ONLINE PAYMENT GATEWAY Frequently Asked Question (Faqs)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

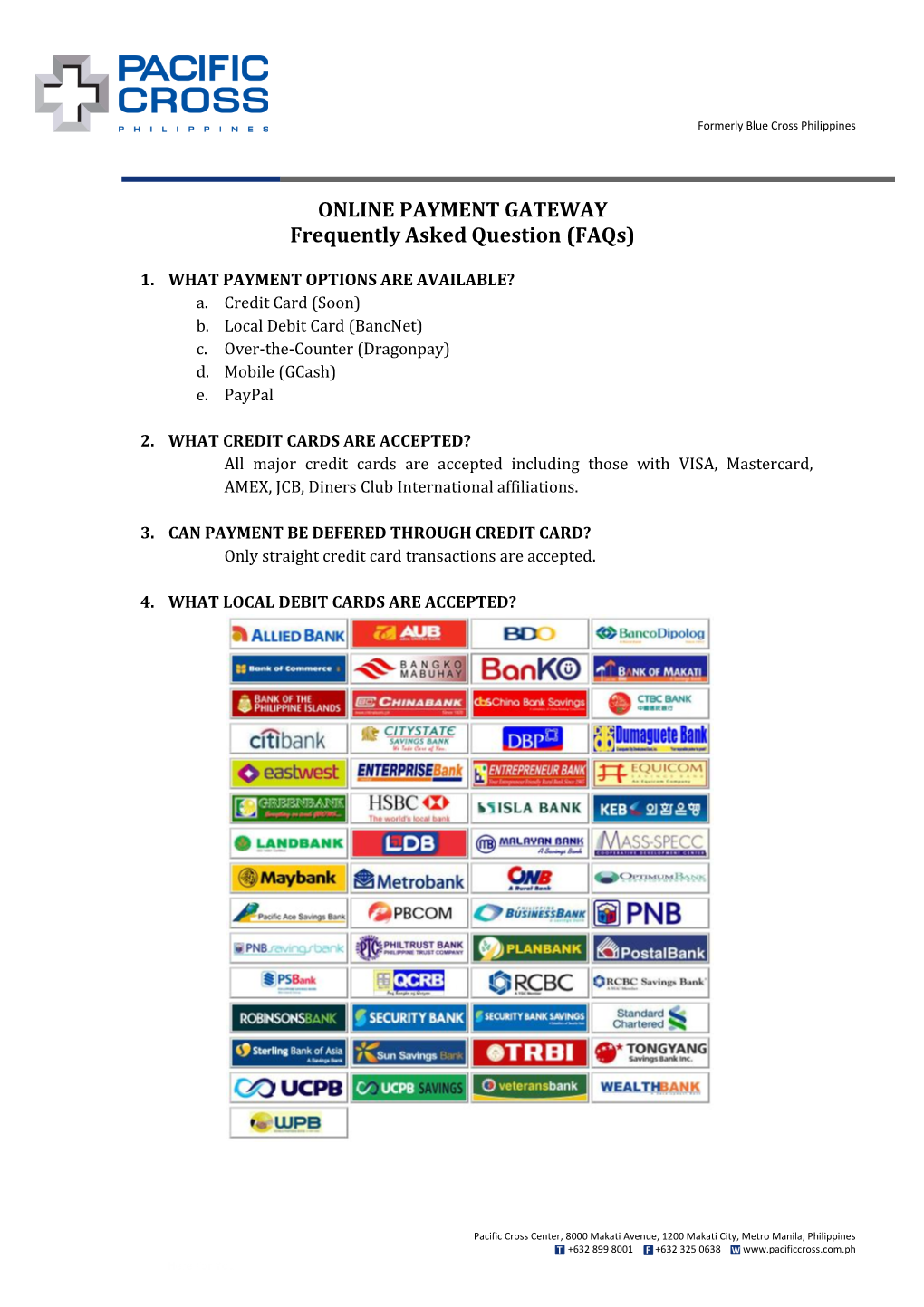

Recommended publications

-

Frequently Asked Questions on What Is Pesonet?

Frequently Asked Questions on What is PESONet? PESONet is a new electronic fund transfer service that enables customers of participating banks, e- money issuers or mobile money operators to transfer funds in Philippine Peso currency to another customer of other participating banks, e-money issuers or mobile money operators in the Philippines. It is more inclusive platform for Electronic Fund Transfers which will make G2B(Government-to- Business) and G2C(Government-to-Consumer) payments more practical, convenient, fast, and secure. What is the purpose of PESONet? Through PESONet, businesses, government, and individuals will be able to conveniently pay or transfer funds from their account to one or multiple recipient accounts in other financial institutions. PESONet is the perfect alternative to the still widely used paper-based check system. What are the features of PESONet? What are the uses of PESONet? How does PESONet work? Customers instruct their financial institution to send credit instructions to other financial institutions via online banking, mobile banking or over-the-counter transaction. They need to provide the payees’ financial institution, account number, and amount. The credit instruction is transmitted by the financial institution to the clearing switch operator, which currently is the Philippine Clearing House Corporation (PCHC). The funds are settled in the respective financial institutions demand deposit accounts held in Bangko Sentral ng Pilipinas (BSP) through BSP’s Philippine Payments and Settlement System (PhilPaSS). Upon settlement, the beneficiary’s or payee’s financial institution will credit the payee's account. How long does it take to transfer funds via PESONet? The availability of funds to the receiving account shall depend on the facility used to carry out your transaction. -

Telegraphic Transfer Format

PHILIPPINE RETIREMENT AUTHORITY TELEGRAPHIC TRANSFER FORMAT TO :________________________________________________________________________ (Name of Remitting International Bank) Pay To :________________________________________________________________________ (Name of Depository Bank) The Amount of US $ _____________________________________ to set up a FDCU time deposit acount in the name of Mr/Ms. _________________________________________________________ (Name of Retiree/Applicant) under the (PRA) Retirement Program. Upon the receipt of the remittances, please telephone/ advise PRA Immediately. __________________________________________________________________ (Signature of Retiree/Applicant) BANK OF COMMERCE Wachovia Bank, Int'l Division Contact Person: Account No. 2000-19113363-5 or MR. EDMUND B. SANTOS Union Bank of California, N.Y. Tel No. (632) 840-3261 Account No. 91-280123-1121 E-mail:[email protected] BANKWISE Union Bank of California Contact Person: International New York MR. DENNIS ROLDAN Swift BOFCUS33NYK MR. AURORA A. CRUZ CHIPS ABA 505 OR MS.LEA PROTACIO FEDWIRE Routing 026005050 Tel. No. (632) 894-4242: 894-4029 813-7419 EQUITABLE PCI BANK Bank of New york,New York Contact Person: Swift Code: IRVTUS3N or American Express Bank, NY MR. ALLAN DAVID L. MATUTINA Swiff code: AEIBUS33 Tel. Nos: (632) 891-2467;840-7000 EAST WEST BANK Wachovia Bank, New York Contact Person: FAO: East West Bank Manila MS. ELIZABETH P. AQUINO Acct. No. 2000-19100258-8 MR. DAVE DE CASTRO For further credit to EWBC Tel. Nos.(632) 830-8741/42 DOLLAR PRIME FUND 818-0080 ACCT. No. 09-70-00516-1 E-mail: [email protected] [email protected] EXPORT BANK Union Bank of California Contact Person: International New York MS. MA. CRISTINA B. GUARINA Account No. 91-278275-1121 Tel. Nos. (632) 533-3546;533-3550 RIZAL COMMERCIAL BANKING CORPORATION Citibank New York, U.S.A. -

This Document Was Downloaded from Duplication Or Reproduction Is Allowed

This document was downloaded from www.psbank.com.ph. Duplication or reproduction is allowed. Please do not modify its content. Document Classification: PUBLIC COVER SHEET 15552 SEC Registration Number P H I L I P P I N E S AV I N G S B A N K (Company’s Full Name) P S B a n k C e n t e r , 7 7 7 P a s e o d e R o x a s c o r n e r S e d e ñ o S t r e e t , M a k a t i C i t y (Business Address: No. Street City/Town/Province) Leah M. Zamora 845-8888 (Contact Person) (Company Telephone Number) 1 2 3 1 1 7 - A Month Day (Form Type) Month Day (Fiscal Year) (Annual Meeting – To be Announced) (Secondary License Type, If Applicable) Markets and Securities Regulation Department Dept. Requiring this Doc. Amended Articles Number/Section Total Amount of Borrowings 1,455 Total No. of Stockholders Domestic Foreign As of March 31, 2020 To be accomplished by SEC Personnel concerned File Number LCU Document ID Cashier S T A M P S Remarks: Please use BLACK ink for scanning purposes. This document was downloaded from www.psbank.com.ph. Duplication or reproduction is allowed. Please do not modify its content. Document Classification: PUBLIC SEC Number 15552 FILE Number PHILIPPINE SAVINGS BANK (COMPANY’S NAME) PSBank Center 777 Paseo de Roxas cor. Sedeño St., Makati City (COMPANY’S ADDRESS) 8885-82-08 (TELEPHONE NUMBER) DECEMBER 31 (FISCAL YEAR ENDING MONTH & DAY) SEC FORM 17-A (FORM TYPE) December 31, 2019 (PERIOD ENDED DATE) Government Securities Eligible Dealer (SECONDARY LICENSE TYPE AND FILE NUMBER) This document was downloaded from www.psbank.com.ph. -

Psbank 2021 ASM Notice with Agenda

NOTICE OF ANNUAL STOCKHOLDERS’ MEETING Notice is hereby given that the annual meeting of stockholders of the Philippine Savings Bank (PSBank) will be held on April 26, 2021, Monday , at 3:00 P.M. In light of the COVID-19 pandemic and to ensure the safety and welfare of our stockholders, the meeting will be conducted virtually via secure online meeting platform (CISCO WEBEX) to pass upon the following matters: 1. Call to Order 2. Certification of Notice and Quorum 3. Approval of the Minutes of the Annual Stockholders’ Meeting held on May 27, 2020 4. Presentation of the President‘s Report and the PSBank’s 2020 Audited Financial Statements 5. Confirmation of All Acts of the Board of Directors, Management and All Committees 6. Extension of Terms of Mr. Jose T. Pardo and Mr. Samson C. Lim as Independent Directors 7. Election of the Members of the Board of Directors 8. Appointment of the External Auditor 9. Other Matters 10. Adjournment Stockholders of record as of March 5, 2021 shall be entitled to vote at the Meeting. Pocholo V. Dela Peña Corporate Secretary Stockholders who intend to participate or be represented in the virtual meeting shall first submit the following via email to [email protected] not later than April 12, 2021, subject to validation procedures, to gain access to the secure online meeting link: • Letter of Intent (LOI) to participate by remote communication and vote in absentia • Duly accomplished proxy instrument for a representative to the virtual meeting, as applicable • Copy of proof of identity, ownership and other certification/information for validation purposes Once validated, a confirmation along with access credentials to the secure online meeting link shall be sent to the stockholder’s email as provided. -

Mabuhay Miles Travel Card – Frequently Asked Questions

Mabuhay Miles Travel Card – Frequently Asked Questions 1. Why should I use the Mabuhay Miles Travel Card over other cards? Your Mabuhay Miles Travel Card earns 1 Mile for every Php100 (or its equivalent in foreign currency) spent. It is the only Travel Card that contains a PHP wallet so you can use it both in domestic and international transactions. It is a multi‐currency card that will allow you to spend in the supported local currency without worry of fluctuating exchange rates. By being able to spend using the local currency, it will also allow you to manage your funds better while you travel. Skip the call to your bank when converting your points to Miles. Your Miles will be credited directly to your Mabuhay Miles account, not to your Travel Card account. 2. What’s the difference between the existing Mabuhay Miles Membership Card and this new Mabuhay Miles Travel Card? For Elite, Premiere Elite or Million Miler members, your Mabuhay Miles Membership Card will 1) remain solely as a membership card and 2) will indicate your tier status and benefits. The Travel Card will function as your multi‐currency prepaid card. For Classic members, the Travel Card will serve as both the membership card and the multi‐ currency prepaid card. 3. Where can I use my Mabuhay Miles Travel Card? You can use the currencies in your Travel Card in stores worldwide that accept UnionPay. You can also use your Travel Card to withdraw cash and check your currency balance at BancNet ATMs in the Philippines and international ATMs that accept UnionPay. -

Managing in the New Normal

MANAGING IN THE NEW NORMAL 2020 ANNUAL REPORT Vision: ABOUT THE THEME CONTENTS To be the country’s consumer and retail bank of choice. Managing in the New Normal 01 About PSBank Mission: The coronavirus (COVID-19) pandemic has dramatically and irreversibly changed, not just 02 Message from the Chairman • As an INSTITUTION: To conform to the highest standards of integrity, professionalism and teamwork. the way we live, but also the way we bank. This unprecedented crisis is ushering in a “new 06 President’s Report • For our CLIENTS: To provide superior products and reliable, normal,” with digital technology playing a pivotal top-quality services responsive to their banking needs. role. Those previously reluctant to embrace 10 Financial Highlights • For our EMPLOYEES: To place a premium on their growth, technology now find themselves thrust into a and nurture an environment of teamwork where outstanding relationship with their laptops or mobile phones 12 Digital Ready performance is recognized. for work, education, health care, commercial transactions, and social interactions. 16 Safety First • For our SHAREHOLDERS: To enhance the value of their investments. At PSBank, putting the customer first has always 20 Employee & Customer Engagement been at the heart of our business strategy. Even before the pandemic, we have already been 22 Sustainability Commitment embarking on digital initiatives that would make ABOUT PSBANK every customer journey simple and maaasahan 26 Risk Management (reliable). This pandemic only deepened our Philippine Savings Bank (PSBank) is the thrift banking arm of the commitment to keep up with the new breed of 31 Audit Committee Report Metrobank Group, one of the largest financial onglc omerates in the “always-connected” customers and to deliver an Philippines. -

The State of Digital Payments in the Philippines (Released in 2015) Found That Adoption Had Been Limited

COUNTRY DIAGNOSTIC The State of Digital Payments in the Philippines DECEMBER 2019 PHILIPPINES Authors Project Leads: Keyzom Ngodup Massally, Rodrigo Mejía Ricart Technical authors: Malavika Bambawale, Swetha Totapally, and Vineet Bhandari Cover photo: © Better Than Cash Alliance/Erwin Nolido 1 FOREWORD Our country was one of the first to pioneer digital payments nearly 20 years ago. Recognizing the untapped market potential and the opportunity to foster greater access to financial inclusion, the Bangko Sentral ng Pilipinas (BSP) has worked, hand in hand, with the government and the leaders across financial, retail, and regulatory sectors to boost digital payments. Over the past three years, since the launch of the first digital payments diagnostic, the Philippines has experienced remarkable progress toward building an inclusive digital payments ecosystem. In 2013, digital payments accounted for only 1% of the country’s total transaction volume. In 2018, this follow through diagnostic study showed that the volume of digital payments increased to 10% corresponding to 20% share in the total transaction value. These numbers speak of significant progress and success. I am optimistic that e-payments will gain further momentum as we have laid the necessary building blocks to accelerate innovation and inclusive growth over the next few years. Notably, Filipino women are ahead of men in the uptake of digital payments, placing us ahead of global standards. The rise of fintech and their solutions are starting to play a transformative role, as we can see from the rapidly-growing adoption of the emerging QR codes for digital transactions. I am confident that the BSP has built a good digital foundation and is well positioned to leverage fintech in increasing the share of digital payments toward a cash- lite Philippines. -

Chapter 1 Introduction

CHAPTER 1 INTRODUCTION Globally, banking system is working continuously from many years. Paper money or cash has been leading payment mechanism worldwide for the centuries. The measure works of a bank to deposits an amount of a customer and returns it to him when he needs. During deposits and withdrawal of the amount bank may use this money for itself as to given loans to other customers who wants to avail it. There are so many types of loan like home loan, agricultural loan, personnel loan, loan for industries and business houses etc. Banks give a particular interest for the depositors on his money and take a certain interest from loan account holder. There are very fast changes occur in the traditional banking operation system. Before a decade ago a bank was involved only with customers when they were at premises of bank. But during this new time a bank provides many more services to the customer’s at their doorsteps. The entire system of banking has changed drastically. In banking system there are two most frequent and important services- one is to deposit cash in the account and second to withdraw cash from the account. Both the service provided to a customer during a time in which banks are open and officials present at that time. Here in this work our main concern is about the withdrawal service provided by the bank. Banks normally provide this cash through teller counters. Only in the past century paper money or cash faced competition from mainly cheques, debit and credit cards. Previously this whole process was thoroughly manual and nowadays it is automatic. -

2021 Prime Time for Real-Time Report from ACI Worldwide And

March 2021 Prime Time For Real-Time Contents Welcome 3 Country Insights 8 Foreword by Jeremy Wilmot 3 North America 8 Introduction 3 Asia 12 Methodology 3 Europe 24 Middle East, Africa and South Asia 46 Global Real-Time Pacific 56 Payments Adoption 4 Latin America 60 Thematic Insights 5 Glossary 68 Request to Pay Couples Convenience with the Control that Consumers Demand 5 The Acquiring Outlook 5 The Impact of COVID-19 on Real-Time Payments 6 Payment Networks 6 Consumer Payments Modernization 7 2 Prime Time For Real-Time 2021 Welcome Foreword Spurred by a year of unprecedented disruption, 2020 saw real-time payments grow larger—in terms of both volumes and values—and faster than anyone could have anticipated. Changes to business models and consumer behavior, prompted by the COVID-19 pandemic, have compressed many years’ worth of transformation and digitization into the space of several months. More people and more businesses around the world have access to real-time payments in more forms than ever before. Real-time payments have been truly democratized, several years earlier than previously expected. Central infrastructures were already making swift For consumers, low-value real-time payments mean Regardless of whether real-time schemes are initially progress towards this goal before the pandemic immediate funds availability when sending and conceived to cater to consumer or business needs, intervened, having established and enhanced real- receiving money. For merchants or billers, it can mean the global picture is one in which heavily localized use time rails at record pace. But now, in response to instant confirmation, settlement finality and real-time cases are “the last mile” in the journey to successfully COVID’s unique challenges, the pace has increased information about the payment. -

SEC 17-A Annual Report 2020 of Psbank

This document was downloaded from www.psbank.com.ph. Duplication or reproduction is not allowed. Please do not modify its content. Document Classification: PUBLIC April 19, 2021 Philippine Stock Exchange 9/F PSE Tower, 28th St. cor. 5th Ave. Bonifacio Global City (BGC) Taguig City, Philippines Attention: MS. JANET A. ENCARNACION Head, Disclosure Department Securities and Exchange Commission G/F Secretariat Building PICC Complex, Roxas Boulevard Pasay City 1307 Attention: Director Vicente Graciano P. Felizmenio, Jr. Corporate Governance and Finance Department Subject: Submission of SEC 17-A Annual Report Dear Director Felizmenio, Relative to the submission of the SEC 17-A or Annual Report, we hereby submit the following documents: 1 Cover letter attached to the online submission of SEC 17-A 2 SEC 17-A Annual Report 3 Exhibits and Reports on SEC Form 17-C 1. Schedule of Bank/Branch Sites Owned by the Bank 2. Schedule of Bank/Branch Sites Under Lease Agreements 3. SEC Form 17-C 4. Statement of Management Responsibility 5. Audited Financial Statements as of December 31, 2020 and 2019 and for the Years Ended December 31, 2020, 2019 and 2018; and Independent Auditor’s Report 6. Independent Auditors’ Report on Supplementary Schedules 7. Independent Auditors’ Report on Components of Financial Soundness Indicators 8. Supplementary Schedules · Reconciliation of retained earnings available for dividend declaration · Map showing the relationships between and among the company and its ultimate parent company, middle parent, subsidiaries or co-subsidiaries, and associates, wherever located or registered · Supplementary schedules as required by Revised SRC Rule 68 - Annex 68- J · Schedule of financial soundness indicators 9. -

Philequity Corner (May 8, 2017) by Wilson Sy the Hunter Games After

Philequity Corner (May 8, 2017) By Wilson Sy The Hunter Games After consolidating for more than three months between 7,100 to 7,400, the PSEi closed last Friday at 7,842. Aside from robust global markets, one of the catalysts that contributed to the PSEi’s strong move is the speculation about possible M&As in the banking sector. Speculation on RCBC takeover leads bank stocks higher Recently, there has been speculation that some banks may be in play as potential acquisition targets. This started with RCB’s gap up move on April 17. 4/12/17 5/5/17 % Chg RCB 39.00 58.70 50.5% PNB 57.50 68.65 19.4% EW 20.80 22.70 9.1% MBT 84.50 86.95 2.9% UBP 79.65 81.95 2.9% BDO 121.00 123.00 1.7% BPI 105.00 105.10 0.1% SECB 217.00 215.60 -0.6% CHIB 38.20 36.45 -4.6% Sources: Bloomberg, Wealth Research From the table above, it can be seen that RCB has risen 50.5% since April 12. Moreover, it has surged 104.2% from its bottom of 28.75 on March 22, 2016 (at the height of the AMLA investigations). Note that RCB has been rumoured to be a takeover target for several years. PNB and EastWest Bank follow RCBC’s lead Aside from RCB, both PNB and EastWest Bank (EW) gained significantly since mid-April. Not surprisingly, these three banks were trading below book value and were the cheapest among liquid banking stocks before this recent move ensued. -

OVERVIEW SUPPORTED PAYMENT METHODS International

OVERVIEW SUPPORTED PAYMENT METHODS International Internationally, credit cards are the widest accepted payment method. Adyen supports the major credit cards, enabling payment acceptance from anywhere in the world. Visa Credit and debit cards by Visa. MasterCard Credit and debit cards by MasterCard. Maestro Debit cards by MasterCard. International Credit cards by American Express, including SafeKey 3D- American Express Secure. Diners Credit cards by Diners Club. JCB Credit cards by JCB, including J/Secure 3D-Secure. UATP Corporate Travel Card. Union Pay Credit cards by UnionPay. Bank Transfer International bank transfer with IBAN or BIC. International CashTicket Prepaid Card. ClickandBuy Wallet. Neteller Wallet. PayPal Wallet. PaySafeCard Prepaid Card. Qiwi Wallet that can also be topped up via payment terminals. Skrill Wallet, formerly known as Moneybookers. Payment via premium SMS and telephone using various SMS and IVR international providers. Ukash Prepaid Card. Western Union Western Union money transfer service. Page 1 Overview Supported Payment Methods c 2012 ADYEN BV - August 23, 2012 Europe Loyalty cards Support for various loyalty and store cards. Austria Bank Transfer Offline bank transfer. Sofortbanking Online banking supporting various local banks. Belgium Bank Transfer Offline bank transfer. BanContact / Mr. Debit card in Belgium. Cash Sofortbanking Online banking supporting various local banks. Denmark Primarily credit card and the local debit scheme. Bank Transfer Offline bank transfer. Dankort Local debit card scheme. Open Invoice Payments on credit by open invoice. Finland Primarily Credit Card. Besides this there is a very good market share for online banking. Bank Transfer Offline bank transfer. Ålandsbanken Online banking. Handelsbanken Online banking. Nordea Online banking.