The Fairtax Treatment of Housing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tearing out the Income Tax by the (Grass)Roots

FLORIDA TAX REVIEW Volume 15 2014 Number 8 TEARING OUT THE INCOME TAX BY THE (GRASS)ROOTS by Lawrence Zelenak* Rich People’s Movements: Grassroots Campaigns to Untax the One Percent. By Isaac William Martin New York: Oxford University Press. 2013. I. INTRODUCTION ............................................................................. 649 II. A CENTURY OF RICH PEOPLE’S ANTI-TAX MOVEMENTS ......... 651 III. EXPLAINING THE SUPPORT OF THE NON-RICH .......................... 656 IV. BUT WHAT ABOUT THE FLAT TAX AND THE FAIRTAX? ............ 661 V. THE RHETORIC OF RICH PEOPLE’S ANTI-TAX MOVEMENTS: PARANOID AND NON-PARANOID STYLES .................................... 665 VI. CONCLUSION ................................................................................. 672 I. INTRODUCTION Why do rich people seeking reductions in their tax burdens, who have the ability to influence Congress directly through lobbying and campaign contributions, sometimes resort to grassroots populist methods? And why do non-rich people sometimes join the rich in their anti-tax movements? These are the puzzles Isaac William Martin sets out to solve in Rich People’s Movements.1 Martin’s historical research—much of it based on original sources to which scholars have previously paid little or no attention—reveals that, far from being a recent innovation, populist-style movements against progressive federal taxation go back nearly a century, to the 1920s. Although Martin identifies various anti-tax movements throughout the past century, he strikingly concludes that there has been “substantial continuity from one campaign to the next, so that, in some * Pamela B. Gann Professor of Law, Duke Law School. 1. ISAAC WILLIAM MARTIN, RICH PEOPLE’S MOVEMENTS: GRASSROOTS CAMPAIGNS TO UNTAX THE ONE PERCENT (2013) [hereinafter MARTIN, RICH PEOPLE’S MOVEMENTS]. -

Reemployment of Retired Members: Federal Tax Issues

MARYLAND STATE RETIREMENT AND PENSION SYSTEM REEMPLOYMENT OF RETIRED MEMBERS - FEDERAL TAX ISSUES There are two key tax issues related to the reemployment of individuals by the State or participating governmental units who are retirees of the Maryland State Retirement and Pension System: (1) the tax qualification of the plans under the Maryland State Retirement and Pension System; and (2) the possibility of the imposition of the 10% early distribution tax on benefits received by retirees. The following information is provided in order that State and participating employers may better understand the rules. 1. PLAN QUALIFICATION – A defined benefit retirement plan, such as the plans under the Maryland State Retirement and Pension Plan, must meet many requirements under the Internal Revenue Code in order to be a “qualified plan” under the Code and receive certain important tax advantages. One of those requirements provides that, in general, a member may not withdraw contributions made by the employer, or earnings on such contributions, before normal retirement, termination of employment, or termination of the plan. Rev. Rul. 74-254, 1974-1 C.B. 94. “Normal retirement age cannot be earlier than the earliest age that is reasonably representative of a typical retirement age for the covered workforce.” Prop. Treas. Reg. Sec. 1.401(a) – 1(b)(1)(i). A retirement age that is lower than 65 is permissible for a governmental plan if it reflects when employees typically retire and is not a subterfuge for permitting in-service distributions. PLR 200420030. Therefore, as a matter of plan qualification, retirement benefits may be paid to an employee who reaches “normal retirement age” once the employee retires and separates from service, and the reemployment of such a retiree by the same employer should not raise concerns regarding plan qualification. -

Real Tax Reform: Flat-Tax Simplicity with a Progressive Twist Donald Marron

Real Tax Reform: Flat-Tax Simplicity with a Progressive Twist Donald Marron Abstract In a contribution to the Christian Science Monitor, Donald Document date: November 28, 2011 Marron agrees that there are good reasons for a simpler tax Released online: November 25, 2011 system, as found in the flat-tax plans of GOP hopefuls Perry, Gingrich, and Cain. But they need to be made more progressive to amount to real tax reform that can pass muster politically. Christian Science Monitor, The New Economy: Real Tax Reform: Flat-Tax Simplicity with a Progressive Twist Tax reform has emerged as a key issue for GOP presidential hopefuls. Texas Gov. Rick Perry wants to scrap our current system and replace it with a 20 percent flat tax on individual and corporate incomes. Former Speaker of the House Newt Gingrich wants to do the same, but with even lower rates. Then there's pizza magnate Herman Cain. His "9-9-9" plan would replace today's income and payroll taxes with a trio of levies: a 9 percent flat tax on individuals, another on businesses, and a 9 percent retail sales tax. But Mr. Cain's ultimate vision is to eliminate anything remotely resembling today's tax system in favor of a national retail sales tax, which proponents call the FairTax. These three plans have much in common. Catchy names, for one. More important, they all focus on taxing consumption - what people spend - rather than income. The flat tax is most famous, of course, for applying a single rate to all corporate earnings and to all individual earnings above some exemption. -

The Viability of the Fair Tax

The Fair Tax 1 Running head: THE FAIR TAX The Viability of The Fair Tax Jonathan Clark A Senior Thesis submitted in partial fulfillment of the requirements for graduation in the Honors Program Liberty University Fall 2008 The Fair Tax 2 Acceptance of Senior Honors Thesis This Senior Honors Thesis is accepted in partial fulfillment of the requirements for graduation from the Honors Program of Liberty University. ______________________________ Gene Sullivan, Ph.D. Thesis Chair ______________________________ Donald Fowler, Th.D. Committee Member ______________________________ JoAnn Gilmore, M.B.A. Committee Member ______________________________ James Nutter, D.A. Honors Director ______________________________ Date The Fair Tax 3 Abstract This thesis begins by investigating the current system of federal taxation in the United States and examining the flaws within the system. It will then deal with a proposal put forth to reform the current tax system, namely the Fair Tax. The Fair Tax will be examined in great depth and all aspects of it will be explained. The objective of this paper is to determine if the Fair Tax is a viable solution for fundamental tax reform in America. Both advantages and disadvantages of the Fair Tax will objectively be pointed out and an educated opinion will be given regarding its feasibility. The Fair Tax 4 The Viability of the Fair Tax In 1986 the United States federal tax code was changed dramatically in hopes of simplifying the previous tax code. Since that time the code has undergone various changes that now leave Americans with over 60,000 pages of tax code, rules, and rulings that even the most adept tax professionals do not understand. -

Traditional Individual Retirement Arrangements (Iras)

(6-2010) TRADITIONAL INDIVIDUAL RETIREMENT ARRANGEMENTS (Traditional IRAs) List of Required Modifications and Information Package (LRMs) (For use with prototype traditional IRAs intending to satisfy the requirements of Code § 408(a) or (b).) Material added since the 3-2002 LRMs is underlined. This information package contains samples of provisions that have been found to satisfy certain specific requirements of the Internal Revenue Code as amended through the Worker, Retiree, and Employer Recovery Act of 2008 (“WRERA”), Pub. L. 110-458. Such language may or may not be acceptable in specific IRAs, depending on the context. We have prepared this package to assist sponsors who are drafting IRAs. To expedite the review process, sponsors are encouraged to use the language contained in this package. Part A, provisions 1-12, applies to individual retirement accounts under Code § 408(a). Part B, provisions 13-22, applies to individual retirement annuities under § 408(b). ________________________________________________________________ PART A: ACCOUNTS - Trust or custodial accounts under Code § 408(a). (1) Statement of Requirement: The IRA is organized and operated for the exclusive benefit of the individual, Code § 408(a). Sample Language: The account is established for the exclusive benefit of the individual or his or her beneficiaries. If this is an inherited IRA within the meaning of Code § 408(d)(3)(C) maintained for the benefit of a designated beneficiary of a deceased individual, references in this document to the “individual” are to the deceased individual. (2) Statement of Requirement: Maximum permissible annual contribution and restrictions on kinds of contributions, Code §§ 72(t)(2)(G), 219(b), 408(a)(1), 408(d)(3)(C), 408(d)(3)(G), 1 408(p)(1)(B) and 408(p)(2)(A)(iv). -

Section 501 on the Ground That All of Its Profits Are Payable to One Or More Organizations Exempt from Taxation Under Section 501

F. IRC 502 - FEEDER ORGANIZATIONS 1. Introduction An organization described in IRC 502 does not qualify for exemption under any paragraph of IRC 501(c). The purpose of this article is to discuss some of the basic issues presented by IRC 502, to explain how it should be interpreted and applied, and to consider the amount of unrelated business activity that an exempt charitable organization may engage in. IRC 502 provides that an organization operated for the primary purpose of carrying on a trade or business for profit shall not be exempt under IRC 501 on the ground that all of its profits are payable to one or more organizations exempt under IRC 501. 2. Purpose of Feeder Provisions A brief consideration of the reasons for the enactment of IRC 502 provides some insight as to how it should be interpreted. There was growing concern, particularly after World War II, about the increasing amount of business activities carried on by exempt organizations, particularly, charitable organizations. In a series of cases involving taxable years prior to 1951, certain organizations popularly called "feeder organizations" were held exempt from federal income tax under the predecessor to IRC 501(c)(3), even though their sole activity was engaging in commercial business, and the only basis for exemption was the fact their profits were payable to specified exempt organizations. See Roche's Beach, Inc. v. Commissioner, 96 F. 2d 776 (1938); C. F. Mueller Company v. Commissioner, 190 F. 2d 120 (1951). The courts held that the exclusive purpose required by the statute was met when the only object of the organization was religious, scientific, charitable, or educational, without regard to the method of obtaining funds necessary to effectuate the objective. -

Home Workers and the Debate Over "Who's a Statutory Employee" Under the Internal Revenue Code

HOME WORKERS AND THE DEBATE OVER "WHO'S A STATUTORY EMPLOYEE" UNDER THE INTERNAL REVENUE CODE ROBERT \V VVOOD ANI) CIlIUSTOPIiER A. KARACIIALE ifferent governmental agencies use different tests for determining who is <1n D employee and who is not. The Internal Revenue Service (IRS) typically uses one test,' the Department of Labor and many employment statutes use another,2 and most state unemployment insurance authorities use another stil\.3 This creates ROBERT W. WOOD CHRISTOPHER A. /?OIlERT W WOOD I'UACT/CI,S KARACHALE a great deal of confusion about what should be a relatively simple question-is a LAW WITH WOOD & POUTEU CIIIUSTOPIIEU KAUACHALE IN SAN FUANCISCO (WWW. /S ,IN ASSOCIATE AT Woov & worker an employee or an independent contractor' WOO DPOUTFU.COM) ANI) IS POUTFU IN SAN FUANCISCO. THE AUTllOU OF TAXATION HI-"Af)VISES INDIVI DUALS AND The test for employee status generally used by the IRS looks to the employer's OF DAMAGE AWAIU)S ANI) IJUSINI;'SS ENTI'I'IESONAHROAD behavioral and financial controls over the worker, as well as the relationship between SETTLEMENT PAYMENTS (4T/-1 IIANGE OF TAX PUNNING AND ED. TAX INSTITUTE, 2009) TAX CONTROVEUSY MATTERS, the parties. This "twenty-factor test" is an uncodified,amorphous, facts and circum AND QUAIIFIFD SETTLEMENT INCI UDING TI-"'" TAXATION FUNDS AND SECTION 468/l OF I),IMAGE AI,VAIIVS AND stances test that, like many of the other tests, tends to provide uneven results. Never (TAX INSTI TUTE, 2009), DEFEUllliD COMPENS ATION, HOTH AVA/tABLE AT WWW. INIJHPFNVJ:NT C:ONTR ACTOU theless, for more than 50 years, the Internal Revenue Code has contained a narrowly TAX1NS TITUTE.COM. -

Comparing Average and Marginal Tax Rates Under the Fairtax and the Current System of Federal Taxation

NBER WORKING PAPER SERIES COMPARING AVERAGE AND MARGINAL TAX RATES UNDER THE FAIRTAX AND THE CURRENT SYSTEM OF FEDERAL TAXATION Laurence J. Kotlikoff David Rapson Working Paper 11831 http://www.nber.org/papers/w11831 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 December 2005 © 2005 by Laurence J. Kotlikoff and David Rapson. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. Comparing Average and Marginal Tax Rates Under the FairTax and the Current System of Federal Taxation Laurence J. Kotlikoff and David Rapson NBER Working Paper No. 11831 December 2005, Revised November 2006 JEL No. H2 ABSTRACT This paper compares marginal and average tax rates on working and saving under our current federal tax system with those that would arise under a federal retail sales tax, specifically the FairTax. The FairTax would replace the personal income, corporate income, payroll, and estate and gift taxes with a 23 percent effective retail sales tax plus a progressive rebate. The 23 percent rate generates more revenue than the taxes it replaces, but the rebate's cost necessitates scaling back non-Social Security expenditures to their 2000 share of GDP. The FairTax's effective marginal tax on labor supply is 23 percent. Its effective marginal tax on saving is zero. In contrast, for the stylized working households considered here, current effective marginal labor taxes are higher or much higher than 23 percent. Take our stylized 45 year-old, married couple earning $35,000 per year with two children. -

Fiscal Federalism-The National Fairtax and the States-BHI 10-25-07

Fiscal Federalism: The National FairTax and the States David G. Tuerck, Ph.D. Paul Bachman, MSIE Sylvia Jacob, MSIE The Beacon Hill Institute at Suffolk University 8 Ashburton Place, Boston, MA 02108 Web: www.beaconhill.org phone: 617-573-8750 Fax: 617-994-4279 e-mail: [email protected] September 2007 Table of Contents Executive Summary............................................................................................................ 3 I. Introduction .................................................................................................................... 5 II. Measuring State-Level FairTax Rates ........................................................................... 8 A. Tax-inclusive versus Tax-exclusive Rates ................................................................ 9 B. Determining the FairTax Rate ................................................................................... 9 III. The Economic Effects of Federal and State FairTaxes on Select State Economies... 19 IV. Logistical and Practical Implications Associated with Combining a National FairTax with State and Local Taxes ........................................................................................ 23 A. The Current State Tax Structure.............................................................................. 23 B. State Piggybacking of the Federal System .............................................................. 25 C. Federal Taxes (National Sales Taxes) Would Not Be Deductible from State Taxes....................................................................................................................... -

STATE of CALIFORNIA COMMISSION on the 21 CENTURY ECONOMY PUBLIC MEETING Thursday, July 16, 2009 1:00 P.M. – 4:55 P.M. Daniel

STATE OF CALIFORNIA COMMISSION ON THE 21 st CENTURY ECONOMY STATE OF CALIFORNIA REVENUE & TAXATION FUNDAMENTAL TAX ALTERNATIVES Part Three PUBLIC MEETING Thursday, July 16, 2009 1:00 p.m. – 4:55 p.m. University of California, San Francisco Mission Bay Conference Center William J. Rutter Community Center Fisher Banquet Room 1675 Owens Street San Francisco, California Reported by: Daniel P. Feldhaus Certified Shorthand Reporter #6949 Registered Diplomate Reporter, Certified Realtime Reporter Daniel P. Feldhaus, C.S.R., Inc. Certified Shorthand Reporters 8414 Yermo Way, Sacramento, California 95828 Telephone 916.682.9482 Fax 916.688.0723 [email protected] 1 st Commission on the 21 Century Economy – July 16, 2009 A P P E A R A N C E S COMMISSION ON THE 21 ST CENTURY ECONOMY Commissioners Present GERRY PARSKY Commission Chair Aurora Capital Group RUBEN BARRALES President/CEO San Diego Regional Chamber of Commerce MICHAEL BOSKIN Professor Stanford University JOHN COGAN Professor Stanford University EDWARD DE LA ROSA Founder and President Edward J. De La Rosa & Company, Inc. CHRISTOPHER EDLEY, JR. Dean/Professor of Law Boalt Hall School of Law GEORGE HALVORSON Chairman/CEO Kaiser Foundation WILLIAM HAUCK Trustee, California State University Director Blue Shield of California & Blue Shield Foundation JENNIFER ITO Research, Training, Policy Director SCOPE FRED KEELEY Treasurer, County of Santa Cruz Professor, San José State University Daniel P. Feldhaus, CSR, Inc. 916.682.9482 2 st Commission on the 21 Century Economy – July 16, 2009 A P P E A R A N C E S COMMISSION ON THE 21 ST CENTURY ECONOMY Commissioners Present continued MONICA LOZANO Publisher/CEO La Opinión REBECCA MORGAN President Morgan Family Foundation RICHARD POMP Alva P. -

How Proposed Legislation Could Affect Corporate Taxes Kaitlin Aspinwall University of Mississippi

University of Mississippi eGrove Honors College (Sally McDonnell Barksdale Honors Theses Honors College) 2016 How Proposed Legislation Could Affect Corporate Taxes Kaitlin Aspinwall University of Mississippi. Sally McDonnell Barksdale Honors College Follow this and additional works at: https://egrove.olemiss.edu/hon_thesis Part of the Accounting Commons Recommended Citation Aspinwall, Kaitlin, "How Proposed Legislation Could Affect Corporate Taxes" (2016). Honors Theses. 495. https://egrove.olemiss.edu/hon_thesis/495 This Undergraduate Thesis is brought to you for free and open access by the Honors College (Sally McDonnell Barksdale Honors College) at eGrove. It has been accepted for inclusion in Honors Theses by an authorized administrator of eGrove. For more information, please contact [email protected]. © 2016 Kaitlin Louise Aspinwall ALL RIGHT RESERVED ii ACKNOWLEDGEMENTS Thank you to Dr. Tonya Flesher for all of the help that you have given me throughout my thesis and for all of the effort you put into assisting me. I could not have completed my thesis without your continued support and guidance. Additionally, thank your Dr. Rhodes and Dr. Wilder for serving as my second and third readers. Thank you to Jon Traub who assisted me in creating a thesis topic that catered to my interests in tax, accounting, and policy. Thank you to all of my friends who supported me throughout this entire process and continuously pushed me and encouraged me to complete my thesis. A special thank you to my family for all of their love and support throughout my entire life but specifically during my time at Ole Miss and in the Honors College. -

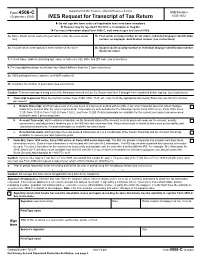

Form 4506-C, IVES Request for Transcript of Tax Return

Department of the Treasury - Internal Revenue Service Form 4506-C OMB Number (September 2020) IVES Request for Transcript of Tax Return 1545-1872 ▶ Do not sign this form unless all applicable lines have been completed. ▶ Request may be rejected if the form is incomplete or illegible. ▶ For more information about Form 4506-C, visit www.irs.gov and search IVES. 1a. Name shown on tax return (if a joint return, enter the name shown 1b. First social security number on tax return, individual taxpayer identification first) number, or employer identification number (see instructions) 2a. If a joint return, enter spouse’s name shown on tax return 2b. Second social security number or individual taxpayer identification number if joint tax return 3. Current name, address (including apt., room, or suite no.), city, state, and ZIP code (see instructions) 4. Previous address shown on the last return filed if different from line 3 (see instructions) 5a. IVES participant name, address, and SOR mailbox ID 5b. Customer file number (if applicable) (see instructions) Caution: This tax transcript is being sent to the third party entered on Line 5a. Ensure that lines 5 through 8 are completed before signing. (see instructions) 6. Transcript requested. Enter the tax form number here (1040, 1065, 1120, etc.) and check the appropriate box below. Enter only one tax form number per request a. Return Transcript, which includes most of the line items of a tax return as filed with the IRS. A tax return transcript does not reflect changes made to the account after the return is processed.