Making Digital Credit Truly Responsible Insights from Analysis of Digital Credit in Kenya

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Strategies Adopted by Smep Deposit Taking Microfinance Limited to Gain a Sustainable Competitive Advantage by Simon Kamau

STRATEGIES ADOPTED BY SMEP DEPOSIT TAKING MICROFINANCE LIMITED TO GAIN A SUSTAINABLE COMPETITIVE ADVANTAGE BY SIMON KAMAU GATHECAH A MANAGEMENT RESEARCH PROJECT SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE AWARD OF THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION (MBA) OF THE SCHOOL OF BUSINESS, UNIVERSITY OF NAIROBI OCTOBER, 2015 DECLARATION I, the undersigned, declare that this research project is my own work and has never been presented in any other university or college for a degree or any other award. Signature: ___________________ Date: ___________________ STUDENT: SIMON KAMAU GATHECAH REG NO: D61/73342/2009 This research project report has been submitted for examination with my approval as the University Supervisor. Signature: ___________________ Date: ___________________ SUPERVISOR: DR. FLORENCE MUINDI SENIOR LECTURER SCHOOL OF BUSINESS UNIVERSITY OF NAIROBI ii DEDICATION To my father and mother, for their strong belief in me, To my lovely wife Jane, for her overwhelming support, To my beautiful angels Rehema and Tabitha, my family‟s hope for academic excellence. iii ACKNOWLEDGEMENTS My special thanks to the Almighty God for a fulfilled dream to pursue a degree course at The University of Nairobi. His grace was sufficient for provision the resources required and good health I enjoyed throughout my study. I acknowledge the exemplary guidance of my supervisor, Dr. Florence Muindi, whose priceless support and advice have made this project a success. I further thank her for setting time for me in the midst of many campus engagements to offer me the much needed guidance. I acknowledge the Department of Commerce, School of business for the structure and content of the MBA program. -

Equipment Leasing in Africa Handbook of Regional Statistics 2017 Including an Overview of 10 Years of IFC Leasing Intervention in the Region

AFRICA LEASING FACILITY II Equipment Leasing in Africa Handbook of Regional Statistics 2017 Including an overview of 10 years of IFC leasing intervention in the region © 2017 INTERNATIONAL FINANCE CORPORATION 2121 Pennsylvania Avenue, N.W., Washington, DC 20433 All rights reserved. First printing, March 2018. This document may not be reproduced in whole or in part without the written consent of the International Finance Corporation. This information, while based on sources that IFC considers to be reliable, is not guaranteed as to accuracy and does not purport to be complete. The conclusions and judgments contained in this handbook should not be attributed to, and do not necessarily represent the views of IFC, its partners, or the World Bank Group. IFC and the World Bank do not guarantee the accuracy of the data in this publication and accept no responsibility for any consequence of its use. Rights and Permissions Reference Section III. What is Leasing? and parts of Section IV. Value of Leasing in Emerging Economies are taken from IFC’s “Leasing in Development: Guidelines for Emerging Economies.” 2005, which draws upon: Halladay, Shawn D., and Sudhir P. Amembal. 1998. The Handbook of Equipment Leasing, Vol. I-II, P.R.E.P. Institute of America, Inc., New York, N.Y.: Available from Amembal, Deane & Associates. EQUIPMENT LEASING IN AFRICA: ACKNOWLEDGEMENT Acknowledgement This first edition of Equipment Leasing in Africa: A handbook of regional statistics, including an overview of 10 years of IFC leasing intervention in the region, is a collaborative efort between IFC’s Africa Leasing Facility team and the regional association of leasing practitioners, known as Africalease. -

Consumer Perceived Risk of Internet Banking in Kenya

CONSUMER PERCEIVED RISK OF INTERNET BANKING IN KENYA: A SURVEY OF THREE SELECTED BANKS IN NAIROBI COUNTY ORUCHO DANIEL OKARI FACULTY OF INFORMATION SCIENCE AND TECHNOLOGY A Research Thesis Submitted to the Graduate School in Partial Fulfillment of the Requirements for the Award of the Degree of Masters in Information Systems KISII UNIVERSITY February, 2017 DECLARATION BY STUDENT Declaration by candidate This is my original work and has not been presented for any degree award in this or any university. Orucho Daniel Okari Signature: …………………..Date: ………………… Registration Number: MIN 14/20189/14 Declaration by the Supervisors This thesis research has been submitted for examination with our approval as university supervisors. Dr. Elisha Ondieki Makori Lecturer, Faculty of Information Science and Technology University of Nairobi Signature: ……………. Date: …………….. Dr. Festus Ngetich Lecturer, Faculty of Information Science and Technology Kabianga University Signature………………. Date: ……………. ii DECLARATION OF NUMBER OF WORDS This form should be signed by the candidate and the candidate‟s supervisor (s) and returned to Director of Postgraduate Studies at the same time as you copies of your thesis/project. Please note at Kisii University Masters and PhD thesis shall comprise a piece of scholarly writing of not less than 20,000 words for the Masters degree and 50 000 words for the PhD degree. In both cases this length includes references, but excludes the bibliography and any appendices. Where a candidate wishes to exceed or reduce the word limit for a thesis specified in the regulations, the candidate must enquire with the Director of Postgraduate about the procedures to be followed. Any such enquiries must be made at least 2 months before the submission of the thesis. -

Bank Code Finder

No Institution City Heading Branch Name Swift Code 1 AFRICAN BANKING CORPORATION LTD NAIROBI ABCLKENAXXX 2 BANK OF AFRICA KENYA LTD MOMBASA (MOMBASA BRANCH) AFRIKENX002 3 BANK OF AFRICA KENYA LTD NAIROBI AFRIKENXXXX 4 BANK OF BARODA (KENYA) LTD NAIROBI BARBKENAXXX 5 BANK OF INDIA NAIROBI BKIDKENAXXX 6 BARCLAYS BANK OF KENYA, LTD. ELDORET (ELDORET BRANCH) BARCKENXELD 7 BARCLAYS BANK OF KENYA, LTD. MOMBASA (DIGO ROAD MOMBASA) BARCKENXMDR 8 BARCLAYS BANK OF KENYA, LTD. MOMBASA (NKRUMAH ROAD BRANCH) BARCKENXMNR 9 BARCLAYS BANK OF KENYA, LTD. NAIROBI (BACK OFFICE PROCESSING CENTRE, BANK HOUSE) BARCKENXOCB 10 BARCLAYS BANK OF KENYA, LTD. NAIROBI (BARCLAYTRUST) BARCKENXBIS 11 BARCLAYS BANK OF KENYA, LTD. NAIROBI (CARD CENTRE NAIROBI) BARCKENXNCC 12 BARCLAYS BANK OF KENYA, LTD. NAIROBI (DEALERS DEPARTMENT H/O) BARCKENXDLR 13 BARCLAYS BANK OF KENYA, LTD. NAIROBI (NAIROBI DISTRIBUTION CENTRE) BARCKENXNDC 14 BARCLAYS BANK OF KENYA, LTD. NAIROBI (PAYMENTS AND INTERNATIONAL SERVICES) BARCKENXPIS 15 BARCLAYS BANK OF KENYA, LTD. NAIROBI (PLAZA BUSINESS CENTRE) BARCKENXNPB 16 BARCLAYS BANK OF KENYA, LTD. NAIROBI (TRADE PROCESSING CENTRE) BARCKENXTPC 17 BARCLAYS BANK OF KENYA, LTD. NAIROBI (VOUCHER PROCESSING CENTRE) BARCKENXVPC 18 BARCLAYS BANK OF KENYA, LTD. NAIROBI BARCKENXXXX 19 CENTRAL BANK OF KENYA NAIROBI (BANKING DIVISION) CBKEKENXBKG 20 CENTRAL BANK OF KENYA NAIROBI (CURRENCY DIVISION) CBKEKENXCNY 21 CENTRAL BANK OF KENYA NAIROBI (NATIONAL DEBT DIVISION) CBKEKENXNDO 22 CENTRAL BANK OF KENYA NAIROBI CBKEKENXXXX 23 CFC STANBIC BANK LIMITED NAIROBI (STRUCTURED PAYMENTS) SBICKENXSSP 24 CFC STANBIC BANK LIMITED NAIROBI SBICKENXXXX 25 CHARTERHOUSE BANK LIMITED NAIROBI CHBLKENXXXX 26 CHASE BANK (KENYA) LIMITED NAIROBI CKENKENAXXX 27 CITIBANK N.A. NAIROBI NAIROBI (TRADE SERVICES DEPARTMENT) CITIKENATRD 28 CITIBANK N.A. -

Microfinance Sector Report 4Th Edition 2017

ASSOCIATION OF MICROFINANCE INSTITUTIONS (AMFI) MICROFINANCE SECTOR REPORT 4TH EDITION 2018 EXECUTIVE SUMMARY (Ag. CEO) n behalf of the Association of Microfinance Institutions (AMFI) Kenya Board and Secretariat, I am proud to present the 4th edition sector report on the Microfinance Sector in Kenya. This publication comprises a section on the Kenyan microfinance sector trends as at 30th June 2017, displaying business information such as portfolio, delivery methods, different target Ogroups, branch network, sectors as well as a list of the microfinance institutions that participated. This publication is part of AMFI-Kenya’s role to foster transparency in the microfinance sector as the national professional association aiming at building the capacity of the sector to ensure the provision of high quality financial services to the low-income people. This publication is also intended to allow the Kenyan microfinance sector to benefit from increased visibility on domestic and international capital markets, besides providing individual microfinance institutions (MFIs) with benchmarks to set their standards and strategic goals. AMFI would like to gratefully and sincerely thank all participants who made the issue and the relevance of the publication possible. This publication indeed raised significant interest among MFIs and in total, we were able to count on the participation of 30 institutions from the AMFI membership comprising; 8 microfinance banks, 1 Sacco and 21 retail credit only microfinance institutions. The data was collected, analyzed and compared between two periods ending 31st December 2016 and 30th June 2017 where applicable. We believe that the publication of this report is a very positive step towards enhancing transparency in the sector. -

SMEP Microfinance Bank Limited Is a Dynamic Christian Based Bank Regulated by the Central Bank of Kenya, Whose Mission Is

SMEP Microfinance Bank Limited is a dynamic Christian based Bank regulated by the Central Bank of Kenya, whose Mission is “To empower our customers through provision of market driven financial solutions”, with over 40 outlets across the country. We are inviting applications from interested and suitably qualified candidates who are passionate about transforming lives in the society, to fill the following position: 1) HEAD OF INTERNAL AUDIT, RISK & COMPLIANCE : – SMEP/HR/01/01/20 (RE-ADVERTISEMENT) Reporting to the Board and the Chief Executive Officer, the role will oversee and review the Banks’ internal control systems, evaluate the level of compliance with set Policies & Procedures, statutory and sector regulations. The role holder will also be responsible for the Banks’ overall enterprise risk management and compliance framework. Key Duties & Responsibilities . Formulating and implementation of the Risk & Compliance framework & policies. Identify and assess potential risks to the institution’s operations and activities. Review the adequacy of internal controls established to ensure compliance with policies, plans, procedures, business objectives and regulatory requirements. Prepare and implement Internal Audit Plans and programmes . Champion Information Systems Audit as well as communication, operating procedures, back up and disaster recovery . Safeguarding of Bank assets and ensuring that the liabilities and expenditure are controlled. Contribute to the development of projects, selected according to the risk involved and benefits; by confirming that the company’s methodology is followed and that, in particular, adequate controls are incorporated. Follow up internal and external audit recommendations to make sure that effective remedial action is taken. Continuous monitoring of compliance with internal policies, procedures and guidelines by thorough regular and comprehensive Risk and Control Assessment and testing. -

Pa Perspectives on Nordic Financial Services

PA PERSPECTIVES ON NORDIC FINANCIAL SERVICES Autumn Edition 2017 CONTENTS The personal banking market 3 Interview with Jesper Nielsen, Head of Personal Banking at Danske bank Platform thinking 8 Why platform business models represent a double-edged sword for big banks What is a Neobank – really? 11 The term 'neobanking' gains increasing attention in the media – but what is a neobank? Is BankID positioned for the 14future? Interview with Jan Bjerved, CEO of the Norwegian identity scheme BankID The dance around the GAFA 16God Quarterly performance development 18 Latest trends in the Nordics Value map for financial institutions 21 Nordic Q2 2017 financial highlights 22 Factsheet 24 Contact us Chief editors and Nordic financial services experts Knut Erlend Vik Thomas Bjørnstad [email protected] [email protected] +47 913 61 525 +47 917 91 052 Nordic financial services experts Göran Engvall Magnus Krusberg [email protected] [email protected] +46 721 936 109 +46 721 936 110 Martin Tillisch Olaf Kjaer [email protected] [email protected] +45 409 94 642 +45 222 02 362 2 PA PERSPECTIVES ON NORDIC FINANCIAL SERVICES The personal BANKING MARKET We sat down with Jesper Nielsen, Head of Personal Banking at Danske Bank to hear his views on how the personal banking market is developing and what he forsees will be happening over the next few years. AUTHOR: REIAR NESS PA: To start with the personal banking market: losses are at an all time low. As interest rates rise, Banking has historically been a traditional industry, loss rates may change, and have to be watched. -

Interbank GIRO Is an Automated Payment Service Which Allows You to Make Monthly Payment to Your ICBC Credit Card Account from Your Designated Bank Account Directly

Interbank GIRO Frequently Asked Questions: 1. What is Interbank GIRO? Interbank GIRO is an automated payment service which allows you to make monthly payment to your ICBC Credit Card account from your designated bank account directly. The amount will be deducted from your designated bank account and paid to ICBC every month. All you need to do is to ensure that the designated bank account has sufficient funds every month. 2. What is the benefit of using Interbank GIRO? Interbank GIRO is a convenient, paperless and cashless payment method. It enables you to make hassle-free monthly payments to ICBC through your designated bank account. There are also no fees charged for the setup. 3. Are there any additional charges for signing up for Interbank GIRO? There are no fees charged for the setup of Interbank GIRO. 4. How can I apply for Interbank GIRO? Simply fill up the Interbank GIRO form, and submit to Credit Card Department. 5. Which banks can I use for Interbank GIRO? You can use any bank that supports Interbank GIRO. 6. How long is the Interbank GIRO application Processing Time? Interbank GIRO applications may take up to 60 days to process, including the processing time required by the deducting bank. We will notify you of your application status as soon as possible. 7. How do I submit the Interbank GIRO form to ICBC Credit Card Department? You can mail the duly signed Original Interbank GIRO form to ICBC Credit Card Department by using the Business Reply Service Envelope attached. Please do not fax the Interbank GIRO form or email the scanned copy of the Interbank GIRO form as the designated bank requires the original signature for verification. -

Building a Customer-Centric Digital Bank in Singapore: It Takes an Ecosystem

White Paper Digital Banking EQUINIX AND KAPRONASIA BUILDING A CUSTOMER-CENTRIC DIGITAL BANK IN SINGAPORE: IT TAKES AN ECOSYSTEM Contents The dawn of digital banking in the Lion City Defining a value proposition . 2 No digital bank, in the purest sense of the term, Digital banking in Singapore amid COVID-19 . 4 currently exists in Singapore. While there are many fintechs, most provide only digital financial services The digital banking opportunity: that do not require a banking license: digital wallet retail and corporate . 5 services, cross-border payments and various virtual- asset-focused services. A digital bank (also known Key success factors for digital banks . 7 as a “neobank” or “virtual bank”) differs in that it is licensed to both accept customer deposits and issue 1. Digital agility to support a better loans, whether to retail customers, corporate customers customer experience. .7 or both. Singapore’s financial regulator, the Monetary 2. Favorable cost structure. .8 Authority of Singapore (MAS) plans to release five digital bank licenses in total and will announce the 3. Optimizing security .............................8 successful licensees in the second half of 2020. The licensed digital banks will likely then launch in mid-2021. Conclusion: The ecosystem opportunity . 10 While many less-developed Southeast Asian economies are leveraging digital banks to focus on financial inclusion, the role of digital banks in Singapore will be slightly different and focused on driving innovation. Bringing together traditional financial services firms, fintechs, other tech companies and even telecoms Singapore will become one of the firms, digital banks could act as a catalyst for financial focal points of Asia’s digital banking innovation in Singapore and help the city-state maintain evolution when the city-state awards its competitive advantage as a regional fintech hub. -

Automated Clearing House Participants Bank / Branches Report

Automated Clearing House Participants Bank / Branches Report 21/06/2017 Bank: 01 Kenya Commercial Bank Limited (Clearing centre: 01) Branch code Branch name 091 Eastleigh 092 KCB CPC 094 Head Office 095 Wote 096 Head Office Finance 100 Moi Avenue Nairobi 101 Kipande House 102 Treasury Sq Mombasa 103 Nakuru 104 Kicc 105 Kisumu 106 Kericho 107 Tom Mboya 108 Thika 109 Eldoret 110 Kakamega 111 Kilindini Mombasa 112 Nyeri 113 Industrial Area Nairobi 114 River Road 115 Muranga 116 Embu 117 Kangema 119 Kiambu 120 Karatina 121 Siaya 122 Nyahururu 123 Meru 124 Mumias 125 Nanyuki 127 Moyale 129 Kikuyu 130 Tala 131 Kajiado 133 KCB Custody services 134 Matuu 135 Kitui 136 Mvita 137 Jogoo Rd Nairobi 139 Card Centre Page 1 of 42 Bank / Branches Report 21/06/2017 140 Marsabit 141 Sarit Centre 142 Loitokitok 143 Nandi Hills 144 Lodwar 145 Un Gigiri 146 Hola 147 Ruiru 148 Mwingi 149 Kitale 150 Mandera 151 Kapenguria 152 Kabarnet 153 Wajir 154 Maralal 155 Limuru 157 Ukunda 158 Iten 159 Gilgil 161 Ongata Rongai 162 Kitengela 163 Eldama Ravine 164 Kibwezi 166 Kapsabet 167 University Way 168 KCB Eldoret West 169 Garissa 173 Lamu 174 Kilifi 175 Milimani 176 Nyamira 177 Mukuruweini 180 Village Market 181 Bomet 183 Mbale 184 Narok 185 Othaya 186 Voi 188 Webuye 189 Sotik 190 Naivasha 191 Kisii 192 Migori 193 Githunguri Page 2 of 42 Bank / Branches Report 21/06/2017 194 Machakos 195 Kerugoya 196 Chuka 197 Bungoma 198 Wundanyi 199 Malindi 201 Capital Hill 202 Karen 203 Lokichogio 204 Gateway Msa Road 205 Buruburu 206 Chogoria 207 Kangare 208 Kianyaga 209 Nkubu 210 -

Bank Supervision Annual Report 2019 1 Table of Contents

CENTRAL BANK OF KENYA BANK SUPERVISION ANNUAL REPORT 2019 1 TABLE OF CONTENTS VISION STATEMENT VII THE BANK’S MISSION VII MISSION OF BANK SUPERVISION DEPARTMENT VII THE BANK’S CORE VALUES VII GOVERNOR’S MESSAGE IX FOREWORD BY DIRECTOR, BANK SUPERVISION X EXECUTIVE SUMMARY XII CHAPTER ONE STRUCTURE OF THE BANKING SECTOR 1.1 The Banking Sector 2 1.2 Ownership and Asset Base of Commercial Banks 4 1.3 Distribution of Commercial Banks Branches 5 1.4 Commercial Banks Market Share Analysis 5 1.5 Automated Teller Machines (ATMs) 7 1.6 Asset Base of Microfinance Banks 7 1.7 Microfinance Banks Market Share Analysis 9 1.8 Distribution of Foreign Exchange Bureaus 11 CHAPTER TWO DEVELOPMENTS IN THE BANKING SECTOR 2.1 Introduction 13 2.2 Banking Sector Charter 13 2.3 Demonetization 13 2.4 Legal and Regulatory Framework 13 2.5 Consolidations, Mergers and Acquisitions, New Entrants 13 2.6 Medium, Small and Micro-Enterprises (MSME) Support 14 2.7 Developments in Information and Communication Technology 14 2.8 Mobile Phone Financial Services 22 2.9 New Products 23 2.10 Operations of Representative Offices of Authorized Foreign Financial Institutions 23 2.11 Surveys 2019 24 2.12 Innovative MSME Products by Banks 27 2.13 Employment Trend in the Banking Sector 27 2.14 Future Outlook 28 CENTRAL BANK OF KENYA 2 BANK SUPERVISION ANNUAL REPORT 2019 TABLE OF CONTENTS CHAPTER THREE MACROECONOMIC CONDITIONS AND BANKING SECTOR PERFORMANCE 3.1 Global Economic Conditions 30 3.2 Regional Economy 31 3.3 Domestic Economy 31 3.4 Inflation 33 3.5 Exchange Rates 33 3.6 Interest -

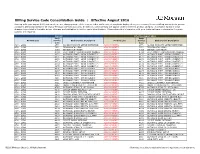

Billing Service Code Consolidation Guide | Effective August 2016

Billing Service Code Consolidation Guide | Effective August 2016 Starting with your August 2016 statement, we are changing some of the service codes and service descriptions displayed on your Treasury Services Billing statement to provide consistent billing standards for all of your Treasury Services accounts. In addition, some services will appear under a different product category. A complete listing of these changes is provided in the table below. Changes are highlighted in red for easier identification. Please share this information with your technical team to determine if system updates are required. Current Effective August 2016 Bank Bank Product Line Service Bank Service Description Product Line Service Bank Service Description Code Code ACH - GIRO 2770 ACHDD MANDATE SETUP(INITIATOR) ACH PAYMENTS 2770 ACHDD MANDATE SETUP(INITIATOR) ACH - GIRO 3971 ZENGIN ACH (LOW) ACH PAYMENTS 3971 ZENGIN ACH (LOW) ACH - GIRO 4093 ZENGIN ACH (HIGH) ACH PAYMENTS 4093 ZENGIN ACH (HIGH) ACH - GIRO 4094 ELECTRONIC TRANSMISSION CHARGE ACH PAYMENTS 4094 ELECTRONIC TRANSMISSION CHARGE ACH - GIRO 4170 OUTWARD PYMT - GIRO (URGENT) 1 ACH PAYMENTS 4170 OUTWARD PYMT - GIRO (URGENT) 1 ACH - GIRO 4171 OUTWARD PYMT - GIRO (URGENT) 2 ACH PAYMENTS 4171 OUTWARD PYMT - GIRO (URGENT) 2 ACH - GIRO 4172 OUTWARD PYMT - GIRO (URGENT) 3 ACH PAYMENTS 4172 OUTWARD PYMT - GIRO (URGENT) 3 ACH - GIRO 4173 OUTWARD PYMT - GIRO (URGENT) 4 ACH PAYMENTS 4173 OUTWARD PYMT - GIRO (URGENT) 4 ACH - GIRO 4174 OUTWARD PYMT - GIRO (URGENT) 5 ACH PAYMENTS 4174 OUTWARD PYMT - GIRO (URGENT)