Top 50 Banking Employers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2010 Employment Report Career Management Center Visit the Career Management Center Online At

2010 Employment Report Career ManageMent Center Visit the Career Management Center online at www.gsb.columbia.edu/recruiters. Post positions online at www.gsb.columbia.edu/jobpost. reCruItIng at CoLumbia Business schooL Columbia Business School students continue to distinguish themselves with their ability to be nimble and flexible during a shifting economic and hiring landscape. employers report that Columbia MBas have the right mix of tangible business skills and social intelligence—enduring assets for any organization. the School’s focus on educating versatile business leaders who can excel in any environment is proven by a curriculum that bridges academic theory and real-world practice through initiatives like Columbia CaseWorks and the Master Class Program. the School’s cluster system and learning teams, as well as the Program on Social Intelligence, foster a team-oriented work ethic and an entrepreneurial mindset that makes creating and capturing opportunity instinctual. Students are able to add value to a wide range of organizations on day one, and the School’s extraordinary network of alumni, global business partners, and faculty members, along with its seamless integration with new York City, makes Columbia Business School stand out among its peers. the Career Management Center (CMC) works with hiring organizations across the public, private, and nonprofit sectors to develop effective and efficient recruiting strategies. recruiters can get to know the School’s talented students in a variety of ways, such as on-campus job fairs, prerecruiting functions, drop-in sessions, interviews, and educational presentations with student clubs, among other opportunities. Companies can also collaborate with the CMC to interview students closer to the time of hiring on an as-needed basis. -

2017 ANNUAL REPORT 2017 Annual Report Table of Contents the Michael J

Roadmaps for Progress 2017 ANNUAL REPORT 2017 Annual Report Table of Contents The Michael J. Fox Foundation is dedicated to finding a cure for 2 A Note from Michael Parkinson’s disease through an 4 Annual Letter from the CEO and the Co-Founder aggressively funded research agenda 6 Roadmaps for Progress and to ensuring the development of 8 2017 in Photos improved therapies for those living 10 2017 Donor Listing 16 Legacy Circle with Parkinson’s today. 18 Industry Partners 26 Corporate Gifts 32 Tributees 36 Recurring Gifts 39 Team Fox 40 Team Fox Lifetime MVPs 46 The MJFF Signature Series 47 Team Fox in Photos 48 Financial Highlights 54 Credits 55 Boards and Councils Milestone Markers Throughout the book, look for stories of some of the dedicated Michael J. Fox Foundation community members whose generosity and collaboration are moving us forward. 1 The Michael J. Fox Foundation 2017 Annual Report “What matters most isn’t getting diagnosed with Parkinson’s, it’s A Note from what you do next. Michael J. Fox The choices we make after we’re diagnosed Dear Friend, can open doors to One of the great gifts of my life is that I've been in a position to take my experience with Parkinson's and combine it with the perspectives and expertise of others to accelerate possibilities you’d improved treatments and a cure. never imagine.’’ In 2017, thanks to your generosity and fierce belief in our shared mission, we moved closer to this goal than ever before. For helping us put breakthroughs within reach — thank you. -

(A) Bond Plaintiffs' Motion

Case 1:08-cv-09522-SHS Document 160 Filed 06/07/13 Page 1 of 89 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK IN RE CITIGROUP INC. BOND LITIGATION Master File No. 08 Civ. 9522 (SHS) ECF Case DECLARATION OF STEVEN B. SINGER IN SUPPORT OF: (I) BOND PLAINTIFFS’ MOTION FOR FINAL APPROVAL OF CLASS ACTION SETTLEMENT AND PLAN OF ALLOCATION, AND (II) BOND COUNSEL’S MOTION FOR AN AWARD OF ATTORNEYS’ FEES AND REIMBURSEMENT OF LITIGATION EXPENSES Case 1:08-cv-09522-SHS Document 160 Filed 06/07/13 Page 2 of 89 TABLE OF CONTENTS I. INTRODUCTION .............................................................................................................. 1 II. PROSECUTION OF THE ACTION .................................................................................. 4 A. Bond Counsel’s Efforts to Identify and Preserve the Claims of Investors in Citigroup’s Bonds and Preferred Stock .................................................................. 4 B. Preparation of the Consolidated Amended Class Action Complaint, and Summary of the Claims Asserted ........................................................................... 6 C. The Citigroup Defendants’ and the Underwriter Defendants’ Extensive Motions to Dismiss ............................................................................................... 12 D. The Court’s Opinions Largely Denying Defendants’ Motions to Dismiss, and Denying Defendants’ Motion for Reconsideration ........................................ 15 E. Bond Plaintiffs Conduct Extensive Discovery and Motion Practice -

Annual Report 2018

2018Annual Report Annual Report July 1, 2017–June 30, 2018 Council on Foreign Relations 58 East 68th Street, New York, NY 10065 tel 212.434.9400 1777 F Street, NW, Washington, DC 20006 tel 202.509.8400 www.cfr.org [email protected] OFFICERS DIRECTORS David M. Rubenstein Term Expiring 2019 Term Expiring 2022 Chairman David G. Bradley Sylvia Mathews Burwell Blair Effron Blair Effron Ash Carter Vice Chairman Susan Hockfield James P. Gorman Jami Miscik Donna J. Hrinak Laurene Powell Jobs Vice Chairman James G. Stavridis David M. Rubenstein Richard N. Haass Vin Weber Margaret G. Warner President Daniel H. Yergin Fareed Zakaria Keith Olson Term Expiring 2020 Term Expiring 2023 Executive Vice President, John P. Abizaid Kenneth I. Chenault Chief Financial Officer, and Treasurer Mary McInnis Boies Laurence D. Fink James M. Lindsay Timothy F. Geithner Stephen C. Freidheim Senior Vice President, Director of Studies, Stephen J. Hadley Margaret (Peggy) Hamburg and Maurice R. Greenberg Chair James Manyika Charles Phillips Jami Miscik Cecilia Elena Rouse Nancy D. Bodurtha Richard L. Plepler Frances Fragos Townsend Vice President, Meetings and Membership Term Expiring 2021 Irina A. Faskianos Vice President, National Program Tony Coles Richard N. Haass, ex officio and Outreach David M. Cote Steven A. Denning Suzanne E. Helm William H. McRaven Vice President, Philanthropy and Janet A. Napolitano Corporate Relations Eduardo J. Padrón Jan Mowder Hughes John Paulson Vice President, Human Resources and Administration Caroline Netchvolodoff OFFICERS AND DIRECTORS, Vice President, Education EMERITUS & HONORARY Shannon K. O’Neil Madeleine K. Albright Maurice R. Greenberg Vice President and Deputy Director of Studies Director Emerita Honorary Vice Chairman Lisa Shields Martin S. -

Board of Directors

Board of directors Sir David Clementi Mark Tucker Philip Broadley Tidjane Thiam Chairman Group Chief Executive Group Finance Director Chief Financial Officer Clark Manning Michael McLintock Nick Prettejohn Barry Stowe Executive director Executive director Executive director Executive director Sir Winfried Bischoff Keki Dadiseth Michael Garrett Ann Godbehere Non-executive director Non-executive director Non-executive director Non-executive director Bridget Macaskill Kathleen O’Donovan James Ross Lord Turnbull Non-executive director Non-executive director Non-executive director Non-executive director 86 Prudential plc Annual Report 2007 Chairman Clark Manning FSA MAAA Executive director Sir David Clementi FCA MBA Clark Manning has been an executive director of Prudential since January Chairman and Chairman of the Nomination Committee 2002. He is also President and Chief Executive Officer of Jackson National Sir David Clementi has been Chairman of Prudential since December Life. He was previously Chief Operating Officer, Senior Vice President and 2002. In 2005, Sir David was appointed as President of the Investment Chief Actuary of Jackson National Life, which he joined in 1995. Prior to Property Forum. In 2003, he joined the Financial Services Authority's that, he was Senior Vice President and Chief Actuary for SunAmerica Inc, Financial Capability Steering Group, and was appointed by the Secretary and prior to that Consulting Actuary at Milliman & Robertson Inc. Clark of State for Constitutional Affairs to carry out a review of the regulation of has more than 25 years' experience in the life insurance industry, and legal services in England and Wales, which was completed in 2004. Since holds both a bachelor's degree in actuarial science and an MBA from the 2003, he has been a non-executive director of Rio Tinto plc. -

Lilly Eli & Co

LILLY ELI & CO FORM 10-K (Annual Report) Filed 02/22/10 for the Period Ending 12/31/09 Address LILLY CORPORATE CTR DROP CODE 1112 For inspection purposes only. INDIANAPOLIS,Consent of copyright owner IN required 46285 for any other use. Telephone 3172762000 CIK 0000059478 Symbol LLY SIC Code 2834 - Pharmaceutical Preparations Industry Major Drugs Sector Healthcare Fiscal Year 12/31 http://www.edgar-online.com © Copyright 2010, EDGAR Online, Inc. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use. EPA Export 26-07-2013:18:49:24 United States Securities and Exchange Commission Washington, D.C. 20549 Form 10-K Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2009 Commission file number 001-06351 Eli Lilly and Company An Indiana corporation I.R.S. employer identification no. 35-0470950 Lilly Corporate Center, Indianapolis, Indiana 46285 (317) 276-2000 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange On Which Registered Common Stock (no par value) New York Stock Exchange 6.57% Notes Due January 1, 2016 New York Stock Exchange 7 1 / 8 % Notes Due June 1, 2025 New York Stock Exchange 6.77% Notes Due January 1, 2036 New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

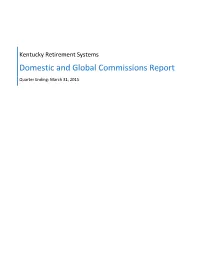

Domestic and Global Commissions Report

Kentucky Retirement Systems Domestic and Global Commissions Report Quarter Ending: March 31, 2015 Kentucky Retirement Systems Domestic Equity - Common Stock Commissions Quarter Ended March 31, 2015 Broker/Account Shares Traded Commission Value of Trade Per Share % Cost of Trade ANCORA SECURITIES INC, JERSEY CITY 880 31 30,354 0.0350 0.1015% ASCENDIANT CAPITAL MARKETS, LLC, IRVINE 84,300 3,372 3,014,254 0.0400 0.1119% BAIRD, ROBERT W & CO INC, MILWAUKEE 98,265 3,359 4,322,425 0.0342 0.0777% BARCLAYS CAPITAL INC, JERSEY CITY 9,581 240 911,504 0.0250 0.0263% BARCLAYS CAPITAL LE, JERSEY CITY 1,362,283 138,958 65,135,774 0.1020 0.2133% BERNSTEIN SANFORD C & CO, NEW YORK 22,805 707 1,631,259 0.0310 0.0433% BMO CAPITAL MARKETS CORP, NEW YORK 3,725 112 139,954 0.0300 0.0798% BNY CONVERGEX, NEW YORK 21,920 718 737,082 0.0327 0.0974% BTIG LLC, SAN FRANCISCO 307,904 5,283 11,727,888 0.0172 0.0450% BUCKINGHAM RESEARCH GRP INC, BROOKLYN 18,990 573 710,704 0.0302 0.0806% CANACCORD GENUITY INC.NEY YORK 7,160 286 517,934 0.0400 0.0553% CITIGROUP GBL MKTS INC, NEW YORK 152,792 3,643 6,393,940 0.0238 0.0570% CITIGROUP GBL MKTS/SALOMON, NEW YORK 930,089 2,464 1,658,458 0.0026 0.1486% COWEN AND COMPANY LLC, NEW YORK 52,300 1,797 2,029,962 0.0344 0.0885% CRAIG HALLUM, MINNEAPOLIS 25,300 759 545,021 0.0300 0.1393% CREDIT SUISSE, NEW YORK (CSUS) 790,960 10,056 43,534,436 0.0127 0.0231% DEUTSCHE BK SECS INC, NY (NWSCUS33) 150,720 4,097 3,910,883 0.0272 0.1048% DOWLING & PARTNERS, JERSEY CITY 26,300 1,052 2,381,174 0.0400 0.0442% FBR CAPITAL MARKETS & CO, ARLINGTON -

Robert Rubin on the Job He Never Wanted the Reluctant Chairman Tells

Robert Rubin on the job he never wanted The reluctant chairman tells Fortune's Carol Loomis why Citi didn't see the subprime mess coming. By Carol Loomis, Fortune senior editor at large Fortune Magazine, November 2007 Rubin on his role: "I tried to help people as they thought their way through this." When the new chairman of Citigroup, Robert Rubin, is asked why he was so tenacious and outspoken in supporting the chairman who just left, Charles "Chuck" Prince, Rubin delivers a typically introspective answer: "People are what they are, and that's what I am." Besides, he asserts, Prince deserved to stay: "He was doing what was right and what needed to be done." Citi's write-downs: What did it know, and when did it know it? Rubin, 69, goes on to recall that he similarly supported Larry Summers in 2006 when the Harvard president was about to be forced out and that he also defended President Clinton in September 1998 during the bonfire days of the Monica Lewinsky affair. Just after prosecutor Kenneth Starr submitted his inflammatory report to Congress, Secretary of the Treasury Rubin declared on Tom Brokaw's NBC Nightly News that, regardless of the obvious problems, he believed Clinton to be doing "a very good job" as President. An extreme irony in all this is that it is Rubin who could right now use a Rubinesque defender. On Sunday, Nov. 4, the same day Rubin reluctantly moved from the job of chairman of the executive committee to chairman of the board, the company announced the startling news that it had $55 billion of collateralized debt obligations (CDOs) and other subprime-related securities on its balance sheet and that large write-offs of an estimated $8 billion to $11 billion were imminent. -

Notice of AGM 2013

THIS DOCUMENT C M IS IMPORTANT AND Y K REQUIRES YOUR PMS 356 IMMEDIATE PMS ??? JOB LOCATION: ATTENTION PRINERGY 3 DISCLAIMER Approver If you have any doubt about the action you should The accuracy and the content of this file is the responsibility of take, it is recommended that you consult your the Approver. Please authorise approval only if you stockbroker, solicitor, accountant or other professional wish to proceed to print. Communisis PMS cannot accept adviser authorised under the Financial Services and liability for errors once the file has been Markets Act 2000. printed. Printer This colour bar is produced manually all If you have sold or transferred all your ordinary shares end users must check final separations to in Lloyds Banking Group plc, please give this and verify colours before printing. the accompanying documents to the purchaser or transferee, or to the stockbroker, bank or other agent 28 March 2013 through whom the sale or transfer was made. Dear Shareholder Annual general meeting Shareholder communications I am pleased to invite you to the annual general I would like to thank our shareholders for the meeting (the “AGM”) of Lloyds Banking Group huge support you have shown for paperless plc (the “Company”) which will be held at the communications, allowing us significantly to reduce Edinburgh International Conference Centre, the amount of paper used in producing our end of The Exchange, Edinburgh EH3 8EE on Thursday year and AGM communications. 16 May 2013 at 11.00 am. In conjunction with Equiniti, you can manage The notice of AGM is set out on pages 3 to 12 of your shareholding securely online, including how this document. -

Including League Tables of Financial Advisors

An Acuris Company Finding the opportunities in mergers and acquisitions Global & Regional M&A Report 2019 Including League Tables of Financial Advisors mergermarket.com An Acuris Company Content Overview 03 Global 04 Global Private Equity 09 Europe 14 US 19 Latin America 24 Asia Pacific (excl. Japan) 29 Japan 34 Middle East & Africa 39 M&A and PE League Tables 44 Criteria & Contacts 81 mergermarket.com Mergermarket Global & Regional Global Overview 3 M&A Report 2019 Global Overview Regional M&A Comparison North America USD 1.69tn 1.5% vs. 2018 Inbound USD 295.8bn 24.4% Outbound USD 335.3bn -2.9% PMB USD 264.4bn 2.2x Latin America USD 85.9bn 12.5% vs. 2018 Inbound USD 56.9bn 61.5% Outbound USD 8.9bn 46.9% EMU USD 30.6bn 37.4% 23.1% Europe USD 770.5bn -21.9% vs. 2018 50.8% 2.3% Inbound USD 316.5bn -30.3% Outbound USD 272.1bn 28.3% PMB USD 163.6bn 8.9% MEA USD 141.2bn 102% vs. 2018 Inbound USD 49.2bn 29% Outbound USD 22.3bn -15.3% Ind. & Chem. USD 72.5bn 5.2x 4.2% 17% 2.6% APAC (ex. Japan) USD 565.3bn -22.5% vs. 2018 Inbound USD 105.7bn -14.8% Outbound USD 98.9bn -24.5% Ind. & Chem. USD 111.9bn -5.3% Japan USD 75.4bn 59.5% vs. 2018 Inbound USD 12.4bn 88.7% Global M&A USD 3.33tn -6.9% vs. 2018 Outbound USD 98.8bn -43.6% Technology USD 21.5bn 2.8x Cross-border USD 1.27tn -6.2% vs. -

Fees – for Plan Related Accounts That Do Not Indicate a Specific Outsid

March 23, 2017 ADP Inc. Re: Form 5500 Schedule C Information To Whom It May Concern: This correspondence is in response to your request dated January 13, 2017, regarding the Form 5500 Schedule C reporting requirements created by regulations issued by the Department of Labor (“DOL”) and its instructions and related guidance (“Schedule C”). We’ve been asked to provide certain information regarding direct or indirect compensation received by our mutual funds and affiliates or paid by our mutual funds to third parties in connection with the investment by the retirement plan clients of ADP Inc. (“Plan”) in our mutual funds for the Plan’s year ended 2016. As an initial matter, please note that the information contained in this response relates solely to reportable compensation, for purposes of Schedule C, received by Morgan Stanley Investment Management Inc. and its affiliated mutual fund service providers (“MSIM”) but does not purport to report compensation for third parties or for any banks or broker dealers that may be affiliated with MSIM. While we are happy to help coordinate inquiries to any other service provider for which the Plan may wish our assistance in contacting, please note we view the reporting of compensation received by such other entities to be beyond the scope of what MSIM is legally obligated to report for Schedule C purposes (as MSIM is not the ultimate recipient of such compensation). For direct or indirect compensation received by MSIM related to the Plan, we intend that all such compensation, as described as follows, is within the definition of Eligible Indirect Compensation (“EIC”) under Schedule C: • Management Fees – Morgan Stanley Investment Management Inc. -

Ellenoff Grossman & Schole

Ellenoff Grossman & Schole LLP Representative SPAC Initial Public Offering Transactions Areas of Practice Include: Far Point Acquisition Corp. Trinity Merger Corp. Fintech Acquisition Corp. III CORPORATE AND (NYSE:FPAC) (NASDAQ:TMCXU) (NASDAQ:FTAC) SECURITIES $632,500,000 $345,00,000 $345,000,000 PUBLIC OFFERING Credit Suisse and BofA Merrill Lynch B.Riley, FBR, Inc. Cantor Fitzgerald acted as joint book-running managers acted as the sole book-running manager acted as joint book-running managers in an initial public offering in an initial public offering in an initial public offering PRIVATE EQUITY/ VENTURE CAPITAL June 14, 2018 May 15, 2018 January 16, 2018 EG&S acted as counsel to Far Point EG&S acted as counsel to the underwriter EG&S acted as counsel to Fintech MERGERS AND ACQUISITIONS PRIVATE Nebula Acquisition Corp. CF Finance Acquisition Corp. (NASDAQ:CFFAU) Thunder Bridge Acquisition Ltd. INVESTMENT FUNDS (NASDAQ:NEBU.U) (NASDAQ:TBRGU) $225,000,000 $275,000,000 $258,000,00000 REAL ESTATE DEVELOPMENT & Deutsche Bank Securities and Cantor Fitzgerald & Co. Cantor Fitzgerald & Co. FINANCE Goldman Sachs & Co. LLC acted as the sole book-running manager acted as joint book-running managers acted as the sole book-running manager in an initial public offering in an initial public offering in an initial public offering COMMERCIAL LEASING January 16, 2018 December 12, 2018 June 21, 2018 EG&S acted as counsel to Nebula EG&S acted as counsel to CF Financey EG&S acted as counsel to Thunder Bridge BROKER-DEALER REGULATION INTERNATIONAL AND 1345 Avenue of the Americas New York, NY 10105-0302 DOMESTIC TAX phone (212) 370-1300 fax (212) 370-7889 www.egsllp.com Ellenoff Grossman & Schole LLP Representative SPAC Initial Public Offering Transactions Areas of Practice Include: .