The Viability of the Fair Tax

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TALES from the KPMG SKUNK WORKS: the BASIS-SHIFT OR DEFECTIVE-REDEMPTION SHELTER by Calvin H

(C) Tax Analysts 2005. All rights reserved. does not claim copyright in any public domain or third party content. TALES FROM THE KPMG SKUNK WORKS: THE BASIS-SHIFT OR DEFECTIVE-REDEMPTION SHELTER By Calvin H. Johnson Table of Contents Calvin H. Johnson is professor of law at the Uni- versity of Texas at Austin. This report arises out of his I. Was FLIP/OPIS Fair Game? ............433 testimony before the U.S. Senate Permanent Subcom- A. Description of the FLIP/OPIS Basis-Shift mittee on Investigation hearings on the role of profes- Shelter ........................ 433 sionals in the U.S. tax shelter industry. Prof. Johnson has agreed to serve as an expert for plaintiffs who B. The Heart of the Shelter ............ 435 bought KPMG shelters and seek recovery of costs. He C. The Paramount Substance-Over-Form thanks James Martens and Samuel Buell for comments Doctrines ....................... 438 on an earlier draft, but acknowledges responsibility II. FLIP/OPIS and Professional Standards ... 440 for errors. A. The One-in-Three Chance Test ........ 440 In this report, Johnson argues that the basis-shift or B. One-in-Three Applied to Outcomes .... 441 defective-redemption shelter, called FLIP or OPIS by III. Concluding Remarks ................ 442 KPMG, was an early product of KPMG’s endeavor to develop complete tax packages that could be sold for KPMG, the fourth largest accounting firm, is negoti- multimillion-dollar fees to many customers. The ating with the Justice Department over the terms by which it might avoid criminal indictment for its conduct FLIP/OPIS shelter gives a rare opportunity, he says, to 1 see both KPMG internal deliberations and also the arising out of its tax shelters. -

Tearing out the Income Tax by the (Grass)Roots

FLORIDA TAX REVIEW Volume 15 2014 Number 8 TEARING OUT THE INCOME TAX BY THE (GRASS)ROOTS by Lawrence Zelenak* Rich People’s Movements: Grassroots Campaigns to Untax the One Percent. By Isaac William Martin New York: Oxford University Press. 2013. I. INTRODUCTION ............................................................................. 649 II. A CENTURY OF RICH PEOPLE’S ANTI-TAX MOVEMENTS ......... 651 III. EXPLAINING THE SUPPORT OF THE NON-RICH .......................... 656 IV. BUT WHAT ABOUT THE FLAT TAX AND THE FAIRTAX? ............ 661 V. THE RHETORIC OF RICH PEOPLE’S ANTI-TAX MOVEMENTS: PARANOID AND NON-PARANOID STYLES .................................... 665 VI. CONCLUSION ................................................................................. 672 I. INTRODUCTION Why do rich people seeking reductions in their tax burdens, who have the ability to influence Congress directly through lobbying and campaign contributions, sometimes resort to grassroots populist methods? And why do non-rich people sometimes join the rich in their anti-tax movements? These are the puzzles Isaac William Martin sets out to solve in Rich People’s Movements.1 Martin’s historical research—much of it based on original sources to which scholars have previously paid little or no attention—reveals that, far from being a recent innovation, populist-style movements against progressive federal taxation go back nearly a century, to the 1920s. Although Martin identifies various anti-tax movements throughout the past century, he strikingly concludes that there has been “substantial continuity from one campaign to the next, so that, in some * Pamela B. Gann Professor of Law, Duke Law School. 1. ISAAC WILLIAM MARTIN, RICH PEOPLE’S MOVEMENTS: GRASSROOTS CAMPAIGNS TO UNTAX THE ONE PERCENT (2013) [hereinafter MARTIN, RICH PEOPLE’S MOVEMENTS]. -

The Economic Effects of the Fairtax: Results from the Beacon Hill Institute CGE Model

The Economic Effects of the FairTax: Results from the Beacon Hill Institute CGE Model David G. Tuerck, Ph.D. Jonathan Haughton, Ph.D. Keshab Bhattarai, Ph.D. Phuong Viet Ngo, MSIE Alfonso Sanchez-Penalver, MSF The Beacon Hill Institute at Suffolk University 8 Ashburton Place, Boston, MA 02108 Phone: 617-573-8750 fax: 617-994-4279 Web: www.beaconhill.org E-mail: [email protected] February 2007 Table of Contents Executive Summary.........................................................................................................................1 I. Introduction .................................................................................................................................3 II. Overview of the BHI Model.......................................................................................................3 III. The Formal Specification of the BHI Model ............................................................................7 A. Production Function............................................................................................................ 10 B. Labor Supply and Capital Accumulation............................................................................ 13 C. Government Revenue and Spending................................................................................... 14 D. Foreign Direct Investment and Capital Inflows.................................................................. 15 E. Calibration .......................................................................................................................... -

Key Elements of the U.S. Tax System

TAX POLICY CENTER BRIEFING BOOK Key Elements of the U.S. Tax System TAXES AND THE FAMILY What are marriage penalties and bonuses? XXXX Q. What are marriage penalties and bonuses? A. A couple incurs a marriage penalty if the two pay more income tax filing as a married couple than they would pay if they were single and filed as individuals. Conversely, a couple receives a marriage bonus if they pay less tax filing as a couple than they would if they were single. CAUSES OF MARRIAGE BONUSES AND PENALTIES Marriage penalties and bonuses occur because income taxes apply to a couple, not to individual spouses. Under a progressive income tax, a couple’s income can be taxed more or less than that of two single individuals. A couple is not obliged to file a joint tax return, but their alternative—filing separate returns as a married couple—almost always results in higher tax liability. Married couples with children are more likely to incur marriage penalties than couples without children because one or both spouses could use the head of household filing status if they were able to file as singles. And tax provisions that phase in or out with income also produce marriage penalties or bonuses. Marriage penalties are more common when spouses have similar incomes. Marriage bonuses are more common when spouses have disparate incomes. Overall, couples receiving bonuses greatly outnumber those incurring penalties. MARRIAGE PENALTIES Couples in which spouses have similar incomes are more likely to incur marriage penalties than couples in which one spouse earns most of the income, because combining incomes in joint filing can push both spouses into higher tax brackets. -

Getting Acquainted with VAT (C) Tax Analysts 2011

Introduction: Getting Acquainted With VAT (C) Tax Analysts 2011. All rights reserved. does not claim copyright in any public domain or third party content. By Martin A. Sullivan Martin A. Sullivan is a contributing editor to Tax Analysts. Until recently, most talk about a value added tax in the United States was an academic exercise. Policy experts kept telling anyone who would listen that we could boost our competitive- ness if some form of a VAT was used to replace all, or at least the worst parts, of our clunky income tax. But there was no pressing need for a VAT and no political incentive to undertake the arduous task of orchestrating a major tax reform. But times are changing. Between the 2007 and 2010 fiscal years, the national debt increased from 36 percent to 62 percent of gross national product. And matters are only getting worse. America is relentlessly moving toward the edge of a fiscal abyss. In Wash- ington, while our leaders may talk tough, they are not taking action. To avoid upsetting voters, they are careful not to even hint at spending cuts or tax increases of the size needed to make a real dent in the problem. With no limit on the national credit card, the daily push and pull of politics continues unhindered by the impending crisis. Our system of checks and balances and the usual political gridlock are partly to blame. Also part of the mix is our national mental block about the federal debt. The tough choices that must be made are outside the scope of current political discourse. -

Form W-4, Employee's Withholding Certificate

Employee’s Withholding Certificate OMB No. 1545-0074 Form W-4 ▶ (Rev. December 2020) Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. ▶ Department of the Treasury Give Form W-4 to your employer. 2021 Internal Revenue Service ▶ Your withholding is subject to review by the IRS. Step 1: (a) First name and middle initial Last name (b) Social security number Enter Address ▶ Does your name match the Personal name on your social security card? If not, to ensure you get Information City or town, state, and ZIP code credit for your earnings, contact SSA at 800-772-1213 or go to www.ssa.gov. (c) Single or Married filing separately Married filing jointly or Qualifying widow(er) Head of household (Check only if you’re unmarried and pay more than half the costs of keeping up a home for yourself and a qualifying individual.) Complete Steps 2–4 ONLY if they apply to you; otherwise, skip to Step 5. See page 2 for more information on each step, who can claim exemption from withholding, when to use the estimator at www.irs.gov/W4App, and privacy. Step 2: Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse Multiple Jobs also works. The correct amount of withholding depends on income earned from all of these jobs. or Spouse Do only one of the following. Works (a) Use the estimator at www.irs.gov/W4App for most accurate withholding for this step (and Steps 3–4); or (b) Use the Multiple Jobs Worksheet on page 3 and enter the result in Step 4(c) below for roughly accurate withholding; or (c) If there are only two jobs total, you may check this box. -

ITEMIZING on STATE and FEDERAL TAX INCOME RETURNS: IT’S (NOW MORE) COMPLICATED David Weiner December 2, 2020

ITEMIZING ON STATE AND FEDERAL TAX INCOME RETURNS: IT’S (NOW MORE) COMPLICATED David Weiner December 2, 2020 A taxpayer’s decision to itemize deductions or to claim the standard deduction on their income tax return is often framed as a simple calculation: Claim the greater of the two so as to minimize tax liability. But in states that require taxpayers to use the same status on their state income tax return as on their federal return, this general rule can produce conflicting results if taxpayers examine liability separately on their federal and state returns. Itemized deductions might be greater than the standard deduction on a state income tax return, but the reverse could be true on a federal return. Recent federal law changes have further complicated the choice. When the federal standard deduction was nearly doubled beginning in 2018, many more taxpayers found a conflict between the best itemization scenario on federal and state income tax returns. Those taxpayers must now calculate their federal and state income taxes under both scenarios if they want to minimize their combined state and federal income tax liability. Many taxpayers in states that link federal and state itemization choices are affected. In Maryland, for example, more than 200,000 taxpayers could benefit by itemizing on their federal returns when that may not be the obvious choice. In this brief, I examine the links between federal and state itemization decisions and explore the implications of relaxing state rules requiring that state itemization choices match federal ones. elatively few federal taxpayers itemize deductions on their income tax returns under current law, and those who do tend to have very high incomes. -

The Alternative Minimum Tax

Updated December 4, 2017 Tax Reform: The Alternative Minimum Tax The U.S. federal income tax has both a personal and a Individual AMT corporate alternative minimum tax (AMT). Both the The modern individual AMT originated with the Revenue corporate and individual AMTs operate alongside the Act of 1978 (P.L. 95-600) and operated in tandem with an regular income tax. They require taxpayers to calculate existing add-on minimum tax prior to its repeal in 1982. their liability twice—once under the rules for the regular Table 2 details selected key individual AMT parameters. income tax and once under the AMT rules—and then pay the higher amount. Minimum taxes increase tax payments Table 2. Selected Individual AMT Parameters, 2017 from taxpayers who, under the rules of the regular tax system, pay too little tax relative to a standard measure of Single/ Married their income. Head of Filing Married Filing Household Jointly Separately Corporate AMT Exemption $54,300 $84,500 $42,250 The corporate AMT originated with the Tax Reform Act of 1986 (P.L. 99-514), which eliminated an “add-on” 28% bracket 187,800 187,800 93,900 minimum tax imposed on corporations previously. The threshold corporate AMT is a flat 20% tax imposed on a Source: Internal Revenue Code. corporation’s alternative minimum taxable income less an exemption amount. A corporation’s alternative minimum The individual AMT tax base is broader than the regular taxable income is the corporation’s taxable income income tax base and starts with regular taxable income and determined with certain adjustments (primarily related to adds back various deductions, including personal depreciation) and increased by the disallowance of a exemptions and the deduction for state and local taxes. -

Chapter 2: What's Fair About Taxes?

Hoover Classics : Flat Tax hcflat ch2 Mp_35 rev0 page 35 2. What’s Fair about Taxes? economists and politicians of all persuasions agree on three points. One, the federal income tax is not sim- ple. Two, the federal income tax is too costly. Three, the federal income tax is not fair. However, economists and politicians do not agree on a fourth point: What does fair mean when it comes to taxes? This disagree- ment explains, in large measure, why it so difficult to find a replacement for the federal income tax that meets the other goals of simplicity and low cost. In recent years, the issue of fairness has come to overwhelm the other two standards used to evaluate tax systems: cost (efficiency) and simplicity. Recall the 1992 presidential campaign. Candidate Bill Clinton preached that those who “benefited unfairly” in the 1980s [the Tax Reform Act of 1986 reduced the top tax rate on upper-income taxpayers from 50 percent to 28 percent] should pay their “fair share” in the 1990s. What did he mean by such terms as “benefited unfairly” and should pay their “fair share?” Were the 1985 tax rates fair before they were reduced in 1986? Were the Carter 1980 tax rates even fairer before they were reduced by President Reagan in 1981? Were the Eisenhower tax rates fairer still before President Kennedy initiated their reduction? Were the original rates in the first 1913 federal income tax unfair? Were the high rates that prevailed during World Wars I and II fair? Were Andrew Mellon’s tax Hoover Classics : Flat Tax hcflat ch2 Mp_36 rev0 page 36 36 The Flat Tax rate cuts unfair? Are the higher tax rates President Clin- ton signed into law in 1993 the hallmark of a fair tax system, or do rates have to rise to the Carter or Eisen- hower levels to be fair? No aspect of federal income tax policy has been more controversial, or caused more misery, than alle- gations that some individuals and income groups don’t pay their fair share. -

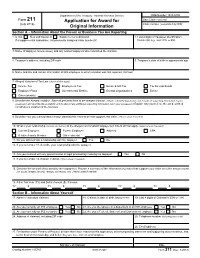

Form 211, Application for Award for Original Information

Department of the Treasury - Internal Revenue Service OMB Number 1545-0409 Form 211 Application for Award for Date Claim received (July 2018) Claim number (completed by IRS) Original Information Section A – Information About the Person or Business You Are Reporting 1. Is this New submission or Supplemental submission 2. Last 4 digits of Taxpayer Identification If a supplemental submission, list previously assigned claim number(s) Number(s) (e.g., SSN, ITIN, or EIN) 3. Name of taxpayer (include aliases) and any related taxpayers who committed the violation 4. Taxpayer's address, including ZIP code 5. Taxpayer's date of birth or approximate age 6. Name and title and contact information of IRS employee to whom violation was first reported, if known 7. Alleged Violation of Tax Law (check all that apply) Income Tax Employment Tax Estate & Gift Tax Tax Exempt Bonds Employee Plans Governmental Entities Exempt Organizations Excise Other (identify) 8. Describe the Alleged Violation. State all pertinent facts to the alleged violation. (Attach a detailed explanation and include all supporting information in your possession and describe the availability and location of any additional supporting information not in your possession.) Explain why you believe the act described constitutes a violation of the tax laws 9. Describe how you learned about and/or obtained the information that supports this claim. (Attach sheet if needed) 10. What is your relationship (current and former) to the alleged noncompliant taxpayer(s)? Check all that apply. (Attach sheet if needed) Current Employee Former Employee Attorney CPA Relative/Family Member Other (describe) 11. Do you still maintain a relationship with the taxpayer Yes No 12. -

ACTEC 2018 Pocket Tax Tables

Pocket Tax Tables Revised through March 1, 2018 SELECTIVE TAX RETURN DUE DATES September 17, 2018 Third estimated installment. October 1, 2018 2017 1041s with 5½ month extension. October 15, 2018 2017 1040s with 6 month extension. January 15, 2019 Fourth estimated installment. April 15, 2019 1040s, fourth estimated installments, calendar year 1041s. May 15, 2019 Form 990. June 17, 2019 Second estimated installment. September 16, 2019 Third estimated installment. October 1, 2019 2018 1041s with 5½ month extension. October 15, 2019 2018 1040s with 6 month extension. January 15, 2020 Fourth estimated installment. POCKET TAX TABLES Revised through March 1, 2018 Although care was taken to make these Pocket Tax Tables an accurate, handy reference, they should not be relied upon as the final basis for action. Neither the College nor the individual editors and advisors (who have volunteered their time and experience in the preparation of the tables) assume any responsibility for the accuracy of the information contained in the tables. Compiling Editors Susan T. Bart Lawrence P. Katzenstein The American College of Trust and Estate Counsel 901 15th Street, N.W. Suite 525 Washington, D.C. 20005 Phone: (202) 684-8460 • Fax: (202) 684-8459 Email: [email protected] • Web Page: actec.org © 2018 ACTEC®. All Rights Reserved. ACTEC is a registered trademark of The American College of Trust and Estate Counsel. CONTENTS Item Page Income Tax Married Filing a Joint Return (or surviving spouse) 4 Head of Household 5 Single Individual 6 Married Filing a -

Chapter 9 - Black Incumbents, White Districts: a Georgia Analysis

Voss Familiarity Doesn’t Breed Contempt 201 Chapter 9 - Black Incumbents, White Districts: A Georgia Analysis The civil rights community made a serious tactical blunder when the U.S. Supreme Court began striking down “racial gerrymanders” in the mid-1990s.1 Filled with dismay after watching majority- minority districts fall one by one at the Court’s hands, activists got carried away with their rhetoric, foretelling a doom destined not to descend. NAACP Legal Defense Fund attorney Theodore Shaw prophesied, for example, that minority members of Congress “eventually” would be able to “meet in the back seat of a taxi cab” (Charen 1996).2 Deval Patrick, the assistant attorney general for civil rights, went even further: he said the Shaw v. Reno line of court decisions portended “a return to all-white government” (Baltimore Sun 1996). Other activists borrowed ugly images from Southern history. U.S. Rep. Cynthia McKinney, whose Georgia district traded away heavily black precincts for much whiter Atlanta suburbs (Tucker 1995), threatened that African-American legislators would face “the same level of extinction” as they did after Reconstruction (Applebome 1994). Elaine Jones, head of the NAACP Legal Defense Fund, summoned memories of lynchings; she said the Supreme Court was “closing the noose” on black legislators (Savage 1996). Not to be outdone, the Rev. Jesse Jackson reached beyond U.S. history for his metaphor–calling the rulings (in an oft-quoted line) “a kind of ethnic cleansing” (Tilove 1996). “The fact that 1996 looks more like 1896 every day cannot be ignored.” No matter how restrained, all implied an immediate and direct threat to congressional diversity.