Low-Cost Carriers and Low Fares: Competition and Concentration in the U.S

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

Airline Schedules

Airline Schedules This finding aid was produced using ArchivesSpace on January 08, 2019. English (eng) Describing Archives: A Content Standard Special Collections and Archives Division, History of Aviation Archives. 3020 Waterview Pkwy SP2 Suite 11.206 Richardson, Texas 75080 [email protected]. URL: https://www.utdallas.edu/library/special-collections-and-archives/ Airline Schedules Table of Contents Summary Information .................................................................................................................................... 3 Scope and Content ......................................................................................................................................... 3 Series Description .......................................................................................................................................... 4 Administrative Information ............................................................................................................................ 4 Related Materials ........................................................................................................................................... 5 Controlled Access Headings .......................................................................................................................... 5 Collection Inventory ....................................................................................................................................... 6 - Page 2 - Airline Schedules Summary Information Repository: -

Overview and Trends

9310-01 Chapter 1 10/12/99 14:48 Page 15 1 M Overview and Trends The Transportation Research Board (TRB) study committee that pro- duced Winds of Change held its final meeting in the spring of 1991. The committee had reviewed the general experience of the U.S. airline in- dustry during the more than a dozen years since legislation ended gov- ernment economic regulation of entry, pricing, and ticket distribution in the domestic market.1 The committee examined issues ranging from passenger fares and service in small communities to aviation safety and the federal government’s performance in accommodating the escalating demands on air traffic control. At the time, it was still being debated whether airline deregulation was favorable to consumers. Once viewed as contrary to the public interest,2 the vigorous airline competition 1 The Airline Deregulation Act of 1978 was preceded by market-oriented administra- tive reforms adopted by the Civil Aeronautics Board (CAB) beginning in 1975. 2 Congress adopted the public utility form of regulation for the airline industry when it created CAB, partly out of concern that the small scale of the industry and number of willing entrants would lead to excessive competition and capacity, ultimately having neg- ative effects on service and perhaps leading to monopolies and having adverse effects on consumers in the end (Levine 1965; Meyer et al. 1959). 15 9310-01 Chapter 1 10/12/99 14:48 Page 16 16 ENTRY AND COMPETITION IN THE U.S. AIRLINE INDUSTRY spurred by deregulation now is commonly credited with generating large and lasting public benefits. -

Appendix C Informal Complaints to DOT by New Entrant Airlines About Unfair Exclusionary Practices March 1993 to May 1999

9310-08 App C 10/12/99 13:40 Page 171 Appendix C Informal Complaints to DOT by New Entrant Airlines About Unfair Exclusionary Practices March 1993 to May 1999 UNFAIR PRICING AND CAPACITY RESPONSES 1. Date Raised: May 1999 Complaining Party: AccessAir Complained Against: Northwest Airlines Description: AccessAir, a new airline headquartered in Des Moines, Iowa, began service in the New York–LaGuardia and Los Angeles to Mo- line/Quad Cities/Peoria, Illinois, markets. Northwest offers connecting service in these markets. AccessAir alleged that Northwest was offering fares in these markets that were substantially below Northwest’s costs. 171 9310-08 App C 10/12/99 13:40 Page 172 172 ENTRY AND COMPETITION IN THE U.S. AIRLINE INDUSTRY 2. Date Raised: March 1999 Complaining Party: AccessAir Complained Against: Delta, Northwest, and TWA Description: AccessAir was a new entrant air carrier, headquartered in Des Moines, Iowa. In February 1999, AccessAir began service to New York–LaGuardia and Los Angeles from Des Moines, Iowa, and Moline/ Quad Cities/Peoria, Illinois. AccessAir offered direct service (nonstop or single-plane) between these points, while competitors generally offered connecting service. In the Des Moines/Moline–Los Angeles market, Ac- cessAir offered an introductory roundtrip fare of $198 during the first month of operation and then planned to raise the fare to $298 after March 5, 1999. AccessAir pointed out that its lowest fare of $298 was substantially below the major airlines’ normal 14- to 21-day advance pur- chase fares of $380 to $480 per roundtrip and was less than half of the major airlines’ normal 7-day advance purchase fare of $680. -

Living the World: a New Look at the Disabled in the Law of Torts

Catholic University Law Review Volume 48 Issue 2 Winter 1999 Article 3 1999 Living the World: A New Look at the Disabled in the Law of Torts Adam A. Milani Follow this and additional works at: https://scholarship.law.edu/lawreview Recommended Citation Adam A. Milani, Living the World: A New Look at the Disabled in the Law of Torts, 48 Cath. U. L. Rev. 323 (1999). Available at: https://scholarship.law.edu/lawreview/vol48/iss2/3 This Article is brought to you for free and open access by CUA Law Scholarship Repository. It has been accepted for inclusion in Catholic University Law Review by an authorized editor of CUA Law Scholarship Repository. For more information, please contact [email protected]. ARTICLES LIVING IN THE WORLD: A NEW LOOK AT THE DISABLED IN THE LAW OF TORTS Adam A. Milani* Table of Contents 1. DISABILITY LEGISLATION: SOLVING A MEDICAL PROBLEM OR GUARANTEEING CIVIL RIGHTS? ........................ .. .. .. .. .. .. .. .. .. 328 A. "Medical Model" Statutes: People Should Overcome Their D isabilities to Rejoin Society ............................................... 329 B. "Civil Rights Model" Statutes and Case Law: Society Should Adapt to People with Disabilities ........................................ 331 II. THE DISABLED IN THE LAW OF TORTS ....................................... 339 A. Liability for Unprotected Hazards on Streets and Sidewalks .................................................................................................3 4 1 1. Pre-Civil Rights Movement Common Law: Landowners' Duty to Foresee Pedestrians with Disabilities vs. Blind Pedestrians are Contributory Negligent Per Se if They Fail to Use Assistive D evices ........................................ 341 2. Post-Civil Rights Movement Common Law: Blind Pedes- trians are Contributorily Negligent Per Se if They Fail to U se Assistive D evices ................................................... -

A Free Bird Sings the Song of the Caged: Southwest Airlines' Fight to Repeal the Wright Amendment John Grantham

Journal of Air Law and Commerce Volume 72 | Issue 2 Article 10 2007 A Free Bird Sings the Song of the Caged: Southwest Airlines' Fight to Repeal the Wright Amendment John Grantham Follow this and additional works at: https://scholar.smu.edu/jalc Recommended Citation John Grantham, A Free Bird Sings the Song of the Caged: Southwest Airlines' Fight to Repeal the Wright Amendment, 72 J. Air L. & Com. 429 (2007) https://scholar.smu.edu/jalc/vol72/iss2/10 This Article is brought to you for free and open access by the Law Journals at SMU Scholar. It has been accepted for inclusion in Journal of Air Law and Commerce by an authorized administrator of SMU Scholar. For more information, please visit http://digitalrepository.smu.edu. A FREE BIRD SINGS THE SONG OF THE CAGED: SOUTHWEST AIRLINES' FIGHT TO REPEAL THE WRIGHT AMENDMENT JOHN GRANTHAM* TABLE OF CONTENTS I. INTRODUCTION .................................. 430 II. HISTORICAL BACKGROUND .................... 432 A. THE BATTLE TO ESTABLISH AIRPORTS IN NORTH T EXAS .......................................... 433 B. PLANNING FOR THE SUCCESS OF THE NEW AIRPORT ........................................ 436 C. THE UNEXPECTED BATTLE FOR AIRPORT CONSOLIDATION ................................... 438 III. THE EXCEPTION TO DEREGULATION ......... 440 A. THE DEREGULATION OF AIRLINE TRAVEL ......... 440 B. DEFINING THE WRIGHT AMENDMENT RESTRICTIONS ................................... 444 C. EXPANDING THE WRIGHT AMENDMENT ........... 447 D. SOUTHWEST COMES OUT AGAINST THE LoVE FIELD RESTRICTIONS ............................... 452 E. THE END OF AN ERA OR THE START OF SOMETHING NEW .................................. 453 IV. THE WRIGHT POLICY ............................ 455 A. COMMERCE CLAUSE ................................. 456 B. THE WRIGHT AMENDMENT WILL REMAIN STRONG LAW IF ALLOWED .................................. 456 1. ConstitutionalIssues ......................... 456 2. Deference to Administrative Agency Interpretation............................... -

Airlines Codes

Airlines codes Sorted by Airlines Sorted by Code Airline Code Airline Code Aces VX Deutsche Bahn AG 2A Action Airlines XQ Aerocondor Trans Aereos 2B Acvilla Air WZ Denim Air 2D ADA Air ZY Ireland Airways 2E Adria Airways JP Frontier Flying Service 2F Aea International Pte 7X Debonair Airways 2G AER Lingus Limited EI European Airlines 2H Aero Asia International E4 Air Burkina 2J Aero California JR Kitty Hawk Airlines Inc 2K Aero Continente N6 Karlog Air 2L Aero Costa Rica Acori ML Moldavian Airlines 2M Aero Lineas Sosa P4 Haiti Aviation 2N Aero Lloyd Flugreisen YP Air Philippines Corp 2P Aero Service 5R Millenium Air Corp 2Q Aero Services Executive W4 Island Express 2S Aero Zambia Z9 Canada Three Thousand 2T Aerocaribe QA Western Pacific Air 2U Aerocondor Trans Aereos 2B Amtrak 2V Aeroejecutivo SA de CV SX Pacific Midland Airlines 2W Aeroflot Russian SU Helenair Corporation Ltd 2Y Aeroleasing SA FP Changan Airlines 2Z Aeroline Gmbh 7E Mafira Air 3A Aerolineas Argentinas AR Avior 3B Aerolineas Dominicanas YU Corporate Express Airline 3C Aerolineas Internacional N2 Palair Macedonian Air 3D Aerolineas Paraguayas A8 Northwestern Air Lease 3E Aerolineas Santo Domingo EX Air Inuit Ltd 3H Aeromar Airlines VW Air Alliance 3J Aeromexico AM Tatonduk Flying Service 3K Aeromexpress QO Gulfstream International 3M Aeronautica de Cancun RE Air Urga 3N Aeroperlas WL Georgian Airlines 3P Aeroperu PL China Yunnan Airlines 3Q Aeropostal Alas VH Avia Air Nv 3R Aerorepublica P5 Shuswap Air 3S Aerosanta Airlines UJ Turan Air Airline Company 3T Aeroservicios -

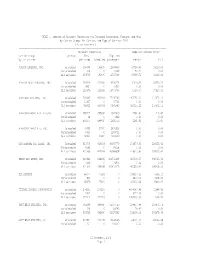

TABLE 1. Summary of Aircraft Departures and Enplaned

TABLE 1. Summary of Aircraft Departures and Enplaned Passengers, Freight, and Mail by Carrier Group, Air Carrier, and Type of Service: 2000 ( Major carriers ) -------------------------------------------------------------------------------------------------------------------------- Aircraft Departures Enplaned revenue-tones Carrier Group Service Total Enplaned by air carrier performed Scheduled passengers Freight Mail -------------------------------------------------------------------------------------------------------------------------- ALASKA AIRLINES, INC. Scheduled 158308 165435 12694899 63018.40 19220.01 Nonscheduled 228 0 12409 50.32 0.00 All services 158536 165435 12707308 63068.72 19220.01 AMERICA WEST AIRLINES, INC. Scheduled 204018 212692 19706774 31326.34 35926.29 Nonscheduled 8861 0 9632 0.00 0.00 All services 212879 212692 19716406 31326.34 35926.29 AMERICAN AIRLINES, INC. Scheduled 769485 800908 77205742 367155.22 210672.12 Nonscheduled 21437 0 37701 0.00 0.00 All services 790922 800908 77243443 367155.22 210672.12 AMERICAN EAGLE AIRLINES,INC Scheduled 459247 499830 11623833 2261.84 713.67 Nonscheduled 28 0 1922 0.00 0.00 All services 459275 499830 11625755 2261.84 713.67 AMERICAN TRANS AIR, INC. Scheduled 49496 50210 5830539 0.00 0.00 Nonscheduled 9425 0 1189721 0.00 0.00 All services 58921 50210 7020260 0.00 0.00 CONTINENTAL AIR LINES, INC. Scheduled 413746 419998 40947770 148373.63 128123.41 Nonscheduled 9592 0 41058 0.00 0.00 All services 423338 419998 40988828 148373.63 128123.41 DELTA AIR LINES, INC. Scheduled 916463 946995 101756198 400539.37 346435.53 Nonscheduled 5156 0 74975 0.04 0.00 All services 921619 946995 101831173 400539.41 346435.53 DHL AIRWAYS Scheduled 68777 77823 0 314057.33 5305.19 Nonscheduled 802 0 0 6872.73 3338.03 All services 69579 77823 0 320930.06 8643.22 FEDERAL EXPRESS CORPORATION Scheduled 274215 274215 0 4478347.96 11348.92 Nonscheduled 2927 0 0 6177.09 0.00 All services 277142 274215 0 4484525.05 11348.92 NORTHWEST AIRLINES, INC. -

Low-Cost Carriers and Low Fares: Competition and Concentration in the U.S

Low-Cost Carriers and Low Fares: Competition and Concentration in the U.S. Airline Industry May 2003 Charles Najda Abstract This analysis will examine the current structure of the domestic airline market to determine the amount of market power incumbent carriers wield, the market dynamics that exist in short haul and long haul routes, and the impact of a new breed of air carrier, the low-cost carrier, on the distribution of airfares. The analysis seeks to determine if a low-cost carrier’s presence on a route significantly impacts airfares. This paper argues that previous analyses may overestimate the effect of route concentration, hubs, and other route specific characteristics on the distribution of market prices. The emerging significance of the low-cost carrier may indicate a shift in the structure of the airline market away from hub-and-spoke networks and towards point-to-point networks. The significance of low-cost carriers suggests that government policies that enforce antitrust laws at hub airports may be ineffective; moreover, encouraging low-cost entry, through equal access to infrastructure, compacts the fare distribution and lowers the median fare. 1. Introduction This paper analyzes the current state of the airline market to determine the impact of a new breed of air carrier, the low-cost carrier, on airfares, the market dynamics that exist in short haul and long haul routes, and by what degree previous analyses overstate the importance of hubs and concentration. Although, financial turmoil surrounds the airline industry today, the evolution of the domestic airline market, in the United States, continues. -

Perimeter Rules, Proprietary Powers, and the Airline Deregulation Act: a Tale of Two Cities...And Two Airports Robert B

Journal of Air Law and Commerce Volume 66 | Issue 1 Article 6 2001 Perimeter Rules, Proprietary Powers, and the Airline Deregulation Act: A Tale of Two Cities...and Two Airports Robert B. Gilbreath Paul C. Walter Follow this and additional works at: https://scholar.smu.edu/jalc Recommended Citation Robert B. Gilbreath et al., Perimeter Rules, Proprietary Powers, and the Airline Deregulation Act: A Tale of Two Cities...and Two Airports, 66 J. Air L. & Com. 223 (2001) https://scholar.smu.edu/jalc/vol66/iss1/6 This Article is brought to you for free and open access by the Law Journals at SMU Scholar. It has been accepted for inclusion in Journal of Air Law and Commerce by an authorized administrator of SMU Scholar. For more information, please visit http://digitalrepository.smu.edu. PERIMETER RULES, PROPRIETARY POWERS, AND THE AIRLINE DEREGULATION ACT: A TALE OF TWO CITIES ... AND TWO AIRPORTS ROBERT B. GILBREATH* PAUL C. WATLER** I. INTRODUCTION T HIS CASE NOTE examines the two most recent court deci- sions in the long-running battle over airline service at Dallas Love Field and Dallas-Fort Worth International Airport - Ameri- can Airlines, Inc. v. Department of Transportation' and Legend Air- lines, Inc. v. City of Fort Worth, Texas.2 From its earliest inception in the 1960's to the present, the goal of establishing and main- taining a regional airport in the Dallas-Fort Worth area has spawned a series of court cases and legislative enactments. The overarching issue in the two cases addressed in this article was whether a local government-in light of the preemption and proprietary powers provisions in the federal Airline Deregula- tion Act-may enforce a regulation designed to protect a re- gional airport from competition by imposing a perimeter rule on a neighboring airport.' * Robert B. -

The Evolution of U.S. Commercial Domestic Aircraft Operations from 1991 to 2010

THE EVOLUTION OF U.S. COMMERCIAL DOMESTIC AIRCRAFT OPERATIONS FROM 1991 TO 2010 by MASSACHUSETTS INSTME OF TECHNOLOGY ALEXANDER ANDREW WULZ UL02 1 B.S., Aerospace Engineering University of Notre Dame (2008) Submitted to the Department of Aeronautics and Astronautics in PartialFulfillment of the Requirementsfor the Degree of MASTER OF SCIENCE at the MASSACHUSETTS INSTITUTE OF TECHNOLOGY June 2012 0 2012 Alexander Andrew Wulz. All rights reserved. .The author hereby grants to MIT permission to reproduce and to distribute publicly paper and electronic copies of this thesis document in whole or in part in any medium now known or hereafter created. Signature of Author ..................................................................... .. ...................... Department of Aeronautr and Astronautics n n May 11, 2012 Certified by ............................................................................ Peter P. Belobaba Principle Research Scientist of Aeronautics and Astronautics / Thesis Supervisor A ccepted by ................................................................... Eytan H. Modiano Professor of Aeronautics and Astronautics Chair, Graduate Program Committee 1 PAGE INTENTIONALLY LEFT BLANK 2 THE EVOLUTION OF U.S. COMMERCIAL DOMESTIC AIRCRAFT OPERATIONS FROM 1991 TO 2010 by ALEXANDER ANDREW WULZ Submitted to the Department of Aeronautics and Astronautics on May 11, 2012 in PartialFulfillment of the Requirementsfor the Degree of MASTER OF SCIENCE IN AERONAUTICS AND ASTRONAUTICS ABSTRACT The main objective of this thesis is to explore the evolution of U.S. commercial domestic aircraft operations from 1991 to 2010 and describe the implications for future U.S. commercial domestic fleets. Using data collected from the U.S. Bureau of Transportation Statistics, we analyze 110 different aircraft types from 145 airlines operating U.S. commercial domestic service between 1991 and 2010. We classify the aircraft analyzed into four categories: turboprop, regional jet, narrow-body, and wide-body. -

Master's Thesis Mergers and Acquisitions in the U.S. Airline Industry

Master’s Thesis MSc in Finance and Investments Mergers and acquisitions in the U.S. airline industry An event study of stock data observations from the last three decades May 15, 2017 Author: Lars Christian Hjorth-Johansen Supervisor: Björn Preuß Consisting of 165,841 characters including spaces - equivalent to 79 pages. ABSTRACT After the Deregulation Act of 1978 changed the U.S. airline industry from being government controlled to a liberalized market, a merger wave struck the industry where consolidation among a great proportion of airlines created the legacy carriers of today. Three decades later, the industry have seen a new wave, only this time with a completely different underlying motivation. From previously consolidating in order to grow geographically and improve operational performance, the new millennium have seen U.S. airlines merge in order to survive as bankruptcies and financial distress have challenged the existence of the majority of U.S. airlines. Where there exists evidence of collusive pricing as a result of the mergers in the post- deregulation time period, there are not any recent research including mergers of the 21st century. With a foundation based on previous studies, this thesis aims to answer two hypotheses. The first hypothesis asks whether there are positive abnormal returns for bidder and target airlines involved in an airline merger at the time of announcement. The second hypothesis looks at the existence of collusion among rivals through the market power hypothesis, which suggests that rivals benefit from competitors’ mergers as collaboration limits output and increase prices. The hypotheses are tested through an event study where all available stock data from U.S.