices associated with a global chain store operation? He knew he faced the challenge of his career. -

Ahold-Dossier-2012-10-23.Pdf

contents SECTION 1. AHOLD DOCUMENTS Document #1 Giant/Martin's Management 10/15/2012 Leaflet to Giant/Martin's Employees in Pennsylvania Document #2 Giant/Martin's Management NO DATE New Associate Union Philosophy Document #3 Giant/Martin's Management NO DATE Produce Manager Training Program Document #4 American Sales Company Management NO DATE American Sales Company Handbook - Mission Statement Document #5 American Sales Company Management NO DATE American Sales Company Handbook - Direct Dealing Document #6 Lynn Blasio (Site Director at American 7/13/2012 Letter to American Sales Company Employees in Sales Company) Lancaster, New York Document #7 American Sales Company Management NO DATE “Direct Dealing” Policy at American Sales Company Document #8 Giant/Martin’s Management 6/27/2012 Letter to Giant/Martin’s Employees in Pennsylvania Document #9 Giant/Martin's Management 3/30/2012 Leaflet to Giant/Martin's Employees in Richmond, Virginia Document #10 Rick Herring (President of Giant/Martin's) 3/12/2012 Letter to Giant/Martin's Employees in Richmond, Virginia Document #11 Ahold 3/6/2012 2011 Corporate Responsibility Report Document #12 Giant/Martin's Management 3/2/2012 Poster in Glen Allen, Virginia Store Document #13 Rick Herring (President of Giant/Martin's) 10/20/2011 Letter to Giant/Martin's Employees in Pennsylvania and Virginia Document #14 Giant/Martin's Management 10/6/2011 Leaflet to Giant/Martin's Employees in Winchester, Virginia Document #15 Rick Herring (President of Giant/Martin's) 8/29/2011 Letter to Giant/Martin's Employees in Pennsylvania Document #16 UFCW 6/17/2011 NLRB Surveillance Charge Document #17 UFCW 6/3/2011 NLRB Parking Lot Charge Document #18 Jackson Lewis (Law Firm) 4/1/2011 Bio of Thomas M. -

Walmart Dominates in D.C

regionalREPORT SN PRICE CHECK: Washington D.C. Price Matchup Walmart’s basket was $10 less expensive than its closest price competitor Walmart dominates in D.C. (Week 3) Value of Total Basket* Walmart was the price leader, and Safeway, a standout in customer service during mystery shops con- ducted in the nation’s capital during the weeks of April 7, April 21 and May 5. Giant Food and Food Lion were Walmart $68.21 also recognized for “Store Appearance” and “Ease of Shopping.” SOURCE: Brand View and RetailData Food Lion $78.62 Giant Food $79.34 WHO Safeway $85.81 * Based on a 20-SKU basket purchased in the Atlanta market during the week of May 5 SCORED Week 1 Week 2 Week 3 Most Lowest-Priced Items* BEST Walmart 15 Least Expensive Basket WALMART WALMART WALMART Giant Food 3 Food Lion 2 Most Lowest-Priced Items WALMART WALMART WALMART Safeway 0 SAFEWAY GIANT FOOD * Based on baskets purchased during the week of May 5. In the case of a tie, both retailers were credited with having the least expensive item. Store Appearance SAFEWAY SAFEWAY FOOD LION SAFEWAY SAFEWAY GIANT FOOD GIANT FOOD Ease of Shopping SAFEWAY FOOD LION FOOD LION ITEM PRICE COMPARISON SAFEWAY GIANT FOOD WALMART FOOD LION PRODUCT NAME* WEEK 1 WEEK 2 WEEK 3 WEEK 1 WEEK 2 WEEK 3 WEEK 1 WEEK 2 WEEK 3 WEEK 1 WEEK 2 WEEK 3 Eight O’Clock Original Ground Coffee/12 oz. $7.29 $4.99 $4.99 $6.29 $5.99 $5.99 $4.98 $4.98 $4.68 $4.49 $6.29 $6.29 Lean Cuisine Traditional Pepperoni Pizza/6 oz. -

Take Care® Flex Benefits Card Retailers

take care® flex benefits card Retailers When you use your take care® card at take care Retailers: P Only FSA eligible purchases will ring up on your take care® Visa® flex benefits card. P You won’t have to submit receipts to verify purchases made with your take care card. take care® flex benefits card Retailer list for January 2008 ACME - SuperValu Fry’s Food & Drug Pathmark Stores Tom Thumb Albertsons - SuperValu Genuardi’s Pavilions Ukrop’s Super Markets A&P Supermarkets Gerbes Pay Less Vons Baker’s Giant Eagle Price Chopper Supermarkets Waldbaum’s Big Y Foods Giant Food Quality Foods Walgreens Bigg’s - SuperValu Hannaford Food & Drug Ralphs Wal-Mart Stores Brookshire’s/Super 1 Foods Hammons Grocery Randalls VisionDirect.com Buehle Food Markets Harris Teeter, Inc. Rosauers/Super 1 Pharmacies July 2008 Carrs H-E-B Roundy’s Bloom City Markets Hen House Markets Safeway Bottom Dollar Food Cubs - SuperValu Hilander Sam’s Club Duane Reade CVS Pharmacy Hornbacher’s - SuperValu Sav-A-Center Fagen Pharmacy Dan’s Hy-Vee Drug Stores Scott’s Foods Food Lion Dick’s Hy-Vee Food Stores Shaw’s - SuperValu Giant Food Stores Dierbergs Jay C Foods Shop ‘n Save - SuperValu Harveys Supermarkets Dillons Jewel - SuperValu ShopKo Stores/Shopko Express Longs Drug Stores Discount Drug Mart Kerr Drug Shoppers - SuperValu Reid’s Dominick’s King Soopers Smith’s Spartan Stores drugstore.com Kroger Star Market - SuperValu Tops Markets Farm Fresh - SuperValu Lin’s Stop & Shop Supermarkets United Supermarkets Food 4 Less Lucky - SuperValu Sunflower - SuperValu Wegmans Food Basics Macey’s Super 1 Foods Winn-Dixie Stores Food Plus Meijer SuperFresh Foods Co. -

New York State WIC Vendors Updated (07/23/2019)

New York State WIC Vendors Updated (07/23/2019) County Vendor Name Address City State Zip Code Albany HANNAFORD #393 5239 WESTERN TPKE GUILDERLAND NY 12009 Albany PRICE CHOPPER #36 240 CONGRESS ST COHOES NY 12047 Albany CVS PHARMACY #375 256 DELAWARE AVE DELMAR NY 12054 Albany HANNAFORD #339 180 DELAWARE AVENUE DELMAR NY 12054 Albany Price Chopper #196 Glenmont 329 Glenmont Road Glenmont NY 12077 Albany Wal-Mart Super Center #3583 311 Route 9W Glemont NY 12077 Albany CVS Pharmacy #1090 416 Route 9W Glenmont NY 12077 Albany Market 32 by Price Chopper #28 2080 Western Ave GUILDERLAND NY 12084 Albany PRICE CHOPPER #183 1706 WESTERN AVENUE GUILDERLAND NY 12084 Albany Price Chopper #138 NEW LOUDON RD RTE 9 LATHAM NY 12110 Albany HANNAFORD #386 579 TROY SCHENECTADY RD LATHAM NY 12110 Albany Target # 1915 675 Troy Schenectady Rd Latham NY 12110 Albany Walmart #1997 800 Loudon Road Latham NY 12110 Albany Ravena Shop 'n Save 2481 Route 9W Ravena NY 12143 Albany PRICE CHOPPER #159 1395 NEW SCOTLAND AVE SLINGERLANDS NY 12159 Albany ShopRite of Slingerlands 41 Vista Blvd Slingerlands NY 12159 Albany Hannaford #233 5 Maple Road Voorheesville NY 12186 Albany Price Chopper #245 1804 2 AVE WATERVLIET NY 12189 Albany PRICE CHOPPER #224 1892 CENTRAL AVE ALBANY NY 12205 Albany HANNAFORD #362 96 WOLF RD ALBANY NY 12205 Albany WAL-MART #2152 141 Washington Ave. Extension Albany NY 12205 Albany Target # 1268 1440 Cenral Avenue Colonie NY 12205 Albany ShopRite of Colonie 1730 Central Ave Colonie NY 12205 Albany Price Chopper #133 911 CENTRAL AVE ALBANY NY 12206