Ahold Delhaize USA Announces Three-Year, $480 Million

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lidl Expanding to New York with Best Market Purchase

INSIDE TAKING THIS ISSUE STOCK by Jeff Metzger At Capital Markets Day, Ahold Delhaize Reveals Post-Merger Growth Platform Krasdale Celebrates “The merger and integration of Ahold and Delhaize Group have created a 110th At NYC’s Museum strong and efficient platform for growth, while maintaining strong business per- Of Natural History formance and building a culture of success. In an industry that’s undergoing 12 rapid change, fueled by shifting customer behavior and preferences, we will focus on growth by investing in our stores, omnichannel offering and techno- logical capabilities which will enrich the customer experience and increase efficiencies. Ultimately, this will drive growth by making everyday shopping easier, fresher and healthier for our customers.” Those were the words of Ahold Delhaize president and CEO Frans Muller to the investment and business community delivered at the company’s “Leading Wawa’s Mike Sherlock WWW.BEST-MET.COM Together” themed Capital Markets Day held at the Citi Executive Conference Among Those Inducted 20 In SJU ‘Hall Of Honor’ Vol. 74 No. 11 BROKERS ISSUE November 2018 See TAKING STOCK on page 6 Discounter To Convert 27 Stores Next Year Lidl Expanding To New York With Best Market Purchase Lidl, which has struggled since anteed employment opportunities high quality and huge savings for it entered the U.S. 17 months ago, with Lidl following the transition. more shoppers.” is expanding its footprint after an- Team members will be welcomed Fieber, a 10-year Lidl veteran, nouncing it has signed an agree- into positions with Lidl that offer became U.S. CEO in May, replac- ment to acquire 27 Best Market wages and benefits that are equal ing Brendan Proctor who led the AHOLD DELHAIZE HELD ITS CAPITAL MARKETS DAY AT THE CITIBANK Con- stores in New York (26 stores – to or better than what they cur- company’s U.S. -

Innovation Transforms the Checkout Experience at Ahold Delhaize USA Brand Stores

Innovation Transforms the Checkout Experience at Ahold Delhaize USA Brand Stores Retail Business Services, an Ahold Delhaize USA company, is a leader in “Through extensive partner the supermarket industry and well known for its eye toward innovation, collaboration, we deployed an passion for great food and dedication to delivering value to its customers. innovative technology solution that Retail Business Services had a goal from its local brand partners - to increase throughput, front-end lane utilization and improve the customer’s supports our strategy, Leading experience. Based on long-term relationships and proven capabilities, Retail Together, while delivering our Business Services turned to Toshiba Global Commerce Solutions and Getronics, plus other key partners to achieve their goals and vision for its promise of a better place to shop.” stores. The result: a unique convertible lane that transforms checkout. —Paul Scorza, EVP, All lanes open, all the time. Information Technology and CIO Retail Business Services came to its partners with a clear vision: all lanes for Retail Business Services. open, all the time. With convertible dual-use checkout lanes, Retail Business Services was able to provide a technology solution to its brand partners to make the most of the square footage in stores by replacing attended lanes that were only used some of the time, with lanes that could be used 100% of the time for either self-service or cashier-led experiences. Through this solution, the stores can CASE STUDY 2 reduce lines during checkout -

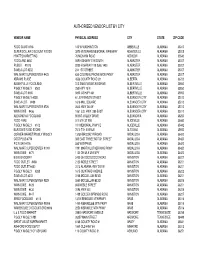

Agtnum Agent Name Agent Address Agent City

AGTNUM AGENT_NAME AGENT_ADDRESS AGENT_CITY STATE ZIP 10175 FIDDLE STIX 6501 GLENWOOD AVE RALEIGH NC 27612 12983 BILL PAYMENT CENTER 215 W MARTIN ST RALEIGH NC 27601 13497 FOOD LION #253 570 RIVERBEND DR CHARLOTTESVILLE VA 22911 13498 FOOD LION #484 501 EAST MAIN ST LOUISA VA 23093 13499 FOOD LION #864 1740 TIMBERWOOD BLVD CHARLOTTESVILLE VA 22911 13501 FOOD LION #870 15105 PATRICK HENRY HWY AMELIA COURT HOUSE VA 23002 13502 FOOD LION #940 136 CEDAR GROVE RD RUCKERSVILLE VA 22968 13504 FOOD LION #959 264 TURKEYSAG TRL PALMYRA VA 22963 13506 FOOD LION #1186 585 BRANCHLANDS BLVD CHARLOTTESVILLE VA 22901 13507 FOOD LION #1298 408 W GORDON AVE GORDONSVILLE VA 22942 13508 FOOD LION #1361 2105 ACADEMY RD POWHATAN VA 23139 13509 FOOD LION #1402 577 MADISON RD ORANGE VA 22960 13510 FOOD LION #1531 85 CALOHILL DR LOVINGSTON VA 22949 13511 FOOD LION #1536 32 MILL CREEK DR CHARLOTTESVILLE VA 22902 13515 FOOD LION #1576 38 S CONSTITUTION RD DILLWYN VA 23936 13516 FOOD LION #2567 46 MADISON PLAZA DR MADISON VA 22727 13519 FOOD LION #297 9157 STAPLES MILL RD RICHMOND VA 23228 13524 FOOD LION #299 11130 HULL STREET RD MIDLOTHIAN VA 23112 13529 FOOD LION #478 8201 HULL STREET RD RICHMOND VA 23235 13531 FOOD LION #514 1288 CONCORD AVE RICHMOND VA 23228 13532 FOOD LION #545 11 DUNLOP VLG COLONIAL HEIGHTS VA 23834 13533 FOOD LION #601 3089 MECHANICSVILLE TPKE RICHMOND VA 23223 13538 FOOD LION #620 15702 JEFFERSON DAVIS HW COLONIAL HEIGHTS VA 23834 13540 FOOD LION #623 8006 BUFORD CT RICHMOND VA 23235 13541 FOOD LION #628 9502 CHAMBERLAYNE RD MECHANICSVILLE -

ECRM Ad Comparisons the LEADING PROVIDER of PROMOTIONAL DATA and BUSINESS INTELLIGENCE St

ECRM Ad Comparisons THE LEADING PROVIDER OF PROMOTIONAL DATA AND BUSINESS INTELLIGENCE St. Patrick’s Day Promotional Review 2013 versus 2014 Confidential and Proprietary to ECRM 1 METHODOLOGY Effective Ad Count Used in Study: Effective Ad Count gives partial credit to any product that shares an ad block with other products in order to provide more context in promotional analysis. For example: If 4 products are present in an ad block each will only receive a .25 count for that particular promotion. If 3 products are present each one receives .33 count. Time Periods: Current Year: 2/16/2014 - 3/22/2014 Prior Year: 2/17/2013 - 3/23/2013 Retailers Used in Representative Market Review: A & P, Albertson's - SoCal (SVU), Albertsons SOC, CVS, Dollar General, Family Dollar, Food Lion, Giant Eagle, Giant Food Landover, H.E.B., Jewel-Osco (NAI), Jewel-Osco (SVU), Kmart, Kroger CIN, Meijer, Rite Aid, Safeway Stores, Stater Bros, Super 1 Foods, Target Stores, Walgreens, Walmart-US, Winn Dixie. Representative Markets Used. Retailers Used in Promoted Price Study: Chicago Market Retailers: CVS, Dominick's Finer Foods, Food 4 Less, Meijer, Strack & Van Til, Target Stores, Ultra Foods. Media Type: Circular Promotions. Sampling Methodology: A typical basket of St. Patrick’s Day items was developed using the following categories: Beef, Cheese, Cheese Chunk/Block, Cordial, Deli Beef/Roast Beef, Deli Cheese, Dry Potatoes, Fingerling Potatoes, Fresh Cut Flowers, Grated Cheese, Imported Beer, Irish Whiskey, Other Vegetables, Petite Potatoes, Potato Chips, Red Potatoes, Russet Potatoes, Specialty Cheeses, White Potatoes, Yellow Potatoes and Bakery In-Store. The basket was used to identify pages containing St. -

Alabama Vendor List.Xlsx

AUTHORIZED VENDOR LIST BY CITY VENDOR NAME PHYSICAL ADDRESS CITY STATE ZIP CODE FOOD GIANT #716 100 W WASHINGTON ABBEVILLE ALABAMA 36310 SUPER DOLLAR DISCOUNT FOODS 3970 VETERANS MEMORIAL PARKWAY ADAMSVILLE ALABAMA 35005 HYATT'S MARKET INC 70 MCHANN ROAD ADDISON ALABAMA 35540 FOODLAND #450 509 HIGHWAY 119 SOUTH ALABASTER ALABAMA 35007 PUBLIX #1073 9200 HIGHWAY 119 Suite 1400 ALABASTER ALABAMA 35007 SAVE-A-LOT #202 244 1ST STREET ALABASTER ALABAMA 35007 WAL MART SUPERCENTER #423 630 COLONIAL PROMENADE PKWY ALABASTER ALABAMA 35007 ABRAMS PLACE 4556 COUNTY ROAD 29 ALBERTA ALABAMA 36720 ALBERTVILLE FOODLAND 313 SAND MOUNTAIN DRIVE ALBERTVILLE ALABAMA 35950 PIGGLY WIGGLY #500 250 HWY 75 N ALBERTVILLE ALABAMA 35950 SAVE-A-LOT #165 5850 US HWY 431 ALBERTVILLE ALABAMA 35950 PIGGLY WIGGLY #238 61 JEFFERSON STREET ALEXANDER CITY ALABAMA 35010 SAVE-A-LOT #489 1616 MILL SQUARE ALEXANDER CITY ALABAMA 35010 WAL MART SUPERCENTER #726 2643 HWY 280 W ALEXANDER CITY ALABAMA 35010 WINN DIXIE #456 1061 U.S. HWY. 280 EAST ALEXANDER CITY ALABAMA 35010 ALEXANDRIA FOODLAND 85 BIG VALLEY DRIVE ALEXANDRIA ALABAMA 36250 FOOD FARE 517 5TH ST NW ALICEVILLE ALABAMA 35442 PIGGLY WIGGLY #102 101 MEMORIAL PKWY E ALICEVILLE ALABAMA 35442 BURTON'S FOOD STORE 7010 7TH AVENUE ALTOONA ALABAMA 35952 CORNER MARKET/PIGGLY WIGGLY 13759 BROOKLYN ROAD ANDALUSIA ALABAMA 36420 COST PLUS #774 305 EAST THREE NOTCH STREET ANDALUSIA ALABAMA 36420 PIC N SAV #776 550 W BYPASS ANDALUSIA ALABAMA 36420 WAL MART SUPERCENTER #1091 1991 MARTIN LUTHER KING PKWY ANDALUSIA ALABAMA 36420 WINN DIXIE -

UTC – Czech Republic

UTC– Czech Republic Area: 78867 sq km, 14 administrative districts Population: 10,6 mio Capital city: Prague, population 1 243 000 Currency: Czech crown ‐ CZK Rate: 1EUR = 27,5 CZK 1USD = 20,0 CZK ‐3 key cities – Prague, Brno, Ostrava > 300 000 citizens ‐ > 100 000 citizens – Plzen, Olomouc ‐12 bank holidays ‐“cucumber season“ CONSUMPTION EXPENDITURE STRUCTURE OF HOUSEHOLDS OTHER RECREATION AND CULTURE COMMUNICATION TRANSPORT HOUSEHOLDS OF PENSIONERS WTHT EA FURNISHING, HOUSEHOLD MEMBERS EQUIPMENT AND ROUTINE AND HOUSEHOLDS WITH CHILDRENS OTHER HOUSEHOLD MAINTENANCE HOUSING, WATER, ELECTRICITY, GAS AND OTHER FUELS CLOTHING AND FOOTWEAR FOOD AND NON‐ALCOHOLIC BEVERAGES 0% 10% 20% 30% 40% ‐ Schwarz, Rewe, Tesco, Ahold ‐ 680 supermarkets ‐ Ahold 280 Albert, Rewe‐Billa 200 and Tesco Stores 149 ‐ 640 discounter stores – 4 disount chains Penny Market ‐ 341, Lidl – 230 shops arround all country, Norma‐45 W and Prague, Coop‐2853 in 7 regions ‐ 300 Hyper stores ‐ 5 hyper chains ‐ Tesco Hypermarkets‐61, Kaufland‐94, Albert Hypermarkets ‐ 55 and Interspar‐36 , in all regions, Globus with 16 stores‐the first hyper in 1996 19% 42% 39% Supermarkets Discounters Hyper 1939 Bílá Labuť 1975 Máj , 1992 K‐Mart, 2009 MY 2007 Palladium Inter Ikea Center Group IICG –Sweden 1998 Prague 200 000 m2 Brno, Ostrava, Prague MHD FUTURUM‐– CBRE – LA 2000 in Hradec Kralove 368000 m2 Brno, Kolín, Ostrava, MHD Olympia‐Olympia Brno, CZ 1999 Brno 238000 m2 MB, Olomouc,Plzen Teplice MHD, cinema OC CHODOV ‐ Rodamco Europe‐Neederland 2005 Prague 55 000m2 200 shops 20 coffee Food and non food DIY Furniture Drugstores Electro 1996 on‐line payments vs cash on delivery personal collection at distribution points stone shops run internet shop price difference On‐line auctions MAGNET and others TENDENCE –Holešovice Prague fair exhibition 11.‐.14.9.2014 Zboží@prodej –household magazin D‐TEST ‐ independent tests, free legal services in trials for subscribers % 27% 20‐40% 2+1 FREE Loyalty programs Bonuses HEUREKA since 1991 Distribution centre: Logistic park D1 ‐ East Logistics Department UTC, s.r.o. -

ANALYSIS of AGREEMENT CONTAINING CONSENT ORDERS to AID PUBLIC COMMENT in the Matter of Koninklijke Ahold N.V./Safeway Inc., File No

ANALYSIS OF AGREEMENT CONTAINING CONSENT ORDERS TO AID PUBLIC COMMENT In the Matter of Koninklijke Ahold N.V./Safeway Inc., File No. 121-0055, Docket No. I. Introduction and Background The Federal Trade Commission (“Commission”) has accepted for public comment, and subject to final approval, an Agreement Containing Consent Orders (“Consent Agreement”) from Koninklijke Ahold N.V. (“Ahold”), its subsidiary, Giant Food Stores, LLC (“Giant”), Safeway Inc. (“Safeway”), and its subsidiary (“Genuardi’s”) (collectively “Respondents”), that is designed to remedy the anticompetitive effects that otherwise would result from Ahold’s acquisition of certain Genuardi’s supermarkets owned by Safeway. The proposed Consent Agreement requires divestiture of the Genuardi’s supermarket in Newtown, Pennsylvania, and its related assets to a Commission-approved purchaser. The proposed Consent Agreement also requires Ahold and Safeway to divest all related assets and real property necessary to ensure the buyer of the divested supermarket will be able to quickly and fully replicate the competition that would have been eliminated by the acquisition. The proposed Consent Agreement has been placed on the public record for 30 days to solicit comments from interested persons. Comments received during this period will become part of the public record. After 30 days, the Commission again will review the proposed Consent Agreement and comments received, and decide whether it should withdraw the Consent Agreement, modify it, or make it final without modification. On January 4, 2012, Ahold and Safeway executed an agreement whereby Ahold would acquire 16 of the Genuardi’s supermarkets from Safeway. The Commission’s Complaint alleges that the proposed acquisition, if consummated, would violate Section 7 of the Clayton Act, as amended, 15 U.S.C. -

Koninklijke Ahold Delhaize N.V. Q3 2020 Report

Koninklijke Ahold Delhaize N.V. Q3 2020 Report Issued on November 4, 2020 Page 1/31 Press Office: +31 88 659 5134 Social Media Investor Relations: +31 88 659 5213 Twitter: @AholdDelhaize Youtube: @AholdDelhaize www.aholddelhaize.com LinkedIn: @Ahold-Delhaize Interim report, Third quarter 2020 Ahold Delhaize reports strong Q3 results; announces initiatives to solidify position as industry- leading local omnichannel retailer in 2021 and beyond * Net sales were €17.8 billion, up 6.8%, or 10.1% at constant exchange rates * In the U.S. and Europe, comp sales growth excluding gas was up 12.4% and 7.5%, respectively * Net consumer online sales grew 62.6% at constant exchange rates; including 114.7% growth in the U.S. * COVID-19-related costs were approximately €470 million year to date, and approximately €140 million in Q3, including safety measures and enhanced associate pay * Underlying operating margin was 4.6%, up 0.2% points from the prior year at constant exchange rates * IFRS reported operating income was €207 million, impacted by the previously announced €577 million provision for a U.S. pension plan withdrawal * Diluted underlying EPS was €0.50, increasing 12.3%; diluted EPS was €0.06, unfavorably impacted by the provision for a U.S. pension plan withdrawal * 2020 underlying EPS outlook raised to growth in the high-20% range; continue to expect free cash flow to be at least €1.7 billion, net of Q4 payment for a U.S. pension plan withdrawal, and capital expenditures of around €2.5 billion * Announcing a new €1 billion share buyback program to start at the beginning of 2021 Zaandam, the Netherlands, November 4, 2020 – Ahold Delhaize, one of the world’s largest food retail groups and a leader in both supermarkets and e-commerce, reports third quarter results today. -

Ahold USA: Strong Positions and Strong Positions and Focused On

Ahold USA: Strong positions and focused on execution Carl Schlicker COO Ahold USA November 29, 2012 Proprietary and Company Confidential Key takeaways Our businesses: • Ahold USA’s divisions collectively are the largest player in the diverse markets of the U.S. Northeast • The divisional structure allows us to act locally while leveraging our scale Our pppposition in the competitive landscape: • Each of our divisions has targeted activities to ensure that they are well-positioned to hold and grow their leading positions • Our divisions continue to gain market share in a diverse competitive landscape Our business model to grow: • We are executing on the Reshaping Retail framework to drive growth Our performance: • Ahold USA continues delivering a healthy and consistent bottom line Proprietary and Company Confidential 2 Our businesses: • Ahold USA’s divisions collectively are the largest player in the diverse markets of the U.S. Northeast • The divisional structure allows us to act locally while leveraging our scale Proprietary and Company Confidential 3 The #5 supermarket retailer in the US and #1 in the Northeast 1 support organization 4 divisions 98 years of local heritage 772 stores 119,000 emppyloyees $25 billion+ in sales Market leader in 3 of our 4 divisions Source: Progressive Grocer Super 50 - 2012 Ranking Proprietary and Company Confidential 4 772 stores serving a trading area of 38 million people: #1 itfktin most of our markets Market # stores 2011 position sales #1 217 $7.5B #3 183 $5.7B #1 173 $5.3B #1 183 $6. 1B #1 n/a $0.4B Proprietary and Company Confidential 5 Operating in markets with differing demographics… Ethnicity Income distribution Ethnicity Income distribution 4% 9% 6% 11% 4% 7% 7% 23% 13% 5% 9% 27% 38% 40% 9% 23% 54% 59% 81% 86% 69% 48% 49% 58% 19% 18% 14% 11% New York New England Giant Landover Giant Carlisle New York New England Giant Landover Giant Carlisle Metro Metro white black hispanic other low (<$25K) medium ($25K to $99K) high(>$100K) Source: Population Division – U.S. -

Growing Our Business in Europe

Growing our business in Europe Sander van der Laan COO Ahold Europe / CEO Albert Heijn November 29, 2012 Proprietary and Company Confidential Key takeaways Still growth opportunities ahead for Albert Heijn in the Netherlands Leveraging our Albert Heijn format and business model in Flanders, Belgium Creating value with Albert in the Czech market Proprietary and Company Confidential Ahold Our joint Reshaping Retail framework Proprietary and Company Confidential 3 Europe we are proud of our strong brands Albert Heijn Supermarkets NL 125 years of • Est. 1887 • 815 stores local heritage • Market leader Albert Heijn New Markets >2,200 stores • 10 supermarkets Belgium • Two to go in Germany • 58 to gos in NL Serving a Albert Heijn Online trade area • Est. 2001 • Delivery and PUP’s (first two open) >40 million people • Market leader Etos In 5 countries • Est. 1918 • 538 stores • #2 in the market 96, 000 emp loyees Gall & Gall • Est. 1884 • 562 stores €12B+ sales • Market leader Czech Republic + Slovakia Joint ventures • Est. 1991 • 282 stores with ICA and JMR • #2 in the Czech market Bol.com • Est. 1999, joined Ahold 2012 • First 59 pick-up points in AH service counters • Market leader online Proprietary and Company Confidential 4 Europe We believe in complementary multi-format growth Discuss supermarkets today: Netherlands Still growth opportunities ahead for Albert Heijn Belgium LiAlbtLeveraging our Albert HijHeijn format and business model in Flanders Czech Republic Creating value with Albert in the CZ market small stores supermarkets online Proprietary and Company Confidential 5 Netherlands Albert Heijn remains the leading supermarket player, managing consistent growth in a tough and consolidating market 40 Main Market share Market share Market share NL 2007 2011 development supermarkets indicative 20 Nielsen Nielsen Albert Heijn 29.5% 33.5% 35.0+% 0 (incl. -

Ahold Czech Republic

Ahold Czech Republic Summary based on research by: Jan Haverkamp & Lenka Simerska Organizační Poradci a Vyzkum (Organization Development and Research) Prague, Czech Republic From December 2004 to October 2005 Research conducted in co-operation with SOMO and FNV Bondgenoten. Commissioned by FNV Mondiaal for the project FNV Company Monitor Summary by SOMO, May 2006 Contents 1. Introduction ....................................................................................................................1 2. Ahold in the Czech Republic.........................................................................................2 Business description ...................................................................................................2 Employment and employment trends..........................................................................4 Company management and relations with the corporation .........................................5 Relevant aspects of Corporate Social Responsibility ..................................................5 The Fair Play Line .......................................................................................................6 Monitoring implementation of the new Code ...............................................................7 3. Labour relations.............................................................................................................7 National law and union tradition ..................................................................................7 Active unions within -

Supermarkets & Grocery Stores in the US

WWW.IBISWORLD.COM Supermarkets & Grocery Stores in the US April 2019 1 Shop smart: Increasing premium brand sales and healthy eating trends will spur growth This report was provided to Illinois SBDC (2133312863) by IBISWorld on 28 June 2019 in accordance with their license agreement with IBISWorld IBISWorld Industry Report 44511 Supermarkets & Grocery Stores in the US April 2019 Darshan Kalyani 2 About this Industry 18 International Trade 31 Whole Foods Market Inc. 2 Industry Definition 19 Business Locations 31 Wakefern Food Corporation 2 Main Activities 32 Walmart Inc. 2 Similar Industries 21 Competitive Landscape 3 Additional Resources 21 Market Share Concentration 33 Operating Conditions 21 Key Success Factors 33 Capital Intensity 4 Industry at a Glance 22 Cost Structure Benchmarks 34 Technology and Systems 23 Basis of Competition 35 Revenue Volatility 5 Industry Performance 24 Barriers to Entry 35 Regulation and Policy 5 Executive Summary 25 Industry Globalization 36 Industry Assistance 5 Key External Drivers 7 Current Performance 26 Major Companies 37 Key Statistics 9 Industry Outlook 26 The Kroger Co. 37 Industry Data 12 Industry Life Cycle 27 Albertsons Companies LLC 37 Annual Change 28 Publix Super Markets Inc. 37 Key Ratios 14 Products and Markets 29 Ahold Delhaize 38 Industry Financial Ratios 14 Supply Chain 30 HEB Grocery Company LP 14 Products and Services 30 Meijer Inc. 39 Jargon & Glossary 16 Demand Determinants 30 ALDI US 17 Major Markets 31 Trader Joe’s www.ibisworld.com | 1-800-330-3772 | [email protected] WWW.IBISWORLD.COM Supermarkets & Grocery Stores in the US April 2019 2 About this Industry Industry Definition The Supermarkets and Grocery Stores fresh and prepared meats, poultry and industry makes up the largest food retail seafood, canned and frozen foods, fresh channel in the United States.