Form 1040 Page Is at IRS.Gov/Form1040; the Pub

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Exploring the Use of the 'They' Pronouns Singularly in English

Shawn Johnson California State University, Fullerton Exploring the use of the ‘they’ pronouns singularly in English Standard English textbooks state that when the gender of a referent is unknown, the default pronoun to be used is the masculine one, and that such usage is actually gender-neutral. A common example in textbooks is “ Everyone must bring his book to class.” Today, however, this usage does not in the mind of some speakers truly convey an image of both males and females being included. Instead, it sounds like the class is filled with only males. Several strategies have been suggested and used to try to avoid usage that some feel sounds sexist. The most commonly used method in somewhat formal settings is to say his or her . This has had fairly widespread acceptance, but it can be quite cumbersome when used multiple times: “A student should bring his or her book to class if he or she wishes to use it during his or her test so that he or she may get a better grade on his or her report card.” A few writers have chosen to alternate between using he gender-neutrally and using she gender- neutrally, but this has not become very popular and certainly doesn’t occur in everyday speech. In writing, some people use a composite form, such as (s)he , s/he , or he/she , or the genitive his/her , but these forms are not used in speech. Writing is usually expected to reflect speech, but in this case, it does not. In fact, it is actually hard to express the composite form (s)he verbally when reading it, as I just tried to do. -

Form W-4, Employee's Withholding Certificate

Employee’s Withholding Certificate OMB No. 1545-0074 Form W-4 ▶ (Rev. December 2020) Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. ▶ Department of the Treasury Give Form W-4 to your employer. 2021 Internal Revenue Service ▶ Your withholding is subject to review by the IRS. Step 1: (a) First name and middle initial Last name (b) Social security number Enter Address ▶ Does your name match the Personal name on your social security card? If not, to ensure you get Information City or town, state, and ZIP code credit for your earnings, contact SSA at 800-772-1213 or go to www.ssa.gov. (c) Single or Married filing separately Married filing jointly or Qualifying widow(er) Head of household (Check only if you’re unmarried and pay more than half the costs of keeping up a home for yourself and a qualifying individual.) Complete Steps 2–4 ONLY if they apply to you; otherwise, skip to Step 5. See page 2 for more information on each step, who can claim exemption from withholding, when to use the estimator at www.irs.gov/W4App, and privacy. Step 2: Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse Multiple Jobs also works. The correct amount of withholding depends on income earned from all of these jobs. or Spouse Do only one of the following. Works (a) Use the estimator at www.irs.gov/W4App for most accurate withholding for this step (and Steps 3–4); or (b) Use the Multiple Jobs Worksheet on page 3 and enter the result in Step 4(c) below for roughly accurate withholding; or (c) If there are only two jobs total, you may check this box. -

The Alternative Minimum Tax

Updated December 4, 2017 Tax Reform: The Alternative Minimum Tax The U.S. federal income tax has both a personal and a Individual AMT corporate alternative minimum tax (AMT). Both the The modern individual AMT originated with the Revenue corporate and individual AMTs operate alongside the Act of 1978 (P.L. 95-600) and operated in tandem with an regular income tax. They require taxpayers to calculate existing add-on minimum tax prior to its repeal in 1982. their liability twice—once under the rules for the regular Table 2 details selected key individual AMT parameters. income tax and once under the AMT rules—and then pay the higher amount. Minimum taxes increase tax payments Table 2. Selected Individual AMT Parameters, 2017 from taxpayers who, under the rules of the regular tax system, pay too little tax relative to a standard measure of Single/ Married their income. Head of Filing Married Filing Household Jointly Separately Corporate AMT Exemption $54,300 $84,500 $42,250 The corporate AMT originated with the Tax Reform Act of 1986 (P.L. 99-514), which eliminated an “add-on” 28% bracket 187,800 187,800 93,900 minimum tax imposed on corporations previously. The threshold corporate AMT is a flat 20% tax imposed on a Source: Internal Revenue Code. corporation’s alternative minimum taxable income less an exemption amount. A corporation’s alternative minimum The individual AMT tax base is broader than the regular taxable income is the corporation’s taxable income income tax base and starts with regular taxable income and determined with certain adjustments (primarily related to adds back various deductions, including personal depreciation) and increased by the disallowance of a exemptions and the deduction for state and local taxes. -

Pronouns: a Resource Supporting Transgender and Gender Nonconforming (Gnc) Educators and Students

PRONOUNS: A RESOURCE SUPPORTING TRANSGENDER AND GENDER NONCONFORMING (GNC) EDUCATORS AND STUDENTS Why focus on pronouns? You may have noticed that people are sharing their pronouns in introductions, on nametags, and when GSA meetings begin. This is happening to make spaces more inclusive of transgender, gender nonconforming, and gender non-binary people. Including pronouns is a first step toward respecting people’s gender identity, working against cisnormativity, and creating a more welcoming space for people of all genders. How is this more inclusive? People’s pronouns relate to their gender identity. For example, someone who identifies as a woman may use the pronouns “she/her.” We do not want to assume people’s gender identity based on gender expression (typically shown through clothing, hairstyle, mannerisms, etc.) By providing an opportunity for people to share their pronouns, you're showing that you're not assuming what their gender identity is based on their appearance. If this is the first time you're thinking about your pronoun, you may want to reflect on the privilege of having a gender identity that is the same as the sex assigned to you at birth. Where do I start? Include pronouns on nametags and during introductions. Be cognizant of your audience, and be prepared to use this resource and other resources (listed below) to answer questions about why you are making pronouns visible. If your group of students or educators has never thought about gender-neutral language or pronouns, you can use this resource as an entry point. What if I don’t want to share my pronouns? That’s ok! Providing space and opportunity for people to share their pronouns does not mean that everyone feels comfortable or needs to share their pronouns. -

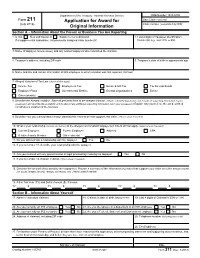

Form 211, Application for Award for Original Information

Department of the Treasury - Internal Revenue Service OMB Number 1545-0409 Form 211 Application for Award for Date Claim received (July 2018) Claim number (completed by IRS) Original Information Section A – Information About the Person or Business You Are Reporting 1. Is this New submission or Supplemental submission 2. Last 4 digits of Taxpayer Identification If a supplemental submission, list previously assigned claim number(s) Number(s) (e.g., SSN, ITIN, or EIN) 3. Name of taxpayer (include aliases) and any related taxpayers who committed the violation 4. Taxpayer's address, including ZIP code 5. Taxpayer's date of birth or approximate age 6. Name and title and contact information of IRS employee to whom violation was first reported, if known 7. Alleged Violation of Tax Law (check all that apply) Income Tax Employment Tax Estate & Gift Tax Tax Exempt Bonds Employee Plans Governmental Entities Exempt Organizations Excise Other (identify) 8. Describe the Alleged Violation. State all pertinent facts to the alleged violation. (Attach a detailed explanation and include all supporting information in your possession and describe the availability and location of any additional supporting information not in your possession.) Explain why you believe the act described constitutes a violation of the tax laws 9. Describe how you learned about and/or obtained the information that supports this claim. (Attach sheet if needed) 10. What is your relationship (current and former) to the alleged noncompliant taxpayer(s)? Check all that apply. (Attach sheet if needed) Current Employee Former Employee Attorney CPA Relative/Family Member Other (describe) 11. Do you still maintain a relationship with the taxpayer Yes No 12. -

Thou and You in Shakespeare

Thou and You in Shakespeare Modern English has only one second person pronoun: you. But Old English had two: thou for second person singular and you for second person plural. By the 13th century, however, people began employing you as a singular pronoun to convey politeness or formality. At this stage, thou and you in English mirrored the French pronouns tu and vous or the Spanish tú and usted: one familiar, the other formal. In the early-modern English of Shakespeare’s time, thou and you could indicate fine distinctions of social status and interpersonal relationships: thou you to social inferiors to social superiors to social equals (lower class) to social equals (upper class) in private in public to express familiarity or intimacy to express formality or neutrality to show scorn or contempt to show respect or admiration Thou A speaker could use the familiar thou to address their social inferiors or to indicate friendship and intimacy. When some one of high rank addressed someone of lower rank (King to subject, parent to child, husband to wife, teacher to student), they would use thou. The subjects, children, wives, and students — on the other hand — would address their betters as you. The hierarchical use of thou made it an excellent way to put someone in their place, condescending to or insulting them. Calling someone thou, implied — all by itself — that they were inferior. But thou could express intimacy as well as superiority. Close friends, romantic partners, husbands and wives (in private) would all use thou to address each other. Speakers also addressed God as thou, signaling a deep spiritual intimacy between the believer and the deity. -

2021 Instructions for Form 6251

Note: The draft you are looking for begins on the next page. Caution: DRAFT—NOT FOR FILING This is an early release draft of an IRS tax form, instructions, or publication, which the IRS is providing for your information. Do not file draft forms and do not rely on draft forms, instructions, and publications for filing. We do not release draft forms until we believe we have incorporated all changes (except when explicitly stated on this coversheet). However, unexpected issues occasionally arise, or legislation is passed—in this case, we will post a new draft of the form to alert users that changes were made to the previously posted draft. Thus, there are never any changes to the last posted draft of a form and the final revision of the form. Forms and instructions generally are subject to OMB approval before they can be officially released, so we post only drafts of them until they are approved. Drafts of instructions and publications usually have some changes before their final release. Early release drafts are at IRS.gov/DraftForms and remain there after the final release is posted at IRS.gov/LatestForms. All information about all forms, instructions, and pubs is at IRS.gov/Forms. Almost every form and publication has a page on IRS.gov with a friendly shortcut. For example, the Form 1040 page is at IRS.gov/Form1040; the Pub. 501 page is at IRS.gov/Pub501; the Form W-4 page is at IRS.gov/W4; and the Schedule A (Form 1040/SR) page is at IRS.gov/ScheduleA. -

An Immigrant Story

THE DANISH IMMIGRANT MUSEUM - AN INTERNATIONAL CULTURAL CENTER Activity book An Immigrant Story The story of Jens Jensen and his journey to America in 1910. The Danish Immigrant Museum 2212 Washington Street Elk Horn, Iowa 51531 712-764-7001 www.danishmuseum.org 1 Name of traveler This is Denmark. From here you start your journey as an emigrant towards America. Denmark is a country in Scandinavia which is in the northern part of Europe. It is a very small country only 1/3 the size of the state of Iowa. It is made up of one peninsula called Jutland and 483 islands so the seaside is never far away. In Denmark the money is called kroner and everyone speaks Danish. The capital is called Copenhagen and is home to Denmark’s Royal Family and Parliament. The Danish royal family is the oldest in Europe. It goes all the way back to the Viking period. Many famous people have come from Denmark including Hans Christian Andersen who wrote The Little Mermaid. He was born in Odense and moved to Copenhagen. The Danish Immigrant Museum 2212 Washington Street Elk Horn, Iowa 51531 712-764-7001 www.danishmuseum.org Can you draw a line from Odense to Copenhagen? Did he have to cross the water to get there? 2 This is Jens Jensen. He lived in Denmark on a farm in 1910. That was a little over a hundred years ago. You can color him in. In 1910 Denmark looked much like it does today except that most people were farmers; they would grow wheat and rye, and raise pigs and cows. -

The Viability of the Fair Tax

The Fair Tax 1 Running head: THE FAIR TAX The Viability of The Fair Tax Jonathan Clark A Senior Thesis submitted in partial fulfillment of the requirements for graduation in the Honors Program Liberty University Fall 2008 The Fair Tax 2 Acceptance of Senior Honors Thesis This Senior Honors Thesis is accepted in partial fulfillment of the requirements for graduation from the Honors Program of Liberty University. ______________________________ Gene Sullivan, Ph.D. Thesis Chair ______________________________ Donald Fowler, Th.D. Committee Member ______________________________ JoAnn Gilmore, M.B.A. Committee Member ______________________________ James Nutter, D.A. Honors Director ______________________________ Date The Fair Tax 3 Abstract This thesis begins by investigating the current system of federal taxation in the United States and examining the flaws within the system. It will then deal with a proposal put forth to reform the current tax system, namely the Fair Tax. The Fair Tax will be examined in great depth and all aspects of it will be explained. The objective of this paper is to determine if the Fair Tax is a viable solution for fundamental tax reform in America. Both advantages and disadvantages of the Fair Tax will objectively be pointed out and an educated opinion will be given regarding its feasibility. The Fair Tax 4 The Viability of the Fair Tax In 1986 the United States federal tax code was changed dramatically in hopes of simplifying the previous tax code. Since that time the code has undergone various changes that now leave Americans with over 60,000 pages of tax code, rules, and rulings that even the most adept tax professionals do not understand. -

![[REG-107100-00] RIN 1545-AY26 Disallowance of De](https://docslib.b-cdn.net/cover/2433/reg-107100-00-rin-1545-ay26-disallowance-of-de-1222433.webp)

[REG-107100-00] RIN 1545-AY26 Disallowance of De

[4830-01-p] DEPARTMENT OF THE TREASURY Internal Revenue Service 26 CFR Part 1 [REG-107100-00] RIN 1545-AY26 Disallowance of Deductions and Credits for Failure to File Timely Return AGENCY: Internal Revenue Service (IRS), Treasury. ACTION: Notice of proposed rulemaking by cross-reference to temporary regulations and notice of public hearing. SUMMARY: This document contains proposed regulations relating to the disallowance of deductions and credits for nonresident alien individuals and foreign corporations that fail to file a timely U.S. income tax return. The current regulations permit nonresident aliens and foreign corporations the benefit of deductions and credits only if they timely file a U.S. income tax return in accordance with subtitle F of the Internal Revenue Code, unless the Commissioner waives the filing deadlines. The temporary regulations revise the waiver standard. The text of the temporary regulations on this subject in this issue of the Federal Register also serves as the text of these proposed regulations set forth in this cross-referenced notice of proposed rulemaking. This document also provides notice of a public hearing on these proposed regulations. DATES: Written comments must be received by April 29, 2002. Requests to speak and outlines of topics to be discussed at the public hearing scheduled for June 3, 2002, at 10 a.m. must be received by May 13, 2002. ADDRESSES: Send submissions to: CC:ITA:RU (REG-107100-00), room 5226, Internal -2- Revenue Service, POB 7604, Ben Franklin Station, Washington, DC 20044. Submissions may be hand delivered Monday through Friday between the hours of 8 a.m. -

History of English Language (Eng1c03)

School of Distance Education HISTORY OF ENGLISH LANGUAGE (ENG1C03) STUDY MATERIAL I SEMESTER CORE COURSE MA ENGLISH (2019 Admission ONWARDS) UNIVERSITY OF CALICUT SCHOOL OF DISTANCE EDUCATION Calicut University P.O, Malappuram Kerala, India 673 635. 190003 History of English Language Page 1 School of Distance Education UNIVERSITY OF CALICUT SCHOOL OF DISTANCE EDUCATION STUDY MATERIAL FIRST SEMESTER MA ENGLISH (2019 ADMISSION) CORE COURSE : ENG1C03 : HISTORY OF ENGLISH LANGUAGE Prepared by : 1. Smt.Smitha N, Assistant Professor on Contract (English) School of Distance Education, University of Calicut. 2. Prof. P P John (Retd.), St.Joseph’s College, Devagiri. Scrutinized by : Dr.Aparna Ashok, Assistant Professor on Contract, Dept. of English, University of Calicut. History of English Language Page 2 School of Distance Education CONTENTS 1 Section : A 6 2 Section : B 45 3 Section : C 58 History of English Language Page 3 School of Distance Education Introduction As English Literature learners, we must know the evolution of this language over the past fifteen hundred years or more. This course offers an overview of the History of English Language from its origin to the present. This SLM will have three sections: Section A briefly considers the early development of English Language and major historical events that had been made changes in its course. Section B takes up the changes that have taken place in English through Foreign invasions in 17th, 18th, and 19th centuries, besides it discusses the contribution of major writers to enrich this language. In the Section C, we trace out the evolution of standard English and the significance of English in this globalized world where technology reigns. -

2021 Form 1099-MISC

Attention: Copy A of this form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. The official printed version of Copy A of this IRS form is scannable, but the online version of it, printed from this website, is not. Do not print and file copy A downloaded from this website; a penalty may be imposed for filing with the IRS information return forms that can’t be scanned. See part O in the current General Instructions for Certain Information Returns, available at www.irs.gov/form1099, for more information about penalties. Please note that Copy B and other copies of this form, which appear in black, may be downloaded and printed and used to satisfy the requirement to provide the information to the recipient. To order official IRS information returns, which include a scannable Copy A for filing with the IRS and all other applicable copies of the form, visit www.IRS.gov/orderforms. Click on Employer and Information Returns, and we’ll mail you the forms you request and their instructions, as well as any publications you may order. Information returns may also be filed electronically using the IRS Filing Information Returns Electronically (FIRE) system (visit www.IRS.gov/FIRE) or the IRS Affordable Care Act Information Returns (AIR) program (visit www.IRS.gov/AIR). See IRS Publications 1141, 1167, and 1179 for more information about printing these tax forms. 9595 VOID CORRECTED PAYER’S name, street address, city or town, state or province, country, ZIP 1 Rents OMB No.