Gannett Annual Report 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Kansas Publisher Official Monthly Publication of the Kansas Press Association June 8, 2011

The Kansas Publisher Official monthly publication of the Kansas Press Association June 8, 2011 Inside Today Page 2 Kevin Slimp says a new website tool is affordable for smaller newspapers. Page 3 Jim Purmarlo has some advice for newspapers on their busi- ness coverage. Page 4 KPA president Patrick Lowry says Joplin tornado underscored the importance of what newspa- pers do for their communities. Page 6 A 16-part newspaper serial story will be available to KPA newspapers this fall. On their trek to the concert area, Symphony in the Flint Hills attendees in 2010 take a break to talk Page 8 with two outriders, whose task was to keep the attendees and the cattle in the pasture safe. NNA research projects cover a wide range of newspaper Flint Hills Symphony project: Part II subjects. University will provide free access to stories, Page 8 Concert content available photographs and videos for use in Kansas news- He may sound like a broken n just a few short years, the Symphony in the papers for the second consecutive year. record, but Doug Anstaett con- Flint Hills has become a marquee event for The material will be available for use in tinues to harp on the importance Ithe state of Kansas. newspapers soon after the event. of uploading digital PDFs. The sixth annual concert is set for Saturday To download stories, photos and videos for (June 11), this time in the Fix Pasture near Vol- your newspaper, go to: http://www.fl inthillsme- land, Kan. in Wabaunsee County. diaproject.com/?page_id=220 KPA Calendar The event celebrates the native grassland The only request is that if you use content, prairie of Kansas, which has remained virtually please send two copies of the work to Anderson, July 20 undisturbed for centuries. -

GHMNE Weekly Ad Rates

S E T A R G N I S I Y L T R K E E V E D W A effective august 29, 2011 GateHouse Media New England Targeted Coverage. Broad Reach. Unique Content. GateHouse Media offers advertisers a powerful way to target consumers in Eastern Massachusetts. With a network of more than 100 newspapers, we deliver the strongest coverage of key demographic groups in the desirable communities around Boston. Whether it’s dailies or weeklies, single paper buys or whole market coverage, print or online, GateHouse can deliver a high impact, cost effective advertising solution to meet your marketing needs. GateHouse Media is one of the largest publishers of locally based print and online media in the United States. The company offers a portfolio of products that includes nearly 500 community publications and more than 250 websites, and seven yellow page directories, serves over 233,000 business advertising accounts and reaches approximately 10 million people a week in 18 states. Weekly Market Coverage There’s a better way to buy Boston — GateHouse Media New England Amesbury Merrimac Salisbury Newburyport West Haverhill Newbury Newbury eland Grov Methuen Georgetown Rowley ce n re w Dracut La Boxford h Ipswich t Dunstable r ug North Pepperell ro o Townsend o Andover p sb k ng Andover c Ty o Lowell R Topsfield Essex Hamilton Gloucester Groton Tewksbury Middleton Wenham Lunenburg Westford Chelmsford North n Manchester to Reading g Danvers Beverly Shirley Ayer Billerica in lm L i y n W n Littleton Carlisle Reading f Peabody Leominster ie ld Har vard ton Wakefield Salem -

Villages Daily Sun Inks Press, Postpress Deals for New Production

www.newsandtech.com www.newsandtech.com September/October 2019 The premier resource for insight, analysis and technology integration in newspaper and hybrid operations and production. Villages Daily Sun inks press, postpress deals for new production facility u BY TARA MCMEEKIN CONTRIBUTING WRITER The Villages (Florida) Daily Sun is on the list of publishers which is nearer to Orlando. But with development trending as winning the good fight when it comes to community news- it is, Sprung said The Daily Sun will soon be at the center of the papering. The paper’s circulation is just over 60,000, and KBA Photo: expanded community. — thanks to rapid growth in the community — that number is steadily climbing. Some 120,000 people already call The Partnerships key Villages home, and approximately 300 new houses are being Choosing vendors to supply various parts of the workflow at built there every month. the new facility has been about forming partnerships, accord- To keep pace with the growth, The Daily Sun purchased a Pictured following the contract ing to Sprung. Cost is obviously a consideration, but success brand-new 100,000-square-foot production facility and new signing for a new KBA press in ultimately depends on relationships, he said — both with the Florida: Jim Sprung, associate printing equipment. The publisher is confident the investment publisher for The Villages Media community The Daily Sun serves and the technology providers will help further entrench The Daily Sun as the definitive news- Group; Winfried Schenker, senior who help to produce the printed product. paper publisher and printer in the region. -

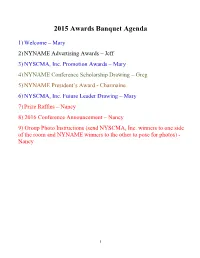

2015 Awards Banquet Script (.Pdf)

2015 Awards Banquet Agenda 1) Welcome – Mary 2) NYNAME Advertising Awards – Jeff 3) NYSCMA, Inc. Promotion Awards – Mary 4) NYNAME Conference Scholarship Drawing – Greg 5) NYNAME President’s Award - Charmaine 6) NYSCMA, Inc. Future Leader Drawing – Mary 7) Prize Raffles – Nancy 8) 2016 Conference Announcement – Nancy 9) Group Photo Instructions (send NYSCMA, Inc. winners to one side of the room and NYNAME winners to the other to pose for photos) - Nancy 1 1. Welcome (Mary) Good evening, and welcome to the 2015 Advertising and Circulation Awards Banquet. Tonight we will honor winners of NYNAME’s Advertising Competition, as well as NYSCMA, Inc.’s Promotion Awards Competition. NYNAME First Vice President Jeff Weigand will begin the ceremony with the Advertising Awards. 2. NYNAME Advertising Awards (Jeff) Thank you, Mary. Each year, the New York Newspapers Advertising and Marketing Executives recognize newspapers for their hard work and service to the art of newspaper advertising. These awards for excellence are a testament to the dedication of advertising professionals to the highest ideals of the industry. These efforts are recognized and rewarded by fellow newspaper professionals who understand the amount of time and effort that goes into each entry submitted to them for judging. This year, contest judges selected first, second, and third place winners from a total of 122 entries submitted by 17 New York State daily newspapers. The judges were: • Wiley Acheson, Retail Advertising Manager at White Mountain Publishing in Show Low, Arizona • Cindy Meaux, Advertising Manager for the Arizona Newspaper Association in Phoenix, Arizona • and Greg Tock, Publisher at Independent NewsMedia, Inc. -

2016-Annual-Report.Pdf

2016ANNUAL REPORT PORTFOLIO OVE RVIEW NEW MEDIA REACH OF OUR DAILY OPERATE IN O VER 535 MARKETS N EWSPAPERS HAVE ACR OSS 36 STATES BEEN PUBLISHED FOR 100% MORE THAN 50 YEARS 630+ TOTAL COMMUNITY PUBLICATIONS REACH OVER 20 MILLION PEOPLE ON A WEEKLY BASIS 130 D AILY N EWSPAPERS 535+ 1,400+ RELATED IN-MARKET SERVE OVER WEBSITES SALES 220K REPRESENTATIVES SMALL & MEDIUM BUSINESSES SAAS, DIGITAL MARKETING SERVICES, & IT SERVICES CUMULATIVE COMMON DIVIDENDS SINCE SPIN-OFF* $3.52 $3.17 $2.82 $2.49 $2.16 $1.83 $1.50 $1.17 $0.84 $0.54 $0.27 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 *As of December 25, 2016 DEAR FELLOW SHAREHOLDERS: New Media Investment Group Inc. (“New Media”, “we”, or the “Company”) continued to execute on its business plan in 2016. As a reminder, our strategy includes growing organic revenue and cash flow, driving inorganic growth through strategic and accretive acquisitions, and returning a substantial portion of cash to shareholders in the form of a dividend. Over the past three years since becoming a public company, we have consistently delivered on this strategy, and we have created a total return to shareholders of over 50% as of year-end 2016. Our Company remains the largest owner of daily newspapers in the United States with 125 daily newspapers, the majority of which have been published for more than 100 years. Our local media brands remain the cornerstones of their communities providing hyper-local news that our consumers and businesses cannot get anywhere else. -

Fall Special 2017

www.newsandtech.com www.newsandtech.com FALL SPECIAL ISSUE 2017 The premier resource for insight, analysis and technology integration in newspaper, magazine, digital and hybrid production. Photo: Unsplash, photographer Carlos Muza and modified by Violet Cruz Turn to page 41 for expanded industry coverage News & Tech FALL SPECIAL ISSUE 2017 u 1 www.newsandtech.com KBA-Digital & Web Solutions Possibilities, Expansion, Growth... All from KBA. retrofits change of web width press inspections press inspections professional training press relocations software updates super panorama formats upgrades width change of web press relocations unique advertising format press inspections retrofits professional training software updates software updates upgrades retrofits software updates upgrades retrofits change of web width change of web upgrades change of web width professional training unique advertising format KBA is on your side Let us make your press as good as new or even better. KBA’s team of industry experts can enhance your current presses’ capabilities. Our team has helped newspapers from around the world enter new markets, expand their potential, and be more productive than ever before. All allowing you to remain competitive. Contact us to learn more on how we can help your organization. KBA North America, Dallas, Texas phone: 469-532-8000, [email protected], www.kba.com 2 t FALL SPECIAL ISSUE 2017 News & Tech www.newsandtech.com Report details digital news preferences u BY KIRSTEN STAPLES CONTRIBUTING WRITER Just like news consumption prefer- States, people are twice as likely to have ences differ from individual to individual, more confidence in news media, according they can also differ from country to country. -

Kansas Publisher Official Monthly Publication of the Kansas Press Association Aug

The Kansas Publisher Official monthly publication of the Kansas Press Association Aug. 21, 2019 Inside Today Page 2 Kevin Slimp says print is still where successful newspapers are making their money. Page 3 John Foust gives tips on how to have more buy-in at your sales meetings. Page 4 KPA president Travis Mounts takes a close look at how the GateHouse/Gannett media merger might affect the industry. Page 6-7 Three of the state press associations briefed executive directors of those associations: Mark Visit KPA’s marketplace. There about the new Think F1rst campaign included Thomas, Oklahoma Press Association; Emily are job openings, newspapers for Oklahoma, Kansas and Missouri. Shown above Bradbury, Kansas Press Association; and Mark sale and equipment for purchase. at a recent meeting in Montreal are (from left) Maassen, Missouri Press Association. Page 8 Emily Bradbury urges editors to States join in ‘Think F1rst’ campaign keep the mission — serving their he Kansas Press Associ- about the First Amendment and your publications and online,” communities — top of mind. ation has joined with the the rights afforded under it.” she said. “Even consider Kansas Association of In a civics survey taken by pairing them with an editorial KPA Calendar BroadcastersT and other associa- the Annenberg Public Policy about why you are running the tions nationwide to promote the Center, nearly four in 10 stu- ads or any other educational “Think F1rst” Campaign. dents couldn’t name even one stories that might take this Aug. 1 - Dec. 31 “Participation in this project of the five freedoms guaranteed campaign one step further.” States work together to promote is voluntary but highly recom- by the First Amendment. -

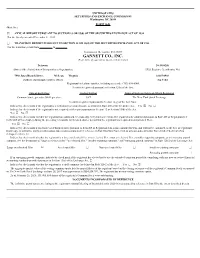

GANNETT CO., INC. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2019 ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 001-36097 GANNETT CO., INC. (Exact name of registrant as specified in its charter) Delaware 38-3910250 (State or Other Jurisdiction of Incorporation or Organization) (I.R.S. Employer Identification No.) 7950 Jones Branch Drive, McLean, Virginia 22107-0910 (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code: (703) 854-6000 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Trading Symbol Name of Each Exchange on Which Registered Common Stock, par value $0.01 per share GCI The New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). -

2016 Newspaper Attendees 5 3 16

This is not a complete list of attendees. Some attendees have chosen to not share their information. Newspaper Attendees Registered as of 5/13/16 12:00 p.m. Newspaper Full Name (Last, First) City and Region Combined Albuquerque Publishing Co. McCallister, Roy Albuquerque, NM American Press Johnson, Darwin Lake Charles, LA Ann Arbor Offset Rupas, Nick Ann Arbor, MI Arizona Daily Star Lundgren, John Tucson, AZ Arkansas Democrat Gazette Elliott, Nick Little Rock, AR Arkansas Democrat Gazette Martin, Fred Little Rock, AR Atlanta Jounral Constitution Thompson, David Norcross, GA Atlanta Journal-Constitution / Cox Media Group Woodman, Brent Norcross, GA Brunswick News Akerley, Anthony Moncton, NB Brunswick News Beek, Gary Moncton, NB Brunswick News MacIsaac, Shaun Moncton, NB Charlotte Sun/Sun Coast Press Hackney, Richard Venice, FL Chattanooga Times Free Press Webb, Gary Chattanooga, TN Civitas Media Fleming, Peter Lumberton, NC Cox Media Group McKinnon, Joe Norcross, GA Daytona Beach News-Journal Cohen, Dwayne Daytona Beach, FL Daytona Beach News-Journal Page, Robert Daytona Beach, FL Diario Aruba Mansur, Luis Oranjestad, El Diario de Hoy Hernández, Iliana San Salvador, El Mercurio Sap Cifuentes, Miguel Santiago, Chile El Mercurio Sap Abarca, Jose Santiago, Chile Evening Post Publishing Company Cartledge, Ron Charleston, SC Express-News Wieters, David San Antonio, TX Fayetteville Observer Noonan, Patrick Fayetteville, NC Florida Times Union Gallalee, Brian Jacksonville, FL Florida Today Holland, Christopher Melbourne, FL Fort Wayne Newspapers -

Notice of Chapter 11 Bankruptcy Case 12/15

17-22445-rdd Doc 18 Filed 03/30/17 Entered 03/31/17 00:22:52 Imaged Certificate of Notice Pg 1 of 40 Information to identify the case: Debtor Metro Newspaper Advertising Services, Inc. EIN 13−1038730 Name United States Bankruptcy Court Southern District of New York Date case filed for chapter 11 3/27/17 Case number: 17−22445−rdd Official Form 309F (For Corporations or Partnerships) Notice of Chapter 11 Bankruptcy Case 12/15 For the debtor listed above, a case has been filed under chapter 11 of the Bankruptcy Code. An order for relief has been entered. This notice has important information about the case for creditors, debtors, and trustees, including information about the meeting of creditors and deadlines. Read both pages carefully. The filing of the case imposed an automatic stay against most collection activities. This means that creditors generally may not take action to collect debts from the debtor or the debtor's property. For example, while the stay is in effect, creditors cannot sue, assert a deficiency, repossess property, or otherwise try to collect from the debtor. Creditors cannot demand repayment from the debtor by mail, phone, or otherwise. Creditors who violate the stay can be required to pay actual and punitive damages and attorney's fees. Confirmation of a chapter 11 plan may result in a discharge of debt. A creditor who wants to have a particular debt excepted from discharge may be required to file a complaint in the bankruptcy clerk's office within the deadline specified in this notice. (See line 11 below for more information.) To protect your rights, consult an attorney. -

Gatehouse-Gannett Merger Threatens Journalism

NewsGuild-CWA: GateHouse-Gannett Merger Threatens Journalism The merger of GateHouse Media and Gannett, Inc. threatens journalism. The high debt load will exert downward pressure on wages and employment. Consolidation may accelerate news deserts. And Gannett shareholders are likely to lose money. The GateHouse purchase of Gannett will weaken newspapers in the communities currently served by the two papers. The combined company will be forced to pay off, at a usurious interest rate, the financing of the deal, which will burden operations afterwards. The merger rewards the owner of GateHouse Media, New Media Investment Group (NYSE:NEWM), for its practices of cash extraction rather than investment in the news industry. The GateHouse-Gannett merger over-compensates Fortress Investment Group, the manager of GateHouse. NEWM is a company in turmoil, with shareholders and management out of alignment. Finally, the deal is harmful to Gannett investors who are likely to receive less value than was offered by Alden Global Capital in January 2019. Gannett shareholders decisively defeated the Alden slate of directors at the annual meeting of shareholders May 16, 2019. The NewsGuild-Communications Workers of America (TNG-CWA) represents working men and women in telecommunications, customer service, media, airlines, health care, public service and education, and manufacturing. TNG-CWA represents 1,200 news industry employees at 33 newspapers owned by Gannett Co., Inc. and GateHouse Media. Additionally, both TNG-CWA and NewsGuild local unions sponsor pension funds that invest in the public equity markets and are substantial Gannett shareholders. 1. The Architecture of the Deal On August 5, 2019, GateHouse (via its parent NEWM) announced its offer to purchase Gannett. -

Ohio SPJ Awards DAYTON, OH Ohioohio SPJ SPJ Awards Awards PAID PAID 13311331 South South Highhigh St

PRSRT STD PRESORT USPRSRT PRPOSTES STDORTAGE PAID FIRST CLASS US STANDARDPOSTAGEPERMIT PAID #166 U.S. Postage PERMITU.S.DAYTON, Postage #166 OH Ohio SPJ Awards DAYTON, OH OhioOhio SPJ SPJ Awards Awards PAID PAID 13311331 South South HighHigh St. St. Columbus OH Columbus OH Columbus,Columbus,1677 Cardiff OHOH 43207 43207Rd. Permit #4592 Permit #4592 Columbus, OH 43221 SPJ AWARDS OHIO’S BEST JOURNALISM BEST OHIO’S OHIO’S BEST JOURNALISM BEST OHIO’S OHIO’S BEST JOURNALIS BEST OHIO’S M OHIO’S BEST JOURNALIS BEST OHIO’S M D R A W A J P P P S S SPJ SPJ AWARDS SPJ AWARDS SPJ 201 5 2017 Pro Football Hall of Fame The Pro Football Hall of Fame (HOF) opened its doors more than a half century ago. From its humble beginnings in 1963 to today, this impressive institution continues to grow in both size and stature. Indeed, as we honor exceptional Ohio journalists during the 2017 Ohio SPJ Awards luncheon, exciting progress is being made at the Johnson Controls Hall of Fame Village. When finished, this $700 million develop- ment will have added a hotel, holographic theater, youth playing fields, the expanded and modernized Tom Benson Stadium (site of the NFL’s an- nual Hall of Fame game), and much more. An exhilarating museum and attraction, the HOF pays tribute to the tal- ents and triumphs of pro football’s greatest stars. Chronicled within these Artist rendering of the Tom Benson Hall of Fame walls are the stories and circumstances of play that bring to life words Stadium’s west end zone.