The Future of Sas

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

![Contents [Edit] Africa](https://docslib.b-cdn.net/cover/9562/contents-edit-africa-79562.webp)

Contents [Edit] Africa

Low cost carriers The following is a list of low cost carriers organized by home country. A low-cost carrier or low-cost airline (also known as a no-frills, discount or budget carrier or airline) is an airline that offers generally low fares in exchange for eliminating many traditional passenger services. See the low cost carrier article for more information. Regional airlines, which may compete with low-cost airlines on some routes are listed at the article 'List of regional airlines.' Contents [hide] y 1 Africa y 2 Americas y 3 Asia y 4 Europe y 5 Middle East y 6 Oceania y 7 Defunct low-cost carriers y 8 See also y 9 References [edit] Africa Egypt South Africa y Air Arabia Egypt y Kulula.com y 1Time Kenya y Mango y Velvet Sky y Fly540 Tunisia Nigeria y Karthago Airlines y Aero Contractors Morocco y Jet4you y Air Arabia Maroc [edit] Americas Mexico y Aviacsa y Interjet y VivaAerobus y Volaris Barbados Peru y REDjet (planned) y Peruvian Airlines Brazil United States y Azul Brazilian Airlines y AirTran Airways Domestic y Gol Airlines Routes, Caribbean Routes and y WebJet Linhas Aéreas Mexico Routes (in process of being acquired by Southwest) Canada y Allegiant Air Domestic Routes and International Charter y CanJet (chartered flights y Frontier Airlines Domestic, only) Mexico, and Central America y WestJet Domestic, United Routes [1] States and Caribbean y JetBlue Airways Domestic, Routes Caribbean, and South America Routes Colombia y Southwest Airlines Domestic Routes y Aires y Spirit Airlines Domestic, y EasyFly Caribbean, Central and -

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

Industry Monitor the EUROCONTROL Bulletin on Air Transport Trends

Issue N°141. 31/05/12 Industry Monitor The EUROCONTROL bulletin on air transport trends European flights declined by 2.7% in April. EUROCONTROL statistics and forecasts 1 May update of the two-year flight forecast is for a Other statistics and forecasts 2 downward revision of 0.4 percentage points to 1.7% fewer flights in 2012 than in 2011. The Passenger airlines 3 outlook for 2013 is for 1.6% growth. Cargo 6 ACI reported overall passenger traffic at Financial results of airlines 7 European airports to be up 3.4% in 1Q12 on Environment 7 1Q11 whereas aircraft movements decreased by 1.7%. Airports 8 Oil 8 European airlines selected in this bulletin recorded €1.7 billion operating losses during Aircraft Manufacturing 9 1Q12, a 17% increase on the same period a year Economy 9 ago. Regulation 9 Oil prices reduced to €79 per barrel on 31 May, Fares 9 dropping 15% from April. EUROCONTROL statistics and forecasts European flights declined by 2.7% in April compared with the same month last year and were similar to April 2009 levels. Strikes in Portugal, but mainly in France resulted in circa 5,000 flight cancellations. With the exception of charter and low-cost, both up 3% and 1.2% respectively on April 2011, other market segments were down circa 4% (see Figure 1) (EUROCONTROL, May). Based on preliminary data for delay from all causes, 36% of flights were delayed on departure in April, resulting in a 3 percentage point increase on April 2011. Analysis of the causes of delay shows a notable increase in reactionary delay. -

September 2001 Interesting Times CONTENTS He Airline Industry Is Living in Interesting Times, As the Old Tchinese Curse Has It

Aviation Strategy Issue No: 47 September 2001 Interesting times CONTENTS he airline industry is living in interesting times, as the old TChinese curse has it. Analysis There are more and more signs of weakening economies, but the official indicators are not pointing to a recession, ie an absolute down-turn in activity The OECD's mid-year Economic Outlook Industry outlook 1 highlights the slow-down in the US economy from real GDP growth of 5.0% in 2000 to 1.9% this year, though a recovery to 3.1% is Sabena, forced to face expected for 2002. The EU is just slightly down this year - GDP reality 2-3 growth of 2.6% against 3.1% in 2000 - and next year is put at 2.7%. Japan, however, continues to plod along its L-shaped recession - 1.3% in 2000, 1.2% in 2001, 0.7% in 2002. Oneworld and SkyTeam: The airlines that are suffering disproportionately are those that Justifying immunity 4-6 followed strategies of tight capacity curtailment yield enhancement and focus on business travel. The US Majors' second quarter Briefing results were unprecedently bad - an operating loss of $0.8bn against a $2.8bn profit a year ago. BA, according to a widely Embraer: new challenges for reported analysis from Merrill Lynch, will be turning to losses for Brazil’s success story 7-10 2001/02. The reason that the airline downturn is worse than that implied KLM: Still searching for by the economic number probably has a lot to do with the collapse a sustainable role 8-14 of the new technology sector. -

Creating the Nordic Model of Capitalism

list of figures vii list of tables jx list of photographs xii acknowledgements xiii notes on the contributors xiv list of abbreviations xviii 1 creating Nordic capitalism - the business history of a competitive periphery i Martin Jes luersen and Lars Thue prologue to the Swedish chapter 20 2 welfare capitalism: the Swedish economy, 1850-2005 22 Hans Sj ogre ft 3 entrepreneurship and ownership: the long-term viability of the Swedish Bonnier and Wallenberg family business groups 75 Mats Larsson, Hakan Lindgren and Daniel Nyberg 4 from ASEA to ABB: managing big business the Swedish way 104 Fredrik Tell prologue to the Finnish chapter 137 5 growth and investment: Finnish capitalism, 18505-2005 139 Susanna Fellman 6 from state ownership to M NC: the path of Enso-Gutzeit to Stora-Enso 218 Jari Ojala, Juha-Antti Lamberg and Anders Melander 7 success and failure of a conglomerate firm: the strategic paths of Nokia and Tampella in the liberalizing Finnish economy after the Second World War 238 Mika Skippari and Jari Ojala prologue to the Danish chapter 263 8 co-operative liberalism: Denmark from 1857 to 2007 265 Martin Jes iwersen and Steen Andersen 9 Aria: from a decentralized co-operation to an MNE Mads Mordhorst 335 10 Carlsberg: regulation of the home market and international expansion 365 Martin Jes iversen and Andrew Arnold prologue to the Norwegian chapter 392 11 Norway: a resource-based and democratic capitalism 394 Lars Thue 12 constructive power: Elkem, 1904-2004 494 Knut Sogner 13 finance and the development of Norwegian capitalism: 530 the case of Christiania Bank Sverre Knutsen 14 conclusion 558 Susanna Fellman and Hans Sjogren statistical appendix 580 index 587 vi CONTENTS list of figures 1.1 The business systems of the Nordic countries 7 2A. -

No. 16673 SWEDEN and IRAN Air Transport Agreement

No. 16673 SWEDEN and IRAN Air Transport Agreement (with annex and related note). Signed at Tehran on 10 June 1975 Authentic texts of the Agreement and annex: Swedish, Persian and English. Authentic text of the related note: English. Registered by the International Civil Aviation Organization on 5 May 1978. SUÈDE et IRAN Accord relatif aux transports aériens (avec annexe et note connexe). Signé à Téhéran le 10 juin 1975 Textes authentiques de l©Accord et de l©annexe : su dois, persan et anglais. Texte authentique de la note connexe : anglais. Enregistr par l©Organisation de l©aviation civile internationale le 5 mai 1978. Vol. 1088,1-16673 1978_____United Nations — Treaty Series • Nations Unies — Recueil des Traités_____283 AIR TRANSPORT AGREEMENT1 BETWEEN THE GOVERNMENT OF THE KINGDOM OF SWEDEN AND THE IMPERIAL GOVERN MENT OF IRAN The Government of the Kingdom of Sweden and the Imperial Government of Iran, Being equally desirous to conclude an Agreement for the purpose of establishing and operating commercial air services between and beyond their respective terri tories, have agreed as follows: Article 1. DEFINITIONS For the purpose of the present Agreement, unless the context otherwise requires: à) The term "aeronautical authorities" means, in the case of Iran, the Depart ment General of Civil Aviation, and any person or body authorized to perform any functions at present exercised by the said Department General or similar functions, and, in the case of Sweden, the Board of Civil Aviation, and any person or body authorized to perform any functions at present exercised by the said Board or similar functions. -

Historia De La Aviación Comercial Desde 1909 Hasta Nuestros Días

FACULTAT DE FILOSOFIA I LETRES, DEPARTAMENT DE CIÈNCIES HISTÒRIQUES I TEORIA DE LES ARTS HISTORIA DE LA AVIACIÓN COMERCIAL DESDE 1909 HASTA NUESTROS DÍAS TESIS DOCTORAL PRESENTADA POR EL DR. MARTÍN BINTANED ARA DIRIGIDA POR EL DR. SEBASTIÁ SERRA BUSQUETS CATEDRÀTIC D'HISTÒRIA CONTEMPORÀNIA PARA OPTAR AL TÍTULO DE DOCTOR EN HISTORIA CURSO ACADÉMICO 2013/2014 Martín Bintaned Ara 2 Historia de la aviación comercial Resumen Esta tesis doctoral investiga acerca de la aportación de la aviación comercial a la historia contemporánea, en particular por su impacto en las relaciones exteriores de los países, su papel facilitador en la actividad económica internacional y por su contribución al desarrollo del turismo de masas. La base de trabajo ha sido el análisis de la prensa especializada, a partir de la cual se han identificado los casos innovadores. Gracias al análisis de su origen (tecnológico, geo- político, aero-político, corporativo, de producto y en la infraestructura) y a su contextualización, hemos podido trazar la historia de la aviación comercial desde su origen en 1919 hasta nuestros días. Palabras clave: Historia contemporánea, Aviación comercial, Política aérea, Relaciones internacionales, Turismo, Innovación, Aerolíneas, Aeropuertos Abstract This doctoral thesis analyses the contribution of commercial aviation to the contemporary history, particularly in the field of external relations, international economy and mass tourism. We have identified all innovations with a structural impact on the industry through specialised press, considering the changes on technology, geopolitics, aeropolitics, business models, product and services, and infrastructure. This methodology has allowed us to write the history of the commercial aviation since its origin in 1919. -

Analysis of Global Airline Alliances As a Strategy for International Network Development by Antonio Tugores-García

Analysis of Global Airline Alliances as a Strategy for International Network Development by Antonio Tugores-García M.S., Civil Engineering, Enginyer de Camins, Canals i Ports Universitat Politècnica de Catalunya, 2008 Submitted to the MIT Engineering Systems Division and the Department of Aeronautics and Astronautics in Partial Fulfillment of the Requirements for the Degrees of Master of Science in Technology and Policy and Master of Science in Aeronautics and Astronautics at the Massachusetts Institute of Technology June 2012 © 2012 Massachusetts Institute of Technology. All rights reserved Signature of Author__________________________________________________________________________________ Antonio Tugores-García Department of Engineering Systems Division Department of Aeronautics and Astronautics May 14, 2012 Certified by___________________________________________________________________________________________ Peter P. Belobaba Principal Research Scientist, Department of Aeronautics and Astronautics Thesis Supervisor Accepted by__________________________________________________________________________________________ Joel P. Clark Professor of Material Systems and Engineering Systems Acting Director, Technology and Policy Program Accepted by___________________________________________________________________________________________ Eytan H. Modiano Professor of Aeronautics and Astronautics Chair, Graduate Program Committee 1 2 Analysis of Global Airline Alliances as a Strategy for International Network Development by Antonio Tugores-García -

Air Transport

The History of Air Transport KOSTAS IATROU Dedicated to my wife Evgenia and my sons George and Yianni Copyright © 2020: Kostas Iatrou First Edition: July 2020 Published by: Hermes – Air Transport Organisation Graphic Design – Layout: Sophia Darviris Material (either in whole or in part) from this publication may not be published, photocopied, rewritten, transferred through any electronical or other means, without prior permission by the publisher. Preface ommercial aviation recently celebrated its first centennial. Over the more than 100 years since the first Ctake off, aviation has witnessed challenges and changes that have made it a critical component of mod- ern societies. Most importantly, air transport brings humans closer together, promoting peace and harmo- ny through connectivity and social exchange. A key role for Hermes Air Transport Organisation is to contribute to the development, progress and promo- tion of air transport at the global level. This would not be possible without knowing the history and evolu- tion of the industry. Once a luxury service, affordable to only a few, aviation has evolved to become accessible to billions of peo- ple. But how did this evolution occur? This book provides an updated timeline of the key moments of air transport. It is based on the first aviation history book Hermes published in 2014 in partnership with ICAO, ACI, CANSO & IATA. I would like to express my appreciation to Professor Martin Dresner, Chair of the Hermes Report Committee, for his important role in editing the contents of the book. I would also like to thank Hermes members and partners who have helped to make Hermes a key organisa- tion in the air transport field. -

Punctuality Airlines

Punctuality for february 2012 per airline Departures scheduled *) Delayed more than 15 minutes. **) Airlines having less than 10 operations. Avg. Planned Flown Cancelled Flown Delayed *) Punctuality Airline delay (number) (number) (number) (%) (number) (%) (min) Adria Airways 10 10 0 100% 3 70% 26 Aeroflot Russian 29 29 0 100% 2 93% 18 Airlines Air Baltic 87 87 0 100% 13 85% 32 Air Berlin 102 102 0 100% 12 88% 30 Air Canada 13 13 0 100% 8 38% 54 Air France 144 140 4 97% 40 72% 40 Air Greenland 16 16 0 100% 1 94% 90 Atlantic Airways 64 62 2 97% 11 83% 108 Austrian 106 106 0 100% 10 91% 23 Airlines Blue 1 165 161 4 98% 17 90% 39 British Airways 213 209 4 98% 23 89% 63 British Midland 75 75 0 100% 2 97% 53 Brussels 123 122 1 99% 20 84% 44 Airlines Cimber Sterling 1160 1120 40 97% 178 85% 40 Continental 20 20 0 100% 5 75% 39 Airlines Croatia Airlines 20 20 0 100% 9 55% 24 Csa Czechoslovak 54 54 0 100% 15 72% 36 Airlines Easyjet 278 276 2 99% 44 84% 45 Egypt Air 22 22 0 100% 7 68% 27 Emirates 29 29 0 100% 20 31% 30 Estonian Air 82 82 0 100% 2 98% 54 Finnair 100 100 0 100% 13 87% 44 Flybe 75 70 5 93% 5 93% 77 Flyniki 44 43 1 98% 6 86% 29 Gulf Air 17 17 0 100% 5 71% 32 Iberia 25 25 0 100% 19 24% 31 Iceland Express 18 18 0 100% 0 100% 0 Icelandair 54 54 0 100% 7 87% 30 Jat Airways 16 16 0 100% 8 50% 115 1 Klm Royal Dutch 167 164 3 98% 15 91% 54 Airlines Lot Polskie 57 57 0 100% 9 84% 37 Linie Lotnicze Lufthansa 216 202 14 94% 58 73% 38 Next Jet 64 63 1 98% 0 100% 0 Norwegian Air 755 748 7 99% 123 84% 43 Shuttle Olt Ostfriesische 38 37 1 97% 6 -

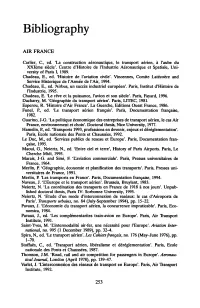

Bibliography

Bibliography AIR FRANCE Carlier, c., ed. 'La construction aeronautique, Ie transport aenen, a I'aube du XXIeme siecle'. Centre d'Histoire de l'Industrie Aeronautique et Spatiale, Uni versity of Paris I, 1989. Chadeau, E., ed. 'Histoire de I'aviation civile'. Vincennes, Comite Latecoere and Service Historique de l'Annee de l'Air, 1994. Chadeau, E., ed. 'Airbus, un succes industriel europeen'. Paris, Institut d'Histoire de l'Industrie, 1995. Chadeau, E. 'Le reve et la puissance, I'avion et son siecle'. Paris, Fayard, 1996. Dacharry, M. 'Geographie du transport aerien'. Paris, LITEC, 1981. Esperou, R. 'Histoire d'Air France'. La Guerche, Editions Ouest France, 1986. Funel, P., ed. 'Le transport aerien fran~ais'. Paris, Documentation fran~aise, 1982. Guarino, J-G. 'La politique economique des entreprises de transport aerien, Ie cas Air France, environnement et choix'. Doctoral thesis, Nice University, 1977. Hamelin, P., ed. 'Transports 1993, professions en devenir, enjeux et dereglementation'. Paris, Ecole nationale des Ponts et Chaussees, 1992. Le Due, M., ed. 'Services publics de reseau et Europe'. Paris, Documentation fran ~ise, 1995. Maoui, G., Neiertz, N., ed. 'Entre ciel et terre', History of Paris Airports. Paris, Le Cherche Midi, 1995. Marais, J-G. and Simi, R 'Caviation commerciale'. Paris, Presses universitaires de France, 1964. Merlin, P. 'Geographie, economie et planification des transports'. Paris, Presses uni- versitaires de France, 1991. Merlin, P. 'Les transports en France'. Paris, Documentation fran~aise, 1994. Naveau, J. 'CEurope et Ie transport aerien'. Brussels, Bruylant, 1983. Neiertz, N. 'La coordination des transports en France de 1918 a nos jours'. Unpub lished doctoral thesis, Paris IV- Sorbonne University, 1995.