QUARTERLY REPORT Public Joint-Stock Company of Power

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

3. Energy Reserves, Pipeline Routes and the Legal Regime in the Caspian Sea

3. Energy reserves, pipeline routes and the legal regime in the Caspian Sea John Roberts I. The energy reserves and production potential of the Caspian The issue of Caspian energy development has been dominated by four factors. The first is uncertain oil prices. These pose a challenge both to oilfield devel- opers and to the promoters of pipelines. The boom prices of 2000, coupled with supply shortages within the Organization of the Petroleum Exporting Countries (OPEC), have made development of the resources of the Caspian area very attractive. By contrast, when oil prices hovered around the $10 per barrel level in late 1998 and early 1999, the price downturn threatened not only the viability of some of the more grandiose pipeline projects to carry Caspian oil to the outside world, but also the economics of basic oilfield exploration in the region. While there will be some fly-by-night operators who endeavour to secure swift returns in an era of high prices, the major energy developers, as well as the majority of smaller investors, will continue to predicate total production costs (including carriage to market) not exceeding $10–12 a barrel. The second is the geology and geography of the area. The importance of its geology was highlighted when two of the first four international consortia formed to look for oil in blocks off Azerbaijan where no wells had previously been drilled pulled out in the wake of poor results.1 The geography of the area involves the complex problem of export pipeline development and the chicken- and-egg question whether lack of pipelines is holding back oil and gas pro- duction or vice versa. -

Guide to Investment

This overview contains important information and facts about business climate in Krasnodar region and designed to help potential investors assess the investment opportunities of the region This overview contains important information and facts about business climate in Krasnodar region and designed Guideto help potential investors assess the investment toopportunities Investment of the region Guide to Investment (maximum potential – credit rating minimum risk) – of Krasnodar region 1A investment attractiveness rating Bа3 according to Moody’s overall amongst Russian regions among Russian regions in terms of total annual investment in population 6 (maximum potential – 3 credit rating minimum risk) – of Krasnodar region 1A investment attractiveness rating Bа3 according to Moody’s overall amongst Russian regions among Russian regions 6 in terms of total annual investment 3 in population PwC Russia (www.pwc.ru) provides industry-focused assurance, tax, legal and advisory services. Over 2,500 professionals working in PwC offices in Moscow, St Petersburg, Ekaterinburg, Kazan, Rostov-on-Don, Krasnodar, Voronezh, Novosibirsk, Vladikavkaz and Ufa share their thinking, expe- rience and solutions to develop fresh perspectives and practical advice for our clients. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Together, these firms form the PwC network, which includes over 236,000 employees in 158 countries. Please see https://www.pwc.ru/en/about/structure.html for further details. This guide was prepared by the Krasnodar Region Administration jointly with PwC. This publication has been prepared solely for general guidance on the matters herein and does not constitute professional advice. -

National Report of the Russian Federation

DEPARTMENT OF NAVIGATION AND OCEANOGRAPHY OF THE MINISTRY OF DEFENSE OF THE RUSSIAN FEDERATION NATIONAL REPORT OF THE RUSSIAN FEDERATION 21TH MEETING OF MEDITERRANEAN and BLACKSEAS HYDROGRAPHIC COMMISSION Spain, Cadiz, 11-13 June 2019 1. Hydrographic office In accordance with the legislation of the Russian Federation matters of nautical and hydrographic services for the purpose of aiding navigation in the water areas of the national jurisdiction except the water area of the Northern Sea Route and in the high sea are carried to competence of the Ministry of Defense of the Russian Federation. Planning, management and administration in nautical and hydrographic services for the purpose of aiding navigation in the water areas of the national jurisdiction except the water area of the Northern Sea Route and in the high sea are carried to competence of the Department of Navigation and Oceanography of the Ministry of Defense of the Russian Federation (further in the text - DNO). The DNO is authorized by the Ministry of Defense of the Russian Federation to represent the State in civil law relations arising in the field of nautical and hydrographic services for the purpose of aiding navigation. It is in charge of the Hydrographic office of the Navy – the National Hydrographic office of the Russian Federation. The main activities of the Hydrographic office of the Navy are the following: to carry out the hydrographic surveys adequate to the requirements of safe navigation in the water areas of the national jurisdiction and in the high sea; to prepare -

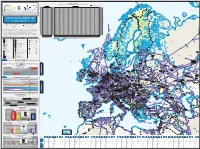

System Development Map 2019 / 2020 Presents Existing Infrastructure & Capacity from the Perspective of the Year 2020

7125/1-1 7124/3-1 SNØHVIT ASKELADD ALBATROSS 7122/6-1 7125/4-1 ALBATROSS S ASKELADD W GOLIAT 7128/4-1 Novaya Import & Transmission Capacity Zemlya 17 December 2020 (GWh/d) ALKE JAN MAYEN (Values submitted by TSO from Transparency Platform-the lowest value between the values submitted by cross border TSOs) Key DEg market area GASPOOL Den market area Net Connect Germany Barents Sea Import Capacities Cross-Border Capacities Hammerfest AZ DZ LNG LY NO RU TR AT BE BG CH CZ DEg DEn DK EE ES FI FR GR HR HU IE IT LT LU LV MD MK NL PL PT RO RS RU SE SI SK SM TR UA UK AT 0 AT 350 194 1.570 2.114 AT KILDIN N BE 477 488 965 BE 131 189 270 1.437 652 2.679 BE BG 577 577 BG 65 806 21 892 BG CH 0 CH 349 258 444 1.051 CH Pechora Sea CZ 0 CZ 2.306 400 2.706 CZ MURMAN DEg 511 2.973 3.484 DEg 129 335 34 330 932 1.760 DEg DEn 729 729 DEn 390 268 164 896 593 4 1.116 3.431 DEn MURMANSK DK 0 DK 101 23 124 DK GULYAYEV N PESCHANO-OZER EE 27 27 EE 10 168 10 EE PIRAZLOM Kolguyev POMOR ES 732 1.911 2.642 ES 165 80 245 ES Island Murmansk FI 220 220 FI 40 - FI FR 809 590 1.399 FR 850 100 609 224 1.783 FR GR 350 205 49 604 GR 118 118 GR BELUZEY HR 77 77 HR 77 54 131 HR Pomoriy SYSTEM DEVELOPMENT MAP HU 517 517 HU 153 49 50 129 517 381 HU Strait IE 0 IE 385 385 IE Kanin Peninsula IT 1.138 601 420 2.159 IT 1.150 640 291 22 2.103 IT TO TO LT 122 325 447 LT 65 65 LT 2019 / 2020 LU 0 LU 49 24 73 LU Kola Peninsula LV 63 63 LV 68 68 LV MD 0 MD 16 16 MD AASTA HANSTEEN Kandalaksha Avenue de Cortenbergh 100 Avenue de Cortenbergh 100 MK 0 MK 20 20 MK 1000 Brussels - BELGIUM 1000 Brussels - BELGIUM NL 418 963 1.381 NL 393 348 245 168 1.154 NL T +32 2 894 51 00 T +32 2 209 05 00 PL 158 1.336 1.494 PL 28 234 262 PL Twitter @ENTSOG Twitter @GIEBrussels PT 200 200 PT 144 144 PT [email protected] [email protected] RO 1.114 RO 148 77 RO www.entsog.eu www.gie.eu 1.114 225 RS 0 RS 174 142 316 RS The System Development Map 2019 / 2020 presents existing infrastructure & capacity from the perspective of the year 2020. -

Anomalously Strong Bora Over the Black Sea: Observations from Space and Numerical Modeling A

ISSN 00014338, Izvestiya, Atmospheric and Oceanic Physics, 2015, Vol. 51, No. 5, pp. 546–556. © Pleiades Publishing, Ltd., 2015. Original Russian Text © A.V. Gavrikov, A.Yu. Ivanov, 2015, published in Izvestiya AN. Fizika Atmosfery i Okeana, 2015, Vol. 51, No. 5, pp. 615–626. Anomalously Strong Bora over the Black Sea: Observations from Space and Numerical Modeling A. V. Gavrikov and A. Yu. Ivanov a Shirshov Institute of Oceanology, Russian Academy of Sciences, Nakhimovskii pr. 36, Moscow, 117997 Russia email: [email protected] Received February 20, 2014; in final form, February 10, 2015 Abstract—An anomalously strong Novorossiysk bora (strong coastal wind) observed in January–February 2012 with synthetic aperture radar (SAR) images from the Radarsat1 and Radarsat2 satellites is studied using the high resolution Weather Research and Forecasting Model (WRF). The bora was reliably reproduced not only in the narrow coastal zone, but also far in the open part of the Black Sea. As a result of modeling we demonstrated that an optimally configured WRF–ARW model with nested grids and horizontal resolution equal to 9/3/1 km quite well qualitatively and quantitatively reproduces the bora events. The details and struc ture of the bora (for example, wind strips and other peculiarities) seen on the SAR images were clearly repro duced by numerical modeling. Coupled analysis allowed us to conclude that these two alternative methods of investigating this dangerous meteorological phenomenon are highly effective. Keywords: Black Sea, Novorossiysk bora, WRFARW model, numerical modeling, SAR images, coupled analysis DOI: 10.1134/S0001433815050059 1. INTRODUCTION occurence in November. -

ST61 Publication

Section spéciale Index BR IFIC Nº 2562 Special Section ST61/1512 Sección especial Indice International Frequency Information Circular (Terrestrial Services) ITU - Radiocommunication Bureau Circular Internacional de Información sobre Frecuencias (Servicios Terrenales) UIT - Oficina de Radiocomunicaciones Circulaire Internationale d'Information sur les Fréquences (Services de Terre) UIT - Bureau des Radiocommunications Date/Fecha : 07.02.2006 Date limite pour les commentaires pour Partie A / Expiry date for comments for Part A / fecha limite para comentarios para Parte A : 02.05.2006 Les commentaires doivent être transmis directement à Comments should be sent directly to the Administration Las observaciones deberán enviarse directamente a la l'Administration dont émane la proposition. originating the proposal. Administración que haya formulado la proposición. Description of Columns / Descripción de columnas / Description des colonnes Intent Purpose of the notification Propósito de la notificación Objet de la notification 1a Assigned frequency Frecuencia asignada Fréquence assignée 4a Name of the location of Tx station Nombre del emplazamiento de estación Tx Nom de l'emplacement de la station Tx B Administration Administración Administration 4b Geographical area Zona geográfica Zone géographique 4c Geographical coordinates Coordenadas geográficas Coordonnées géographiques 6a Class of station Clase de estación Classe de station 1b Vision / sound frequency Frecuencia de portadora imagen/sonido Fréquence image / son 1ea Frequency stability Estabilidad de frecuencia Stabilité de fréquence 1e carrier frequency offset Desplazamiento de la portadora Décalage de la porteuse 7c System and colour system Sistema de transmisión / color Système et système de couleur 9d Polarization Polarización Polarisation 13c Remarks Observaciones Remarques 9 Directivity Directividad Directivité 8b Max. e.r.p., dbW P.R.A. -

Appendix 5), Each Member Member Each (Paragraph5), 2, Appendix Company the If to Theelected Ofboard Directors of Thefor Company the with 422Order No

ROSSETI ANNUAL REPORT 2013 09130 APPENDICES MAJOR RUSSIAN GRIDS IN OUR BUSINESS OUR CAPITAL MANAGEMENT REPORT WITH CORPORATE OUR SUSTAINED SHAREHOLDERS’ APPENDICES INDICATORS ENERGY INDUSTRY INVESTMENT FINANCIAL OVERVIEW GOVERNANCE DEVELOPMENT INFORMATION CONTENT 9.1. Information about shares held by the Company in subsidiaries 132 9.2. List of Corporate Local Regulatory Documents 136 9.3. List of offices 139 9.4. Consolidated IFRS financial statement 168 9.5. Related party transactions and major transaction of the Company 239 9.6. Information on Significant Capital Investment Projects 256 9.7. Information Concerning Compliance by the Company with the Corporate Governance Code 263 9.8. Instructions issued by the Government, the Government Executive Office, and the Ministry of Energy of the Russian Federation 288 9.9. Minutes of the meeting Board of Directors and Issues considered by Committees of the Board of Directors of the Company 299 9.10. Contact Information 596 9.11. Glossary 604 Report of the Internal Audit Commission 608 131 ROSSETI ANNUAL REPORT 2013 9.1. Information about shares held by the Company in subsidiaries 9.1. Information about shares held by the Company in subsidiaries Information About Shares Held by JSC Russian Grids in Subsidiaries and Dependent Companies as of December 31, 2013 JSC Russian Grids’ JSC Russian Joint-Stock Company Name Share in Authorized Grids’ Share in ITEM Capital, % Votes, % TRANSMISSION GRID COMPANIES 1 Federal Grid Company of Unified Energy system, 80,60%* 80,60%* Joint Stock Company INTERREGIONAL -

056C6d55fd1f0f94a24aa8188d4

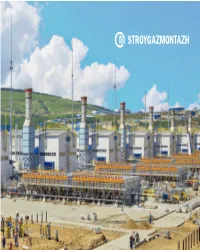

1 SGM GROUP OF COMPANIES 2 SGM GROUP OF COMPANIES SGM Group of Companies employs over 20 000 people SGM Group has over 20 000 employees of construction and other professions, among them welders, doggers, pipelayer operators, excavator operators, etc. More than 90% of its employees are workers, technicians and engineers of highest qualification. Every third employee of the Group has a university degree, 71% of the workforce has secondary (vocational and other) education. SGM Group supports the succession strategy and has quite a number of dynastic families; some of them are in business for more than 70 years! The Group has well-developed mentoring system, encourages traditions transfer to succeeding generations and respect for elders. 3 SGM Group SGM Group Staff Composition by Category Staff Composition by Gender 22% 11% Management Female Professionals and office staff Male Production workers, labourers 67% 22% 78% SGM Group SGM Group Staff Composition by Level of Education Staff Composition by Age 29% 20% 25% University education Under 30 Secondary 31–50 (vocational or other) 51 and over education 71% 55% Every fourth employee of SGM Group is under the age of 30 4 SGM GROUP STRUCTURE SGM Group of Companies consists of: > LLC «STROYGAZMONTAZH» – the parent company of the group; And major construction enterprises: > JSC «Lengazspetsstroy» > JSC «Krasnodargazstroy» > LLC «SCC Gazregion» > LLC «Neftegazkomplektmontazh» > JSC «Volgogaz» > JSC «Volgogradneftemash» – the largest high-tech gas, oil and petrochemical equipment manufacturer. The Group’s subsidiaries, territorial-production construction departments and standalone divisions operate in more than 50 towns and settlements in Russia. SGM Group LLC «STROYGAZMONTAZH» JSC «Lengazspetsstroy» JSC «Krasnodargazstroy» LLC «SCC Gazregion» JSC «Volgogradneftemash» JSC «Volgogaz» LLC «Neftegazkomplektmontazh» 5 STROYGAZMONTAZH Volgogradneftemash Volgogaz Est. -

Survey of Hazelnut Germplasm from Russia and Crimea for Response To

JOBNAME: horts 42#1 2007 PAGE: 1 OUTPUT: December 27 11:08:31 2006 tsp/horts/131494/01787 HORTSCIENCE 42(1):51–56. 2007. eral random amplified polymorphic DNA (RAPD) markers tightly linked to the ‘Gas- away’ gene (Davis and Mehlenbacher, 1997; Survey of Hazelnut Germplasm from Mehlenbacher et al., 2004). Marker-assisted selection is now routinely and effectively Russia and Crimea for Response to used in the hazelnut breeding program at Oregon State University (OSU), Corvallis, Eastern Filbert Blight Ore., to screen progeny segregating for the ‘Gasaway’ allele in absence of the fungus Thomas J. Molnar1, David E. Zaurov, and Joseph C. Goffreda (S. Mehlenbacher, personal communication, Department of Plant Biology & Pathology, Foran Hall, 59 Dudley Road, 2006; Chen et al., 2005; Lunde et al., 2000). Cook College, Rutgers University, New Brunswick, NJ 08901-8520 Although the ‘Gasaway’ gene has yet to be overcome by A. anomala in the Pacific Shawn A. Mehlenbacher Northwest, hazelnut breeders have been con- Department of Horticulture, 4017 Agricultural & Life Sciences Bldg., cerned with the long-term stability of using only one source of single gene resis- Oregon State University, Corvallis, OR 97331-7304 tance (Coyne et al., 1998; Osterbauer, 1996; Additional index words. Corylus avellana, Anisogramma anomala, hazelnut breeding, disease Pinkerton et al., 1998) and have been search- resistance ing for additional sources. Fortunately, sour- ces of qualitative and quantitative resistance Abstract. Six hundred five hazelnut (Corylus avellana L.) seedlings from a diverse have been identified in several C. avellana germplasm collection made in the Russian Federation and the Crimean peninsula of the cultivars and selections as well as other Ukraine were inoculated with the eastern filbert blight (EFB) pathogen Anisogramma Corylus L. -

Event Passport of Krasnodar Region.Pdf

КRАS NODAR REGION EVENT PASSPORT KRASNODAR REGION — a portrait of the region in a few facts Krasnodar Region is one of the most dynamically developing regions of Russia, which has a powerful transport infrastructure, rich natural resources and is located in a favorable climate zone. Kuban is rightfully considered a health resort of Russia and is a center of attraction for tourists from all over the country and abroad. Krasnodar Region is the most popular resort and tourist region HEALTH RESORT OF RUSSIA of Russia, which is visited by more than 16 million tourists a year. THE MAIN MEDIA CENTER The largest events held OF THE OLYMPIC PARK (SOCHI) ● Area: 158,000 sq. m. Pushkin — 465 places; a. XXII Winter Olympic Games and XI Winter Paralympic Games ● Overall dimensions of the building — Tolstoy — 220 places; (2014) 423 x 394 m. Dostoevsky — 140 places; ● The premises of the Main Media Chekhov — 50 places; b. 2018 FIFA World Cup (2018) Center housed: 3 rooms for preparing speakers for c. FORMULA 1 GRAND PRIX OF International Broadcasting Center — press conferences. RUSSIA (annually since 2015) 60 thousand sq.m. ● Height — 3 floors. d. Russian Investment Forum Main Press Center — Parking: 2,500 places. (annually) 20 thousand sq.m. ● ● Distance to the city center: 30 km. ● 4 conference rooms: e. Russia — ASEAN Summit (2016) LEADING INDUSTRIES Agriculture Wine Resorts and Industrial Information industry tourism complex Technology PLANNING YOUR VISIT THE MOST VIVID WEATHER IMPRESSIONS Accessibility Take a ride in the Olympic Park with Season Average International airports of federal a golf cart, bike or segway. -

Joint Stock Company National Radiotechnical Bureau

Address: 64 building 2, Leningradskoe shosse, Moscow, 125565 Phone / fax: +7 (495) 748 3187 E-mail: [email protected] www.nrtb.ru Joint Stock Company Joint Stock Company National National RadioTechnical Bureau RadioTechnical Bureau The National RadioTechnical Bureau (NRTB) was established in 2000 to conduct work to ensure electromagnetic compatibility (EMC) of cellular networks of GSM standard and navigation systems of state aviation. Today NRTB is a multi-profile enterprise, developer and supplier of complex solutions in the field of development of cellular networks of the third, fourth and fifth generations, radio relay communication, digital Member of the Radio Sector (ITU-R) Corporate Member Member of the Association television and optimization of radio frequency resource use. The of the International Telecommunication Union - of Russian Academy "Financial and Business Association of UN specialized agency of Natural Sciences Euro-Asian Cooperation» enterprise actively participates in works on creation of means of air navigation, the automated control systems, complex systems test support complexes, IT-projects of various orientation. NRTB is a member of the Radiocommunication Sector of the International Telecommunication Union (ITU-R), Financial and Business Association of Euro-Asian Cooperation, has the status of a Collective Member of the Russian Academy of Natural Sciences. The company has all necessary licenses to carry out the work. There is a Federal security service FSTEC License for activities License of the Ministry of Industry License -

Social & Behavioural Sciences SCTCMG 2018 International Scientific Conference «Social and Cultural Transformations In

The European Proceedings of Social & Behavioural Sciences EpSBS Future Academy ISSN: 2357-1330 https://dx.doi.org/10.15405/epsbs.2019.03.02.196 SCTCMG 2018 International Scientific Conference «Social and Cultural Transformations in the Context of Modern Globalism» REGIONAL SOCIAL POLITICAL TRANSFORMATIONS IN SOUTH OF RUSSIA I.V. Yurchenko (a)*, V.M. Yurchenko (b), M.V. Dontsova (c), N.N. Yurchenko (d). *Corresponding author (a) Federal Research Centre the Southern Scientific Centre of the RAS (FRC SSC RAN), 41, Chekhov avenue, Rostov-on-Don, Russia, (b) Kuban State University, 149, Stavropolskaya st., Krasnodar, Russia (c) Federal Research Centre the Southern Scientific Centre of the RAS (FRC SSC RAN), 41, Chekhov avenue, Rostov-on-Don, Russia, (d) Kuban State University, 149, Stavropolskaya st., Krasnodar, Russia, Abstract Transformation processes in regions of southern Russia during social political changes in the post- Soviet period are analyzed. Challenges of modern globalization against the background of a new world order formation in the context of the emerging problems in the social economic development of individual subjects of the Southern Federal District are considered. Special attention is paid to factors of the political regime stability and threats of the situation destabilization under the influence of external and internal social political transformations in politics and economics. It is emphasized that problems of inter-ethnic relations within the region, ethnic factors that form a significant conflict potential associated with contradictions of a territorial, value and social economic nature play an important role in these processes. As an empirical base, data from an expert survey conducted by the authors in the Krasnodar Territory from May to September 2018, materials from earlier sociological studies are used.