Petroleum Illuminating the Markets Argus White Paper: WCS at Cushing: the Emerging US Trading Center for Canada's Heavy Sour C

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

WTI Crude Oil West Texas Intermediate

WTI Crude Oil West Texas Intermediate Alexander Filitz Minh Khoa Nguyen Outline • Crude Oil • Value Chain • Politics • Market • Demand • Facts & Figures • Discussion Crude Oil • Flammable liquid consisting of a complex mixture of hydrocarbons of various molecular weights and other liquid organic compounds • Is recovered mostly through oil drilling • In its strictest sense, petroleum includes only crude oil, but in common usage it includes all liquid, gaseous, and solid hydrocarbons. • An oil well produces predominantly crude oil, with some natural gas dissolved in it Classification • By the geographic location it is produced in • Its API gravity (an oil industry measure of density) • Its sulfur content • Some of the common reference crudes are: • West Texas Intermediate (WTI), a very high-quality, sweet, light oil delivered at Cushing, Oklahoma for North American oil. • Brent Blend, comprising 15 oils from fields in the North Sea. • Dubai-Oman, used as benchmark for Middle East sour crude oil flowing to the Asia-Pacific region • The OPEC Reference Basket, a weighted average of oil blends from various OPEC (The Organization of the Petroleum Exporting Countries) countries West Texas Intermediate • Also known as Texas light sweet, used as a benchmark in oil pricing • API gravity of around 39.6 and specific gravity of 0.827 and 0.24% sulfur • WTI is refined mostly in the Midwest and Gulf Coast regions in the U.S • It is the underlying commodity of New York Mercantile Exchange's (NYMEX) oil futures contracts • Often referenced in news reports -

Climate and Energy Benchmark in Oil and Gas Insights Report

Climate and Energy Benchmark in Oil and Gas Insights Report Partners XxxxContents Introduction 3 Five key findings 5 Key finding 1: Staying within 1.5°C means companies must 6 keep oil and gas in the ground Key finding 2: Smoke and mirrors: companies are deflecting 8 attention from their inaction and ineffective climate strategies Key finding 3: Greatest contributors to climate change show 11 limited recognition of emissions responsibility through targets and planning Key finding 4: Empty promises: companies’ capital 12 expenditure in low-carbon technologies not nearly enough Key finding 5:National oil companies: big emissions, 16 little transparency, virtually no accountability Ranking 19 Module Summaries 25 Module 1: Targets 25 Module 2: Material Investment 28 Module 3: Intangible Investment 31 Module 4: Sold Products 32 Module 5: Management 34 Module 6: Supplier Engagement 37 Module 7: Client Engagement 39 Module 8: Policy Engagement 41 Module 9: Business Model 43 CLIMATE AND ENERGY BENCHMARK IN OIL AND GAS - INSIGHTS REPORT 2 Introduction Our world needs a major decarbonisation and energy transformation to WBA’s Climate and Energy Benchmark measures and ranks the world’s prevent the climate crisis we’re facing and meet the Paris Agreement goal 100 most influential oil and gas companies on their low-carbon transition. of limiting global warming to 1.5°C. Without urgent climate action, we will The Oil and Gas Benchmark is the first comprehensive assessment experience more extreme weather events, rising sea levels and immense of companies in the oil and gas sector using the International Energy negative impacts on ecosystems. -

Price Forecast June 30, 2015 Contents

Resource Evaluation & Advisory Price forecast June 30, 2015 Contents Canadian price forecast 1 International price forecast 5 Global outlook 6 Western Canada royalty comparison 8 Pricing philosophy 11 Glossary 12 Canadian domestic price forecast Forecast commentary Andrew Botterill Senior Manager, Resource Evaluation & Advisory “Everything is in a state of fl ux, including status quo” - Robert Byrne As industry adjusts to the “new normal” we have analyzed This narrowing has been most notable on the heavy oil in our last two forecasts, activities in the energy sector side, where diff erentials have decreased more than 30 per are beginning to demonstrate a cautious, but optimistic cent compared with where they were in summer 2014. view of the future. While not anticipating $100 oil in the With greater than 60 per cent of Canadian production near term, these views show an expectation industry will being from oil sands (CAPP 2015 forecast report) the bring a more focused approach to North American oil narrowing of heavy diff erentials is welcome news to much development within the coming 12 to 18 months. of the sector. In recent weeks, the WTI to heavy diff erential has been narrower than we have seen recently as In recent weeks, Canadian-received oil prices have been production from some projects was shut-in due to wildfi res stronger relative to the beginning of the year, with daily in northern Alberta. The shut-in production has since been WTI settlements hovering around $60/bbl USD and brought back on-stream, which has slowed the narrowing Canadian Light settlements greater than $70/bbl CAD. -

Sustainability Report LETTER from OUR CEO

2017 Sustainability Report LETTER FROM OUR CEO Dear stakeholders In 2017 we presented our strategy: always safe, high value, low In Statoil we believe the winners in the energy transition will be carbon, and we set clear ambitions for the future. Statoil is now a the producers that can deliver at low cost and with low carbon stronger, more resilient and more competitive company. emissions. We believe there are attractive business opportunities in the transition to a low-carbon economy. The safety of our people and integrity of our operations is our top priority. Over the past decade we have steadily improved our We prepare for continued volatility in our markets. Last year safety results. Following some negative developments in 2016, we improved our cash flow and generated USD 3.1 billion in we reinforced our efforts, and last year we again saw a positive free cash flow, tripled adjusted earnings to USD 12.6 billion, development. For the year as a whole, our serious incident and net operating income was to USD 13.8 billion. Statoil’s frequency came in at 0.6. We will use this as inspiration and portfolio continued to improve its robustness in 2017 achieving continue our efforts. The “I am safety” initiative, launched across a breakeven oil price of USD 21 per barrel for next generation the company is an important part of these efforts. projects. Statoil has created substantial value and contributed to the CO2 emissions from our oil and gas production were reduced development of society for almost 50 years. Today we supply by 10% per barrel last year. -

Athabasca Oil Corporation Takes Further Actions in Response to The

FOR IMMEDIATE RELEASE ‐ April 2, 2020 Athabasca Oil Corporation Takes Further Actions in Response to the Current Environment CALGARY – Athabasca Oil Corporation (TSX: ATH) (“Athabasca” or the “Company”) is taking further immediate actions in response to the significant decline in global oil prices to bolster balance sheet strength and corporate resiliency. Shut‐in of Hangingstone Asset Due to the significant decline in oil prices combined with the economic uncertainty associated to the ongoing COVID crisis, Athabasca has decided to suspend the Hangingstone SAGD operation. This suspension was initiated on April 2, 2020 and will involve shutting in the well pairs, halting steam injection to the reservoir, and taking measures to preserve the processing facility and pipelines in a safe manner so that it could be re‐started at a future date when the economy has recovered. The Hangingstone asset has an operating break‐even of approximately US$37.50 Western Canadian Select and this action is expected to significantly improve corporate resiliency in the current environment. As part of this action, Athabasca is reducing its corporate staff count by 15%. Hangingstone was Athabasca’s first operated oil sands project that began construction in 2013 and was commissioned in 2015. The Company would like to thank all staff that have worked hard over the years to bring this asset on stream. It is unfortunate that made‐in‐Alberta assets like Hangingstone cannot continue operations under current prices. Revised 2020 Guidance Annual corporate guidance is 30,000 – 31,500 boe/d and reflects a ~2,500 boe/d reduction related to the shut‐in. -

U.S.-Canada Cross- Border Petroleum Trade

U.S.-Canada Cross- Border Petroleum Trade: An Assessment of Energy Security and Economic Benefits March 2021 Submitted to: American Petroleum Institute 200 Massachusetts Ave NW Suite 1100, Washington, DC 20001 Submitted by: Kevin DeCorla-Souza ICF Resources L.L.C. 9300 Lee Hwy Fairfax, VA 22031 U.S.-Canada Cross-Border Petroleum Trade: An Assessment of Energy Security and Economic Benefits This report was commissioned by the American Petroleum Institute (API) 2 U.S.-Canada Cross-Border Petroleum Trade: An Assessment of Energy Security and Economic Benefits Table of Contents I. Executive Summary ...................................................................................................... 4 II. Introduction ................................................................................................................... 6 III. Overview of U.S.-Canada Petroleum Trade ................................................................. 7 U.S.-Canada Petroleum Trade Volumes Have Surged ........................................................... 7 Petroleum Is a Major Component of Total U.S.-Canada Bilateral Trade ................................. 8 IV. North American Oil Production and Refining Markets Integration ...........................10 U.S.-Canada Oil Trade Reduces North American Dependence on Overseas Crude Oil Imports ..................................................................................................................................10 Cross-Border Pipelines Facilitate U.S.-Canada Oil Market Integration...................................14 -

Canadian Crude Oil and Natural Gas Production and Supply Costs Outlook (2016 – 2036)

Study No. 159 September 2016 CANADIAN CANADIAN CRUDE OIL AND NATURAL GAS ENERGY PRODUCTION AND SUPPLY COSTS OUTLOOK RESEARCH INSTITUTE (2016 – 2036) Canadian Energy Research Institute | Relevant • Independent • Objective CANADIAN CRUDE OIL AND NATURAL GAS PRODUCTION AND SUPPLY COSTS OUTLOOK (2016 – 2036) Canadian Crude Oil and Natural Gas Production and Supply Costs Outlook (2016 – 2036) Authors: Laura Johnson Paul Kralovic* Andrei Romaniuk ISBN 1-927037-43-0 Copyright © Canadian Energy Research Institute, 2016 Sections of this study may be reproduced in magazines and newspapers with acknowledgement to the Canadian Energy Research Institute September 2016 Printed in Canada Front photo courtesy of istockphoto.com Acknowledgements: The authors of this report would like to extend their thanks and sincere gratitude to all CERI staff involved in the production and editing of the material, including but not limited to Allan Fogwill, Dinara Millington and Megan Murphy. *Paul Kralovic is Director, Frontline Economics Inc. ABOUT THE CANADIAN ENERGY RESEARCH INSTITUTE The Canadian Energy Research Institute is an independent, not-for-profit research establishment created through a partnership of industry, academia, and government in 1975. Our mission is to provide relevant, independent, objective economic research in energy and environmental issues to benefit business, government, academia and the public. We strive to build bridges between scholarship and policy, combining the insights of scientific research, economic analysis, and practical experience. For more information about CERI, visit www.ceri.ca CANADIAN ENERGY RESEARCH INSTITUTE 150, 3512 – 33 Street NW Calgary, Alberta T2L 2A6 Email: [email protected] Phone: 403-282-1231 Canadian Crude Oil and Natural Gas Production and Supply Costs Outlook iii (2016 – 2036) Table of Contents LIST OF FIGURES ............................................................................................................ -

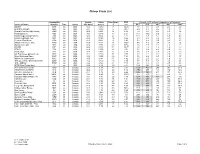

Chicap-Crude-List-7-15-2020.Pdf

Chicap Crude List Commodity Gravity Sulfur Pour Point RVP Viscosity (cST) at listed temperature in Fahrenheit Crude Oil Name Identifier Type Origin °API @60°F mass% °F psi 40°F 50°F 68°F 86°F 104°F Bakken BAK sw USA 42.5 0.080 -71 10.21 4.1 3.6 2.9 2.5 2.0 Grand Mesa Light GML sw USA 48.7 0.060 5 10.67 2.9 2.7 2.2 1.9 1.6 Grand Mesa Sweet@Cushing GMS sw USA 40.2 0.206 32 8.26 7.2 6.0 4.6 3.6 3.0 Mississippi Lime MSL sw USA 34.3 0.519 -11 6.27 16.1 13.2 9.6 7.2 6 Niobrara @Cushing Pony PL NIB sw USA 37.5 0.402 27 8.11 11.1 8.8 6.7 5.1 4.0 Niobrara @Saddlehorn SSC sw USA 43.2 0.144 -38 9.55 5.3 4.5 3.5 2.8 2.3 Permian Sour Blend PRM sw USA 41.9 0.281 -6 8.03 5.1 4.4 3.5 2.8 2.3 Saddlehorn Intermediate SHM sw USA 42.5 0.137 21 10.67 5.6 4.9 3.8 3.1 2.6 Saddlehorn Light SHL sw USA 48.4 0.058 -33 10.54 2.8 2.5 2.1 1.8 1.6 SCOOP SCP sw USA 54.4 0.015 -71 10.77 2.0 1.8 1.6 1.4 1.2 STACK STK sw USA 41.9 0.079 -22 9.71 7.1 6.4 4.9 4.0 3.2 Stack Light STL sw USA 47.4 0.022 5 8.17 3.6 3.3 2.7 2.3 2.0 US High Sweet @Clearbrook UHC sw USA 42.1 0.120 -71 9.78 4.7 4.1 3.2 2.6 2.2 West Oklahoma Sweet WOS sw USA 49.0 0.025 -38 7.84 3.1 2.8 2.3 1.9 1.7 Whitecliffs Condensate WCC sw USA 48.5 0.141 -71 8.82 2.5 2.5 2.1 1.9 1.6 WTI @Cushing - Domestic Sweet DSW sw USA 41.2 0.400 -38 7.69 6.7 5.7 4.4 3.5 2.8 WTI - Midland WTM sw USA 43.6 0.163 -11 7.13 5.3 4.5 3.4 2.7 2.3 WTS (West Texas Sour) C so USA 32.9 1.64 -23 5.67 18.0 14.3 9.9 7.2 5.5 Access Western Blend AWB H Canada 21.6 3.79 -46 6.67 672 457 248 145 91.0 Albian Heavy Synthetic AHS H Canada 20.0 -

World Oil Outlook 2040

Organization of the Petroleum Exporting Countries 2019 World Oil Outlook 2040 2019 World Oil Outlook 2040 Organization of the Petroleum Exporting Countries Digital access to the WOO: an interactive user experience 24/7 OPEC’s World Oil Outlook (WOO) is part of the Organization’s commitment to market stability. The publication is a means to highlight and further the understanding of the many possible future challenges and opportunities for the oil industry. It is also a channel to encourage dialogue, cooperation and transparency between OPEC and other stakeholders within the industry. As part of OPEC’s ongoing efforts to improve user experience of the WOO and provide data transparency, two digital interfaces are available: the OPEC WOO App and the interactive version of the WOO. The OPEC WOO App provides increased access to the publication’s vital analysis and energy-related data. It is ideal for energy professionals, oil industry stakeholders, policymakers, market analysts, academics and the media. The App’s search engine enables users to easily find information, and its bookmarking function allows them to store and review their favourite articles. Its versatility also allows users to compare graphs and tables interactively, thereby maximizing information extraction and empowering users to undertake their own analysis. The interactive version of the WOO also provides the possibility to download specific data and information, thereby enhancing user experience. Download Access the OPEC WOO App interactive version Available for Android and iOS OPEC is a permanent, intergovernmental organization, established in Baghdad, Iraq, on 10–14 September 1960. The Organization comprises 14 Members: Algeria, Angola, Republic of the Congo, Ecuador, Equatorial Guinea, Gabon, the Islamic Republic of Iran, Iraq, Kuwait, Libya, Nigeria, Saudi Arabia, the United Arab Emirates and Venezuela. -

2018 ANNUAL INFORMATION FORM Suncor Energy Inc

11FEB201917213713 ANNUAL INFORMATION FORM Dated February 28, 2019 Suncor Energy Inc. 19FEB201920364295 ANNUAL INFORMATION FORM DATED FEBRUARY 28, 2019 TABLE OF CONTENTS 1 Advisories 2 Glossary of Terms and Abbreviations 2 Common Industry Terms 4 Common Abbreviations 4 Conversion Table 5 Corporate Structure 5 Name, Address and Incorporation 5 Intercorporate Relationships 6 General Development of the Business 6 Overview 7 Three-Year History 10 Narrative Description of Suncor’s Businesses 10 Oil Sands 15 Exploration and Production 19 Refining and Marketing 23 Other Suncor Businesses 24 Suncor Employees 24 Ethics, Social and Environmental Policies 26 Statement of Reserves Data and Other Oil and Gas Information 28 Oil and Gas Reserves Tables and Notes 33 Future Net Revenues Tables and Notes 39 Additional Information Relating to Reserves Data 51 Industry Conditions 58 Risk Factors 68 Dividends 69 Description of Capital Structure 71 Market for Securities 72 Directors and Executive Officers 78 Audit Committee Information 80 Legal Proceedings and Regulatory Actions 80 Interests of Management and Others in Material Transactions 80 Transfer Agent and Registrar 80 Material Contracts 80 Interests of Experts 81 Disclosure Pursuant to the Requirements of the NYSE 81 Additional Information 82 Advisory – Forward-Looking Information and Non-GAAP Financial Measures Schedules A-1 SCHEDULE ‘‘A’’ – AUDIT COMMITTEE MANDATE B-1 SCHEDULE ‘‘B’’ – SUNCOR ENERGY INC. POLICY AND PROCEDURES FOR PRE-APPROVAL OF AUDIT AND NON-AUDIT SERVICES C-1 SCHEDULE ‘‘C’’ – FORM 51-101F2 REPORT ON RESERVES DATA BY INDEPENDENT QUALIFIED RESERVES EVALUATOR OR AUDITOR D-1 SCHEDULE ‘‘D’’ – FORM 51-101F2 REPORT ON RESERVES DATA BY INDEPENDENT QUALIFIED RESERVES EVALUATOR OR AUDITOR E-1 SCHEDULE ‘‘E’’ – FORM 51-101F3 REPORT OF MANAGEMENT AND DIRECTORS ON RESERVES DATA AND OTHER INFORMATION ADVISORIES In this Annual Information Form (AIF), references to ‘‘Suncor’’ each year in the two-year period ended December 31, 2018. -

2020 Report on Saipem's Remuneration Policy and Paid

01-36RelRemSaipem20Ing.qxd 3-04-2020 19:19 Pagina I 2020 Report on Saipem’s Remuneration Policy and Paid Compensation APPROVED BY THE BOARD OF DIRECTORS ON MARCH 12, 2020 01-36RelRemSaipem20Ing.qxd 3-04-2020 19:19 Pagina II Mission Our mission is to implement challenging, safe and innovative projects, leveraging on the competence of our people and on the solidity, multiculturalism and integrity of our organisational model. With the ability to face and overcome the challenges posed by the evolution of the global scenarios, we must seize the opportunities to create economic and social value for all our stakeholders. OUR VALUES Innovation; health, safety and environment; multiculturalism; passion; integrity. COUNTRIES IN WHICH SAIPEM OPERATES EUROPE Albania, Austria, Bulgaria, Croatia, Cyprus, France, Germany, Greece, Italy, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Serbia, Spain, Sweden, Switzerland, Turkey, United Kingdom AMERICAS Argentina, Bolivia, Brazil, Canada, Chile, Colombia, Ecuador, Guyana, Mexico, Peru, United States, Venezuela CIS Azerbaijan, Georgia, Kazakhstan, Russia AFRICA Algeria, Angola, Congo, Egypt, Ghana, Libya, Morocco, Mauritania, Mozambique, Namibia, Nigeria, Senegal, South Africa, Tunisia, Uganda MIDDLE EAST Iraq, Kuwait, Oman, Qatar, Saudi Arabia, United Arab Emirates ESTREMO ORIENTE E OCEANIA Australia, China, India, Indonesia, Japan, Malaysia, Pakistan, Singapore, South Korea, Taiwan, Thailand, Vietnam 01-36RelRemSaipem20Ing.qxd 3-04-2020 19:19 Pagina 1 2020 Report on Saipem’s Remuneration -

Equinor Detailed Assessment of Equinor’S Corporate Industry Association Review

April 2021 Equinor Detailed assessment of Equinor’s corporate industry association review April 2021 This document outlines a detailed breakdown of InfluenceMap's assessment of the company's corporate disclosure on industry association lobbying, using the traffic-light assessment framework summarized below. Further details on the assessment methodology is available in the Appendix, and in our April 2021 report here. Key Explanation Has broadly met investor expectations in this area. Has made some progress on investor expectations in this area, but with significant deficiencies. Has fallen short of investor expectations in this area. A summary of Equinor’s disclosures on industry associations is shown below. Equinor has published two reviews of its industry associations to date. The Review Score represents InfluenceMap’s overall assessment of the quality of the company’s industry association review process, where 100 would indicate that a company has met investor expectations for all criteria related to the review process. Date of Review Review Score March 2020 21 / 100 March 2021 29 / 100 This assessment is based on Equinor’s latest disclosure on industry associations and climate lobbying, which can be found here. InfluenceMap's online profile of Equinor, including access to the underlying data which forms this assessment, can be found here. Item Comment Corporate Equinor has disclosed top-line statements describing its top-line policy priorities (e.g. adopt climate carbon pricing, promote research and development, phase out fossil fuel subsidies). However, positions the company does not disclose its position on or engagement with specific climate policies. Industry group Equinor has disclosed the climate policy positions and influencing activities of three industry climate associations with “some” or “material” misalignment, but the company does not disclose any positions details of the climate positions of the 90 remaining “aligned” industry associations.