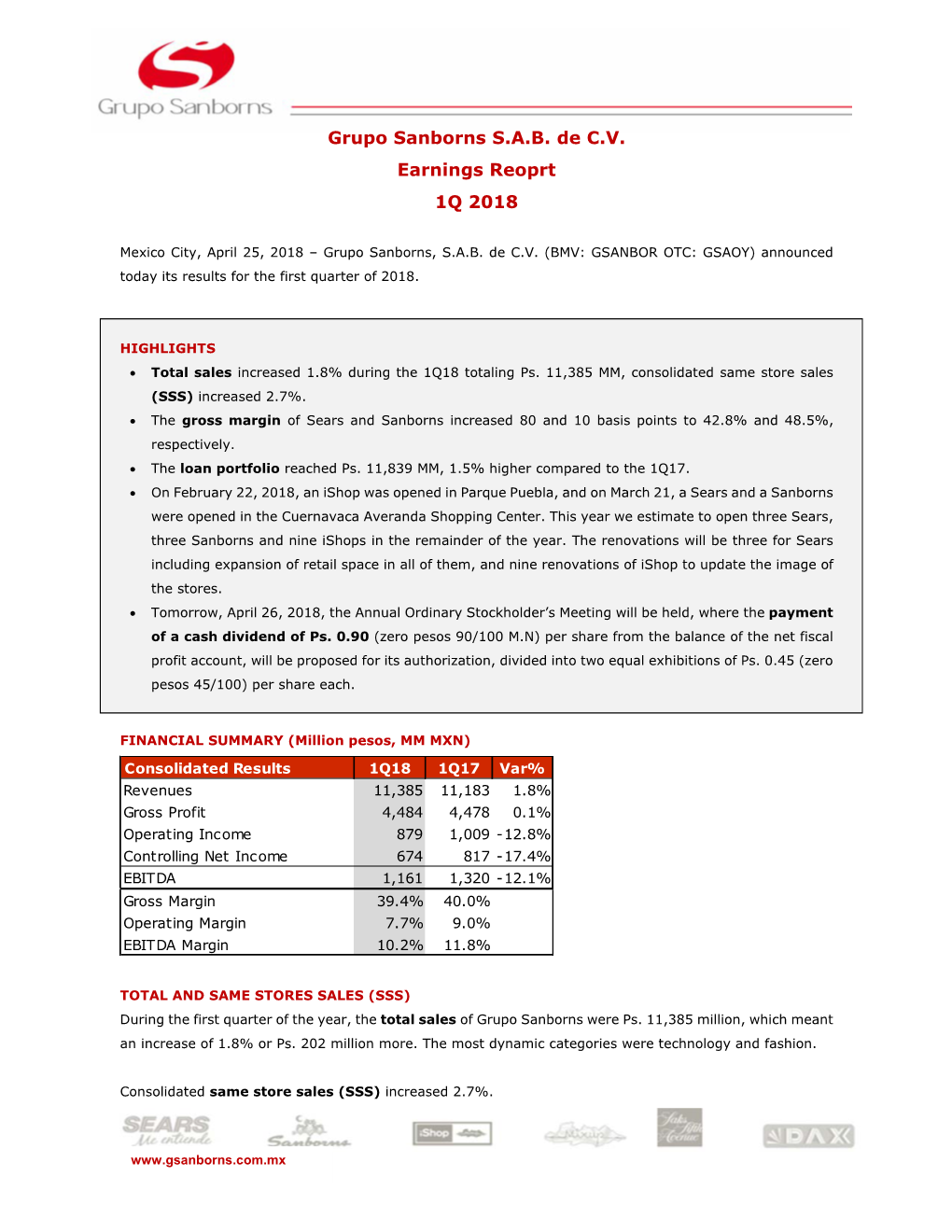

Grupo Sanborns S.A.B. De C.V. Earnings Reoprt 1Q 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PUEBLA: URBANIZACIÔN Y Polfticas URBANAS

PUEBLA: URBANIZACIÔN y POLfTICAS URBANAS Patrice Melé PUEBLA: URBANIZACI6N y POUTICAS URBANAS ~..~••... UNIVERSIDAD Am AUTONOMA Benemérlta METROPOLITANA •Universidad Aut6noma de Puebla Casa abierta al tiempo AzcapotzaJco '*~ IN5TITUTO DE CIENeIAS UNIVERSIDADAUT6NOMA DEPUEBLA Rector Lie. José Doger Cone Secretario Geoenl Lie. Victor Espîodola Cabrera CoonlinadordellDstituto de Ciendas Dr. Eduardo Salinas Slefanon UNIVERSIDADAUT6NOMA METROPOUTANA Rector Geoen1 Dr. Julio Rubio Oca SecretariaGeoenl M. en C. Magdalena Fresao Orozco UNIDADAZCAPOTZALCO Rector Lie. Edmundo Jacobo Molina Secretario de la Unidad Miro. Adrilio de Garay Slioehez Coordinaclorde Extension Universitaria José Lever Jeta de la Sec:àlin Editorial Mira. Silvia Pappe Traduccion Jean Henoequin Diseiio de la portada: Luisa Manmez Originales mec8nicos de los mapas Salvador Guadarrama ISBN: 970-620-408-3 la.ed.I994 C Universidad AutOnoma de Puebla Puebla, Pue C Uoiversidad AutOnoma Metropolitana-Azcapotzalco San Pablo 180 Reyoosa.Taroaulipas México D.F., C.P. 02200 C Patrice Melé Impreso en México Pr;nte4 in Mexico INDICE PRESENTACI6N 7 INTRODuca6N 9 1 EL LUGAR DE PUEBLA EN EL AMBITO NACIONAL 13 A Una localizaci6n estratégica como base de la fundaci6n de la ciudad de Puebla 13 B La perpetuaci6n de una situaci6n privilegiada en el eje de México-Veracruz 15 C Puebla y la estructura urbana nacional 17 II EL LUGAR DE PUEBLA EN lAS POLITICAS NACIONALES DE ORDENAMIENTO TERRITORIAL 25 A Las politicas de desarrollo urbano 25 1 Instaurar una red urbana jerarquizada 26 2 Puebla en la primera -

1. Grupo Diniz

Grupo Diniz Presentación para Inversionistas Certificados de Corto Plazo 1. Grupo Diniz 2 Grupo Diniz - Recórcholis ¿Quién es Grupo Diniz? • Empresa líder en México dedicada al desarrollo de centros de entretenimiento familiar, en ellos se ofrecen una amplia gama de juegos mecánicos, pista de hielo, juegos de redención, boliches, guarderías infantiles y salones de fiesta con alta tecnología • Marca “Recórcholis” reconocida con más de 29 años de experiencia brindando sana diversión a toda la familia los 365 días del año • Marca líder en centros de entretenimiento familiar • 51 unidades de negocio (cuatro en construcción) en 18 estados de la República Mexicana • Asociación con Northgate Capital, un fondo de capital privado reconocido mundialmente • Es considerado tienda Sub-Ancla • Al cierre del ejercicio 2016 se presentó un incremento en ventas del 23.21% con respecto al año anterior, se deriva de un aumento en la afluencia de los Centros de Entretenimiento ya establecidos, de la Apertura de 2 Centros de Entretenimiento ,la remodelación de 4 locales, la reubicación de 1 mas, y la apertura de la pista de Hielo en Mundo E Plaza Pista Hielo Portal San Chedraui Plaza Portal Irapuato Salamanca Vía Vallejo Parque Delta Tampico Victoria Mundo E Angel Ajusco Puebla Centro Querétaro 2016 | 2017 2015 Fuente: Grupo Diniz. 3 Trayectoria de Grupo Diniz 2009 – Empieza la Scotiabank GDINIZ llega a Northgate Capital adquiere GDINIZ inicia operaciones y relación con autoriza una línea 17 sucursales, el 49% de participación en establece la primera sucursal Private Export por $50 millones se integra un el Capital de GDINIZ en Toluca. Almacen y un Funding de pesos Laboratorio de Ingeniería Apertura Pista de Hielo en Mundo E 1988 1999 2003 2005 2012 2013 2015 2016 2017 De 2005 a 2008 se La fronteras se Se logra la apertura de 5 Se abre el primer local con llega a 27 sucursales fortalecen y se Centros de superficie mayor a 1500 mts En 2009, se abre la pretende abrir la 3ª entretenimiento Familiar 2. -

Programas Especiales

Lista de Centros Comerciales reportados para su cobertura a traves de Brigadas Itinerantes durante el Buen Fin. Centros Comerciales programados para su cobertura durante el Buen Fin No. UA 1 DEL - AGUASCALIENTES Centro Nombre del Municipio Dirección Referencias Responsable de Comercial Centro Brigada No. Comercial BLVD. JOSÉ MA. CHÁVEZ AV. MAHATMA S/N, MESONEROS, GANDHI Y 20280 ABRAHAM LIC. DORA ELISA 1 VILLASUNCION AGUASCALIENTES AGUASCALIENTES, AGS. GONZALEZ PORTUGAL IBARRA BOULEVARD A ZACATECAS NORTE 849, TROJES DE ALONSO, BLVD. A 20116 ZACATECAS Y LIC. DORA ELISA 2 ALTARIA AGUASCALIENTES AGUASCALIENTES, AGS. ARTICULO 1° PORTUGAL IBARRA AV. AVENIDA UNIVERSIDAD AGUASCALIENTE 935, BOSQUES DEL S NTE Y SIERRA PLAZA PRADO, 20127 DE LAS LIC. DORA ELISA 3 UNIVERSIDAD AGUASCALIENTES AGUASCALIENTES, AGS PALOMAS PORTUGAL IBARRA AV. AV TECNOLÓGICO 120, TECNOLOGICO Y COLONIA: CARRETERA SAN LIC. DORA ELISA 4 ESPACIO AGUASCALIENTES OJOCALIENTE, 20198 LUIS POTOSI PORTUGAL IBARRA 1 DEL - AGUASCALIENTES BOULEVARD A ZACATECAS NORTE 849, AV. CENTRO TROJES DE ALONSO, AGUASCALIENTE COMERCIAL 20116 S NORTE Y AV. DIEGO ABRAHAM 5 ALTARIA AGUASCALIENTES AGUASCALIENTES, AGS. SIGLO XXI BONILLA ORTIZ 5 DE MAYO ZONA CENTRO 20000 LIC. DORA ELISA 6 PLAZA PATRIA AGUASCALIENTES AGUASCALIENTES, AGS. RAYON Y NIETO PORTUGAL IBARRA AV MAHATMA GANDHI, DESARROLLO ESPECIAL VALENTE PLAZA VILLA ASUNCIÓN, 20230 QUINTANA Y LIC. DORA ELISA 7 CHEDRAUI AGUASCALIENTES AGUASCALIENTES, AGS. ANGEL GOMEZ PORTUGAL IBARRA BLVD. LUIS AV. INDEPENDENCIA DONALDO 2351, TROJES DE COLOSIO ALONSO, 20116 MURRIETA Y LIC. DORA ELISA 8 GALERIAS AGUASCALIENTES AGUASCALIENTES, AGS. JORGE REYNOSO PORTUGAL IBARRA CENTRO BLVD. JOSÉ MA. CHÁVEZ COMERCIAL S/N, MESONEROS, AV. SIGLO XXI Y PLAZA 20280 AV. MAHATMA DIEGO ABRAHAM 9 VILLASUNCION AGUASCALIENTES AGUASCALIENTES, AGS. -

HOTELS OPERATION UPDATE HOTELS REOPENING July 1, 2020

LIVE AQUA BEACH RESORT CANCÚN HOTELS OPERATION UPDATE HOTELS REOPENING July 1, 2020. Dear Clients and Business Partners, Though recent circumstances may have forced physical distance between us, we remain as united as ever. We have stayed in touch throughout the process as we took all the necessary measures to reopen. Now, thanks to our passion for service, we are ready to offer not just guaranteed safety but also the same amazing experiences that we always have and always will offer––so you never have to stop traveling or staying with us. I am very pleased to inform you that as of today, Live Aqua, Grand Fiesta Americana, Fiesta Americana, The Explorean, Fiesta Inn, Gamma, and one hotels will begin a gradual reopening over the course of the coming weeks according to a timeline established by local authorities. JUNE 1 GRAND FIESTA AMERICANA GAMMA Grand Fiesta Americana Guadalajara Country Club Gamma Monterrey Gran Hotel Ancira Gamma Morelia Beló FIESTA AMERICANA Gamma Orizaba Grand Hotel de France Fiesta Americana Guadalajara Gamma Pachuca Gamma Xalapa Nubara FIESTA INN Fiesta Inn Aeropuerto Ciudad de México ONE Fiesta Inn Celaya Galerías one Ciudad del Carmen Concordia Fiesta Inn Ciudad del Carmen one Guadalajara Centro Histórico Fiesta Inn Ciudad Obregón one Guadalajara Periférico Norte Fiesta Inn Colima one Guadalajara Periférico Poniente Fiesta Inn Cuautitlán one León Antares Fiesta Inn Guadalajara Expo one Monterrey Aeropuerto Fiesta Inn Guadalajara Periférico Poniente one Puerto Vallarta Aeropuerto Fiesta Inn Monterrey Tecnológico -

AVISO CORPORATIVO Ciudad De México, a 5 De Enero De 2017 Fibra

AVISO CORPORATIVO Ciudad de México, a 5 de enero de 2017 Fibra Danhos (BMV: DANHOS) informa que el pasado 27 de diciembre de 2016, de conformidad con los acuerdos adoptados en (i) la Asamblea General de Tenedores celebrada el 16 de marzo de 2016, (ii) la Asamblea General de Tenedores celebrada el 18 de junio de 2014, y (iii) la Sesión del Comité Técnico celebrada el 21 de julio de 2016, así como (iv) el Oficio número 153/106197/2016 emitido por la Comisión Nacional Bancaria y de Valores (CNBV) con fecha 16 de diciembre de 2016: (1) se emitieron 10,000,000 (diez millones) de CBFIs a ser mantenidos en Tesorería del Fideicomiso Fibra Danhos para ser utilizados de tiempo en tiempo para el pago por la aportación y/o adquisición de ciertos bienes inmuebles y/o proyectos inmobiliarios de terceras partes no relacionadas, mismos cuya entrega y liberación deberán ser aprobados previamente por el Comité Técnico, en los términos del Fideicomiso Fibra Danhos y de la legislación aplicable; y (2) se cancelaron 32,480,252 (treinta y dos millones cuatrocientos ochenta mil doscientos cincuenta y dos) CBFIs sobrantes para la adquisición de Parque Vía Vallejo y los terrenos de Parque Puebla. De esta manera, el numero de CBFIs emitidos de Fibra Danhos a la fecha asciende a 1,518,764,772 (mil quinientos dieciocho millones setecientos sesenta y cuatro mil setecientos setenta y dos) CBFIs. Acerca de Fibra Danhos Fibra Danhos es un Fideicomiso mexicano constituido principalmente para desarrollar, ser propietarios de, arrendar, operar y adquirir activos inmobiliarios comerciales icónicos y de calidad premier en México. -

Grupo Sanborns S.A.B. De C.V. Earnings Report 2Q 2017

Grupo Sanborns S.A.B. de C.V. Earnings Report 2Q 2017 Mexico City, July 27, 2017 – Grupo Sanborns, S.A.B. de C.V. (BMV: GSANBOR OTC: GSAOY) announced today its results for the second quarter of 2017. HIGHLIGHTS Total sales increased 7.0% during the 2Q17 reaching Ps. 11,555 MM. Consolidated Same Store Sales (SSS) increased 3.4% in the quarter and 4.2% in the first semester. Controlling Net Income posted a 16.5% increase in the 2Q17, reaching Ps. 793 million pesos, compared with Ps. 681 million recorded in the 2Q16. The credit portfolio totaled Ps. 11,444 MM being 11.7% higher compared with the 2Q16. On June 20, 2017 the first installment of Ps. 0.44 (forty-four cents) was paid, of the annual dividend of Ps. 0.88 (eighty-eight cents) decreed in the Ordinary General Shareholders´ Meeting. Retail space increased 5.0% year over year, reaching 1,194,117 sqm. Renovations continued at the Sears Puebla Center store, as well as the stores in Perisur and Historic Center in Mexico City. FINANCIAL SUMMARY (Million pesos, MM Ps) Consolidated Results 2Q17 2Q16 Var% 6M17 6M16 Var% Revenues 11,555 10,803 7.0% 22,738 21,088 7.8% Gross Profit 4,704 4,400 6.9% 9,182 8,535 7.6% Operating Income 1,159 1,162 -0.3% 2,167 2,115 2.5% Controlling Net Inc ome 793 681 16.5% 1,610 1,312 22.7% EBITDA 1,473 1,435 2.7% 2,794 2,655 5.2% Gross Margin 40.7% 40.7% 40.4% 40.5% Operating Margin 10.0% 10.8% 9.5% 10.0% EBITDA Margin 12.7% 13.3% 12.3% 12.6% TOTAL AND SAME STORE SALES (SSS) During the second quarter of the year, Grupo Sanborns' total sales amounted to Ps. -

Cine Ciudad Disponibilidad De Paquetes Por Cine Cinepolis Ajusco

Promoción: “Tarjetas Coleccionables Pokémon Detective Pikachu” Bases y condiciones 1. Aceptación de las bases y condiciones. La promoción denominada “Tarjetas Coleccionables Pokémon Detective Pikachu” implica el conocimiento, aceptación incondicional, expresa e irrevocable de las presentes bases y condiciones, así como también sometimiento a dichas reglas. Cualquier violación a las mismas o a los procedimientos o sistemas establecidos para la realización de esta promoción implicará la inmediata descalificación y exclusión de la misma y/o la revocación de los beneficios. 2. Organizador. El organizador, responsable y encargado de la operación, desarrollo, realización de la promoción es Cinépolis de México, S.A. de C.V. (en lo sucesivo “Cinépolis y/o el Organizador”), con domicilio en Av. Cumbre de Naciones número 1200, Fraccionamiento Tres Marías, C.P. 58254, en la ciudad de Morelia, Michoacán. 3. Vigencia y Cobertura. La promoción “Tarjetas Coleccionables Pokemón Detective Pikachu” estará vigente a partir del 22 de abril de 2019, hasta agotar existencias: 132,599 unidades. Se estarán entregando las tarjetas a partir del 9 de mayo y ninguna fecha anterior. 4. Participación. Podrán participar todas las personas que sean mayores de edad, que tengan domicilio en la Ciudad de México, Ciudad Juárez, Guadalajara, Mérida, Mexicali, Monterrey, Puebla, Querétaro, Tijuana y Toluca, que cumplan con las condiciones referidas en estas bases y que hayan adquirido boletos de preventa, para la función de Pokémon Detective Pikachu, en uno de los cines que se mencionan en la Tabla 1. No podrán participar los empleados, socios, dependientes de los programadores, patrocinadores, el Organizador, afiliados o subsidiarias, ni los cónyuges o familiares hasta el cuarto grado de parentesco. -

Horarios Y Cierres Temporales Por Contingencia

Información actualizada al 11.05.2020 Cambio de horario y cierres temporales por contingencia. En cumplimiento al Acuerdo por el que se declara como emergencia sanitaria por causa de fuerza mayor, a la epidemia de enfermedad generada por el virus SARS-CoV2 (COVID-19), publicado en el Diario Oficial de la Federación el 30 de marzo de 2020 y a las diferentes Declaratorias de Emergencia emitidas por las Entidades Federativas del país, a través de las cuales se ha decretado la suspensión de actividades o se ordenó el cierre temporal de diversos centros de trabajo, empresas, negocios u otros establecimientos que concentren personas; Telcel ha tenido que cerrar algunos Centros de Atención a Clientes, o bien, modificar los horarios de atención de dichos establecimientos. Durante la contingencia Telcel continúa dando atención a través de los Centros de Atención a Clientes que permanecen abiertos, así como a través de su página en Internet, chat en línea, correo electrónico, atención telefónica en el *111 y *264 desde su Telcel y de los números 800 gratuitos y/o regionales comunicados en telcel.com. NUEVO HORARIO DE ATENCIÓN POR REGIÓN NOMBRE DEL CAC ESTATUS CONTINGENCIA R01 MEXICALI 2 CERRADO POR CONTINGENCIA CERRADO POR CONTINGENCIA R01 LA PAZ III CERRADO POR CONTINGENCIA CERRADO POR CONTINGENCIA R01 MINI CAC SANBORNS MEXICALI BOUTIQUE CERRADO POR CONTINGENCIA CERRADO POR CONTINGENCIA R01 RIO ABIERTO L - D 10:00 a 18:00 hrs. R01 MEXICALI ABIERTO L - D 10:00 a 18:00 hrs. L - V 10:00 a 18:00 hrs. R01 LA PAZ ABIERTO S – D CERRADO POR CONTINGENCIA R01 LOS CABOS ABIERTO L - D 10:00 a 18:00 hrs. -

![[411000-AR] Datos Generales - Reporte Anual](https://docslib.b-cdn.net/cover/6719/411000-ar-datos-generales-reporte-anual-4746719.webp)

[411000-AR] Datos Generales - Reporte Anual

Clave de Cotización: AXO Fecha: 2020-12-31 [411000-AR] Datos generales - Reporte Anual Reporte Anual: Anexo N Oferta pública restringida: No Tipo de instrumento: Deuda LP,Deuda CP Emisora extranjera: No Mencionar si cuenta o no con aval u otra garantía, Garantía AXO 00120: Los Certificados Bursátiles no cuentan especificar la Razón o Denominación Social: con el Aval de ninguna sociedad. Garantía AXO 19-2: Los Certificados Bursátiles cuentan con el aval de las siguientes subsidiarias del emisor: Ledery México, S.A. de C.V.; I Nostri Fratelli, S. de R.L. de C.V.; Multibrand Outlet Stores S.A.P.I. de C.V., Servicios de Capital Humano Axo S.A. de C.V., Tennix, S.A. de C.V., Red Stripes, S.A. de C.V., East Coast Moda, S.A. de C.V. y cualquier otra subsidiaria presente o futura del Emisor que, durante la vigencia de la Emisión, (a) sea propiedad al 99% (noventa y nueve por ciento) (directa o indirectamente) del Emisor, y (b) represente al último trimestre del Emisor por lo menos el 5% de la UAFIDA o de los activos totales consolidados del Emisor; con excepción de las siguientes subsidiarias del Emisor que no podrán ser Avalistas durante la vigencia de la Emisión: Baseco, S.A.P.I. de C.V. Garantía AXO 19: Los Certificados Bursátiles cuentan con el aval de las siguientes subsidiarias del emisor: Ledery México, S.A. de C.V.; I Nostri Fratelli, S. de R.L. de C.V.; Multibrand Outlet Stores S.A.P.I. de C.V., Servicios de Capital Humano Axo S.A. -

Reporte Anual

Clave de Cotización: AXO Fecha: 2019-12-31 [411000-AR] Datos generales - Reporte Anual Reporte Anual: Anexo N Oferta pública restringida: No Tipo de instrumento: Deuda LP,Deuda CP Emisora extranjera: No Mencionar si cuenta o no con aval u otra garantía, Garantía AXO 19-2: Los Certificados Bursátiles cuentan con el especificar la Razón o Denominación Social: aval de las siguientes subsidiarias del emisor: Ledery México, S.A. de C.V.; I Nostri Fratelli, S. de R.L. de C.V.; Multibrand Outlet Stores S.A.P.I. de C.V., Servicios de Capital Humano Axo S.A. de C.V., Tennix, S.A. de C.V., Red Stripes, S.A. de C.V., East Coast Moda, S.A. de C.V. y cualquier otra subsidiaria presente o futura del Emisor que, durante la vigencia de la Emisión, (a) sea propiedad al 99% (noventa y nueve por ciento) (directa o indirectamente) del Emisor, y (b) represente al último trimestre del Emisor por lo menos el 5% de la UAFIDA o de los activos totales consolidados del Emisor; con excepción de las siguientes subsidiarias del Emisor que no podrán ser Avalistas durante la vigencia de la Emisión: Baseco, S.A.P.I. de C.V. Garantía AXO 19: Los Certificados Bursátiles cuentan con el aval de las siguientes subsidiarias del emisor: Ledery México, S.A. de C.V.; I Nostri Fratelli, S. de R.L. de C.V.; Multibrand Outlet Stores S.A.P.I. de C.V., Servicios de Capital Humano Axo S.A. de C.V., Tennix, S.A. -

El Puerto De Liverpool, Sab De Cv

LIVEPOL EL PUERTO DE LIVERPOOL, S.A.B. DE C.V. REPORT ON 2018 FOURTH QUARTER RESULTS Highlights Tailwinds During the year, remittances showed record growth. Compared to the same period in the prior year, growth for the fourth quarter was 13.9%, for an accumulated 10.4%. In January 2019, the consumer confidence index reached its highest level since August 2001. At the December 2018 close, it showed a 23.5% improvement over the December 2017 reading. Exchange rate: the average for the quarter showed 4.5% devaluation with respect to the same period the prior year; however, on a cumulative basis, depreciation was only 1.7% with respect to 2017, nearly leveling at the year end. Headwinds: Inflation was 4.83% at the year-end, 2 p.p. below the figure for the prior year, although above Banxico’s (Mexico's Central Bank) target level. Consumer credit: As a result of the increase in interest rates, consumer credit has been affected throughout the year. The increase with respect to the prior year, mainly in November and December, was only 1.5%. Benchmark interest rate: During the quarter, Banxico raised the benchmark rate by 25 bps twice, and was 8.25% by the year end. Unemployment in December reached its highest level in two years. Company highlights: For Liverpool, same-store sales grew 6.4% during the quarter and 6.5% year-to-date. For Suburbia, growth in same-store sales is 6.6% for the quarter and 10.6% on a cumulative basis. Total income for the quarter grew 8.6% and 10.9% on a cumulative basis. -

Términos Y Condiciones

Términos y condiciones El obsequio del Adaptador Nikon FTZ y del battery grip MB-D18 es una promoción organizada por NIKON MÉXICO, S.A DE C.V. (en lo sucesivo “NIKON”) con domicilio en Avenida Paseo de la Reforma número 250, Torre Niza, Piso 12, Colonia Juárez, Delegación Cuauhtémoc, C.P. 06600 en la Ciudad de México, mismo que se llevará a cabo en las ciudades y estados pertenecientes al territorio Mexicano; con la finalidad de que los usuarios de la marca puedan experimentar los beneficios en fotografía y video de la serie de cámaras Nikon sin espejo (mirrorless) y del incremento del desempeño en el equipo DSLR D850 Cuerpo. I. DESCRIPCIÓN DE LA PROMOCIÓN: 1. Nikon México obsequiará un adaptador de montura Nikon FTZ a los clientes que adquieran una cámara Nikon Z7 y Z6 cuerpo así como Z7 y Z6 kit con lente Nikkor Z 24- 70mm f/4 S. 2. Nikon México obsequiará un battery grip modelo MB-D18 a los clientes que adquieran una cámara Nikon D850 Cuerpo. 3. Para hacer válida esta promoción, es necesario que la compra de los equipos Z7, Z6, D850 cuerpo así como los equipos Z7 y Z6 kit de un lente (Nikkor Z 24-70mm f/4 S) se realice en los canales autorizados por Nikon México, mismos que se anexan a continuación: Sanborns Tiendas Sanborns Madero Cuernavaca Centro Cuernavaca Plaza Xochimilco Chihuahua Pabellon Cuauhtémoc Xalapa Cuautitlán Centro Media Luna Nuevo Tlalnepantla Churubusco Monterrey Centro Interlomas Puebla Héroes Guadalajara Gran Plaza Zaragoza Coatzacoalcos Ciudad Jardín Neza La Raza Insurgentes Acapulco Centro Ermita Aeropuerto Veracruz