Fiscal Year 2021 Statutory Audit of Compliance with Legal Guidelines Prohibiting the Use of Illegal Tax Protester and Similar Designations

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Engagement Guidance on Corporate Tax Responsibility Why and How to Engage with Your Investee Companies

ENGAGEMENT GUIDANCE ON CORPORATE TAX RESPONSIBILITY WHY AND HOW TO ENGAGE WITH YOUR INVESTEE COMPANIES An investor initiative in partnership with UNEP Finance Initiative and UN Global Compact THE SIX PRINCIPLES We will incorporate ESG issues into investment analysis and 1 decision-making processes. We will be active owners and incorporate ESG issues into our 2 ownership policies and practices. We will seek appropriate disclosure on ESG issues by 3 the entities in which we invest. We will promote acceptance and implementation of the Principles 4 within the investment industry. We will work together to enhance our effectiveness in 5 implementing the Principles. We will each report on our activities and progress towards 6 implementing the Principles. CREDITS & ACKNOWLEDGEMENTS Authors: Athanasia Karananou and Anastasia Guha, PRI Editor: Mark Kolmar, PRI Design: Alessandro Boaretto, PRI The PRI is grateful to the investor taskforce on corporate tax responsibility for their contributions to the guidance: ■ Harriet Parker, Investment Analyst, Alliance Trust Investments ■ Steven Bryce, Investment Analyst, Arisaig Partners (Asia) Pte Ltd ■ Francois Meloche, Extra Financial Risks Manager, Bâtirente ■ Adam Kanzer, Managing Director, Domini Social Investments LLC ■ Pauline Lejay, SRI Officer, ERAFP ■ Meryam Omi, Head of Sustainability, Legal & General Investment Management ■ Robert Wilson, Research Analyst, MFS Investment Management ■ Michelle de Cordova, Director, Corporate Engagement & Public Policy, NEI Investments ■ Rosa van den Beemt, ESG Analyst, NEI Investments ■ Kate Elliot, Ethical Researcher, Rathbone Brothers Plc ■ Matthias Müller, Senior SI Analyst, RobecoSAM ■ Rosl Veltmeijer, Head of Research, Triodos Investment Management We would like to warmly thank Sol Picciotto, Emeritus Professor, Lancaster University and Coordinator, BEPS Monitoring Group, and Katherine Ng, PRI, for their contribution to the guidance. -

Form W-4, Employee's Withholding Certificate

Employee’s Withholding Certificate OMB No. 1545-0074 Form W-4 ▶ (Rev. December 2020) Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. ▶ Department of the Treasury Give Form W-4 to your employer. 2021 Internal Revenue Service ▶ Your withholding is subject to review by the IRS. Step 1: (a) First name and middle initial Last name (b) Social security number Enter Address ▶ Does your name match the Personal name on your social security card? If not, to ensure you get Information City or town, state, and ZIP code credit for your earnings, contact SSA at 800-772-1213 or go to www.ssa.gov. (c) Single or Married filing separately Married filing jointly or Qualifying widow(er) Head of household (Check only if you’re unmarried and pay more than half the costs of keeping up a home for yourself and a qualifying individual.) Complete Steps 2–4 ONLY if they apply to you; otherwise, skip to Step 5. See page 2 for more information on each step, who can claim exemption from withholding, when to use the estimator at www.irs.gov/W4App, and privacy. Step 2: Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse Multiple Jobs also works. The correct amount of withholding depends on income earned from all of these jobs. or Spouse Do only one of the following. Works (a) Use the estimator at www.irs.gov/W4App for most accurate withholding for this step (and Steps 3–4); or (b) Use the Multiple Jobs Worksheet on page 3 and enter the result in Step 4(c) below for roughly accurate withholding; or (c) If there are only two jobs total, you may check this box. -

Reemployment of Retired Members: Federal Tax Issues

MARYLAND STATE RETIREMENT AND PENSION SYSTEM REEMPLOYMENT OF RETIRED MEMBERS - FEDERAL TAX ISSUES There are two key tax issues related to the reemployment of individuals by the State or participating governmental units who are retirees of the Maryland State Retirement and Pension System: (1) the tax qualification of the plans under the Maryland State Retirement and Pension System; and (2) the possibility of the imposition of the 10% early distribution tax on benefits received by retirees. The following information is provided in order that State and participating employers may better understand the rules. 1. PLAN QUALIFICATION – A defined benefit retirement plan, such as the plans under the Maryland State Retirement and Pension Plan, must meet many requirements under the Internal Revenue Code in order to be a “qualified plan” under the Code and receive certain important tax advantages. One of those requirements provides that, in general, a member may not withdraw contributions made by the employer, or earnings on such contributions, before normal retirement, termination of employment, or termination of the plan. Rev. Rul. 74-254, 1974-1 C.B. 94. “Normal retirement age cannot be earlier than the earliest age that is reasonably representative of a typical retirement age for the covered workforce.” Prop. Treas. Reg. Sec. 1.401(a) – 1(b)(1)(i). A retirement age that is lower than 65 is permissible for a governmental plan if it reflects when employees typically retire and is not a subterfuge for permitting in-service distributions. PLR 200420030. Therefore, as a matter of plan qualification, retirement benefits may be paid to an employee who reaches “normal retirement age” once the employee retires and separates from service, and the reemployment of such a retiree by the same employer should not raise concerns regarding plan qualification. -

The Alternative Minimum Tax

Updated December 4, 2017 Tax Reform: The Alternative Minimum Tax The U.S. federal income tax has both a personal and a Individual AMT corporate alternative minimum tax (AMT). Both the The modern individual AMT originated with the Revenue corporate and individual AMTs operate alongside the Act of 1978 (P.L. 95-600) and operated in tandem with an regular income tax. They require taxpayers to calculate existing add-on minimum tax prior to its repeal in 1982. their liability twice—once under the rules for the regular Table 2 details selected key individual AMT parameters. income tax and once under the AMT rules—and then pay the higher amount. Minimum taxes increase tax payments Table 2. Selected Individual AMT Parameters, 2017 from taxpayers who, under the rules of the regular tax system, pay too little tax relative to a standard measure of Single/ Married their income. Head of Filing Married Filing Household Jointly Separately Corporate AMT Exemption $54,300 $84,500 $42,250 The corporate AMT originated with the Tax Reform Act of 1986 (P.L. 99-514), which eliminated an “add-on” 28% bracket 187,800 187,800 93,900 minimum tax imposed on corporations previously. The threshold corporate AMT is a flat 20% tax imposed on a Source: Internal Revenue Code. corporation’s alternative minimum taxable income less an exemption amount. A corporation’s alternative minimum The individual AMT tax base is broader than the regular taxable income is the corporation’s taxable income income tax base and starts with regular taxable income and determined with certain adjustments (primarily related to adds back various deductions, including personal depreciation) and increased by the disallowance of a exemptions and the deduction for state and local taxes. -

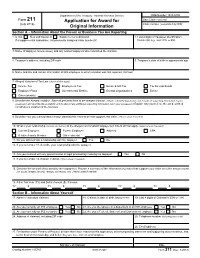

Form 211, Application for Award for Original Information

Department of the Treasury - Internal Revenue Service OMB Number 1545-0409 Form 211 Application for Award for Date Claim received (July 2018) Claim number (completed by IRS) Original Information Section A – Information About the Person or Business You Are Reporting 1. Is this New submission or Supplemental submission 2. Last 4 digits of Taxpayer Identification If a supplemental submission, list previously assigned claim number(s) Number(s) (e.g., SSN, ITIN, or EIN) 3. Name of taxpayer (include aliases) and any related taxpayers who committed the violation 4. Taxpayer's address, including ZIP code 5. Taxpayer's date of birth or approximate age 6. Name and title and contact information of IRS employee to whom violation was first reported, if known 7. Alleged Violation of Tax Law (check all that apply) Income Tax Employment Tax Estate & Gift Tax Tax Exempt Bonds Employee Plans Governmental Entities Exempt Organizations Excise Other (identify) 8. Describe the Alleged Violation. State all pertinent facts to the alleged violation. (Attach a detailed explanation and include all supporting information in your possession and describe the availability and location of any additional supporting information not in your possession.) Explain why you believe the act described constitutes a violation of the tax laws 9. Describe how you learned about and/or obtained the information that supports this claim. (Attach sheet if needed) 10. What is your relationship (current and former) to the alleged noncompliant taxpayer(s)? Check all that apply. (Attach sheet if needed) Current Employee Former Employee Attorney CPA Relative/Family Member Other (describe) 11. Do you still maintain a relationship with the taxpayer Yes No 12. -

2021 Instructions for Form 6251

Note: The draft you are looking for begins on the next page. Caution: DRAFT—NOT FOR FILING This is an early release draft of an IRS tax form, instructions, or publication, which the IRS is providing for your information. Do not file draft forms and do not rely on draft forms, instructions, and publications for filing. We do not release draft forms until we believe we have incorporated all changes (except when explicitly stated on this coversheet). However, unexpected issues occasionally arise, or legislation is passed—in this case, we will post a new draft of the form to alert users that changes were made to the previously posted draft. Thus, there are never any changes to the last posted draft of a form and the final revision of the form. Forms and instructions generally are subject to OMB approval before they can be officially released, so we post only drafts of them until they are approved. Drafts of instructions and publications usually have some changes before their final release. Early release drafts are at IRS.gov/DraftForms and remain there after the final release is posted at IRS.gov/LatestForms. All information about all forms, instructions, and pubs is at IRS.gov/Forms. Almost every form and publication has a page on IRS.gov with a friendly shortcut. For example, the Form 1040 page is at IRS.gov/Form1040; the Pub. 501 page is at IRS.gov/Pub501; the Form W-4 page is at IRS.gov/W4; and the Schedule A (Form 1040/SR) page is at IRS.gov/ScheduleA. -

The Viability of the Fair Tax

The Fair Tax 1 Running head: THE FAIR TAX The Viability of The Fair Tax Jonathan Clark A Senior Thesis submitted in partial fulfillment of the requirements for graduation in the Honors Program Liberty University Fall 2008 The Fair Tax 2 Acceptance of Senior Honors Thesis This Senior Honors Thesis is accepted in partial fulfillment of the requirements for graduation from the Honors Program of Liberty University. ______________________________ Gene Sullivan, Ph.D. Thesis Chair ______________________________ Donald Fowler, Th.D. Committee Member ______________________________ JoAnn Gilmore, M.B.A. Committee Member ______________________________ James Nutter, D.A. Honors Director ______________________________ Date The Fair Tax 3 Abstract This thesis begins by investigating the current system of federal taxation in the United States and examining the flaws within the system. It will then deal with a proposal put forth to reform the current tax system, namely the Fair Tax. The Fair Tax will be examined in great depth and all aspects of it will be explained. The objective of this paper is to determine if the Fair Tax is a viable solution for fundamental tax reform in America. Both advantages and disadvantages of the Fair Tax will objectively be pointed out and an educated opinion will be given regarding its feasibility. The Fair Tax 4 The Viability of the Fair Tax In 1986 the United States federal tax code was changed dramatically in hopes of simplifying the previous tax code. Since that time the code has undergone various changes that now leave Americans with over 60,000 pages of tax code, rules, and rulings that even the most adept tax professionals do not understand. -

THE LANGUAGE of TAX PROTESTS © Monica Haven, E.A

THE LANGUAGE OF TAX PROTESTS © Monica Haven, E.A. 120704 Language and the Law Professor Peter Tiersma Loyola Law School Fall 2004 Monica Haven [email protected] Table of Contents I. INTRODUCTION..................................................................................... 1 A. The Purpose of Protest B. Philosophy of Protest C. Syllabus II. THE PRE-DETERMINED OUTCOME ................................................ 6 A. Tax Protesters Defined B. Judicial Response III. THE LANGUAGE OF PROTEST .......................................................... 8 A. Parsing The Code 1. “Individuals” Defined Statutory Definition Common Usage Trade Usage 2. “Income” Defined The Protester’s Misconstrued Precedent Quotes Taken Out Of Context The Burden Of Proof Is Improperly Shifted B. Common Defects IV. TAX SCAMS ........................................................................................... 19 V. JUDICIAL REASONING ...................................................................... 21 A. Historic Development B. Pre-empting Future Protests 1. Finding Support in Constitutional Construction 2. Applying the Plain Meaning Rule 3. Applicable Canons VI. JUDICIAL PREJUDICE ....................................................................... 30 A. Are Judges Passing The Buck? B. Are Judges Afraid? C. Protester Victories? 1. Retrials 2. Settlements 3. Criminal Convictions D. Victories Are Not Always What They Seem VII. CONCLUSION ....................................................................................... 36 i THE LANGUAGE -

GGD-81-83 Illegal Tax Protesters Threaten System

- ./ t REPORTBY THE Comptroller General OF THE UNITEDSTATES Illegal Tax Protesters Threaten Tax System The number of illegal tax protesters--persons who, according to IRS, advocate and/or use schemes to evade paying taxes--has increased significantly in recent years. Since they rep- resent a threat to our Nation’s voluntary tax system, IRS has taken some important counter measures, including the establishment of a high-priority Illegal Tax Protester Program and a program to prevent the filing of false Form W-4s, Employee’s Withholding Allow- ance Certificates. IRS has made some progress in detecting pro- testers and in deterring them through civil . , and criminal enforcement actions. However, it can further increase its effectiveness by in- vestigating protesters in a more timely manner and by making additional organizational and administrative changes. Also, the Congress can help by amending the summons provi- sions of the 1976 Ta Reform Act GGD-81-83 JULY 8.1981 COMPTROLLER GENERAL OF THE UNITED STATES WASHINGTON D.C. zo54a B-203682 The Honorable Benjamin S. Rosenthal Chairman, Subcommittee on Commerce, Consumer and Monetary Affairs Committee on Government Operations House of Representatives Dear Mr. Chairman: This report, in response to your request, discusses the nature and extent of.the illegal tax protest problem and the adequacy of the Internal Revenue Service's efforts to detect and deter illegal protesters. The report, which consists of the summary and comprehensive statements given in testimony before your subcommittee on June 10, 1981, makes several recommendations for improving IRS' efforts against illegal tax protesters. We did not obtain official comments from the Internal Rev- enue Service because of time limitations and because the Service had been asked to present its views at your subcommittee's hear- ing. -

The Fairtax Treatment of Housing

A FairTaxsm White Paper The FairTax treatment of housing Advocates of tax reform share a common motivation: To iron out the mangled economic incentives resulting from statutory inequities and misguided social engineering that perversely cripple the American economy and the American people. Most importantly, ironing out the statutory inequities of the federal tax code need not harm homebuyers and homebuilders. The FairTax does more than do no harm. The FairTax encourages home ownership and homebuilding by placing all Americans and all businesses on equal footing – no loopholes, no exceptions. A specific analysis of the impact of the FairTax on the homebuilding industry/the housing market shows that the new homebuilding market would greatly benefit from enactment of the FairTax. The analysis necessarily centers upon two issues: (1) Whether the FairTax’s elimination of the home mortgage interest deduction (MID) adversely impacts the housing market (new and existing) in general, and home ownership and the homebuilding industry specifically; and (2) Whether the FairTax’s superficially disparate treatment of new vs. existing housing has an adverse impact on the market for new homes and homebuilding. The response to both of the above questions is no. Visceral opposition to the repeal of a “good loophole” such as the MID is understandable, absent a more thorough and empirical analysis of the impact of the FairTax vs. the MID on home ownership and the homebuilding industry. Such an analysis demonstrates that preserving the MID is the classic instance of a situation where the business community confuses support for particular businesses with support for enterprise in general. -

Excuses—What Works and What Doesn’T © Monica Haven 010405

Excuses—what works and what doesn’t © Monica Haven 010405 Inez Morin complained, “It’s just a lot of paperwork.” Not surprisingly, the Tax Court did not rule favorably. Others contend that our system is based on voluntary compliance and conveniently overlook that “Congress gave the Secretary of Treasury the power to enforce the income tax laws through involuntary collection.” When their arguments fail, these recalcitrant taxpayers are dubbed as tax protesters. Monica Haven, E.A. will recount the often humorous and always creative arguments that have been litigated. I. The Philosophy of Protest Purpose: To lodge formal disapproval of public policies and persuade others to support the cause Tax protester seeks validation at the expense of society’s welfare To the extent that some people are dishonest or careless in their dealings with A. Tax Protest Defined the government, the majority is forced to Self-centered endeavor to evade tax liability carry a heavier tax burden. --John F. Kennedy Motivated by greed or anarchy Argued in bad faith The good faith defense encompasses a Based upon unsupportable positions misunderstanding of the law, not disagreement with the law. --Judge Meskill B. The Inevitable Outcome Judicial mandate to protect tax system for the support of government The government’s view of the budget is distorted because it includes Trust Funds (e.g. Social Security) and because the expenses of past military spending are not distinguished from nonmilitary spending These revised percentages do not include trust funds which are raised and spent separately from income taxes. The practice of combining trust and federal funds (the so-called “Unified Budget”) began in the 1960s during the Vietnam War and makes the human needs portion of the budget seem larger and the military portion smaller. -

Form 1040 Page Is at IRS.Gov/Form1040; the Pub

Note: The draft you are looking for begins on the next page. Caution: DRAFT—NOT FOR FILING This is an early release draft of an IRS tax form, instructions, or publication, which the IRS is providing for your information. Do not file draft forms and do not rely on draft forms, instructions, and publications for filing. We do not release draft forms until we believe we have incorporated all changes (except when explicitly stated on this coversheet). However, unexpected issues occasionally arise, or legislation is passed—in this case, we will post a new draft of the form to alert users that changes were made to the previously posted draft. Thus, there are never any changes to the last posted draft of a form and the final revision of the form. Forms and instructions generally are subject to OMB approval before they can be officially released, so we post only drafts of them until they are approved. Drafts of instructions and publications usually have some changes before their final release. Early release drafts are at IRS.gov/DraftForms and remain there after the final release is posted at IRS.gov/LatestForms. All information about all forms, instructions, and pubs is at IRS.gov/Forms. Almost every form and publication has a page on IRS.gov with a friendly shortcut. For example, the Form 1040 page is at IRS.gov/Form1040; the Pub. 501 page is at IRS.gov/Pub501; the Form W-4 page is at IRS.gov/W4; and the Schedule A (Form 1040/SR) page is at IRS.gov/ScheduleA.