Form W-4, Employee's Withholding Certificate

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Enhancing Accessibility Information in Google Maps Adding New Pieces of Information to GTFS to Improve Accessibility

SMART ACCESSIBILITY 2017 : The Second International Conference on Universal Accessibility in the Internet of Things and Smart Environments Enhancing Accessibility Information in Google Maps Adding new pieces of information to GTFS to improve accessibility Paloma Cáceres, Almudena Sierra-Alonso, Carlos E. Cuesta, José María Cavero, Belén Vela Escuela Técnica Superior de Ingeniería Informática Universidad Rey Juan Carlos, URJC Móstoles (Madrid), Spain e-mail: {paloma.caceres, almudena.sierra, carlos.cuesta, josemaria.cavero, belen.vela}@urjc.es Abstract—Google is the most important information provider validated against real data for the subway in the city of on Internet. Within the Google ecosystem, Maps is a relevant Madrid, Spain (METRO Madrid [2]). tool, which is used to calculate routes and to find points of Our proposal to specify the accessibility data of public interest. As part of this effort, it has defined Google Transit transport is based on the Identification of Fixed Objects in Feed Specification (GTFS), a format to specify data of public Public Transport (IFOPT [3]) standard, which is an extension transport. Now public transport agents can provide a “feed” of the European Reference Data Model for Public Transport complying with this specification and Google can use them and Information (Transmodel [4]) standard. IFOPT defines a represent them on Maps. In spite of their relevance for model for the main fixed objects related to access to Public accessibility in mobility, Google Maps does not offer detailed Transport, which also includes constructions to describe information about accessibility facilities to transit, and GTFS accessibility data. does not specify the necessary structure to provide that information about public transport. -

Key Elements of the U.S. Tax System

TAX POLICY CENTER BRIEFING BOOK Key Elements of the U.S. Tax System TAXES AND THE FAMILY What are marriage penalties and bonuses? XXXX Q. What are marriage penalties and bonuses? A. A couple incurs a marriage penalty if the two pay more income tax filing as a married couple than they would pay if they were single and filed as individuals. Conversely, a couple receives a marriage bonus if they pay less tax filing as a couple than they would if they were single. CAUSES OF MARRIAGE BONUSES AND PENALTIES Marriage penalties and bonuses occur because income taxes apply to a couple, not to individual spouses. Under a progressive income tax, a couple’s income can be taxed more or less than that of two single individuals. A couple is not obliged to file a joint tax return, but their alternative—filing separate returns as a married couple—almost always results in higher tax liability. Married couples with children are more likely to incur marriage penalties than couples without children because one or both spouses could use the head of household filing status if they were able to file as singles. And tax provisions that phase in or out with income also produce marriage penalties or bonuses. Marriage penalties are more common when spouses have similar incomes. Marriage bonuses are more common when spouses have disparate incomes. Overall, couples receiving bonuses greatly outnumber those incurring penalties. MARRIAGE PENALTIES Couples in which spouses have similar incomes are more likely to incur marriage penalties than couples in which one spouse earns most of the income, because combining incomes in joint filing can push both spouses into higher tax brackets. -

2021 Revenue Ordinance

2021 Revenue Ordinance As Proposed on December 5, 2019 ii Revenue Ordinance of 2021 to Levy Taxes and Fees and Raise Revenue For the City of Savannah Georgia As adopted on December 18, 2020 Published by City of Savannah Revenue Department Post Office Box 1228 Savannah, GA 31402-1228 CITY OF SAVANNAH 2021 CITY COUNCIL Mayor Van R. Johnson, II Post 1 At-Large Post 2 At-Large Kesha Gibson-Carter Alicia Miller Blakely District 1 District 2 Bernetta B. Lanier Detric Leggett District 3 District 4 Linda Wilder-Bryan Nick Palumbo District 5 District 6 Dr. Estella Edwards Shabazz Kurtis Purtee Revenue Ordinance Compiled By Revenue Director/City Treasurer Ashley L. Simpson Utility Billing Manager Nicole Brantley Treasury Manager Joel Paulk Business Tax & Alcohol License Manager Judee Jones Revenue Special Projects Coordinator Saja Aures Table of Contents Revenue Ordinance of 2021 ....................................................................................................................... 1 ARTICLE A. GENERAL ............................................................................................................................... 1 Section 1. SCOPE; TAXES AND FEES .................................................................................................... 1 Section 2. DEFINITIONS ........................................................................................................................... 1 Section 3. JANUARY 1 GOVERNS FOR YEAR ...................................................................................... -

Panama Papers Leaks

GRAY TOLUB1 LLP Focusing on Domestic & International Taxation, Real Estate, Corporate, and Trust & Estate Matters. Client AlertAPRIL 04, 2016 AUTHORS Armin Gray Benjamin Tolub PANAMA PAPERS LEAKS: SUBJECT THE TAX MAN COMETH OVDP Panama On April 03, 2016, the press reported that 11.5 million records were leaked from Panamanian law firm Mossack Fonseca. The records detail offshore holdings of the celebrities, politicians, and the mega-rich many of which were purportedly engaged in illegal activities including tax evasion. Such leaks have been referred to as the “Panama papers” or the “Wikileaks of the mega-rich” by some newspapers.1 More details can be found at the website of the International Consortium of Investigative Journalists (“ICIJ”), which have summarized their findings as follows: The largest cross-border journalism collaboration ever has uncovered a giant leak of documents from Mossack Fonseca, a global law firm based in Panama. The secret files: • Include 11.5 million records, dating back nearly 40 years – making it the largest leak in offshore history. Contains details on more than 214,000 offshore entities connected to people in more than 200 countries and territories. Company owners 1 See Toppo, Greg, “Worldwide, jaws drop to Panama Papers’ Leak”, USA Today, last accessed April 3, 2016, available at: http://www.usatoday.com/story/news/2016/04/03/reactions- panama-papers-leak-go-global/82589874/. www.graytolub.com Client Alert Page 2 in [sic] billionaires, sports stars, drug smugglers and fraudsters. • Reveal the offshore holdings 140 politicians and public officials around the world – including 12 current and former world leaders. -

Amendments | Transportation, Economic Development And

Amend Senate S2508, Assembly A3008, AN ACT to amend the 2021 law, in relation to TED Page Line Amendment Page 4, Unnumbered line After “(Part SS);” strike out “and” 19(AN ACT CLAUSE), Page 4, Unnumbered line After “(Part TT) insert “; relating to the merger 26(AN ACT of the College Retirement Equities Fund and the CLAUSE), Teachers Insurance and Annuity Association of America; and to repeal chapter 124 of the laws of 1952 relating to the charter of the college retirement equities fund (Part UU); to amend the public authorities law, the canal law and the economic development law in relation to enacting the New York state canal system revitalization act; and to repeal article 13-A of the canal law relating to the canal recreationway commission and section 57 of the canal law relating to special conditions for leases entered prior to approval of the canal recreationway plan (Part VV); and to authorize utility and cable television assessments that provide funds to the department of health from cable tele-vision assessment revenues and to the department of agriculture and markets, department of environmental conservation, department of state, and the office of parks, recreation and historic preservation from utility assessment revenues (Part WW) Page 4, Line 4, After “through” strike out “TT” and insert “XX” Page 17, Line 3, After "§5." strike out “Paragraphs (f) and (g) of subdivision 9 of section 1209 of the public authorities law are REPEALED." and insert “The opening paragraph of subdivision 9 of section 1209 of the public authorities law is amended to read as follows: 9. -

ITEMIZING on STATE and FEDERAL TAX INCOME RETURNS: IT’S (NOW MORE) COMPLICATED David Weiner December 2, 2020

ITEMIZING ON STATE AND FEDERAL TAX INCOME RETURNS: IT’S (NOW MORE) COMPLICATED David Weiner December 2, 2020 A taxpayer’s decision to itemize deductions or to claim the standard deduction on their income tax return is often framed as a simple calculation: Claim the greater of the two so as to minimize tax liability. But in states that require taxpayers to use the same status on their state income tax return as on their federal return, this general rule can produce conflicting results if taxpayers examine liability separately on their federal and state returns. Itemized deductions might be greater than the standard deduction on a state income tax return, but the reverse could be true on a federal return. Recent federal law changes have further complicated the choice. When the federal standard deduction was nearly doubled beginning in 2018, many more taxpayers found a conflict between the best itemization scenario on federal and state income tax returns. Those taxpayers must now calculate their federal and state income taxes under both scenarios if they want to minimize their combined state and federal income tax liability. Many taxpayers in states that link federal and state itemization choices are affected. In Maryland, for example, more than 200,000 taxpayers could benefit by itemizing on their federal returns when that may not be the obvious choice. In this brief, I examine the links between federal and state itemization decisions and explore the implications of relaxing state rules requiring that state itemization choices match federal ones. elatively few federal taxpayers itemize deductions on their income tax returns under current law, and those who do tend to have very high incomes. -

The Alternative Minimum Tax

Updated December 4, 2017 Tax Reform: The Alternative Minimum Tax The U.S. federal income tax has both a personal and a Individual AMT corporate alternative minimum tax (AMT). Both the The modern individual AMT originated with the Revenue corporate and individual AMTs operate alongside the Act of 1978 (P.L. 95-600) and operated in tandem with an regular income tax. They require taxpayers to calculate existing add-on minimum tax prior to its repeal in 1982. their liability twice—once under the rules for the regular Table 2 details selected key individual AMT parameters. income tax and once under the AMT rules—and then pay the higher amount. Minimum taxes increase tax payments Table 2. Selected Individual AMT Parameters, 2017 from taxpayers who, under the rules of the regular tax system, pay too little tax relative to a standard measure of Single/ Married their income. Head of Filing Married Filing Household Jointly Separately Corporate AMT Exemption $54,300 $84,500 $42,250 The corporate AMT originated with the Tax Reform Act of 1986 (P.L. 99-514), which eliminated an “add-on” 28% bracket 187,800 187,800 93,900 minimum tax imposed on corporations previously. The threshold corporate AMT is a flat 20% tax imposed on a Source: Internal Revenue Code. corporation’s alternative minimum taxable income less an exemption amount. A corporation’s alternative minimum The individual AMT tax base is broader than the regular taxable income is the corporation’s taxable income income tax base and starts with regular taxable income and determined with certain adjustments (primarily related to adds back various deductions, including personal depreciation) and increased by the disallowance of a exemptions and the deduction for state and local taxes. -

Chapter 2: What's Fair About Taxes?

Hoover Classics : Flat Tax hcflat ch2 Mp_35 rev0 page 35 2. What’s Fair about Taxes? economists and politicians of all persuasions agree on three points. One, the federal income tax is not sim- ple. Two, the federal income tax is too costly. Three, the federal income tax is not fair. However, economists and politicians do not agree on a fourth point: What does fair mean when it comes to taxes? This disagree- ment explains, in large measure, why it so difficult to find a replacement for the federal income tax that meets the other goals of simplicity and low cost. In recent years, the issue of fairness has come to overwhelm the other two standards used to evaluate tax systems: cost (efficiency) and simplicity. Recall the 1992 presidential campaign. Candidate Bill Clinton preached that those who “benefited unfairly” in the 1980s [the Tax Reform Act of 1986 reduced the top tax rate on upper-income taxpayers from 50 percent to 28 percent] should pay their “fair share” in the 1990s. What did he mean by such terms as “benefited unfairly” and should pay their “fair share?” Were the 1985 tax rates fair before they were reduced in 1986? Were the Carter 1980 tax rates even fairer before they were reduced by President Reagan in 1981? Were the Eisenhower tax rates fairer still before President Kennedy initiated their reduction? Were the original rates in the first 1913 federal income tax unfair? Were the high rates that prevailed during World Wars I and II fair? Were Andrew Mellon’s tax Hoover Classics : Flat Tax hcflat ch2 Mp_36 rev0 page 36 36 The Flat Tax rate cuts unfair? Are the higher tax rates President Clin- ton signed into law in 1993 the hallmark of a fair tax system, or do rates have to rise to the Carter or Eisen- hower levels to be fair? No aspect of federal income tax policy has been more controversial, or caused more misery, than alle- gations that some individuals and income groups don’t pay their fair share. -

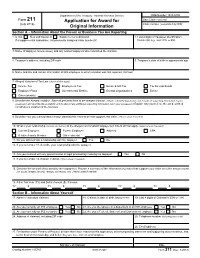

Form 211, Application for Award for Original Information

Department of the Treasury - Internal Revenue Service OMB Number 1545-0409 Form 211 Application for Award for Date Claim received (July 2018) Claim number (completed by IRS) Original Information Section A – Information About the Person or Business You Are Reporting 1. Is this New submission or Supplemental submission 2. Last 4 digits of Taxpayer Identification If a supplemental submission, list previously assigned claim number(s) Number(s) (e.g., SSN, ITIN, or EIN) 3. Name of taxpayer (include aliases) and any related taxpayers who committed the violation 4. Taxpayer's address, including ZIP code 5. Taxpayer's date of birth or approximate age 6. Name and title and contact information of IRS employee to whom violation was first reported, if known 7. Alleged Violation of Tax Law (check all that apply) Income Tax Employment Tax Estate & Gift Tax Tax Exempt Bonds Employee Plans Governmental Entities Exempt Organizations Excise Other (identify) 8. Describe the Alleged Violation. State all pertinent facts to the alleged violation. (Attach a detailed explanation and include all supporting information in your possession and describe the availability and location of any additional supporting information not in your possession.) Explain why you believe the act described constitutes a violation of the tax laws 9. Describe how you learned about and/or obtained the information that supports this claim. (Attach sheet if needed) 10. What is your relationship (current and former) to the alleged noncompliant taxpayer(s)? Check all that apply. (Attach sheet if needed) Current Employee Former Employee Attorney CPA Relative/Family Member Other (describe) 11. Do you still maintain a relationship with the taxpayer Yes No 12. -

Africa 2016 Latin America 2016 Latin America 2015-2016

In 2016 a large catch-up* in infrastructure investments is being confirmed by several Latin American countries, driven by the knowledge that economic growth relies heavily on quality infrastructure. The transport sector is going to firmly benefit from the expected increase in public and private funds. The continent being one of the most urbanized regions in the world, a large focus goes into urban rail projects: Mexico, Guatemala, Paraguay, Colombia, Chile, Brazil… are planning new projects for metro, light rail, high speed rail, monorail and passenger trains. One country is clearly taking the lead: Argentina. Besides boosting its investment climate and PPP laws, Argentina made public the ambitious 8-year 14.187 m USD investment in Buenos Aires` commuter network. Related key projects are the city`s RER and tunneling of the Sarmiento line. The Latin America Passenger Rail Expansion Summit will bring together local and international stakeholders, government officials, operators, developers, architects, consultants and equipment plus solution providers to discuss the current rail sector. *300.000 m USD is what Latam should be investing annually, versus the 150.000 m USD spent annually on infrastructure in the previous 20 years. http://latinamerica.railexpansionsummit.com OUTLOOK SOME OF THE TO BE INVITED DELEGATES Argentina foresees 14187 m USD ANPTrilhos INCOFER, Costa Rica Ministerio de Transporte y Comunicaciones, Peru 14187 investment in AFE Uruguay VLT Carioca Consortium Directorio de Transporte Público Metropolitano, Chile suburban network. FEPASA Paraguay Metro de Santiago, Chile Subterráneos de Buenos Aires SE (SBASE) CPTM São Paulo ANTT Brazil Gobierno Autónomo Municipal Santa Cruz Bolivia STM São Paulo ProInversión Peru Transporte Metropolitano de Barcelona New Rolling stock wagons in use in Metro Rio Metro DF Brazil Ministerio de Transporte Argentina 735-> Buenos Aires. -

Eliminating the Head of Household Filing Status Would Hurt Women

NATIONAL WOMEN’S LAW CENTER | FACT SHEET | JULY 2017 TAX & BUDGET ELIMINATING THE HEAD OF HOUSEHOLD FILING STATUS WOULD HURT WOMEN Since his campaign, President Donald Trump has • Have a dependent live with him or her for at least half 5 expressed interest in reforming the tax code. And during the year. This can include a qualifying child, or another 6 his campaign, he proposed a number of policies to do qualifying person such as a relative. so, including eliminating the head of household tax filing • Have paid more than half the cost of keeping up a home. status.1 Eliminating this filing status would negatively impact unmarried individuals supporting dependents – including What are the benefits of the head of household filing many women who are single parents. status? Now, the Administration’s tax reform efforts are moving The head of household filing status provides two main tax forward, with “tax principles” released in April 2017 and benefits as compared to taxpayers filing either single or a statement of principles issued in July 2017,2 and a more married filing separately: a larger standard deduction and a detailed tax plan to be released in early September. While preferential tax rate. First, head of household status creates these principles and Administration statements to date have a standard deduction that is higher than for taxpayers who not specifically mentioned eliminating head of household, file as single (or married filing separately), but less than the 7 the Administration and congressional leaders involved in tax deduction for married filing jointly taxpayers. The standard reform have signaled their intent to simplify the tax code for deduction for each of these filing statuses in 2016 is as 8 individuals. -

Osprey Nest Queen Size Page 2 LC Cutting Correction

Template Layout Sheets Organizing, Bags, Foundation Papers, and Template Layout Sheets Sort the Template Layout Sheets as shown in the graphics below. Unit A, Temp 1 Unit A, Temp 1 Layout UNIT A TEMPLATE LAYOUT SHEET CUT 3" STRIP BACKGROUND FABRIC E E E ID ID ID S S S Please read through your original instructions before beginning W W W E E E Sheet. Place (2) each in Bag S S S TEMP TEMP TEMP S S S E E A-1 A-1 A-1 E W W W S S S I I I D D D E E E C TEMP C TEMP TEMP U U T T A-1 A-1 T A-1 #6, #7, #8, and #9 L L I the queen expansion set. The instructions included herein only I C C C N N U U U T T T T E E L L L I I I N N N E E replace applicable information in the pattern. E Unit A, Temp 2, UNIT A TEMPLATE LAYOUT SHEET Unit A, Temp 2 Layout CUT 3" STRIP BACKGROUND FABRIC S S S E E E The Queen Foundation Set includes the following Foundation Papers: W W W S S S ID ID ID E TEMP E TEMP E TEMP Sheet. Place (2) each in Bag A-2 A-2 A-2 E E E D D D I I TEMP I TEMP TEMP S S S A-2 A-2 A-2 W W W C E C E E S S S U C C U C U U U T T T T T T L L L L IN IN L IN I I N #6, #7, #8, and #9 E E N E E NP 202 (Log Cabin Full Blocks) ~ 10 Pages E NP 220 (Log Cabin Half Block with Unit A Geese) ~ 2 Pages NP 203 (Log Cabin Half Block with Unit B Geese) ~ 1 Page Unit B, Temp 1, ABRIC F BACKGROUND Unit B, Temp 1 Layout E E T SHEE YOUT LA TE TEMPLA A T UNI E D I D I D I S S STRIP 3" T CU S W W E W TP 101 (Template Layout Sheets for Log Cabins and Geese) ~ 2 Pages E S S E S TEMP TEMP TEMP S S S E E E 1 A- 1 A- 1 A- W W W S S S I I I D D D E E E C C Sheet.