MYANMAR: REPORT No

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

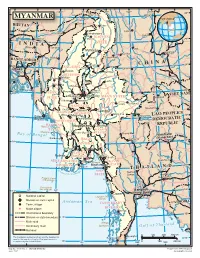

Map of Myanmar

94 96 98 J 100 102 ° ° Indian ° i ° ° 28 n ° Line s Xichang Chinese h a MYANMAR Line J MYANMAR i a n Tinsukia g BHUTAN Putao Lijiang aputra Jorhat Shingbwiyang M hm e ra k Dukou B KACHIN o Guwahati Makaw n 26 26 g ° ° INDIA STATE n Shillong Lumding i w d Dali in Myitkyina h Kunming C Baoshan BANGLADE Imphal Hopin Tengchong SH INA Bhamo C H 24° 24° SAGAING Dhaka Katha Lincang Mawlaik L Namhkam a n DIVISION c Y a uan Gejiu Kalemya n (R Falam g ed I ) Barisal r ( r Lashio M a S e w k a o a Hakha l n Shwebo w d g d e ) Chittagong y e n 22° 22° CHIN Monywa Maymyo Jinghong Sagaing Mandalay VIET NAM STATE SHAN STATE Pongsali Pakokku Myingyan Ta-kaw- Kengtung MANDALAY Muang Xai Chauk Meiktila MAGWAY Taunggyi DIVISION Möng-Pan PEOPLE'S Minbu Magway Houayxay LAO 20° 20° Sittwe (Akyab) Taungdwingyi DEMOCRATIC DIVISION y d EPUBLIC RAKHINE d R Ramree I. a Naypyitaw Loikaw w a KAYAH STATE r r Cheduba I. I Prome (Pye) STATE e Bay Chiang Mai M kong of Bengal Vientiane Sandoway (Viangchan) BAGO Lampang 18 18° ° DIVISION M a e Henzada N Bago a m YANGON P i f n n o aThaton Pathein g DIVISION f b l a u t Pa-an r G a A M Khon Kaen YEYARWARDY YangonBilugyin I. KAYIN ATE 16 16 DIVISION Mawlamyine ST ° ° Pyapon Amherst AND M THAIL o ut dy MON hs o wad Nakhon f the Irra STATE Sawan Nakhon Preparis Island Ratchasima (MYANMAR) Ye Coco Islands 92 (MYANMAR) 94 Bangkok 14° 14° ° ° Dawei (Krung Thep) National capital Launglon Bok Islands Division or state capital Andaman Sea CAMBODIA Town, village TANINTHARYI Major airport DIVISION Mergui International boundary 12° Division or state boundary 12° Main road Mergui n d Secondary road Archipelago G u l f o f T h a i l a Railroad 0 100 200 300 km Chumphon The boundaries and names shown and the designations Kawthuang 10 used on this map do not imply official endorsement or ° acceptance by the United Nations. -

Scanned Image

UNOPS eSourcing v2017.1 Section II: Schedule of Requirements eSourcing reference: RFQ/2020/15086 Terms of Reference Foundation Investigation for health facilities in Hlaing Thar Yar Township in Yangon Region of Myanmar 1.0 SCOPE The works for soil investigation shall be carried out in accordance with the specification set out below and as directed by the UNOPS, wherever necessary. The main scope of the work shall include but not limited to the following: ● Performing Site-Specific Ground Motion Study for Seismic Design of Building, ● Soil Liquefaction assessment during Seismic events and foundation recommendations to mitigate liquefaction effects The detail scope is indicated in the section 2.2- reporting below. The scope of the work conform to the relevant Standards on Soils and Foundations for field investigations and Laboratory testing. Reference to any code in these TOR shall mean the latest revision of the code unless otherwise mentioned. In the event of any conflict between the requirements in these TOR and the referred codes, the former shall govern. 2.0 TECHNICAL REQUIREMENTS 2.1 GENERAL The purpose of the proposed sub-soil investigation is to provide adequate information on sub-surface and surface conditions for the foundations and other sub-structures for the proposed project, with special attention to the analysis of liquefied soils, leading to safe foundation design and site specific ground motion study for determining spectral parameters for design of superstructure. The planning of the work, choice of the method of boring, -

THE STATE of LOCAL GOVERNANCE: TRENDS in YANGON Photo Credits

Local Governance Mapping THE STATE OF LOCAL GOVERNANCE: TRENDS IN YANGON Photo credits Yangon Heritage Trust Thomas Schaffner (bottom photo on cover and left of executive summary) Gerhard van ‘t Land Susanne Kempel Myanmar Survey Research The views expressed in this publication are those of the author, and do not necessarily represent the views of UNDP. Local Governance Mapping THE STATE OF LOCAL GOVERNANCE: TRENDS IN YANGON UNDP MYANMAR Table of Contents Acknowledgements II Acronyms III Executive Summary 1 - 4 1. Introduction to the Local Governance Mapping 5 - 8 1.1 Yangon Region - most striking features 7 1.2 Yangon City Development Committee and the Region government 8 1.3 Objectives of the report and its structure 8 2. Descriptive overview of governance structures in Yangon Region 9 - 38 2.1 Yangon Region - administrative division 11 2.2 Yangon Region - Socio-economic and historical context 13 2.3 Yangon City Development Committee (YCDC) 18 2.4 Yangon Region Government 24 2.5 Representation of Yangon Region in the Union Hluttaws 33 2.6 Some of the governance issues that Yangon Region and YCDC are facing 37 3. Organisation of service delivery at the township level 39 - 62 3.1 Governance structures at the township level 43 3.2 Planning and Budgeting 46 3.3 Role of GAD and the VTAs/WAs 48 3.4 The TDSC and the TMAC 51 3.5 Election and selection processes for peoples’ representatives 53 3.6 Three concrete services - people’s participation and providers views 54 3.7 Major development issues from a service provider perspective 60 4. -

Flash Alert – Covid-19 Pandemic in Myanmar: Details on 29 September Cases Wednesday, September 30, 2020

Flash alert – Covid-19 Pandemic in Myanmar: Details on 29 September Cases Wednesday, September 30, 2020 Yesterday evening at 20:00 hrs, 7971 new Covid-19 cases were identified, i.e. 12,053 cases since the beginning of the second wave on 16 August. Since the beginning of the pandemic in March, 12,427 people have been contaminated in Myanmar, and a total of 284 people have died of Covid-19. At 16:30 Hrs, the MoHS released the spatial breakdown of those 797 cases: 661 in Yangon Region, 32 in Mandalay Region, 24 Kachin State, 23 in Rakhine State, 16 in Ayeyarwaddy Region, 15 in Bago Region, 11 in Mon State, 7 in Magway Region, 3 in Tanintharyi Region, 2 in Kayin State, 2 in Naypyitaw Territory of Union and 1 in Shan State. Since 16 August, 8,979 cases have been reported in Yangon Region. Yesterday, the most significant surges took place in Insein Township (+108 cases), Shwepyithar Township (+51) and Twantay Township (+49). Insein is the most-affected township in Yangon, ahead of Thingangyun, South and North Okkalapa, Tarmwe, Hlaing, Hlaing Thayar, Thaketa and Mingaladon Townships. Imported cases N° of new cases on 29 N° of total cases Township Local cases from abroad September since 16 August Ahlone 6 121 Bahan 15 193 Botahtaung 1 126 Dagon 4 182 Dagon Myothit (East) 28 180 Dagon Myothit (North) 4 184 Dagon Myothit (South) 10 199 Dagon Seikkan 6 97 Dala 5 286 1 The announcement originally mentioned 795 cases, but two additional cases were added after the details were released. -

Burma 2015 Human Rights Report

BURMA 2015 HUMAN RIGHTS REPORT EXECUTIVE SUMMARY Burma has a quasi-parliamentary system of government in which national parliament selects the president and constitutional provisions grant one-quarter of national, regional, and state parliamentary seats to active-duty military appointees. The military also has the authority to appoint the ministers of defense, home affairs, and border affairs and indefinitely assume power over all branches of the government should the president declare a national state of emergency. On November 8, the country held nationwide parliamentary elections that the public widely accepted as a credible reflection of the will of the people, despite some structural flaws. The opposition National League for Democracy (NLD) party, chaired by Aung San Suu Kyi, won 390 of 491 contested seats in the bicameral parliament. Civilian authorities did not maintain effective control over the security forces. The three leading human rights problems in the country were restrictions on freedoms of speech, association, and assembly; human rights violations in ethnic minority areas affected by conflict; and restrictions on members of the Rohingya population. Arrests of students, land rights activists, and individuals in connection with the exercise of free speech and assembly continued throughout the year, and the excessive sentencing of many of these individuals after prolonged trial diminished trust in the judicial system. Mass displacement and gross human rights abuses took place in ethnic areas with renewed clashes, and the government took marginal steps to address reports of abuses. The government did little to address the root causes of human rights abuses, statelessness, violence, and discrimination against Rohingya. -

Myanmar Issue Brief No

CHINA, THE UNITED STATES AND THE KACHIN CONFLICT GREAT POWERS AND THE CHANGING MYANMAR ISSUE BRIEF NO. 2 JANUARY 2014 [UPDATED] China, the United States and the Kachin Conflict By Yun Sun This issue brief examines the development of the Kachin conflict in northern Myanmar’s Kachin and Shan states, the negotiations between the Kachin Independence Organization (KIO) and the Myan- mar government, and the roles China and the United States have played in the conflict. KEY FINDINGS: 1 The prolonged Kachin conflict is a 3 The disagreements on terms have 5 Promoting national peace and major obstacle to Myanmar’s national hindered a formal cease-fire. In ad- reconciliation is a pillar of the US reconciliation and a challenging test dition, the existing economic inter- policy toward Myanmar. However, the for the democratization process. est groups profiting from the armed United States is being very careful not conflict have further undermined the to impose itself into the peace process prospect for progress. itself, including Kachin talks, given 2 The KIO and the Myanmar the government’s sensitivity that the government differ on the priority process remains an internal affair of between the cease-fire and the political 4 China intervened in the Kachin ne- the country. dialogue. Without addressing this gotiations in 2013 to protect its national difference, the nationwide peace interests. A crucial motivation was a accord proposed by the government concern about the “internationaliza- will most likely lack the KIO’s tion” of the Kachin issue and the poten- participation. tial US role along the Chinese border. -

Myanmar Transport Infrastructure Brief | 6 June – 13 June 2019 2

Issue 128 | 19 June 2019 News Analysis Myanmar Transport Tenders Companies Infrastructure Brief Data Market Updates Foreign developer appears to drop bid for elevated expressway The Ministry of Construction implies French developer Vinci Highways has withdrawn Its bid for the Yangon Elevated Expressway project amid more procurement delays Company of the Week Golden Myanmar Airlines drops out of airport upgrade project The DCA will reissue a tender for the Kawthaung Airport upgrade in an effort to find China Eastern Airlines a new developer for the potential international gateway to the Mergui Archipelago has launched the first direct flight service Two new road projects highlighted in ASEAN master plan linking Yangon to The proposed Mandalay-Tigyaing-Muse Expressway and Naypyitaw-Kyaukphyu Shanghai. Expressway have been deemed critical for increased ASEAN connectivity Chinese airline introduces first direct flight to Shanghai MIC approvals include two logistics investments Thilawa terminal receives investment insurance Yangon power project to include new LNG terminal Mandalay city officials to inaugurate new road Local airline expands domestic fleet Ministry receives insurance payout for destroyed steel shipment Yangon Region parliament rejects proposed vessel purchase Project of the Week Metro AG eyes expansion across Myanmar New rural road opened near Myanmar-Thailand border Mandalay’s revamped Submersible bridge to be developed with Japanese financial assistance 38th Street is now Construction Industry Development Law -

Flash Alert – Covid-19 Pandemic in Myanmar: Details on 30 September Cases Thursday, October 1, 2020

Flash alert – Covid-19 Pandemic in Myanmar: Details on 30 September Cases Thursday, October 1, 2020 Yesterday evening at 20:00 hrs, 946 new Covid-19 cases were identified, i.e. 12,999 cases since the beginning of the second wave on 16 August. Since the beginning of the pandemic in March, 13,373 people have been contaminated in Myanmar, and a total of 310 people have died of Covid-19. At 16:30 Hrs, the MoHS released the spatial breakdown of those 946 cases: 786 in Yangon Region, 68 in Ayeyarwaddy Region, 25 in Rakhine State, 21 in Bago Region, 19 in Sagaing Region, 7 in Mandalay Region, 6 in Kachin State, 5 in Tanintharyi Region, 4 in Shan State, 3 in Mon State, 1 in Kayin State, 1 in Nay Pyi Taw. Since 16 August, 9,765 cases have been reported in Yangon Region. Out of the 786 new cases from yesterday, 15 cases did not come along with any detail about their townships; this information will be released later. Usually, a handful of townships stand out as the most massive surges in the last 24 hours; but yesterday, 9 townships had comparable growth, ranging from 46 to 57 new cases. Insein is the most-affected township in Yangon, ahead of Thingangyun, South and North Okkalapa, Tarmwe, Hlaing, Hlaing Thayar, Thaketa and Mingaladon Townships. Imported cases N° of new cases on 30 N° of total cases Township Local cases from abroad September since 16 August Ahlone 5 5 126 Bahan 7 7 200 Botahtaung 46 46 172 Dagon 8 8 190 Dagon Myothit (East) 14 14 194 Dagon Myothit (North) 9 9 193 Dagon Myothit (South) 11 11 210 Dagon Seikkan 15 15 112 Dala 56 56 -

Course Report Social Media and Icts for Improved Governance: E Gov for Parliamentarians

Course report Social media and ICTs for improved governance: E gov for Parliamentarians 22-23 June 2016 Yangon Regional Parliament Myanmar This work was carried out with the aid of a grant from the International Development Research Centre, Canada and the Department for International Development, UK LIRNEasia organized a 2-day training course on social media and ICTs for e- governance for the members of the Yangon Regional Parliament. The training took place on 22 and 23 July 2016 within the Yangon Regional Parliament premises. Over 80 Parliamentarians attended the course on each day. The Deputy Speaker of the Yangon Regional Parliament conducted a welcome address on the first day of training, after which the sessions began. Rohan Samarajiva spoke of the significance of ICTs for regional legislature, speaking of the functions within the jurisdiction of the Regional Parliament. He then briefly explained how e-government could be used to improve the delivery of services. Helani Galpaya then spoke of the findings of LIRNEasia’s 2015 nationally representative survey on ICT needs and information needs, drawing attention to the high penetration of mobile phones in the newly liberalized telecommunications sector. Rohan Samarajiva then picked up where he left off earlier, giving a more detailed talk on how e-government could be used to deliver services more effectively. He first drew attention to the New York Call Centre, which is used to respond to the queries of the citizens- simple voice calls were used for this. He also spoke of going beyond voice, in the form of web inquiries. The session on big data from call centers helping improve government service delivery drew particular interest from the audience. -

IMPORTANCE of MYANMAR in CHINA's STRATEGIC INTEREST: a CASE STUDY on SINO-MYANMAR OIL and GAS PIPELINES Dissertation Submitted

IMPORTANCE OF MYANMAR IN CHINA’S STRATEGIC INTEREST: A CASE STUDY ON SINO-MYANMAR OIL AND GAS PIPELINES Dissertation Submitted to the Department of International Relations, Sikkim University in Partial Fulfilment of the Requirement for the Award of the Degree of Master of Philosophy Submitted by Tenzing Chopel Sherpa Department of International Relations School of Social Sciences Sikkim University Gangtok-737101 2016 1 Date: 08th February 2016 DECLARATION I declare that the dissertation entitled “Importance of Myanmar in China’s Strategic Interest: A Case Study on Sino-Myanmar Oil and Gas Pipelines” submitted to the Sikkim University for the award of the degree of Master of Philosophy is my original work. This dissertation has not been submitted for any other degree of this university or any other university. Tenzing Chopel Sherpa Roll Number: 14MPIR08 Registration No: 13SU9941 The Department recommends that this dissertation be placed before the examiner for evaluation. Dr. Manish Mr. Ph. Newton Singh Head of the Department SUPERVISOR 2 CERTIFICATE This is to certify that the dissertation entitled “Importance of Myanmar in China’s Strategic Interest: A Case Study on Sino-Myanmar Oil and Gas Pipelines” submitted to the Sikkim University in partial fulfillment of the requirements for the degree of Master of Philosophy in International Relations, embodies the results of bona fide research work carried out by Mr. Tenzing Chopel Sherpa under my guidance and supervision.. No part of the dissertation has been submitted for any other degree, diploma, associate-ship, fellowship. All the assistance and help received during the course of the investigation have been duly acknowledged by him. -

Yangon University of Economics Master of Public Administration Programme

YANGON UNIVERSITY OF ECONOMICS MASTER OF PUBLIC ADMINISTRATION PROGRAMME A STUDY ON STATUS OF TOWNSHIP ADMINISTRAION (AFTER 1988) (Case Study: Western and Northern Districts in Yangon Region) KYAW KYAW EMPA - 22 (16th BATCH) DECEMBER, 2019 YANGON UNIVERSITY OF ECONOMICS MASTER OF PUBLIC ADMINISTRATION PROGRAMME A STUDY ON STATUS OF TOWNSHIP ADMINISTRATION (AFTER 1988) (Case Study: Western and Northern Districts in Yangon Region) A thesis submitted as a partial fulfillment of the requirement for the Degree of Master of Public Administration (MPA) Supervised by: Submitted by: Daw Yi Yi Khin Kyaw Kyaw Associate Professor Roll No. 22 Department of Applied Economics EMPA-16th Batch Yangon University of Economics (2017-2019) December, 2019 YANGON UNIVERSITY OF ECONOMICS MASTER OF PUBLIC ADMINISTRATION PROGRAMME This is to certify that this thesis entitled “A Study on Status of township Administration -After 1988 (Case Study: Western and Northern Districts in Yangon Region)” submitted as a partial fulfilment towards the requirements for the degree of Master of Public Administration has been accepted by the Board of Examiners. BOARD OF EXAMINERS 1. Professor Dr. Tin Win Rector Yangon University of Economics (Chief Examiner) 2. Professor Dr. Ni Lar Myint Htoo Pro-Rector Yangon University of Economics (Examiner) 3. Professor Dr. Phyu Phyu Ei Programme Director and Head of Department Department of Applied Economics Yangon University of Economics (Examiner) 4. Daw Khin Chaw Myint Associate Professor (Retired) Department of Applied Economics Yangon University of Economics (Examiner) 5. U Thein Naing Associate Professor Department of Applied Economics Yangon University of Economics (Examiner) December, 2019 ABSTRACT Township administration plays a very important role in providing public services of the government to the glass root people. -

Sino–Myanmar Relations: Security and Beyond

Sino–Myanmar Relations: Security and Beyond Niklas Swanström ASIA PAPER June 2012 Sino–Myanmar Relations: Security and Beyond Niklas Swanström Institute for Security and Development Policy Västra Finnbodavägen 2, 131 30 Stockholm-Nacka, Sweden www.isdp.eu Sino–Myanmar Relations: Security and Beyond is an Asia Paper published by the Insti- tute for Security and Development Policy. The Asia Papers Series is the Occasional Paper series of the Institute’s Asia Program, and addresses topical and timely subjects. The Institute is based in Stockholm, Sweden, and cooperates closely with research centers worldwide. Through its Silk Road Studies Program, the Institute runs a joint Transatlan- tic Research and Policy Center with the Central Asia-Caucasus Institute of Johns Hopkins University’s School of Advanced International Studies. The Institute is firmly established as a leading research and policy center, serving a large and diverse community of ana- lysts, scholars, policy-watchers, business leaders, and journalists. It is at the forefront of research on issues of conflict, security, and development. Through its applied research, publications, research cooperation, public lectures, and seminars, it functions as a focal point for academic, policy, and public discussion. The opinions and conclusions expressed are those of the author and do not necessarily reflect the views of the Institute for Security and Development Policy or its sponsors. © Institute for Security and Development Policy, 2012 ISBN: 978-91-86635-36-7 Printed in Singapore Distributed in Europe by: Institute for Security and Development Policy Västra Finnbodavägen 2, 131 30 Stockholm-Nacka, Sweden Tel. +46-841056953; Fax. +46-86403370 Email: [email protected] Distributed in North America by: The Central Asia-Caucasus Institute Paul H.