Presentación De Powerpoint

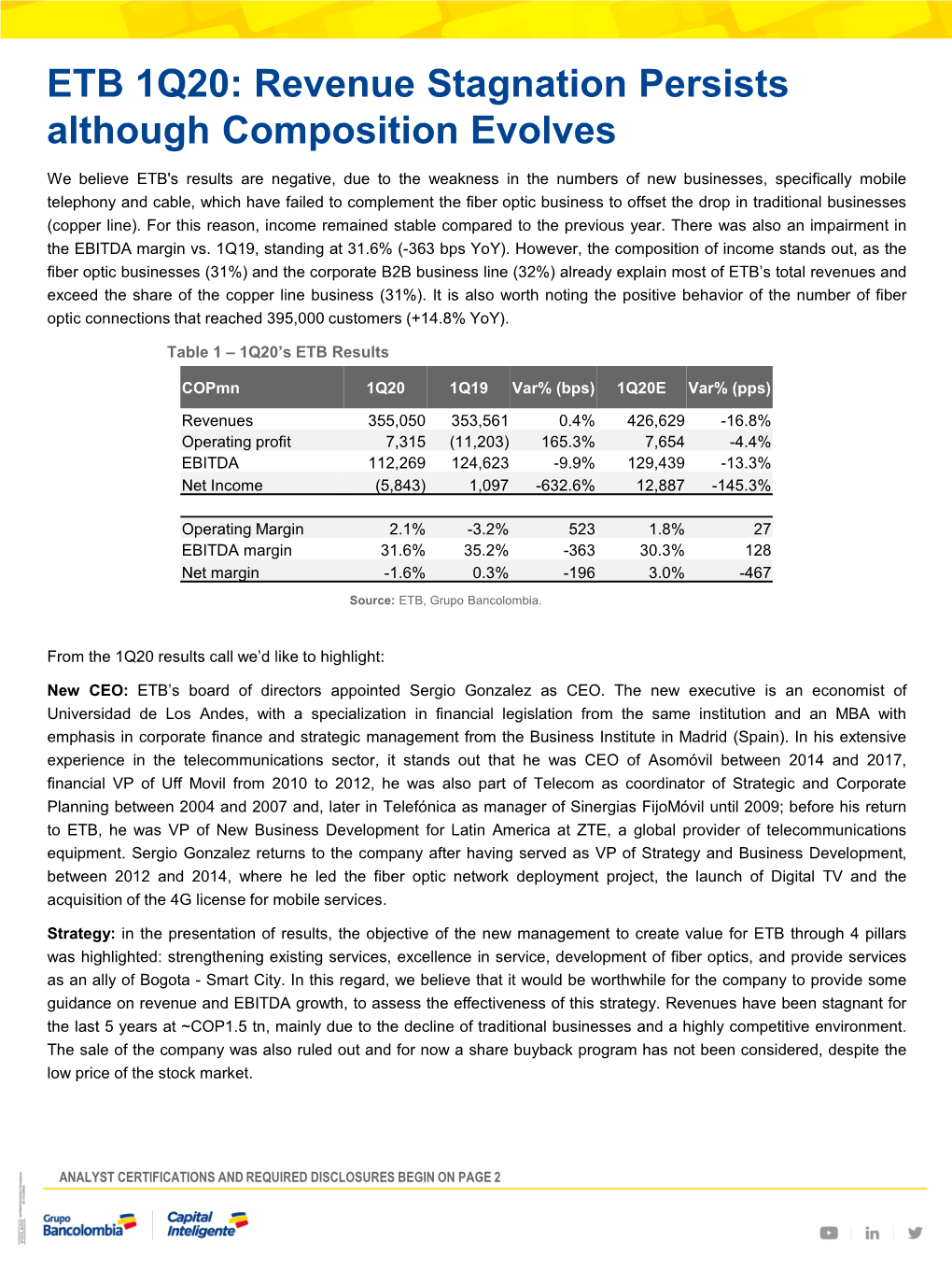

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

20160803 Banco Bancolombia.Xlsx

COD. NOMBRE SUCURSAL- TELÉFONO BANCO DEPARTAMENTO CIUDAD DIRECCIÓN INDICATIVO HORARIO NORMAL HORARIO ADICIONAL HORARIO ATENCION SABADOS SUCURSAL OFICINA OFICINA 5642735 - BANCOLOMBIA 709 ABREGO NORTE DE SANTANDER ABREGO CARRERA 14 N° 7 – 93 97 5642023 8:00 - 11:30 AM - 14:00 - 16:30 PM BANCOLOMBIA 890 ACACIAS META ACACIAS CALLE 14 No 14-20-24 98 6569060 8:00 - 17:00 PM BANCOLOMBIA 297 AGUACHICA CESAR AGUACHICA CALLE 5 N° 17 - 80 95 5651394 8:30 - 18:00 PM BANCOLOMBIA 643 AGUADAS CALDAS AGUADAS CARRRERA 5 N° 6 - 18 96 8514600 8:00 - 12:00 AM - 14:00 - 16:00 PM BANCOLOMBIA 365 AGUAZUL CASANARE AGUAZUL CALLE 10 N° 17 - 06 98 6384247 8:00 - 16:30 PM 16:30 - 18:00 PM 8389569 BANCOLOMBIA 485 AIPE HUILA AIPE CALLE 4 N° 4 - 29 98 8389673 8:00 - 11:30 AM - 14:00 - 16:30 PM BANCOLOMBIA 861 ALBANIA LA GUAJIRA ALBANIA Calle 3 N° 3-38 Albania Guajira 0 8:00 - 11:30 AM - 14:00 - 16:30 PM 847 22 19 – 847 22 20 – BANCOLOMBIA 520 AMAGA ANTIOQUIA AMAGÁ Calle 51 N° 49-43 94 847 22 21 8:00 - 14:00 PM BANCOLOMBIA 443 AMBALEMA TOLIMA AMBALEMA CALLE 8A N° 4 - 23 98 2856163 8:00 - 11:30 AM - 14:00 - 16:00 PM BANCOLOMBIA 384 ANAPOIMA CUNDINAMARCA ANAPOIMA CARRERA 3 N° 3 - 33 91 8993587 8:00 - 15:30 PM BANCOLOMBIA 438 ANDES ANTIOQUIA ANDES CARRERA 50 N° 49A - 52 94 8417262 8:00 - 14:00 PM BANCOLOMBIA 708 ANSERMA CALDAS ANSERMA CARRERA 4 N° 9 - 06 96 8531419 8:00 - 12:00 AM - 14:00 - 16:00 PM BANCOLOMBIA 549 PLAZA DEL RIO ANTIOQUIA APARTADO CALLE 100 CON CARRERA 103 94 8280610 8:00 - 16:00 PM BANCOLOMBIA 645 APARTADO ANTIOQUIA APARTADO CALLE 96 N° 99A - 11 94 8280083 -

Estudio Comparativo De Sostenibilidad Entre Las Entidades

ESTUDIO COMPARATIVO DE SOSTENIBILIDAD ENTRE LAS ENTIDADES FINANCIERAS BANCOLOMBIA Y BANCO BRADESCO DE BRASIL Lina Marcela Hernández Ortega Lucia Galvis Quintero Sara Cristina Vahos Pérez Estudiantes Universidad de San Buenaventura –Seccional Medellín Facultad Ciencia Empresariales Programa Administración de Negocios Medellín 2012 2 ESTUDIO COMPARATIVO DE SOSTENIBILIDAD ENTRE LAS ENTIDADES FINANCIERAS BANCOLOMBIA Y BANCO BRADESCO DE BRASIL ESTUDIO COMPARATIVO DE SOSTENIBILIDAD ENTRE LAS ENTIDADES FINANCIERAS BANCOLOMBIA Y BANCO BRADESCO DE BRASIL Lina Marcela Hernández Ortega Lucia Galvis Quintero Sara Cristina Vahos Pérez Estudiantes Germán Escobar Aristizábal Asesor de Trabajo de Grado Trabajo de grado para optar el título de Administrador de Negocios Universidad de San Buenaventura –Seccional Medellín Facultad Ciencia Empresariales Programa Administración de Negocios Medellín 2012 3 ESTUDIO COMPARATIVO DE SOSTENIBILIDAD ENTRE LAS ENTIDADES FINANCIERAS BANCOLOMBIA Y BANCO BRADESCO DE BRASIL TABLA DE CONTENIDO INTRODUCCION ........................................................................................................................................ 7 1. PROBLEMA DE INVESTIGACIÓN .............................................................................................. 9 1.1. Descripción del Problema. ................................................................................................................ 9 1.2 Formulación del Problema ............................................................................................................ -

Arbitraje Con Adrs: Un Estudio De Caso Sectorial Para Empresas De Colombia, México, Brasil Y Chile

Arbitraje con ADRs: un estudio de caso sectorial para empresas de Colombia, México, Brasil y Chile Arbitrage with ADRs: a sectorial case study for companies in Colombia, Mexico, Brazil and Chile Nicolás Acevedo V. * Daniela Fleisman V. ** Angélica Montoya V. *** Andrés Mauricio Mora C. **** Fecha de recepción: Fecha de aprobación: * (FRQRPLVWD 8QLYHUVLGDG ($),7 0DJLVWHU HQ (FRQRPtD ,68 *HUHQWH GH ,QYHVWLJDFLyQ\'HVDUUROORGH3URGXFWRV9DORUHV%DQFRORPELD&RORPELD &RUUHRHOHFWUyQLFRQDYHOH]#\DKRRFRP ** (FRQRPLVWD8QLYHUVLGDG($),7$QDOLVWD3RUWDIROLRV3ULYDGRV%ROVD\5HQWD6$ &RORPELD&RUUHRHOHFWUyQLFRGIOHLVPDQ#EROVD\UHQWDFRP *** (FRQRPLVWD 8QLYHUVLGDG ($),7 (MHFXWLYD &RPHUFLDO 9DORUHV %DQFRORPELD &RORPELD&RUUHRHOHFWUyQLFRDQJHOLPR#9DORUHV%DQFRORPELDFRP **** Administrador de Negocios, Especialista en Finanzas, Magíster en Administración )LQDQFLHUD 0DJtVWHU HQ &LHQFLDV GH OD $GPLQLVWUDFLyQ 8QLYHUVLGDG ($),7 (VSHFLDOLVWDHQ$QiOLVLV%XUViWLO,QVWLWXWRGH(VWXGLRV%XUViWLOHV ,(% -HIHGHO 'HSDUWDPHQWRGH)LQDQ]DV8QLYHUVLGDG($),7&RORPELD &RUUHRHOHFWUyQLFRDPRUDF#HDILWHGXFR ISSN 1657-4206 I Año 15 I No. 33 I julio-diciembre 2011 I pp. 7-23 I Medellín-Colombia 8 Arbitraje con ADRs: un estudio de caso sectorial para empresas de Colombia, México, Brasil y Chile 1,&2/É6$&(9('29 '$1,(/$)/(,60$19 $1*e/,&$02172<$9 $1'5e60$85,&,2025$& Resumen (O SUHVHQWH DUWtFXOR HV OD FRQWLQXDFLyQ GHO DUWtFXOR ´*HQHUDOLGDGHV GH ORV $'5V 8Q estudio de caso sectorial para empresas de Colombia, México, Brasil y Chile” y al igual que este, es un subproducto de la investigación “Arbitraje con -

Interim Condensed Consolidated Financial Statements As of June 30, 2020 and December 31, 2019 and for the Three and Six Month Periods Ended June 30, 2020 and 2019

Interim condensed consolidated financial statements As of June 30, 2020 and December 31, 2019 and for the three and six month periods ended June 30, 2020 and 2019 CREDICORP LTD. AND SUBSIDIARIES Interim condensed consolidated financial statements as of June 30, 2020 and December 31, 2019 and for the three and six month periods ended June 30, 2020 and 2019 Content Pages Interim condensed consolidated statement of financial position 1 Interim condensed consolidated statement of income 2 - 3 Interim condensed consolidated statement of comprehensive income 4 Interim condensed consolidated statement of changes in net equity 5 Interim condensed consolidated statement of cash flows 6 - 8 Notes to the interim condensed consolidated financial statements 9 - 111 US$ = United States dollar S/ = Sol CREDICORP LTD. AND SUBSIDIARIES Interim condensed consolidated statement of financial position As of June 30, 2020 (unaudited) and December 31, 2019 (audited) As of June 30, As of December As of June 30, As of December Note 2020 31, 2019 Note 2020 31, 2019 S/(000) S/(000) S/(000) S/(000) Assets Liabilities Cash and due from banks: Deposits and obligations: 14 Non-interest-bearing 6,685,864 6,177,356 Non-interest-bearing 41,310,487 28,316,170 Interest-bearing 29,430,518 19,809,406 Interest-bearing 88,353,845 83,689,215 4 36,116,382 25,986,762 129,664,332 112,005,385 Cash collateral, reverse repurchase agreements and Payables from repurchase agreements and securities lending 5(b) 22,437,742 7,678,016 securities borrowing 5(a) 2,920,789 4,288,524 Due to banks -

Actualización Conjunta De Nuestro Universo De Cobertura

Actualización conjunta de nuestro universo de cobertura Mercado accionario Análisis fundamental en medio de la pandemia colombiano Dirección de Investigaciones Económicas, Sectoriales y de Mercados Julio de 2020 Análisis fundamental en medio de la pandemia 47% sobreponderar, 5% Neutral, 37% subponderar y 11% Bajo Revisión La incertidumbre y el miedo hacen una mezcla explosiva para los mercados financieros, generando descalces de valor como los que, en nuestra opinión, vivimos en la actualidad. Esta sobrerreacción a las noticias económicas negativas en medio del pánico (covid-19) es normal en el corto plazo, abriendo oportunidades de inversión desde un punto de vista fundamental para portafolios que quieran apostarle a la recuperación económica. Actualizamos nuestro universo de cobertura realizando diferentes ajustes a nuestra metodología de valoración, entre las que destacamos ajustes en la tasa de descuento, expectativas de crecimiento en los diferentes sectores económicos, al igual que nuevas proyecciones macroeconómicas para Colombia y los países de la región. Con base en lo anterior, concluimos que el mercado colombiano presenta un atractivo descuento fundamental, con un índice COLCAP que presenta un potencial de valorización del 38,9%. Es importante tener presente que ninguna compañía nos arroja un potencial de valorización negativo, en otras palabras, la recomendación de Subponderar obedece a que dichos activos rentarán un 5% menos que la expectativa fundamental del índice Colcap Nunca antes el trabajo de un analista fundamental había sido tan complejo, pues las compañías de cara a la coyuntura han dejado de dar su visión de expectativa de resultados para 2020, lo que incrementa el nivel de riesgo de nuestras recomendaciones. -

Códigos Entidades En Bvc

CÓDIGOS ENTIDADES EN BVC Para el registro registro de instrumentos Financieros Derivados y productos estructurados celebrados en el mercado OTC, debe tenerse en cuenta la siguiente codificación para la identificación en el sistema. Código Nombre entidad Entidad 1 ADCAP COLOMBIA S.A COMISIONISTA DE BOLSA 2 CORREDORES DAVIVIENDA S.A. 3 AFIN S.A. 4 HELM COMISIONISTA DE BOLSA S.A 5 BBVA - VALORES COLOMBIA S.A. 7 ACCIONES Y VALORES S.A. 10 VALORES BANCOLOMBIA S.A. C.B. 13 VALORALTA S.A COMISIONISTA DE BOLSA 18 ALIANZA VALORES S.A. 26 PROFESIONALES DE BOLSA S.A 29 CREDICORP CAPITAL COLOMBIA S.A 34 COMPASS GROUP S.A. 35 CITIVALORES S.A. 37 ULTRASERFINCO S.A. 45 CASA DE BOLSA S.A. 50 BTG PACTUAL COLOMBIA S.A COMISIONISTA DE BOLSA 51 GLOBAL SECURITIES COLOMBIA S.A 56 SERVIVALORES GNB SUDAMERIS 57 SCOTIA SECURITIES S.A 58 OLD MUTUAL VALORES S.A C de B. 62 LARRAIN VIAL COLOMBIA S.A COMISIONISTA DE BOLSA 228 CASA DE BOLSA - CARTERAS COLECTIVAS 305 COLFONDOS S.A. 309 BANCOLOMBIA S.A. 317 CAPITALIZADORA COLPATRIA S.A. 318 BANCO COLPATRIA RED MULTIBANCA S.A 320 CORPBANCA INVESTMENT TRUST COLOMBIA S.A 321 FIDUCIARIA POPULAR S.A. 332 SERVITRUST GNB SUDAMERIS S.A. 333 BANCO BCSC-FUNDACION SOCIAL S.A. 336 FIDUCIARIA COLMENA S.A. 340 RIESGOS LABORALES COLMENA S.A 341 CAPITALIZADORA COLMENA 344 ALIANZA FIDUCIARIA S.A. 348 FIDUCIARIA DE OCCIDENTE S.A. 353 FIDUCIARIA LA PREVISORA S.A. 354 BANCO DE BOGOTA S.A. 356 PORVENIR S.A. SOC ADM DE PENSION 359 BANCO GNB SUDAMERIS S.A. -

Corporate Presentation September 2019 Disclaimer

Corporate Presentation September 2019 Disclaimer Grupo Aval Acciones y Valores S.A. (“Grupo Aval”) is an issuer of securities in Colombia and in the United States, registered with Colombia’s National Registry of Shares and Issuers (Registro Nacional de Valores y Emisores) and the United States Securities and Exchange Commission (“SEC”). As such, it is subject to compliance with securities regulation in Colombia and applicable U.S. securities regulation. All of our banking subsidiaries (Banco de Bogotá, Banco de Occidente, Banco Popular and Banco AV Villas), Porvenir and Corficolombiana, are subject to inspection and supervision as financial institutions by the Superintendency of Finance. Grupo Aval is now also subject to the inspection and supervision of the Superintendency of Finance as a result of Law 1870 of 2017, also known as Law of Financial Conglomerates, which came in effect on February 6, 2019. Grupo Aval, as the holding company of its financial conglomerate is responsible for the compliance with capital adequacy requirements, corporate governance standards, risk management and internal control and criteria for identifying, managing and revealing conflicts of interest, applicable to its financial conglomerate. The consolidated financial information included in this document is presented in accordance with IFRS as currently issued by the IASB. Details of the calculations of non-GAAP measures such as ROAA and ROAE, among others, are explained when required in this report. Grupo Aval has adopted IFRS 16 retrospectively from January 1, 2019 but has not restated comparatives for the 2018 reporting period, as permitted under the specific transitional provisions in the standard. The reclassifications and the adjustments arising from the new leasing rules are therefore recognized in the opening Condensed Consolidated Statement of Financial Position on January 1, 2019. -

Schedule of Investments (Unaudited) Blackrock Advantage Emerging Markets Fund January 31, 2021 (Percentages Shown Are Based on Net Assets)

Schedule of Investments (unaudited) BlackRock Advantage Emerging Markets Fund January 31, 2021 (Percentages shown are based on Net Assets) Security Shares Value Security Shares Value Common Stocks China (continued) China Life Insurance Co. Ltd., Class H .................. 221,000 $ 469,352 Argentina — 0.0% China Longyuan Power Group Corp. Ltd., Class H ....... 52,000 76,119 (a) 313 $ 60,096 Globant SA .......................................... China Mengniu Dairy Co. Ltd.(a) ......................... 15,000 89,204 Brazil — 4.9% China Merchants Bank Co. Ltd., Class H ................ 36,000 275,683 Ambev SA ............................................. 236,473 653,052 China Overseas Land & Investment Ltd.................. 66,500 151,059 Ambev SA, ADR ....................................... 94,305 263,111 China Pacific Insurance Group Co. Ltd., Class H......... 22,000 90,613 B2W Cia Digital(a) ...................................... 20,949 315,188 China Railway Group Ltd., Class A ...................... 168,800 138,225 B3 SA - Brasil Bolsa Balcao............................. 33,643 367,703 China Resources Gas Group Ltd. ....................... 30,000 149,433 Banco do Brasil SA..................................... 15,200 94,066 China Resources Land Ltd. ............................. 34,000 134,543 BRF SA(a).............................................. 22,103 85,723 China Resources Pharmaceutical Group Ltd.(b) .......... 119,500 62,753 BRF SA, ADR(a) ........................................ 54,210 213,045 China Vanke Co. Ltd., Class A .......................... 67,300 289,157 Cia de Saneamento de Minas Gerais-COPASA .......... 52,947 150,091 China Vanke Co. Ltd., Class H .......................... 47,600 170,306 Duratex SA ............................................ 19,771 71,801 CITIC Ltd............................................... 239,000 186,055 Embraer SA(a).......................................... 56,573 90,887 Contemporary Amperex Technology Co. Ltd., Class A .... 1,700 92,204 Gerdau SA, ADR ...................................... -

Credicorp Ltd. and Subsidiaries

CREDICORP LTD. AND SUBSIDIARIES INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS AS OF SEPTEMBER 30, 2020, AND DECEMBER 31, 2019 AND FOR THE THREE AND NINE-MONTH PERIODS ENDED SEPTEMBER 30, 2020 AND 2019 CREDICORP LTD. AND SUBSIDIARIES INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS AS OF SEPTEMBER 30, 2020 AND DECEMBER 31, 2019 AND FOR THE THREE AND NINE-MONTH PERIODS ENDED SEPTEMBER 30, 2020 AND 2019 CONTENT Pages Interim condensed consolidated statement of financial position 1 Interim condensed consolidated statement of income 2 - 3 Interim condensed consolidated statement of comprehensive income 4 Interim condensed consolidated statement of changes in net equity 5 Interim condensed consolidated statement of cash flows 6 - 8 Notes to the interim condensed consolidated financial statements 9 - 123 US$ = United States dollar S/ = Sol CREDICORP LTD. AND SUBSIDIARIES INTERIM CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS OF SEPTEMBER 30, 2020 (UNAUDITED) AND DECEMBER 31, 2019 (AUDITED) As of September As of December As of September As of December Note 30, 2020 31, 2019 Note 30, 2020 31, 2019 S/(000) S/(000) S/(000) S/(000) Assets Liabilities Cash and due from banks: Deposits and obligations: 14 Non-interest-bearing 6,916,416 6,177,356 Non-interest-bearing 45,680,396 28,316,170 Interest-bearing 28,221,543 19,809,406 Interest-bearing 91,522,278 83,689,215 4 35,137,959 25,986,762 137,202,674 112,005,385 Cash collateral, reverse repurchase agreements and Payables from repurchase agreements and securities lending 5(b) 27,778,922 -

Colibri Flowers Bancolombia CEMEX Grupo Nacional De Chocolates

Alpina ASOCOLFLORES - Colibri Flowers Bancolombia CEMEX Corona Ecopetrol Fundación Santa Fe de Bogotá Grupo Nacional de Chocolates Holcim Indupalma IALMENTE C R O E S S P S O O N T S C A U B D L E O S R P Telefónica 100% PAPEL RECICLADO BANDERA DE COLABORADORES DERECHOS Todos los derechos de esta publicación pertenecen al Consejo Empresarial Colombiano para el Desarrollo Sostenible – CECODES. DIRECTOR DE LA PUBLICACIÓN JAIME MONCADA Director de Programas Consejo Empresarial Colombiano para el Desarrollo Sostenible - CECODES INVESTIGACIÓN Y EDICIÓN IRENE BELLO GONZÁLEZ CORRECCIÓN DE ESTILO GUILLERMO CAMACHO CABRERA ISBN 978-958-99020-2-8 DISEÑO Y DIAGRAMACIÓN GATOS GEMELOS COMUNICACIÓN PRIMERA EDICIÓN FEBRERO DE 2011 IMPRESO EN COLOMBIA AGRADECIMIENTOS En nombre del Consejo Empresarial Colombiano para el Desarrollo Sostenible CECODES, nuestro agradecimiento por el apoyo brindado durante la edición del libro Cambiando el rumbo 2010: casos de sostenibilidad en Colombia, a las siguientes empresas: Alpina Productos Alimenticios Asocolflores - Colibriflowers Bancolombia Cemex Corona Ecopetrol Fundación Santa Fe de Bogotá Grupo Nacional de Chocolates / Colcafé Holcim Indupalma Telefónica CONTENIDO 6 IntroduccIón Consejo empresarial Colombiano para el Desarrollo sostenible - CeCoDES 10 10 Palabras del Director ejecutIvo 12 alpina Productos alImentIcIos Caso empresarial “alpina buen VeCino” 20 alpina Productos alImentIcIos Caso empresarial “reCiClaje inClusiVo” 26 asocolflores – colIbrIflowers Caso empresarial “proDucción De pulpa a partir De los -

Terpel Llenando El Tanque Neutral Petróleo Y Gas COP10.800/Acción Noviembre 26, 2018 Llenando El Tanque

Terpel Llenando el tanque Neutral Petróleo y Gas COP10.800/acción Noviembre 26, 2018 Llenando el tanque Reinicio de cobertura Reiniciamos cobertura de Terpel con un precio objetivo de COP10.800/acción a Resumen diciembre de 2019, lo que representa un potencial de valorización de 18,2% para Precio objetivo (COP) 10.800 una recomendación Neutral. Precio de cierre (COP) 9.140 Nuestro modelo refleja los efectos de la más reciente transacción con ExxonMobil, Noviembre 22, 2018 la cual calificamos como positiva en la medida que le permite a Terpel continuar Potencial valorización 18,2% fortaleciendo su posición en la región y el país como uno de los principales distribuidores de combustibles y lubricantes. Lo anterior esperamos se vea Rango 52 semanas (COP) 8.800 – 14.300 reflejado en mayores volúmenes de venta en Ecuador, Perú y Colombia y mejores Capitalización bursátil (COPmn) 1.687.248 márgenes operacionales en los últimos dos, ofreciendo así una operación estable y generación de caja positiva en el mediano plazo. Acciones en circulación (mn) 181,4 Flotante (no AFPs) (mn) 46 Aún pendiente, está la venta del negocio de distribución de combustibles líquidos Volumen promedio diario 12m de ExxonMobil en Colombia, el cual comprende 745 EDS y 12 terminales valoradas 527,1 en aproximadamente COP825.000mn en los estados financieros de Terpel. Dichos (COPmn) activos deben ser transferidos a un tercero, por requerimiento de la Precio objetivo 12m(COP) 12.580 Superintendencia de Industria y Comercio (SIC), lo que representa un reto en cuanto a la consecución de un comprador con la capacidad financiera y operacional Retorno esperado 18,2% para asumir una operación de gran envergadura. -

Global Report

Global Report S T A T E O F N E W J E R S E Y D I V I S I O N O F I N V E S T M E N T GLOBAL INVESTMENTS -*- TRANSACTION ACTIVITY REPORTING CURRENCY IS US DOLLAR BASED ON TRADE-FX PAGE: 1 TRANS-TYPE: PUR TRADES FROM 12/01/10 THROUGH 12/31/10 ** COMMON PENSION FD D ** X-TYPE TRADE BANK ---- DESCRIPTION ----- PAR-OR-SHARES COMMIS-USD TOTAL-PAID-(L) P/S-INT(L) BOOK-VALUE-(L) GAIN/LOSS- (L) INVST# SETTLE CURR RATE MATURITY T/DOC# PRICE X-RATE PURCH-YTM TOTAL-PAID-USD P/S-INT-USD BOOK-VALUE-USD GAIN/LOSS- USD DEV MKT COMMON STOCK (2220) PUR 12/01/10 60 FORTIS INC NPV 717.00 22,509.48 22,509.48 252272 12/07/10 CAD 27607 31.394 1.020 22,076.78 22,076.78 PUR 12/14/10 60 TIM HORTON COM 673.00 27,449.89 27,449.89 250848 12/14/10 CAD 40.787 1.007 27,268.55 27,268.55 PUR 12/15/10 60 MAGNA INT CLASS A 822.00 41,887.71 41,887.71 230225 12/15/10 CAD 50.958 1.026 40,810.32 40,810.32 PUR 12/15/10 60 THOMSON REUTERS GRP(FM 2,301.00 87,242.63 87,242.63 230253 12/15/10 CAD 37.915 1.017 85,792.73 85,792.73 PUR 12/24/10 60 SUNCOR ENERGY INC 3,985.00 148,148.00 148,148.00 248036 12/31/10 CAD 37.176 1.006 147,293.70 147,293.70 PUR 12/29/10 60 PETROMINERALES LTD 36,852.00 1,161,206.52 1,161,206.52 255108 12/29/10 CAD 27614 31.510 1.000 1,161,613.08 1,161,613.08 PUR 12/31/10 60 SUN LIFE FINL SVCS CDA 5,099.00 151,836.84 151,836.84 247136 12/31/10 CAD 27632 29.778 .994 152,807.17 152,807.17 50,449.00 1,640,281.07 1,640,281.07 1,637,662.33 1,637,662.33 7 TRANSACTIONS IN COUNTRY: CANADA ( 300) PUR 12/01/10 60 MITSUBISHI UFJ FINANCI 1,150,700.00 6,461.47 454,085,751.00