Domestic and Global Commissions Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2010 Employment Report Career Management Center Visit the Career Management Center Online At

2010 Employment Report Career ManageMent Center Visit the Career Management Center online at www.gsb.columbia.edu/recruiters. Post positions online at www.gsb.columbia.edu/jobpost. reCruItIng at CoLumbia Business schooL Columbia Business School students continue to distinguish themselves with their ability to be nimble and flexible during a shifting economic and hiring landscape. employers report that Columbia MBas have the right mix of tangible business skills and social intelligence—enduring assets for any organization. the School’s focus on educating versatile business leaders who can excel in any environment is proven by a curriculum that bridges academic theory and real-world practice through initiatives like Columbia CaseWorks and the Master Class Program. the School’s cluster system and learning teams, as well as the Program on Social Intelligence, foster a team-oriented work ethic and an entrepreneurial mindset that makes creating and capturing opportunity instinctual. Students are able to add value to a wide range of organizations on day one, and the School’s extraordinary network of alumni, global business partners, and faculty members, along with its seamless integration with new York City, makes Columbia Business School stand out among its peers. the Career Management Center (CMC) works with hiring organizations across the public, private, and nonprofit sectors to develop effective and efficient recruiting strategies. recruiters can get to know the School’s talented students in a variety of ways, such as on-campus job fairs, prerecruiting functions, drop-in sessions, interviews, and educational presentations with student clubs, among other opportunities. Companies can also collaborate with the CMC to interview students closer to the time of hiring on an as-needed basis. -

In a Year of Contraction, Asia Feels the Ripple Effect of Mifid II 2016 Greenwich Leaders: Asian Equities

In a Year of Contraction, Asia Feels the Ripple Effect of MiFID II 2016 Greenwich Leaders: Asian Equities Q1 2017 Three global brokers are pulling away from the pack in the Asian equity research/advisory business—a break from historical patterns characterized by a more gradual slope among major competitors. Credit Suisse, Bank of America Merrill Lynch and Morgan Stanley are statistically deadlocked atop the list of 2016 Greenwich Leaders in Asian Equity Research/Advisory Vote Share. These three firms have opened a significant lead over UBS, CLSA Asia-Pacific Markets and J.P. Morgan, which are also virtually tied in terms of vote share and round out the list of this year’s winners. In Asian Equity Trading, the same three firms are statistically tied for the top spot in overall share, but in this business, their lead over fellow Greenwich Share Leaders CLSA, UBS and Citi is much narrower. In the growing algorithmic trading business, Bank of America Merrill Lynch widened its lead over the competition. Credit Suisse and Morgan Stanley claim the title of 2016 Greenwich Quality Leaders in Asian Equity Research Product & Analyst Service, and Greenwich Share Leaders — 2016 GREENWICH ASSOCIATES Greenwich Share20 1Leade6r Asian Equity Research/Advisory Vote Share Asian Equity Algorithmic Trading Share Broker Statistical Rank Broker Statistical Rank Credit Suisse 1T Bank of America Merrill Lynch 1 Bank of America Merrill Lynch 1T UBS 2T Morgan Stanley 1T Morgan Stanley 2T UBS 4T Credit Suisse 2T CLSA Asia-Pacific Markets 4T Goldman Sachs 5T J.P. Morgan 4T Citi 5T ITG 5T Asian Equity Trading Share, Options & Volatility Product Important Relationships—Asia Broker Statistical Rank* Broker Statistical Rank Morgan Stanley 1T Morgan Stanley 1T Bank of America Merrill Lynch 1T Goldman Sachs 1T Credit Suisse 1T Bank of America Merrill Lynch 3T CLSA Asia-Pacific Markets 4T Deutsche Bank 3T UBS 4T J.P. -

Domestic and Global Commissions Report

Kentucky Retirement Systems Domestic and Global Commissions Report Quarter Ending: March 31, 2015 Kentucky Retirement Systems Domestic Equity - Common Stock Commissions Quarter Ended March 31, 2015 Broker/Account Shares Traded Commission Value of Trade Per Share % Cost of Trade ANCORA SECURITIES INC, JERSEY CITY 880 31 30,354 0.0350 0.1015% ASCENDIANT CAPITAL MARKETS, LLC, IRVINE 84,300 3,372 3,014,254 0.0400 0.1119% BAIRD, ROBERT W & CO INC, MILWAUKEE 98,265 3,359 4,322,425 0.0342 0.0777% BARCLAYS CAPITAL INC, JERSEY CITY 9,581 240 911,504 0.0250 0.0263% BARCLAYS CAPITAL LE, JERSEY CITY 1,362,283 138,958 65,135,774 0.1020 0.2133% BERNSTEIN SANFORD C & CO, NEW YORK 22,805 707 1,631,259 0.0310 0.0433% BMO CAPITAL MARKETS CORP, NEW YORK 3,725 112 139,954 0.0300 0.0798% BNY CONVERGEX, NEW YORK 21,920 718 737,082 0.0327 0.0974% BTIG LLC, SAN FRANCISCO 307,904 5,283 11,727,888 0.0172 0.0450% BUCKINGHAM RESEARCH GRP INC, BROOKLYN 18,990 573 710,704 0.0302 0.0806% CANACCORD GENUITY INC.NEY YORK 7,160 286 517,934 0.0400 0.0553% CITIGROUP GBL MKTS INC, NEW YORK 152,792 3,643 6,393,940 0.0238 0.0570% CITIGROUP GBL MKTS/SALOMON, NEW YORK 930,089 2,464 1,658,458 0.0026 0.1486% COWEN AND COMPANY LLC, NEW YORK 52,300 1,797 2,029,962 0.0344 0.0885% CRAIG HALLUM, MINNEAPOLIS 25,300 759 545,021 0.0300 0.1393% CREDIT SUISSE, NEW YORK (CSUS) 790,960 10,056 43,534,436 0.0127 0.0231% DEUTSCHE BK SECS INC, NY (NWSCUS33) 150,720 4,097 3,910,883 0.0272 0.1048% DOWLING & PARTNERS, JERSEY CITY 26,300 1,052 2,381,174 0.0400 0.0442% FBR CAPITAL MARKETS & CO, ARLINGTON -

Espinal, Et Al. V. Didi Global Inc., Et Al. 21-CV-05807-U.S. District Court

Espinal v. Didi Global Inc. et al, Docket No. 1:21-cv-05807 (S.D.N.Y. Jul 06, 2021), Court Docket Current on Bloomberg Law as of 2021-07-08 13:03:33 U.S. District Court Southern District of New York (Foley Square) CIVIL DOCKET FOR CASE #: 1:21-cv-05807-LAK Espinal v. Didi Global Inc. et al Date Filed: Jul 6, 2021 Nature of suit: 850 Securities/ Commodities Assigned to: Judge Lewis A. Kaplan Cause: 15:77 Securities Fraud Jurisdiction: Federal Question Jury demand: Plaintiff Parties and Attorneys Plaintiff Rafaela Espinal individually and on behalf of all others similarly situated Representation Gregory Bradley Linkh Glancy Prongay & Murray LLP 230 Park Avenue Suite 358 New York, NY 10169 (212) 682-5340 [email protected] ATTORNEY TO BE NOTICED Defendant Didi Global Inc. formerly known as: Xiaoju Kuaizhi Inc. Defendant Will Wei Cheng © 2021 The Bureau of National Affairs, Inc. All Rights Reserved. Terms of Service // PAGE 1 Espinal v. Didi Global Inc. et al, Docket No. 1:21-cv-05807 (S.D.N.Y. Jul 06, 2021), Court Docket Defendant Alan Yue Zhuo Defendant Jean Qing Liu Defendant Stephen Jingshi Zhu Defendant Zhiyi Chen Defendant Martin Chi Ping Lau Defendant Kentaro Matsui Defendant Adria Perica Defendant Daniel Yong Zhang Defendant Goldman Sachs (ASIA) L.L.C. Defendant Morgan Stanley & Co. LLC Defendant J.P. Morgan Securities LLC Defendant Bofa Securities, Inc. Defendant Barclays Capital Inc. Defendant China Renaissance Securities (Hong Kong) Limited Defendant China International Capital Corporation Hong Kong Securities Limited © 2021 The Bureau of National Affairs, Inc. -

Landscape Portrait

CLSA (UK) ORDER EXECUTION POLICY 1 General Information about this Policy 1.1 Background CLSA UK (“CLSA”) provides general broker dealer and other ancillary services to its clients. It is authorised and regulated by the Financial Conduct Authority of the United Kingdom (the "FCA") and is an investment firm subject to the requirements of the rules of the FCA (the “FCA Rules”) that implement the Markets in Financial Instruments Directive 2014/65/EU ("MiFID II"). CLSA executes orders in relation to financial instruments on behalf of its clients. There are two methods that it can use to execute those orders that are distinguished for the purposes of the FCA Rules. (A) First, CLSA can execute the relevant transaction on behalf of the client directly with a counterparty or on an exchange or other trading system (e.g., by dealing directly with a market maker on a “request for quote” basis). The counterparty, exchange or trading system with which CLSA chooses to execute such a transaction is referred to in this policy as an “Execution Venue”. In accordance with the FCA Rules, an Execution Venue can include an EEA regulated market, or other exchange, a multilateral trading facility, organised trading facility, a systematic internaliser, a market maker or other liquidity provider or non-EEA entity performing similar functions to the Execution Venues listed above. (B) Secondly, CLSA can place an order as agent with a third party (e.g., another broker or investment bank) and/or any of its affiliates for that third party or affiliate to execute on behalf of the client. -

China 2025 16

China | Equity Strategy China 14 December 2014 EQUITY RESEARCH China The Year of the Ram: Stars Aligned for a Historic Bull Run Key Takeaway The Ram, the Bull and the Heavenly Twins – the stars are now aligned for China’s historic bull-run. China's stock market offers massive untapped potential given the high savings rate and low penetration. “Keeping Growth Steady” is a top priority for 2015; we expect SHCOMP and HSCEI to test 4,050 and 15,420, up 38% and 37% from current levels. As confidence gains momentum, volatility becomes the investors’ best friend. CHINA China Gallops into a Historic Bull Run. On Nov 20, 2013, we wrote “The Year of the Horse will see China unleash its full potential, as President Xi ushers in a new era of profound change.” “We expect capital markets to gradually gain confidence in China’s ability to drive fundamental reforms and expect Chinese stocks to enter a historic multi-year bull run.” Indeed, 2014 has been a remarkable year. As of Dec.12, SHCOMP surged 39% to 2938, breaking a seven-year bearish trend to become the best performing index in the world. China Stock Market: Massive Untapped Potential. According to China Household Finance Survey, property accounted for 66.4% of total Chinese household assets in 2013. Financial assets accounted for a mere 10.1% of household wealth. While over 61% of Chinese families have bank deposits, only 6.5% of them invested in the stock market. Given China’s high savings rate and low stock market penetration, we believe the A-share market offers significant upside potential. -

Fees – for Plan Related Accounts That Do Not Indicate a Specific Outsid

March 23, 2017 ADP Inc. Re: Form 5500 Schedule C Information To Whom It May Concern: This correspondence is in response to your request dated January 13, 2017, regarding the Form 5500 Schedule C reporting requirements created by regulations issued by the Department of Labor (“DOL”) and its instructions and related guidance (“Schedule C”). We’ve been asked to provide certain information regarding direct or indirect compensation received by our mutual funds and affiliates or paid by our mutual funds to third parties in connection with the investment by the retirement plan clients of ADP Inc. (“Plan”) in our mutual funds for the Plan’s year ended 2016. As an initial matter, please note that the information contained in this response relates solely to reportable compensation, for purposes of Schedule C, received by Morgan Stanley Investment Management Inc. and its affiliated mutual fund service providers (“MSIM”) but does not purport to report compensation for third parties or for any banks or broker dealers that may be affiliated with MSIM. While we are happy to help coordinate inquiries to any other service provider for which the Plan may wish our assistance in contacting, please note we view the reporting of compensation received by such other entities to be beyond the scope of what MSIM is legally obligated to report for Schedule C purposes (as MSIM is not the ultimate recipient of such compensation). For direct or indirect compensation received by MSIM related to the Plan, we intend that all such compensation, as described as follows, is within the definition of Eligible Indirect Compensation (“EIC”) under Schedule C: • Management Fees – Morgan Stanley Investment Management Inc. -

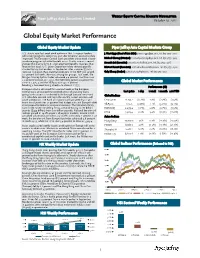

Gl B L E It M K T P F Global Equity Market Performance

Weekly Equity Capital Markets Newsletter Piper Jaffray Asia Securities Limited October 10, 2011 Glo ba l Equit y Mark et Per formance Global Equity Market Update Piper Jaffray Asia Capital Markets Group U.S. stocks rose last week amid optimism that European leaders J. West Riggs (Head of Asia ECM), [email protected], Tel: 852 3755 - 2333 will tame the region’s debt crisis and after American economic data improved. The European Central Bank president announced a bond- Michael Cheung (Principal), [email protected], Tel: 852 3755 - 2323 purchase program to tackle the debt crisis. Stocks rose as a report Amanda Lui (Associate), [email protected], Tel: 852 3755 - 2318 showed that claims for U.S. unemployment benefits rose less than ftforecast ltlast week. USU.S. LbLabor DttDepartment dtdata shdhowed payrolls Michlhael Bassett (Associate), michlhael.w. [email protected], Tel: 852 3755 -2322 climbed by 103,000 workers in September after a revised 57,000 increase in August. Raw-material producers in the S&P 500 surged Gaby Zhang (Analyst), [email protected], Tel: 852 3755 - 2321 6.2 percent last week, the most among ten groups. Last week, the Morgan Stanley Cyclical Index advanced 4.4 percent, the Dow rose 1.7 percent to close at 11,103.1, the NASDAQ gained 2.6 percent to close at 2,479.4 and the S&P500 was up 2.1 percent— Global Market Performance breaking a two-week losing streak—to close at 1,155.5. Performance (%) European stocks advanced for a second week as the European Central Bank announced the reintroduction of year-long loans— Last price 1 day 1 week 1 month 2011YTD giving banks access to unlimited cash through January 2013—and Global Indices U.S. -

Wanda Woo PARTNER

Wanda Woo PARTNER Corporate Hong Kong [email protected] 852-39724963 FOCUS AREAS HIGHLIGHTS Capital Markets Experienced Hong Kong Capital Markets Practitioner Wanda advises on IPOs, share placings, rights offerings, bond offerings, and other corporate Corporate compliance work associated with the Stock Exchange of Hong Kong and the Hong Kong Greater China Securities and Futures Commission. Mergers & Acquisitions Represents Leading Investment Banks Private Equity Wanda works with top-tier investment banks such as Morgan Stanley, Bank of America Merrill Lynch, CICC, Citi, and JP Morgan. A Recognized Practitioner Wanda has been recognized as a leading capital markets attorney by The Legal 500 Asia Pacific. EXPERIENCE Wanda Woo is a partner in the Hong Kong office of Wilson Sonsini Goodrich & Rosati, where she focuses on Hong Kong capital markets transactions, including initial public offerings, share placings, rights offerings, bond offerings, and other corporate compliance work associated with the Stock Exchange of Hong Kong and the Hong Kong Securities and Futures Commission. Wanda has extensive experience advising issuers and underwriters in these transactions, counseling clients on HKSE listing rules, and working with top-tier investment banks such as Morgan Stanley, Bank of America Merrill Lynch, CICC, Citi, and JP Morgan. She began her career with a magic-circle firm and worked at two leading international law firms before joining WSGR. Wanda speaks Cantonese, English, and Mandarin. CREDENTIALS Education Postgraduate Certificate in Laws, City University of Hong Kong, 2008 LL.B., University of London, 2006 B.A., Economics and English, The University of British Columbia, 2002 Associations and Memberships Member, Hong Kong Law Society Honors Copyright © 2021 Wilson Sonsini Goodrich & Rosati. -

Ellenoff Grossman & Schole

Ellenoff Grossman & Schole LLP Representative SPAC Initial Public Offering Transactions Areas of Practice Include: Far Point Acquisition Corp. Trinity Merger Corp. Fintech Acquisition Corp. III CORPORATE AND (NYSE:FPAC) (NASDAQ:TMCXU) (NASDAQ:FTAC) SECURITIES $632,500,000 $345,00,000 $345,000,000 PUBLIC OFFERING Credit Suisse and BofA Merrill Lynch B.Riley, FBR, Inc. Cantor Fitzgerald acted as joint book-running managers acted as the sole book-running manager acted as joint book-running managers in an initial public offering in an initial public offering in an initial public offering PRIVATE EQUITY/ VENTURE CAPITAL June 14, 2018 May 15, 2018 January 16, 2018 EG&S acted as counsel to Far Point EG&S acted as counsel to the underwriter EG&S acted as counsel to Fintech MERGERS AND ACQUISITIONS PRIVATE Nebula Acquisition Corp. CF Finance Acquisition Corp. (NASDAQ:CFFAU) Thunder Bridge Acquisition Ltd. INVESTMENT FUNDS (NASDAQ:NEBU.U) (NASDAQ:TBRGU) $225,000,000 $275,000,000 $258,000,00000 REAL ESTATE DEVELOPMENT & Deutsche Bank Securities and Cantor Fitzgerald & Co. Cantor Fitzgerald & Co. FINANCE Goldman Sachs & Co. LLC acted as the sole book-running manager acted as joint book-running managers acted as the sole book-running manager in an initial public offering in an initial public offering in an initial public offering COMMERCIAL LEASING January 16, 2018 December 12, 2018 June 21, 2018 EG&S acted as counsel to Nebula EG&S acted as counsel to CF Financey EG&S acted as counsel to Thunder Bridge BROKER-DEALER REGULATION INTERNATIONAL AND 1345 Avenue of the Americas New York, NY 10105-0302 DOMESTIC TAX phone (212) 370-1300 fax (212) 370-7889 www.egsllp.com Ellenoff Grossman & Schole LLP Representative SPAC Initial Public Offering Transactions Areas of Practice Include: . -

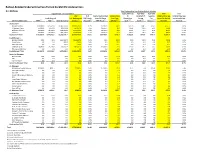

Bailout-Related Underwriting Fees Earned by GM IPO Underwriters

Bailout-Related Underwriting Fees Earned by GM IPO Underwriters $ in Millions Total Underwriting Fees Paid for Bailout Activities: Support from U.S. Government Equity Offerings TLGP Debt TLGP Debt Total % of Total % of Equity, Equity-Linked Underwriting to on Behalf of Issuance Underwriting Fees Underwriting Fees Funds Received U.S. Government TARP Funds Issued to Repay Fees from Recapitalize Issuing for Earned on Bailout Earned on Bailout GM IPO Underwriters TARP (1) TLGP (2) Other Borrowing Support(3) Received(4) TARP Funds(5) GM IPO(6)(7) Itself (5)(7) Bank (5)(7) Others (5)(7) Activities Activities Bookrunners Morgan Stanley $10,000.0 $25,075.0 $1,877,550.0 $1,912,625.0 1.4% $6,923.0 $36.9 $125.0 $68.5 $26.1 $256.5 8.3% JP Morgan Chase 25,000.0 39,679.0 898,442.8 963,121.8 3.6% 16,505.5 36.9 425.2 107.8 22.9 592.8 19.2% BofA Merrill Lynch 45,000.0 44,500.0 2,036,494.9 2,125,994.9 6.4% 36,200.0 22.5 690.3 73.9 67.6 854.2 27.7% Citigroup 50,000.0 64,600.0 1,642,169.0 1,756,769.0 7.1% 29,162.0 22.5 603.5 86.6 80.2 792.8 25.7% Bookrunners Total $130,000.0 $173,854.0 $6,454,656.7 $6,758,510.7 18.6% $88,790.5 $118.7 $1,844.0 $336.8 $196.7 $2,496.3 80.9% Lead Managers Barclays Capital $0.0 $0.0 $410,437.0 $410,437.0 0.0% $0.0 $22.5 $0.0 $0.0 $8.4 $30.9 1.0% Credit Suisse 0.0 0.0 1,500.0 1,500.0 0.0% 0.0 22.5 0.0 0.0 0.0 22.5 0.7% Deutsche Bank 0.0 0.0 500.0 500.0 0.0% 0.0 22.5 0.0 0.0 0.0 22.5 0.7% Goldman Sachs 10,000.0 21,235.0 558,072.5 589,307.5 1.4% 11,500.0 22.5 317.0 24.7 29.2 393.3 12.7% RBC Capital Markets 0.0 0.0 0.0 0.0 0.0% 0.0 -

On Page 3 and Important Disclosures Beginning on Page 4 1

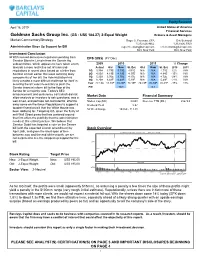

Equity Research April 16, 2010 United States of America Financial Services Goldman Sachs Group Inc. (GS - US$ 184.27) 2-Equal Weight Brokers & Asset Managers Market Commentary/Strategy Roger A. Freeman, CFA Eric Bertrand 1.212.526.4662 1.212.526.1369 Administration Steps Up Support for Bill [email protected] [email protected] BCI, New York BCI, New York Investment Conclusion With revised derivatives legislation pending from EPS (US$) (FY Dec) Senator Blanche Lincoln from the Senate Ag subcommittee, which appears to have taken a turn 2009 2010 2011 % Change towards a more restrictive set of rules and Actual Old New St. Est. Old New St. Est. 2010 2011 regulations in recent days based on a letter from 1Q 3.39A 3.79E 3.79E 4.01E N/A N/A 4.71E 12% N/A Senator Lincoln earlier this week outlining likely 2Q 4.93A 4.19E 4.19E 4.37E N/A N/A 4.94E -15% N/A components of her bill, the Administration has 3Q 5.25A 3.76E 3.76E 4.17E N/A N/A 4.72E -28% N/A likely created a more difficult challenge for itself in 4Q 8.20A 6.48E 6.48E 5.39E N/A N/A 5.49E -21% N/A securing the 60 votes necessary to push the Year 22.13A 18.28E 18.28E 18.15E 20.23E 20.23E 20.31E -17% 11% Senate financial reform bill to the floor of the P/E 10.1 9.1 Senate for a majority vote.