Applicable Credit Card Fees and Charges

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mabuhay Miles Travel Card – Frequently Asked Questions

Mabuhay Miles Travel Card – Frequently Asked Questions 1. Why should I use the Mabuhay Miles Travel Card over other cards? Your Mabuhay Miles Travel Card earns 1 Mile for every Php100 (or its equivalent in foreign currency) spent. It is the only Travel Card that contains a PHP wallet so you can use it both in domestic and international transactions. It is a multi‐currency card that will allow you to spend in the supported local currency without worry of fluctuating exchange rates. By being able to spend using the local currency, it will also allow you to manage your funds better while you travel. Skip the call to your bank when converting your points to Miles. Your Miles will be credited directly to your Mabuhay Miles account, not to your Travel Card account. 2. What’s the difference between the existing Mabuhay Miles Membership Card and this new Mabuhay Miles Travel Card? For Elite, Premiere Elite or Million Miler members, your Mabuhay Miles Membership Card will 1) remain solely as a membership card and 2) will indicate your tier status and benefits. The Travel Card will function as your multi‐currency prepaid card. For Classic members, the Travel Card will serve as both the membership card and the multi‐ currency prepaid card. 3. Where can I use my Mabuhay Miles Travel Card? You can use the currencies in your Travel Card in stores worldwide that accept UnionPay. You can also use your Travel Card to withdraw cash and check your currency balance at BancNet ATMs in the Philippines and international ATMs that accept UnionPay. -

The State of Digital Payments in the Philippines (Released in 2015) Found That Adoption Had Been Limited

COUNTRY DIAGNOSTIC The State of Digital Payments in the Philippines DECEMBER 2019 PHILIPPINES Authors Project Leads: Keyzom Ngodup Massally, Rodrigo Mejía Ricart Technical authors: Malavika Bambawale, Swetha Totapally, and Vineet Bhandari Cover photo: © Better Than Cash Alliance/Erwin Nolido 1 FOREWORD Our country was one of the first to pioneer digital payments nearly 20 years ago. Recognizing the untapped market potential and the opportunity to foster greater access to financial inclusion, the Bangko Sentral ng Pilipinas (BSP) has worked, hand in hand, with the government and the leaders across financial, retail, and regulatory sectors to boost digital payments. Over the past three years, since the launch of the first digital payments diagnostic, the Philippines has experienced remarkable progress toward building an inclusive digital payments ecosystem. In 2013, digital payments accounted for only 1% of the country’s total transaction volume. In 2018, this follow through diagnostic study showed that the volume of digital payments increased to 10% corresponding to 20% share in the total transaction value. These numbers speak of significant progress and success. I am optimistic that e-payments will gain further momentum as we have laid the necessary building blocks to accelerate innovation and inclusive growth over the next few years. Notably, Filipino women are ahead of men in the uptake of digital payments, placing us ahead of global standards. The rise of fintech and their solutions are starting to play a transformative role, as we can see from the rapidly-growing adoption of the emerging QR codes for digital transactions. I am confident that the BSP has built a good digital foundation and is well positioned to leverage fintech in increasing the share of digital payments toward a cash- lite Philippines. -

Chapter 1 Introduction

CHAPTER 1 INTRODUCTION Globally, banking system is working continuously from many years. Paper money or cash has been leading payment mechanism worldwide for the centuries. The measure works of a bank to deposits an amount of a customer and returns it to him when he needs. During deposits and withdrawal of the amount bank may use this money for itself as to given loans to other customers who wants to avail it. There are so many types of loan like home loan, agricultural loan, personnel loan, loan for industries and business houses etc. Banks give a particular interest for the depositors on his money and take a certain interest from loan account holder. There are very fast changes occur in the traditional banking operation system. Before a decade ago a bank was involved only with customers when they were at premises of bank. But during this new time a bank provides many more services to the customer’s at their doorsteps. The entire system of banking has changed drastically. In banking system there are two most frequent and important services- one is to deposit cash in the account and second to withdraw cash from the account. Both the service provided to a customer during a time in which banks are open and officials present at that time. Here in this work our main concern is about the withdrawal service provided by the bank. Banks normally provide this cash through teller counters. Only in the past century paper money or cash faced competition from mainly cheques, debit and credit cards. Previously this whole process was thoroughly manual and nowadays it is automatic. -

2021 Prime Time for Real-Time Report from ACI Worldwide And

March 2021 Prime Time For Real-Time Contents Welcome 3 Country Insights 8 Foreword by Jeremy Wilmot 3 North America 8 Introduction 3 Asia 12 Methodology 3 Europe 24 Middle East, Africa and South Asia 46 Global Real-Time Pacific 56 Payments Adoption 4 Latin America 60 Thematic Insights 5 Glossary 68 Request to Pay Couples Convenience with the Control that Consumers Demand 5 The Acquiring Outlook 5 The Impact of COVID-19 on Real-Time Payments 6 Payment Networks 6 Consumer Payments Modernization 7 2 Prime Time For Real-Time 2021 Welcome Foreword Spurred by a year of unprecedented disruption, 2020 saw real-time payments grow larger—in terms of both volumes and values—and faster than anyone could have anticipated. Changes to business models and consumer behavior, prompted by the COVID-19 pandemic, have compressed many years’ worth of transformation and digitization into the space of several months. More people and more businesses around the world have access to real-time payments in more forms than ever before. Real-time payments have been truly democratized, several years earlier than previously expected. Central infrastructures were already making swift For consumers, low-value real-time payments mean Regardless of whether real-time schemes are initially progress towards this goal before the pandemic immediate funds availability when sending and conceived to cater to consumer or business needs, intervened, having established and enhanced real- receiving money. For merchants or billers, it can mean the global picture is one in which heavily localized use time rails at record pace. But now, in response to instant confirmation, settlement finality and real-time cases are “the last mile” in the journey to successfully COVID’s unique challenges, the pace has increased information about the payment. -

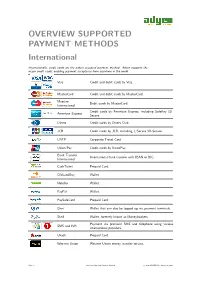

OVERVIEW SUPPORTED PAYMENT METHODS International

OVERVIEW SUPPORTED PAYMENT METHODS International Internationally, credit cards are the widest accepted payment method. Adyen supports the major credit cards, enabling payment acceptance from anywhere in the world. Visa Credit and debit cards by Visa. MasterCard Credit and debit cards by MasterCard. Maestro Debit cards by MasterCard. International Credit cards by American Express, including SafeKey 3D- American Express Secure. Diners Credit cards by Diners Club. JCB Credit cards by JCB, including J/Secure 3D-Secure. UATP Corporate Travel Card. Union Pay Credit cards by UnionPay. Bank Transfer International bank transfer with IBAN or BIC. International CashTicket Prepaid Card. ClickandBuy Wallet. Neteller Wallet. PayPal Wallet. PaySafeCard Prepaid Card. Qiwi Wallet that can also be topped up via payment terminals. Skrill Wallet, formerly known as Moneybookers. Payment via premium SMS and telephone using various SMS and IVR international providers. Ukash Prepaid Card. Western Union Western Union money transfer service. Page 1 Overview Supported Payment Methods c 2012 ADYEN BV - August 23, 2012 Europe Loyalty cards Support for various loyalty and store cards. Austria Bank Transfer Offline bank transfer. Sofortbanking Online banking supporting various local banks. Belgium Bank Transfer Offline bank transfer. BanContact / Mr. Debit card in Belgium. Cash Sofortbanking Online banking supporting various local banks. Denmark Primarily credit card and the local debit scheme. Bank Transfer Offline bank transfer. Dankort Local debit card scheme. Open Invoice Payments on credit by open invoice. Finland Primarily Credit Card. Besides this there is a very good market share for online banking. Bank Transfer Offline bank transfer. Ålandsbanken Online banking. Handelsbanken Online banking. Nordea Online banking. -

About Bancnet

About BancNet Presented at 19th Floor, Equitable Tower, 8751 Paseo de Roxas Makati City 1226 Who is BancNet • Electronic Switch Network that has financial institutions as its shareholders / members • 113 Member Banks • The largest inter bank network in the Philippines • First and Largest ATM Consortium in the Philippines • More than 23 years experience in ATM Networks • 113 Member Banks and Subscribers … and growing • Over 33.2 Million Active Cardholders, 11,383 ATMs • Strategy of Going Beyond ATM Banking • Multi-Bank, Multi-Channel Electronic Payment Network National and International Interconnection • ATM Networks Expressnet, Megalink • ATM Networks Mastercard, VISA • ATM & POS Network China Union Pay (CUP) • International partnership with NYCE BancNet Network I.CAN Government Agencies EPS POS POS Network ATM Network Network WeePay Member Banks ECS Bankard POS Network GHL BDO POS Network ATM Network Channels, Products & Services Point-of-Sale Internet Mobile Phone Mobile Phone Cash Withdrawal Intrabank Fund Transfer Cash Advance Inter Bank Fund Transfer Intrabank Fund Transfer Debit Card Purchase/Cash (CUP/VISA/JBC/Discover/D Checkbook Reorder Inter Bank Fund Transfer Withdrawal or Cash-out iners/MasterCard/Local) e-Shopping Checkbook Reorder Intrabank Fund Transfer Tax Payment e-Load Inter Bank Fund Transfer SSS-EDI Corporate G-Cash Reload Checkbook Reorder Philhealth (softlaunch) Statement Request Pagibig (Soon) G-Cash Reload/Auto Reload Balance Inquiry and Bills Payment Going Beyond ATM Banking BANCNET TAX PAYMENT ENROLLMENT PROCESS via BIR WEBSITE BANCNET BIR RDO EMPLOYER HSBC-AAB INFRASTRUCTURE Enroll via BIR Website Validate required documents submitted by Employer Bank to enroll the ff: via BancNet TPG Receive email 1. -

Atms in the New York City Area

April 25, 2005 Issue 05:04:02 What You Don't Know Inside This Issue: News Could Hurt You Industry Update ..........................................8 War of Words usiness owners are often agents out on the street representing Over Interchange Intensifies ..................20 employers and rely, as the company, and you've contracted Feds Step In to Stop Kiosk, ATM they do in other areas of with several to sign merchant and POS Fraud Scams ..........................59 their ventures, on the accounts. Have you taken precau- Strings Attached to Stored-Value Cards ......86 Bability to read people in the hiring tions against your liability? Are you A Can of Soda on Credit? ........................88 process. The subtle and not-so- certain that the business is protected Morgan Stanley Announces Discover Spin Off ................................96 subtle clues projected by job appli- against losses or fines resulting from cants during interviews can indicate the actions of unscrupulous agents? Features a great deal about the candidates. Do you really know your employees? With Tidel in Its Quiver, Will NCR Have a New Shot at Retail? First impressions matter when build- Employment verification and back- By Tracy Kitten, ATMmarketplace.com ....29 ing a staff or team; they help deter- ground checks are becoming more Trade Association News: mine if candidates have the qualities common across all business sectors, 2005 Association Mid-year necessary to do the job well and to from retail and restaurants to finan- Activities in Full Swing ..........................50 mesh with the staff. However, the cial services. For ISOs/merchant Views smartest hiring decisions sometimes level salespeople (MLSs), this is a Checks and Card Costs Driving ACH Growth involve more than likeability and the two-pronged issue: Not only has the By Patti Murphy....................................23 face value of the information provid- need for closer examination of Using Software to Gain New Business ed by a job applicant. -

BSP Digital Payments Transformation Roadmap Report

BSP Digital Payments Transformation Roadmap 2020-2023 I. Vision and Strategic Outcomes (Targets by 2023) The BSP’s thrust to promote financial inclusion and digitalization of payments are mutually reinforcing: they go hand-in-hand, each enabling the other. As the BSP continues to foster the growth and development of digital payment innovations through enabling policies and regulations, it also promotes further financial inclusion. Digital payment innovations lower transaction costs and eliminate the oft-cited barriers to owning a transaction account. The widespread use of the internet and emergence of technological innovations make digital payments ubiquitous, more accessible and affordable, thereby propelling the progressive shift towards a cash-lite economy. Moreover, with the sudden onset of the COVID-19 global pandemic, the shift towards digital payments has become an imperative as physical distancing rules become the norm under the “New Economy” environment. By using digital payments with due care and vigilance, Filipinos reduce the need for mobility and prevent health risks from face-to-face and over-the-counter (OTC) financial transactions. The greater usage of digital payments will also facilitate the growth of Fintech businesses engaged in e-commerce businesses as the consumption of goods and services is increasingly driven by online purchases. Objective An efficient, inclusive, safe and secure digital payments ecosystem that supports the diverse needs and capabilities of individuals and firms, towards achievement of the BSP’s mandates Strategic Outcomes a. Strengthened customer preference for digital payments by: • Converting 50% of the total volume of retail payments into digital form, considering that payment services are the gateway of most Filipinos to the formal financial system. -

Settlement Systems of East Asian Economies

Settlement Systems of East Asian Economies Commissioned by Ministry of Finance Japan March 2004 Institute for International Monetary Affairs Table of Contents Foreword.........................................................................................................................................1 List of Abbreviation ....................................................................................................................3 Chapter 1 Payment Systems of Hong Kong and Singapore, and Cross-border Linkages.........8 1. Payment Systems of Hong Kong....................................................................................................8 (1) Payment Systems...............................................................................................................8 i. HK-Dollar RTGS System ................................................................................................8 ii. USD RTGS System..........................................................................................................8 iii. Euro RTGS System........................................................................................................10 iv. Plans for a Yen RTGS System.......................................................................................11 v. Plans for Linking PvP Settlement Systems....................................................................11 (2) Securities Settlement Systems .........................................................................................12 i. Central Moneymarkets -

Investment Banking

LeadingAsia ANNUAL REPORT 2012 ANNUAL REPORT 2012 MALAYAN BANKING BERHAD Today, we stand by Asia with assets in excess of RM495 billion. 16% Return on Equity Building Ahead of Target Today, we stand by Asia with assets in excess of RM495 billion. Maybank, one of Southeast Asia’s largest banks, has been supporting your aspirations for more Rising Regional than 50 years. Serving you in 20 countries across the globe and connecting you Strength to new opportunities through 2,200 offices across Southeast Asia, Greater China Contribution 30% International Profit Contribution and the world. We are Humanising Financial Services Across Asia. Across On Track with (3813-K) Maybank’s 2015 Southeast Asia www.maybank.com Strategic Objectives Presence in 10 Southeast Asian countries Leading in more ways than one. With a presence in 10 WE’RE LEADING ASIA Southeast Asian countries and expansion of our business footprint across the region, we have accelerated our momentum across Asia and we’re confident of our role in contributing to Asia’s prosperity and sustainability. We offer consistent service with seamless banking and a wider spectrum of value-added services. We provide our customers with easy access to financial services, fair terms and pricing and advise them on their financial needs. At the same time, we remain committed to being at the heart of the communities we serve. to grow in spite of a challenging world economy, we AS ASIA CONTINUES remain committed to its people and its diverse communities. In the spirit of Maybank, we continue to humanise financial services and provide enhanced value in the diversity of our products and services. -

MERCHANT AGREEMENT A

MERCHANT AGREEMENT This Merchant Agreement (the “Agreement”) is made and executed in the City of ___________________, on this day of _______________________________, by and between: BANK OF THE PHILIPPINE ISLANDS, a universal banking corporation duly organized and existing under and by virtue of the laws of the Republic of the Philippines, with principal office and place of business at BPI Card Center, 8753 Paseo de Roxas, Makati City, hereinafter referred to as “BPI”; - and - ________________________________________, a corporation duly organized and existing under and by virtue of the laws of the Philippines/sole proprietorship owned and operated by ___________________________________________________, doing business under the name and style “______________________________________________”, with principal office and place of business at __________________________________________________________________________, represented herein by its authorized representative _________________________________________ , hereinafter referred to as the “MERCHANT”. WITNESSETH THAT: WHEREAS, BPI is engaged in the business of acquiring credit, debit and/or prepaid card transactions at affiliated merchant establishments and is licensed to enter into this Agreement with MERCHANT to honor these cards for the purchase of goods and/ or services from the MERCHANT’s establishments; WHEREAS, the MERCHANT is duly licensed to engage in business and agrees to honor all credit, debit and/or prepaid cards, whether BPI issued or not, (each, a “Card”) as payment for its sale of goods and/or services, and agrees to be bound by the terms and conditions set forth hereunder; NOW THEREFORE, for and in consideration of the foregoing premises, BPI and MERCHANT agree as follows: DEFINITION OF TERMS The following terms used in this Agreement shall have the following meanings: a. -

2020 Plans and Programs Accomplishment Report for Q1

2020 PLANS AND PROGRAMS ACCOMPLISHMENT REPORT FOR Q1 LANDBANK BOARD 30 APRIL 2020 SUMMARY: 2020 PLANS AND PROGRAMS ACCOMPLISHMENT REPORT FOR Q1 ADLS – 1st Quarter Highlights Targets were achieved in the following: Speedy development and launching of two new lending programs, HEAL and i-RESCUE, and the rationalization of CARES Program in response to credit requirements under the Bayanihan We Heal as One Act (RA 11469) Yield on loans at 5.514% as of March 2020 Number of farmers and fishers assisted – 1.202 M against 1.2M target for Q1 Loan releases under program tie-ups with DA – P1.45B Deployment of AOs and AAs (368 Teams) to cover all 1,634 municipalities Areas needing improvement: o Reduction of past due to 1% o Loans to agriculture shortfall against the yearend target of P265B o Capability building of farmers and lending staff – trainings with LCDFI; delays due to ECQ BBS – 1st Quarter Highlights Targets are on track in the following: Successfully distributed Social Amelioration proceeds of P16.34B to 3.7M CCT beneficiaries in 3 days Branches remain open during ECQ; branch personnel “frontliners” bravely ensuring uninterrupted service to clients amidst the threat of possible virus exposure Surpassed deposit targets – P1.861T against target of P1.802T Cost of deposits was down to 0.856% resulting to better returns for the bank Q1 targets achieved in various process improvement initiatives (alternative channels for loan disbursement, collection and e-banking transactions reconciliation) Areas needing improvement: o Establishment of touchpoints – ATMs, CDMs, mobile ATMs and mobile branches due to limitations caused by ECQ, among others.