Finance and Insurance Issues in Relation to Trade Efficiency

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pa Perspectives on Nordic Financial Services

PA PERSPECTIVES ON NORDIC FINANCIAL SERVICES Autumn Edition 2017 CONTENTS The personal banking market 3 Interview with Jesper Nielsen, Head of Personal Banking at Danske bank Platform thinking 8 Why platform business models represent a double-edged sword for big banks What is a Neobank – really? 11 The term 'neobanking' gains increasing attention in the media – but what is a neobank? Is BankID positioned for the 14future? Interview with Jan Bjerved, CEO of the Norwegian identity scheme BankID The dance around the GAFA 16God Quarterly performance development 18 Latest trends in the Nordics Value map for financial institutions 21 Nordic Q2 2017 financial highlights 22 Factsheet 24 Contact us Chief editors and Nordic financial services experts Knut Erlend Vik Thomas Bjørnstad [email protected] [email protected] +47 913 61 525 +47 917 91 052 Nordic financial services experts Göran Engvall Magnus Krusberg [email protected] [email protected] +46 721 936 109 +46 721 936 110 Martin Tillisch Olaf Kjaer [email protected] [email protected] +45 409 94 642 +45 222 02 362 2 PA PERSPECTIVES ON NORDIC FINANCIAL SERVICES The personal BANKING MARKET We sat down with Jesper Nielsen, Head of Personal Banking at Danske Bank to hear his views on how the personal banking market is developing and what he forsees will be happening over the next few years. AUTHOR: REIAR NESS PA: To start with the personal banking market: losses are at an all time low. As interest rates rise, Banking has historically been a traditional industry, loss rates may change, and have to be watched. -

Interbank GIRO Is an Automated Payment Service Which Allows You to Make Monthly Payment to Your ICBC Credit Card Account from Your Designated Bank Account Directly

Interbank GIRO Frequently Asked Questions: 1. What is Interbank GIRO? Interbank GIRO is an automated payment service which allows you to make monthly payment to your ICBC Credit Card account from your designated bank account directly. The amount will be deducted from your designated bank account and paid to ICBC every month. All you need to do is to ensure that the designated bank account has sufficient funds every month. 2. What is the benefit of using Interbank GIRO? Interbank GIRO is a convenient, paperless and cashless payment method. It enables you to make hassle-free monthly payments to ICBC through your designated bank account. There are also no fees charged for the setup. 3. Are there any additional charges for signing up for Interbank GIRO? There are no fees charged for the setup of Interbank GIRO. 4. How can I apply for Interbank GIRO? Simply fill up the Interbank GIRO form, and submit to Credit Card Department. 5. Which banks can I use for Interbank GIRO? You can use any bank that supports Interbank GIRO. 6. How long is the Interbank GIRO application Processing Time? Interbank GIRO applications may take up to 60 days to process, including the processing time required by the deducting bank. We will notify you of your application status as soon as possible. 7. How do I submit the Interbank GIRO form to ICBC Credit Card Department? You can mail the duly signed Original Interbank GIRO form to ICBC Credit Card Department by using the Business Reply Service Envelope attached. Please do not fax the Interbank GIRO form or email the scanned copy of the Interbank GIRO form as the designated bank requires the original signature for verification. -

Building a Customer-Centric Digital Bank in Singapore: It Takes an Ecosystem

White Paper Digital Banking EQUINIX AND KAPRONASIA BUILDING A CUSTOMER-CENTRIC DIGITAL BANK IN SINGAPORE: IT TAKES AN ECOSYSTEM Contents The dawn of digital banking in the Lion City Defining a value proposition . 2 No digital bank, in the purest sense of the term, Digital banking in Singapore amid COVID-19 . 4 currently exists in Singapore. While there are many fintechs, most provide only digital financial services The digital banking opportunity: that do not require a banking license: digital wallet retail and corporate . 5 services, cross-border payments and various virtual- asset-focused services. A digital bank (also known Key success factors for digital banks . 7 as a “neobank” or “virtual bank”) differs in that it is licensed to both accept customer deposits and issue 1. Digital agility to support a better loans, whether to retail customers, corporate customers customer experience. .7 or both. Singapore’s financial regulator, the Monetary 2. Favorable cost structure. .8 Authority of Singapore (MAS) plans to release five digital bank licenses in total and will announce the 3. Optimizing security .............................8 successful licensees in the second half of 2020. The licensed digital banks will likely then launch in mid-2021. Conclusion: The ecosystem opportunity . 10 While many less-developed Southeast Asian economies are leveraging digital banks to focus on financial inclusion, the role of digital banks in Singapore will be slightly different and focused on driving innovation. Bringing together traditional financial services firms, fintechs, other tech companies and even telecoms Singapore will become one of the firms, digital banks could act as a catalyst for financial focal points of Asia’s digital banking innovation in Singapore and help the city-state maintain evolution when the city-state awards its competitive advantage as a regional fintech hub. -

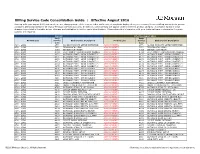

Billing Service Code Consolidation Guide | Effective August 2016

Billing Service Code Consolidation Guide | Effective August 2016 Starting with your August 2016 statement, we are changing some of the service codes and service descriptions displayed on your Treasury Services Billing statement to provide consistent billing standards for all of your Treasury Services accounts. In addition, some services will appear under a different product category. A complete listing of these changes is provided in the table below. Changes are highlighted in red for easier identification. Please share this information with your technical team to determine if system updates are required. Current Effective August 2016 Bank Bank Product Line Service Bank Service Description Product Line Service Bank Service Description Code Code ACH - GIRO 2770 ACHDD MANDATE SETUP(INITIATOR) ACH PAYMENTS 2770 ACHDD MANDATE SETUP(INITIATOR) ACH - GIRO 3971 ZENGIN ACH (LOW) ACH PAYMENTS 3971 ZENGIN ACH (LOW) ACH - GIRO 4093 ZENGIN ACH (HIGH) ACH PAYMENTS 4093 ZENGIN ACH (HIGH) ACH - GIRO 4094 ELECTRONIC TRANSMISSION CHARGE ACH PAYMENTS 4094 ELECTRONIC TRANSMISSION CHARGE ACH - GIRO 4170 OUTWARD PYMT - GIRO (URGENT) 1 ACH PAYMENTS 4170 OUTWARD PYMT - GIRO (URGENT) 1 ACH - GIRO 4171 OUTWARD PYMT - GIRO (URGENT) 2 ACH PAYMENTS 4171 OUTWARD PYMT - GIRO (URGENT) 2 ACH - GIRO 4172 OUTWARD PYMT - GIRO (URGENT) 3 ACH PAYMENTS 4172 OUTWARD PYMT - GIRO (URGENT) 3 ACH - GIRO 4173 OUTWARD PYMT - GIRO (URGENT) 4 ACH PAYMENTS 4173 OUTWARD PYMT - GIRO (URGENT) 4 ACH - GIRO 4174 OUTWARD PYMT - GIRO (URGENT) 5 ACH PAYMENTS 4174 OUTWARD PYMT - GIRO (URGENT) -

Payment Services Guide

CitiDirect® Online Banking Payments Services Guide March 2004 Proprietary and Confidential These materials are proprietary and confidential to Citibank, N.A., and are intended for the exclusive use of CitiDirect ® Online Banking customers. The foregoing statement shall appear on all copies of these materials made by you in whatever form and by whatever means, electronic or mechanical, including photocopying or in any information storage system. In addition, no copy of these materials shall be disclosed to third parties without express written authorization of Citibank, N.A. Table of Contents Overview .......................................................................................................................................1 Payments Services....................................................................................................................1 Creating Service Requests From Transaction Lookup..............................................................2 Creating Service Requests From Transaction Details ..............................................................9 Modifying Service Requests....................................................................................................14 Authorizing or Deleting Service Requests...............................................................................16 Viewing Service Request Transactions...................................................................................18 Disclaimer ...................................................................................................................................20 -

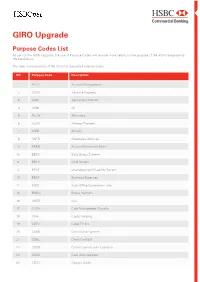

GIRO Upgrade Purpose Codes List

GIRO Upgrade Purpose Codes List As part of the GIRO Upgrade, the use of Purpose Codes will provide more details on the purpose of the ACH transaction to the beneficiary. The table below consists of the full list of supported purpose codes. SN Purpose Code Description 1 ACCT Account Management 2 ADVA Advance Payment 3 AGRT Agricultural Transfer 4 AIRB Air 5 ALLW Allowance 6 ALMY Alimony Payment 7 ANNI Annuity 8 ANTS Anesthesia Services 9 AREN Account Receivable Entry 10 BBSC Baby Bonus Scheme 11 BECH Child Benefit 12 BENE Unemployment Disability Benefit 13 BEXP Business Expenses 14 BOCE Back Office Conversion Entry 15 BONU Bonus Payment 16 BUSB Bus 17 CASH Cash Management Transfer 18 CBFF Capital Building 19 CBTV Cable TV Bill 20 CCRD Credit Card Payment 21 CDBL Credit Card Bill 22 CDCB Credit Payment with Cashback 23 CDCD Cash Disbursement 24 CDOC Original Credit SN Purpose Code Description 25 CDQC Quasi cash 26 CFEE Cancellation Fee 27 CHAR Charity Payment 28 CLPR Car Loan Principal Repayment 29 CMDT Commodity Transfer 30 COLL Collection Payment 31 COMC Commericial Payment 32 COMM Commission 33 COMT Consumer Third Party Consolidate Payment 34 COST Costs 35 CPKC Carpark Charges 36 CPYR Copyright 37 CSDB Cash Disbursement 38 CSLP Company Social Loan Payment To Bank 39 CVCF Convalescent Care facility 40 DBTC Debit Collection Payment 41 DCRD Debit Card Payment 42 DEPT Deposit 43 DERI Derivatives 44 DIVD Dividend 45 DMEQ Durable Medical Equipment 46 DNTS Dental Services 47 EDUC Education 48 ELEC Electricity Bill 49 ENRG Energies 50 ESTX Estate -

Italian City-States and Financial Evolution

European Review of Economic History, 10, 257–278. C 2006 Cambridge University Press Printed in the United Kingdom doi:10.1017/S1361491606001754 Italian city-states and financial evolution MICHELE FRATIANNI† AND FRANCO SPINELLI‡ †Indiana University CIBER, Kelley School of Business, Bloomington, Indiana 47405,USAandUniversita` Politecnica delle Marche, Dipartimento di Economia, Piazza Martelli, 60121 Ancona, Italy ‡Universita` degli Studi di Brescia, Dipartimento di Economia, via San Faustino 74B, Brescia 25122, Italy The term financial revolution has been abused in the literature. Revolution connotes a sharp and unique break from the past that should stand up to careful historical scrutiny, but in fact it does not. Evolution describes financial history better than revolutions. We compare the classic ‘financial revolutions’ with the financial innovations of Genoa, Venice and Florence in the Quattrocento and Cinquecento and the upshot is that these Italian city-states – the two maritime cities more than Florence – had developed many of the features that were to be found later on in the Netherlands, England and the United States. The importance of the early financial innovators has been eclipsed by the fact that these city-states did not survive politically. Instead, the innovations were absorbed in the long chain of financial evolution and, in the process, lost the identity of their creators. 1. Introduction By ‘financial revolution’ most economic historians refer to the series of events surrounding the Glorious Revolution of 1688 in England, from the creation of a national debt to the establishment of the Bank of England (Dickson 1967). Approximately a hundred years later, the young United States went through a ‘financial revolution’ of its own, according to Sylla’s (1998) assessment. -

Making Digital Credit Truly Responsible Insights from Analysis of Digital Credit in Kenya

Making Digital Credit Truly Responsible Insights from analysis of digital credit in Kenya September 2019 1.0 Executive summary 3-6 2.0 Calls to action 7-11 3.0 State of digital credit in Kenya 12-21 Table of 4.0 Suppliers’ landscape and key challenges 22-36 contents 5.0 Understanding Kenyan digital credit users 37-65 6.0 About the study 66-72 Annexures 73-103 1.0 Executive summary Seven years since the launch of the first digital credit offering, the following key changes were observed: 3 1 Kenya has seen remarkable progress on 2 In the past two years, the number of Compared to 2016, digital loans issued financial inclusion in the past decade. digital loans issued has approximately have increased by 1.9 times in 2018. Yet This has largely been fueled by the doubled1. Between 2016 and 2018, 86% despite the entry of almost 50 fintechs in mobile money revolution that has of the loans taken by Kenyans were the past four years, bank and MNO- expanded the access to and use of digital in nature. This trend continues facilitated products still dominate the financial services beyond payments. with traditional players, such as banks. market, amounting to 97% of supply. Digital credit products, such as M-Shwari Now, approximately half of the loans and KCB-M-Pesa from MNO-facilitated issued are digital. banks are already popular in the market. 4 Among borrowers in Kenya, 2.2 million 5 The percentage of non-performing loans2 individuals have non-performing loans1 is approximately three times higher for for digital loans taken between 2016 digital loans (16%) compared to and 2018. -

PAYMENT SYSTEMS in KOREA 13 (Domestic Currency Funds Transfer Service)

1. Large-Value Payment System 1.1 Outline The BOK has been running BOK-Wire as the only RTGS system for large-value funds since December 1994. It guarantees settlement finality for individual funds transfer requests by adopting the method of real-time gross settlement (RTGS). In other words, once a settlement is cleared, it is irrevocable and unconditional so that settlement risks are entirely eliminated. BOK-Wire plays a pivotal role in the payment system in Korea because it also provides finality of settlement regarding interbank credits and receipts within the retail payment systems run by KFTC. It is also linked with the DvP (Delivery versus Payment) and PvP Systems to reduce settlement risks in securities and foreign exchange transactions. 1.2 Functions Services provided through BOK-Wire can be categorized into funds settlement business and other business. The former includes domestic currency funds transfers, foreign currency funds transfers, and government and public bonds issuance and redemption, and the latter includes the Bank of Korea loans and the transmission of information concerning Treasury payments. PAYMENT SYSTEMS IN KOREA 13 (Domestic Currency Funds Transfer Service) The Domestic Currency Funds Transfer Service carries out general funds transfers for transactions between financial institutions, call transaction settlement to process automatically the principal and interest arising from direct or brokered transactions, and recipient-specific funds transfers that allow an individual or a business to make a large- value funds transfer as a third party through a participant bank. It also deals with DvP transactions and net settlements for retail payment systems. The General Settlement of Domestic Currency Funds Transfer Service executes the transfer of funds between participant institutions and their head office and local branches across current accounts held with the Payment Systems & Treasury Service Department of the BOK or its regional headquarters. -

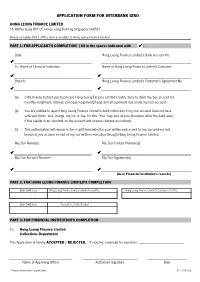

Application Form for Interbank Giro

APPLICATION FORM FOR INTERBANK GIRO HONG LEONG FINANCE LIMITED 16 Raffles Quay #01-05 Hong Leong Building Singapore 048581 Please complete Part 1 of this form and return to Hong Leong Finance Limited PART 1: FOR APPLICANT'S COMPLETION ( fill in the spaces indicated with ) Date: Hong Leong Finance Limited's Bank Account No. To: Name of Financial Institution Name of Hong Leong Finance Limited's Customer Branch: Hong Leong Finance Limited's Customer's Agreement No. (a) I/We hereby instruct you to process Hong Leong Finance Limited's instructions to debit my/our account for monthly instalment, interest, principal repayment(if any) and all payments due under my/our account. (b) You are entitled to reject Hong Leong Finance Limited's debit instruction if my/our account does not have sufficient funds and charge me/us a fee for this. You may also at your discretion allow the debit even if this results in an overdraft on the account and impose charges accordingly. (c) This authorisation will remain in force until terminated by your written notice sent to my/our address last known to you or upon receipt of my/our written revocation through Hong Leong Finance Limited. My/Our Name(s): My/Our Contact Number(s): My/Our Account Number: My/Our Signature(s): (As in Financial Institution's records) PART 2: FOR HONG LEONG FINANCE LIMITED'S COMPLETION Bank Swift Code Hong Leong Finance Limited's Bank Account No. Hong Leong Finance Limited's Customer's Ref No. Bank Swift Code Account No. To Be Debited PART 3: FOR FINANCIAL INSTITUTION'S COMPLETION To: Hong Leong Finance Limited Collections Department This Application is hereby ACCEPTED / REJECTED. -

Person-To-Person Electronic Funds Transfers: Recent Developments and Policy Issues

No. 10-1 Person-to-Person Electronic Funds Transfers: Recent Developments and Policy Issues Oz Shy Abstract: The paper investigates the reasons why person-to-person electronic funds transfers are still not very common in the United States compared with practices in many other countries. The paper also describes recent enhancements to online and mobile banking that provide account holders with low-cost interfaces to manage person-to-person electronic funds transfers via automated clearing house (ACH). On the theoretical side, the paper characterizes the critical mass levels needed for payment instruments to become widely adopted. Given the Fed's long-term heavy involvement in check clearing, the paper concludes with policy discussions of whether intervention is needed. Keywords: Automated clearing houses (ACH); Person-to-person Electronic Funds Transfers; Account-to-account transfers; Online Banking; Mobile banking. JEL Classifications: E42, G29, D14 Oz Shy is a senior economist at the Federal Reserve Bank of Boston and a member of the Consumer Payments Research Center in the research department. I thank Terri Bradford, Sean Carter, Dickson Chu, Paul Connolly, Marianne Crowe, Jean Fisher, Charles Fletcher, Fumiko Hayashi, Ben Levinger, Suzanne Lorant, Richard Oliver, Scott Schuh, Joanna Stavins, Bob Triest, Marianne Verdier, Mike Zabek, and Jeff Zhang for all their help and guidance. This paper, which may be revised, is available on the web site of the Federal Reserve Bank of Boston at http://www.bos.frb.org/economic/ppdp/index.htm. The views and opinions expressed in this paper are those of the author and do not necessarily represent the views of the Federal Reserve Bank of Boston or the Federal Reserve System. -

Payment Systems in Singapore

Payment systems in Singapore Singapore Table of contents List of abbreviations............................................................................................................................. 319 Introduction .......................................................................................................................................... 321 1. The institutional aspects............................................................................................................ 321 1.1 The general legal and regulatory framework .................................................................. 321 1.2 The role of the Monetary Authority of Singapore ............................................................ 322 1.2.1 Development and regulation of payment systems................................................ 322 1.3 The role of other private and public sector bodies .......................................................... 322 1.3.1 Singapore Clearing House Association (SCHA)................................................... 322 1.3.2 Association of Banks in Singapore (ABS)............................................................. 323 1.3.3 Electronic Payments Technical Committee (EPTC) ............................................. 323 1.3.4 Controller of Certification Authorities (CCA) ......................................................... 323 1.4 The role of financial intermediaries ................................................................................. 323 1.4.1 Banks 323 1.4.2 Banking liberalisation