Return of Organization Exempt from Income

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

House of Representatives

HULES AND ORDERS TO BE OBSERVED IN THE HOUSE OF REPRESENTATIVES OF THE ©ommontoealtlj of JHassacijusctts, FOR THE YEAR 1850. PUBLISHED BY ORDER OF THE HOUSE. BOSTON: DUTTON AND WENTWORTH, STATE PRINTERS. 1850. RULES AND ORDERS OF TIIE HOUSE. CHAPTER I. I O f the Duties and Powers of the Speaker. I. T h e Speaker shall take the Chair every day at the hour to which the House shall have adjourned ; shall call the Members to order; and, on the ap pearance of a quorum, shall proceed to business. II. He shall preserve decorum and order; may speak to points of order in preference to other Members ; and shall decide all questions of order, subject to an appeal to the House by motion regularly seconded ; and no other business shall be in order till the ques tion on the appeal shall have been decided. III. He shall declare all votes; but, if any Member rises to doubt a vote, the Speaker shall order a re turn of the number voting in the affirmative, and in the negative, without any further debate upon the question. IV. He shall rise to put a question, or to address the House, but may read sitting. V. In all cases the Speaker may vote. 4 Duties of the Speaker. Ch. I. VI. When the House shall determine to go into a Committee of the whole House, the Speaker shall appoint the Member who shall take the Chair. VII. On all questions and motions whatsoever, the Speaker shall take the sense of the House by yeas and nays, provided one fifth of the Members pres ent shall so require. -

Nerin-En.Pdf

FOLLOWING THE FOOTPRINTS OF COLONIAL BARCELONA Gustau Nerín It is hardly unusual to find people, even highly educated people, who claim Catalonia can analyse colonialism with sufficient objectivity given that it has never taken part in any colonial campaign and never been colonialist. Even though most historians do not subscribe to this view, it is certainly a common belief among ordinary people. Dissociating ourselves from colonialism is obviously a way of whitewashing our history and collective conscience. But Barcelona, like it or not, is a city that owes a considerable amount of its growth to its colonial experience. First, it is obvious that the whole of Europe was infected with colonial attitudes at the height of the colonial period, towards the end of the 19th century and first half of the 20th. Colonial beliefs were shared among the English, French, Portuguese and Belgians, as well as the Swedes, Swiss, Italians, Germans and Catalans. Colonialist culture was constantly being consumed in Barcelona as in the rest of Europe. People were reading Jules Verne’s and Emilio Salgari's novels, collecting money for the “poor coloured folk” at missions in China and Africa and raising their own children with the racist poems of Kipling. The film industry, that great propagator of colonial myths, inflamed passions in our city with Tarzan, Beau Geste and The Four Feathers. Barcelona’s citizens certainly shared this belief in European superiority and in the white man’s burden, with Parisians, Londoners and so many other Europeans. In fact, even the comic strip El Capitán Trueno, which was created by a communist Catalan, Víctor Mora, proved to be a perfect reflection of these colonial stereotypes. -

The History of Lowell House

The History Of Lowell House Charles U. Lowe HOW TO MAKE A HOUSE Charles U. Lowe ’42, Archivist of Lowell House Lucy L. Fowler, Assistant CONTENTS History of Lowell House, Essay by Charles U. Lowe Chronology Documents 1928 Documents 1929 Documents 1930-1932 1948 & Undated Who’s Who Appendix Three Essays on the History of Lowell House by Charles U. Lowe: 1. The Forbes story of the Harvard Riverside Associates: How Harvard acquired the land on which Lowell House was built. (2003) 2. How did the Russian Bells get to Lowell House? (2004) 3. How did the Russian Bells get to Lowell House? (Continued) (2005) Report of the Harvard Student Council Committee on Education Section III, Subdivision into Colleges The Harvard Advocate, April 1926 The House Plan and the Student Report 1926 Harvard Alumni Bulletin, April, 1932 A Footnote to Harvard History, Edward C. Aswell, ‘26 The Harvard College Rank List How Lowell House Selected Students, Harvard Crimson, September 30, 1930, Mason Hammond “Dividing Harvard College into Separate Groups” Letter from President Lowell to Henry James, Overseer November 3, 1925 Lowell House 1929-1930 Master, Honorary Associates, Associates, Resident and Non-Resident Tutors First Lowell House High Table Harvard Crimson, September 30, 1930 Outline of Case against the Clerk of the Dunster House Book Shop for selling 5 copies of Lady Chatterley’s Lover by D. H. Lawrence Charles S. Boswell (Undated) Gift of a paneled trophy case from Emanuel College to Lowell House Harvard University News, Thursday. October 20, 1932 Hizzoner, the Master of Lowell House - Essay about Julian Coolidge on the occasion of his retirement in 1948 Eulogy for Julian L. -

Thesis Tirant Lo Blanc(H)

THESIS TIRANT LO BLANC(H): MASCULINITIES, PHALLOSOCIAL DESIRE, AND TRIANGULAR CONSTELLATIONS Submitted by Francisco Macías Department of English In partial fulfillment of the requirements For the Degree of Master of Arts Colorado State University Fort Collins, Colorado Fall 2011 Master’s Committee: Advisor: Roze Hentschell Ellen Brinks Fernando Valerio-Holguín Copyright by Francisco Macías 2011 All Rights Reserved ABSTRACT TIRANT LO BLANC(H): MASCULINITIES, PHALLOSOCIAL DESIRE, AND TRIANGULAR CONSTELLATIONS The introduction of this thesis provides a revised survey that examines the analysis of Tirant scholars to date, including evaluations of its sources and influences, theories concerning its circulation, its autobiographical aspects, and its genre, among other approaches to literary criticism. It draws attention to points of contention and highlights and rectifies those that have been overlooked or that have remained undisputed. “Chapter One: Queer Heterosexualities in the Tirant: Straight until Proven ‘Other’” addresses the issue of masculinities in the clergy, the chivalry, and the monarchy by mapping models of masculinity—conventional and competing—within a phallosocial context. And “Chapter Two: Bizarre Love Triangles in the Tirant: Consummation of Phallosocial Desire” traces phallosocial desire by analyzing the processes that lead to a symbolic consummation of same-sex relations by means of erotic triangles within a (mandatory) heterosexuality, where women become the (required) vessel by which phallosocial desire is reified and -

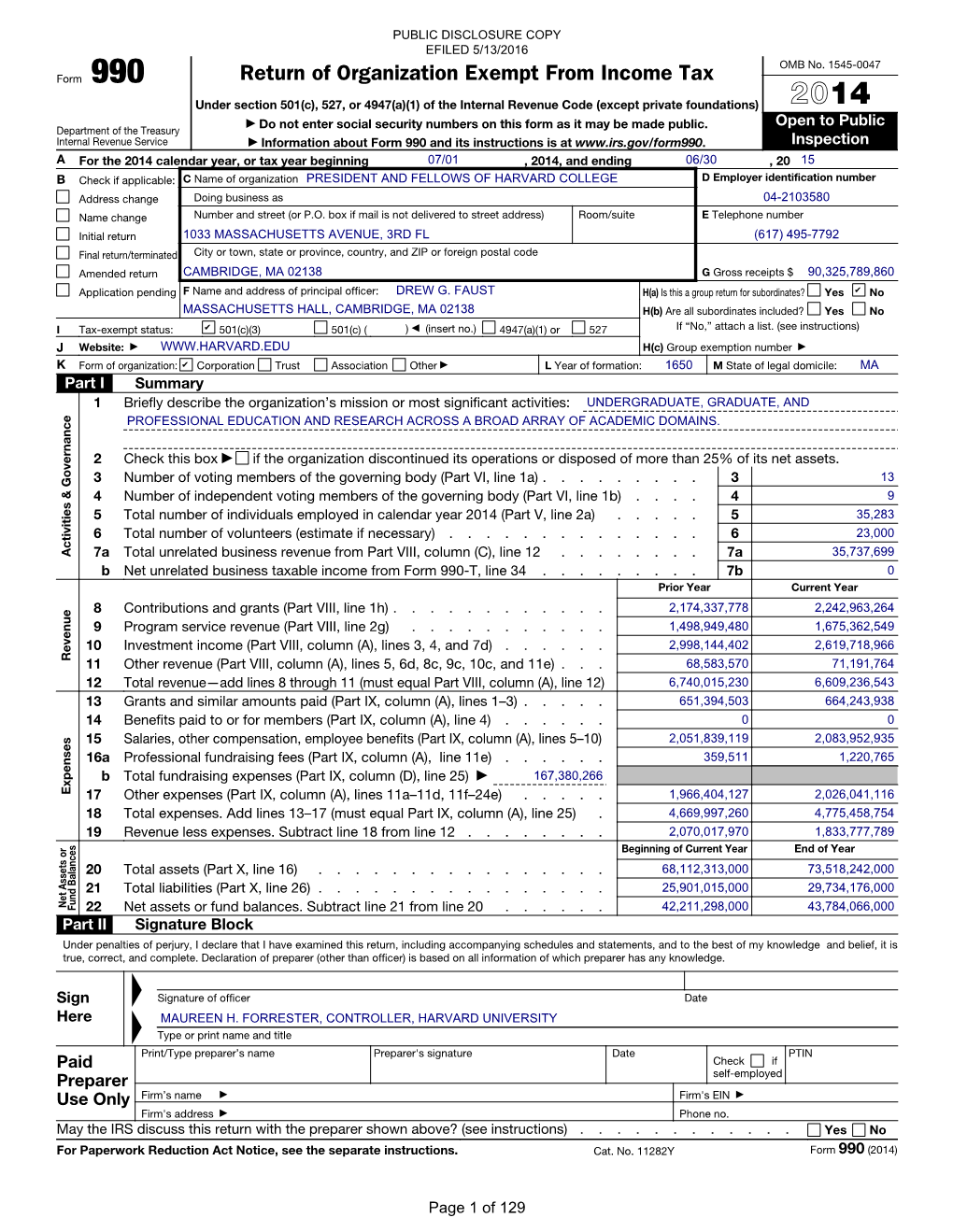

2015 C Name of Organization B Check If Applicable D Employer Identification Number President and Fellows of Harvard College F Address Change 04-2103580

lefile GRAPHIC print - DO NOT PROCESS I As Filed Data - I DLN: 934931340403061 990 Return of Organization Exempt From Income Tax OMB No 1545-0047 Form Under section 501 (c), 527, or 4947(a)(1) of the Internal Revenue Code ( except private foundations) 201 4 Department of the Treasury Do not enter social security numbers on this form as it may be made public Internal Revenue Service 1-Information about Form 990 and its instructions is at www.IRS.gov/form990 For the 2014 calendar year, or tax year beginning 07-01-2014 , and ending 06-30-2015 C Name of organization B Check if applicable D Employer identification number President and Fellows of Harvard College F Address change 04-2103580 F Name change Doing businesss as 1 Initial return E Telephone number Final Number and street (or P 0 box if mail is not delivered to street address) Room/suite 1033 MASSACHUSETTS AVENUE 3RD FL fl return/terminated (617) 495-7792 1 Amended return City or town, state or province, country, and ZIP or foreign postal code CAMBRIDGE, M A 02138 G Gross receipts $ 90,325,789,860 (- Application pending F Name and address of principal officer H(a) Is this a group return for DREW G FAUST subordinates? (-Yes No 1033 MASSACHUSETTS AVENUE 3RD FL CAMBRIDGE,MA 02138 H(b) Are all subordinates 1Yes(-No included? I Tax-exempt status F 501(c)(3) 1 501(c) ( ) I (insert no ) (- 4947(a)(1) or F_ 527 If "No," attach a list (see instructions) J Website : - WWW HARVARD EDU H(c) Group exemption number 0- K Form of organization F Corporation 1 Trust F_ Association (- Other 0- L Year of formation 1650 M State of legal domicile MA Summary 1 Briefly describe the organization's mission or most significant activities UNDERGRADUATE, GRADUATE, AND PROFESSIONAL EDUCATION AND RESEARCH ACROSS A BROAD ARRAY OF ACADEMIC DOMAINS w 2 Check this box Of- if the organization discontinued its operations or disposed of more than 25% of its net assets 3 Number of voting members of the governing body (Part VI, line 1a) . -

Harvard and Radcliffe Class of 1964 Fiftieth Reunion May 25–30, 2014

Harvard and Radcliffe Class of 1964 Fiftieth Reunion May 25–30, 2014 PROGRAM GUIDE Contents Dear Classmates and Friends, WELCOME BACK TO HARVARD! Letter to Classmates 1 We hope you have a grand time at our Reunion: Class of 1964 Reunion Committees 2 • catching up with classmates and friends; Fiftieth Reunion Schedule 4 • making new friends and new connections; • enjoying the stimulating programs our committee Additional Schedule Information 9 has planned; A Note on House/Dorm and Affinity Tables For Those Coming Solo to Reunion • joining us for meals (and drinks) together; Presentations and Events • sharing experiences and insights with one another; Symposia • reconnecting with the greatest college in the world. Brief Talks ’64 Special thanks to all the members of our program Attendee Services 19 committee for the work they have done in preparation Reunion Headquarters for the Reunion. They are listed here but will also be Tickets and Name Badges wearing special name tags. Bags and Personal Items Parking and Transportation And special thanks as well to the students who will Gratuities assist us as bellhops, bartenders, and van drivers; to our Library and Museum Privileges wonderful student coordinators; and to those at the Exercise and Athletics Internet Access Alumni Association, particularly Michele Blanc, Phone Directory and Mail Serghino Rene, and Shealan Anderson, without whose Fax assistance this Reunion would not be happening. Security and Emergency Phones Medical Services They are all here to help—just ask if you need anything. Liability for Injury or Loss In the following pages, you will find details of what is Reunion Photographs planned and how you can navigate your way through Lost and Found the Reunion. -

GIPE-002625-Contents.Pdf (1.026Mb)

~ - lHE STORY "OF" THE NATIONS " • • EDITION· .~ " " QI:be ~tor1! of tbe lSations, u THE BYZANTINE EMPIRE. THE STORY OF THE NATIONS I. ~MB. By "ARTHUI( GII.MAN, "9. THE NORMANS. By SARAH M.A.. , ORNE JEWETT. 2. 'l'HE .mwS. By 1'1oof. J. K. 30. THE BTZANTINB ElIIlPIRE. HOSMER. • By C. W. C. OMAN. 3. GERMANY. EyRev. S. BARING 31. SIOILY: PbCBniclan, Gre"k and ~U\.D, M.A. Roman. By tbe late Prof. E. 4- CARTHAGE. By Prof. ALPRIID A. FRREMAN. J. CHURCH. 32. 'l'HB 'l'USCAN REPUBLICS. 5. ALEXANDER'S 1lII/IPIRE. By By BELLA DUFFY. Prof. J. P. MAHAPFY. 33. POLAND. By W. R. MORFILL, 6. THE MOORS IN .PAIN. By M.A. STANLEY LANE-POOLE. 34. PARTHIA. By Prof. GEORGE 7. ANOIEN'l' EGYPT. By Prof. RAWLINSON. GBORGR RAWL1NSOH. 35. AUSTRALIAN COMMON- 8. HUNGARY. By Prof. ARMINIUS WEALTH. By GREVILLB VAMBERY. TREGARTHEN. 9- 'l'HE SARACENS. By ARTHUR 36. SPAIN. By H. E. WATTS. GILMAN. M.A. 31. JAPAN. By DAVID MURRAY, 10. IRELAND. By ~e Hon. EMILY Ph.D. LAWLEss. 38. BOU'l'jI AFRICA. By GEORGB n. CHALDEA. By ZtNAiDE A. M. THEAL. RA80ZIN. 39. VENIOE. By ALETHEA W,EL. 12. ~E GOTHS. By HENRY BRAD. 40. 'l'HB ORUSADES. By T. A. LEy..... • 'r ARCHER and C. L. KINGSFORD. '3' ASSYRIA. !y .ZtNAiDE A. .- VEDIC INDIA. By Z. A. RA- RAGOZIN. • CiOZIN. '4. 'lURKEY. By STANLEY LANE 42. WESTINDIESa.ndtboSPANISH POOLE. MAIN. By JAMES RODWAY. '5. EOLLAND. By Prot J. E. 43. BOHBMIA. By C. EDMUND THOR01.D ROGERS. MAURICB• .•6. -

Crimson Commentary

Harvard Varsity Club NEWS & VIEWS of Harvard Sports Volume 47 Issue No. 1 www.varsityclub.harvard.edu September 23, 2004 Football Opens Season With Convincing Win Drenching Rain Did Not Hinder Crimson Attack by Chuck Sullivan Lister might be the only person Director of Athletic Communications under Harvard’s employ who wasn’t necessarily pleased with Saturday’s Jon Lister, whose job, among other result. Under weather conditions that things, is to oversee the maintenance and yielded the potential to level what had caretaking of Harvard’s outdoor playing appeared to be a significant edge in talent fields, could only stand and watch what was for the Crimson as well as create the happening on the Harvard Stadium grass possibility of serious injury, Harvard’s Saturday. skill shone through, and the Crimson After the Crimson’s 35-0 Opening Day came out of the game largely unscathed. win against Holy Cross, Lister and The Crimson broke the game open in the members of his staff spent about two hours second quarter, emptied the bench in the on the Stadium field, which had been pelted third period, and simply tried to keep the by downpours and shredded by the cleats clock moving in the fourth quarter. It was of 22 200-to-300-pound men for the better pouring, after all. part of three hours. We don’t know for All three units — offense, defense certain what they were talking about, but it and special teams — made measurable likely had something to do with how exactly contributions. The offense reeled off 325 they were going to have that field ready for yards and scored on six of its first 10 play again in three weeks. -

Lordship of Negroponte

http://upload.wikimedia.org/wikipedia/commons/1/1d/LatinEmpire2.png Lordship of Negroponte From Wikipedia, the free encyclopedia Jump to: navigation, search This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed. (May 2007) Lordship of Negroponte Nigropont Client state* 1204–1470 → ← The Latin Empire with its vassals and the Greek successor states after the partition of the Byzantine Empire, c. 1204. The borders are very uncertain. Capital Chalkis (Negroponte) Venetian officially, Language(s) Greek popularly Roman Catholic Religion officially, Greek Orthodox popularly Political structure Client state Historical era Middle Ages - Principality 1204 established - Ottoman Conquest 1470 * The duchy was nominally a vassal state of, in order, the Kingdom of Thessalonica, the Latin Empire (from 1209), the Principality of Achaea (from 1236), but effectively, and from 1390 also de jure, under Venetian control The Lordship of Negroponte was a crusader state established on the island of Euboea (Italian: Negroponte) after the partition of the Byzantine Empire following the Fourth Crusade. Partitioned into three baronies (terzieri) run by a few interrelated Lombard families, the island soon fell under the influence of the Republic of Venice. From ca. 1390, the island became a regular Venetian colony as the Kingdom of Negroponte (Regno di Negroponte). Contents • 1 History o 1.1 Establishment o 1.2 Succession disputes o 1.3 Byzantine interlude o 1.4 Later history • 2 List of rulers of Negroponte o 2.1 Triarchy of Oreos o 2.2 Triarchy of Chalkis o 2.3 Triarchy of Karystos • 3 References • 4 Sources and bibliography History Establishment According to the division of Byzantine territory (the Partitio terrarum imperii Romaniae), Euboea was awarded to Boniface of Montferrat, King of Thessalonica. -

Samuel Starr Richardson

Samuel Starr Richardson LBJ School of Public Affairs ▪ The University of Texas at Austin ▪ P.O. Box Y, Austin, TX 78713 ▪ (512) 232-3687 ▪ [email protected] EDUCATION Harvard University. Cambridge, MA PhD, Health Policy, Economics Concentration Expected November 2012 Dissertation: “Quality-based payment in health care: Theory and practice” Stanford University. Stanford, CA BA with Honors, ΦΒΚ, Human Biology, Health Policy Concentration, Economics Minor 2002 EXPERIENCE Lyndon B. Johnson School of Public Affairs, The University of Texas at Austin. Austin, TX Instructor July 2012-present Harvard Kennedy School and National Bureau of Economic Research. Cambridge, MA Research Assistant to Amitabh Chandra 2006-2009 VA Health Economics Resource Center. Menlo Park, CA Research Assistant to Wei Yu, Mark W. Smith, and Todd H. Wagner 2003-2006 PUBLICATIONS Papers in progress: Richardson SS. “Integrating pay-for-performance into health care payment systems.” Richardson SS, Gosden TB, Batata, A. “Effect of payment reform on quality of primary care for coronary heart disease, diabetes, and chronic kidney disease in the United Kingdom.” Richardson SS, Gosden TB, Batata, A. “Specificity of provider responses to incentives under pay-for- performance in the United Kingdom.” Peer-reviewed publications: Richardson SS, Sullivan G, Hill A, Yu W. 2007. “Use of aggressive medical treatments near the end of life: Differences between patients with and without dementia.” Health Serv Res. 42(1p1): 183-200. Wagner TH, Richardson SS, Vogel WB, Wing K, Smith MW. 2006. “The cost of inpatient rehabilitation care in the Department of Veterans Affairs.” J Rehabil Res Dev. 43(7): 929-937. Richardson SS, Yu W. -

HARVARD Magazine

HARVARD Magazine May-June 1981 FACING PAGE: The first leaves of spring appear on Mill Street, which divides Volume 83, Number 5 Lowell House from John Winthrop House. Lowell's lesser tower is at left. The photograph is by Michael Nagy. ROUNDTABLE --------------------- Essays: The oilman cometh. The scars that remain. Last words. 4 The Science Watch: William Bennett on new cancer research. 16 Letters: The eclipse of 1780, nonsense DNA, Harvard on the edge. 19. ARTICLES ----------------------- PRESIDENT'S REPORT Business and the academy 23 A re-examination of the use and abuse of professorial talent. By Derek C. Bok. AMERICAN The manongs of California 36 CIVILIZATION Migrant farm workers from the Philippines reaped discrimination and poverty in America. By Peter W. Stanley, with photographs by Bill Ravanesi. LITERATURE Historian of the present 47 Daniel Aaron has a massive editing project in hand-' 'the most completely frank, revealing diary in all of American history." By George Howe Colt. EDUCATION "Taking blocks out of women's paths" 54 At Radcliffe's Bunting Institute, founded two decades ago, the scholarly enterprise has many faces. Written and photographed by Georgia Litwack. VITA Joan of Arc 59 A brief life of the virgin warrior (1412-1431) on the 550th anniversary of her martyrdom. By Deborah Fraioli. PHOTOGRAPHY Manufacturing, marketing, and modernism 60 Harvard's photographic archives document a hidden aesthetic from the Industrial Revolution. Fifteenth in a series by Christopher S. Johnson. DISCOVERY The senses are for survival 64A We may be oblivious to many, but a host of sensory cues allow living beings to cope with their environment. -

Harvard College

Appendix A Harvard University’s Responses to Committee Requests Dated September 25, 2019 The following information and materials enclosed or cited are submitted in response to the Chairman’s questions. Although some have tried to place the decision not to reappoint Professor Sullivan and Ms. Robinson at the conclusion of their term into broader political narratives of academic freedom or even the Sixth Amendment right to legal representation, the simple truth is that this was an administrative decision about the best path forward for Winthrop House after a period of considerable disruption. Professor Sullivan and Ms. Robinson remain at Harvard University as faculty members in good standing. Question 1: The American Bar Association’s Model Rule of Professional Conduct 1.2(b) states, “A lawyer’s representation of a client, including representation by appointment, does not constitute an endorsement of the client's political, economic, social or moral views or activities.” Do you believe it is important for students of Harvard College, whether they intend to engage in the legal profession in some future capacity or not, to appreciate the essence of this rule and the implications it has for the concept of due process afforded to individuals accused of committing crimes in the United States? How heavily did Harvard College weigh consideration of this value when it decided to discontinue its relationship with Ronald S. Sullivan, Jr., and his wife, Stephanie Robinson, as faculty deans of Winthrop House? Response: The mission of Harvard College (the “College”) is to educate citizens and leaders for our society, which we achieve through our commitment to the transformative power of a liberal arts and sciences education.