Athabasca Oil Corporation Takes Further Actions in Response to The

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

U.S.-Canada Cross- Border Petroleum Trade

U.S.-Canada Cross- Border Petroleum Trade: An Assessment of Energy Security and Economic Benefits March 2021 Submitted to: American Petroleum Institute 200 Massachusetts Ave NW Suite 1100, Washington, DC 20001 Submitted by: Kevin DeCorla-Souza ICF Resources L.L.C. 9300 Lee Hwy Fairfax, VA 22031 U.S.-Canada Cross-Border Petroleum Trade: An Assessment of Energy Security and Economic Benefits This report was commissioned by the American Petroleum Institute (API) 2 U.S.-Canada Cross-Border Petroleum Trade: An Assessment of Energy Security and Economic Benefits Table of Contents I. Executive Summary ...................................................................................................... 4 II. Introduction ................................................................................................................... 6 III. Overview of U.S.-Canada Petroleum Trade ................................................................. 7 U.S.-Canada Petroleum Trade Volumes Have Surged ........................................................... 7 Petroleum Is a Major Component of Total U.S.-Canada Bilateral Trade ................................. 8 IV. North American Oil Production and Refining Markets Integration ...........................10 U.S.-Canada Oil Trade Reduces North American Dependence on Overseas Crude Oil Imports ..................................................................................................................................10 Cross-Border Pipelines Facilitate U.S.-Canada Oil Market Integration...................................14 -

Canadian Crude Oil and Natural Gas Production and Supply Costs Outlook (2016 – 2036)

Study No. 159 September 2016 CANADIAN CANADIAN CRUDE OIL AND NATURAL GAS ENERGY PRODUCTION AND SUPPLY COSTS OUTLOOK RESEARCH INSTITUTE (2016 – 2036) Canadian Energy Research Institute | Relevant • Independent • Objective CANADIAN CRUDE OIL AND NATURAL GAS PRODUCTION AND SUPPLY COSTS OUTLOOK (2016 – 2036) Canadian Crude Oil and Natural Gas Production and Supply Costs Outlook (2016 – 2036) Authors: Laura Johnson Paul Kralovic* Andrei Romaniuk ISBN 1-927037-43-0 Copyright © Canadian Energy Research Institute, 2016 Sections of this study may be reproduced in magazines and newspapers with acknowledgement to the Canadian Energy Research Institute September 2016 Printed in Canada Front photo courtesy of istockphoto.com Acknowledgements: The authors of this report would like to extend their thanks and sincere gratitude to all CERI staff involved in the production and editing of the material, including but not limited to Allan Fogwill, Dinara Millington and Megan Murphy. *Paul Kralovic is Director, Frontline Economics Inc. ABOUT THE CANADIAN ENERGY RESEARCH INSTITUTE The Canadian Energy Research Institute is an independent, not-for-profit research establishment created through a partnership of industry, academia, and government in 1975. Our mission is to provide relevant, independent, objective economic research in energy and environmental issues to benefit business, government, academia and the public. We strive to build bridges between scholarship and policy, combining the insights of scientific research, economic analysis, and practical experience. For more information about CERI, visit www.ceri.ca CANADIAN ENERGY RESEARCH INSTITUTE 150, 3512 – 33 Street NW Calgary, Alberta T2L 2A6 Email: [email protected] Phone: 403-282-1231 Canadian Crude Oil and Natural Gas Production and Supply Costs Outlook iii (2016 – 2036) Table of Contents LIST OF FIGURES ............................................................................................................ -

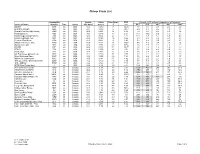

Chicap-Crude-List-7-15-2020.Pdf

Chicap Crude List Commodity Gravity Sulfur Pour Point RVP Viscosity (cST) at listed temperature in Fahrenheit Crude Oil Name Identifier Type Origin °API @60°F mass% °F psi 40°F 50°F 68°F 86°F 104°F Bakken BAK sw USA 42.5 0.080 -71 10.21 4.1 3.6 2.9 2.5 2.0 Grand Mesa Light GML sw USA 48.7 0.060 5 10.67 2.9 2.7 2.2 1.9 1.6 Grand Mesa Sweet@Cushing GMS sw USA 40.2 0.206 32 8.26 7.2 6.0 4.6 3.6 3.0 Mississippi Lime MSL sw USA 34.3 0.519 -11 6.27 16.1 13.2 9.6 7.2 6 Niobrara @Cushing Pony PL NIB sw USA 37.5 0.402 27 8.11 11.1 8.8 6.7 5.1 4.0 Niobrara @Saddlehorn SSC sw USA 43.2 0.144 -38 9.55 5.3 4.5 3.5 2.8 2.3 Permian Sour Blend PRM sw USA 41.9 0.281 -6 8.03 5.1 4.4 3.5 2.8 2.3 Saddlehorn Intermediate SHM sw USA 42.5 0.137 21 10.67 5.6 4.9 3.8 3.1 2.6 Saddlehorn Light SHL sw USA 48.4 0.058 -33 10.54 2.8 2.5 2.1 1.8 1.6 SCOOP SCP sw USA 54.4 0.015 -71 10.77 2.0 1.8 1.6 1.4 1.2 STACK STK sw USA 41.9 0.079 -22 9.71 7.1 6.4 4.9 4.0 3.2 Stack Light STL sw USA 47.4 0.022 5 8.17 3.6 3.3 2.7 2.3 2.0 US High Sweet @Clearbrook UHC sw USA 42.1 0.120 -71 9.78 4.7 4.1 3.2 2.6 2.2 West Oklahoma Sweet WOS sw USA 49.0 0.025 -38 7.84 3.1 2.8 2.3 1.9 1.7 Whitecliffs Condensate WCC sw USA 48.5 0.141 -71 8.82 2.5 2.5 2.1 1.9 1.6 WTI @Cushing - Domestic Sweet DSW sw USA 41.2 0.400 -38 7.69 6.7 5.7 4.4 3.5 2.8 WTI - Midland WTM sw USA 43.6 0.163 -11 7.13 5.3 4.5 3.4 2.7 2.3 WTS (West Texas Sour) C so USA 32.9 1.64 -23 5.67 18.0 14.3 9.9 7.2 5.5 Access Western Blend AWB H Canada 21.6 3.79 -46 6.67 672 457 248 145 91.0 Albian Heavy Synthetic AHS H Canada 20.0 -

2018 ANNUAL INFORMATION FORM Suncor Energy Inc

11FEB201917213713 ANNUAL INFORMATION FORM Dated February 28, 2019 Suncor Energy Inc. 19FEB201920364295 ANNUAL INFORMATION FORM DATED FEBRUARY 28, 2019 TABLE OF CONTENTS 1 Advisories 2 Glossary of Terms and Abbreviations 2 Common Industry Terms 4 Common Abbreviations 4 Conversion Table 5 Corporate Structure 5 Name, Address and Incorporation 5 Intercorporate Relationships 6 General Development of the Business 6 Overview 7 Three-Year History 10 Narrative Description of Suncor’s Businesses 10 Oil Sands 15 Exploration and Production 19 Refining and Marketing 23 Other Suncor Businesses 24 Suncor Employees 24 Ethics, Social and Environmental Policies 26 Statement of Reserves Data and Other Oil and Gas Information 28 Oil and Gas Reserves Tables and Notes 33 Future Net Revenues Tables and Notes 39 Additional Information Relating to Reserves Data 51 Industry Conditions 58 Risk Factors 68 Dividends 69 Description of Capital Structure 71 Market for Securities 72 Directors and Executive Officers 78 Audit Committee Information 80 Legal Proceedings and Regulatory Actions 80 Interests of Management and Others in Material Transactions 80 Transfer Agent and Registrar 80 Material Contracts 80 Interests of Experts 81 Disclosure Pursuant to the Requirements of the NYSE 81 Additional Information 82 Advisory – Forward-Looking Information and Non-GAAP Financial Measures Schedules A-1 SCHEDULE ‘‘A’’ – AUDIT COMMITTEE MANDATE B-1 SCHEDULE ‘‘B’’ – SUNCOR ENERGY INC. POLICY AND PROCEDURES FOR PRE-APPROVAL OF AUDIT AND NON-AUDIT SERVICES C-1 SCHEDULE ‘‘C’’ – FORM 51-101F2 REPORT ON RESERVES DATA BY INDEPENDENT QUALIFIED RESERVES EVALUATOR OR AUDITOR D-1 SCHEDULE ‘‘D’’ – FORM 51-101F2 REPORT ON RESERVES DATA BY INDEPENDENT QUALIFIED RESERVES EVALUATOR OR AUDITOR E-1 SCHEDULE ‘‘E’’ – FORM 51-101F3 REPORT OF MANAGEMENT AND DIRECTORS ON RESERVES DATA AND OTHER INFORMATION ADVISORIES In this Annual Information Form (AIF), references to ‘‘Suncor’’ each year in the two-year period ended December 31, 2018. -

Crudemonitor.Ca Western Canadian Select (WCS)

CrudeMonitor.ca - Canadian Crude Quality Monitoring Program Page 1 of 2 crudemonitor.ca Home Monthly Reports Tools Library Industry Resources Contact Us Western Canadian Select (WCS) What is Western Canadian Select crude? Western Canadian Select is a Hardisty based blend Canada of conventional and oilsands production managed by Liberia Canadian Natural Resources, Cenovus Energy, Manilol Suncor Energy, and Talisman Energy. Argus has sti. launched daily volume-weighted average price ibia Saskalchewan Edmon-i t indexes for Western Canadian Select (WCS) and will publish this index in the daily Argus Crude and Argus Americas Crude publications. Calgary Winnipt Map data ©2013 Google Most Recent Sample Comments: Light Ends Summary Last 6 Samples WCS-807, Sep 17, 2013 Most Property 6 Month 1 Year 5 Year Recent The September 17th sample of Western Canadian ( vol% ) Average Average Average Select contained slightly elevated density, Sample sulphur, MCR, BTEX and C7 x C10 concentrations, C3- 0.04 0.05 0.06 0.06 while butanes and pentanes were slightly Butanes 1.04 1.68 1.82 2.02 decreased. Simulated distillation results indicate Pentanes 3.56 4.76 4.87 4.44 an increase in the residue fraction. Hexanes 3.86 4.10 4.21 3.94 Monthly Reports Heptanes 3.70 3.00 2.96 2.82 Octanes 3.08 2.27 2.14 2.12 Basic Analysis Nonanes 2.36 1.72 1.57 1.50 Decanes 1.27 0.89 0.82 0.72 Most 6 Month 1 Year 5 Year Property Recent Average Average Average Sample BTEX H Density (kg/m3) 934.5 929.6 928.3 929.2 Most 6 Gravity (oAPI) 19.8 20.6 20.8 20.7 Property 1 Year 5 Year Recent Month 0 (vol%) Average Average Sulphur ( wt o) 3.71 3.53 3.51 3.52 Sample Average MCR (wt%) 10.20 10.02 9.84 9.71 Benzene 0.18 0.17 0.18 0.16 Sediment (ppmw) 305 302 296 329 Toluene 0.41 0.33 0.32 0.30 TAN (mgKOH/g) 0.94 0.91 0.93 0.94 • Ethyl Benzene 0.09 0.07 0.06 0.06 Salt (ptb) 28.0 30.9 46.4 Xyl enes 0.45 0.33 0.30 0.29 Nickel (mg/L) 62.7 60.7 59.0 Vanadium (mg/L) 147.0 143.7 141.8 Olefins (wt%) ND ND Distillation *ND indicates a tested value below the instrument threshold. -

WCS Houston: a New Price Signal for Heavy Crude at the US Gulf Coast

Argus White Paper: WCS Houston: A new price signal for heavy crude at the US Gulf coast Growing Canadian heavy crude output and new pipeline Array of Argus US Gulf coast markers connections to the US Gulf coast have created the first active pipeline spot market for heavy sour crude at the US Gulf 0 coast. Canadian heavy Western Canadian Select (WCS) now LLS trades regularly on a spot basis at multiple terminals in the 1 Houston area. The US Gulf market has searched for years WTI for a representative and market-based price benchmark to Houston Mars reflect the value of heavy crude at the coast. But robust and 2 ASCI transparent spot markets never developed around inbound cargoes of Mexican, Venezuelan, Colombian and other heavy sulphur percent sours. Now WCS Houston is ready to fill that gap. 3 Maya The better benchmark WCS For years, the small volumes of Canadian heavy crude arriving 4 at the US Gulf coast traded with reference to medium sour 15 20 25 30 35 40 45 Mars, ASCI, or to Mexico’s heavy Maya. In this way, the API gravity industry attempted to relate the price of heavy Canadian crude to prevailing market value. But Mars is much lighter and Maya and WCS Houston: Discounts to LLS, $/bl lower in sulphur content than Canadian heavy crude, making it an imperfect match (see graph at top right). -4 Maya, though similar in quality to WCS, is not a market but a -7 price set by a government formula based 40pc on the price of West Texas Sour (WTS) crude at Midland, Texas, hundreds of -10 miles from the Gulf coast. -

2020-03-24 the Oilsands in a Carbon-Constrained Canada FINAL

The oilsands in a carbon- constrained Canada The collision course between overall emissions and national climate commitments Benjamin Israel Jan Gorski, Nina Lothian, Chris Severson-Baker, Nikki Way February 2020 updated March 2020 Photo: Kris Krüg, CC BY-NC-ND 2.0 The oilsands in a carbon- constrained Canada The collision course between overall emissions and national climate commitments Benjamin Israel Jan Gorski, Nina Lothian, Chris Severson-Baker and Nikki Way February 2020 updated March 2020 Production management: Michelle Bartleman Editors: Michelle Bartleman, Roberta Franchuk, ISBN 1-897390-44-0 Sarah MacWhirter Contributors: Nichole Dusyk, Simon Dyer, The Pembina Institute Duncan Kenyon, Morrigan Simpson-Marran 219 19 Street NW Calgary, AB ©2020 The Pembina Institute Canada T2N 2H9 All rights reserved. Permission is granted to Phone: 403-269-3344 reproduce all or part of this publication for non- commercial purposes, as long as you cite the Additional copies of this publication may be source. downloaded from the Pembina Institute website, www.pembina.org. Recommended citation: Israel, Benjamin. The oilsands in a carbon-constrained Canada. The Pembina Institute, 2020. Pembina Institute The oilsands in a carbon-constrained Canada | ii About the Pembina Institute The Pembina Institute is a national non-partisan think tank that advocates for strong, effective policies to support Canada’s clean energy transition. We employ multi-faceted and highly collaborative approaches to change. Producing credible, evidence-based research and analysis, we consult directly with organizations to design and implement clean energy solutions, and convene diverse sets of stakeholders to identify and move toward common solutions. ————————————————— pembina.org ————————————————— twitter.com/pembina facebook.com/pembina.institute Donate to the Pembina Institute Together, we can lead Canada's transition to clean energy. -

The Canadian Oil Transport Conundrum

STUDIES IN ENERGY TRANSPORTATION September 2013 The Canadian Oil Transport Conundrum by Gerry Angevine, with an Introduction by Kenneth P. Green Contents An Overview of Oil Transportation in Canada By Kenneth P. Green Introduction / 1 Overview / 3 Conclusion / 14 References / 15 About the author / 19 Challenges Posed by Pipeline Infrastructure Bottlenecks By Gerry Angevine Introduction / 20 Transportation bottlenecks faced by Canada’s oil producers / 21 Conclusion / 33 References / 34 About the author / 37 Publishing information / 38 Supporting the Fraser Institute / 40 Purpose, funding, & independence / 41 About the Fraser Institute / 42 Editorial board / 43 An Overview of Oil Transportation in Canada By Kenneth P. Green Introduction Recent events have elevated the importance of how we transport energy—spe- cifically oil—to high profile status. The long-stalled approval of the Keystone XL pipeline is probably the highest profile political event that has caused oil trans- port to surge to the fore in energy policy discussions today, but more prosaic economic issues also have played a role. Most importantly, because of limita- tions in the ability to ship oil to coastal refiners and overseas markets, Canada is forced to sell crude oil into the US market at a considerable discount relative to world oil price markers such as Brent.1 This is costing Canadians at least $15 billion each year (Beltrame, 2003, Apr. 13). Among other things, this shortfall has been blamed (wrongly, we believe) for problems with the balance sheet of Alberta’s government, bringing the issue to still greater prominence (Milke, 2013). Economic research has shown that eliminating bottlenecks (whether physical or political) can reduce oil price discounting similar to that which Canada currently endures (Bausell Jr. -

The Cumulative Impact of Harmful Policies – the Case of Oil and Gas in Alberta

RESEARCH PAPERS MAY 2019 THE CUMULATIVE IMPACT OF HARMFUL POLICIES THE CASE OF OIL AND GAS IN ALBERTA By Jean Michaud and Germain Belzile The Montreal Economic Institute is an independent, non-partisan, not-for-profit research and educational organization. Through its publications, media appearances and conferences, the MEI stimu- lates debate on public policies in Quebec and across Canada by pro- posing wealth-creating reforms based on market mechanisms. It does 910 Peel Street, Suite 600 not accept any government funding. Montreal (Quebec) H3C 2H8 Canada The opinions expressed in this study do not necessarily represent those of the Montreal Economic Institute or of the members of its Phone: 514-273-0969 board of directors. The publication of this study in no way implies Fax: 514-273-2581 that the Montreal Economic Institute or the members of its board of Website: www.iedm.org directors are in favour of or oppose the passage of any bill. The MEI’s members and donors support its overall research program. Among its members and donors are companies active in the oil and gas sector, whose financial contribution corresponds to around 5.73% of the MEI’s total budget. These companies had no input into the process of preparing the final text of this Research Paper, nor any control over its public dissemination. Reproduction is authorized for non-commercial educational purposes provided the source is mentioned. ©2019 Montreal Economic Institute ISBN 978-2-922687-93-4 Legal deposit: 2nd quarter 2019 Bibliothèque et Archives nationales du Québec -

|File OF-Tolls-Group1-E101-2019-02 02 CANADA ENERGY REGULATOR in the MATTER of the Canadian Energy Regulator Act, SC 2019, C

|File OF-Tolls-Group1-E101-2019-02 02 CANADA ENERGY REGULATOR IN THE MATTER OF the Canadian Energy Regulator Act, SC 2019, c 28, s 10 and the regulations made thereunder; AND IN THE MATTER OF an application by Enbridge Pipelines Inc. for approval of the Transportation Service and Toll Methodology for the Canadian Mainline; AND IN THE MATTER OF Hearing Order RH-001-2020. Written Argument of the Canadian Shippers Group July 7, 2021 To: Mr. Jean-Denis Charlebois Secretary of the Commission Suite 210, 517 10 Ave SW Calgary, AB T2R 0A8 LEGAL_CAL:15526888.10 TABLE OF CONTENTS I. INTRODUCTION ................................................................................................. 4 II. EXECUTIVE SUMMARY ..................................................................................... 5 III. BACKGROUND ................................................................................................. 11 IV. LEGISLATIVE FRAMEWORK ........................................................................... 12 Canadian Public Interest ......................................................................... 14 Just and Reasonable Tolls ...................................................................... 16 No Unjust Discrimination ......................................................................... 17 Burden of Proof ....................................................................................... 18 V. CONSULTATION AND NEGOTIATIONS WERE NEITHER FAIR, OPEN NOR TRANSPARENT, AND THE DEGREE OF OPPOSITION IS UNPRECEDENTED ......................................................................................... -

Teck Fort Hills Blend Market Strategy

Energy Business Unit & Marketing March 31, 2015 Ray Reipas, Senior Vice President, Energy Energy Business Unit & Marketing Forward Looking Information Both these slides and the accompanying oral presentation contain certain forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of the Securities Act (Ontario) and comparable legislation in other provinces. Forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variation of such words and phrases or state that certain actions, events or results “may”, “could”, “should”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Teck to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These forward-looking statements include statements relating to management’s expectations regarding future oil prices, that PFT bitumen produced at Fort Hills is expected to be equivalent to WCS, other statements regarding our Fort Hills project, including mine life of Fort Hills, projected revenues and economics, cash flow potential, future production targets, our market access options and projected railway and pipeline capacity. These forward-looking statements involve numerous assumptions, risks and uncertainties and actual results may vary materially. Management’s expectations of mine life are based on the current planned production rate and assume that all resources described in this presentation are developed. -

Chicap Pipeline Approved Crude List (Updated 8-1-16)

ChiCap Pipeline Approved Crudes List Viscosity, SUS Symbol Type Origin Gravity Sulfur 20C (68F) 30C (86F) 40C (104F) 50C (122F) Domestic Bakken BAK sw ND 44.7 0.12 34.0 32.6 32.0 Bonito Sour BSR so LA 33.6 1.05 65.2 43 Eugene Island EI so LA 33.2 1.21 63.1 42.7 HLS HLS sw LA 32.8 0.38 63.1 52.6 45.6 41.1 Illinois Basin ILB sw IL/MO 36.3 0.20 54.0 LLS LLS sw LA 37.1 0.35 46.8 42.9 39.5 36.6 Mars MAR so GOM 28.8 1.80 126 90.3 70 57.5 Memphis Light Sweet MLS sw USA 34.8 0.39 49 Mississippi Sweet LMS sw MS 40.3 0.42 41.7 38.5 36.3 34.3 North Dakota Sweet UHC sw ND 38.0 0.41 42.6 39.1 36.9 35.3 North Dakota Light NDL sw ND 40.6 0.23 38.6 North Dakota Bakken Sweet NSW sw ND 41.5 0.21 38.2 35.6 Platte Light Sweet PSW sw ND/MT 42.6 0.39 80.5 42.4 Port Hudson LPS sw LA 43.0 0.05 36.2 35.0 34.6 Poseidon POS so GOM 29.1 1.94 120 85.7 66.7 55.4 South Louisiana Sweet SLS sw LA 32.5 0.40 71.9 57.0 48.8 43.3 Thunder Horse THD so GOM 33.8 0.68 70.7 57.0 49.1 44.0 West Hackberry Sweet WHS sw SPR 36.7 0.33 47.9 42.2 38.4 35.80 WTI (West Texas Sweet) B sw Texas/NM 39.8 0.42 41.0 38.2 36.0 WTS (West Texas Sour) C so Texas/NM 32.0 1.88 54.3 46.8 41.8 Wyoming Sweet (Montana Mix) WSC sw WY 31.3 0.49 103 77.3 62.4 53.4 Enbridge Pools The following Enbridge pool segregations** are approved for movement on Chicap Pipeline HSC - Light Synthetic HSC sw Canada 34.6 0.15 47 PSY - Light Synthetic PSY sw Canada 34.2 0.15 42 SYN - Light Synthetic SYN sw Canada 32.8 0.21 45 LSB - Sour LSB so Canada 38.3 1.17 40 MSB - Sour MSB so Canada 32.8 1.71 77 CHV - Conventional