Shareholder Counterproposals and Nominations

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Qualitative and Quantitative Analysis of Siemens Ag

QUALITATIVE AND QUANTITATIVE ANALYSIS OF SIEMENS AG Authors (Universitat de Barcelona): Patrícia Amor Agut Clara Valls Moreno Gemma Casserras EDITOR: Jordi Marti Pidelaserra (Dpt. Comptabilitat, Universitat Barcelona) 1 Patrícia Amor 14961785 Clara Valls 14959906 Gemma Casserras 14965090 Alessandra Cortegiani (Bloc 3) 14991480 2 BLOC 1: SIEMENS AG BLOC 2: Risk Analysis BLOC 3: Profitability Analysis 3 BLOC 1 SIEMENS AG BASIC INFORMATION 4 Index 1. Introduction 2. Company History 3. Vision, Mission and Strategy 3.1. Vision 3.2. Mission 3.3. Strategy 4. Company Structure 4.1. Board of directors 4.2. Management by sector 5. Company Sectors 5.1. Energy Sector 5.2. Industry Sector 5.3. Healthcare Sector 5.4. Infrastructure and cities Sector 5.5. Financial Services 5.6. Other activities 5.7. Revenues importance 6. Shareholders 7. Stakeholders 8. Competitors 5 1. Introduction: Siemens AG is a German multinational engineering and electronics conglomerate company headquartered in Munich, Germany. It is the largest based in Europe. Founded to manufacture and install telegraphic systems, Germany-based Siemens AG has prospered and grown over 165 years to become a multifaceted electronics and electrical engineering enterprise, and one of the most international corporations in the world. Founded to manufacture and install telegraphic systems, Germany-based Siemens AG has prospered and grown over 165 years to become a multifaceted electronics and electrical engineering enterprise, and one of the most international corporations in the world. The Siemens name has been synonymous with cutting-edge technologies and continuous growth in profitability. With their wide array of products, systems and services, they are world leaders in information and communications, automation and control, power, medical solutions, transportation and lighting. -

Siemens Company History Phase8

New paths in a time of crisis 1989–2006 The years from 1989 to 2006 confronted the company with challenges unlike any before – including the first comprehensive reform of the corporate organization, the launch of the Ten- Point Program, and the compliance crisis – that compelled its chief players to make fundamental changes. 1989 was a year of profound changes, not just for Germany and global politics, but for Siemens. Twenty years after the company’s last major organizational reform, there was a need for action. Siemens AG had outgrown the structure that had been laid out back in 1966 and 1969. Where revenues in fiscal 1969 had been 12.7 billion deutschmarks, by 1986 they had risen to 51.4 billion. The number of business units had grown to eight by the end of the 1980s. Karlheinz Kaske, CEO from 1981 to 1992, aimed to improve "mo- bility, effectiveness and competitiveness," with an organizational structure that took due account of the company's changing envi- ronment – the technological paradigm shift from mechanical de- vices to electronics and microelectronics, the growth of interna- tional business, a greatly expanded worldwide customer base, and ever-intensifying competition. So top management first of all set up a more effective administrative structure. The eight former business units were rearranged into 15 new, leaner units, two operating Groups with their own legal form, and two independ- ent Divisions. Each was responsible for its own profits and value chain – from development through production to sales – and each was managed by three Group Executive Managers. Top management, which formerly included more than 30 people, was © Siemens Historical Institute 2017 1/4 siemens.com/history cut by a third. -

Siemens Management Innovation at the Corporate Level Case Study Reference No 310-114-1

Siemens Management Innovation at the Corporate Level Case study Reference no 310-114-1 This case was written by Dr Markus Menz and Professor Dr Guenter Mueller-Stewens, University of St Gallen, Switzerland. It is intended to be used as the basis for class discussion rather than to illustrate either effective or ineffective handling of a management situation. The case was written with the support of a Philip Law Scholarship awarded by ecch. The case was made possible by the co-operation of Siemens AG and from published sources. © 2010, University of St Gallen, Switzerland. No part of this publication may be copied, stored, transmitted, reproduced or distributed in any form or medium whatsoever without the permission of the copyright owner. Distributed by ecch, UK and USA North America Rest of the world www.ecch.com t +1 781 239 5884 t +44 (0)1234 750903 ecch the case for learning All rights reserved f +1 781 239 5885 f +44 (0)1234 751125 Printed in UK and USA e [email protected] e [email protected] 310-114-1 MARKUS MENZ GÜNTER MÜLLER-STEWENS SIEMENS: MANAGEMENT INNOVATION AT THE CORPORATE LEVEL INTRODUCTION At the Annual Shareholders’ Meeting in February 1998, Siemens announced disappointing overall results for fiscal 1997. While the firm’s sales growth met shareholder expectations, net income remained largely stable. During the following weeks and months, Siemens’ top management not only faced increased pressure from its shareholders, but also higher environmental uncertainty and stronger global competition than during the early and mid-1990s. The challenge for the top management team was to optimize the business portfolio in a way that promised to add substantial shareholder value over the next years. -

Wir Sind CSU Erlangen

November 2016 Gestern. Heute. Morgen. Wir sind CSU Erlangen. ahre 70 J en rlang CSU E en rzlich He ch! wuns Glück „Mein London“ Benefizkonzert mit den Nürnberger Symphonikern „Very british“ - so lässt sich das Neujahrskonzert 2017 unserer VR-Bank beschreiben. Erleben Sie Englands Hauptstadt musikalisch: in den Werken berühmter britischer Komponisten, interpretiert von den Nürnberger Symphonikern nach ihrem Qualitätsanspruch „Made in Nuremberg“. Am Dirigentenpult: Chefdirigent Alexander Shelley, der seine Geburtsstadt London perfekt zu inszenieren weiß. Programm: vr-bank-ehh.de/benefizkonzert Dienstag, 3. Januar 2017 Einlass: 18:30 Uhr - Beginn: 19:00 Uhr Heinrich-Lades-Halle, 91052 Erlangen Eintritt für VR-Mitglieder: 1. Kategorie -ausverkauft-, 2. Kategorie 21,50 Euro Eintritt für Nicht-Mitglieder: 1. Kategorie -ausverkauft-, 2. Kategorie 27,50 Euro Kinder/Jugendliche bis 16 Jahre: halber Preis Kartenbestellung: Telefon 09131 781-725, in unseren Filialen vr-bank-ehh.de/benefizkonzert – 70 Jahre CSU Erlangen – Wir sind CSU Erlangen. Gestern. Heute. Morgen. „Wir müssen uns immer wieder Grußwort Parteivorsitzender Horst Seehofer ....................................... 7 von neuem bemühen, die parlamen- Grußwort Kreisvorsitzende tarischen Prozesse der breiten Alexandra Wunderlich ........................... 9 Öffentlichkeit verständlich zu Gratulanten ......................................... 10 machen [...] und unsere Arbeit transparent und bürgernah gestalten“ in memoriam ....................................... 15 Dr. Wilhelm Vorndran CHRONIK -

Christine Johnson , Et Al. V. Siemens AG, Et Al. 09-CV-5310-Complaint

Case 1:09-cv-05310-JG -RER Document 1 Filed 12/04/09 Page 1 of 39 UNITED STATES DISTRICT COURT. EASTERN DISTRICT OF NEW YORK CHRISTINE JOHNSON, Individually and On ^ 3' ^ o Behalf of All Others Similarly Situated, VeO-9 Plaintiff, ) CLASS ACTION vs. ) COMPLAINT FOR VIOLATIONS OF THE FEDERAL SECURITIES LAWS SIEMENS AG, ) Defendant. } a 0 DEMAND FOR JUR^A SUMMARY AND OVERVIEW REYES, M J 1. This is a federal class action on behalf of purchasers of the American Depository Receipt Shares ("ADRs" or "shares") of Siemens AG ("Siemens" or the "Company") between November 8, 2007 and April 30, 2008, inclusive ( the "Class Period"), seeking to pursue remedies under the Securities Exchange Act of 1934 (the "Exchange Act'). Siemens is a German based corporation which does substantial business in the United States through its various U.S. operations, with a focus in electronics and electrical engineering, and operating in the industry, energy and healthcare sectors. 2. As more fully set forth herein, Siemens has plead guilty in the United States to violating the Securities Exchange Act of 1934 (the "Exchange Act') and the United States Foreign Corrupt Practices Act of 1977 (the "FCPA") by systemically and extensively engaging in illegal activities, including the establishment of sham businesses, phoney contracts, phantom invoices, shadow companies, mail and wire fraud, bribery, and money laundering, in order to obtain contracts or retain business for the Company. It knowingly used bagmen, elaborate payment schemes and secret off-book accounts to conceal bribery payments; mischaracterized Case 1:09-cv-05310-JG -RER Document 1 Filed 12/04/09 Page 2 of 39 bribes and kickbacks in corporate accounting records; circumvented and failed to maintain adequate internal controls; and failed to comply with the books and records provisions of the FCPA. -

Der Bedeutungszuwachs Betrieblicher Humaner Und Sozialer Ressourcen Im Lichte Der Krisensituation Der 1970Er Und 1980Er Jahre

Faktor Mensch Der Bedeutungszuwachs betrieblicher humaner und sozialer Ressourcen im Lichte der Krisensituation der 1970er und 1980er Jahre Dissertation zur Erlangung des Doktorgrades der Philosophie an der Philosophischen Fakultät der Universität Potsdam vorgelegt von: Diplom-Kaufmann, Diplom-Volkswirt Kim-Holger Opel Potsdam 2016 Erstgutachter: Prof. Dr. André Steiner, Universität Potsdam Zweitgutachter: Prof. em. Dr. Toni Pierenkemper, Universität zu Köln Datum der mündlichen Prüfung: 7. Juni 2017 Online veröffentlicht auf dem Publikationsserver der Universität Potsdam: URN urn:nbn:de:kobv:517-opus4-404767 http://nbn-resolving.de/urn:nbn:de:kobv:517-opus4-404767 Für Jannis und Niklas Vorwort An dieser Stelle möchte ich meinen besonderen persönlichen Dank nachstehenden Per- sonen entgegenbringen, ohne deren Mithilfe die Anfertigung dieser Promotionsschrift niemals zustande gekommen wäre: Mein Dank gilt zunächst Herrn Prof. Dr. André Steiner, meinem Doktorvater, und Herrn Prof. Dr. Toni Pierenkemper, meinem Zweitgutachter, für die hilfsbereite und wissen- schaftliche Betreuung dieser Arbeit. Die Gespräche waren immer ein bereichernder und konstruktiver Austausch, den ich als Ermutigung und Motivation empfunden habe. Des Weiteren möchte ich Herrn Alexander Huseby vom Centrum för Näringslivshistoria in Stockholm für seine ausgezeichnete Hilfe danken. Er gab mir nicht nur Zugang zu un- entbehrlichen Informationen und historischen Dokumenten schwedischer Unterneh- men, sondern war jederzeit Ansprechpartner für meine zahlreichen und unermüdli- chen fachlichen Fragen. Auch die vielen „nicht-wissenschaftlichen“ motivierenden Ge- spräche haben meine Arbeit sehr unterstützt. Mein weiterer Dank gilt den Mitarbeite- rinnen und Mitarbeitern der Universität Oxford und der Bodleian Library (insbesondere Herrn Michael Hughes) sowie des Siemens-Unternehmensarchivs in München in ihrer steht hilfsbereiten Unterstützung meiner Arbeit. Dankbar bin ich außerdem Herrn Prof. -

Siemens A.G. Business Information, Profile, and History

Siemens A.G. Business Information, Profile, and History http://companies.jrank.org/pages/3759/Siemens-G.html Wittelsbacherplatz 2 D 80333 Munich Germany Siemens A.G. is Europe's largest electrical and electronics company, producing over 50,000 products manufactured at 400 sites in 40 countries. Referring to the company's history of achieving success through well engineered refinements of other people's inventions, one Fortune analyst noted that "second is best" might well serve as Siemens' motto. But opportunism is not the only interesting facet of Siemens' history, which is also a story of a long family tradition and intimate involvement with some of the most important events of the 19th and 20th centuries. Siemens & Halske was founded in Berlin in 1847 by Werner Siemens and J. G. Halske to manufacture and install telegraphic systems. Siemens, a former artillery officer in the Prussian army and an engineer who already owned a profitable patent for electroplating, was the driving force behind the company and remained so for the rest of his life. The company received its first major commission in 1848, when it contracted to build a telegraph link between Berlin and Frankfurt. Construction of telegraph systems boomed in the mid 19th century, and Siemens & Halske was well equipped to take advantage of the situation. In 1853, it received a commission to build an extensive telegraph system in Russia. Upon its completion, the company opened an office in St. Petersburg under the direction of Werner Siemens' brother Carl Siemens. In 1857 Siemens & Halske helped develop the first successful deep sea telegraphic cable. -

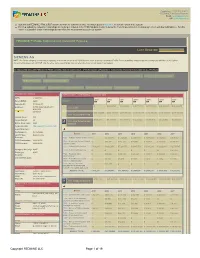

SIEMENS AG NOTE : If a Parent Company for This Entity Is Reported, Click the Link on Its Parent DUNS Number Below to See Its Consolidated Profile

Created on : 11/07/2012 20:43:22 © FEDMINE™ All Rights Reserved Email: [email protected] URL: www.fedmine.us ● Hyperlinks in FEDMINE HTML & PDF documents work for subscribers only. You may request a FREE TRIAL to view all reports in the system ● Parent & subsidiary company relationships are no longer included in the FPDS-NG data in order to honor the Federal Government’s licensing agreement with Dun & Bradstreet. For that reason it is possible those relationships do not reflect the most current status in our system FEDMINE™ PRIME CONTRACTOR COMPANY PROFILE LAST UPDATED: 11/07/2012 08:43:22 PM SIEMENS AG NOTE : If a Parent company for this entity is reported, click the link on its Parent DUNS number below to see its consolidated Profile. Parent subsidiary relationships are no longer provided due to the Federal Government's agreement with D&B, and therefore, some relationships may not reflect the most current status in our system. All OBLIGATED DOLLARS PERTAIN TO PRIME CONTRACTING DOLLARS ONLY. IF PURCHASED SEPARATELY SUBCONTRACTS DATA IS INCLUDED IN ALL PROFILES SUB CONTRACTS AWARDED VIEW PROFILE BY SUBSIDIARIES CONTRACT AWARDS IN LAST 30 DAYS CONTRACTS BY PLACE OF PERFORMANCE CONTRACTS BY CONTRACTING OFF. FEDBIZOPPS AWARDS CONTRACTS BY NAICS CODES CONTRACTS BY PSC CODES CONTRACTS BY SOCIO ECONOMIC STATUS CONTRACTS BY SETASIDE TYPE CONTRACTS BY PRICING TYPE ORGANIZATION DETAILS COMPARATIVE 7 - YEAR FEDERAL CONTRACTS VIEW DUNS: 316067164 2013 2012 2011 2010 2009 2008 2007 Parent DUNS: NONE AGENCY Fedmine ID: F128384287 0 $ 3,488,781 $ 6,296,536 $ 19,777,110 $ 20,769,381 $ 16,402,938 $ 15,925,275 Address: WITTELSBACHERPLATZ 2 2100 - ARMY MUNCHEN GM 80333- $ 38,933,075 $ 163,279,115 $ 117,755,986 $ 210,580,217 $ 203,271,452 $ 145,427,643 $ 127,953,485 3600 - VETERANS AFFAIRS County Code: 000 Cong. -

General Meeting 2008 Counterproposals

General Meeting 2008 Counterproposals As of May 20, 2008 Counterproposals Counterproposals received by us are classified into two groups: We designate with capital letters those counterproposals for which, if you wish to vote for them, you need only tick the appropriate capital letter on the reply form. In this case, too, however, please tick the appropri- ate box under the respective item on the agenda to indicate how you would like to vote in order to make sure that your vote is counted even if the counterproposal is not made, is retracted or, for some other reason, is not voted on at the General Meeting. The other counterproposals, which merely reject proposals by the Board of Managing Directors and the Supervisory Board, or by the Supervisory Board alone, are not designated with capital letters. If you wish to vote for these counterproposals, you must vote “No” to the respective item on the Agenda. For our ordinary General Meeting taking place on Thursday, May 29, 2008 in Frankfurt am Main, we have to date received the following counterproposals. The proposals and reasons are the authors’ views as notified to us. We have also placed assertions of fact in the Internet without changing or verifying them. Shareholder ThomaS VehlieS, langenhagen, re agenda iTem 9: Re Item 09 // “Election to the Supervisory Board” of the Agenda for the General Meeting of Deutsche Bank on May 29, 2008, I submit the counterproposal not to elect Professor Dr. von Pierer on to the Supervisory Board of Deutsche Bank. reaSonS What was probably the biggest scandal in German economic history in connection with “slush funds” took place while Professor Dr. -

Shareholder Proposals

Shareholder Proposals Shareholder Proposals for the Annual Shareholders’ Meeting of Siemens AG on January 25, 2007 www.siemens.com Latest update: January 17, 2007 Below you find all shareholder proposals relating to items on the Agenda for the Annual Shareholders’ Meeting on January 25, 2007, together with Management’s discussion thereon. This version of the Shareholder Proposals, prepared for the convenience of English- speaking readers, is a translation of the German original. For the purposes of inter- pretation the German text shall be authoritative and final. Hans-Walter Grünewälder, Wuppertal, has submitted the following shareholder proposals: With regard to Agenda Item 4, “To ratify the acts of the Managing Board” and Agenda Item 5 “To ratify the acts of the Supervisory Board”: Hans-Walter Grünewälder Brahmsstrasse 27 42289 Wuppertal 0202 62 17 57 Siemens Aktiengesellschaft Corporate Finance Treasury Investor Relations (CF T 3) Wittelsbacherplatz 2 80333 Munich By telefax 089 636 32830 December 14, 2006 Counter-proposals to be voted on at the Annual Shareholders’ Meeting of Siemens AG on January 25, 2007 Ladies and gentlemen: At the Annual Shareholders’ Meeting of Siemens AG to be held on January 25, 2007, I will present the following counter-proposals and request the shareholders present at the meeting to support my proposals: With regard to Agenda Item 4 “To ratify the acts of the Managing Board” and Agenda Item 5 “To ratify the acts of the Supervisory Board” Be it resolved that the acts of the two Boards are not ratified. Supporting statement: The Compensation Report of the Supervisory Board as published in the Company’s Annual Report for the fiscal year from October 1, 2005 to September 30, 2006 reads as follows: “The remuneration of the members of the Supervisory Board was determined at the Annual Shareholders’ Meeting through shareholder approval of a proposal of the Managing and Supervisory Boards. -

EMERGING MARKETS: a Review of Business and Legal I Legal and Business of a MARKETS:Review EMERGING

EMERGING MARKETS: EMERGING MARKETS: Review A of Business and Legal I Emerging Markets : A Review of Business and Legal Issues VOLUME 1 | No 1 | APRIL 2009 ssues ssues Articles: The Siemens Corruption Outburst and the CEOs Who Combat It: A Corporate Governance Case Study Wojciech Rogowski Capital Market Supervision in Poland Andrzej Michór Cybercrime Challenges in the Framework of Information-Oriented Society Kseniya Yurtayeva Judicially Legal Forms Of Copyrights Property Protection (Exceptional) According To The Legislation Of Ukraine And EU Burlakov Sergіy Yurievych Report on insurance frauds in Poland (2009) Tomasz Gulla VOLUME1 No| 1 APRIL | 2009 Student notes: Institution of The Crown Witness In Poland On The Basis Of The Crown Witness Act of June 25 1997 Marta Flis Poland as a part of the Eurozone. Current Problems and Discussions Agata Kochman EMERGING MARKETS: A Review of Business and Legal Issues The purpose of the journal is to provide forum Emerging Markets : for international, interdisciplinary work on the A Review of Business and business and legal issues confronting emerging markets. Legal Issues The journal combines theoretical soundness and practical relevance. The articles guide policy makers while also advancing theoretical understanding. Editorial Board Advisory Board Richard Warner Edward Carter Editor In Chief Assistant Illinois Attorney General Professor of Law Supervisor of the Financial Crimes Prosecution Unit Faculty Director, Center for Law and Computers Adjunct Professor of Law Chicago-Kent College of Law Chicago-Kent -

European Semiconductor Industry Service (ESIS) Have Received This Data As a Loose-Leaf Service Section to Be Filed in Their Binder Set

DataQuest a company of MThe Dun & Bradstreet Corporation 7th April Dear Client, NEW FORMAT—MARKET SHARE DATA Dataquest's Eviropean Components Group completed preliminary 1988 European semiconductor market share estimates, which are enclosed herein. In the past, clients of the European Semiconductor Industry Service (ESIS) have received this data as a loose-leaf service section to be filed in their binder set. For your convenience we are now publishing this data in the form of a booklet. This booklet can still be filed as before, but offers much greater ease of use "on the move". We have also presented the market share estimates in a ranked format, rather than in alphabetical format, for your ease in comparing of vendors' market positions in different products and technologies. The previous year's rank is also shown for reference. Extra analysis is given, such as percentage market share for each vendor, for further ease in interpreting the estimates. We hope this helps make our estimates more usefuL to you. We would be interested in your comments regarding this new format. Yours sincerely %Y^^ • Bypon Harding Research Analyst European Components Group. 1290 Ridder Park Drive, San Jose, CA 95131-2398 (408) 437-8000 Telex 171973 Fax (408) 437-0292 European Semiconductor Industry Service Volume III—Companies E)ataQuest nn acompanyof IISI TheDun&Biadstreetcorporation 12^ Ridder Park Drive San Jose, California 95131-2398 (408) 437-8000 Telex: 171973 I^: (408) 437-0292 Sales/Service Offices: UNITED KINGDOM FRANCE EASTERN U.S. Dataquest Europe Limited Dataquest Europe SA Dataquest Boston Roussel House, Tour Gallieni 2 1740 Massachusetts Ave.