Gazprom in Figures 2006–2010

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Environmental Impact Assessment for the Baydaratskaya Bay Crossing of the Yamai - West Europe Gas Pipeline System

Proceedings of the Seventh (1997) International Offshore and Polar Engineering Conference Honolulu, USA, May 25-30, 1997 Copyright © 1997 by The International Society of Offshore and Polar Engineers ISBN 1-880653.-28-1 (Set); ISBN 1-880653-29-X (Vol. I) Environmental Impact Assessment for the Baydaratskaya Bay Crossing of the Yamai - West Europe Gas Pipeline System Alexander V. Beloshapkov, Vladimir B. Leschinsky and Alexander S. Tsvetsinsky EPS EcoSystem Moscow, Russia Konstantin A. Kashunin JSC Petergaz BV Moscow, Russia ABSTRACT BOVANENKOVSKOE GAS FIELD~ The Baydaratskaya Bay crossing in the Kara Sea is a part of the Yamal - West Europe gas system project, It is the fast ° experience of the large-diameter gas pipeline engineering in the Russian Arctic seas. The Environmental Impact Assessment of the construction for the fast two lines of the crossing is based on the results of six-year scientific program of Baydaratskaya r YAMAL Bay environmental studies. Laws, rules and regulations MARRE-SALE applicable to Environmental Impact Assessment in the Russian Federation are considered. The sources and types of possible impact during construction and operation stages are shown. % q4} KEY WORDS: Environment, impact, assessment, pipeline, underwater crossing, ecological examination. O q/. INTRODUCTION URAI \, B s ° The development of the Bovanenkovskoye gas field on the Z~ 20 40 km Yamal Peninsula in Northwest Siberia by JSC Gazprom, the Russian Gas company, requires a gas transport system to be PIPELINE i laid across the Baydaratskaya Bay in the Kara Sea. The .... PIPELINEUNDERWATER CROSSING i underwater crossing of main gas pipeline will connect the Yamal gas fields and onshore pipelines in the Yamal Peninsula with the Ural - West Europe pipeline system. -

View Full Article

SOCIAL DEVELOPMENT UDC 316.35(470.12) © Gulin K.A. © Dementieva I.N. Protest sentiments of the region’s population in crisis One form of social protest is the protest sentiments of the population, i.e., the expression of extreme dissatisfaction with their position in the current situation. In the present paper we make an attempt to trace the dynamics of protest potential in the region, draw a social portrait of the inhabitants of the region prone to protest behavior, identify the most important factors determining the formation of a latent protest activity, and identify the causes of the relative stability of protest potential in the region during the economic crisis. The study was conducted on the basis of statistics and results of regular monitoring held by ISEDT RAS in the Vologda region. Social conflict, protest behavior, protest potential, community, monitoring, social management, public opinion, crisis, socio-economic situation. Konstantin A. GULIN Ph.D. in History, Deputy Director of ISEDT RAS [email protected] Irina N. DEMENTIEVA Junior scientific associate of ISEDT RAS [email protected] In the contradictory trends in the socio- One form of conflict expressions is social economic development of territories and the protest. The concept of “social protest” in modern sociological literature covers a rather population’s material welfare, the issue of wide range of phenomena. In its most general socio-psychological climate in society, the form protest means “strong objection to escalation of internal contradictions and anything, a statement of disagreement with conflicts is being updated. anything, the reluctance of something” [1]. 46 3 (15) 2011 Economical and social changes: facts, trends, forecast SOCIAL DEVELOPMENT K.A. -

The Economics of the Nord Stream Pipeline System

The Economics of the Nord Stream Pipeline System Chi Kong Chyong, Pierre Noël and David M. Reiner September 2010 CWPE 1051 & EPRG 1026 The Economics of the Nord Stream Pipeline System EPRG Working Paper 1026 Cambridge Working Paper in Economics 1051 Chi Kong Chyong, Pierre Noёl and David M. Reiner Abstract We calculate the total cost of building Nord Stream and compare its levelised unit transportation cost with the existing options to transport Russian gas to western Europe. We find that the unit cost of shipping through Nord Stream is clearly lower than using the Ukrainian route and is only slightly above shipping through the Yamal-Europe pipeline. Using a large-scale gas simulation model we find a positive economic value for Nord Stream under various scenarios of demand for Russian gas in Europe. We disaggregate the value of Nord Stream into project economics (cost advantage), strategic value (impact on Ukraine’s transit fee) and security of supply value (insurance against disruption of the Ukrainian transit corridor). The economic fundamentals account for the bulk of Nord Stream’s positive value in all our scenarios. Keywords Nord Stream, Russia, Europe, Ukraine, Natural gas, Pipeline, Gazprom JEL Classification L95, H43, C63 Contact [email protected] Publication September 2010 EPRG WORKING PAPER Financial Support ESRC TSEC 3 www.eprg.group.cam.ac.uk The Economics of the Nord Stream Pipeline System1 Chi Kong Chyong* Electricity Policy Research Group (EPRG), Judge Business School, University of Cambridge (PhD Candidate) Pierre Noёl EPRG, Judge Business School, University of Cambridge David M. Reiner EPRG, Judge Business School, University of Cambridge 1. -

ACC JOURNAL 2020, Volume 26, Issue 2 DOI: 10.15240/Tul/004/2020-2-002

ACC JOURNAL 2020, Volume 26, Issue 2 DOI: 10.15240/tul/004/2020-2-002 THE DEVELOPMENT OF THE NONPROFIT SECTOR IN RUSSIAN REGIONS: MAIN CHALLENGES Anna Artamonova Vologda Research Center of the Russian Academy of Sciences, Department of Editorial-and-Publishing Activity and Science-Information Support, 56A, Gorky str., 160014, Vologda, Russia e-mail: [email protected] Abstract This article aims at identifying the main barriers hindering development of the nonprofit sector in Russian regions. The research is based on the conviction that the development of the nonprofit sector is crucial for the regional socio-economic system and depends upon civic engagement. The results of an analysis of available statistical data and a sociological survey conducted in one of the Russian regions reveal that the share of the Russians engaged in volunteer activities is low; over 80% of the population do not participate in public activities; less than 10% have definite knowledge of working nonprofit organizations. The study allowed identifying three groups of the main barriers and formulating some recommendations for their overcoming. Keywords Russia; Nonprofit sector; Nongovernmental organization; Civic participation; Civic engagement. Introduction Sustainable development of Russian regions requires the fullest use of their internal potential. As the public and private sectors cannot meet all demands concerning the provision of high living standards for all groups of the population, it is necessary for local authorities to find new opportunities for effective and mutually beneficial cooperation with other economic actors. In Russian regions, in this regard a new trend becomes evident government starts to pay more attention to organizations of the third (nonprofit) sector. -

Gazprom in Figures 2007–2011 Factbook Gazprom in Figures 2007–2011

REACHING NEW HORIZONS GAZPROM IN FIGURES 2007–2011 FACTBOOK GAZPROM IN FIGURES 2007–2011. FACTBOOK OAO GAZPROM TABLE OF CONTENTS Gazprom in Russian and global energy industry 3 Macroeconomic Data 4 Market Data 5 Reserves 7 Licenses 16 Production 18 Geological exploration, production drilling and production capacity in Russia 23 Geologic search, exploration and production abroad 26 Promising fields in Russia 41 Transportation 45 Gas transportation projects 47 Underground gas storage 51 Processing of hydrocarbons and production of refined products 55 Electric power and heat generation 59 Gas sales 60 Sales of crude oil, gas condensate and refined products 64 Sales of electricity and heat energy, gas transportation sales 66 Environmental measures, energy saving, research and development 68 Personnel 70 Convertion table 72 Glossary of basic terms and abbreviations 73 Preface Factbook “Gazprom in Figures 2007–2011” is an informational and statistical edition, prepared for OAO Gazprom annual General shareholders meeting 2012. The Factbook is prepared on the basis of corporate reports of OAO Gazprom, as well as on the basis of Russian and foreign sources of publicly disclosed information. In the present Factbook, the term OAO Gazprom refers to the head company of the Group, i.e. to Open Joint Stock Company Gazprom. The Gazprom Group, the Group or Gazprom imply OAO Gazprom and its subsidiaries taken as a whole. For the purposes of the Factbook, the list of subsidiaries was prepared on the basis used in the preparation of OAO Gazprom’s combined ac- counting (financial) statements in accordance with the requirements of the Russian legislation. Similarly, the terms Gazprom Neft Group and Gazprom Neft refer to OAO Gazprom Neft and its subsidiaries. -

Science of Economics

ACC JOURNAL XXVI 2/2020 Issue B Science of Economics TECHNICKÁ UNIVERZITA V LIBERCI HOCHSCHULE ZITTAU/GÖRLITZ INTERNATIONALES HOCHSCHULINSTITUT ZITTAU (TU DRESDEN) UNIWERSYTET EKONOMICZNY WE WROCŁAWIU WYDZIAŁ EKONOMII, ZARZĄDZANIA I TURYSTYKI W JELENIEJ GÓRZE Indexed in: Liberec – Zittau/Görlitz – Wrocław/Jelenia Góra © Technická univerzita v Liberci 2020 ISSN 1803-9782 (Print) ISSN 2571-0613 (Online) ACC JOURNAL je mezinárodní vědecký časopis, jehož vydavatelem je Technická univerzita v Liberci. Na jeho tvorbě se podílí čtyři vysoké školy sdružené v Akademickém koordinačním středisku v Euroregionu Nisa (ACC). Ročně vycházejí zpravidla tři čísla. ACC JOURNAL je periodikum publikující původní recenzované vědecké práce, vědecké studie, příspěvky ke konferencím a výzkumným projektům. První číslo obsahuje příspěvky zaměřené na oblast přírodních věd a techniky, druhé číslo je zaměřeno na oblast ekonomie, třetí číslo pojednává o tématech ze společenských věd. ACC JOURNAL má charakter recenzovaného časopisu. Jeho vydání navazuje na sborník „Vědecká pojednání“, který vycházel v letech 1995-2008. ACC JOURNAL is an international scientific journal. It is published by the Technical University of Liberec. Four universities united in the Academic Coordination Centre in the Euroregion Nisa participate in its production. There are usually three issues of the journal annually. ACC JOURNAL is a periodical publishing original reviewed scientific papers, scientific studies, papers presented at conferences, and findings of research projects. The first issue focuses on natural sciences and technology, the second issue deals with the science of economics, and the third issue contains findings from the area of social sciences. ACC JOURNAL is a reviewed one. It is building upon the tradition of the “Scientific Treatises” published between 1995 and 2008. -

Transporting Russian Natural Gas to Western Europe – from Source to Market

FACT SHEET December 2013 Transporting Russian Natural Gas to Western Europe – From Source to Market Overview of the pipelines connecting to Nord Stream Owner of the pipeline Operator 1 Bovanenkovo-Ukhta pipeline 2 SRTO-Torzhok pipeline 3 Brotherhood pipeline Gazprom Gazprom 4 Pochinki-Gryazovets pipeline 5 Gryazovets-Vyborg pipeline 6 Nord Stream Pipeline Nord Stream AG shareholders: Nord Stream AG OAO Gazprom (51%), Wintershall Holding GmbH (15.5%), E.ON SE (15.5%), N.V. Nederlandse Gasunie (9%), GDF SUEZ (9%) OPAL Gastransport W & G Beteiligungs-GmbH & Co. KG (80%), GmbH & Co. KG, 7 OPAL pipeline Lubmin-Brandov Gastransport GmbH (20%) Lubmin-Brandov Gastransport GmbH NEL Gastransport GmbH, NEL Gastransport GmbH (51%), Gasunie Gasunie Ostseeanbindungsleitung GmbH 8 NEL pipeline Ostseeanbindun (25%), gsleitung GmbH, Fluxys Deutschland GmbH (24%) Fluxys Deutschland GmbH 1 Industriestrasse 18 Moscow Branch 6304 Zug, Switzerland ul. Znamenka 7, bld. 3 Tel. +41 (0) 41 766 91 91 119019 Moscow, Russia Fax +41 (0) 41 766 91 92 Tel. +7 (0) 495 229 65 85 www.nord-stream.com Fax +7 (0) 495 229 65 80 Gas production sources Russia is one of the countries with the largest gas reserves in the world. With 32,900 bcm, Russia has 17.6% of the world's currently known natural gas reserves.1 This is equal to around 56 years of Russian gas production at 2012 levels or around 74 years of EU gas demand at 2012 levels. The International Energy Agency (IEA) estimates the ultimately recoverable gas resources2 in Russia to be three times as high – 127,000 bcm, of which 21,000 bcm have already been produced. -

Downloaded Daily to the Geodetic Survey Division in Ottawa, Where They Are Reviewed for Quality Control, Archived, and Uploaded to the International GPS Service

Arctic Coastal Dynamics Report of the 4th International Workshop VNIIOkeangeologia, St. Petersburg (Russia), 10-13 November 2003 Edited by Volker Rachold and Georgy Cherkashov Volker Rachold, Alfred Wegener Institute, Research Unit Potsdam, Telegrafenberg A43, 14473 Potsdam, Germany Georgy Cherkashov, VNIIOkeangeologia (Institute for Geology and Mineral Resources of the Ocean), Angliysky prospect 1, 190121 St. Petersburg, Russia Preface Arctic Coastal Dynamics (ACD) is a joint project of the International Arctic Sciences Committee (IASC) and the International Permafrost Association (IPA) and a regional project of IGBP-LOICZ (International Geosphere-Biosphere Programme – Land- Ocean Interactions in the Coastal Zone). Its overall objective is to improve our understanding of circum-Arctic coastal dynamics as a function of environmental forcing, coastal geology and cryology and morphodynamic behavior. The fourth IASC-sponsored ACD workshop was held in St. Petersburg, Russia, on November 10-13, 2003. Participants from Canada (7), Germany (7), Great Britain (2), the Netherlands (1), Norway (1), Russia (32), Ukraine (1) and the United States (8) attended. During the first part of the workshop, 63 papers dealing with regional and/or circum-Arctic coastal dynamics were presented. Based on the material presented, five thematic working groups were identified: (1) GIS working group to develop of a circum-Arctic coastal GIS system, (2) coastal permafrost working group to discuss processes involved in the transition of onshore to offshore permafrost, (3) biogeochemistry working group with the focus on transport and fate of eroded material (4) biodiversity working group to initiate planning of an Arctic Coastal Biodiversity research agenda, (5) environmental data working group to discuss coastal dynamics as a function of environmental forcing. -

Landfall: the Starting Point of the Pipelines

from the Russian gas transportation system transportation gas Russian the from into the Nord Stream offshore pipelines pipelines offshore Stream Nord the into In Portovaya Bay, near Vyborg, gas is fed fed is gas Vyborg, near Bay, Portovaya In VYBORG – the Russian Coast Russian the Safe Operations Landfall: A TOWN AT A Connecting Hub Begins on on Begins THE CROSSROADS Gas Transport Transport Gas Start at The Starting Point OF CULTURES on the Russian Coast Portovaya Bay Vyborg is a Russian city with a 700-year history that still bears The Landfall facility through up to date diagnostics, adjusted in terms of pressure of the Pipelines the hallmarks of old Europe. Its maintenance and repair tech- and volume as well as temper- The initial section of the Nord Stream Pipelines on at Portovaya Bay in the Russian shore is vitally important to the safe narrow winding paved streets niques. The UGSS of Russia is ature, before being transported with low buildings and summer Russia is the logistical controlled round-the-clock by further. The OPAL pipeline links operation of the entire gas transport system. In cafés as well as its medieval link between the Uni- Gazprom’s Central Operations Nord Stream with the existing order to transport gas over a distance of 1,224 kilo- monuments create a special fied Gas Transport Sys- and Dispatching Department, European natural gas transport metres, a powerful compressor station is needed cosy atmosphere the year tem of Russia and the which ensures uninterrupted systems. It is capable of trans- to build sufficient pressure of nearly 220 bar. -

MARKET-ORIENTED FARM SUPPORT ACTIVITY (MOFSA) VOLOGDA OBLAST FINAL REPORT Contract No OP/ENI/NIS 95 P 01 Subrmtted to USAID/Russ

MARKET-ORIENTED FARM SUPPORT ACTIVITY (MOFSA) VOLOGDA OBLAST FINAL REPORT Contract No OP/ENI/NIS 95 P 01 Subrmtted to USAID/Russia Subrmtted by Chemomcs International Inc December 1997 TABLE OF CONTENTS Page EXECUTIVE SUMMARY 1 SECTION I INTRODUCTION I- 1 Conditions m the Agricultural Economy Contract Specifications Phase I Diagnostx Analysis and Work Plan Development Creatmg a Results-Oriented Work Plan Pllot Raion Selection F Fmdmgs of the Diagnostic Analysis and Thelr Application to the Work Plan G Tralnrng Model H Phase I1 IrnplementaDon I Phase I11 Roll-out SECTION I1 PROJECT COMPONENTS 11- 1 A Social Services B Agribusmess C Agricultural Credit SECTION I11 LESSONS LEARNED 111- 1 Exhlblt I- 1 MOFSA Results Framework - Social Services Component 1-6 Exhlblt 1-2 MOFSA Results Framework - Agribusmess Component 1-7 Exhiblt 1-3 MOFSA Results Framework - Agricultural Credit & Flnance Component 1-8 Table 11-1 Results of Social Services Component Table 11-2a Distribution of Techmcal Assistance to Reorgamzed Farms, Non-Reorgamed Farms, and Agribusmess Frrms Table 11-2b Agribusmess Strengthemg Results Table 11-3 Results of Agricultural Credit Component EXECUTIVE SUMMARY In March 1996, Chemomcs International Inc signed a contract with the U S Agency for International Development (USAID) to provide techcal services to carry out the Market- Oriented Farm Support Actlvity (MOFSA) project m Vologda, Russia Under the direction of USAIDIRussia and m cooperalon with the Government of the Russian Federation, Chemomcs fulfilled the terms of the contract -

Coastal Dynamics of the Pechora and Kara Seas

DOI: 10.15356/2071-9388_03v09_2016_04 Stanislav A. Ogorodov1*, Alisa V. Baranskaya2, Nataliya G. Belova3, Anatoly M. Kamalov4, Dmitry E. Kuznetsov5, Paul P. Overduin6, Natalya N. Shabanova7, Aleksey P. Vergun8 1 Faculty of Geography, Lomonosov Moscow State University, Leninskie Gory 1, 119991 Moscow, Russia, Tel: + 7-495-939 25 26 Fax: + 7-495-932 88 36; e-mail: [email protected] * Corresponding author ENVIRONMENT 2 Faculty of Geography, Lomonosov Moscow State University, Leninskie Gory 1, 119991 Moscow, Russia, Tel: + 7-495-939 25 26 Fax: + 7-495-932 88 36; 53 e-mail: [email protected] 3 Faculty of Geography, Lomonosov Moscow State University, Leninskie Gory 1, 119991 Moscow, Russia, Tel: + 7-495-939 25 26 Fax: + 7-495-932 88 36; e-mail: [email protected] 4 Faculty of Geography, Lomonosov Moscow State University, Leninskie Gory 1, 119991 Moscow, Russia, Tel: + 7-495-939 25 26 Fax: + 7-495-932 88 36; e-mail: [email protected] 5 Faculty of Geography, Lomonosov Moscow State University, Leninskie Gory 1, 119991 Moscow, Russia, Tel: + 7-495-939 25 26 Fax: + 7-495-932 88 36; e-mail: [email protected] 6 Department of Geosciences, division of periglacial research, Alfred Wegener Institute Telegrafenberg A43, D-14473 Potsdam, Germany; e-mail: [email protected] 7 Faculty of Geography, Lomonosov Moscow State University, Leninskie Gory 1, 119991 Moscow, Russia, Tel: + 7-495-939 25 26 Fax: + 7-495-932 88 36; e-mail: [email protected] 8 Faculty of Geography, Lomonosov Moscow State University, Leninskie Gory 1, 119991 Moscow, Russia, Tel: + 7-495-939 25 26 Fax: + 7-495-932 88 36; Zubov State Oceanographic Institute, Kropotkinskiy pereulok, 6, 119034, Moscow, Russia, e-mail: [email protected] COASTAL DYNAMICS OF THE PECHORA AND KARA SEAS UNDER CHANGING CLIMATIC CONDITIONS AND HUMAN DISTURBANCES ABSTRACT. -

Atlas of High Conservation Value Areas, and Analysis of Gaps and Representativeness of the Protected Area Network in Northwest R

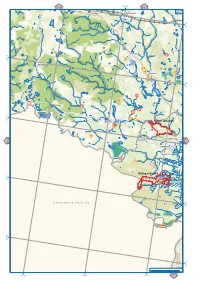

34°40' 216 217 Chudtsy Efimovsky 237 59°30' 59°20' Anisimovo Loshchinka River Somino Tushemelka River 59°20' Chagoda River Golovkovo Ostnitsy Spirovo 59°10' Klimovo Padun zakaznik Smordomsky 238 Puchkino 236 Ushakovo Ignashino Rattsa zakaznik 59°0' Rattsa River N O V G O R O D R E G I O N 59°0' 58°50' °50' 58 0369 км 34°20' 34°40' 35°0' 251 35°0' 35°20' 217 218 Glubotskoye Belaya Velga 238 protected mire protected mire Podgornoye Zaborye 59°30' Duplishche protected mire Smorodinka Volkhovo zakaznik protected mire Lid River °30' 59 Klopinino Mountain Stone protected mire (Kamennaya Gora) nature monument 59°20' BABAEVO Turgosh Vnina River °20' 59 Chadogoshchensky zakaznik Seredka 239 Pervomaisky 237 Planned nature monument Chagoda CHAGODA River and Pes River shores Gorkovvskoye protected mire Klavdinsky zakaznik SAZONOVO 59°10' Vnina Zalozno Staroye Ogarevo Chagodoshcha River Bortnikovo Kabozha Pustyn 59°0' Lake Chaikino nature monument Izbouishchi Zubovo Privorot Mishino °0' Pokrovskoye 59 Dolotskoye Kishkino Makhovo Novaya Planned nature monument Remenevo Kobozha / Anishino Chernoozersky Babushkino Malakhovskoye protected mire Kobozha River Shadrino Kotovo protected Chikusovo Kobozha mire zakazhik 58°50' Malakhovskoye / Kobozha 0369 protected mire км 35°20' 251 35°40' 36°0' 252 36°0' 36°20' 36°40' 218 219 239 Duplishche protected mire Kharinsky Lake Bolshoe-Volkovo zakaznik nature monument Planned nature monument Linden Alley 59°30' Pine forest Sudsky, °30' nature monument 59 Klyuchi zakaznik BABAEVO абаево Great Mosses Maza River 59°20'